Resources

About Us

Sterilization Equipment Market Size, Share, Forecast, & Trends Analysis by Offering (Equipment [Heat {Moist (Gravity, High-speed), Dry (Static Air, Forced Air)}, Low-temperature {ETO, Formaldehyde}, Radiation, Filtration] Services – Global Forecast to 2035

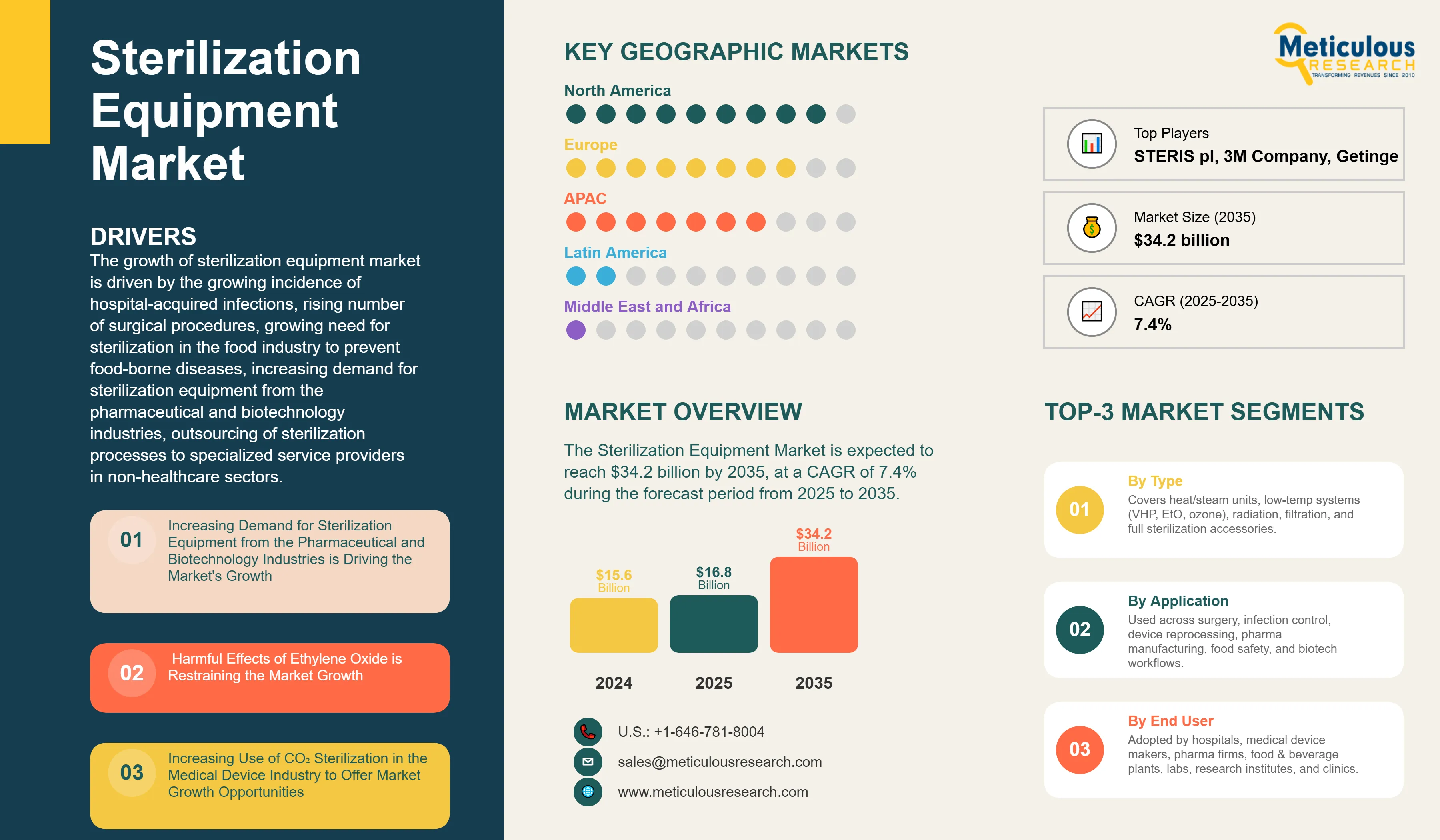

Report ID: MRHC - 104445 Pages: 334 Nov-2025 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe Sterilization Equipment Market was valued at $15.6 billion in 2024. This market is expected to reach $34.2 billion by 2035 from an estimated $16.8 billion in 2025, at a CAGR of 7.4% during the forecast period from 2025 to 2035.

The growth of sterilization equipment market is driven by the growing incidence of hospital-acquired infections, rising number of surgical procedures, growing need for sterilization in the food industry to prevent food-borne diseases, increasing demand for sterilization equipment from the pharmaceutical and biotechnology industries, outsourcing of sterilization processes to specialized service providers in non-healthcare sectors. However, the market growth is restrained by harmful effects of ethylene oxide and concerns regarding the safety of reprocessed instruments. Moreover, the rising adoption of e-beam sterilization, growing demand for sterilization products in emerging markets, rising utilization of CO2 sterilization technology in the medical device industry, and increased focus on infection control in both healthcare and non-healthcare sectors are expected to generate growth opportunities for market stakeholders. Non-compliance with sterilization standards in the healthcare sector and the shift from reusable medical devices to disposable medical devices pose challenges to the growth of the market.

Click here to: Get Free Sample Pages of this Report

Increasing Demand for Sterilization Equipment from the Pharmaceutical and Biotechnology Industries

Companies in the pharmaceutical and biotechnology industries are key end users of sterilization technologies, as these solutions are essential for maintaining sterile processing environments in pharmaceutical manufacturing facilities. As the pharmaceutical and biotechnology sectors grow, the products being developed, including biologics, gene therapies, and advanced therapeutics, have become increasingly complex.

Contamination risks present significant challenges for both manufacturers and patients, resulting in the increased demand for effective sterilization solutions. The growing focus on higher quality standards and the increasing prevalence of infections linked to compromised manufacturing environments are driving the demand for advanced sterilization techniques and related equipment in the development and manufacturing processes of pharmaceutical and biopharmaceutical products.

Furthermore, the demand for biologics is increasing due to their effectiveness in treating various diseases. However, the need for the sterile manufacturing of these sensitive molecules presents significant challenges to manufacturers. Biologics must be produced under aseptic conditions, typically using sterile filtration, as they cannot withstand traditional sterilization methods such as heat, chemical treatments, or radiation. Additionally, unit operations during sterile production, such as pumping, can potentially damage and degrade biologics. Therefore, sterile manufacturing requires skilled professionals with extensive knowledge of sterilization equipment. As a result, many pharmaceutical companies are opting to outsource the sterilization of biologics to specialized providers.

Harmful Effects of Ethylene Oxide is Restraining the Market Growth

Sterilization of medical devices using ethylene oxide (EtO) is commonly preferred by healthcare organizations for instruments that cannot withstand heat sterilization or that contain electrical components sensitive to other sterilization methods. However, concerns about the safety of EtO as a sterilizing agent have grown, particularly following statements from the CDC indicating that repeated exposure to EtO may lead to skin and mucous membrane irritation, central nervous system abnormalities, and an increased risk of cancer in some cases.

Acute exposure to EtO is associated with symptoms such as headache, nausea, vomiting, cyanosis, and shortness of breath. These health concerns have led to a growing reluctance among healthcare organizations and other users to utilize the EtO sterilization method. In the U.S., the Environmental Protection Agency (EPA) has classified ethylene oxide as a potential human carcinogen and has restricted its use in specific sterilization applications.

Furthermore, the European Union has banned the use of ethylene oxide (EtO) in the food and beverage industry due to safety and environmental concerns. The demand for both EtO sterilization equipment and contract sterilization services is expected to decline in the coming years as regulatory authorities in various countries continue to tighten policies regarding the use of EtO for sterilization purposes.

EtO sterilization usage is declining, especially in the U.S., due to stricter environmental regulations. The U.S. EPA finalized emission control standards in April 2024 mandating 80% reduction in EtO emissions at sterilization plants. In the EU, REACH legislation classifies EtO as a “Substance of Very High Concern” (SVHC) under review for total phase-down by 2026.

These actions are pushing hospitals and contract sterilizers to transition toward vaporized hydrogen peroxide (VHP) and ozone technologies. Companies like Sterigenics and Sotera Health have invested in retrofitting EtO facilities with hybrid or alternative sterilization systems to maintain compliance.

Sterilization Equipment Market Trends

Use of Ozone Sterilization

Ozone is recognized as an oxidizing microbial agent with a strong bactericidal effect that can destroy microorganisms such as bacteria and viruses. Decontamination and disinfection using ozone significantly reduce the microbial load. Ozone is produced naturally when ultraviolet light or sunlight interacts with oxygen, as well as through electrical discharge. However, its use has historically been limited due to its instability. Recent technological advances have made ozone generation easier and more stable, leading to its increased application in sterilization.

Ozone sterilization is primarily used for medical devices, such as endoscopes, which cannot withstand the high heat and humidity associated with standard steam autoclaving. The advantages of ozone sterilization of ozone sterilization include the requirement of only medical -grade oxygen, which is safe to handle and transport and is readily available in hospitals worldwide, eliminating the need for costly sterilant stocking, shorter cycle time for ozone sterilization as compared to EtO sterilization, and lower costs per cycle as compared to EtO sterilization.

Sterilization Equipment Market Opportunity

Increasing Use of CO2 Sterilization in the Medical Device Industry to Offer Market Growth Opportunities

The demand for carbon dioxide (CO2) sterilization is expected to rise due to increasing concerns and restrictions regarding the use of ethylene oxide (EtO). CO2 is utilized in the form of supercritical carbon dioxide (scCO2), a state in which CO2 exhibits both gas and liquid-like properties. The supercritical state is achieved when pressure exceeds approximately 1,070 psi (73 atm) and temperature is above ~31°C.

ScCO2 sterilization effectively inactivates bacterial, viral, fungal, and yeast pathogens. The benefits of using scCO2 sterilization for medical devices include:

Furthermore, Supercritical CO2 (scCO2) sterilization remains one of the fastest-growing segments, advancing at an estimated CAGR of 9% between 2025 and 2032. The method’s low toxicity, absence of residue, and shorter cycle times make it attractive for implantable and biocompatible medical devices.

Since 2023, medical device manufacturers such as STERIS plc and 3M Company have launched scCO2-based prototype systems for shielding polymer-based materials and electronics-sensitive devices. The development of CO2-compatible packaging films by French and Japanese material technology firms is aiding adoption, particularly in reusable instrument processing.

Additionally, according to Qarboon, a France-based machine manufacturer, scCO2 is well-suited for the treatment of various medical devices, including textiles, silicone, plastics, bi-materials, and intelligent medical devices. ScCO2 has a strong impact on the biological load present on these devices and can be used to pre-sterilize both implantable and non-implantable, single-use/reusable medical devices. The growth of the medical device industry is expected to drive demand for scCO2 sterilization, creating opportunities for market growth.

Sterilization Equipment Market Study: Key Findings

The Equipment Segment to Account for the Largest Share of this Market in 2025

Based on offerings, the sterilization equipment market is segmented into equipment, services, and consumables & accessories. In 2025, the equipment segment is expected to account for the largest share of 55% of the sterilization equipment market. The substantial market share of this segment is due to the rising incidence of hospital-acquired infections, the high adoption of sterilization equipment in the medical devices and pharmaceutical industries, and the increasing need to ensure the safety of food & beverages.

The Pharmaceutical and Biotechnology Companies Segment to Account for the Largest Share of this Market in 2025

Based on end users, the sterilization equipment market is segmented into hospitals & clinics, medical device companies, pharmaceutical companies, food & beverage industry, and other end users. In 2025, the hospitals & clinics segment is expected to account for the largest share of 36% of the sterilization equipment market. This segment's substantial market share is due to the high prevalence of HAIs, rising number of surgical procedures, growing demand for clean and quality healthcare facilities among people, and increasing burden of chronic diseases associated with an aging population. According to the World Health Organization (WHO), out of every 100 patients in acute care hospitals, seven patients in high-income countries and 15 patients in low- and middle-income countries will be affected by at least one healthcare-acquired infection (HAI) during their hospital stay.

Geographical Analysis

In 2025, North America to Dominate the Sterilization Equipment Market

Based on geography, the global sterilization equipment market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of 45% of the global sterilization equipment market, followed by Europe and Asia-Pacific. The largest share of the region is attributed to the growing hospital & outpatient visits, rising number of surgical procedures, growing incidence of HAIs, increasing healthcare expenditure, growth in the pharma & biotech industries, and government initiatives to reduce HAIs and implement effective sterilization practices in the region.

Sterilization Equipment Market: Key Companies

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants over the past three to four years. The key players profiled in sterilization equipment market report are STERIS plc (U.S.), 3M Company (U.S.), Getinge AB (Sweden), Cardinal Health, Inc. (U.S.), Advanced Sterilization Products, Inc. (U.S.) (A subsidiary of Fortive Corporation), Fedegari Autoclavi SpA (Italy), Stryker Corporation (U.S.), ANTONIO MATACHANA, S. A. (Spain), SteelcoBelimed AG (Switzerland), Sotera Health Company (U.S.), Benchmark Scientific Inc (U.S.), MMM Münchener Medizin Mechanik GmbH (Germany), Tuttnauer (Netherlands), and Consolidated Sterilizer Systems (U.S.), Andersen Sterilizers, Inc. (U.S.).

Sterilization Equipment Market Industry Overview: Latest Developments from Key Industry Players

|

Particulars |

Details |

|

Page No |

334 |

|

Format |

|

|

Forecast Period |

2025-2035 |

|

Base Year |

2024 |

|

CAGR |

7.4% |

|

Market Size (2025) |

$16.8 billion |

|

Market Size (2035) |

$34.2 billion |

|

Segments Covered |

By Offering

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Belgium, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (Saudi Arabia, U.A.E., South Africa, and Rest of Middle East & Africa) |

|

Key Companies |

STERIS plc (U.S.), 3M Company (U.S.), Getinge AB (Sweden), Cardinal Health, Inc. (U.S.), Advanced Sterilization Products, Inc. (U.S.) (A subsidiary of Fortive Corporation), Fedegari Autoclavi SpA (Italy), Stryker Corporation (U.S.), ANTONIO MATACHANA, S. A. (Spain), SteelcoBelimed AG (Switzerland), Sotera Health Company (U.S.), Benchmark Scientific Inc (U.S.), MMM Münchener Medizin Mechanik GmbH (Germany), Tuttnauer (Netherlands), and Consolidated Sterilizer Systems (U.S.), Andersen Sterilizers, Inc. (U.S.) |

This study provides insights into sterilization equipment market segmented based on offering (equipment, services, consumables & accessories) offered by key companies to various end users, such as hospitals & clinics, medical device companies, pharmaceutical companies, food & beverage industry, and other end users. This report involves the value analysis of various segments and sub-segments of the market at the regional and country levels.

The sterilization equipment market is projected to reach $34.2 billion by 2035, at a CAGR of 7.4% during the forecast period.

The equipment segment is expected to account for the largest share of sterilization equipment market in 2025. Factors such as their effectiveness in sterilizing the reusable medical instruments, surgical instruments, and other materials required for various microbial-safe environments support this segment's largest share.

Based on end-user, the hospitals & clinics segment is projected to register the highest growth during the forecast period.

The growing incidence of hospital-acquired infections, rising number of surgical procedures, growing need for sterilization in the food industry to prevent food-borne diseases, increasing demand for sterilization equipment from the pharmaceutical and biotechnology industries, outsourcing of sterilization processes to specialized service providers in non-healthcare sectors are factors supporting the growth of this market. Further, the rising adoption of e-beam sterilization, growing demand for sterilization products in emerging markets, rising utilization of CO2 sterilization technology in the medical device industry, and increased focus on infection control in both healthcare and non-healthcare sectors are anticipated to offer significant growth opportunities for companies operating in this market.

The key players operating in sterilization equipment market are STERIS plc (U.S.), 3M Company (U.S.), Getinge AB (Sweden), Cardinal Health, Inc. (U.S.), Advanced Sterilization Products, Inc. (U.S.) (A subsidiary of Fortive Corporation), Fedegari Autoclavi SpA (Italy), Stryker Corporation (U.S.), ANTONIO MATACHANA, S. A. (Spain), SteelcoBelimed AG (Switzerland), Sotera Health Company (U.S.), Benchmark Scientific Inc (U.S.), MMM Münchener Medizin Mechanik GmbH (Germany), Tuttnauer (Netherlands), and Consolidated Sterilizer Systems (U.S.), Andersen Sterilizers, Inc. (U.S.).

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Data Collection & Validation Process

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Sizing & Forecasting

2.3.1. Market Size Estimation Approach

2.3.2. Market Share Analysis

2.3.3. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Impact Analysis of Market Dynamics

4.2.1.1. Increasing Demand for Sterilization Equipment from the Pharmaceutical and Biotechnology Industries is Driving the Market's Growth

4.2.1.2. Harmful Effects of Ethylene Oxide is Restraining the Market Growth

4.2.1.3. Increasing Use of CO₂ Sterilization in the Medical Device Industry to Offer Market Growth Opportunities

4.2.1.4. Concerns Regarding the Safety of Reprocessed Instruments is Challenging the Market Growth

4.2.2. Macroindicators

4.3. Industry & Technology Trends

4.3.1. Ozone Sterilization

4.3.2. Electrostatic Spraying

4.3.3. Liquid Chemical Sterilization

4.3.4. Enhanced Efficiency and Speed

4.3.5. Integration of Intelligent Control Systems

4.4. Regulatory Analysis

4.4.1. International Organization for Standardization (ISO)

4.4.2. North America

4.4.2.1. U.S.

4.4.2.2. Canada

4.4.3. Europe

4.4.4. Asia-Pacific

4.4.4.1. China

4.4.4.2. Japan

4.4.4.3. India

4.4.5. Latin America

4.4.6. Middle East & Africa

4.5. Pricing Analysis

4.6. Value Chain Analysis

5. Global Sterilization Equipment Market Assessment — by Offering

5.1. Overview

5.2. Equipment

5.2.1. Heat/Steam Sterilization Equipment

5.2.1.1. Moist Heat Sterilizers

5.2.1.1.1. Horizontal Sterilizer

5.2.1.1.2. Vertical Sterilizers

5.2.1.1.3. Table-Top Sterilizers

5.2.2. Low-Temperature Sterilization Equipment

5.2.2.1. Hydrogen Peroxide/Gas Plasma Sterilizers

5.2.2.2. Ethylene Oxide Sterilizers

5.2.2.3. Ozone-Based Sterilizers

5.2.2.4. Formaldehyde Sterilizers

5.2.2.5. Other Low-Temperature Sterilization Equipment

5.2.3. Radiation Sterilization Equipment

5.2.3.1. Ionizing Radiation Sterilizers

5.2.3.2. Non-Ionizing Radiation Sterilizers

5.2.4. Filtration Sterilization Equipment

5.3. Services

5.3.1. Ethylene Oxide Sterilization Services

5.3.2. Gamma Sterilization Services

5.3.3. E-Beam Sterilization Services

5.3.4. Steam Sterilization Services

5.3.5. Other Sterilization Services

5.4. Consumables & Accessories

5.4.1. Instrument Packaging & Pouches

5.4.2. Sterilants

5.4.3. Sterilization Indicators

5.4.3.1. Biological Indicators

5.4.3.2. Chemical Indicators

5.4.4. Other Consumables & Accessories

6. Sterilization Equipment Market — by End User

6.1. Overview

6.2. Hospitals & Clinics

6.3. Medical Device Companies

6.3.1. Class IIb

6.3.2. Class III

6.3.3. Others

6.4. Pharmaceutical Companies

6.5. Food & Beverage Industry

6.6. Diagnostic Laboratories

6.7. Academic and Research Institutes

6.8. Other End Users

7. Sterilization Equipment Market Assessment — by Geography

7.1. Overview

7.2. North America

7.2.1. U.S.

7.2.2. Canada

7.3. Europe

7.3.1. Germany

7.3.2. France

7.3.3. U.K.

7.3.4. Italy

7.3.5. Spain

7.3.6. Switzerland

7.3.7. Belgium

7.3.8. Rest of Europe

7.4. Asia-Pacific

7.4.1. China

7.4.2. Japan

7.4.3. India

7.4.4. Australia

7.4.5. South Korea

7.4.6. Rest of Asia-Pacific

7.5. Latin America

7.5.1. Brazil

7.5.2. Mexico

7.5.3. Rest of Latin America

7.6. Middle East & Africa

7.6.1. Saudi Arabia

7.6.2. UAE

7.6.3. South Africa

7.6.4. Rest of Middle East & Africa

8. Competition Analysis

8.1. Overview

8.2. Key Growth Strategies

8.3. Competitive Benchmarking

8.4. Competitive Dashboard

8.4.1. Industry Leaders

8.4.2. Market Differentiators

8.4.3. Vanguards

8.4.4. Emerging Companies

8.5. Market Share Analysis (2024)

8.5.1. Steris Plc (U.S.)

8.5.2. Advanced Sterilization Products, Inc. (U.S.) (A Subsidiary of Fortive Corporation)

8.5.3. Getinge AB (Sweden)

8.5.4. Steelcobelimed AG (Switzerland)

8.6. Key Equipment Players and Their Primary Targeted End Users/Customer Segments

9. Company Profiles

9.1. Steris plc

9.1.1. Company Overview

9.1.2. Financial Overview

9.1.3. Product Portfolio

9.1.4. Strategic Developments

9.1.5. SWOT Analysis

9.2. Getinge AB

9.2.1. Company Overview

9.2.2. Financial Overview

9.2.3. Product Portfolio

9.2.4. Strategic Developments

9.2.5. SWOT Analysis

9.3. Advanced Sterilization Products, Inc. (A Subsidiary of Fortive Corporation)

9.3.1. Company Overview

9.3.2. Financial Overview

9.3.3. Product Portfolio

9.3.4. Strategic Developments

9.3.5. SWOT Analysis

9.4. Sotera Health Company (U.S.)

9.4.1. Company Overview

9.4.2. Financial Overview

9.4.3. Product Portfolio

9.4.4. Strategic Developments

9.4.5. SWOT Analysis

9.5. Steelcobelimed AG (A Subsidiary of Miele & Cie. Kg)

9.5.1. Company Overview

9.5.2. Product Portfolio

9.5.3. Strategic Developments

9.5.4. SWOT Analysis

9.6. Tuttnauer

9.6.1. Company Overview

9.6.2. Product Portfolio

9.6.3. Strategic Developments

9.7. Consolidated Sterilizer Systems

9.7.1. Company Overview

9.7.2. Product Portfolio

9.8. Antonio Matachana, S. A. (Matachana Group)

9.8.1. Company Overview

9.8.2. Product Portfolio

9.8.3. Strategic Developments

9.9. Stryker Corporation (U.S.)

9.9.1. Company Overview

9.9.2. Financial Overview

9.9.3. Product Portfolio

9.10. Benchmark Scientific Inc.

9.10.1. Company Overview

9.10.2. Product Portfolio

9.10.3. Strategic Developments

9.11. MMM Münchener Medizin Mechanik GmbH

9.11.1. Company Overview

9.11.2. Product Portfolio

9.11.3. Strategic Developments

9.12. Fedegari Autoclavi SpA

9.12.1. Company Overview

9.12.2. Product Portfolio

9.12.3. Strategic Developments

9.13. 3M Company

9.13.1. Company Overview

9.13.2. Financial Overview

9.13.3. Product Portfolio

9.14. Andersen Sterilizers, Inc.

9.14.1. Company Overview

9.14.2. Product Portfolio

9.14.3. Strategic Developments

10. Appendix

10.1. Available Customization

List of Tables

Table 1 Current Health Expenditure Per Capita, by Country, 2024 (in USD)

Table 2 Percentage of Knee/Hip Replacement Patients with More Than Three Months of Waiting Time (From Specialist Assessment to Treatment), by Country, 2020 Vs. 2021 (%)

Table 3 Percentage of the Population Aged 65 Years or Above, by Region, 2022 Vs. 2030 Vs. 2050

Table 4 Common Haisw with Their Incidence Rate Worldwide

Table 5 ISO Compliance Regulations

Table 6 Standards for Development, Validation, and Routine Control of a Sterilization Process

Table 7 Tuttnauer (Netherlands): Product Pricing (USD/Unit)

Table 8 Steris Plc (Ireland): Product Pricing (USD/Unit)

Table 9 3m Company (U.S.): Product Pricing (USD/Unit)

Table 10 Benchmark Scientific Inc (U.S.): Product Pricing (USD/Unit)

Table 11 Global Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 12 Global Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 13 Global Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 14 Global Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 15 Global Heat/Steam Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 16 Global Moist Heat Sterilizers Market, by Type, 2023-2035 (USD Million)

Table 17 Global Moist Heat Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 18 Global Horizontal Sterilizer Market, by Country/Region, 2023-2035 (USD Million)

Table 19 Global Vertical Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 20 Global Table-Top Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 21 Global Low-Temperature Sterilizers Market, by Type, 2023-2035 (USD Million)

Table 22 Global Low-Temperature Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 23 Global Hydrogen Peroxide/Gas Plasma Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 24 Global Ethylene Oxide Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 25 Global Ozone-Based Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 26 Global Formaldehyde Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 27 Global Other Low-Temperature Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 28 Comparison of Various Radiation Sterilization Methods

Table 29 Global Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 30 Global Radiation Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 31 Global Ionizing Radiation Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 32 Global Non-Ionizing Radiation Sterilizers Market, by Country/Region, 2023-2035 (USD Million)

Table 33 Global Filtration Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 34 Global Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 35 Global Sterilization Services Market, by Country/Region, 2023-2035 (USD Million)

Table 36 Global Ethylene Oxide Sterilization Services Market, by Country/Region, 2023-2035 (USD Million)

Table 37 Global Gamma Sterilization Services Market, by Country/Region, 2023-2035 (USD Million)

Table 38 Advantages of E-Beam Sterilization

Table 39 Global E-Beam Sterilization Services Market, by Country/Region, 2023-2035 (USD Million)

Table 40 Global Steam Sterilization Services Market, by Country/Region, 2023-2035 (USD Million)

Table 41 Global Other Sterilization Services Market, by Country/Region, 2023-2035 (USD Million)

Table 42 Global Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 43 Global Sterilization Consumables & Accessories Market, by Country/Region, 2023-2035 (USD Million)

Table 44 Global Instrument Packaging & Pouches Market, by Country/Region, 2023-2035 (USD Million)

Table 45 Global Sterilant Market, by Country/Region, 2023-2035 (USD Million)

Table 46 Global Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 47 Global Sterilization Indicators Market, by Country/Region, 2023-2035 (USD Million)

Table 48 Global Biological Indicators Market, by Country/Region, 2023-2035 (USD Million)

Table 49 Global Chemical Indicators Market, by Country/Region, 2023-2035 (USD Million)

Table 50 Global Other Consumables & Accessories Market, by Country/Region, 2023-2035 (USD Million)

Table 51 Global Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 52 Global Sterilization Equipment Market for Hospitals & Clinics, by Country/Region, 2023–2035 (USD Million)

Table 53 Global Sterilization Equipment Market for Medical Device Companies, by Country/Region, 2023–2035 (USD Million)

Table 54 Global Sterilization Equipment Market for Class Iib Medical Device Companies, by Country/Region, 2023–2035 (USD Million)

Table 55 Global Sterilization Equipment Market for Class Iii Medical Device Companies, by Country/Region, 2023–2035 (USD Million)

Table 56 Global Sterilization Equipment Market for Other Medical Device Companies, by Country/Region, 2023–2035 (USD Million)

Table 57 Global Sterilization Equipment Market for Pharmaceutical Companies, by Country/Region, 2023–2035 (USD Million)

Table 58 Global Sterilization Equipment Market for the Food & Beverage Industry, by Country/Region, 2023–2035 (USD Million)

Table 59 Global Sterilization Equipment Market for the Diagnostic Laboratories, by Country/Region, 2023–2035 (USD Million)

Table 60 Global Sterilization Equipment Market for the Academic and Research Institutes, by Country/Region, 2023–2035 (USD Million)

Table 61 Global Sterilization Equipment Market for Other End Users, by Country/Region, 2023–2035 (USD Million)

Table 62 Global Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 63 North America: Sterilization Equipment Market, by Country, 2023-2035 (USD Million)

Table 64 North America: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 65 North America: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 66 North America: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 67 North America: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 68 North America: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 69 North America: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 70 North America: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 71 North America: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 72 North America: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 73 North America: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 74 U.S.: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 75 U.S.: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 76 U.S.: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 77 U.S.: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 78 U.S.: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 79 U.S.: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 80 U.S.: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 81 U.S.: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 82 U.S.: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 83 U.S.: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 84 Canada: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 85 Canada: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 86 Canada: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 87 Canada: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 88 Canada: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 89 Canada: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 90 Canada: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 91 Canada: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 92 Canada: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 93 Canada: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 94 Europe: Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 95 Europe: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 96 Europe: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 97 Europe: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 98 Europe: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 99 Europe: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 100 Europe: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 101 Europe: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 102 Europe: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 103 Europe: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 104 Europe: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 105 Germany: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 106 Germany: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 107 Germany: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 108 Germany: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 109 Germany: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 110 Germany: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 111 Germany: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 112 Germany: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 113 Germany: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 114 Germany: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 115 France: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 116 France: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 117 France: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 118 France: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 119 France: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 120 France: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 121 France: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 122 France: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 123 France: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 124 France: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 125 U.K.: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 126 U.K.: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 127 U.K.: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 128 U.K.: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 129 U.K.: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 130 U.K.: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 131 U.K.: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 132 U.K.: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 133 U.K.: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 134 U.K.: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 135 Italy: Food & Agricultural Product Exports to the U.S., 2021 (USD)

Table 136 Italy: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 137 Italy: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 138 Italy: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 139 Italy: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 140 Italy: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 141 Italy: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 142 Italy: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 143 Italy: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 144 Italy: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 145 Italy: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 146 Spain: Number of Surgeries Performed, by Type (2021–2023)

Table 147 Spain: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 148 Spain: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 149 Spain: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 150 Spain: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 151 Spain: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 152 Spain: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 153 Spain: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 154 Spain: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 155 Spain: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 156 Spain: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 157 Switzerland: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 158 Switzerland: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 159 Switzerland: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 160 Switzerland: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 161 Switzerland: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 162 Switzerland: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 163 Switzerland: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 164 Switzerland: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 165 Switzerland: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 166 Switzerland: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 167 Belgium: Pharmaceutical Production, 2020–2023 (USD Billion)

Table 168 Belgium: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 169 Belgium: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 170 Belgium: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 171 Belgium: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 172 Belgium: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 173 Belgium: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 174 Belgium: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 175 Belgium: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 176 Belgium: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 177 Belgium: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 178 Rest of Europe: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 179 Rest of Europe: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 180 Rest of Europe: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 181 Rest of Europe: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 182 Rest of Europe: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 183 Rest of Europe: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 184 Rest of Europe: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 185 Rest of Europe: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 186 Rest of Europe: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 187 Rest of Europe: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 188 Asia-Pacific: Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 189 Asia-Pacific: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 190 Asia-Pacific: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 191 Asia-Pacific: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 192 Asia-Pacific: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 193 Asia-Pacific: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 194 Asia-Pacific: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 195 Asia-Pacific: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 196 Asia-Pacific: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 197 Asia-Pacific: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 198 Asia-Pacific: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 199 China: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 200 China: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 201 China: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 202 China: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 203 China: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 204 China: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 205 China: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 206 China: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 207 China: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 208 China: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 209 Japan: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 210 Japan: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 211 Japan: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 212 Japan: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 213 Japan: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 214 Japan: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 215 Japan: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 216 Japan: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 217 Japan: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 218 Japan: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 219 India: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 220 India: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 221 India: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 222 India: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 223 India: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 224 India: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 225 India: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 226 India: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 227 India: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 228 India: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 229 Australia: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 230 Australia: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 231 Australia: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 232 Australia: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 233 Australia: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 234 Australia: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 235 Australia: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 236 Australia: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 237 Australia: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 238 Australia: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 239 South Korea: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 240 South Korea: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 241 South Korea: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 242 South Korea: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 243 South Korea: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 244 South Korea: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 245 South Korea: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 246 South Korea: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 247 South Korea: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 248 South Korea: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 249 Rest of Asia-Pacific: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 250 Rest of Asia-Pacific: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 251 Rest of Asia-Pacific: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 252 Rest of Asia-Pacific: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 253 Rest of Asia-Pacific: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 254 Rest of Asia-Pacific: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 255 Rest of Asia-Pacific: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 256 Rest of Asia-Pacific: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 257 Rest of Asia-Pacific: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 258 Rest of Asia-Pacific: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 259 Latin America: Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 260 Latin America: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 261 Latin America: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 262 Latin America: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 263 Latin America: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 264 Latin America: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 265 Latin America: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 266 Latin America: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 267 Latin America: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 268 Latin America: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 269 Latin America: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 270 Brazil: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 271 Brazil: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 272 Brazil: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 273 Brazil: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 274 Brazil: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 275 Brazil: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 276 Brazil: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 277 Brazil: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 278 Brazil: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 279 Brazil: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 280 Mexico: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 281 Mexico: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 282 Mexico: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 283 Mexico: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 284 Mexico: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 285 Mexico: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 286 Mexico: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 287 Mexico: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 288 Mexico: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 289 Mexico: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 290 Rest of Latin America: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 291 Rest of Latin America: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 292 Rest of Latin America: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 293 Rest of Latin America: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 294 Rest of Latin America: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 295 Rest of Latin America: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 296 Rest of Latin America: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 297 Rest of Latin America: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 298 Rest of Latin America: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 299 Rest of Latin America: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 300 Middle East & Africa: Sterilization Equipment Market, by Country/Region, 2023-2035 (USD Million)

Table 301 Middle East & Africa: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 302 Middle East & Africa: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 303 Middle East & Africa: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 304 Middle East & Africa: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 305 Middle East & Africa: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 306 Middle East & Africa: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 307 Middle East & Africa: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 308 Middle East & Africa: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 309 Middle East & Africa: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 310 Middle East & Africa: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 311 Saudi Arabia: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 312 Saudi Arabia: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 313 Saudi Arabia: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 314 Saudi Arabia: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 315 Saudi Arabia: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 316 Saudi Arabia: Sterilization Equipment Services Market, by Type, 2023-2035 (USD Million)

Table 317 Saudi Arabia: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 318 Saudi Arabia: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 319 Saudi Arabia: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 320 Saudi Arabia: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 321 UAE: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 322 UAE: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 323 UAE: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 324 UAE: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 325 UAE: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 326 UAE: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 327 UAE: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 328 UAE: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 329 UAE: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 330 UAE: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 331 South Africa: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 332 South Africa: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 333 South Africa: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 334 South Africa: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 335 South Africa: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 336 South Africa: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 337 South Africa: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 338 South Africa: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 339 South Africa: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 340 South Africa: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 341 Rest of Middle East & Africa: Sterilization Equipment Market, by Offering, 2023-2035 (USD Million)

Table 342 Rest of Middle East & Africa: Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 343 Rest of Middle East & Africa: Heat/Steam Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 344 Rest of Middle East & Africa: Low-Temperature Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 345 Rest of Middle East & Africa: Radiation Sterilization Equipment Market, by Type, 2023-2035 (USD Million)

Table 346 Rest of Middle East & Africa: Sterilization Services Market, by Type, 2023-2035 (USD Million)

Table 347 Rest of Middle East & Africa: Sterilization Consumables & Accessories Market, by Type, 2023-2035 (USD Million)

Table 348 Rest of Middle East & Africa: Sterilization Indicators Market, by Type, 2023-2035 (USD Million)

Table 349 Rest of Middle East & Africa: Sterilization Equipment Market, by End User, 2023-2035 (USD Million)

Table 350 Rest of Middle East & Africa: Sterilization Equipment Market for Medical Device Companies, by Type, 2023-2035 (USD Million)

Table 351 Recent Developments, by Company (2023-2025)

Table 352 Heat/Steam Sterilization Equipment (Moist & Dry-Heat Autoclaves)

Table 353 Dry-Heat & Depyrogenation Ovens

Table 354 Low Temperature Sterilization Equipment: Ethylene Oxide (Eto) Sterilizers

Table 355 Low Temperature Sterilization Equipment: H₂O₂ / Gas-Plasma / VHP

Table 356 Low Temperature Sterilization Equipment: Ozone / Formaldehyde / Other Niche Low-Temp Methods

Table 357 Filtration Sterilization Equipment

Table 358 Getinge Ab: Financial Snapshot (2024)

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing & Growth Forecast Approach

Figure 7 Global Sterilization Equipment Market, by Offering, 2025 Vs. 2035 (USD Million)

Figure 8 Global Sterilization Equipment Market, by End User, 2025 Vs. 2035 (USD Million)

Figure 9 Global Sterilization Equipment Market, by Geography, 2025 Vs. 2035 (USD Million)

Figure 10 Impact Analysis of Market Dynamics

Figure 11 Global Pharmaceutical R&D Expenditure, 2016-2028 (USD Billion)

Figure 12 National Institutes of Health (NIH) Annual Budgets, 2016-2022 (USD Billion)

Figure 13 India: Medical Devices Regulatory Pathway

Figure 14 Value Chain Analysis

Figure 15 Global Sterilization Equipment Market, by Offering, 2025 Vs. 2035 (USD Million)

Figure 16 Global Sterilization Equipment Market, by End User, 2025 Vs. 2035 USD Million)

Figure 17 Global Sterilization Equipment Market, by Geography, 2025 Vs. 2035 (USD Million)

Figure 18 North America: Sterilization Equipment Market Snapshot

Figure 19 U.S.: Number of Individuals with Chronic Conditions, 2005–2030 (in Million)

Figure 20 Europe: Pharmaceutical Industry R&D Expenditure, 2000–2021 (USD Million)

Figure 21 Europe: Sterilization Equipment Market Snapshot

Figure 22 Asia-Pacific: Sterilization Equipment Market Snapshot

Figure 23 Japan: Number of Hip Fractures, 2007-2040

Figure 24 Latin America: Sterilization Equipment Market Snapshot

Figure 25 Middle East & Africa: Sterilization Equipment Market Snapshot

Figure 26 Key Growth Strategies Adopted by Leading Players (2023–2025)

Figure 27 Sterilization Equipment Market: Competitive Benchmarking (Based on Offering)

Figure 28 Sterilization Equipment Market: Competitive Benchmarking (Based on Geography)

Figure 29 Competitive Dashboard: Sterilization Equipment Market

Figure 30 Global Sterilization Equipment Market Share Analysis, by Key Players, 2024 (%)

Figure 31 Steris Plc: Financial Snapshot (2024)

Figure 32 Fortive Corporation: Financial Snapshot (2024)

Figure 33 Sotera Health Company: Financial Overview (2022-2024)

Figure 34 Stryker Corporation: Financial Overview (2024)

Figure 35 3M Company: Financial Snapshot (2024)

Published Date: Oct-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates