Resources

About Us

Offshore Drilling Waste Management Market Size, Share & Forecast 2025-2035 | Growth Analysis by Service Type, Waste Type, Treatment Method, End-User & Geography

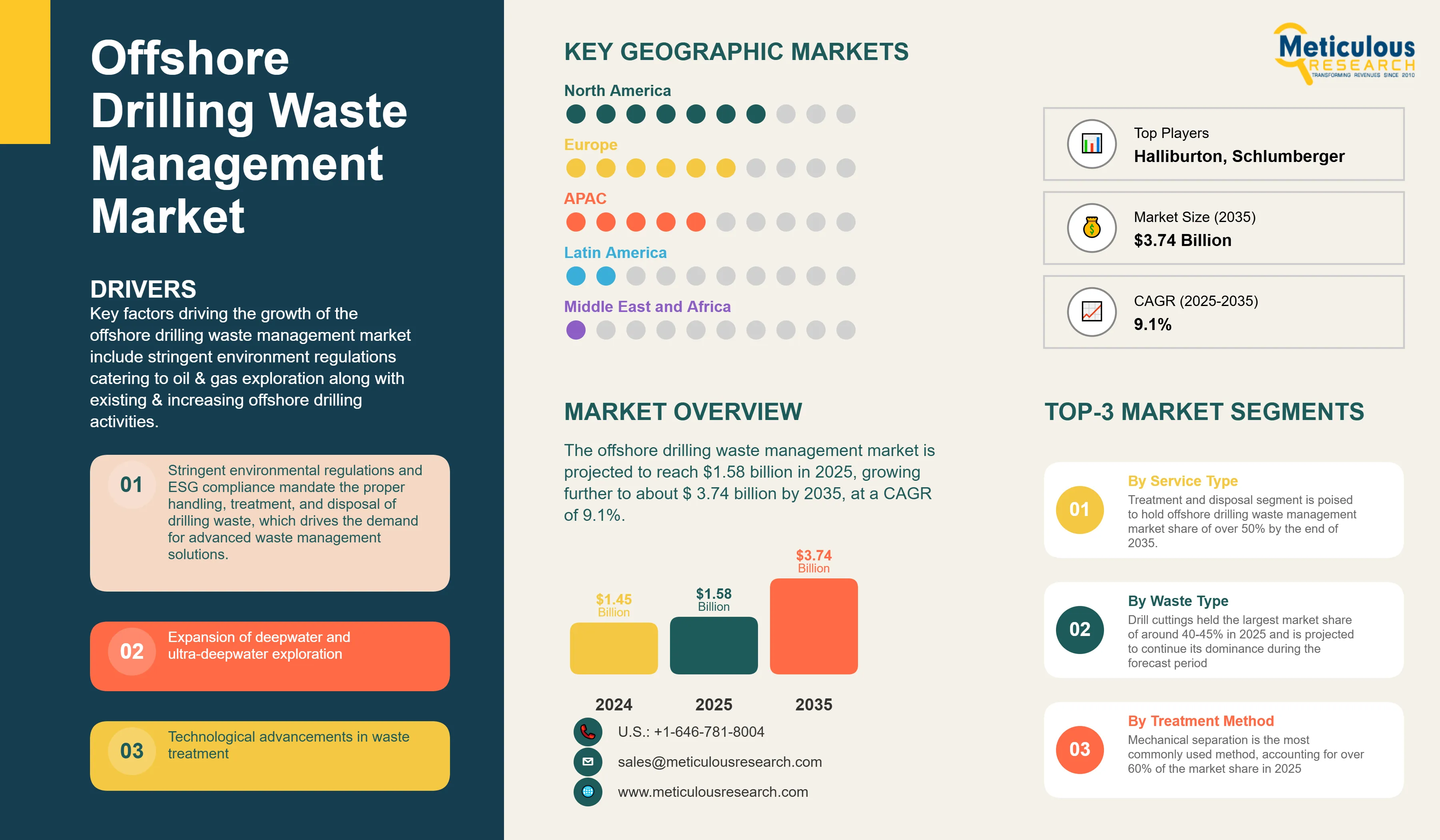

Report ID: MREP - 1041518 Pages: 185 Jun-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the offshore drilling waste management market include stringent environment regulations catering to oil & gas exploration along with existing & increasing offshore drilling activities, technological advancements in waste treatment and disposal methods, growing emphasis on corporate social responsibility (CSR) and sustainability in the oil and gas industry, increasing deepwater and ultra-deepwater exploration activities, and rising focus on Environmental, Social, and Governance (ESG) compliance. However, this growth is restrained by high capital intensity of offshore waste management systems compared to onshore operations, logistical complexities in remote offshore locations, harsh weather conditions affecting waste transportation and disposal, and limited storage capacity on offshore platforms.

Additionally, emerging opportunities in robotic and autonomous waste handling technologies, development of advanced treatment solutions like thermal desorption units, expansion of offshore drilling activities in emerging markets including Southeast Asia and Latin America, integration of IoT and digital monitoring systems for predictive waste management, and growing trend of outsourcing specialized waste management services to expert providers are poised to offer significant growth opportunities for market players. The adoption of advanced oil-water separation technologies and development of bio-remediation solutions are emerging as notable trends in this market.

Stringent Environmental Regulations and ESG Compliance

Governments and international organizations are imposing strict regulations to minimize the environmental impact of offshore drilling. These regulations mandate the proper handling, treatment, and disposal of drilling waste, which drives the demand for advanced waste management solutions. Companies have to adhere to the environmental, social, and governance (ESG) guidelines in their operations which leads to greater investments in treatment and disposal segment. Modern offshore operations must demonstrate compliance with zero-discharge standards and marine pollution prevention protocols, requiring sophisticated waste management systems that can handle the complex nature of offshore drilling waste while meeting strict environmental standards.

The regulatory landscape continues to evolve with increasingly stringent requirements for waste discharge, disposal methods, and environmental monitoring. Of the total waste produced from the offshore drilling activity, over 85% of them are hazardous. This high percentage of hazardous waste necessitates specialized treatment and disposal solutions that comply with international maritime environmental regulations and local environmental protection standards.

Expansion of Deepwater and Ultra-Deepwater Exploration

The dependency on non-renewable resources is higher than renewable resources and to answer the growing demands globally, there has been greater explorations in deepwater and ultra-deepwater locations. Increase in the exploration and production (E&P) activities in deepwater and ultra-deepwater reservoirs is expected to increase the number of wells drilled, and drive the demand for the oilfield services, thereby creating opportunity for the drilling waste management services market.

The complexity of deepwater drilling operations generates substantial volumes of specialized waste that require sophisticated management solutions. In September 2024, Transocean Ltd. announced a USD 232 million ultra-deepwater drilling contract for its Deepwater Atlas drillship with BP in the US Gulf of Mexico. The 365-day contract is scheduled to begin operations in the second quarter of 2028. These large-scale projects demonstrate the continued expansion of deepwater activities that directly drive demand for comprehensive waste management services.

Technological Advancements in Waste Treatment

Innovations in waste management technologies, such as thermal desorption units, cuttings reinjection, and advanced filtration systems, are enhancing the efficiency and effectiveness of offshore drilling waste management. These technologies allow for the safer and environmentally friendly handling of waste, reducing the ecological footprint of drilling operations. Innovations in oil-water separation, bioremediation, chemical treatment, thermal desorption units (TDU) are driving the offshore drilling waste management market's profit share.

Advanced technologies are making offshore waste management more cost-effective and environmentally sustainable. The development of mobile treatment units, enhanced containment systems, and real-time monitoring solutions enables operators to minimize environmental impact while reducing operational costs.

Market Segmentation Analysis

By Service Type

Treatment and disposal segment is poised to hold offshore drilling waste management market share of over 50% by the end of 2035. The treatment & disposal services segment of offshore drilling waste management industry is set to grow at a CAGR of over 9% through 2035, driven by swift technological advancements, rigorous regulatory adherence, and a heightened emphasis on sustainability.

The service type segmentation includes:

By Waste Type

The Offshore Drilling Waste Management Market segmentation based on Waste Type can be categorized into Drill Cuttings, Drilling Fluids, and Produced Water. Among these segments, Drill Cuttings held the largest market share of around 40-45% in 2025 and is projected to continue its dominance during the forecast period.

By Treatment Method

The Offshore Drilling Waste Management Market is segmented based on treatment methods into mechanical separation, chemical treatment, and biological treatment. Mechanical separation is the most commonly used method, accounting for over 60% of the market share in 2025.

By End-User

The Offshore Drilling Waste Management Market Segmentation by End User comprises Oil and Gas Companies, Offshore Drilling Contractors, and Waste Management Companies. Among these, Oil and Gas Companies dominate the market with a share of around 50-55% in 2025.

Regional Analysis

Asia-Pacific: Leading Growth Market

The Asia Pacific offshore drilling waste management market is witnessing steady growth and is projected to have the fastest increase in revenue share globally during the forecast period. The market is driven by growing off shore oil and gas exploration activities in China, India, Malaysia, and Australia.

China is expected to lead the drilling waste management services market during the forecast period owing to extensive and widespread exploration and production activities in the region, especially in the South China sea. In India, offshore drilling activities are steadily increasing in offshore regions such as Cauvery Basin, Krishna-Godavari Basin, and Mumbai High.

North America: Mature Market with Continued Growth

North America offshore drilling waste management industry is predicted to grow significantly, due to the intensifying focus on environmental protection along with the preference for environmentally friendly waste management solutions. North America is expected to lead the drilling waste management services market during the forecast period owing to extensive and widespread exploration and production activities in the region.

The region benefits from established regulatory frameworks, advanced technology adoption, and significant ongoing exploration activities in the Gulf of Mexico and offshore Canada.

Europe: Focus on Sustainability and Innovation

Europe represents a significant market driven by stringent environmental regulations, established offshore operations in the North Sea, and strong emphasis on sustainable drilling practicesIn May 2024, oil and gas companies operating on the Norwegian Continental Shelf were projected to invest approximately USD 24 billion , marking a significant increase in spending on exploration and the development of existing fields across both offshore and onshore applications.

Middle East & Africa: Emerging Growth Region

In July 2024, the Government of Egypt announced plans to drill 110 exploratory wells with an investment of approximately USD 1.2 billion during the fiscal year 2024/2025 to strengthen the country's oil and gas production capabilities. This large-scale drilling initiative is expected to significantly contribute to the growth of the global drilling waste management market by increasing operational activities and associated waste volumes.

Latin America: Developing Market

The expansion of offshore drilling in emerging markets including Africa, Latin America, and Southeast Asia are witnessing significant growth in offshore drilling activities. The development of new offshore fields in these regions is increasing the demand for waste management services.

Competitive Landscape

The offshore drilling waste management market is characterized by a mix of large multinational oilfield service companies, specialized waste management providers, and regional service companies. Industry leaders such as Halliburton, Baker Hughes, Weatherford, and Schlumberger command a significant market share owing to their extensive expertise in oil and gas exploration, diverse product portfolios, and extensive global presence.

Leading Companies Include:

Major Integrated Service Providers:

Specialized Waste Management Companies:

Technology and Equipment Providers:

Regional and Emerging Players:

These companies are focusing on strategies such as advanced technology development, expansion into emerging offshore markets, strategic partnerships with drilling contractors and operators, sustainability initiatives, and development of integrated waste management and monitoring solutions to strengthen their market position.

|

Particulars |

Details |

|

Market Size 2024 |

USD 1.45 billion |

|

Market Size 2025 |

USD 1.58 billion |

|

Market Size 2035 |

USD 3.74 billion |

|

CAGR (2025-2035) |

9.1% |

|

Base Year |

2024 |

|

Forecast Period |

2025-2035 |

|

Segments Covered |

By Service Type, Waste Type, Treatment Method, End-User |

|

Leading Service Segment |

Treatment and Disposal (55-60% share) |

|

Leading Waste Type |

Drill Cuttings (40-45% share) |

|

Leading Treatment Method |

Mechanical Separation (50-60% share) |

|

Leading End-User |

Oil and Gas Companies (50-55% share) |

|

Fastest Growing Region |

Asia-Pacific |

The offshore drilling waste management market is projected to reach USD 3.74 billion by 2035 from USD 1.58 billion in 2025, at a CAGR of 9.1% during the forecast period.

The treatment and disposal segment is anticipated to secure a 55-60% share by 2035, due to the global focus on ESG compliance and sustainable offshore waste management.

The drill cuttings segment is projected to maintain the largest share at approximately 40-45% throughout the forecast period due to high volume generation during drilling operations.

Key factors driving growth include stringent environmental regulations and ESG compliance requirements, expansion of deepwater and ultra-deepwater exploration, technological advancements in waste treatment solutions, rising corporate social responsibility focus, and increasing offshore drilling activities globally.

Major opportunities include robotic and autonomous waste handling technologies, advanced treatment solutions like thermal desorption units, emerging market expansion in Southeast Asia and Latin America, IoT integration for predictive waste management, and growing outsourcing trends for specialized services.

Asia-Pacific leads with the highest growth potential, while North America maintains the largest market share. Europe shows strong growth driven by sustainability focus, and emerging markets in the Middle East, Africa, and Latin America present significant expansion opportunities due to increasing offshore exploration activities.

1. Introduction

1.1. Market Definition & Scope

1.2. Offshore Drilling Waste Management Market Ecosystem

1.3. Currency and Units

1.4. Key Stakeholders in Offshore Drilling Waste Management Value Chain

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Offshore Drilling Waste Management Market Analysis: by Service Type

3.2.2. Offshore Drilling Waste Management Market Analysis: by Waste Type

3.2.3. Offshore Drilling Waste Management Market Analysis: by Treatment Method

3.2.4. Offshore Drilling Waste Management Market Analysis: by End-User

3.3. Offshore Drilling Waste Management Market, by Regional Analysis

3.4. Competitive Landscape & Market Competitors

4. Industry Insights

4.1. Overview

4.2. Offshore Drilling Waste Management Technology Overview

4.2.1. Mechanical vs. Chemical vs. Biological Treatment Comparison

4.2.2. Onboard vs. Onshore Treatment Methods

4.3. Value Chain Analysis

4.3.1. Overview

4.3.2. Waste Management Equipment and Solution Suppliers

4.3.3. Service Providers and System Integrators

4.3.3.1. Key Offshore Drilling Waste Management Service Providers, by Scale

4.3.3.1.1. Local and Regional Service Providers

4.3.3.1.2. National Waste Management Companies

4.3.3.1.3. International Oilfield Service Specialists

4.3.3.1.4. Integrated Offshore O&M Providers

4.3.4. Technology Development and Innovation

4.3.5. Installation and Training Services

4.3.6. End-User Offshore Drilling Operators

4.3.7. Environmental Monitoring and Compliance Reporting

4.4. Impact of Sustainability on Offshore Drilling Waste Management Market

4.4.1. ESG Compliance and Investment Decisions

4.4.2. Circular Economy Principles in Waste Management

4.4.3. Carbon Footprint Reduction Initiatives

4.4.4. Marine Ecosystem Protection Requirements

4.4.5. Sustainable Technology Adoption and Innovation

4.4.6. Corporate Social Responsibility (CSR) Impact on Market Dynamics

4.5. Porter's Five Forces Analysis

4.5.1. Bargaining Power of Equipment Suppliers

4.5.2. Bargaining Power of Offshore Drilling Operators

4.5.3. Threat of In-House Waste Management Operations

4.5.4. Threat of New Service Entrants

4.5.5. Degree of Competition Among Service Providers

5. Market Insights

5.1. Overview

5.2. Factors Affecting Market Growth

5.2.1. Drivers

5.2.1.1. Stringent Environmental Regulations and ESG Compliance

5.2.1.2. Expansion of Deepwater and Ultra-Deepwater Exploration

5.2.1.3. Technological Advancements in Waste Treatment

5.2.1.4. Growing Corporate Social Responsibility Focus

5.2.1.5. Increasing Offshore Drilling Activities Globally

5.2.1.6. Regulatory Requirements for Marine Environment Protection

5.2.1.7. Rising Volume of Drilling Waste Generation

5.2.1.8. Growth of Offshore O&M Service Industry

5.2.2. Restraints

5.2.2.1. High Capital Intensity of Offshore Systems

5.2.2.2. Logistical Complexities in Remote Locations

5.2.2.3. Limited Storage Capacity on Offshore Platforms

5.2.2.4. Harsh Weather Conditions and Operational Challenges

5.2.2.5. Specialized Equipment and Technology Requirements

5.2.3. Opportunities

5.2.3.1. Robotic and Autonomous Waste Handling Technologies

5.2.3.2. Advanced Treatment Solutions and Thermal Desorption

5.2.3.3. Emerging Market Offshore Expansion

5.2.3.4. IoT Integration and Digital Monitoring Systems

5.2.3.5. Offshore Waste Management Outsourcing Trends

5.3. Trends

5.3.1. Mobile Treatment Units and Onboard Processing

5.3.2. Advanced Oil-Water Separation Technologies

5.3.3. AI-Powered Waste Management Optimization

5.4. Standards and Regulations

5.4.1. Offshore Environmental Protection Standards

5.4.2. Regional Marine Environmental Regulations

5.4.2.1. North America (EPA, Coast Guard, State Regulations)

5.4.2.2. Europe (IMO, EU Marine Directives, North Sea Standards)

5.4.2.3. Asia-Pacific (National Maritime Environmental Standards)

5.4.2.4. Latin America (Regional Marine Compliance)

5.4.2.5. Middle East & Africa (Maritime Authority Regulations)

5.5. Technology Adoption Trends Across Applications

6. Offshore Drilling Waste Management Market Assessment - by Service Type

6.1. Overview

6.2. Treatment & Disposal

6.3. Solid Control

6.4. Containment & Handling

6.5. Waste Collection Services

6.6. Environmental Monitoring & Compliance

6.7. Specialized Offshore Transportation

7. Offshore Drilling Waste Management Market Assessment - by Waste Type

7.1. Overview

7.2. Drill Cuttings

7.2.1. Water-Based Drilling Cuttings

7.2.2. Oil-Based Drilling Cuttings

7.2.3. Synthetic-Based Drilling Cuttings

7.3. Drilling Fluids

7.3.1. Water-Based Drilling Fluids

7.3.2. Oil-Based Drilling Fluids

7.3.3. Synthetic-Based Drilling Fluids

7.4. Produced Water

7.4.1. Formation Water

7.4.2. Injection Water

7.4.3. Flowback Water

8. Offshore Drilling Waste Management Market Assessment - by Treatment Method

8.1. Overview

8.2. Mechanical Separation

8.3. Chemical Treatment

8.4. Biological Treatment

9. Offshore Drilling Waste Management Market Assessment - by End-User

9.1. Overview

9.2. Oil & Gas Companies

9.3. Offshore Drilling Contractors

9.4. Waste Management Companies

9.5. Offshore Service Companies

9.5. Others

10. Offshore Drilling Waste Management Market Assessment - by Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. Norway

10.3.2. United Kingdom

10.3.3. Netherlands

10.3.4. Denmark

10.3.5. Germany

10.3.6. France

10.3.7. Italy

10.3.8. Rest of Europe (RoE)

10.4. Asia-Pacific

10.4.1. China

10.4.2. India

10.4.3. Japan

10.4.4. Australia

10.4.5. Malaysia

10.4.6. Indonesia

10.4.7. South Korea

10.4.8. Thailand

10.4.9. Rest of Asia-Pacific (RoAPAC)

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Colombia

10.5.5. Venezuela

10.5.6. Rest of Latin America (RoLATAM)

10.6. Middle East & Africa

10.6.1. Saudi Arabia

10.6.2. UAE

10.6.3. Qatar

10.6.4. Kuwait

10.6.5. Nigeria

10.6.6. Angola

10.6.7. South Africa

10.6.8. Egypt

10.6.9. Rest of Middle East & Africa

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies in Offshore Drilling Waste Management Market

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Technology Leaders

11.4.2. Service Specialists

11.4.3. Regional Market Leaders

11.4.4. Emerging Technology Providers

11.5. Market Ranking/Positioning Analysis of Key Players, 2024

12. Company Profiles

(Company Overview, Financial Overview, Service Portfolio, and Strategic Developments)

12.1 Leading Offshore Drilling Waste Management Companies

12.1.1 Halliburton Company (USA)

12.1.2 Baker Hughes Co. (USA)

12.1.3 Schlumberger Limited (USA)

12.1.4 Weatherford International PLC (USA)

12.1.5 National-Oilwell Varco Inc. (USA)

12.1.6 Clean Harbors, Inc. (USA)

12.1.7 Secure Energy Services, Inc. (Canada)

12.1.8 Ridgeline Canada Inc. (Canada)

12.1.9 Newpark Resources Inc. (USA)

12.1.10 GN Solids Control (China)

12.1.11 Derrick Equipment Company (USA)

12.1.12 Imdex Limited (Australia)

12.1.13 Soli-Bond (USA)

12.1.14 Geminor (Norway)

12.1.15 Augean PLC (UK)

12.1.16 Select Water Solutions (USA)

12.1.17 China Oilfield Services Ltd. (China)

12.1.18 TWMA Group Ltd (UK)

12.1.19 Eco-Logic Environmental Engineering Inc. (Canada)

12.1.20 Others

(Note: SWOT Analysis of Top 5 Offshore Drilling Waste Management Companies Will Be Provided)

13. Appendix

13.1. Available Customization

13.2. Related Reports

13.3. Offshore Industry Standards and Best Practices

13.4. Glossary of Offshore Drilling Waste Management Terms

List of Tables

Table 1 Mechanical vs. Chemical vs. Biological Treatment Comparison

Table 2 Onboard vs. Onshore Treatment Methods Analysis

Table 3 Indicative List of Offshore Drilling Waste Management Service Providers and their Capabilities

Table 4 List of Local and Regional Offshore Waste Management Service Providers

Table 5 List of National Waste Management Companies

Table 6 List of International Oilfield Service Specialists

Table 7 List of Integrated Offshore O&M Providers

Table 8 Global Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 9 Global Offshore Drilling Waste Management Treatment & Disposal Market, by Country, 2023-2035 (USD Million)

Table 10 Global Offshore Drilling Waste Solid Control Market, by Country, 2023-2035 (USD Million)

Table 11 Global Offshore Drilling Waste Containment & Handling Market, by Country, 2023-2035 (USD Million)

Table 12 Global Offshore Drilling Waste Collection Services Market, by Country, 2023-2035 (USD Million)

Table 13 Global Offshore Drilling Waste Environmental Monitoring Market, by Country, 2023-2035 (USD Million)

Table 14 Global Offshore Drilling Waste Specialized Transportation Market, by Country, 2023-2035 (USD Million)

Table 15 Global Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 16 Global Offshore Drilling Waste Management Market for Drill Cuttings, by Country, 2023-2035 (USD Million)

Table 17 Global Offshore Drilling Waste Management Market for Drilling Fluids, by Country, 2023-2035 (USD Million)

Table 18 Global Offshore Drilling Waste Management Market for Produced Water, by Country, 2023-2035 (USD Million)

Table 19 Global Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 20 Global Offshore Drilling Waste Management Market for Mechanical Separation, by Country, 2023-2035 (USD Million)

Table 21 Comparison of Treatment Requirements by Waste Type

Table 22 Global Offshore Drilling Waste Management Market for Chemical Treatment, by Country, 2023-2035 (USD Million)

Table 23 Global Offshore Drilling Waste Management Market for Biological Treatment, by Country, 2023-2035 (USD Million)

Table 24 Global Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 25 Global Offshore Drilling Waste Management Market for Oil & Gas Companies, by Country, 2023-2035 (USD Million)

Table 26 Global Offshore Drilling Waste Management Market for Drilling Contractors, by Country, 2023-2035 (USD Million)

Table 27 Global Offshore Drilling Waste Management Market for Waste Management Companies, by Country, 2023-2035 (USD Million)

Table 28 Global Offshore Drilling Waste Management Market for Offshore Service Companies, by Country, 2023-2035 (USD Million)

Table 29 Global Offshore Drilling Waste Management Market, by Region, 2023-2035 (USD Million)

Table 30 North America: Offshore Drilling Waste Management Market, by Country, 2023-2035 (USD Million)

Table 31 North America: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 32 North America: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 33 North America: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 34 North America: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 35 U.S.: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 36 U.S.: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 37 U.S.: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 38 U.S.: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 39 Canada: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 40 Canada: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 41 Canada: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 42 Canada: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 43 Mexico: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 44 Mexico: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 45 Mexico: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 47 Mexico: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 48 Europe: Offshore Drilling Waste Management Market, by Country/Region, 2023-2035 (USD Million)

Table 49 Europe: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 50 Europe: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 51 Europe: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 52 Europe: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 53 Norway: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 54 Norway: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 55 Norway: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 56 Norway: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 57 United Kingdom: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 58 United Kingdom: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 59 United Kingdom: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 60 United Kingdom: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 61 Netherlands: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 62 Netherlands: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 63 Netherlands: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 64 Netherlands: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 65 Denmark: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 66 Denmark: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 67 Denmark: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 68 Denmark: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 69 Germany: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 70 Germany: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 71 Germany: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 72 Germany: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 73 France: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 74 France: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 75 France: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 76 France: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 77 Italy: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 78 Italy: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 79 Italy: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 80 Italy: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 81 Rest of Europe: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 82 Rest of Europe: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 83 Rest of Europe: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 84 Rest of Europe: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 85 Asia-Pacific: Offshore Drilling Waste Management Market, by Country/Region, 2023-2035 (USD Million)

Table 86 Asia-Pacific: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 87 Asia-Pacific: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 88 Asia-Pacific: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 89 Asia-Pacific: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 90 China: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 91 China: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 92 China: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 93 China: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 94 India: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 95 India: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 96 India: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 97 India: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 98 Japan: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 99 Japan: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 100 Japan: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 101 Japan: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 102 Australia: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 103 Australia: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 104 Australia: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 105 Australia: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 106 Malaysia: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 107 Malaysia: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 108 Malaysia: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 109 Malaysia: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 110 Indonesia: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 111 Indonesia: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 112 Indonesia: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 113 Indonesia: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 114 South Korea: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 115 South Korea: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 116 South Korea: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 117 South Korea: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 118 Thailand: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 119 Thailand: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 120 Thailand: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 121 Thailand: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 122 Rest of Asia-Pacific: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 123 Rest of Asia-Pacific: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 124 Rest of Asia-Pacific: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 125 Rest of Asia-Pacific: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 126 Latin America: Offshore Drilling Waste Management Market, by Country/Region, 2023-2035 (USD Million)

Table 127 Latin America: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 128 Latin America: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 129 Latin America: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 130 Latin America: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 131 Brazil: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 132 Brazil: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 133 Brazil: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 134 Brazil: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 135 Argentina: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 136 Argentina: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 137 Argentina: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 138 Argentina: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 139 Colombia: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 140 Colombia: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 141 Colombia: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 142 Colombia: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 143 Venezuela: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 144 Venezuela: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 145 Venezuela: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 146 Venezuela: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 147 Rest of Latin America: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 148 Rest of Latin America: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 149 Rest of Latin America: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 150 Rest of Latin America: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 151 Middle East & Africa: Offshore Drilling Waste Management Market, by Country/Region, 2023-2035 (USD Million)

Table 152 Middle East & Africa: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 153 Middle East & Africa: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 154 Middle East & Africa: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 155 Middle East & Africa: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 156 Saudi Arabia: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 157 Saudi Arabia: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 158 Saudi Arabia: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 159 Saudi Arabia: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 160 UAE: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 161 UAE: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 162 UAE: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 163 UAE: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 164 Qatar: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 165 Qatar: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 166 Qatar: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 167 Qatar: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 168 Kuwait: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 169 Kuwait: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 170 Kuwait: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 171 Kuwait: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 172 Nigeria: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 173 Nigeria: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 174 Nigeria: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 175 Nigeria: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 176 Angola: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 177 Angola: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 178 Angola: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 179 Angola: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 180 South Africa: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 181 South Africa: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 182 South Africa: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 183 South Africa: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 184 Egypt: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 185 Egypt: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 186 Egypt: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 187 Egypt: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

Table 188 Rest of Middle East & Africa: Offshore Drilling Waste Management Market, by Service Type, 2023-2035 (USD Million)

Table 189 Rest of Middle East & Africa: Offshore Drilling Waste Management Market, by Waste Type, 2023-2035 (USD Million)

Table 190 Rest of Middle East & Africa: Offshore Drilling Waste Management Market, by Treatment Method, 2023-2035 (USD Million)

Table 191 Rest of Middle East & Africa: Offshore Drilling Waste Management Market, by End-User, 2023-2035 (USD Million)

List of Figures

Figure 1 Research Process for Offshore Drilling Waste Management Market

Figure 2 Secondary Sources Referenced for Offshore Drilling Waste Management Study

Figure 3 Primary Research Techniques for Offshore Waste Management Market Analysis

Figure 4 Key Executives Interviewed in Offshore Drilling Waste Management Industry

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach for Offshore Drilling Waste Management

Figure 7 In 2025, the Treatment & Disposal Segment to Dominate the Global Offshore Drilling Waste Management Market

Figure 8 In 2025, the Drill Cuttings Segment to Show Largest Waste Type Share

Figure 9 In 2025, the Mechanical Separation Segment to Lead Treatment Method Applications

Figure 10 In 2025, the Oil & Gas Companies Segment to Dominate the Market

Figure 11 Asia-Pacific and North America Lead the Offshore Drilling Waste Management Market Growth

Figure 12 Benefits of Advanced Offshore Drilling Waste Management on Environmental Impact

Figure 13 Offshore Drilling Waste Management Process Flow and Best Practices

Figure 14 Offshore Drilling Waste Management Market: Value Chain Analysis

Figure 15 Offshore Drilling Waste Management Market: Porter's Five Forces Analysis

Figure 16 Impact Analysis of Offshore Drilling Waste Management Market Dynamics

Figure 17 Treatment & Disposal vs. Solid Control vs. Containment & Handling: Technology Comparison

Figure 18 Global Offshore Drilling Waste Management Market, by Service Type, 2025 Vs. 2035 (USD Million)

Figure 19 Global Offshore Drilling Waste Management Market, by Waste Type, 2025 Vs. 2035 (USD Million)

Figure 20 Global Offshore Drilling Waste Management Market, by Treatment Method, 2025 Vs. 2035 (USD Million)

Figure 21 Offshore Drilling Waste Management: Service Provider to End User Flow

Figure 22 Offshore Drilling Waste Management: Equipment Manufacturer Distribution Flow

Figure 23 Global Offshore Drilling Waste Management Market, by End-User, 2025 Vs. 2035 (USD Million)

Figure 24 Global Offshore Drilling Waste Management Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 25 Impact of Waste Management on Offshore Drilling Operations and Environmental Compliance

Figure 26 Global Offshore Drilling Waste Management Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 27 North America: Offshore Drilling Waste Management Market Snapshot (2024)

Figure 28 Europe: Offshore Drilling Waste Management Market Snapshot (2025)

Figure 29 Asia-Pacific: Offshore Drilling Waste Management Market Snapshot (2025)

Figure 30 Latin America: Offshore Drilling Waste Management Market Snapshot (2025)

Figure 31 Middle East & Africa: Offshore Drilling Waste Management Market Snapshot (2025)

Figure 32 Key Growth Strategies Adopted by Leading Offshore Waste Management Players (2022-2025)

Figure 33 Global Offshore Drilling Waste Management Market Competitive Benchmarking, by Service Type

Figure 34 Competitive Dashboard: Global Offshore Drilling Waste Management Market

Figure 35 Global Offshore Drilling Waste Management Market Ranking/Positioning of Key Players, 2025

Figure 36 Halliburton Company: Financial Overview (2024)

Figure 37 Baker Hughes Co.: Financial Overview (2024)

Figure 38 Schlumberger Limited: Financial Overview (2024)

Figure 39 Weatherford International PLC: Financial Overview (2024)

Figure 40 Advanced vs. Conventional Offshore Waste Management: Technology and Cost Comparison (2024)

Figure 41 Offshore Drilling Waste Management Technology Development Timeline and Market Impact

Figure 42 Offshore Drilling Waste Management: Environmental Impact and Sustainability Analysis

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates