Resources

About Us

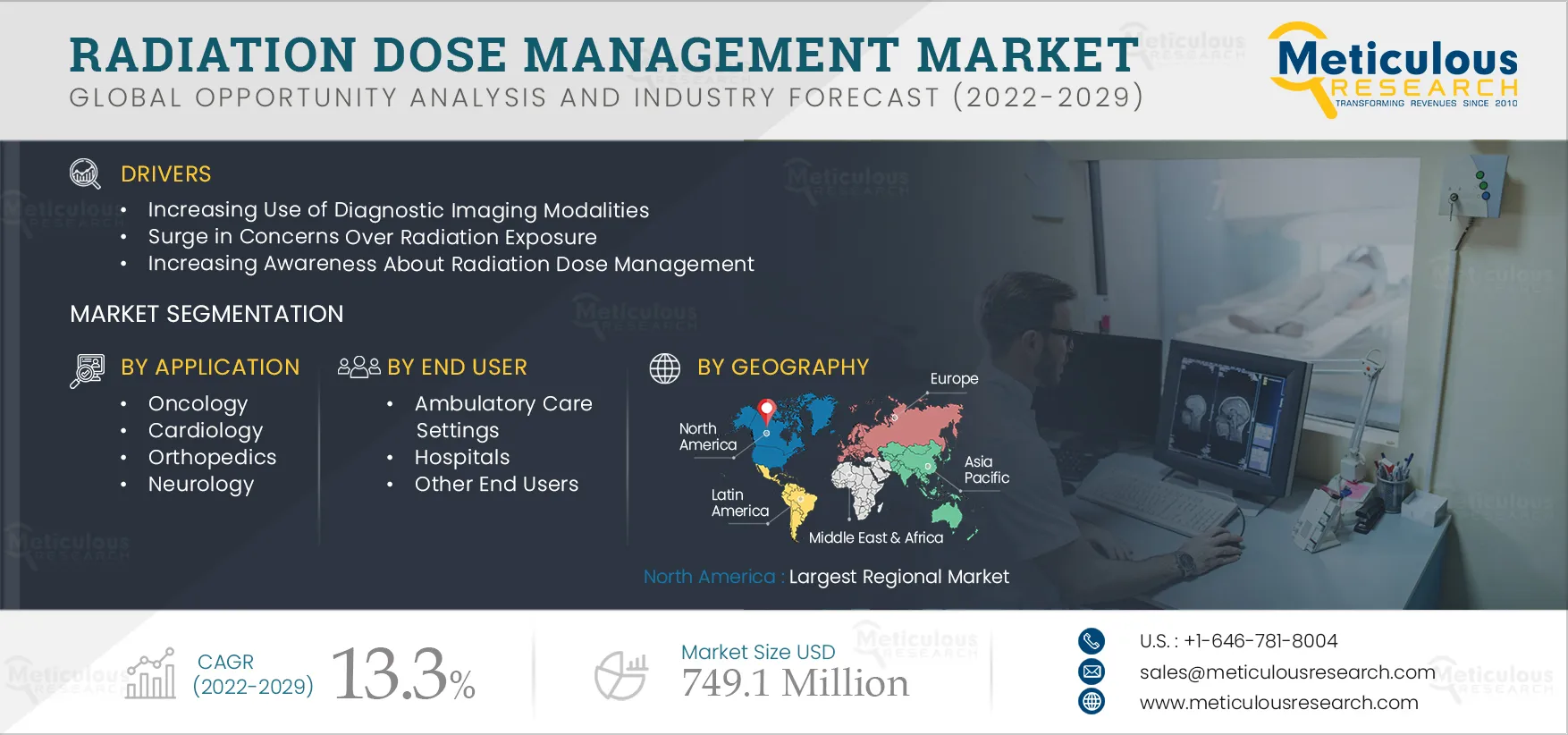

Radiation Dose Management Market by Solution & Service, Modality (CT, Nuclear Medicine, Fluoroscopy, Mammography), Application (Oncology, Cardiology, Orthopedic, Neurology), End User (Hospitals, Ambulatory Care Setting) - Global Forecast to 2029

Report ID: MRHC - 104710 Pages: 190 Nov-2022 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Radiation Dose Management Market is projected to reach $749.1 million by 2029, at a CAGR of 13.3% from 2022 to 2029. Dose management systems are used for monitoring patient exposure to ionization emission, optimization, compliance with diagnostic reference levels, and quality assurance. Dose management systems support the tasks and duties of radiation protection in accordance with local and national requirements. They support radiographers, medical practitioners, medical physics experts (MPE) and other health professionals involved in imaging.

During the initial phase of the pandemic, several countries postponed non-urgent diagnostic imaging surgeries. Considering the contagious nature of the disease, the usage of imaging equipment on COVID-19 patients posed a serious hazard for other patients and healthcare providers. There was an abrupt decline in demand for imaging services. Additionally, in the U.S., the Centers for Disease Control and Prevention and the American College of Radiology recommend using alternative techniques to diagnose COVID-19 rather than the routine use of chest radiographs or CT scans. This temporarily negatively impacted the market.

However, there was a surge in diagnostic imaging after the first phase of the lockdown. For example, in Australia, there was a significant decrease in total imaging services performed from March to May 2020. Later, a significant increase was observed in nuclear medicine and CT services post-June 2020. Thus, radiology volumes were dependent on the stage/period of lockdown, location, and imaging modality. The market is recovering from the negative impact of COVID-19, and the demand for medical imaging is further expected to rise.

Click here to: Get Free Sample Copy of this report

Physicians are using diagnostic medical modalities to diagnose and treat diseases. They rely on these modalities for various reasons, such as increased patient inflow and advancements in diagnostic imaging. Also, there has been a surge in the burden of chronic diseases. The prevalence of cancer, cardiac, and orthopedic diseases is increasing due to various factors which require imaging modalities for diagnosis. For example, according to International Agency for Research on Cancer (IARC), in 2020, there were 2.3 million women diagnosed with breast cancer, with 685,000 deaths globally. Between 2015 and 2020, there were 7.8 million women diagnosed with breast cancer. The incidence of breast cancer is estimated to reach 2.74 million cases by 2030.

In pediatric radiology, greater body size and composition variation within and across age groups pose a challenge in dose optimization. Radiation dose optimization is important in pediatric radiology, as children are more susceptible to the potentially harmful effects of ionizing radiation. As per National Cancer Institute, in the U.S., approximately 5 million to 9 million CT examinations are performed on children annually. Additionally, most of the known dose values and trends correspond to adults. Thus, there is a trend in pediatric imaging to reduce the levels of radiation dose within pediatric imaging exams.

Based on Offering, in 2022, the Solutions Segment is Expected to Account for the Largest Share of the Market

Increased awareness and regulations for ionizing radiation contributed to the large market share of the solutions segment. The U.S. Joint Commission, which accredits and certifies more than 22,000 hospitals and healthcare organizations in the country , has introduced new standards effective from July 2022. As per the new regulations, hospitals are required to establish stricter radiation dose management processes. Furthermore, with the approval of the National Electrical Manufacturers Association's Medical Imaging & Technology Alliance (MITA) Smart Dose, MITA has continued its efforts on dose reduction. MITA Smart Dose is a standard that offers healthcare providers an additional tool to optimize and manage doses in CT scanning.

Based on Modality, in 2022, the Computed Topography Segment is Expected to Account for the Largest Share of the Market

Based on modality, the radiation dose management market is segmented into computed tomography, fluoroscopy and interventional imaging, nuclear medicine, radiography, and mammography. In 2022, the computed tomography segment is expected to account for the largest share of the radiation dose management market. The large market share of this segment is attributed to the increased early disease diagnosis, a rise in the prevalence of targeted diseases, and the preference for non-invasive diagnostic procedures owing to a surge in computed tomography examinations.

Based on Application, in 2022, the Oncology Segment is Expected to Account for the Largest Share of the Market

Based on application, the radiation dose management market is segmented into oncology, cardiology, orthopedics, neurology, and other applications. In 2022, the oncology segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the increasing burden of cancer and increased usage of imaging modalities in oncology. As per the American Cancer Society, in 2021, 1.9 million new cancer cases and 608,570 deaths due to cancer were recorded in the U.S. Furthermore, according to the International Agency for Research on Cancer (IARC), in 2018, globally, there were 18.1 million cancer cases compared to 19.3 million in 2020.

In March 2021, the World Health Organization (WHO) introduced a Global Breast Cancer Initiative which aims to reduce global breast mortality by 2.5% by 2040. The initiative aims to reduce 2.5 million deaths globally, especially in low-income countries where more efforts are needed to tackle the disease. In October 2021, The Breast Cancer Research Foundation (BCRF) announced funding of USD 47.5 million in breast cancer research. This funding will support 250 scientists at leading academic and medical institutions across 14 countries worldwide. The funding will be used to study the entire cancer spectrum, from the basic biology of a cancer cell to developing innovative treatments and improving quality of life.

Based on End user, in 2022, the Hospitals Segment is Expected to Account for the Largest Share of the Market

The large market share of the hospitals segment is attributed to the rising prevalence of chronic diseases, the increasing patient population, increased awareness about early diagnosis, and technological advancements in imaging modalities. The prevalence of chronic diseases has substantially increased over the period. Hospitals are the most preferred healthcare settings for diagnosis and therapy, which supports the large market share of this segment.

North America: Largest Regional Market

The large share of this market is attributed to factors such as advanced healthcare infrastructure, technological advancements, high awareness related to radiation exposure, and strict accreditation & regulatory requirements related to radiation exposure. According to American Cancer Society Recommendations for the Early Detection of Cancer, women between the age of 40-54 should undergo regular screening mammography starting at age 45. Additionally, U.S. healthcare expenditure increased from USD 2,658 Billion in 2009 to USD 3,795 Billion in 2019. These factors have contributed significantly to the large market share of the region.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that led market participants to adopt over the past two years. The key players profiled in the global radiation dose management market report are Bayer AG (Germany), Siemens Healthineers GmbH (Germany), Bracco Imaging S.p.A. (Italy), FUJIFILM Holdings Corporation (Japan), GE Healthcare (U.S.), Medsquare (France), Novarad Corporation (U.S.), PACSHealth, LLC. (U.S.), Koninklijke Philips N.V. (Netherlands), Qaelum N.V. (Belgium), Sectra AB (Sweden), Agfa Healthcare (Belgium), Canon Inc. (Japan), Guerbet (France), Medic Vision (U.S.), and Volpara Health Limited (U.S.).

Scope of the Report:

Radiation Dose Management Market, by Offering

Radiation Dose Management Market, by Modality

Radiation Dose Management Market, by Application

Radiation Dose Management Market, by End User

Radiation Dose Management Market, by Geography

Key questions answered in the report:

This study offers a detailed assessment of the radiation dose management market, including the market size & forecast for various segmentations such as offering, modality, application, and end user. The radiation dose management market studied in this report also consists of the value analysis of various segments and sub-segments of radiation dose management at regional and country levels.

The global radiation dose management market is projected to reach $749.1 million by 2029, at a CAGR of 13.3% during the forecast period.

Based on offering, in 2022, the solutions segment is expected to account for the largest share of the market.

Based on modality, in 2022, the computed tomography segment is expected to account for the largest share of the market. The increase in computed tomography examinations is the key factor supporting the large market share of this segment.

The growth of this market is mainly attributed to the increasing use of diagnostic imaging modalities, concerns over radiation exposure, and increasing awareness about radiation dose management. Moreover, the growing focus on pediatric procedures offers significant opportunities for market growth.

The key players profiled in the global radiation dose management market are Bayer AG (Germany), Siemens Healthineers GmbH (Germany), Bracco Imaging S.p.A. (Italy), FUJIFILM Holdings Corporation (Japan), GE Healthcare (U.S.), Medsquare (France), Novarad Corporation (U.S.), PACSHealth, LLC. (U.S.), Koninklijke Philips N.V. (Netherlands), Qaelum N.V. (Belgium), Sectra AB (Sweden), Agfa Healthcare (Belgium), Canon Inc. (Japan), Guerbet (France), Medic Vision (U.S.), and Volpara Health Limited (U.S.).

In 2022, North America is expected to account for the largest share of the radiation dose management market. Strict accreditation & regulatory requirements and high awareness related to radiation exposure are contributing to the large market share of this region.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.1.3. Growth Forecast

2.4. Assumptions for the Study

2.5. Limitations for the Study

3. Executive Summary

4. Market Insights

4.1. Market Overview

4.2. Drivers

4.2.1. Increasing Use of Diagnostic Imaging Modalities

4.2.2. Surge in Concerns Over Radiation Exposure

4.2.3. Increasing Awareness About Radiation Dose Management

4.2.4. Growing Focus on Prevention and Early Diagnosis of Diseases

4.3. Restraints

4.3.1. Lack of Reimbursement for Adopting Radiation Dose Management Solutions

4.4. Opportunities

4.4.1. Radiation Dose Management for Pediatric Patients

4.4.2. Artificial Intelligence in Radiation Dose Management

4.5. Challenges

4.5.1. Lack of Awareness and Infrastructure in Low- & Middle-income Countries

4.6. The Impact of COVID-19 on the Radiation Dose Management Market

5. Radiation Dose Management Market, by Offering

5.1. Introduction

5.2. Solutions

5.3. Services

6. Radiation Dose Management Market, by Modality

6.1. Introduction

6.2. Computed Tomography

6.3. Fluoroscopy and Interventional Imaging

6.4. Nuclear Medicine

6.5. Radiography and Mammography

7. Radiation Dose Management Market, by Application

7.1. Introduction

7.2. Oncology

7.3. Cardiology

7.4. Orthopedics

7.5. Neurology

7.6. Other Applications

8. Radiation Dose Management Market, by End User

8.1. Introduction

8.2. Ambulatory Care Settings

8.3. Hospitals

8.4. Other End Users

9. Radiation Dose Management Market, by Geography

9.1. Introduction

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Rest of Asia Pacific (RoAPAC)

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

10. Competitive Landscape

10.1. Introduction

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

11. Company Profiles

11.1. Bayer AG

11.2. Siemens Healthineers GmbH

11.3. Bracco Imaging S.p.A.

11.4. FUJIFILM Holdings Corporation

11.5. GE Healthcare

11.6. Medsquare

11.7. Novarad Corporation

11.8. PACSHealth, LLC.

11.9. Koninklijke Philips N.V.

11.10. Qaelum N.V.

11.11. Sectra AB

11.12. Agfa Healthcare

11.13. Canon Inc.

11.14. Guerbet

11.15. Medic Vision

11.16. Volpara Health Limited

12. Appendix

12.1. Questionnaire

12.2. Available Customization

List of Tables

Table 1 Global Radiation Dose Management Market Drivers: Impact Analysis (2022–2029)

Table 2 Global Radiation Dose Management Market Restraints: Impact Analysis (2022–2029)

Table 3 Global Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 4 Global Radiation Dose Management Market Size for Solutions, by Country/Region, 2020–2029 (USD Million)

Table 5 Global Radiation Dose Management Market Size for Services, by Country/Region, 2020–2029 (USD Million)

Table 6 Global Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 7 Global Radiation Dose Management Market Size for Computed Tomography, by Country/Region, 2020–2029 (USD Million)

Table 8 Global Radiation Dose Management Market Size for Fluoroscopy and Interventional Imaging, by Country/Region, 2020–2029 (USD Million)

Table 9 Global Radiation Dose Management Market Size for Nuclear Medicine, by Country/Region, 2020–2029 (USD Million)

Table 10 Global Radiation Dose Management Market Size for Radiography and Mammography, by Country/Region, 2020–2029 (USD Million)

Table 11 Global Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 12 Global Radiation Dose Management Market Size for Oncology, by Country/Region, 2020–2029 (USD Million)

Table 13 Global Radiation Dose Management Market Size for Cardiology, by Country/Region, 2020–2029 (USD Million)

Table 14 Global Radiation Dose Management Market Size for Orthopedics, by Country/Region, 2020–2029 (USD Million)

Table 15 Global Radiation Dose Management Market Size for Neurology, by Country/Region, 2020–2029 (USD Million)

Table 16 Global Radiation Dose Management Market Size for Other Applications, by Country/Region, 2020–2029 (USD Million)

Table 17 Global Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 18 Global Radiation Dose Management Market Size for Ambulatory Care Settings, by Country/Region, 2020–2029 (USD Million)

Table 19 Global Radiation Dose Management Market Size for Hospitals, by Country/Region, 2020–2029 (USD Million)

Table 20 Global Radiation Dose Management Market Size for Other End Users, by Country/Region, 2020–2029 (USD Million)

Table 21 Global Radiation Dose Management Market Size, by Country/Region, 2020–2029 (USD Million)

Table 22 North America: Radiation Dose Management Market Size, by Country, 2020–2029 (USD Million)

Table 23 North America: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 24 North America: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 25 North America: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 26 North America: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 27 U.S.: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 28 U.S.: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 29 U.S.: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 30 U.S.: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 31 Canada: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 32 Canada: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 33 Canada: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 34 Canada: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 35 Europe: Radiation Dose Management Market Size, by Country/Region, 2020–2029 (USD Million)

Table 36 Europe: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 37 Europe: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 38 Europe: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 39 Europe: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 40 U.K.: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 41 U.K.: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 42 U.K.: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 43 U.K.: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 44 Germany: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 45 Germany: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 46 Germany: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 47 Germany: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 48 France: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 49 France: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 50 France: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 51 France: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 52 Italy: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 53 Italy: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 54 Italy: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 55 Italy: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 56 Spain: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 57 Spain: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 58 Spain: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 59 Spain: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 60 Rest of Europe: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 61 Rest of Europe: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 62 Rest of Europe: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 63 Rest of Europe: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 64 Asia-Pacific: Radiation Dose Management Market Size, by Country/Region, 2020–2029 (USD Million)

Table 65 Asia-Pacific: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 66 Asia-Pacific: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 67 Asia-Pacific: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 68 Asia-Pacific: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 69 China: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 70 China: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 71 China: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 72 China: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 73 Japan: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 74 Japan: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 75 Japan: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 76 Japan: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 77 India: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 78 India: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 79 India: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 80 India: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 81 Rest of Asia-Pacific: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 82 Rest of Asia-Pacific: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 83 Rest of Asia-Pacific: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 84 Rest of Asia-Pacific: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 85 Latin America: Radiation Dose Management Market Size, by Country/Region, 2020–2029 (USD Million)

Table 86 Latin America: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 87 Latin America: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 88 Latin America: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 89 Latin America: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 90 Brazil: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 91 Brazil: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 92 Brazil: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 93 Brazil: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 94 Mexico: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 95 Mexico: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 96 Mexico: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 97 Mexico: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 98 Rest of Latin America: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 99 Rest of Latin America: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 100 Rest of Latin America: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 101 Rest of Latin America: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 102 Middle East & Africa: Radiation Dose Management Market Size, by Offering, 2020–2029 (USD Million)

Table 103 Middle East & Africa: Radiation Dose Management Market Size, by Modality, 2020–2029 (USD Million)

Table 104 Middle East & Africa: Radiation Dose Management Market Size, by Application, 2020–2029 (USD Million)

Table 105 Middle East & Africa: Radiation Dose Management Market Size, by End User, 2020–2029 (USD Million)

Table 106 Recent Developments, (2020–2022)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Size Estimation

Figure 7 Global Radiation Dose Management Market Size, by Offering, 2022–2029 (USD Million)

Figure 8 Global Radiation Dose Management Market Size, by Modality, 2022–2029 (USD Million)

Figure 9 Global Radiation Dose Management Market Size, by Application, 2022–2029 (USD Million)

Figure 10 Global Radiation Dose Management Market Size, by End User, 2022–2029 (USD Million)

Figure 11 Radiation Dose Management Market, by Geography

Figure 12 Market Dynamics

Figure 13 Global Radiation Dose Management Market Size, by Offering, 2022–2029 (USD Million)

Figure 14 Global Radiation Dose Management Market Size, by Modality, 2022–2029 (USD Million)

Figure 15 Global Radiation Dose Management Market Size, by Application, 2022–2029 (USD Million)

Figure 16 Global Radiation Dose Management Market Size, by End User, 2022–2029 (USD Million)

Figure 17 Global Radiation Dose Management Market Size, by Geography, 2022–2029 (USD Million)

Figure 18 North America: Radiation Dose Management Market Snapshot

Figure 19 Europe: Radiation Dose Management Market Snapshot

Figure 20 Asia-Pacific: Radiation Dose Management Market Snapshot

Figure 21 Latin America: Radiation Dose Management Market Snapshot

Figure 22 Competitive Benchmarking: Radiation Dose Management Market: Based on Offering

Figure 23 Competitive Benchmarking: Radiation Dose Management Market: Based on Geography

Figure 24 Market Share Analysis: Radiation Dose Management Market, 2021

Figure 25 Bayer AG: Financial Overview, 2021

Figure 26 Siemens Healthineers Gmbh: Financial Overview, 2021

Figure 27 FUJIFILM Holdings Corporation: Financial Overview, 2021

Figure 28 GE Healthcare: Financial Overview, 2021

Figure 29 Koninklijke Philips N.V.: Financial Overview, 2021

Figure 30 Sectra AB: Financial Overview, 2021

Figure 31 Agfa-Gevaert Group: Financial Overview, 2021

Figure 32 Canon Inc.: Financial Overview, 2021

Figure 33 Guerbet: Financial Overview, 2021

Published Date: May-2018

Published Date: Nov-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates