Resources

About Us

Portable Oxygen Concentrators Market by Type (Pulse Flow, Continuous Flow, Dual Mode), Technology (Molecular Sieve, Membrane Separation), Weight (Below 5 lbs, 5-10 lbs, Above 10 lbs), Application, End User, and Geography—Global Forecast to 2035

Report ID: MRHC - 1041599 Pages: 210 Sep-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Portable Oxygen Concentrators Market Size?

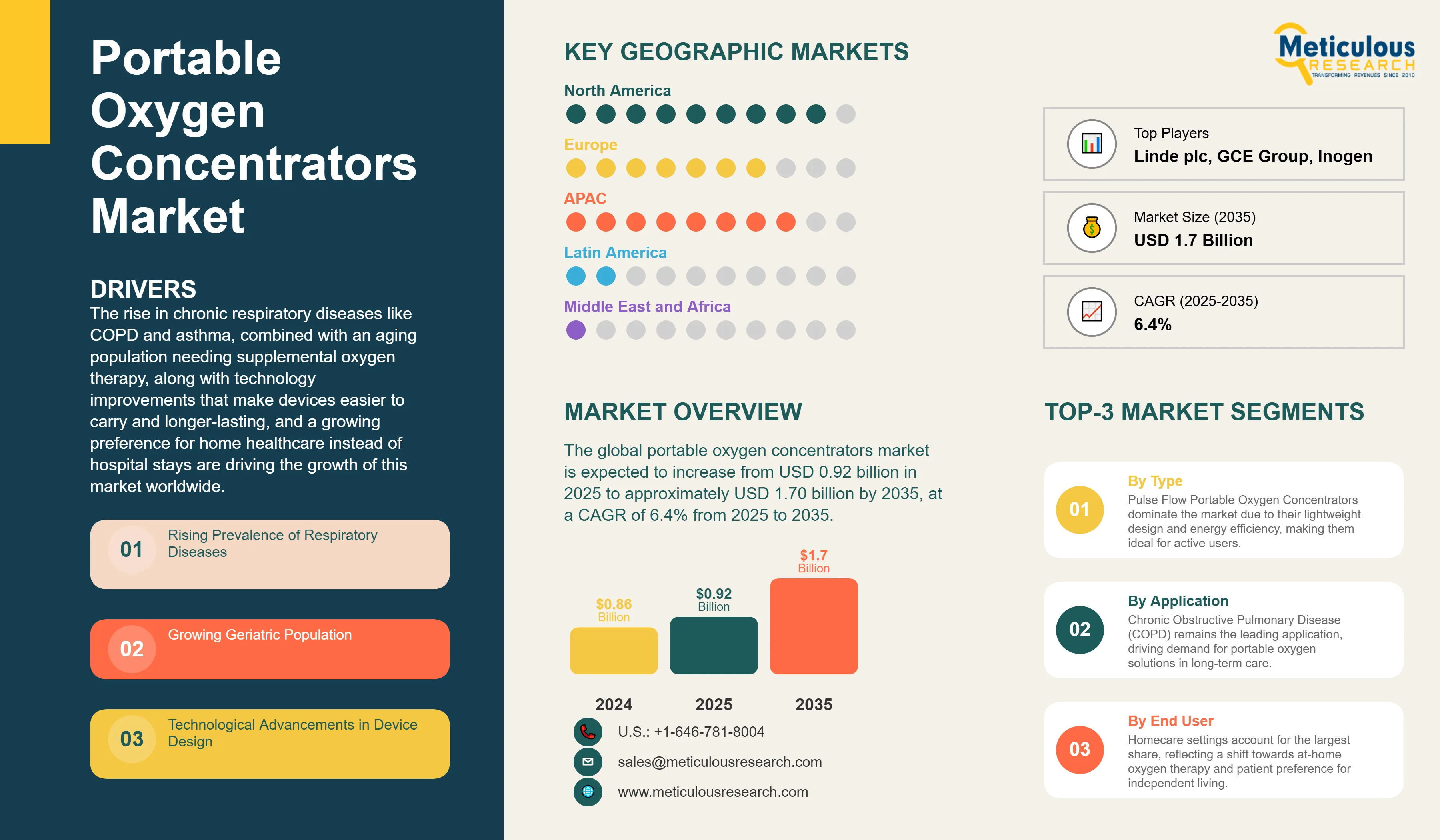

The global portable oxygen concentrators market was valued at USD 0.86 billion in 2024 and is expected to increase from USD 0.92 billion in 2025 to approximately USD 1.70 billion by 2035, growing at a CAGR of 6.4% from 2025 to 2035.

The rise in chronic respiratory diseases like COPD and asthma, combined with an aging population needing supplemental oxygen therapy, along with technology improvements that make devices easier to carry and longer-lasting, and a growing preference for home healthcare instead of hospital stays are driving the growth of this market worldwide.

Portable Oxygen Concentrators Market Key Highlights

Click here to: Get Free Sample Pages of this Report

The portable oxygen concentrators market involves the design, manufacturing, distribution, and servicing of small medical devices that extract oxygen from the air and supply concentrated oxygen to patients who need respiratory support. These battery-powered devices use pressure swing adsorption or membrane separation technology to filter nitrogen from the air, providing medical-grade oxygen with concentrations of 87-95%.

Unlike traditional oxygen cylinders that need refilling, portable oxygen concentrators generate oxygen continuously from the surrounding air. This feature offers greater mobility and independence for patients with chronic respiratory issues. The market is driven by the increasing cases of respiratory diseases caused by air pollution and smoking. It is also fueled by greater awareness of the benefits of portable oxygen therapy, supportive reimbursement policies in developed countries, technological advancements that lower device weight and noise levels, and a rising demand for maintaining an active lifestyle among oxygen-dependent patients in home care, travel, and outdoor settings.

How is AI Transforming the Portable Oxygen Concentrators Market?

Artificial intelligence is transforming the market for portable oxygen concentrators. It allows for better oxygen delivery, predicts maintenance needs, adjusts therapy for each patient, and enables remote patient monitoring. AI algorithms look at breathing patterns, activity levels, and oxygen saturation data. They automatically change oxygen flow rates to ensure the best therapeutic delivery while also extending battery life.

Machine learning models can identify when devices need maintenance by spotting performance issues and signs of wear. This helps avoid unexpected breakdowns and cuts down on downtime. AI-based mobile apps track therapy compliance in real time, suggest activities based on oxygen levels, and send automated alerts to caregivers in emergencies. These smart concentrators adapt to individual patient habits over time, adjusting settings for different activities and times of day. This improves therapy effectiveness by 25-30% and increases patient comfort and device usability with voice controls and smart user interfaces.

What are the Key Trends in the Portable Oxygen Concentrators Market?

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 1.7 Billion |

|

Market Size in 2025 |

USD 0.92 Billion |

|

Market Size in 2024 |

USD 0.86 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 6.4% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Type, Technology, Weight, Application, End User, Distribution Channel, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Respiratory Diseases and Aging Population

A key factor behind the growth of the portable oxygen concentrators market is the rising global number of chronic respiratory diseases. The WHO estimates that COPD affects over 380 million people worldwide and is the third leading cause of death. The aging population, especially in developed countries, is also a concern. By 2050, the number of individuals over 65 is expected to double, leading to a larger group needing oxygen therapy for conditions like COPD, pulmonary fibrosis, and heart failure.

Environmental issues such as air pollution, workplace hazards, and smoking are raising the incidence of respiratory diseases even among younger people. The COVID-19 pandemic has introduced a new group of patients who need long-term oxygen therapy due to post-COVID pulmonary complications and recovery. Also, improved diagnosis rates and greater awareness of the benefits of oxygen therapy in emerging markets are broadening the potential patient base. Moreover, longer life expectancies are extending the need for oxygen therapy, which continues to boost market demand.

Restraint

High Device Costs and Limited Insurance Coverage

Despite growing demand, the portable oxygen concentrators market faces major challenges due to high upfront costs, which range from $2,000 to $5,000. This makes the devices unaffordable for many patients, especially in developing countries. Insurance coverage varies widely between regions and providers. Many plans only cover stationary concentrators or oxygen cylinders, which forces patients to pay out of pocket for portable units. Medicare and private insurance reimbursement rates often do not cover the full price of high-quality portable concentrators, limiting their use among older patients on fixed incomes. Additional costs for accessories, batteries, maintenance, and regular filter replacements increase the overall cost of ownership. In emerging markets, a lack of healthcare infrastructure and the absence of reimbursement policies severely limit market growth, even with high disease prevalence.

Opportunity

Emerging Markets and Medical Tourism

The growing healthcare infrastructure in emerging economies offers strong opportunities for portable oxygen concentrator manufacturers to reach large, underserved patient groups. Countries such as India, China, Brazil, and Mexico are seeing rapid increases in healthcare spending. They also have a rising middle class that can afford portable oxygen devices and a greater awareness of respiratory care options. Medical tourism for respiratory treatments is creating demand for portable concentrators that patients can use while traveling and recovering.

The creation of affordable, locally made devices that meet the needs of these markets, along with new financing options like rental programs and pay-per-use plans, makes oxygen therapy more accessible for more patients. Government initiatives that support home healthcare and reduce the burden on hospitals in countries with limited healthcare capacity further encourage the use of portable oxygen solutions.

Type Insights

Why are Pulse Flow Concentrators Most Popular?

The pulse flow segment is set to hold the largest market share of around 50-55% in 2025. Pulse flow delivery systems detect when a patient inhales and provide oxygen only during that time. This significantly extends battery life compared to continuous flow devices. With this technology, devices can be smaller and lighter, making them ideal for active patients who need oxygen therapy while going about their daily routines or traveling.

Pulse flow concentrators typically weigh between 3 and 5 pounds and offer 10 to 12 hours of battery life, so users can rely on them all day without needing to recharge. Most ambulatory oxygen patients can effectively use pulse flow delivery, making these devices the preferred option for those looking to maintain active lifestyles. Smart pulse flow algorithms optimize oxygen delivery even during sleep or physical activity by adjusting the timing and size of the boluses.

The dual mode (pulse and continuous) segment is expected to grow the fastest over the next few years. Dual mode concentrators provide both pulse and continuous flow, giving patients maximum flexibility as their oxygen needs change throughout the day or during various activities. This is particularly helpful for users who require continuous flow for sleep or demanding situations but want the efficiency of pulse flow during regular activities.

Technology Insights

How do Molecular Sieve Concentrators Dominate the Market?

The molecular sieve oxygen concentrator segment holds the largest market share of around 80-85% in 2025. Molecular sieve technology uses zeolite materials for pressure swing adsorption. This method is the most mature and reliable for portable oxygen concentration. It achieves high oxygen purity levels of 90-95%, which meet medical-grade requirements. It also maintains consistent performance across different altitudes and environmental conditions. The proven reliability, established manufacturing processes, and extensive clinical validation of molecular sieve concentrators make them the standard choice for medical oxygen therapy. Continuous improvements in sieve materials and adsorption cycles have improved efficiency and reduced device size while keeping therapeutic effectiveness.

However, the membrane separation segment is expected to grow at the fastest CAGR during the forecast period. New membrane technologies that use selective permeation offer potential benefits, such as silent operation, fewer moving parts, and less maintenance. Advanced polymer membranes and new separation methods promise ultra-compact devices with better reliability.

Weight Insights

How does the 5-10 lbs Category Balance Portability and Performance?

The 5-10 lbs segment holds the largest share of around 50% of the overall portable oxygen concentrators market in 2025. This weight range represents the optimal balance between portability and functionality, providing sufficient oxygen output and battery life for most ambulatory patients while remaining manageable for daily carrying. Devices in this category typically offer 1-3 liters per minute equivalent continuous flow or pulse settings 1-6, meeting the therapeutic needs of moderate to severe COPD patients. The 5-10 pound range allows for robust construction ensuring durability during travel and daily use while incorporating user-friendly features like LCD displays, multiple flow settings, and extended battery options.

Application Insights

Why does COPD Drive Primary Demand?

The COPD segment commands the largest share of around 30-35% of the overall portable oxygen concentrators market in 2025. Chronic Obstructive Pulmonary Disease has the biggest patient population needing long-term oxygen therapy. Millions of patients around the world require supplemental oxygen to keep their blood oxygen levels adequate. COPD patients usually need oxygen therapy for over 15 hours a day, making portable concentrators vital for their mobility and quality of life. Since COPD progresses, patients often need oxygen therapy for many years or even decades. This creates a constant demand for portable devices. Clinical guidelines suggest using ambulatory oxygen for COPD patients with exercise-induced hypoxemia. This recommendation boosts the use of portable concentrators that support physical activity and pulmonary rehabilitation.

End User Insights

Why has Home Healthcare Emerged as the Largest Segment?

The home healthcare segment accounts for about 45% share of the overall market in 2025. The shift toward home-based care is driven by patient choice, cost issues, and limits in healthcare system capacity. This makes home healthcare the primary setting for providing oxygen therapy. Portable concentrators let patients receive therapy at home, allowing them to stay independent and avoid hospital costs. The trend of older adults aging in place and the emphasis on patient-centered care promote the use of home oxygen therapy.

Improvements in remote monitoring and telehealth services make home oxygen therapy safer and more effective, reducing the need for frequent clinical visits. Insurance coverage for home oxygen therapy and access to home healthcare services support this trend.

On the other hand, the ambulatory care centers segment is expected to grow at the fastest CAGR through 2035. The increase in outpatient respiratory clinics, pulmonary rehabilitation centers, and ambulatory surgery centers boosts the demand for portable oxygen concentrators that help with patient mobility during procedures and recovery.

Distribution Channel Insights

Why are Direct Sales Preferred for Medical Devices?

Based on distribution channel, the direct sales segment holds the largest share of around 40% of the overall portable oxygen concentrators market in 2025. Direct sales through manufacturers and authorized medical equipment providers ensure proper patient assessment, device selection based on prescription needs, and thorough training on device operation and maintenance.

Healthcare providers prefer direct channels to ensure device authenticity, warranty support, and adherence to regulations. Direct sales allow for personalized service, including home setup, ongoing support, and help with insurance claims that patients need for complex medical devices. The option to offer trial periods, trade-in programs, and financing options through direct channels helps attract cost-conscious patients.

However, the online pharmacy segment is expected to grow at the fastest CAGR through 2035. Digital changes in healthcare and consumer comfort with buying medical devices online are driving the growth of e-pharmacy channels. These channels offer convenience, clear pricing, and discreet home delivery for oxygen therapy equipment.

How is the North America Portable Oxygen Concentrators Market Growing Dominantly Across the Globe?

North America accounts for about 40% of the global portable oxygen concentrators market in 2025. This is mainly due to the high prevalence of COPD, which affects over 16 million Americans, as well as favorable Medicare and private insurance coverage for oxygen therapy. A strong healthcare system also backs home oxygen programs. Leading manufacturers like Inogen, Respironics (Philips), Invacare, and Chart Industries fuel innovation and competition in the market.

Strong healthcare systems with established pulmonary rehabilitation programs and respiratory therapy services help ensure proper device prescription and patient support. High healthcare spending and patients' willingness to invest in devices that improve their quality of life encourage the adoption of premium products. The active lifestyle culture in North America creates demand for truly portable solutions that enable travel and outdoor activities. FAA approval for using portable concentrators on flights and a well-developed transportation network further boost market growth.

Which Factors Support the Asia Pacific Portable Oxygen Concentrators Market Growth?

Asia Pacific is expected to experience the fastest growth rate between 2025 and 2035. This growth is fueled by the rapidly aging populations in Japan, China, and South Korea, which need respiratory support. Increased air pollution in major cities contributes to the burden of respiratory diseases. Additionally, the expanding middle class is becoming more able to afford healthcare.

There is rising awareness of the benefits of oxygen therapy. People are shifting from traditional oxygen cylinders to portable concentrators. This shift is speeding up adoption. Government initiatives in countries like China and India are improving healthcare access and insurance coverage, which broadens the market.

Local manufacturing is lowering device costs, and products are being developed to meet the specific needs of the Asian market. This enhances accessibility. The growth of the medical tourism industry and increased domestic travel among the elderly are creating more demand for portable oxygen solutions.

Improved distribution networks and better after-sales services in smaller cities are expanding the market's reach.

Value Chain Analysis

Key Players:

Segments Covered in the Report

By Type

By Technology

By Weight

By Application

By End User

By Distribution Channel

By Region

The portable oxygen concentrators market is expected to increase from USD 0.92 billion in 2025 to USD 1.7 billion by 2035.

The portable oxygen concentrators market is expected to grow at a CAGR of 6.4% from 2025 to 2035.

The major players in the portable oxygen concentrators market include Inogen Inc., Koninklijke Philips N.V. (Respironics), Invacare Corporation, Chart Industries Inc. (CAIRE Inc.), Drive DeVilbiss Healthcare, GCE Group, O2 Concepts LLC, Nidek Medical Products Inc., ResMed Inc., Besco Medical Co. Ltd., Precision Medical Inc., Belluscura PLC, Oxus America Inc., Longfian Scitech Co. Ltd., Yuyue Medical Equipment & Supply Co. Ltd., Teijin Limited, Linde plc, Air Liquide S.A., 3B Medical Inc., and Rythmia Medical.

The driving factors of the portable oxygen concentrators market are the increasing prevalence of chronic respiratory diseases such as COPD and asthma, growing geriatric population requiring supplemental oxygen therapy, technological advancements improving device portability and battery life, and rising preference for home healthcare over hospital stays.

North America region will lead the global portable oxygen concentrators market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Type

3.3. Market Analysis, By Technology

3.4. Market Analysis, By Weight

3.5. Market Analysis, By Application

3.6. Market Analysis, By End User

3.7. Market Analysis, By Distribution Channel

3.8. Market Analysis, By Geography

3.9. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Portable Oxygen Concentrators Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Rising Prevalence of Respiratory Diseases

4.2.2. Growing Geriatric Population

4.2.3. Technological Advancements in Device Design

4.3. Global Portable Oxygen Concentrators Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. High Device Costs

4.3.2. Limited Insurance Coverage in Developing Countries

4.4. Global Portable Oxygen Concentrators Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Emerging Markets Expansion

4.4.2. Post-COVID Respiratory Care Demand

4.5. Global Portable Oxygen Concentrators Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Regulatory Compliance Requirements

4.5.2. Competition from Alternative Oxygen Delivery Systems

4.6. Global Portable Oxygen Concentrators Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Integration with Digital Health Platforms

4.6.2. Development of Ultra-Lightweight Devices

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Sustainability on the Global Portable Oxygen Concentrators Market

5.1. Introduction to Sustainable Medical Device Manufacturing

5.2. Energy Efficiency and Battery Technology

5.3. Recyclable Materials and Eco-Friendly Design

5.4. Reducing Medical Waste Through Reusable Devices

5.5. Carbon Footprint of Oxygen Therapy Solutions

5.6. Regulatory Framework for Sustainable Medical Devices

5.7. Corporate Social Responsibility in Healthcare

5.8. Impact on Market Growth and Innovation

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Ranking by Key Players

7. Global Portable Oxygen Concentrators Market, By Type

7.1. Introduction

7.2. Pulse Flow

7.3. Continuous Flow

7.4. Dual Mode (Pulse & Continuous)

8. Global Portable Oxygen Concentrators Market, By Technology

8.1. Introduction

8.2. Molecular Sieve Oxygen Concentrator

8.2.1. Single Bed

8.2.2. Double Bed

8.3. Membrane Separation

8.4. Others

9. Global Portable Oxygen Concentrators Market, By Weight

9.1. Introduction

9.2. Below 5 lbs

9.3. 5-10 lbs

9.4. 10-15 lbs

9.5. Above 15 lbs

10. Global Portable Oxygen Concentrators Market, By Application

10.1. Introduction

10.2. Chronic Obstructive Pulmonary Disease (COPD)

10.3. Asthma

10.4. Cystic Fibrosis

10.5. Pulmonary Fibrosis

10.6. Sleep Apnea

10.7. COVID-19 Recovery

10.8. Others

11. Global Portable Oxygen Concentrators Market, By End User

11.1. Introduction

11.2. Home Healthcare

11.3. Hospitals

11.4. Ambulatory Care Centers

11.5. Travel & Emergency Medical Services

11.6. Hospice Care

11.7. Others

12. Global Portable Oxygen Concentrators Market, By Distribution Channel

12.1. Introduction

12.2. Direct Sales

12.3. Distributors & Dealers

12.4. Online Pharmacy

12.5. Retail Pharmacy

13. Portable Oxygen Concentrators Market, By Geography

13.1. Introduction

13.2. North America

13.2.1. U.S.

13.2.2. Canada

13.3. Europe

13.3.1. Germany

13.3.2. U.K.

13.3.3. France

13.3.4. Italy

13.3.5. Spain

13.3.6. Netherlands

13.3.7. Rest of Europe

13.4. Asia-Pacific

13.4.1. Japan

13.4.2. China

13.4.3. India

13.4.4. South Korea

13.4.5. Australia

13.4.6. Singapore

13.4.7. Rest of Asia-Pacific

13.5. Latin America

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Middle East & Africa

13.6.1. UAE

13.6.2. Saudi Arabia

13.6.3. Israel

13.6.4. South Africa

13.6.5. Rest of Middle East & Africa

14. Company Profiles

14.1. Inogen Inc.

14.2. Koninklijke Philips N.V. (Respironics)

14.3. Invacare Corporation

14.4. Chart Industries Inc. (CAIRE Inc.)

14.5. Drive DeVilbiss Healthcare

14.6. GCE Group

14.7. O2 Concepts LLC

14.8. Nidek Medical Products Inc.

14.9. ResMed Inc.

14.10. Besco Medical Co. Ltd.

14.11. Precision Medical Inc.

14.12. Belluscura PLC

14.13. Oxus America Inc.

14.14. Longfian Scitech Co. Ltd.

14.15. Yuyue Medical Equipment & Supply Co. Ltd.

14.16. Teijin Limited

14.17. Linde plc

14.18. Air Liquide S.A.

14.19. 3B Medical Inc.

14.20. Rythmia Medical

15. Appendix

15.1. Questionnaire

15.2. Available Customization

Published Date: Mar-2024

Published Date: Mar-2016

Published Date: Jul-2024

Published Date: May-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates