Resources

About Us

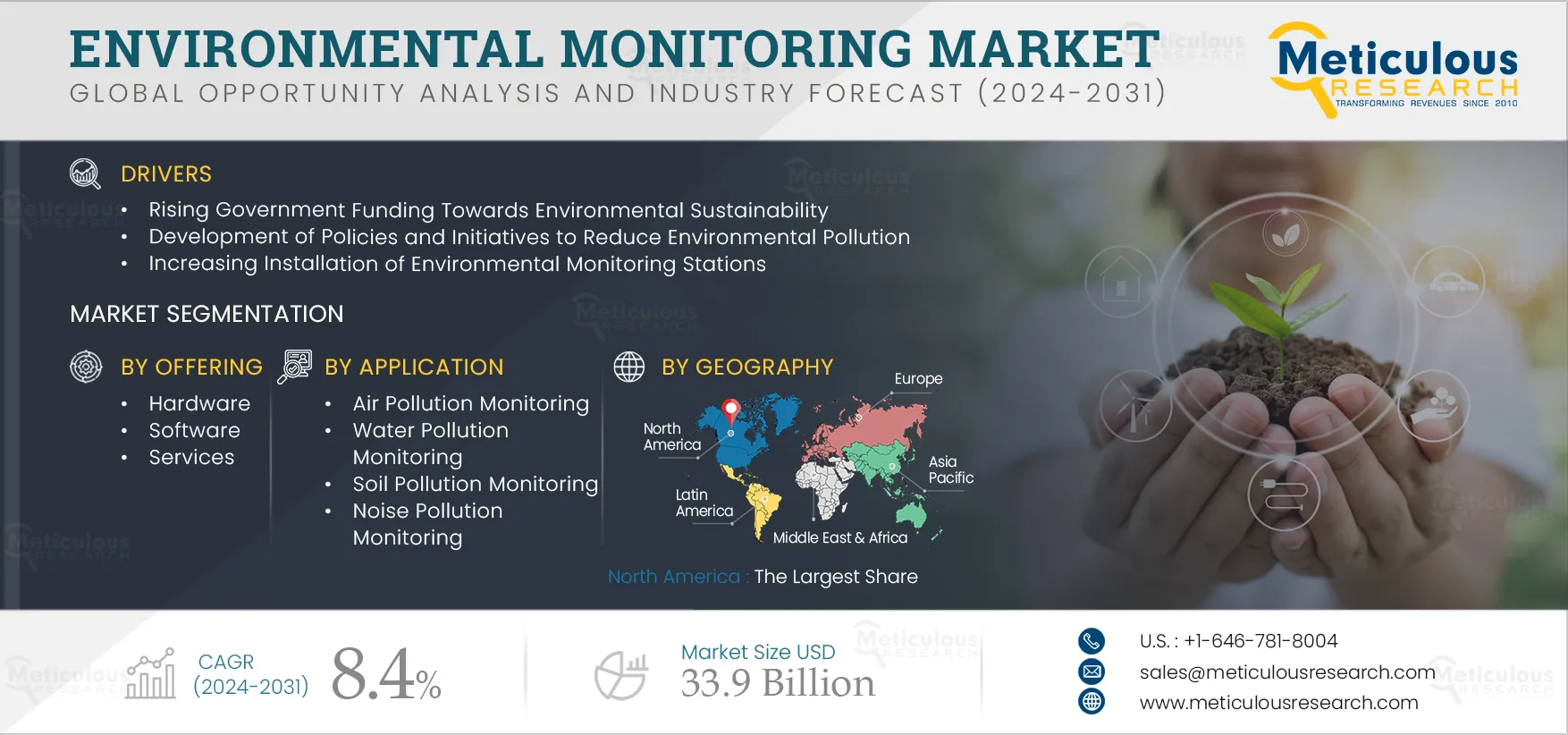

Environmental Monitoring Market Size, Share, Forecast, & Trends Analysis by Offering (Hardware (Sensors, Monitors, Others), Software, Services), Sampling, Application (Air Pollution Monitoring, Water Pollution Monitoring, Other), End User, Geography - Global Forecast to 2031

Report ID: MRICT - 104324 Pages: 225 Jun-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportKey factors driving the growth of the environmental monitoring stations market include rising government investments aimed at promoting environmental sustainability, the formulation of policies and initiatives aimed at curbing pollution, and an increase in the installation of environmental monitoring stations. However, trade constraints on environmental technologies in developing countries and the gradual pace of adopting & enforcing pollution control policies restrain the growth of this market.

Furthermore, the incorporation of IoT and nanotechnology into environmental monitoring systems and the increasing deployment of unmanned aerial vehicles for monitoring purposes are anticipated to offer opportunities for market growth. However, the high costs of implementing environmental monitoring solutions pose challenges to the market's growth.

In recent years, taking decisive action to achieve environmental sustainability has become crucial globally. Key practices to promote sustainability include protecting renewable resources by adopting sustainable agriculture, buying from local farmers, purchasing carbon offsets to support reforestation and other regenerative projects, shifting away from fossil fuels in favor of renewable energy sources, and supporting clean air and water initiatives. Governments and organizations worldwide are increasingly investing in efforts to reduce carbon footprints and foster an environmentally sustainable economy.

Various green investment banks (GIBs), such as the UK Green Investment Bank, Malaysian Green Technology Corporation (GreenTech Malaysia), Connecticut Green Bank, Clean Energy Finance Corporation (CEFC), and California CLEEN Center, are focusing on investing in and funding projects that have the potential to reduce greenhouse gas (GHG) emissions.

Click here to: Get a Free Sample Copy of this Report

Click here to: Get a Free Sample Copy of this Report

Government regulations and policies are essential for shaping and improving a country’s environmental conditions. International agreements tackle major global issues such as air and water pollution, hazardous waste management, and climate change. However, since no single policy can address all environmental challenges, the number of policies has increased to handle more complex issues and meet future emission reduction goals. For instance, the Paris Climate Agreement and the 2030 Agenda have progressively adapted to address these growing environmental challenges.

The systems required to meet environmental monitoring standards come with substantial procurement and maintenance costs. Pollutant monitoring is primarily conducted using analytical instruments, such as optical and chemical analyzers, which are often complex, bulky, and expensive. The cost of each analyzer ranges from approximately USD 7,000 to 12,000 (EUR 6,000 to 11,000), and they require considerable resources for routine maintenance and calibration. This high expense is partly due to the inclusion of accessories such as calibration standards, pumps, and valves, which contribute to ongoing maintenance costs.

Although sensor prices have decreased in recent years, maintaining sensor networks and processing the collected data remains labor-intensive and can drive up monitoring costs. Establishing and managing networks of fixed monitoring stations also requires significant investment. While these stations, when sparsely distributed throughout a city, provide detailed and accurate measurements, they are limited to specific locations. This limitation makes it challenging to obtain reliable data for an entire urban area, necessitating more stations and further increasing costs for both purchase and upkeep.

In India, the national air quality monitoring network is operational in only 268 out of 5,000 cities and towns due to excessive costs, high labor requirements, and expensive operations and maintenance procedures (Source: Oizom Instruments Pvt. Ltd).

Nanomaterials serve as effective adsorbents, catalysts, and sensors due to their large specific surface areas and high reactivities. Nanotechnology significantly enhances the specificity of sensors used to detect pollutants. Nanosensors are increasingly utilized to identify toxic compounds at parts per million (ppm) and parts per billion (ppb) levels across various environmental systems. Nanotechnological innovations are poised to improve resource efficiency, reduce energy and water consumption, and decrease greenhouse gas emissions and hazardous waste.

Key applications of nanotechnology in environmental monitoring include:

Based on offering, the environmental monitoring market is segmented into hardware, software, and services. In 2024, the hardware segment is expected to dominate the environmental monitoring market with over 78.0% of the total share. This segment’s significant market share can be attributed to the increasing installation of environmental monitoring stations, the growing application of environmental sensors in the industrial sector, and the implementation of stringent regulations aimed at lowering environmental pollution.

However, the solutions segment is slated to register the highest compound annual growth rate during the forecast period. This growth is driven by the increasing adoption of environmental monitoring solutions by organizations in the industrial sector to better manage and reduce their environmental impact and the initiatives by market players to develop innovative environmental monitoring technologies.

Based on sampling method, the environmental monitoring market is segmented into continuous monitoring, intermittent monitoring, passive monitoring, and active monitoring. In 2024, the continuous monitoring segment is expected to dominate the environmental monitoring market with over 47.5% of the total share. This segment’s significant market share can be attributed to the benefits offered by continuous monitoring systems, which include rapid pollutant analysis, real-time detection of changes in pollutant levels, and the facilitation of swift corrective actions.

Furthermore, the continuous monitoring segment is slated to register the highest compound annual growth rate during the forecast period.

Based on application, the environmental monitoring market is segmented into air pollution monitoring, water pollution monitoring, soil pollution monitoring, noise pollution monitoring, and other applications. In 2024, the air pollution monitoring segment is expected to dominate the environmental monitoring market with over 42.5% of the total share. This segment’s significant market share can be attributed to increasing air pollution levels and the implementation of stringent guidelines & regulations for air quality control.

Furthermore, the air pollution monitoring segment is slated to register the highest compound annual growth rate during the forecast period.

Based on end user, the environmental monitoring market is segmented into residential, government & public utilities, commercial, and industrial. In 2024, the industrial segment is expected to dominate the environmental monitoring market. This segment’s significant market share can be attributed to the increasing focus on predictive maintenance and remote monitoring, stringent government regulations on pollution monitoring in the industrial sector, and rapid industrialization globally.

Furthermore, the industrial segment is slated to register the highest compound annual growth rate during the forecast period.

In 2024, North America is expected to dominate the environmental monitoring market with over 34.4% of the total share. North America’s significant market share can be attributed to the widespread adoption of advanced monitoring technologies, stringent environmental regulations, and rising environmental protection initiatives in the region.

However, the market in Asia-Pacific is slated to register the highest compound annual growth rate of over 9.0% during the forecast period. This growth is driven by the increasing implementation of stringent environmental regulations and the rising adoption of monitoring technologies among organizations in the industrial sector.

The report provides a competitive analysis based on an extensive evaluation of the major players' product portfolios, geographic reach, and the key growth strategies they have implemented over the past 3–4 years. Some of the major companies operating in the environmental monitoring market are Danaher Corporation (U.S.), Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Agilent Technologies, Inc. (U.S.), TE Connectivity Ltd. (Switzerland), Siemens AG (Germany), Emerson Electric Co. (U.S.), Honeywell International Inc. (U.S.), Teledyne Technologies Incorporated (U.S.), Horiba, Ltd (Japan), Shimadzu Corporation (Japan), Testo SE & Co. KGaA (Germany), ACOEM Group (France), and Halma plc (U.K.).

|

Particulars |

Details |

|

Number of Pages |

225 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

8.4% |

|

Market Size (Value) |

USD 33.9 Billion by 2031 |

|

Segments Covered |

By Offering

By Sampling Method

By Application

Bby End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Sweden, Denmark, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Malaysia, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Danaher Corporation (U.S.), Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Agilent Technologies, Inc. (U.S.), TE Connectivity Ltd. (Switzerland), Siemens AG (Germany), Emerson Electric Co. (U.S.), Honeywell International Inc. (U.S.), Teledyne Technologies Incorporated (U.S.), Horiba, Ltd (Japan), Shimadzu Corporation (Japan), Testo SE & Co. KGaA (Germany), ACOEM Group (France), and Halma plc (U.K.). |

This study focuses on market assessment and opportunity analysis by analyzing the sales of environmental monitoring solutions across various regions and countries. This study also offers a competitive analysis of the environmental monitoring market based on an extensive assessment of the leading players' product portfolios, geographic presence, and key growth strategies.

The environmental monitoring market is projected to reach $33.9 billion by 2031, at a CAGR of 8.4% during the forecast period.

In 2024, the hardware segment is expected to dominate the environmental monitoring market.

In 2024, the continuous monitoring segment is expected to dominate the environmental monitoring market.

In 2024, the air pollution monitoring segment is expected to dominate the environmental monitoring market.

In 2024, the industrial segment is expected to dominate the environmental monitoring market.

The growth of the environmental monitoring stations market is fueled by several factors, including increased government investments in environmental sustainability initiatives, the implementation of policies aimed at reducing pollution, and a rise in the number of monitoring stations.

Additionally, advancements such as the integration of IoT and nanotechnology in monitoring systems and the increasing use of unmanned aerial vehicles for environmental surveillance are anticipated to offer opportunities for market growth.

The key players operating in the environmental monitoring market are Danaher Corporation (U.S.), Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Agilent Technologies, Inc. (U.S.), TE Connectivity Ltd. (Switzerland), Siemens AG (Germany), Emerson Electric Co. (U.S.), Honeywell International Inc. (U.S.), Teledyne Technologies Incorporated (U.S.), Horiba, Ltd (Japan), Shimadzu Corporation (Japan), Testo SE & Co. KGaA (Germany), ACOEM Group (France), and Halma plc (U.K.).

Asia-Pacific is projected to register the highest growth rate over the coming years, consequently offering significant growth opportunities for companies operating in this market.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates