Resources

About Us

Asia-Pacific Healthcare IT Market by Product [{EMR, EHR, RCM, PACS, mHealth, RIS, Telehealth, SCM, Healthcare Analytics, HIE}, Component {Software, Service}, Delivery Mode {Web, Cloud}, End User {Hospitals, Homecare, Pharmacies, Ambulatory}] - Forecast to 2032

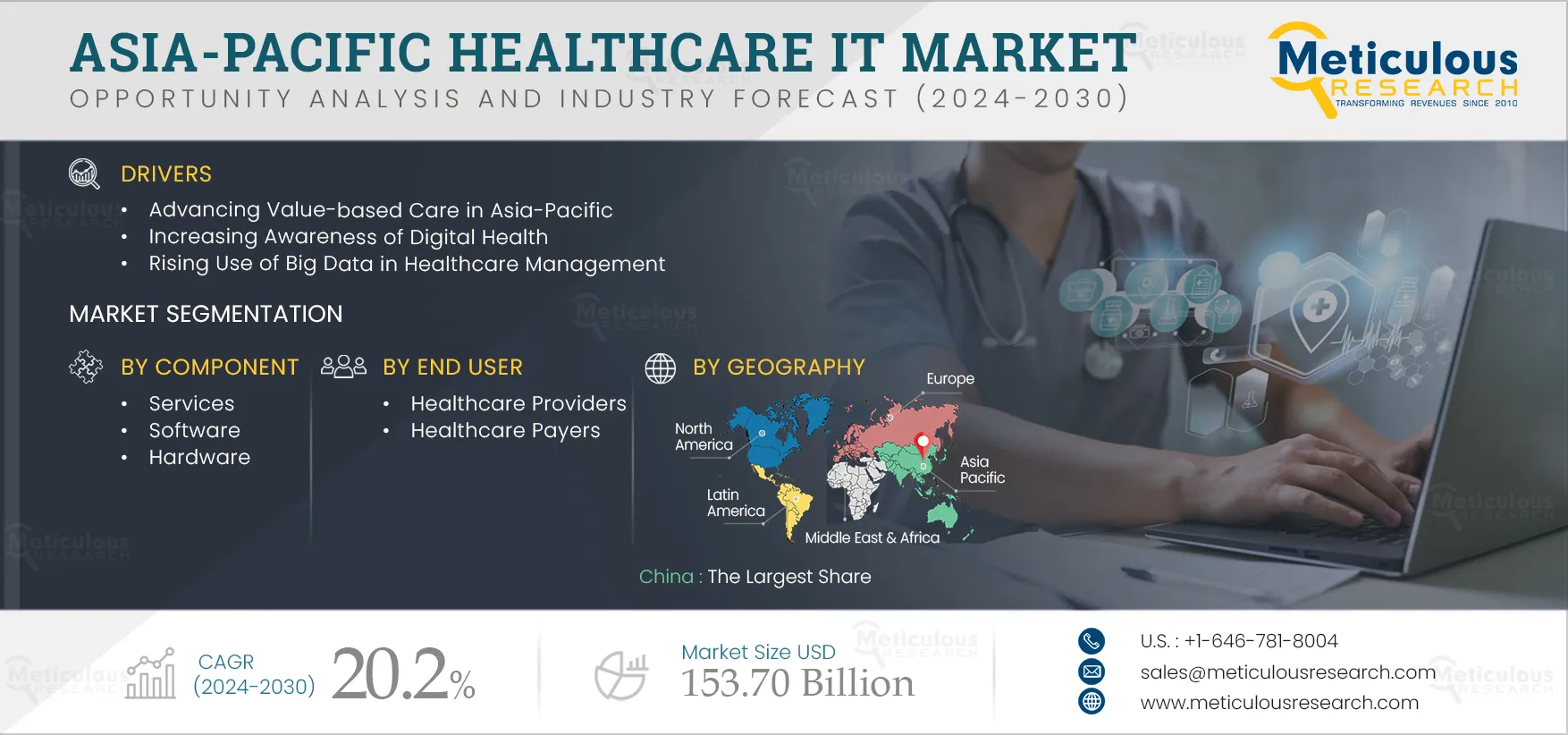

Report ID: MRHC - 1041030 Pages: 200 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Asia-Pacific Healthcare IT Market is projected to reach $153.70 billion by 2032, at a CAGR of 20.2% from 2025 to 2032. The healthcare information technology (HCIT) industry comprises various technologies that gather, store, analyze, and represent information from several areas in the healthcare industry. Over the years, the healthcare IT industry has transitioned from the application of IT solutions from basic administrative functions to core clinical tasks. The increased amount of data gathered through patient records has now led to the deployment of advanced IT solutions in the healthcare industry. This includes the deployment of advanced analytics solutions, population health management solutions, and AI solutions for a variety of clinical and non-clinical applications.

Asia-Pacific healthcare IT market is growing due to advancing value-based care, increasing awareness about digital health, rising use of big data in healthcare management, high return on IT investment in the Healthcare industry, and supportive government initiatives for healthcare IT. Furthermore, the rising adoption of AI and IoT in healthcare and the growing focus on cloud-based solutions are expected to offer immense growth opportunities for market expansion. However, high installation and maintenance cost is expected to restrain the growth of this market to some extent. In addition, lack of interoperability and data security and privacy concerns are the major challenges to the market’s growth.

Click here to: Get Free Sample Pages of this Report

Healthcare IT solutions help organizations create a paperless environment, thereby enabling physicians to always have access to a patient’s medical information. This results in better decision-making and reduces medical errors for physicians. For hospitals, it enables efficiency and streamlines the transfer of health information to manage hospital workflows in a better manner, thereby reducing the overall operational cost of care delivery.

Considering the benefits of healthcare IT solutions in lowering the cost of care delivery and enhancing the productivity of healthcare systems to manage the growing number of patient populations, many government agencies are also promoting the use of digital health in their country and therefore, taking several initiatives to increase related awareness. For instance,

Thus, the increasing awareness about the value of digital health and its ongoing advancements through user recognition and government initiatives are enhancing the adoption of health IT solutions and related infrastructure across the region, thereby providing an impetus to the growth of the healthcare IT solutions market.

Growing Focus on Cloud-based Solutions Creates an Opportunity for Growth of Market

With rapid digitalization in the healthcare industry, the amount of healthcare data generated every day is increasing exponentially. Along with the volume of data, the complexity of data is also increasing multi-fold with increasing sources and applications of data. This has led healthcare IT solutions vendors to develop new and innovative solutions that leverage cloud platforms. Growing awareness of the benefits of open platforms and increasing industry focus on interoperability and collaborative solution design is creating a heavy demand for vertically integrated cloud platforms that open the data to multiple stakeholders who are willing to share the risks and the rewards of shared data assets.

Current cloud applications among healthcare providers are dominated by non-clinical, back-office functions, especially those supporting information technology (IT) workflows. However, the adoption of cloud-based clinical applications is also expected to grow rapidly over the coming years. Some of the key opportunities for cloud platforms will be storage, management, and analytics of imaging data; enabling health information continuity through electronic medical records (EMRs), electronic health records (EHRs), and health information exchanges (HIEs); and creating robust platforms for telehealth solutions, especially teleradiology and virtual consultations. Currently, technology vendors are increasingly introducing cloud-based digital ecosystems that enable data sharing effectively and ensure better utilization of IT and human resources. This trend is expected to continue over the coming years as well, supporting the proliferation of cloud technologies in the healthcare industry.

In 2025, the Healthcare IT Provider Solutions Segment is Expected to Account for the Largest Share of the Market

Among all the product types, in 2025, the healthcare IT provider solutions segment is expected to account for the largest share of the market. Factors such as increasing demand for integrated healthcare systems, growing focus on patient safety & care, increasing demand for quality healthcare, growing healthcare infrastructure in emerging countries, rising investments & regulatory mandates on implementing eHealth solutions, rising awareness about EHRs, and aging population are driving the growth of this segment. In Singapore, EHR was adopted across 280 healthcare institutions and 14,000 clinicians in January 2020.

In 2025, the Web & Cloud-based Segment is Expected to Account for the Largest Share of the Market

Among all the delivery modes, in 2025, the web & cloud-based segment is expected to account for the largest share of the market. Factors such as low storage & upfront cost, excessive storage flexibility, on-demand self-serving, and no maintenance cost are expected to contribute the large market share of this segment. Web & cloud-based solutions are rapidly gaining traction across the region, where cloud-based models help healthcare organizations share and integrate information from disparate locations or systems in real time and allow large enterprises to work smoothly.

In 2025, the Services Segment is Expected to Account for the Largest Share of the Market

Among all the components, in 2025, the services segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the advancing cloud-based services, the increasing need to reduce healthcare costs, and the increasing installation of digital solutions across healthcare organizations. The healthcare IT services segment includes implementation services, support & maintenance services, upgrades, training, and consulting & advisory services. Services providers mainly focus on addressing the implementation needs across core systems, clinical applications, healthcare analytics platforms, and consumer experience systems.

In 2025, the Ambulatory Centers Segment is Projected to Register the Highest CAGR during the Forecast Period

Among all the end users, in 2025, the ambulatory centers segment is registering the highest CAGR during the forecast period. Ambulatory care or outpatient care is medical care provided on an outpatient basis, including diagnosis, observation, consultation, treatment, intervention, and rehabilitation services. The growth of this segment is driven by the increasing number of ambulatory centers, the rising shift of care delivery from in-patient to out-patient settings, increasing patient volume, and incentives offered by healthcare ministries to adopt HCIT solutions.

China: Largest Share of the Asia-Pacific Healthcare IT Market

In 2025, China is expected to account for the largest share of the Asia-Pacific healthcare IT market. The growth in this market is attributed to the rising geriatric population and the resultant increase in the prevalence of chronic diseases, improving healthcare infrastructure, government initiatives for digitization of healthcare infrastructure, and increasing adoption of artificial intelligence and telehealth services.

Key Players:

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by major market players in the last 3–4 years. The key players profiled in the Asia-Pacific healthcare IT market report are Cerner Corporation (U.S.), McKesson Corporation (U.S.), International Business Machine Corporation (IBM) (U.S.), Allscripts Healthcare Solutions, Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (U.S.), athenahealth, Inc. (U.S.), Optum, Inc. (U.S.), Dell Technologies Inc. (U.S.), Oracle Corporation (U.S.), Infor, Inc. (U.S.), Cognizant Technology Solutions Corporation (U.S.), Nuance Communications, Inc. (U.S.), eClinicalWorks (U.S.), NextGen Healthcare, Inc. (U.S.), Computer Programs and Systems, Inc. (U.S.), Conifer Health Solutions, LLC. (U.S.), and 3M Company (U.S.).

Scope of the Report:

Asia-Pacific Healthcare IT Market, by Product

Asia-Pacific Healthcare IT Market, by Delivery Mode

Asia-Pacific Healthcare IT Market, by Component

Asia-Pacific Healthcare IT Market, by End User

Asia-Pacific Healthcare IT Market, by Country

Key questions answered in the report:

This study offers a detailed assessment of the healthcare IT market in Asia-Pacific, including the market sizes & forecasts for various market segments such as product, delivery mode, component, and end user. The healthcare IT study provides an in-depth analysis of several segments & subsegments of the healthcare IT market at the country level.

The Asia-Pacific healthcare IT market is projected to reach $153.70 billion by 2032, at a CAGR of 20.2% during the forecast period.

In 2025, the healthcare IT provider solutions segment is expected to account for the largest share of the Asia-Pacific healthcare IT market. Factors such as increasing demand for integrated healthcare systems, growing focus on patient safety & care, growing healthcare infrastructure in emerging countries, increasing demand for quality healthcare, increasing investments & regulatory mandates on implementing eHealth solutions, rising awareness about EHRs, and growing geriatric population are contributing to the largest share of this segment.

In 2025, the services segment is expected to account for the largest share of the market. The largest share of this segment is attributed to the advancing cloud-based services in the Asia-Pacific region, the increasing need to reduce healthcare costs, and the increasing installation of digital solutions across healthcare organizations.

In 2025, the healthcare providers segment is expected to account for the largest share of the market. The largest share of this segment is attributed to the rising patient volume, growing healthcare spending, increasing awareness about electronic health records, aging population, and increasing adoption of healthcare IT solutions by healthcare providers.

The growth of the Asia-Pacific healthcare IT market is attributed to the advancing value-based care in the Asia-Pacific region, increasing awareness about digital health, rising use of big data in healthcare management, high return on IT investment in the Healthcare industry, and supportive government initiatives for healthcare IT. Furthermore, the rising adoption of AI and IoT in healthcare, and the growing adoption of cloud-based solutions offer significant opportunities for the market’s growth.

The key players profiled in the Asia-Pacific healthcare IT market study are Cerner Corporation (U.S.), McKesson Corporation (U.S.), International Business Machine Corporation (IBM) (U.S.), Allscripts Healthcare Solutions, Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (U.S.), athenahealth, Inc. (U.S.), Optum, Inc. (U.S.), Dell Technologies Inc. (U.S.), Oracle Corporation (U.S.), Infor, Inc. (U.S.), Cognizant Technology Solutions Corporation (U.S.), Nuance Communications, Inc. (U.S.), eClinicalWorks (U.S.), NextGen Healthcare, Inc. (U.S.), Computer Programs and Systems, Inc. (U.S.), Conifer Health Solutions, LLC. (U.S.), and 3M Company (U.S.).

China and India offer significant growth opportunities for the players operating in this market due to the rising geriatric population and resultant increases in the prevalence of chronic diseases, improving healthcare infrastructure, government initiatives for digitization of healthcare infrastructure, and increasing adoption of artificial intelligence and telehealth services.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates