Resources

About Us

Plant-based Food Market by Type (Dairy Alternatives, Plant-based Meat, Meals, Confectionery, Beverages, Egg Alternatives, Seafood), Source (Soy, Wheat, Pea, Rice), Distribution Channel (B2B, B2C [Convenience Store, Online Retail]) - Global Forecast to 2031

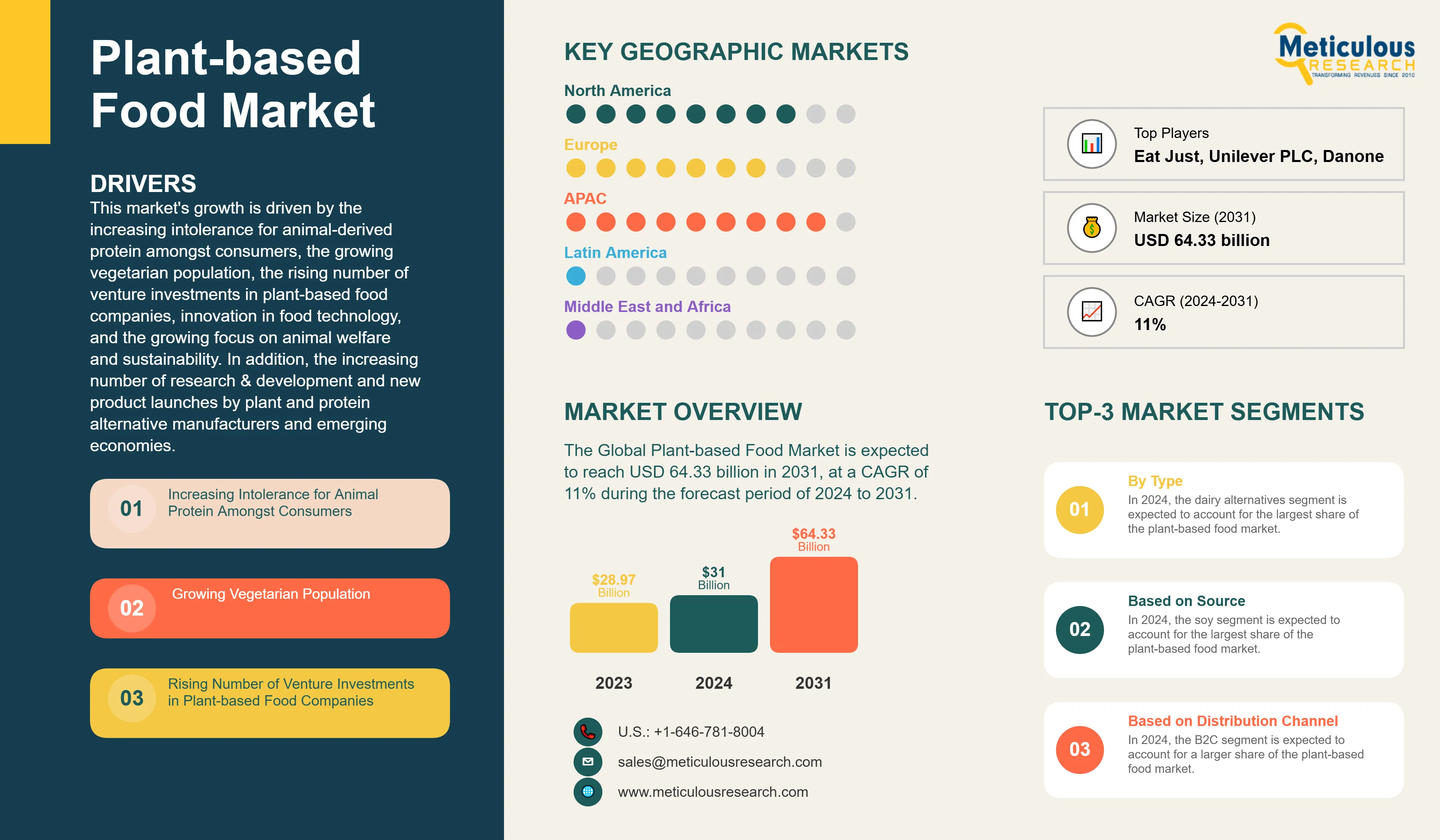

Report ID: MRFB - 104412 Pages: 263 Aug-2025 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe Global Plant-based Food Market was valued at USD 28.97 billion in 2023. This market is expected to reach USD 64.33 billion in 2031, and is projected to reach approximately USD 31 billion by 2024, at a CAGR of 11% during the forecast period of 2024 to 2031.

This market's growth is driven by the increasing intolerance for animal-derived protein amongst consumers, the growing vegetarian population, the rising number of venture investments in plant-based food companies, innovation in food technology, and the growing focus on animal welfare and sustainability. In addition, the increasing number of research & development and new product launches by plant and protein alternative manufacturers and emerging economies, such as Asia-Pacific, Latin America, and the Middle East & Africa, are expected to create lucrative opportunities for players operating in this market.

However, factors such as the comparatively higher price range of meat substitutes, significant preference for animal-based products, and consumer preference for soy and gluten-free products are expected to hinder the growth of this market to a notable extent.

Click here to: Get Free Sample Pages of this Report

The report includes a competitive analysis based on an extensive assessment of the key growth strategies adopted by leading market players in the past three to four years and the benchmarking of key players' product offerings by type. The key players profiled in the plant-based food market are Beyond Meat Inc. (U.S.), Impossible Foods Inc. (U.S.), Danone S.A. (France), Garden Protein International, Inc. (Canada), Amy's Kitchen Inc. (U.S.), Plamil Foods Ltd. (U.K.), The Hain Celestial Group, Inc. (U.S.), Sahmyook Foods (South Korea), Sanitarium Health and Wellbeing Company (Australia), Daiya Foods Inc. (Canada), Earth's Own Food Company Inc. (Canada), Lightlife Foods, Inc. (U.S.), Taifun –Tofu GmbH (Germany), Atlantic Natural Foods LLC (U.S.), VBIte Food Ltd (U.K.), Nutrisoy Pty Ltd. (Australia), Nestlé S.A. (Switzerland), Unilever PLC (U.K.), Sophie’s Kitchen (U.S.), and Eat Just, Inc. (U.S.).

Plant-based products are trending and have marked serious growth in vegan product development. Across the food value chain, companies are looking to generate growth through innovation and product development in plant-based products, both within their legacy brands and by creating new product offerings. Some plant-based product developments in the global market are as follows:

Likewise, many food innovators are exploring new formulations to impact the existing protein supply chain, showcasing the opportunity for vendors in the global plant-based food market.

In recent years, the plant-based foods industry has witnessed an influx of investments aimed at capitalizing on the veganism trend and the surging demand for sustainable foods. Alongside the growing risk profile of livestock production, well-established meat and dairy players are increasingly under attack by animal welfare groups. Protein diversification has the potential to transform a food company’s core business and value proposition.

The growing trend of millennials adopting flexitarian and meat-free diets signals a change in purchasing habits that significantly shift from earlier generations. However, the plant-based movement is bigger than any one generation. Everyone, from celebrities to athletes to entire companies, including Google, and countries as big as China, are supporting the movement to eat more plant-based foods. The key players across the food value chain, from producers to retailers, are already investing in these opportunities.

Some companies are hedging against or preparing for the decline of demand for animal products by investing in other companies producing alternatives. The market has received investments and funding from several high-profile individuals, financial investors, and companies in the past few years. According to the Good Food Institute, in 2022, the alternative proteins industry received USD 2.9 billion in disclosed investments. In the same year, plant-based meat, egg, and dairy companies received USD 1.9 billion in investments, a significant increase over USD 693 million raised in 2019. Plant-based meat, seafood, egg, and dairy companies have raised USD 6.3 billion in investments since 2010.

Some of these investments are as follows:

Thus, growing venture capital investments in plant-based product companies are expected to drive the global plant-based food market.

Based on type, the plant-based food market is segmented into dairy alternatives, meat substitutes, plant-based meals, plant-based baked goods, plant-based confectionery, plant-based beverages, egg substitutes, fish and seafood alternatives, and other plant-based foods. In 2024, the dairy alternatives segment is expected to account for the largest share of the plant-based food market. The large market share of this segment is attributed to factors such as the increasing number of lactose intolerant people, the growing ethical concerns amongst consumers about animal abuse in modern dairy farming practices, and the nutritional benefits offered by plant-based dairy products.

However, the egg substitute segment is expected to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to the increasing consumer demand for egg alternatives, the rising number of investments and food innovations in egg alternatives, the increasing number of new product launches, and the low cholesterol levels provided by egg substitutes.

Based on source, the plant-based food market is segmented into soy, almond, wheat, pea, rice protein, and other sources. In 2024, the soy segment is expected to account for the largest share of the plant-based food market. The large market share of this segment is attributed to factors such as the easy and wide availability of raw materials, lower cost compared to other sources, significant demand from meat alternatives manufacturers, higher consumer acceptance level, and its wide range of applications in numerous food & beverage sectors, including meat, dairy alternative, and bakery.

However, the pea segment is expected to register the highest CAGR during the forecast period. The rapid growth of this segment is attributed to the increasing desire amongst consumers to find sustainable and good-tasting alternatives to animal-based proteins, the rising number of investments from leading manufacturers to increase pea protein production, and the growing adoption of pea protein in plant-based foods. In addition, peas are allergen-free, gluten-free, and lactose-free, which further increases the demand for pea-based food.

Based on distribution channel, the plant-based food market is segmented into business-to-business and business-to-consumer. In 2024, the B2C segment is expected to account for a larger share of the plant-based food market. This segment's large market share is attributed to factors such as the increased sales of plant-based food in well-established supermarkets and hypermarket chains, consumer preference for shopping from brick-and-mortar grocers due to easy access and availability, and the increasing consumer expenses on vegan food products.

Additionally, this segment is also expected to grow at the fastest CAGR during the forecast period due to the rapidly growing online retail sector. The rapid growth of this segment is mainly attributed to the faster accessibility, convenience, and cost-effectiveness offered by the online retail sector.

Based on geography, in 2024, Asia-Pacific is expected to account for the largest share of the plant-based food market. The leading position of Asia-Pacific in the plant-based food market is attributed to factors such as collaborations between international and domestic food companies, increasing protein-rich diet awareness, booming food & beverages industry, growing economy, rapid urbanization, and the large base of vegan and vegetarian population. Additionally, this country is expected to grow at the fastest CAGR during the forecast period due to increasing investment in the plant-based sector and the growing adoption of emerging technologies for product innovation.

|

Particular |

Details |

|

Page No. |

263 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

11% |

|

Market Size (Value) |

USD 64.33 billion |

|

Segments Covered |

By Type

By Source

By Distribution Channel

|

|

Countries/Regions Covered |

North America (U.S., Canada), Europe (Germany, U.K., Spain, Italy, France, Netherlands, Belgium, Austria, Poland, Portugal, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, Thailand, South Korea, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Beyond Meat Inc. (U.S.), Impossible Foods Inc. (U.S.), Danone S.A. (France), Garden Protein International, Inc. (Canada), Amy's Kitchen Inc. (U.S.), Plamil Foods Ltd. (U.K.), The Hain Celestial Group, Inc. (U.S.), Sahmyook Foods (South Korea), Sanitarium Health and Wellbeing Company (Australia), Daiya Foods Inc. (Canada), Earth's Own Food Company Inc. (Canada), Lightlife Foods, Inc. (U.S.), Taifun –Tofu GmbH (Germany), Atlantic Natural Foods LLC (U.S.), VBIte Food Ltd (U.K.), Nutrisoy Pty Ltd. (Australia), Nestlé S.A. (Switzerland), Unilever PLC (U.K.), Sophie’s Kitchen (U.S.), and Eat Just, Inc. (U.S.). |

The plant-based food market is projected to reach $64.33 billion by 2031, at a CAGR of 11% during the forecast period.

The dairy alternatives segment is expected to account for the largest share of the plant-based food market in 2024.

The business-to-consumer segment is projected to record the highest CAGR during the forecast period of 2024–2031.

This market's growth is driven by the increasing intolerance for animal protein amongst consumers, the growing vegetarian population, the rising number of venture investments in plant-based food companies, innovation in food technology, and the growing focus on animal welfare and sustainability. In addition, the increasing number of research & development and new product launches by plant and protein alternative manufacturers and emerging economies, such as Asia-Pacific, Latin America, and the Middle East & Africa, are expected to create lucrative opportunities for players operating in this market.

Countries from Asia-Pacific and Latin America are projected to offer significant growth opportunities for vendors in this market.

The key players profiled in the plant-based food market study are Beyond Meat Inc. (U.S.), Impossible Foods Inc. (U.S.), Danone S.A. (France), Garden Protein International, Inc. (Canada), Amy's Kitchen Inc. (U.S.), Plamil Foods Ltd. (U.K.), The Hain Celestial Group, Inc. (U.S.), Sahmyook Foods (South Korea), Sanitarium Health and Wellbeing Company (Australia), Daiya Foods Inc. (Canada), Earth's Own Food Company Inc. (Canada), Lightlife Foods, Inc. (U.S.), Taifun –Tofu GmbH (Germany), Atlantic Natural Foods LLC (U.S.), VBIte Food Ltd (U.K.), Nutrisoy Pty Ltd. (Australia), Nestlé S.A. (Switzerland), Unilever PLC (U.K.), Sophie’s Kitchen (U.S.), and Eat Just, Inc. (U.S.).

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-Up Approach

2.3.1.2. Top-Down Approach

2.3.1.3. Growth Forecast

2.4. Assumptions for the Study

2.5. Limitations for the Study

3. Executive Summary

3.1. Introduction

3.2. Market Dynamics

3.3. Segment Analysis

3.3.1. Type Analysis

3.3.1.1. Dairy Alternatives Market, By Type

3.3.1.2. Meat Substitutes Market, By Type

3.3.2. Source Analysis

3.3.3. Distribution Channel Analysis

3.3.3.1. B2C Distribution Channel Market, By Type

3.3.4. Regional-Level Analysis

4. Market Insights

4.1. Introduction

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Increasing Intolerance for Animal Protein Amongst Consumers

4.2.1.2. Growing Vegetarian Population

4.2.1.3. Rising Number of Venture Investments in Plant-Based Food Companies

4.2.1.4. Innovation in Food Technology

4.2.1.5. Growing Focus on Animal Welfare and Sustainability

4.2.2. Restraints

4.2.2.1. Comparatively Higher Price Range of Meat Substitutes

4.2.2.2. Significant Preference for Animal-Based Products

4.2.2.3. Consumer Preference for Soy and Gluten-Free Products

4.2.3. Opportunities

4.2.3.1. Product Launches by Plant-Based Food and Alternative Protein Manufacturers

4.2.3.2. Emerging Economies

4.2.4. Trends

4.2.4.1. Rising Industry Concentration with Growth in Mergers and Acquisitions in the Plant-Based Food Space

5. Global Plant-Based Food Market, By Type

5.1. Introduction

5.2. Dairy Alternatives

5.2.1. Milk

5.2.2. Cheese

5.2.3. Yogurt

5.2.4. Butter

5.2.5. Ice Cream

5.2.6. Creamer

5.2.7. Other Dairy Alternatives

5.3. Meat Substitutes

5.3.1. Tofu

5.3.2. Textured Vegetable Protein (TVP)

5.3.3. Burger Patties

5.3.4. Tempeh

5.3.5. Hot Dogs & Sausages

5.3.6. Seitan

5.3.7. Meatballs

5.3.8. Ground Meat

5.3.9. Nuggets

5.3.10. Crumbles

5.3.11. Shreds

5.3.12. Other Meat Substitutes

5.4. Meals

5.5. Baked Goods

5.6. Confectionery

5.7. RTD Beverages

5.8. Egg Substitutes

5.9. Seafood Substitutes

5.10. Other Plant-Based Food

6. Global Plant-Based Food Market, By Source

6.1. Introduction

6.2. Soy

6.3. Almond

6.4. Wheat

6.5. Pea

6.6. Rice

6.7. Other Sources

7. Global Plant-Based Food Market, By Distribution Channel

7.1. Introduction

7.2. Business-To-Business

7.3. Business-To-Consumer

7.3.1. Modern Groceries

7.3.2. Convenience Stores

7.3.3. Specialty Stores

7.3.4. Online Retail Stores

7.3.5. Other B2C Distribution Channels

8. Plant-Based Food Market, By Geography

8.1. Introduction

8.2. Asia-Pacific

8.2.1. China

8.2.2. India

8.2.3. Japan

8.2.4. Australia

8.2.5. Thailand

8.2.6. South Korea

8.2.7. Rest of Asia-Pacific (RoAPAC)

8.3. North America

8.3.1. U.S.

8.3.2. Canada

8.4. Europe

8.4.1. Germany

8.4.2. U.K.

8.4.3. Spain

8.4.4. Italy

8.4.5. France

8.4.6. Netherlands

8.4.7. Belgium

8.4.8. Austria

8.4.9. Poland

8.4.10. Portugal

8.4.11. Rest of Europe (RoE)

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Argentina

8.5.4. Rest of Latin America (RoLATAM)

8.6. Middle East & Africa

9. Competitive Landscape

9.1. Competitive Dashboard

9.1.1. Industry Leaders

9.1.2. Market Differentiators

9.1.3. Vanguards

9.1.4. Emerging Companies

9.2. Market Share/Position Analysis

10. Company Profiles

10.1. Beyond Meat Inc.

10.1.1. Company Overview

10.1.2. Business Description

10.1.3. Financial Overview

10.1.4. Geographic Presence

10.1.5. Plant-Based Food Product Portfolio

10.1.6. SWOT Analysis

10.2. Impossible Foods Inc.

10.2.1. Company Overview

10.2.2. Business Description

10.2.3. Financial Overview

10.2.4. Plant-Based Food Product Portfolio

10.2.5. SWOT Analysis

10.3. Danone S.A.

10.3.1. Company Overview

10.3.2. Business Description

10.3.3. Financial Overview

10.3.4. Geographic Presence

10.3.5. Plant-Based Food Product Portfolio

10.3.6. SWOT Analysis

10.4. Garden Protein International Inc.

10.4.1. Company Overview

10.4.2. Business Description

10.4.3. Financial Overview

10.4.4. Plant-Based Food Product Portfolio

10.4.5. SWOT Analysis

10.5. Amy's Kitchen Inc.

10.5.1. Company Overview

10.5.2. Business Description

10.5.3. Financial Overview

10.5.4. Plant-Based Food Product Portfolio

10.5.5. SWOT Analysis

10.6. Plamil Foods Ltd.

10.6.1. Company Overview

10.6.2. Business Description

10.6.3. Financial Overview

10.6.4. Plant-Based Food Product Portfolio

10.6.5. SWOT Analysis

10.7. The Hain Celestial Group Inc.

10.7.1. Company Overview

10.7.2. Business Description

10.7.3. Financial Overview

10.7.4. Plant-Based Food Product Portfolio

10.7.5. SWOT Analysis

10.8. Sahmyook Foods

10.8.1. Company Overview

10.8.2. Business Description

10.8.3. Financial Overview

10.8.4. Plant-Based Food Product Portfolio

10.8.5. SWOT Analysis

10.9. Sanitarium Health and Wellbeing Company

10.9.1. Company Overview

10.9.2. Business Description

10.9.3. Financial Overview

10.9.4. Plant-Based Food Product Portfolio

10.9.5. SWOT Analysis

10.10. Daiya Foods Inc.

10.10.1. Company Overview

10.10.2. Business Description

10.10.3. Financial Overview

10.10.4. Geographic Presence

10.10.5. Plant-Based Food Product Portfolio

10.10.6. SWOT Analysis

10.11. Earth's Own Food Company Inc.

10.11.1. Company Overview

10.11.2. Business Description

10.11.3. Financial Overview

10.11.4. Geographic Presence

10.11.5. Plant-Based Food Product Portfolio

10.11.6. SWOT Analysis

10.12. Lightlife Foods Inc.

10.12.1. Company Overview

10.12.2. Business Description

10.12.3. Financial Overview

10.12.4. Plant-Based Food Product Portfolio

10.12.5. SWOT Analysis

10.13. Taifun-Tofu GmbH

10.13.1. Company Overview

10.13.2. Business Description

10.13.3. Financial Overview

10.13.4. Geographic Presence

10.13.5. Plant-Based Food Product Portfolio

10.13.6. SWOT Analysis

10.14. Atlantic Natural Foods LLC

10.14.1. Company Overview

10.14.2. Business Description

10.14.3. Financial Overview

10.14.4. Plant-Based Food Product Portfolio

10.14.5. SWOT Analysis

10.15. VBites Food Ltd.

10.15.1. Company Overview

10.15.2. Business Description

10.15.3. Financial Overview

10.15.4. Plant-Based Food Product Portfolio

10.15.5. SWOT Analysis

10.16. Nutrisoy Pty Ltd.

10.16.1. Company Overview

10.16.2. Business Description

10.16.3. Financial Overview

10.16.4. Geographic Presence

10.16.5. Plant-Based Food Product Portfolio

10.16.6. SWOT Analysis

10.17. Nestlé S.A.

10.17.1. Company Overview

10.17.2. Business Description

10.17.3. Financial Overview

10.17.4. Geographic Presence

10.17.5. Plant-Based Food Product Portfolio

10.17.6. SWOT Analysis

10.18. Unilever Plc

10.18.1. Company Overview

10.18.2. Business Description

10.18.3. Financial Overview

10.18.4. Geographic Presence

10.18.5. Plant-Based Food Product Portfolio

10.18.6. SWOT Analysis

10.19. Sophie's Kitchen

10.19.1. Company Overview

10.19.2. Business Description

10.19.3. Financial Overview

10.19.4. Plant-Based Food Product Portfolio

10.19.5. SWOT Analysis

10.20. Eat Just Inc.

10.20.1. Company Overview

10.20.2. Business Description

10.20.3. Financial Overview

10.20.4. Geographic Presence

10.20.5. Plant-Based Food Product Portfolio

10.20.6. SWOT Analysis

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Global Plant-Based Food Market Size, By Type, 2024–2031 (USD Million)

Table 2 Global Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 3 Plant-Based Dairy Alternatives Market Size, By Country/Region, 2022–2031 (USD Million)

Table 4 Plant-Based Milk Market Size, By Country/Region, 2022–2031 (USD Million)

Table 5 Plant-Based Cheese Market Size, By Country/Region, 2022–2031 (USD Million)

Table 6 Plant-Based Yogurts Market Size, By Country/Region, 2022–2031 (USD Million)

Table 7 Plant-Based Butter Market Size, By Country/Region, 2022–2031 (USD Million)

Table 8 Plant-Based Ice Cream Market Size, By Country/Region, 2022–2031 (USD Million)

Table 9 Plant-Based Creamer Market Size, By Country/Region, 2022–2031 (USD Million)

Table 10 Other Plant-Based Dairy Alternatives Market Size, By Country/Region, 2022–2031 (USD Million)

Table 11 Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 12 Plant-Based Meat Substitutes Market Size, By Country/Region, 2022–2031 (USD Million)

Table 13 Plant-Based Tofu Market Size, By Country/Region, 2022–2031 (USD Million)

Table 14 Plant-Based Tvp Market Size, By Country/Region, 2022–2031 (USD Million)

Table 15 Plant-Based Burger Patties Market Size, By Country/Region, 2022–2031 (USD Million)

Table 16 Plant-Based Tempeh Market Size, By Country/Region, 2022–2031 (USD Million)

Table 17 Plant-Based Hot Dogs and Sausages Market Size, By Country/Region, 2022–2031 (USD Million)

Table 18 Plant-Based Seitan Market Size, By Country/Region, 2022–2031 (USD Million)

Table 19 Plant-Based Meatballs Market Size, By Country/Region, 2022–2031 (USD Million)

Table 20 Plant-Based Ground Meat Market Size, By Country/Region, 2022–2031 (USD Million)

Table 21 Plant-Based Nuggets Market Size, By Country/Region, 2022–2031 (USD Million)

Table 22 Plant-Based Crumbles Market Size, By Country/Region, 2022–2031 (USD Million)

Table 23 Plant-Based Shreds Market Size, By Country/Region, 2022–2031 (USD Million)

Table 24 Other Plant-Based Meat Substitutes Market Size, By Country/Region, 2022–2031 (USD Million)

Table 25 Plant-Based Meals Market Size, By Country/Region, 2022–2031 (USD Million)

Table 26 Plant-Based Baked Goods Market Size, By Country/Region, 2022–2031 (USD Million)

Table 27 Plant-Based Confectionery Market Size, By Country/Region, 2022–2031 (USD Million)

Table 28 Plant-Based Rtd Beverages Market Size, By Country/Region, 2022–2031 (USD Million)

Table 29 Plant-Based Egg Substitutes Market Size, By Country/Region, 2022–2031 (USD Million)

Table 30 Plant-Based Seafood Substitutes Market Size, By Country/Region, 2022–2031 (USD Million)

Table 31 Other Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 32 Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 33 Soy Derived Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 34 Almond-Derived Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 35 Wheat-Derived Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 36 Pea-Derived Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 37 Rice-Derived Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 38 Other Sources-Derived Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 39 Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 40 B2b Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 41 B2C Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 42 B2C Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Table 43 Plant-Based Food Market Size for Convenience Stores, By Country/Region, 2022–2031 (USD Million)

Table 44 Plant-Based Food Market Size for Specialty Stores, By Country/Region, 2022–2031 (USD Million)

Table 45 Plant-Based Food Market Size for online Retail Stores, By Country/Region, 2022–2031 (USD Million)

Table 46 Plant-Based Food Market Size for Other B2C Distribution Channels, By Country/Region, 2022–2031 (USD Million)

Table 47 Asia-Pacific: Plant-Based Food Market Size, By Country, 2022–2031 (USD Million)

Table 48 Asia-Pacific: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 49 Asia-Pacific: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 50 Asia-Pacific: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 51 Asia-Pacific: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million

Table 52 Asia-Pacific: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 53 Asia-Pacific: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 54 China: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 55 China: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 56 China: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 57 China: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 58 China: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 59 China: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 60 India: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 61 India: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 62 India: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 63 India: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 64 India: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 65 India: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 66 Japan: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 67 Japan: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 68 Japan: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 69 Japan: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 70 Japan: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 71 Japan: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 72 Australia: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 73 Australia: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 74 Australia: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 75 Australia: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 76 Australia: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 77 Australia: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 78 Thailand: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 79 Thailand: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 80 Thailand: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 81 Thailand: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 82 Thailand: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 83 Thailand: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 84 South Korea: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 85 South Korea: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 86 South Korea: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 87 South Korea: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 88 South Korea: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 89 South Korea: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 90 Rest of Asia-Pacific: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 91 Rest of Asia-Pacific: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 92 Rest of Asia-Pacific: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 93 Rest of Asia-Pacific: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 94 Rest of Asia-Pacific: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 95 Rest of Asia-Pacific: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 96 North America: Plant-Based Food Market Size, By Country, 2022–2031 (USD Million)

Table 97 North America: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 98 North America: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 99 North America: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 100 North America: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 101 North America: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 102 North America: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 103 U.S.: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 104 U.S.: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 105 U.S.: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 106 U.S.: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 107 U.S.: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 108 U.S.: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 109 Canada: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 110 Canada: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 111 Canada: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 112 Canada: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 113 Canada: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 114 Canada: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 115 Europe: Plant-Based Food Market Size, By Country, 2022–2031 (USD Million)

Table 116 Europe: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 117 Europe: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 118 Europe: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 119 Europe: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 120 Europe: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 121 Europe: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 122 Germany: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 123 Germany: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 124 Germany: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 125 Germany: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 126 Germany: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 127 Germany: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 128 U.K.: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 129 U.K.: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 130 U.K.: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 131 U.K.: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 132 U.K.: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 133 U.K.: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 134 Spain: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 135 Spain: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 136 Spain: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 137 Spain: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 138 Spain: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 139 Spain: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 140 Italy: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 141 Italy: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 142 Italy: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 143 Italy: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 144 Italy: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 145 Italy: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 146 France: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 147 France: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 148 France: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 149 France: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 150 France: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 151 France: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 152 Netherlands: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 153 Netherlands: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 154 Netherlands: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 155 Netherlands: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 156 Netherlands: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 157 Netherlands: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 158 Belgium: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 159 Belgium: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 160 Belgium: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 161 Belgium: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 162 Belgium: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 163 Belgium: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 164 Austria: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 165 Austria: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 166 Austria: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 167 Austria: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 168 Austria: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 169 Austria: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 170 Poland: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 171 Poland: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 172 Poland: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 173 Poland: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 174 Poland: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 175 Poland: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 176 Portugal: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 177 Portugal: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 178 Portugal: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 179 Portugal: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 180 Portugal: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 181 Portugal: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 182 Rest of Europe: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 183 Rest of Europe: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 184 Rest of Europe: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 185 Rest of Europe: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 186 Rest of Europe: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 187 Rest of Europe: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 188 Latin America: Plant-Based Food Market Size, By Country, 2022–2031 (USD Million)

Table 189 Latin America: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 190 Latin America: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 191 Latin America: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 192 Latin America: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 193 Latin America: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 194 Latin America: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 195 Brazil: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 196 Brazil: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 197 Brazil: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 198 Brazil: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 199 Brazil: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 200 Brazil: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 201 Mexico: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 202 Mexico: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 203 Mexico: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 204 Mexico: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 205 Mexico: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 206 Mexico: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 207 Argentina: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 208 Argentina: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 209 Argentina: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 210 Argentina: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 211 Argentina: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 212 Argentina: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 213 Rest of Latin America: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 214 Rest of Latin America: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 215 Rest of Latin America: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 216 Rest of Latin America: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 217 Rest of Latin America: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 218 Rest of Latin America: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 219 Middle East & Africa: Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

Table 220 Middle East & Africa: Plant-Based Dairy Alternatives Market Size, By Type, 2022–2031 (USD Million)

Table 221 Middle East & Africa: Plant-Based Meat Substitutes Market Size, By Type, 2022–2031 (USD Million)

Table 222 Middle East & Africa: Plant-Based Food Market Size, By Source, 2022–2031 (USD Million)

Table 223 Middle East & Africa: Plant-Based Food Market Size, By Distribution Channel, 2022–2031 (USD Million)

Table 224 Middle East & Africa: Business-To-Consumer Plant-Based Food Market Size, By Type, 2022–2031 (USD Million)

List of Figures

Figure 1 Market Ecosystem

Figure 2 Research Process

Figure 3 Key Secondary Sources

Figure 4 Primary Research Techniques

Figure 5 Key Executives interviewed

Figure 6 Breakdown of Primary interviews (Supply-Side & Demand-Side)

Figure 7 Market Sizing and Growth forecast Approach

Figure 8 In 2024, the Dairy Alternatives Segment Is Expected to Dominate Plant Based-Food Market

Figure 9 In 2024, the Soy Segment is Expected to Dominate the Plant-Based Food Market

Figure 10 In 2024, the B2C Distribution Channel Segment is Expected to Dominate the Plant-Based Food Market

Figure 11 Global Plant-Based Food Market, By Region, 2024 Vs 2031

Figure 12 Factors Affecting Market Growth

Figure 13 Global Plant-Based Food Market Size, By Type, 2024–2031 (USD Million)

Figure 14 Global Dairy Alternatives Market Size, By Type, 2024–2031 (USD Million)

Figure 15 Global Plant-Based Meat Substitutes Market Size, By Type, 2024–2031 (USD Million)

Figure 16 Plant-Based Food Market Size, By Source, 2024–2031 (USD Million)

Figure 17 Plant-Based Food: Value Chain with Key Business Activities and Players within

Figure 18 Plant-Based Food Market Size, By Distribution Channel, 2024–2031 (USD Million)

Figure 19 B2C Plant-Based Food Market Size, By Type, 2024–2031 (USD Million)

Figure 20 Plant-Based Food Market Size for Modern Groceries, By Country/Region, 2022–2031 (USD Million)

Figure 21 Plant-Based Food Market Size, By Region, 2024–2031 (USD Million)

Figure 22 Plant-Based Food Market Size, By Country/Region, 2022–2031 (USD Million)

Figure 23 Competitive Dashboard: Plant Based Food Market

Figure 24 Plant Based Food Market Position Analysis, 2024

Figure 25 SWOT Analysis - Beyond Meat inc.

Figure 26 SWOT Analysis - Impossible Foods inc.

Figure 27 SWOT Analysis - Danone S.A.

Figure 28 SWOT Analysis - Garden Protein international, inc.

Figure 29 SWOT Analysis – Amy's Kitchen inc.

Figure 30 SWOT Analysis - Plamil Foods Ltd.

Figure 31 SWOT Analysis - The Hain Celestial Group, inc.

Figure 32 SWOT Analysis - Sahmyook Foods

Figure 33 SWOT Analysis - Sanitarium Health and Wellbeing Company

Figure 34 SWOT Analysis - Daiya Foods inc.

Figure 35 SWOT Analysis - Earth's Own Food Company inc.

Figure 36 SWOT Analysis - Lightlife Foods, inc.

Figure 37 SWOT Analysis - Taifun-Tofu Gmbh

Figure 38 SWOT Analysis - Atlantic Natural Foods Llc

Figure 39 SWOT Analysis - VBites Food Ltd

Figure 40 SWOT Analysis - Nutrisoy Pty Ltd.

Figure 41 SWOT Analysis - Nestlé S.A.

Figure 42 SWOT Analysis - Unilever Plc

Figure 43 SWOT Analysis - Sophie's Kitchen

FIGURE 44 SWOT Analysis - Eat Just, Inc.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates