Resources

About Us

Europe Healthcare IT Market by Product (EMR, mHealth, PHM, RIS, PACS, RCM, Healthcare Analytics, Telehealth, SCM, HIE), Component (Software, Service), Delivery Mode (Web, Cloud), and End User (Hospital, Payer, Ambulatory, Homecare) - Forecast to 2032

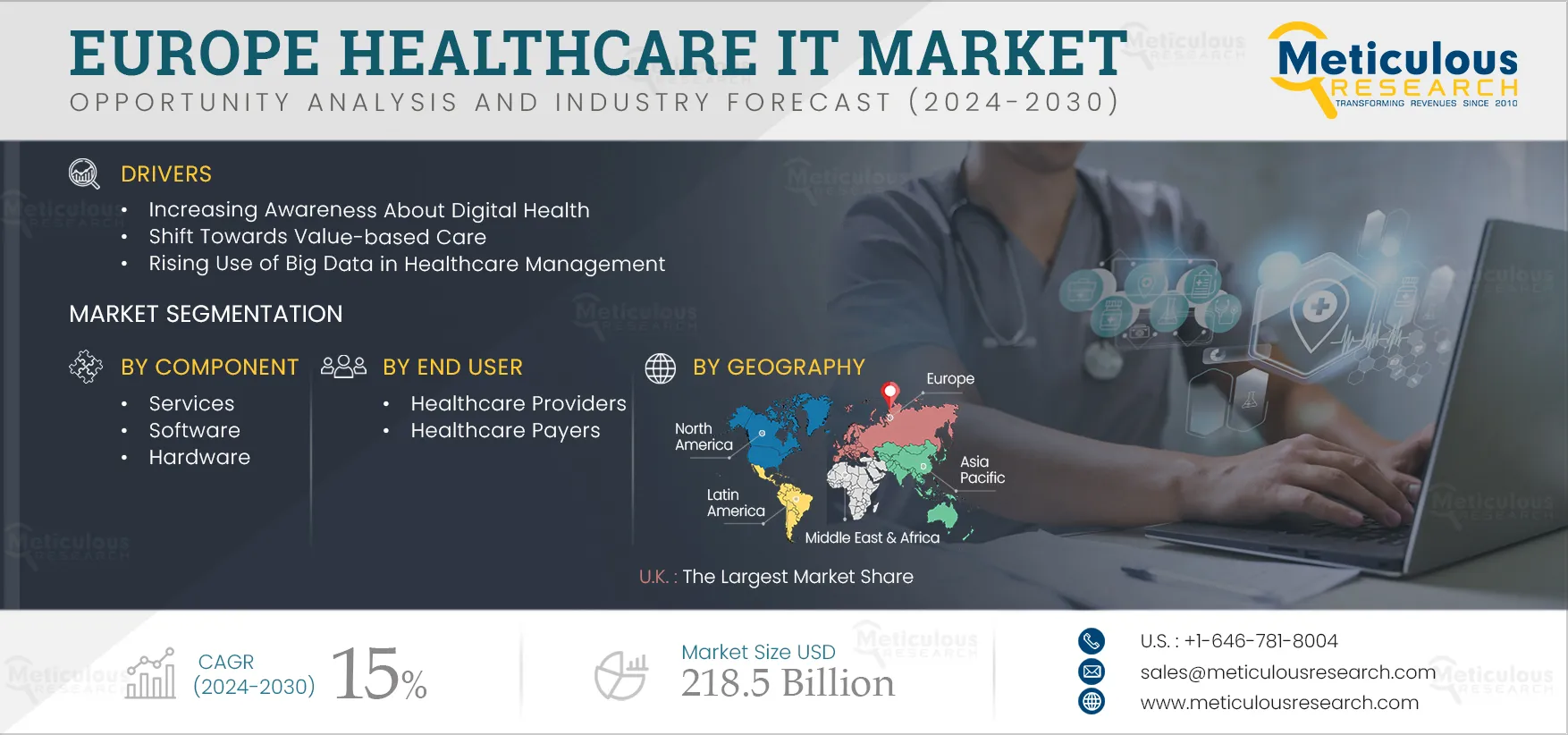

Report ID: MRHC - 1041003 Pages: 350 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe Healthcare IT Market is expected to reach $218.5 billion by 2032, at a CAGR of 15% from 2025 to 2032. Healthcare IT comprises various technologies that gather, store, analyze, and represent information for various areas in the healthcare industry. Over the years, the Europe healthcare IT industry has transitioned from applying IT solutions for basic administrative functions to core clinical tasks. The increased amount of data gathered through patient records has resulted in the need for advanced IT solutions in the healthcare industry. This includes deploying advanced analytics solutions, population health management solutions, and AI solutions for various clinical and non-clinical applications.

The key factors driving the growth of the Europe healthcare IT market are the increasing awareness about digital health, government mandates and financial incentives for the adoption of HCIT solutions, the shift towards value-based care, the rising use of big data in healthcare management, the high returns on IT investment in the healthcare industry, and the rising incidence of chronic diseases. However, high installation and maintenance costs are restraining the market’s growth.

Furthermore, the growing focus on cloud-based solutions and the rising adoption of AI and IoT in healthcare are creating opportunities for market growth. However, interoperability issues and data security and privacy concerns are challenging market growth.

Click here to: Get Free Sample Pages of this Report

In recent years, the adoption of e-Health solutions has been on the rise, driven by the increasing digitization of healthcare services across Europe. This trend has been facilitated by the proliferation of electronic processes and communication systems. The widespread adoption of e-Health solutions is driven by the need to enhance healthcare services, improve service quality, and provide patients with easy access to health information. These advancements not only save time but also reduce the workload and associated costs for healthcare service providers. However, as e-health programs and strategies continue to evolve, there is a pressing need for a more consistent and comprehensive policy and regulatory framework that would simplify data exchange among service providers across Europe.

Similar to the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., Europe launched the General Data Protection Regulations (GDPR) in April 2016, which is a set of compliance requirements that came into effect in May 2018 and is applied to any organization that deals with data provided by citizens of the European Union. As per these regulations, healthcare organizations from European countries need to comply with all the mandates to ensure that the collected patient data is highly protected and not shared without the permission of the authorized person. The law also states that organizations that violate the law could face fines of up to 4% of their global annual revenue or €20 ($21.5) million.

Benefits Offered by e-health Apps Support the Adoption of Healthcare IT Solutions

eHealth apps provide a new, innovative way to deliver healthcare services outside traditional care settings, enhancing healthcare professionals’ productivity and improving patients’ health outcomes.

Conventionally, patients visit healthcare facilities regularly for their regular checkups, diagnoses, or treatment. Following are some of the benefits offered by the eHealth apps:

In European countries, eHealth adoption is high in primary healthcare. According to the European Commission, countries such as Denmark, Estonia, Finland, Spain, Sweden, and the U.K. have the highest levels of eHealth adoption. The study also showed that EHR is currently available across all EU countries, and nearly 96% of general practitioners (GPs) use it in their practice.

On the other hand, countries such as Greece, Lithuania, Luxembourg, Malta, Romania, and Slovakia have the lowest levels of adoption. According to an eHealth survey by the Healthcare Information and Management Systems Society (HIMSS), EMR implementation is a top priority in Germany (24%) and Switzerland (23%) but plays a minor role in more EMR-mature countries like the Nordics (8%), Spain (6%), and the Netherlands (3%).

In 2025, the Healthcare IT Provider Solutions Segment is Expected to Account for the Largest Share of the Market

Based on product, the market is broadly segmented into healthcare IT provider solutions, healthcare IT payer solutions, and healthcare IT outsourcing services. In 2025, the healthcare IT provider solutions segment is expected to account for the largest share of the market. The large market share of this segment is attributed to various factors, including a heightened focus on patient safety and care, the well-established healthcare infrastructure in Europe, the increasing demand for high-quality healthcare services, the growing investments and regulatory mandates for the adoption of e-health solutions, the rising adoption of Electronic Health Records (EHRs), and the growing population of elderly individuals with chronic illnesses. For instance, in Germany, the e-health law enacted in 2015 outlined a roadmap for the integration of digital applications into the healthcare system. According to this law, all medical practices and hospitals were expected to be connected to the telematic infrastructure by the end of 2018. The framework and objectives established by this legislation have significantly boosted the growth of the e-Health sector in the country.

Among the Components, in 2025, the Services Segment is Expected to Account for the Largest Share of Europe Healthcare IT Market

In 2025, the services segment is estimated to account for the largest share of the Europe healthcare IT market. This is primarily due to factors such as a shortage of physicians and specialists, the shift towards cloud-based services, and the growing burden of chronic diseases. For instance, according to the IDF Diabetes Atlas, the number of people with diabetes aged 20-79 years was 61.4 million in 2021, and it is projected to increase to 67.0 million by 2032 and further to 69.0 million by 2045.

In 2025, the Web/Cloud-based Segment is Expected to Account for the Largest Share of the Europe Healthcare IT Market

Based on delivery mode, in 2025, the web/cloud-based segment is estimated to account for the largest share of the Europe healthcare IT market. The large market share of this segment is attributed to the benefits offered by private cloud solutions, such as lower upfront costs, absence of maintenance expenses, and flexible storage options. Cloud and web-based software eliminate the need for physical servers, reducing the costs associated with maintaining on-premises servers. They are more cost-effective than on-premise solutions, resulting in cost savings, are platform-agnostic and user-friendly, and can be accessed at any time, all of which contribute to their widespread adoption.

In 2025, the Healthcare Providers Segment is Expected to Account for the Largest Share of the Europe Healthcare IT Market

Based on end user, in 2025, the healthcare providers segment is estimated to account for the largest share of the Europe Healthcare IT market. This segment's significant market share can be attributed to several factors, including the increasing demand for convenient healthcare services due to the high prevalence of chronic diseases, the shortage of medical professionals, advanced healthcare IT infrastructure in hospitals, and the growing focus on and availability of provider-specific healthcare IT solutions. Healthcare IT solutions are known to enhance patient care, reduce hospital administrative costs, and streamline workflows in healthcare settings, contributing to their widespread adoption among healthcare providers.

Among the Countries, the U.K. Expected to Account for the Largest Market Share in 2025

This significant market share can be primarily attributed to government-sponsored programs aimed at enhancing the quality of healthcare in the country through improved infrastructure and data storage facilities. In England, the National Health Service (NHS) has made significant commitments to an informatics strategy aimed at transforming healthcare service delivery through the use of technology, both at the national and local levels. For instance, the formation of the National Advisory Group on Health Information Technology in late 2015 was a significant step, providing guidance to the Department of Health and NHS England in their efforts to digitize the secondary care system. Various incentive schemes such as reimbursement schemes, provision of free computers and software, grants, and pay-for-performance mechanisms like the quality and outcomes framework (QOF) and Personalized Health Care (PHC) 2020 have all played a role in driving strong incentives for HIT adoption.

Key Players

The report also includes an extensive assessment of the market based on product, component, delivery mode, end user, and country. It also offers insights into the key growth strategies adopted by leading market players between 2020 and 2025. The key players profiled in the Europe healthcare IT market study are McKesson Corporation (U.S.), Optum Health (U.S.), International Business Machine Corporation (IBM) (U.S.), Allscripts Healthcare Solutions, Inc. (U.S.), athenahealth, Inc. (U.S.), Epic Systems Corporation (U.S.), Dell Technologies Inc. (U.S.), GE Healthcare (U.S.), Cerner Corporation (U.S.), Oracle Corporation (U.S.), Cognizant Technology Solutions Corporation (U.S.), Nuance Communications, Inc. (U.S.), eClinicalWorks (U.S.) NextGen Healthcare, Inc. (U.S.), Computer Programs and Systems, Inc. (CPSI) (U.S.), Conifer Health Solutions, LLC. (U.S.), 3M Company (U.S.), Koninklijke Philips N.V. (Netherlands), and Infor, Inc. (U.S.).

Scope of the Report:

Europe Healthcare IT Market Assessment, by Product

Europe Healthcare IT Market Assessment, by Delivery Mode

Europe Healthcare IT Market Assessment, by Component

Europe Healthcare IT Market Assessment, by End User

Europe Healthcare IT Market Assessment, by Country

Key questions answered in the report:

Europe Healthcare IT market report covers the market sizes and forecasts for various products, components, delivery modes, end users, and countries. The report also provides the value analysis of various segments and sub-segments of Europe healthcare IT at the country level.

The Europe healthcare IT market is projected to reach $218.5 billion by 2032, at a CAGR of 15% during the forecast period of 2025–2032.

The market is segmented into hardware, software, and services. In 2025, the services segment is estimated to account for the largest share of the Europe healthcare IT market.

The key factors driving the growth of the Europe healthcare IT market are the increasing awareness about digital health, government mandates and financial incentives for the adoption of HCIT solutions, the shift towards value-based care, rising use of big data in healthcare management, the high returns on IT investment in the healthcare industry, and the rising incidence of chronic diseases. However, high installation and maintenance costs are restraining the market growth to a certain extent.

Furthermore, the growing focus on cloud-based solutions and the rising adoption of AI and IoT in healthcare are creating opportunities for market growth.

The key players operating in Europe healthcare IT market are McKesson Corporation (U.S.), Optum Health (U.S.), International Business Machine Corporation (IBM) (U.S.), Allscripts Healthcare Solutions, Inc. (U.S.), athenahealth, Inc. (U.S.), Epic Systems Corporation (U.S.), Dell Technologies Inc. (U.S.), GE Healthcare (U.S.), Cerner Corporation (U.S.), Oracle Corporation (U.S.), Cognizant Technology Solutions Corporation (U.S.), Nuance Communications, Inc. (U.S.), eClinicalWorks (U.S.) NextGen Healthcare, Inc. (U.S.), Computer Programs and Systems, Inc. (CPSI) (U.S.), Conifer Health Solutions, LLC. (U.S.), 3M Company (U.S.), Koninklijke Philips N.V. (Netherlands), and Infor, Inc. (U.S.).

The market in the U.K. is expected to register the highest growth rate during the forecast period and offer significant growth opportunities for the players operating in this market. The well-established healthcare infrastructure, the presence of prominent healthcare IT companies, favorable government programs, an increasing number of people diagnosed with chronic diseases, the need to curtail the cost of healthcare delivery, and a growing focus on enhancing the quality of healthcare are some key factors contributing to the growth of the healthcare IT market in the U.K.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Aug-2024

Published Date: Mar-2024

Published Date: Feb-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates