Resources

About Us

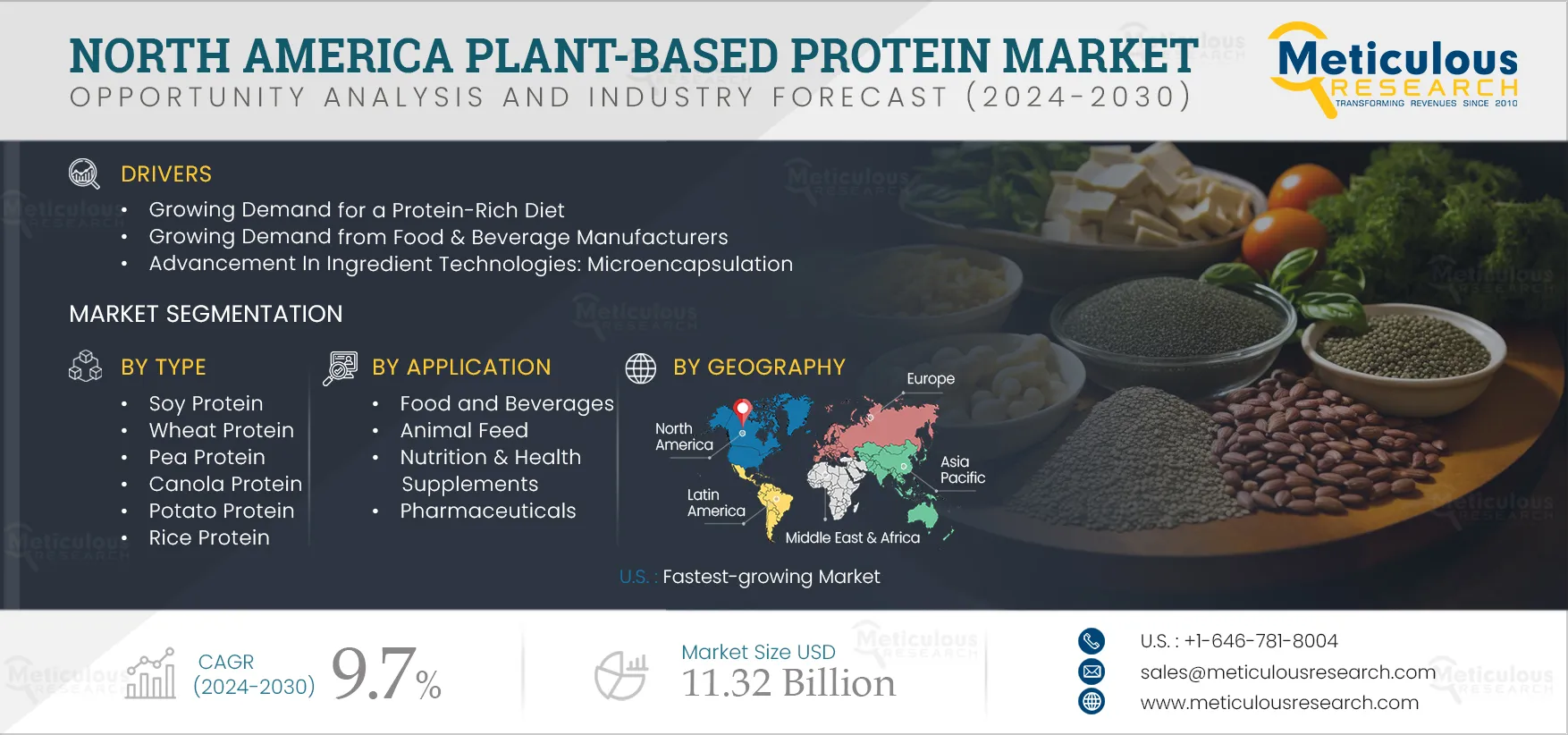

North America Plant-based Protein Market by Type (Soy Protein, Wheat Protein, Pea Protein), Crop Type (Non-GMO, GMO), Source Process (Conventional, Organic), and Application (Food and Beverages, Animal Feed, Nutritional Supplements) - Forecast to 2032

Report ID: MRFB - 104954 Pages: 130 Jan-2025 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe North America Plant-based Protein Market is expected to reach $11.32 billion by 2032, at a CAGR of 9.7% during the forecast period of 2025 to 2032. The growth of this market is attributed to the growing demand for a protein-rich diet, rising consumer awareness regarding nutritional benefits offered by plant-based proteins, growing demand from food & beverage manufacturers, and advancement in ingredient technologies: microencapsulation. Additionally, increasing inclination towards a vegan diet and increasing intolerance for animal proteins offer significant growth opportunities for North America plant-based protein vendors. However, a significant preference for animal-based proteins and fluctuating raw material prices restrain the plant-based protein market growth.

Key Players

The report includes a competitive analysis based on an extensive assessment of the key growth strategies adopted by leading market players in the past four years. The key players profiled in the North America plant-based protein market are Archer Daniels Midland Company (U.S.), Cargill, Incorporated (U.S.), Roquette Frères (France), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), International Flavors & Fragrances Inc. (U.S.), Tate & Lyle PLC (U.K.), Axiom Foods Inc. (U.S.), Glanbia, Plc. (Ireland), The Scoular Company (U.S.), Now Foods (U.S.), AMCO Protein (U.S.), Burcon NutraScience Corporation (Canada), Farbest Brands (U.S.), and CHS Inc. (U.S.).

Click here to: Get Free Sample Pages of this Report

Proteins are used in the food industry for both nutritional and functional reasons. Human uptake of proteins can be accomplished by consuming plant-based proteins. In recent years, a growing trend towards health and fitness has arisen due to increasing health awareness. This growing health awareness increases demand for food products that support better health, especially low-calorie, nutritious, and weight-control products. There is an increasing demand for functional food primarily due to the increasing prevalence of diseases, health awareness, nutritional requirements, and willingness to experiment with new products. As a result, the number of foodstuffs containing nutritional ingredients has grown distinctly in recent years. These consumer trends in North America are driving the growth of the functional food ingredients market, such as plant-based protein.

Protein is a key ingredient to enhance nutritional content in food and improve functionality. A protein's most important functional properties are its water solubility, water & fat binding capacity, gel-forming & rheological behaviors, and emulsifying & foaming ability. Also, plant-based protein is used in food applications to form gels, absorb juices during cooking, and for their whipping and binding properties. They form a key ingredient in creating food with consumer-winning claims like protein-rich and natural ingredients with an appealing sensory aspect of food, shelf life, and stability in many food applications.

In addition, due to health concerns, ethics, and sustainability, diets are changing among North American consumers. Around 10% of Americans over the age of 18 are vegetarian, 3% are vegan, and almost 40% are shifting toward eating more plant-based foods, according to Vegetarian Resource Group (2022). In the U.S. plant-based food market, some of the key players are focusing on researching and introducing next-generation protein-rich products, as consumers’ concern is shifting from regular to plant-based food. For instance, leading meat processors Tyson, Smithfield, Perdue, and Hormel have rolled out meat alternatives with plant-based burgers, meatballs, and chicken nuggets. Moreover, as of 2020, flexitarians in the U.S. are reducing their animal product consumption, which comprises about one-third of the U.S. population (Source: Danone North America).

Thus, increasing applications in a range of food products owing to its functional & nutritional properties, there is an increasing demand for plant-based protein from the food and beverages industry in North America.

In 2025, the Soy Proteins Segment is Expected to Account for the Largest Share of the North America Plant-based Protein Market

Based on type, the North America plant-based protein market is segmented into soy protein, wheat protein, pea protein, canola protein, potato protein, rice protein, corn protein, and other types of protein. In 2025, the soy protein segment is expected to account for the largest share of the North America plant-based protein market. The large market share of this segment is attributed to increased demand from food and beverage manufacturers, higher consumer acceptance levels, lower cost than other types of proteins, and immense availability and functionality. However, the pea protein segment is expected to register the highest CAGR during the forecast period due to its nutritional benefits and allergen-free, gluten-free, and lactose-free properties.

In 2025, the Non-genetically Modified Organism Crops Segment is Expected to Account for the Largest Share of the North America Plant-based Protein Market

Based on crop type, the North America plant-based protein market is segmented into non-genetically modified and genetically modified organism crops. In 2025, the non-genetically modified organism crops segment is expected to account for the largest share of the North America plant-based protein market. The large market share of this segment is attributed to increased awareness about the harmful effects of genetically modified crops and the increased trend of clean-label products. Moreover, this segment is also expected to grow at the fastest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to rising demand for eco-friendly, natural, and organic food products as well as stringent regulations for GM crops in North America.

In 2025, the Organic Plant-based Protein Ingredients Segment to Witness the Highest Growth during the Forecast Period

Based on source process, the North America plant-based protein market is segmented into conventional and organic plant-based protein ingredients. In 2025, the conventional plant-based protein ingredients segment is expected to account for the largest share of the North America plant-based protein market. The large market share of this segment is attributed to lower prices than organic protein ingredients, longer shelf life, and availability of substantial crop varieties. However, the organic plant-based protein ingredients segment is expected to grow at the fastest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to growing awareness regarding the health benefits of organic food products.

In 2025, the Solid Form Segment is Expected to Account for the Largest Share of the North America Plant-based Protein Market

Based on form, the North America plant-based protein market is segmented into solid (dry) and liquid. In 2025, the solid (dry) segment is expected to account for the largest share of the North America plant-based protein market. The large market share of this segment is attributed to the growing demand for powdered plant-based proteins coupled with their rising preference considering ease of handling and transport, comparatively lower costs, low chance of formulation mistakes, and their capacity to maintain ingredient stability. However, the liquid segment is expected to register the highest CAGR during the forecast period due to its improved shelf life, natural and fresh appeal, and versatility for various applications.

In 2025, the Nutrition & Health Supplement Segment to Witness Significant Growth during the Forecast Period

Based on application, the North America plant-based protein market is segmented into food and beverages, animal feed, nutrition & health supplements, pharmaceuticals, and other applications. In 2025, the food and beverages segment is expected to account for the largest share of the North America plant-based protein market. The large market share of this segment is attributed to high consumer demand for sustainable food products, growing awareness about the health benefits of plant proteins, increased health concerns over animal products and ingredients, increasing new product launches of plant-based products, increasing vegan population, rising meat prices, and clean label trend. However, the nutrition & health supplements segment is expected to grow at the highest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to changing lifestyles, growing health & wellness trends, increasing demand for sports nutrition, and increasing prevalence of diseases.

U.S.: Fastest-growing Market

Based on country, in 2025, the U.S. is expected to account for the largest share of the North America plant-based protein market. This country’s major market share is attributed to the well-established food and beverage sector, strong economic growth, increased consumption of meat products, increasing vegan population, growing demand for plant-based food, high focus on health & wellness, and improved research and development within the food sector. Moreover, this country is projected to register the highest CAGR during the forecast period.

Scope of the report:

North America Plant-based Protein Market, by Type

North America Plant-based Protein Market, by Crop Type

North America Plant-based Protein Market, by Source Process

North America Plant-based Protein Market, by Form

North America Plant-based Protein Market, by Application

North America Plant-based Protein Market, by Country

Key questions answered in the report:

The North America plant-based protein market is projected to reach $11.32 billion by 2032, at a CAGR of 9.7% during the forecast period.

In 2025, the soy proteins segment is expected to account for the largest share of the North America plant-based protein market.

In 2025, the food & beverage segment is expected to account for the major share of the North America plant-based protein market.

The growth of this market is attributed to the growing demand for a protein-rich diet, rising consumer awareness regarding nutritional benefits offered by plant-based proteins, growing demand from food & beverage manufacturers, and advancement in ingredient technologies: microencapsulation. Additionally, increasing inclination towards a vegan diet and increasing intolerance for animal proteins offer significant growth opportunities for North America plant-based protein vendors.

The U.S. is projected to offer significant growth opportunities for vendors in this market.

The key players profiled in the North America plant-based protein market study are Archer Daniels Midland Company (U.S.), Cargill, Incorporated (U.S.), Roquette Frères (France), Ingredion Incorporated (U.S.), Kerry Group plc (Ireland), International Flavors & Fragrances Inc. (U.S.), Tate & Lyle PLC (U.K.), Axiom Foods Inc. (U.S.), Glanbia, Plc. (Ireland), The Scoular Company (U.S.), Now Foods (U.S.), AMCO Protein (U.S.), Burcon NutraScience Corporation (Canada), Farbest Brands (U.S.), and CHS Inc. (U.S.).

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates