Resources

About Us

Inductive Position Sensor Market by Sensor Type (Cylinder Sensors, Rectangular Sensors, Ring & Slot Sensors, Tubular Sensors), Technology (Analog Output, Digital Output, IO-Link Enabled), Application (Automotive, Industrial Manufacturing, Aerospace & Defense, Consumer Electronics, and Region - Global Forecast to 2035

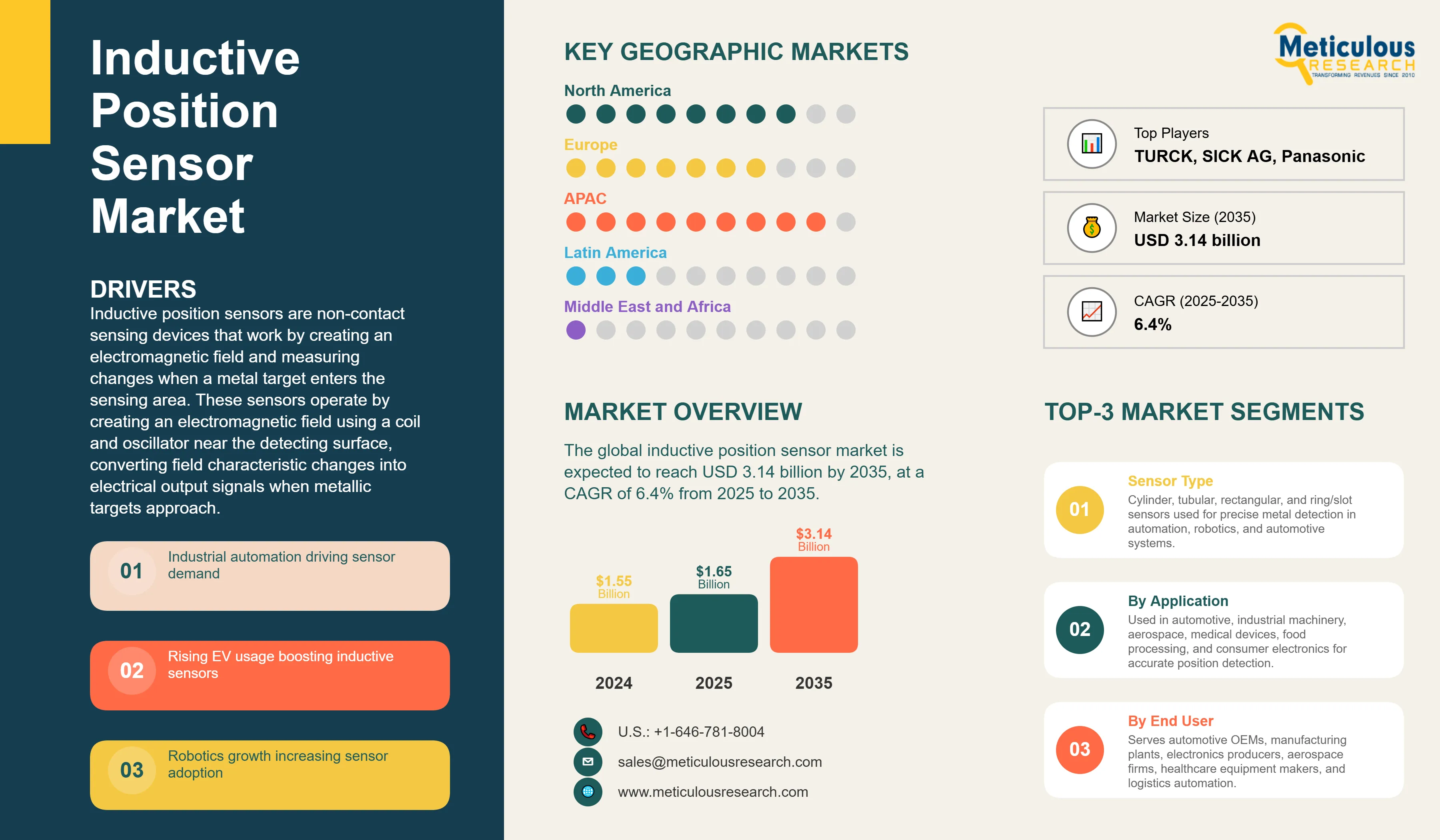

Report ID: MRSE - 1041638 Pages: 198 Dec-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe global inductive position sensor market is expected to reach USD 3.14 billion by 2035 from USD 1.65 billion in 2025, at a CAGR of 6.4% from 2025 to 2035.

Inductive position sensors are non-contact sensing devices that work by creating an electromagnetic field and measuring changes when a metal target enters the sensing area. These sensors operate by creating an electromagnetic field using a coil and oscillator near the detecting surface, converting field characteristic changes into electrical output signals when metallic targets approach. Vastly essential for precision measurement in industrial and automotive applications, inductive position sensors first entered use in the middle of the 1960s. Since then, inductive position sensors have undergone vast changes with miniaturization, increased digital integration, IO-Link connectivity, and even AI-enabled diagnostics, opening up new frontiers on high reliability, non-contact operation, and resistance to contaminants for several industries, including automotive, aerospace, robotics, industrial automation, and consumer electronics.

|

Parameter |

Details |

|---|---|

|

Market Size Value in 2025 |

USD 1.65 Billion |

|

Revenue Forecast in 2035 |

USD 3.14 Billion |

|

Growth Rate |

CAGR of 6.4% from 2025 to 2035 |

|

Base Year for Estimation |

2024 |

|

Historical Data |

2023–2024 |

|

Forecast Period |

2025–2035 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2035 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Sensor Type, Technology, Application, End-User Industry, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Italy, Japan, China, South Korea, India, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa |

|

Key Companies Profiled |

ifm electronic GmbH, Pepperl+Fuchs SE, TURCK, Omron Corporation, Eaton Corporation plc, Baumer Holding AG, Honeywell International Inc., Schneider Electric SE, Rockwell Automation Inc., Balluff GmbH, SICK AG, Panasonic Corporation, Carlo Gavazzi Holding AG, Keyence Corporation, Melexis NV, Microchip Technology Inc., Renesas Electronics Corporation |

Click here to: Get Free Sample Pages of this Report

What are the key highlights of the inductive position sensor market?

What is the Inductive Position Sensor Market?

Inductive position sensors detect the presence and position of metallic objects in a non-contact way, using electromagnetic induction principles. These sensors work by generating an electromagnetic field in the area around the detection surface using a coil and oscillator and by converting changes to field characteristics into electrical output signals when metallic targets enter the sensing area. Because operation is non-contact, mechanical wear is avoided, which guarantees long operational life; as a result, inductive position sensors are some of the most important components in precision measurement for demanding industrial surroundings where reliability and resistance against contamination are required.

Some of the sensor configurations in the market include cylinder sensors, rectangular sensors, ring and slot sensors, and tubular sensors to respond to various mounting requirements and detection capabilities. Inductive position sensors also have a number of advantageous properties, including very high reliability with an average failure rate of less than 0.02% per year, predictable timing with deterministic properties, low power consumption, and insensitivity to environmental factors such as dust, oil, and moisture. The sensor can detect a wide range of metallic objects such as iron, aluminum, brass, copper, and steel, among others, at different sensing distances. Therefore, these sensors find applications in automotive throttle control, aerospace flight systems, industrial robotics, food processing equipment, and medical device manufacturing.

What are the major trends that drive the inductive position sensor market?

Overall, the inductive position sensor market is seeing major transformation driven by the integration between smart sensing and IO-Link connectivity. IO-Link has emerged as the building block of Industry 4.0 deployments because it makes commissioning easy with diagnostics that are able to predict failure events using standardized protocols for communication. The modern range of inductive position sensors with IO-Link capabilities has better diagnostic data output, enabling smarter factories with minimum disruption caused by unplanned maintenance downtime.

Miniaturization has emerged as one of the top trends: Miniaturization continues to be a key trend in inductive sensor design, with several manufacturers now offering compact cylindrical and rectangular models below 6 mm in diameter for use in robotic end-effectors, semiconductor handling, and medical automation systems. Top suppliers such as Pepperl+Fuchs, Baumer, ifm, and others provide miniature inductive sensors engineered for tight-tolerance integration, including ultra-flat and short-body formats intended for confined mounting environments.

At present, magnet-free inductive position sensing technology finds its place in automotive and industrial applications as a substitute to magnetic encoders. Inductive sensors offer immunity to stray magnetic fields; electric vehicles do indeed generate that form of electromagnetic interference from the motors and power electronics that could affect traditional magnetic sensors. Melexis and Renesas are among the companies developing inductive sensor ICs rated for wide ambient temperature ranges from -40°C to +160°C for automotive applications.

Inductive position sensors are increasingly being integrated with AI-enabled sensing and predictive maintenance capabilities. These smart sensors are now capable of capturing data in real-time, detecting anomalies, and scheduling predictive maintenance, thus ensuring measurable gains in deployment stability and process optimization across automated manufacturing environments.

What are the main driving factors in the inductive position sensor market?

Driver: Increasing Adoption of Industrial Automation & Industry 4.0

The major factors driving growth in the inductive position sensor market include increasing automation in industries such as automotive manufacturing and industrial sectors. Industry 4.0 initiatives accelerated the adoption by integration with PLCs and IoT platforms, as shown in expansions from TURCK and Balluff offering IO-Link-enabled models for improved diagnostics and real-time monitoring. Demand for accurate and reliable position sensing favors the deployment of robotics, assembly line automation, and smart factory systems.

Driver: Electric Vehicle Adoption and Automotive Electronics Growth

The automotive segment is a significant demand driver for inductive position sensors, supporting throttle position sensing, gear detection, camshaft monitoring, accelerator pedal position, and electronic power steering applications across electric and hybrid vehicle platforms. This translates to very significant demand for precision sensing in motor control, battery management systems, and by-wire applications, driven by industry trends in vehicle electrification and the development of autonomous driving, with global EV sales reaching record volumes in 2024 and expected to grow significantly through 2035.

What are the crucial opportunities available in the inductive position sensor market?

Opportunity: Electric Vehicle Motor Control and Battery Management

This is driven by demand from the rapidly growing electric vehicle market for inductive position sensors in motor encoders, battery management systems, and by-wire applications including steer-by-wire and brake-by-wire systems. Because of superior accuracy and immunity to magnetic interference, automotive OEMs are increasingly adopting inductive position sensors for throttle control, motor commutation, and pedal position sensing in EVs. Automotive-grade inductive sensors are available, with AEC-Q100 certification and ISO 26262 compliance enabling ASIL D safety compliance for mission-critical automotive applications needing functional safety assurance.

Opportunity: Medical Devices and Healthcare Applications

Applications of inductive sensors within medical imaging equipment, surgical robotics, and general healthcare devices continue to expand due to the high level of reliability with minimum maintenance intervention. Precision robotics used during minimally invasive surgery rely on inductive sensors for detecting movement and optimal performance in critical medical procedures. Non-contact inductive sensing eliminates the risk of contamination in sterile applications, while miniaturized sensors allow the integration into compact medical devices such as diagnostic equipment, patient monitoring systems, and therapeutic delivery mechanisms.

What are the major segments of the inductive position sensor market?

By Sensor Type:

Cylinder sensors hold the largest share of the overall market, primarily because of their compact structure, high resistance to shock and vibration, and compatibility with confined spaces in automated assembly lines and robotic actuation systems. This is well evidenced by TURCK's models, BI20U-M30, and similar offerings from ifm electronic and Pepperl+Fuchs.

Tubular sensors are anticipated to see the highest CAGR from 2025 to 2035, driven by increased demand within high-temperature automation environments, Industry 4.0 diagnostics via IO-Link integrations, and increased EV manufacturing and warehouse AGV applications requiring robust, non-contact precision sensing.

By Technology:

Digital output sensors hold the largest share due to Industry 4.0 requirements for real-time data acquisition, processing capabilities, and seamless integration with industrial control networks, driven by TURCK's 2024 IO-Link sensor expansions providing 2-byte process data and enhanced diagnostic functionalities.

The IO-Link enabled sensors segment is expected to grow at the highest CAGR from 2025 to 2035, powered by rapid adoption in smart factories for predictive maintenance applications, parameter transfer capabilities, and increased connectivity in EV motor control, industrial robotics, and automation systems requiring standardized communication protocols.

By Application:

Automotive industry holds the largest share of the overall market, mainly due to essential applications in throttle position sensing, gear detection, electronic power steering, and EV motor control, supported by ASIL D compliant ICs from Melexis and Renesas amid electrification trends.

However, the industrial manufacturing segment is expected to grow at the highest CAGR from 2025-2035, driven by Industry 4.0 automation, robotics (542,000 installs in 2024), and IO-Link expansions from TURCK/Balluff for assembly lines and AGVs.

Which region leads in the inductive position sensor market?

The Asia-Pacific region holds the largest share of the global inductive position sensor market in 2025, due to substantial deployments within automotive manufacturing, consumer electronics production, and industrial automation across China, Japan, South Korea, and India. China leads this market, while local manufacturing investments are supportive of high-volume supply chains to serve the automotive, industrial automation, and robotics industries. The country also continues its development of miniaturized tubular sensors below 6 mm in diameter, embeds diagnostic functions, and extends integrations to factory IoT architectures.

North America inductive position sensor market is mainly driven by its powerful R&D ecosystem, heavy presence of sensor manufacturers, and fast pace of integration of smart manufacturing technologies across industrial facilities.

The European region has been at the forefront when it comes to deploying industrial automation technologies, and manufacturers have been investing heavily in Industry 4.0 infrastructure development. Germany continues to remain a hotbed of innovation, with heavy demand being driven by its robust automotive and industrial automation sectors supporting precision sensing requirements. Global production leadership is concentrated in Europe and North America, where established companies including ifm electronic, Pepperl+Fuchs, and TURCK maintain manufacturing excellence and technology innovation leadership.

Who are the major players in the inductive position sensor market?

The inductive position sensor market is moderately consolidated, with key players ifm Electronic GmbH, Pepperl+Fuchs SE, and TURCK together accounting for the majority of share. Other major players in the market include Omron Corporation (Japan), Eaton Corporation plc (Ireland), Baumer Holding AG (Switzerland), Schneider Electric SE (France), Rockwell Automation Inc. (U.S.), Balluff GmbH (Germany), SICK AG (Germany), Panasonic Corporation (Japan), Carlo Gavazzi Holding AG (Switzerland), Keyence Corporation (Japan), and Fargo Controls Inc. (U.S.). The semiconductor companies dealing in inductive sensor ICs include Melexis NV (Belgium), Microchip Technology Inc. (U.S.), Renesas Electronics Corporation (Japan), ams OSRAM AG (Austria), Texas Instruments Incorporated (U.S.), and Infineon Technologies AG (Germany).

What are the Recent Developments in the Inductive Position Sensor Market?

The inductive position sensor market is expected to grow from USD 1.65 billion in 2025 to USD 3.14 billion by 2035.

The inductive position sensor market is expected to grow at a CAGR of 6.4% from 2025 to 2035.

The major players include ifm electronic GmbH, Pepperl+Fuchs SE, TURCK, Omron Corporation, Eaton Corporation plc, Baumer Holding AG, Honeywell International Inc., Schneider Electric SE, Rockwell Automation Inc., Balluff GmbH, SICK AG, Panasonic Corporation, and Keyence Corporation. ifm Electronic, Pepperl+Fuchs, and TURCK collectively hold approximately 60% market share.

The main factors driving the market include rising adoption of industrial automation and Industry 4.0, electric vehicle adoption and automotive electronics growth, increasing robotics deployment, growing demand for IoT-enabled sensing solutions, and the need for precise non-contact position sensing in harsh industrial environments.

Asia-Pacific region leads the global inductive position sensor market in 2025, driven by significant automotive manufacturing in China, Japan, and South Korea, rapid industrial automation adoption, and growing electronics production.

The automotive segment dominates the market, driven by applications in throttle position, gear position, accelerator pedal sensing, electronic power steering, and motor commutation in electric and hybrid vehicles.

Published Date: Apr-2025

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates