Resources

About Us

North America Healthcare IT Market by Product (EMR, mHealth, PHM, RIS, PACS, RCM, Healthcare Analytics, Telehealth, SCM, HIE), Component (Software, Service), Delivery Mode (Web, Cloud), and End User (Hospital, Payer, Ambulatory, Homecare)- Forecast to 2032

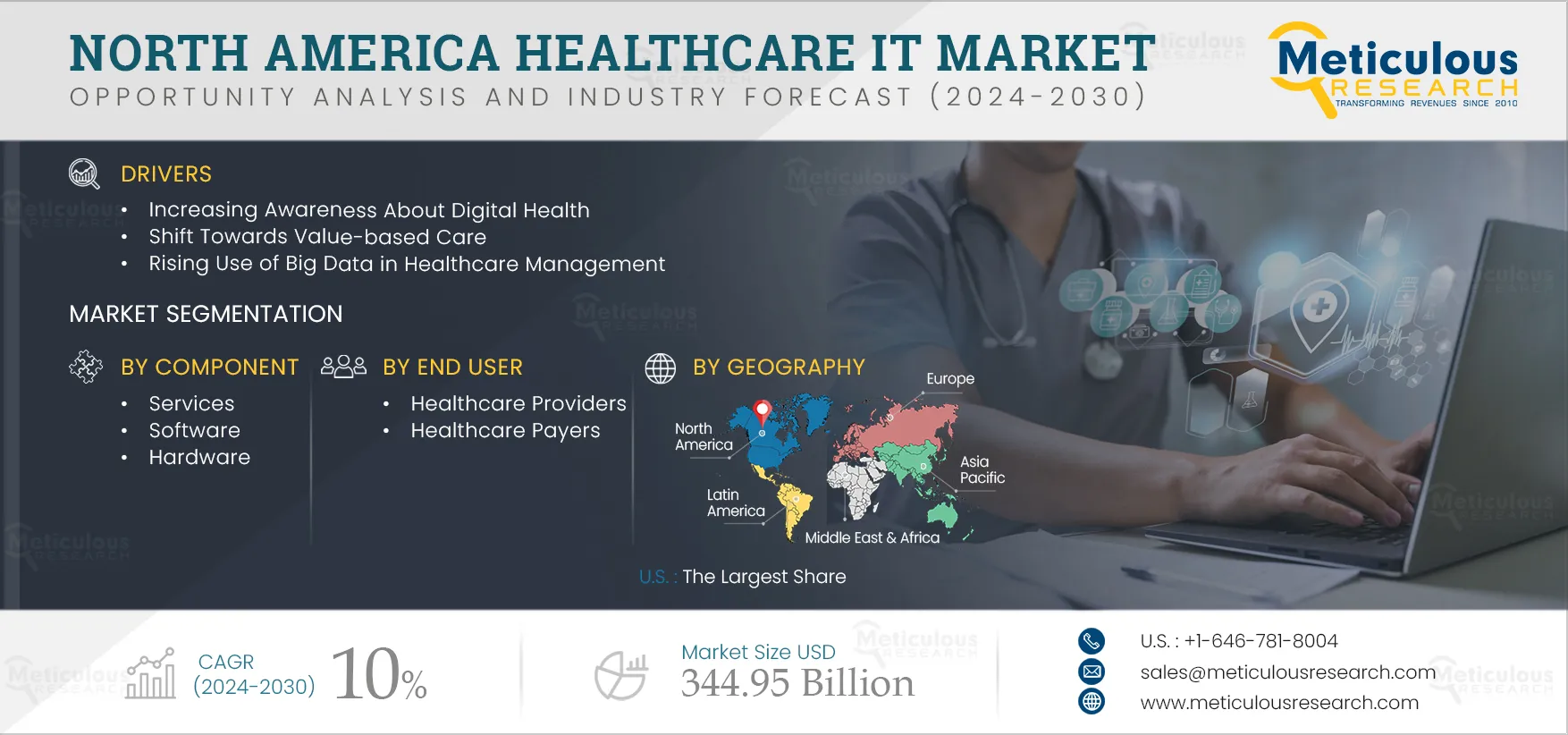

Report ID: MRHC - 104951 Pages: 250 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe North America Healthcare IT Market is expected to grow at a CAGR of 10% from 2025 to 2032 to reach $344.95 billion by 2032. North America healthcare IT comprises various technologies that gather, store, analyze, and represent information for various areas in the healthcare industry. Over the years, the North America healthcare IT industry has transitioned from applying IT solutions for basic administrative functions to core clinical tasks. The increased amount of data gathered through patient records has now led to deploying advanced IT solutions in the healthcare industry. This includes deploying advanced analytics solutions, population health management solutions, and AI solutions for various clinical and non-clinical applications.

The key factors driving the North America Healthcare IT market are the increasing awareness about digital health, government mandates and financial incentives for the adoption of HCIT solutions, the shift towards value-based care, rising use of big data in healthcare management, high return on IT investment in the healthcare industry, and rising incidence of chronic diseases. However, high installation & maintenance cost is restraining the market growth to a certain extent. Growing focus on cloud-based solutions and rising adoption of AI and IoT in healthcare are creating opportunities for market growth. Interoperability issues and data security and privacy concerns are challenging market growth.

Many hospitals and health systems are currently dealing with escalating operational costs. Healthcare analytics are known to improve medical practice efficiency. The operational costs can be reduced by lowering transcription costs, reducing time spent on documentation, improving documentation for billing, and limiting or eliminating chart pull, storage, improving patient outcome & treatment. Implementation of healthcare IT solutions reportedly leads to significant cost savings.

Hospitals and practices that use analytical software can curb excess and wasteful spending. In addition, studies have reported that medical errors can cost billions of dollars, such as additional costs for patient care who need treatment to recover from medical mistakes and the high cost of malpractice lawsuits. Implementation of healthcare analytics reduces the risk of disease in the future and can provide better treatment for patients. Therefore, the rising need to reduce operational costs in the healthcare industry is expected to factor in the growth of the healthcare IT market.

Click here to: Get Free Sample Pages of this Report

Benefits Offered by mHealth Apps Support the Adoption of Healthcare IT Solutions

mHealth apps are the medical and public health practices supported by smartphones, tablets, or other mobile communication devices. They provide a new, innovative way to deliver healthcare services outside traditional care settings. They are expected to be a potential resource to enhance healthcare professionals’ productivity and improve patients’ health outcomes.

Conventionally, patients visit healthcare facilities regularly for their regular checkups, diagnosis, or treatment. Following are some of the benefits offered by the mHealth apps:

Such benefits lead to increased mHealth solution adoption for efficient medical diagnosis and treatment, thereby driving the market.

Among the products, in 2025, Healthcare IT provider solutions are Expected to Account for the Largest Share of the Market

Based on product, the market is broadly segmented into healthcare IT provider solutions, healthcare IT payer solutions, and healthcare IT outsourcing services. Factors such as high demand for integrated healthcare systems, growing focus on patient safety & care, advanced healthcare infrastructure in the U.S. and Canada, increasing demand for quality healthcare, increasing investments & regulatory mandates on implementing eHealth solutions, rising awareness about EHRs, and growing geriatric population are among the factors supporting the largest share of healthcare IT provider solutions in the market.

Among the components, in 2025, the services segment is expected to account for the largest share of the North America Healthcare IT Market

In 2025, the services segment is estimated to account for the largest share of the North America Healthcare IT market. The use of healthcare IT services in rural areas, owing to the closure of many rural hospitals in the U.S., is a key factor supporting the largest adoption of healthcare IT services. Additionally, the shortage of physicians & specialists, the shift towards cloud-based services, and the increasing burden of chronic diseases supported the market growth. According to the Association of American Medical Colleges (AAMC), the demand for physicians grows faster than the supply, leading to a projected total physician shortfall of between 61,700 and 94,700 physicians by 2025 in the U.S.

In 2025, the web & cloud-based solutions segment is expected to account for the largest share of the North America Healthcare IT Market

In 2025, the web & cloud-based solutions segment is estimated to account for the largest share of the North America Healthcare IT market. This is mainly due to lower upfront costs, no maintenance costs, excessive storage flexibility, and greater security in private clouds. Cloud & web-based software eliminates the need for physical servers and thus the cost of maintaining physical on-premises servers. Cloud & web-based solutions are also less expensive than on-premise solutions, save costs, are simple to use on any platform, and are accessible at any time, supporting their largest adoption.

In 2025, the Healthcare Providers Segment is Expected to Account for the Largest Share of the North America Healthcare IT Market

In 2025, the healthcare providers segment is estimated to account for the largest share of the North America Healthcare IT market. The large share of this segment is attributed to factors such as the high demand for convenient healthcare owing to a high incidence of chronic diseases, the dearth of medical professionals, advanced healthcare IT infrastructure in hospitals, and an increase in the focus and availability of provider-specific healthcare IT solutions. Healthcare IT solutions offer improved patient care, reduced hospital administration costs, and managing workflows in healthcare settings. Thus, the reliance of healthcare providers on healthcare IT solutions has increased.

Among the Countries, the U.S. accounted for the Largest Market Share in 2025

The largest share of the U.S. is primarily attributed to the high awareness of the benefits and convenience of healthcare IT services, the presence of leading players, well-established health digital systems, an increased prevalence of chronic diseases in the region, and a robust healthcare infrastructure. Additionally, initiatives supporting the adoption of digital health also support the largest share of the market. For instance, in June 2021, the U.S. Department of Health and Human Services’ (HHS) Office of the National Coordinator for Health Information Technology (ONC) announced the establishment of a USD 80 million public health informatics & technology workforce development program (PHIT Workforce Program) to strengthen U.S. public health informatics and data science.

Key Players

The report includes a competitive landscape based on an extensive assessment of the product portfolio offerings, component, applications, end user, geographic presence, and key strategic developments adopted by leading market players in the industry over the years 2020–2025. The key players profiled in the North America healthcare IT market are McKesson Corporation (U.S.), Optum Health (U.S.), International Business Machine Corporation (IBM) (U.S.), Allscripts Healthcare Solutions, Inc. (U.S.), athenahealth, Inc. (U.S.), Epic Systems Corporation (U.S.), Dell Technologies Inc. (U.S.), GE Healthcare (U.S.), Cerner Corporation (U.S.), Oracle Corporation (U.S.), Cognizant Technology Solutions Corporation (U.S.), Nuance Communications, Inc. (U.S.), eClinicalWorks (U.S.) NextGen Healthcare, Inc. (U.S.), Computer Programs and Systems, Inc. (CPSI) (U.S.), Conifer Health Solutions, LLC. (U.S.), 3M Company (U.S.), Koninklijke Philips N.V. (The Netherlands), and Infor, Inc. (U.S.).

Scope of the Report:

North America Healthcare IT Market, by Product

North America Healthcare IT Market, by Delivery Mode

North America Healthcare IT Market, by Component

North America Healthcare IT Market, by End User

North America Healthcare IT Market, by Country

Key questions answered in the report:

North America Healthcare IT market report covers the market size & forecasts for various products, components, delivery modes, end users, and geography. The North America Healthcare IT market studied in this report involves the value analysis of various segments and sub-segments of North America Healthcare IT at the country level.

The North America Healthcare IT market is projected to reach $344.95 billion by 2032, at a CAGR of 10% during the forecast period of 2025–2032.

The various components are hardware, software, and services. In 2025, the services segment is estimated to account for the largest share of the North America Healthcare IT market.

The key factors driving the North America Healthcare IT market are the increasing awareness about digital health, government mandates and financial incentives for the adoption of HCIT solutions, the shift towards value-based care, rising use of big data in healthcare management, high return on IT investment in the healthcare industry, and rising incidence of chronic diseases. Growing focus on cloud-based solutions and rising adoption of AI and IoT in healthcare are creating opportunities for market growth.

The key players operating in the North America Healthcare IT market are McKesson Corporation (U.S.), Optum Health (U.S.), International Business Machine Corporation (IBM) (U.S.), Allscripts Healthcare Solutions, Inc. (U.S.), athenahealth, Inc. (U.S.), Epic Systems Corporation (U.S.), Dell Technologies Inc. (U.S.), GE Healthcare (U.S.), Cerner Corporation (U.S.), Oracle Corporation (U.S.), Cognizant Technology Solutions Corporation (U.S.), Nuance Communications, Inc. (U.S.), eClinicalWorks (U.S.) NextGen Healthcare, Inc. (U.S.), Computer Programs and Systems, Inc. (CPSI) (U.S.), Conifer Health Solutions, LLC. (U.S.), 3M Company (U.S.), Koninklijke Philips N.V. (The Netherlands), and Infor, Inc. (U.S.) among others.

The U.S. is the fastest-growing country and offers significant growth opportunities for the players operating in this market. The presence of robust healthcare infrastructure and prominent healthcare IT companies, a growing aging population, an increasing number of people diagnosed with chronic diseases, the need to curtail the cost of healthcare delivery, and a growing focus on enhancing the quality of healthcare are some key factors contributing to the growth of the healthcare IT market in the U.S.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Increasing Awareness About Digital Health

4.2.1.2. Government Mandates and Financial Incentives for Adoption of HCIT Solutions

4.2.1.3. Shift Towards Value-based Care

4.2.1.4. Rising Use of Big Data in Healthcare Management

4.2.1.5. High Return on IT Investment in the Healthcare Industry

4.2.1.6. Rising Incidence of Chronic Diseases

4.2.2. Restraint

4.2.2.1. High Installation & Maintenance Cost

4.2.3. Opportunities

4.2.3.1. Growing Adoption of Cloud-based Solutions

4.2.3.2. Rising Adoption of AI and IoT in Healthcare

4.2.4. Challenges

4.2.4.1. Interoperability Issues

4.2.4.2. Data Security and Privacy Concerns

4.2.5. Factor Analysis

4.3. Market Trends

4.4 Case Studies

4.5. Porter’s Five Forces Analysis

4.5.1. Bargaining Power of Buyers

4.5.2. Bargaining Power of Suppliers

4.5.3. Threat of Substitutes

4.5.4. Threat of New Entrants

4.5.5. Degree of Competition

4.6. Adjacent Market Analysis: North America Healthcare IT Market

5. North America Healthcare IT Market, by Product Type

5.1. Overview

5.2. Healthcare IT Provider Solutions

5.2.1. Clinical Healthcare IT Solutions

5.2.1.1. Electronic Health Records (EHR)

5.2.1.2. PACS & VNA

5.2.1.3. Computerized Physician Order Entry (CPOE) Solutions

5.2.1.4. Population Health Management Solutions

5.2.1.5. Specialty Information Management Systems

5.2.1.6. mHealth Solutions

5.2.1.7. Healthcare Integration Solutions

5.2.1.8. Telehealth Solutions

5.2.1.9. Medical Image Analysis Systems

5.2.1.10. Laboratory Information Systems (LIS)

5.2.1.11. Practice Management Systems

5.2.1.12. Clinical Decision Support Systems (CDSS)

5.2.1.13. E-Prescribing Systems

5.2.1.14. Radiology Information Systems (RIS)

5.2.1.15. Radiation Dose Management (RDM) Solutions

5.2.1.16. Patient Engagement Solutions

5.2.1.17. Patient Registry Software

5.2.1.18. Infection Surveillance Solutions

5.2.1.19. Care Management Solutions

5.2.2. Non-clinical Healthcare IT Solutions

5.2.2.1. Healthcare Asset Management Solutions

5.2.2.2. Pharmacy Information Systems

5.2.2.3. Healthcare Workforce Management Solutions

5.2.2.4. Revenue Cycle Management Solutions

5.2.2.4.1. Front-end RCM

5.2.2.4.2. Mid-end RCM

5.2.2.4.3. Back-end RCM

5.2.2.5. Medical Document Management Solutions

5.2.2.6. Healthcare Information Exchanges

5.2.2.7. Supply Chain Management Solutions

5.2.2.8. Healthcare Analytics

5.2.2.8.1. Clinical Analytics

5.2.2.8.2. Financial Analytics

5.2.2.8.3. Operational & Administrative Analytics

5.2.2.9. Customer Relationship Management Solutions

5.2.2.10. Medication Management Systems

5.2.2.10.1. Electronic Medication Administration Systems

5.2.2.10.2. Barcode Medication Administration Systems

5.2.2.10.3. Medication Inventory Management Systems

5.2.2.10.4. Medication Assurance Systems

5.2.2.11. Healthcare Quality Management Solutions

5.2.2.12. Healthcare Interoperability Solutions

5.2.2.13. Financial Management Solutions (Accounting & Billing)

5.3. Healthcare Payer Solutions

5.3.1. Claims Management Solutions

5.3.2. Customer Relationship Management

5.3.3. Fraud Analytics Solutions

5.3.4. Provider Network Management

5.3.5. Pharmacy Audit & Analysis Solutions

5.3.6. Member Eligibility Management Solutions

5.3.7. Population Health Management Solutions

5.3.8. Payment Management Solutions

5.4. HCIT Outsourcing Services

5.4.1. Provider HCIT Outsourcing Services

5.4.1.1. Revenue Cycle Management Services

5.4.1.2. EMR/Medical Document Management Services

5.4.1.3. Laboratory Information Management Services

5.4.1.4. Other Provider HCIT Outsourcing Services

5.4.2. Payer HCIT Outsourcing Services

5.4.2.1. Claims Management Services

5.4.2.2. Provider Network Management Services

5.4.2.3. Billing & Accounts Management Services

5.4.2.4. Fraud Analytics Services

5.4.2.5. Other Payer HCIT Outsourcing Services

5.4.3. Operational HCIT Outsourcing Services

5.4.3.1. Business Process Management Services

5.4.3.2. Supply Chain Management Services

5.4.3.3. Other Operational IT Outsourcing Services

5.4.4. IT Infrastructure Management Services

6. North America Healthcare IT Market, by Delivery Mode

6.1. Overview

6.2. Web & Cloud-Based

6.3. On-Premise

7. North America Healthcare IT Market, by Component

7.1. Overview

7.2. Services

7.3. Software

7.4. Hardware

8. North America Healthcare IT Market, by End User

8.1. Overview

8.2. Healthcare Providers

8.2.1. Hospitals

8.2.2. Ambulatory Care Centers

8.2.3. Home Healthcare Agencies & Assisted Living Facilities

8.2.4. Diagnostic & Imaging Centers

8.2.5. Pharmacies

8.3. Healthcare Payers

8.3.1. Private Payers

8.3.2. Public Payers

9. North America Healthcare IT Market, by Country

9.1. Overview

9.1.1. U.S.

9.1.2. Canada

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share Analysis/Market Ranking, 2022

11. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

11.1. Cerner Corporation

11.2. McKesson Corporation

11.3. International Business Machine Corporation (IBM)

11.4. Allscripts Healthcare Solutions, Inc.

11.5. Koninklijke Philips N.V.

11.6. GE HealthCare Technologies Inc.

11.7. athenahealth, Inc.

11.8. Optum, Inc.

11.9. Dell Technologies Inc.

11.10. Oracle Corporation

11.11. Infor, Inc.

11.12. Cognizant Technology Solutions Corporation

11.13. Nuance Communications, Inc.

11.14. eClinicalWorks

11.15. NextGen Healthcare, Inc.

11.16. Computer Programs and Systems, Inc.

11.17. Conifer Health Solutions, LLC.

11.18. 3M Company

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Table

Table 1 North America Healthcare IT Market, by Product, 2021-2032 (USD Million)

Table 2 North America Healthcare Provider Solutions Market, by Type, 2021-2032 (USD Million)

Table 3 North America Healthcare Provider Solutions Market, by Country, 2021-2032 (USD Million)

Table 4 North America Clinical Healthcare IT Solutions Market, by Type, 2021-2032 (USD Million)

Table 5 North America Clinical Healthcare IT Solutions Market, by Country, 2021-2032 (USD Million)

Table 6 North America Electronic Health Records (EHR) Market, by Country, 2021-2032 (USD Million)

Table 7 North America PACS & VNA Market, by Country, 2021-2032 (USD Million)

Table 8 North America Computerized Physician Order Entry (CPOE) Solutions Market, by Country, 2021-2032 (USD Million)

Table 9 North America Population Health Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 10 North America Specialty Information Management Systems Market, by Country, 2021-2032 (USD Million)

Table 11 North America mHealth Solutions Market, by Country, 2021-2032 (USD Million)

Table 12 North America Healthcare Integration Solutions Market, by Country, 2021-2032 (USD Million)

Table 13 North America Telemedicine Solutions Market, by Country, 2021-2032 (USD Million)

Table 14 North America Medical Image Analysis Systems Market, by Country, 2021-2032 (USD Million)

Table 15 North America Laboratory Information Systems (LIS) Market, by Country, 2021-2032 (USD Million)

Table 16 North America Practice Management Systems Market, by Country, 2021-2032 (USD Million)

Table 17 North America Clinical Decision Support Systems (CDSS) Market, by Country, 2021-2032 (USD Million)

Table 18 North America E-Prescribing Systems Market, by Country, 2021-2032 (USD Million)

Table 19 North America Radiology Information Systems (RIS) Market, by Country, 2021-2032 (USD Million)

Table 20 North America Radiation Dose Management (RDM) Solutions Market, by Country, 2021-2032 (USD Million)

Table 21 North America Patient Engagement Solutions Market, by Country, 2021-2032 (USD Million)

Table 22 North America Patient Registry Software Market, by Country, 2021-2032 (USD Million)

Table 23 North America Infection Surveillance Solutions Market, by Country, 2021-2032 (USD Million)

Table 24 North America Care Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 25 North America Non-clinical Healthcare IT Solutions Market, by Type, 2021-2032 (USD Million)

Table 26 North America Non-clinical Healthcare IT Solutions Market, by Country, 2021-2032 (USD Million)

Table 27 North America Healthcare Asset Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 28 North America Pharmacy Information Systems Market, by Country, 2021-2032 (USD Million)

Table 29 North America Healthcare Workforce Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 30 North America Revenue Cycle Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 31 North America Revenue Cycle Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 32 North America Front-end RCM Market, by Country, 2021-2032 (USD Million)

Table 33 North America Mid-end RCM Market, by Country, 2021-2032 (USD Million)

Table 34 North America Back-end RCM Market, by Country, 2021-2032 (USD Million)

Table 35 North America Medical Document Management Market, by Country, 2021-2032 (USD Million)

Table 36 North America Healthcare Information Exchanges Market, by Country, 2021-2032 (USD Million)

Table 37 North America Supply Chain Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 38 North America Healthcare Analytics Market, by Type, 2021-2032 (USD Million)

Table 39 North America Healthcare Analytics Market, by Country, 2021-2032 (USD Million)

Table 40 North America Clinical Analytics Market, by Country, 2021-2032 (USD Million)

Table 41 North America Financial Analytics Market, by Country, 2021-2032 (USD Million)

Table 42 North America Operational & Administrative Analytics Market, by Country, 2021-2032 (USD Million)

Table 43 North America Customer Relationship Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 44 North America Medication Management Systems Market, by Type, 2021-2032 (USD Million)

Table 45 North America Medication Management Systems Market, by Country, 2021-2032 (USD Million)

Table 46 North America Electronic Medication Administration Systems Market, by Country, 2021-2032 (USD Million)

Table 47 North America Barcode Medication Administration Systems Market, by Country, 2021-2032 (USD Million)

Table 48 North America Medication Inventory Management Systems Market, by Country, 2021-2032 (USD Million)

Table 49 North America Medication Assurance Systems Market, by Country, 2021-2032 (USD Million)

Table 50 North America Healthcare Quality Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 51 North America Healthcare Interoperability Solutions Market, by Country, 2021-2032 (USD Million)

Table 52 North America Financial Management Solutions (Accounting & Billing) Market, by Country, 2021-2032 (USD Million)

Table 53 North America Healthcare Payers Solutions Market, by Type, 2021-2032 (USD Million)

Table 54 North America Healthcare Payers Solutions Market, by Country, 2021-2032 (USD Million)

Table 55 North America Claims Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 56 North America Customer Relationship Management Market, by Country, 2021-2032 (USD Million)

Table 57 North America Fraud Analytics Solutions Market, by Country, 2021-2032 (USD Million)

Table 58 North America Provider Network Management Market, by Country, 2021-2032 (USD Million)

Table 59 North America Pharmacy Audit & Analysis Solutions Market, by Country, 2021-2032 (USD Million)

Table 60 North America Member Eligibility Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 61 North America Population Health Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 62 North America Payment Management Solutions Market, by Country, 2021-2032 (USD Million)

Table 63 North America Healthcare IT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 64 North America Healthcare IT Outsourcing Services Market, by Country, 2021-2032 (USD Million)

Table 65 North America Provider HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 66 North America Provider HCIT Outsourcing Services Market, by Country, 2021-2032 (USD Million)

Table 67 North America Revenue Cycle Management Services Market, by Country, 2021-2032 (USD Million)

Table 68 North America EMR/Medical Document Management Services Market, by Country, 2021-2032 (USD Million)

Table 69 North America Laboratory Information Management Services Market, by Country, 2021-2032 (USD Million)

Table 70 North America Other Provider HCIT Outsourcing Services Market, by Country, 2021-2032 (USD Million)

Table 71 North America Payer HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 72 North America Payer HCIT Outsourcing Services Market, by Country, 2021-2032 (USD Million)

Table 73 North America Claim Management Services Market, by Country, 2021-2032 (USD Million)

Table 74 North America Provider Network Management Services Market, by Country, 2021-2032 (USD Million)

Table 75 North America Billing & Account Management Services Market, by Country, 2021-2032 (USD Million)

Table 76 North America Fraud Analytics Services Market, by Country, 2021-2032 (USD Million)

Table 77 North America Claim Management Services Market, by Country, 2021-2032 (USD Million)

Table 78 North America Other Payer Healthcare IT Outsourcing Services Market, by Country, 2021-2032 (USD Million)

Table 79 North America Operational Healthcare IT Outsourcing Services Market, by Country, 2021-2032 (USD Million)

Table 80 North America Business Process Management Services Market, by Country, 2021-2032 (USD Million)

Table 81 North America Supply Chain Management Services Market, by Country, 2021-2032 (USD Million)

Table 82 North America Other Operational HCIT Outsourcing Services Market, by Country, 2021-2032 (USD Million)

Table 83 North America IT Infrastructure Management Services Market, by Country, 2021-2032 (USD Million)

Table 84 North America Healthcare IT Market, by Delivery Mode, 2021-2032 (USD Million)

Table 85 North America Web & Cloud-based Healthcare IT Solutions Market, by Country, 2021-2032 (USD Million)

Table 86 North America On-premise Healthcare IT Solutions Market, by Country, 2021-2032 (USD Million)

Table 87 North America Healthcare IT Market, by Component, 2021-2032 (USD Million)

Table 88 North America Healthcare IT Services Market, by Country, 2021-2032 (USD Million)

Table 89 North America Healthcare IT Software Market, by Country, 2021-2032 (USD Million)

Table 90 North America Healthcare IT Hardware Market, by Country, 2021-2032 (USD Million)

Table 91 North America Healthcare IT Market, by End User, 2021-2032 (USD Million)

Table 92 North America Healthcare IT Market for Healthcare Providers, by Type, 2021-2032 (USD Million)

Table 93 North America Healthcare IT Market for Healthcare Providers, by Country, 2021-2032 (USD Million)

Table 94 North America Healthcare IT Market for Hospitals, by Country, 2021-2032 (USD Million)

Table 95 North America Healthcare IT Market for Ambulatory Centers, by Country, 2021-2032 (USD Million)

Table 96 North America Healthcare IT Market for Home Healthcare & Assisted Living Centers, by Country, 2021-2032 (USD Million)

Table 97 North America Healthcare IT Market for Diagnostic Centers, by Country, 2021-2032 (USD Million)

Table 98 North America Healthcare IT Market for Pharmacies, by Country, 2021-2032 (USD Million)

Table 99 North America Healthcare IT Market for Healthcare Payers, by Type, 2021-2032 (USD Million)

Table 100 North America Healthcare IT Market for Healthcare Payers, by Country, 2021-2032 (USD Million)

Table 101 North America Healthcare IT Market for Private Payers, by Country, 2021-2032 (USD Million)

Table 102 North America Healthcare IT Market for Public Payers, by Country, 2021-2032 (USD Million)

Table 103 North America Healthcare IT Market, by Country, 2021-2032 (USD Million)

Table 104 North America: Healthcare IT Market, by Product, 2021-2032 (USD Million)

Table 105 North America: Healthcare IT Providers Solutions Market, by Type, 2021-2032 (USD Million)

Table 106 North America: Clinical Healthcare IT Solutions Market, by Type, 2021-2032 (USD Million)

Table 107 North America: Non-clinical Healthcare IT Solutions Market, by Type, 2021-2032 (USD Million)

Table 108 North America: Revenue Cycle Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 109 North America: Healthcare Analytics Market, by Type, 2021-2032 (USD Million)

Table 110 North America: Customer Relationship Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 111 North America: Medication Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 112 North America: Healthcare Payers Solutions Market, by Type, 2021-2032 (USD Million)

Table 113 North America: Healthcare IT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 114 North America: Provider HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 115 North America: Payer HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 116 North America: Operational HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 117 North America: Healthcare IT Solutions Market, by Delivery Mode, 2021-2032 (USD Million)

Table 118 North America: Healthcare IT Solutions Market, by Component, 2021-2032 (USD Million)

Table 119 North America: Healthcare IT Solutions Market, by End User, 2021-2032 (USD Million)

Table 120 North America: Healthcare IT Solutions Market for Healthcare Providers, by Type, 2021-2032 (USD Million)

Table 121 North America: Healthcare IT Solutions Market for Healthcare Payers, by Type, 2021-2032 (USD Million)

Table 122 U.S.: Healthcare IT Market, by Product, 2021-2032 (USD Million)

Table 123 U.S.: Healthcare IT Providers Solutions Market, by Type, 2021-2032 (USD Million)

Table 124 U.S.: Clinical Healthcare IT Solutions Market, by Type, 2021-2032 (USD Million)

Table 125 U.S.: Non-clinical Healthcare IT Solutions Market, by Type, 2021-2032 (USD Million)

Table 126 U.S.: Revenue Cycle Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 127 U.S.: Healthcare Analytics Market, by Type, 2021-2032 (USD Million)

Table 128 U.S.: Customer Relationship Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 129 U.S.: Medication Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 130 U.S.: Healthcare Payers Solutions Market, by Type, 2021-2032 (USD Million)

Table 131 U.S.: HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 132 U.S.: Provider HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 133 U.S.: Payer HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 134 U.S.: Operational HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 135 U.S.: Healthcare IT Solutions Market, by Delivery Mode, 2021-2032 (USD Million)

Table 136 U.S.: Healthcare IT Solutions Market, by Component, 2021-2032 (USD Million)

Table 137 U.S.: Healthcare IT Solutions Market, by End User, 2021-2032 (USD Million)

Table 138 U.S.: Healthcare IT Solutions Market for Healthcare Providers, by Type, 2021-2032 (USD Million)

Table 139 U.S.: Healthcare IT Solutions Market for Healthcare Payers, by Type, 2021-2032 (USD Million)

Table 140 Canada: Healthcare IT Market, by Product, 2021-2032 (USD Million)

Table 141 Canada: Healthcare IT Providers Solutions Market, by Type, 2021-2032 (USD Million)

Table 142 Canada: Clinical Healthcare IT Solutions Market, by Type, 2021-2032 (USD Million)

Table 143 Canada: Non-clinical Healthcare IT Solutions Market, by Type, 2021-2032 (USD Million)

Table 144 Canada: Revenue Cycle Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 145 Canada: Healthcare Analytics Market, by Type, 2021-2032 (USD Million)

Table 146 Canada: Customer Relationship Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 147 Canada: Medication Management Solutions Market, by Type, 2021-2032 (USD Million)

Table 148 Canada: Healthcare Payers Solutions Market, by Type, 2021-2032 (USD Million)

Table 149 Canada: HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 150 Canada: Provider HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 151 Canada: Payer HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 152 Canada: Operational HCIT Outsourcing Services Market, by Type, 2021-2032 (USD Million)

Table 153 Canada: Healthcare IT Solutions Market, by Delivery Mode, 2021-2032 (USD Million)

Table 154 Canada: Healthcare IT Solutions Market, by Component, 2021-2032 (USD Million)

Table 155 Canada: Healthcare IT Solutions Market, by End User, 2021-2032 (USD Million)

Table 156 Canada: Healthcare IT Solutions Market for Healthcare Providers, by Type, 2021-2032 (USD Million)

Table 157 Canada: Healthcare IT Solutions Market for Healthcare Payers, by Type, 2021-2032 (USD Million)

Table 158 Recent Developments, by Company, 2020-2025

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 North America Healthcare IT Market, by Product, 2025 Vs 2032 (USD Million)

Figure 8 North America Healthcare IT Market, by Delivery Mode, 2025 Vs 2032 (USD Million)

Figure 9 North America Healthcare IT Market, by Component, 2025 Vs 2032 (USD Million)

Figure 10 North America Healthcare IT Market, by End User, 2025 Vs 2032 (USD Million)

Figure 11 North America Healthcare IT Market, by Country, 2025 Vs 2032 (USD Million)

Figure 12 Impact Analysis: North America Healthcare IT Market

Figure 13 North America Healthcare IT Market, by Product, 2025 Vs 2032 (USD Million)

Figure 14 North America Healthcare IT Market, by Delivery Mode, 2025 Vs 2032 (USD Million)

Figure 15 North America Healthcare IT Market, by Component, 2025 Vs. 2032 (USD Million)

Figure 16 North America Healthcare IT Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 17 North America Healthcare IT Market, by Country, 2025 Vs 2032 (USD Million)

Figure 18 North America: Healthcare IT Market Snapshot

Figure 19 Competitive Dashboard: North America Healthcare IT Market

Figure 20 Cerner Corporation: Financial Overview (2022)

Figure 21 Medtronic plc: Financial Overview (2022)

Figure 22 Koninklijke Philips N.V.: Financial Overview (2022)

Figure 23 American Well Corporation: Financial Overview (2022)

Figure 24 McKesson Corporation: Financial Overview (2022)

Figure 25 International Business Machine Corporation: Financial Overview (2022)

Figure 26 GE Healthcare: Financial Overview (2022)

Figure 27 Allscripts Healthcare Solutions, Inc.: Financial Overview (2022)

Figure 28 Infors, Inc.: Financial Overview (2022)

Figure 29 Cognizant Technology Solution Corporation: Financial Overview (2022)

Figure 30 Oracle Corporation: Financial Overview (2022)

Figure 31 athenahealth, Inc.: Financial Overview (2022)

Figure 32 Dell Technologies, Inc.: Financial Overview (2022)

Figure 33 Optum, Inc.: Financial Overview (2022)

Figure 34 Nuance Communication, Inc.: Financial Overview (2022)

Figure 35 3M Company: Financial Overview (2022)

Figure 36 NextGen Healthcare, Inc.: Financial Overview (2022)

Figure 37 Computer Programs and Systems, Inc.: Financial Overview (2022)

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Mar-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates