Resources

About Us

Modular Chillers Market Size, Share & Growth Forecast 2025-2035 | Air-Cooled & Water-Cooled Chillers Analysis

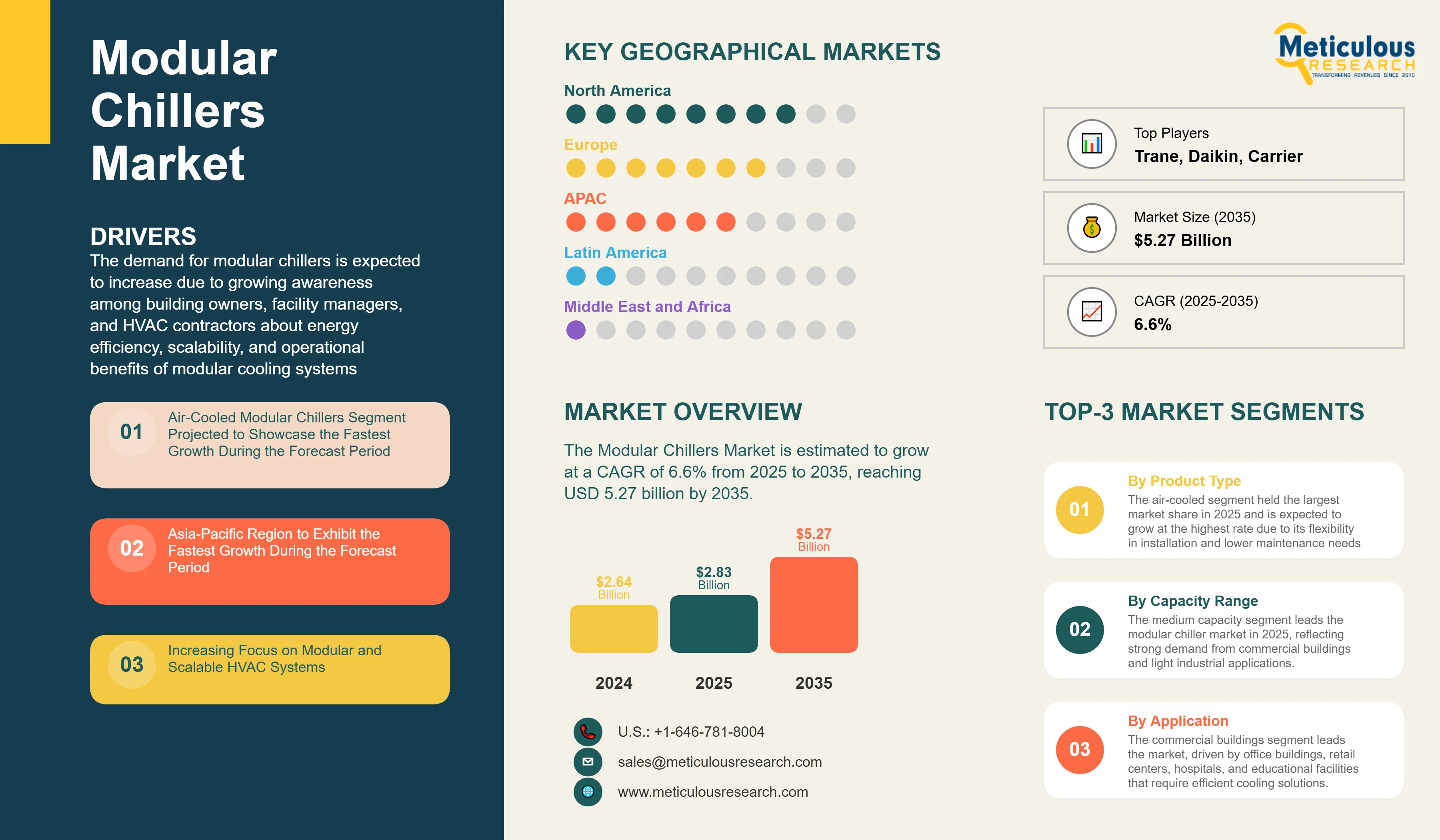

Report ID: MREP - 1041530 Pages: 286 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportIn the coming years, the demand for modular chillers is expected to increase due to growing awareness among building owners, facility managers, and HVAC contractors about energy efficiency, scalability, and operational benefits of modular cooling systems. There has been a growing demand for air-cooled and water-cooled modular chillers. A rising focus on sustainable building practices and the need for flexible HVAC solutions contribute to this demand. Green building certifications and government regulations that support energy-efficient cooling technologies are also assisting the growth of this market. As a result, energy-efficient modular chillers are becoming the preferred choice for commercial and industrial applications.

Although no explicit federal mandate exists, the adoption of high-efficiency modular chillers is increasing across commercial buildings, data centers, and industrial facilities. This trend is primarily driven by stringent state-level energy regulations, tax incentives from the Inflation Reduction Act, growing demand for scalable cooling in data centers, and shift toward smart, energy-efficient building systems.

The modular chillers industry is seeing significant technological changes mainly due to heat recovery systems, variable speed drive (VSD) technology, and IoT-enabled smart controls. To comply with environmental regulations and improve system performance, leading modular chiller manufacturers are investing heavily in environmentally friendly refrigerants with low global warming potential (GWP). These technological advancements allow suppliers to provide cooling solutions that are more compact, efficient, and environmentally sustainable while ensuring reliability and reducing operational costs.

In 2024, Daikin Industries introduced next-generation modular chillers utilizing the low-GWP R-32 refrigerant, featuring advanced heat recovery capabilities. These innovations demonstrate the HVAC industry’s strong commitment to sustainable cooling technology, aiming to meet stringent environmental standards while significantly reducing energy consumption compared to traditional systems.

Air-Cooled Modular Chillers Segment Projected to Showcase the Fastest Growth During the Forecast Period

During the forecast period, air-cooled modular chillers are expected to grow significantly in the modular chillers market. These systems feature heat rejection capabilities, variable speed drives, and integrated controls for peak performance. They use scroll, screw, and centrifugal compressor technologies. Air-cooled systems are becoming increasingly popular because they do not need cooling towers or water treatment systems. This makes them ideal for places with strict water conservation rules or limited water supplies.

More than 40% of commercial buildings are looking to upgrade their HVAC systems to meet sustainability goals. Therefore, the demand for energy-efficient cooling solutions is driving the growth of air-cooled modular chillers. The industry needs reliable, low-maintenance cooling systems that are easy to install and can be scaled to fit facility needs. Industry data shows that buildings equipped with modern air-cooled modular chillers use 20 to 25% less energy than those with conventional packaged systems.

Industry leaders like Carrier, Johnson Controls, and Mitsubishi Electric have recently expanded their lines of air-cooled modular chillers. They launched new models with smart IoT-enabled controls, variable-speed or magnetic-bearing compressors, and low-GWP refrigerants. These systems enable predictive maintenance, which improves system lifespan, reduces operating costs, and maximizes performance.

Asia-Pacific Region to Exhibit the Fastest Growth During the Forecast Period

Rapid urbanization, infrastructure development, and a growing demand for energy-efficient cooling solutions are likely to drive significant growth in the Asia-Pacific region during the forecast period. As commercial construction, manufacturing expansion, and data center growth speed up throughout the region, countries like China, India, and Southeast Asia face an unprecedented demand for modular chillers.

China leads the region with large investments in commercial real estate and industrial infrastructure, which increases the need for scalable cooling systems. Due to supportive government programs that promote environmental sustainability and energy efficiency, the country's modular chillers market is expected to dominate the region through 2035. India is close behind, with notable growth in the manufacturing, pharmaceutical, and IT services sectors that require precise temperature control.

The region's growth is also backed by major manufacturing expansions and investments in technology. For example, while global companies like Daikin and Mitsubishi Electric continue to establish regional manufacturing hubs to meet the rising market demand, firms like Midea and Gree significantly boosted their production. In 2025, Midea’s Chongqing factory, which produces large central‑air‑conditioning chillers, was recognized as the first fully AI-enabled lighthouse factory in the central A/C chiller sector. It features AI-driven order customization, a shortened chiller selection cycle by 81% and design cycle by 45%.

Modular Chillers Market Analysis

Raw materials price fluctuations, especially steel and copper, create challenges for the modular chiller industry since they have an impact on the pricing and manufacturing costs. Due to significant shortages of skilled technicians in specialized HVAC trades, operational challenges arise in installation and maintenance services. Additionally, product development and market expansion strategies are complicated by evolving regulatory compliance requirements across different regions and the ongoing transition to new refrigerant standards.

Despite these challenges, IoT-enabled monitoring systems, smart building integration, and entry into new markets offer significant growth opportunities for the modular chiller industry. The increasing use of artificial intelligence and machine learning for predictive maintenance helps facility managers improve chiller performance while lowering energy consumption and maintenance costs. Government incentives support upgrades for energy efficiency and green building certifications, creating favorable conditions for modular chiller technologies.

The modular chillers market is divided by product type into air-cooled modular chillers and water-cooled modular chillers. The air-cooled segment held the largest market share in 2024 and is expected to grow at the highest rate due to its flexibility in installation and lower maintenance needs. The market is also segmented by capacity range into small capacity (up to 100 TR), medium capacity (100-500 TR), large capacity (500-1000 TR), and extra-large capacity (above 1000 TR). The medium capacity segment leads the modular chiller market in 2024, reflecting strong demand from commercial buildings and light industrial applications.

Finally, the market serves commercial buildings, industrial applications, residential applications, and others. The commercial buildings segment leads the overall modular chiller market, driven by office buildings, retail centers, hospitals, and educational facilities that require efficient cooling solutions.

Regional Market Analysis

North America leads the modular chillers market. Building automation systems and strict energy efficiency rules are driving the use of high-performance cooling technologies. The region’s well-established commercial real estate market and focus on building upgrades create a steady need for modular chiller replacements.

Europe is increasing its modular chiller installations to meet EU energy efficiency rules and carbon reduction goals. The region's focus on sustainable building practices and district cooling systems offers chances for large-scale modular chiller installations in city development projects.

Asia-Pacific shows the strongest growth potential. Rapid industrialization, commercial construction, and expansion in manufacturing are boosting the demand for scalable cooling solutions. The region's hot climate and rising energy awareness continue to support the use of efficient modular chiller technologies.

Latin America and the Middle East & Africa present new opportunities. Economic growth and infrastructure investments are increasing the need for commercial cooling systems in these regions. They benefit from technology transfers and manufacturing investments by global chiller companies.

Modular Chillers Market Share

The modular chillers market is very competitive. Major players include Johnson Controls International, Daikin Industries, Carrier Global Corporation, and Trane Technologies. These companies focus on technological innovation, energy efficiency, and forming partnerships to strengthen their market positions and expand globally. They invest heavily in research and development, grow their manufacturing abilities, and build their service networks as the demand for sustainable cooling solutions rises in the commercial, industrial, and institutional sectors.

Leading manufacturers are partnering with building automation companies, energy service providers, and construction contractors to create integrated cooling solutions. These collaborations improve system integration, energy performance, and service offerings. The market is also paying more attention to sustainability. Manufacturers are developing eco-friendly refrigerants and energy-efficient technologies to meet environmental regulations.

Modular Chillers Market Companies

Major players operating in the modular chillers industry include:

Modular Chillers Industry Segmentation

The modular chillers market includes air-cooled and water-cooled chiller systems that are designed for easy installation and scalable capacity. The report focuses on factory-assembled modular units with integrated controls, leaving out field-erected chiller systems and residential air conditioning equipment.

The modular chillers market is divided by product type, capacity range, application, and geography. For product type, the market consists of air-cooled modular chillers and water-cooled modular chillers. In terms of capacity range, the market includes small capacity (up to 100 TR), medium capacity (100-500 TR), large capacity (500-1000 TR), and extra large capacity (above 1000 TR). The report offers a thorough market analysis and forecasts for each segment.

|

Particulars |

Details |

|

Number of Pages |

286 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.6% |

|

Market Size (Value)in 2025 |

USD 2.79 Billion |

|

Market Size (Value) in 2035 |

USD 5.27 Billion |

|

Segments Covered |

By Product Type

By Capacity Range

By Application

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

Trane Technologies plc, Daikin Industries, Ltd., Carrier Global Corporation, Johnson Controls International plc, Mitsubishi Electric Corporation, Gree Electric Appliances, Inc., Midea Group Co., Ltd., LG Electronics Inc., Lennox International Inc., Emerson Electric Co., Honeywell International Inc., Schneider Electric SE, ABB Ltd., Multistack International Limited, Airedale International Air Conditioning Ltd., Blue Star Limited, Smardt Chiller Group Inc., Thermax Limited, Climaveneta S.p.A. (Mitsubishi Electric Group), Dunham-Bush Holdings Pte Ltd. |

The Modular Chillers Market size is expected to reach USD 2.79 billion in 2025 and grow at a CAGR of 6.6% to reach USD 5.27 billion by 2035.

In 2025, the Modular Chillers Market size is expected to reach USD 2.79 billion.

Trane Technologies plc, Daikin Industries Ltd., Carrier Global Corporation, Johnson Controls International plc, and Mitsubishi Electric Corporation are the major companies operating in the Modular Chillers Market.

The Asia-Pacific region is estimated to grow at the highest CAGR over the forecast period (2025-2035).

In 2025, air-cooled modular chillers will account for the largest market share in the Modular Chillers Market.

In 2024, the Modular Chillers Market size was estimated at USD 2.64 billion. The report covers historical market size data and forecasts through 2035.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Modular Chillers Market, by Product Type

3.2.2. Modular Chillers Market, by Capacity Range

3.2.3. Modular Chillers Market, by Application

3.2.4. Modular Chillers Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growing Demand for Energy-Efficient Cooling Solutions

4.2.1.2. Rising Construction and Infrastructure Development

4.2.1.3. Increasing Focus on Modular and Scalable HVAC Systems

4.2.1.4. Stringent Environmental Regulations and Green Building Standards

4.2.1.5. Technological Advancements in Chiller Design

4.2.2. Restraints

4.2.2.1. High Initial Capital Investment

4.2.2.2. Complex Installation and Maintenance Requirements

4.2.2.3. Availability of Alternative Cooling Technologies

4.2.3. Opportunities

4.2.3.1. Expansion in Emerging Markets

4.2.3.2. Integration with Smart Building Technologies and IoT

4.2.3.3. Retrofitting and Replacement of Legacy Systems

4.2.3.4. Growing Data Center and Cloud Computing Industry

4.2.4. Trends

4.2.4.1. Adoption of Variable Speed Drive (VSD) Technology

4.2.4.2. Integration of Heat Recovery Systems

4.2.4.3. Development of Compact and Space-Saving Designs

4.2.4.4. Focus on Low Global Warming Potential (GWP) Refrigerants

4.2.5. Challenges

4.2.5.1. Skilled Labor Shortage for Installation and Maintenance

4.2.5.2. Fluctuating Raw Material Prices

4.2.5.3. Regulatory Compliance Across Different Geographies

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on the Modular Chillers Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Energy Efficiency and Carbon Footprint Reduction

4.4.1.2. Refrigerant Management and Phaseout Programs

4.4.2. Market Response to Sustainability Demands

4.4.2.1. Regulatory Compliance and Green Certifications

4.4.2.2. Manufacturer-led Environmental Initiatives

4.4.3. Market Opportunities Created by Sustainability Focus

4.4.3.1. Development of Eco-Friendly Refrigerants

4.4.3.2. Challenges in Sustainable Manufacturing and Design

5. Modular Chillers Market Assessment—By Product Type

5.1. Overview

5.2. Air-Cooled Modular Chillers

5.3. Water-Cooled Modular Chillers

6. Modular Chillers Market Assessment—By Capacity Range

6.1. Overview

6.2. Small Capacity (Up to 100 TR)

6.3. Medium Capacity (100-500 TR)

6.4. Large Capacity (500-1000 TR)

6.5. Extra Large Capacity (Above 1000 TR)

7. Modular Chillers Market Assessment—By Application

7.1. Overview

7.2. Commercial Buildings

7.3. Industrial Applications

7.4. Residential Applications

7.5. Others

8. Modular Chillers Market Assessment—By Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Netherlands

8.3.7. Rest of Europe (RoE)

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. South Korea

8.4.5. Australia

8.4.6. Rest of Asia-Pacific (RoAPAC)

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Rest of Latin America (RoLATAM)

8.6. Middle East & Africa

8.6.1. Saudi Arabia

8.6.2. United Arab Emirates (UAE)

8.6.3. Rest of Middle East & Africa (RoMEA)

9. Competitive Landscape

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Contemporary Stalwarts

9.5. Market Share/Ranking Analysis, by the Key Players, 2024

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

10.1. Trane Technologies plc

10.2. Daikin Industries, Ltd.

10.3. Carrier Global Corporation

10.4. Johnson Controls International plc

10.5. Mitsubishi Electric Corporation

10.6. Gree Electric Appliances, Inc.

10.7. Midea Group Co., Ltd.

10.8. LG Electronics Inc.

10.9. Lennox International Inc.

10.10. Emerson Electric Co.

10.11. Honeywell International Inc.

10.12. Schneider Electric SE

10.13. ABB Ltd.

10.14. Multistack International Limited

10.15. Airedale International Air Conditioning Ltd.

10.16. Blue Star Limited

10.17. Smardt Chiller Group Inc.

10.18. Thermax Limited

10.19. Climaveneta S.p.A. (Mitsubishi Electric Group)

10.20. Dunham-Bush Holdings Pte Ltd.

11. Appendix

11.1. Available Customization

11.2. Related Reports

LIST OF TABLES

Table 1. Global Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 2. Global Air-Cooled Modular Chillers Market, by Country/Region, 2025–2035 (USD Million)

Table 3. Global Water-Cooled Modular Chillers Market, by Country/Region, 2025–2035 (USD Million)

Table 4. Global Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 5. Global Small Capacity (Up to 100 TR) Modular Chillers Market, by Country/Region, 2025–2035 (USD Million)

Table 6. Global Medium Capacity (100-500 TR) Modular Chillers Market, by Country/Region, 2025–2035 (USD Million)

Table 7. Global Large Capacity (500-1000 TR) Modular Chillers Market, by Country/Region, 2025–2035 (USD Million)

Table 8. Global Extra Large Capacity (Above 1000 TR) Modular Chillers Market, by Country/Region, 2025–2035 (USD Million)

Table 9. Global Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 10. Global Modular Chillers Market for Commercial Buildings, by Country/Region, 2025–2035 (USD Million)

Table 11. Global Modular Chillers Market for Industrial Applications, by Country/Region, 2025–2035 (USD Million)

Table 12. Global Modular Chillers Market for Residential Applications, by Country/Region, 2025–2035 (USD Million)

Table 13. Global Modular Chillers Market for Others, by Country/Region, 2025–2035 (USD Million)

Table 14. North America: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 15. North America: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 16. North America: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 17. U.S.: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 18. U.S.: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 19. U.S.: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 20. Canada: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 21. Canada: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 22. Canada: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 23. Europe: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 24. Europe: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 25. Europe: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 26. Germany: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 27. Germany: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 28. Germany: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 29. France: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 30. France: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 31. France: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 32. U.K.: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 33. U.K.: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 34. U.K.: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 35. Italy: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 36. Italy: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 37. Italy: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 38. Spain: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 39. Spain: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 40. Spain: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 41. Netherlands: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 42. Netherlands: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 43. Netherlands: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 44. Rest of Europe: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 45. Rest of Europe: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 46. Rest of Europe: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 47. Asia-Pacific: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 48. Asia-Pacific: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 49. Asia-Pacific: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 50. China: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 51. China: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 52. China: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 53. Japan: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 54. Japan: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 55. Japan: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 56. India: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 57. India: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 58. India: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 59. South Korea: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 60. South Korea: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 61. South Korea: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 62. Australia: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 63. Australia: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 64. Australia: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 65. Rest of Asia-Pacific: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 66. Rest of Asia-Pacific: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 67. Rest of Asia-Pacific: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 68. Latin America: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 69. Latin America: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 70. Latin America: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 71. Brazil: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 72. Brazil: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 73. Brazil: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 74. Mexico: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 75. Mexico: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 76. Mexico: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 77. Rest of Latin America: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 78. Rest of Latin America: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 79. Rest of Latin America: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 80. Middle East & Africa: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 81. Middle East & Africa: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 82. Middle East & Africa: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 83. Saudi Arabia: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 84. Saudi Arabia: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 85. Saudi Arabia: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 86. United Arab Emirates: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 87. United Arab Emirates: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 88. United Arab Emirates: Modular Chillers Market, by Application, 2025–2035 (USD Million)

Table 89. Rest of Middle East & Africa: Modular Chillers Market, by Product Type, 2025–2035 (USD Million)

Table 90. Rest of Middle East & Africa: Modular Chillers Market, by Capacity Range, 2025–2035 (USD Million)

Table 91. Rest of Middle East & Africa: Modular Chillers Market, by Application, 2025–2035 (USD Million)

LIST OF FIGURES

Figure 1. Research Process

Figure 2. Secondary Components Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Air-Cooled Modular Chillers segment to Account for the Largest Share

Figure 8. In 2025, the Medium Capacity (100-500 TR) segment to Account for the Largest Share

Figure 9. In 2025, the Modular Chillers Market for Commercial Buildings to Account for the Largest Share

Figure 10. Asia-Pacific to be the Fastest-growing Regional Market

Figure 11. Impact Analysis of Market Dynamics

Figure 12. Global Modular Chillers Market: Porter's Five Forces Analysis

Figure 13. Global Modular Chillers Market, by Product Type, 2025 Vs. 2035 (USD Million)

Figure 14. Global Modular Chillers Market, by Capacity Range, 2025 Vs. 2035 (USD Million)

Figure 15. Global Modular Chillers Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 16. Global Modular Chillers Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 17. North America: Modular Chillers Market Snapshot (2025)

Figure 18. Europe: Modular Chillers Market Snapshot (2025)

Figure 19. Asia-Pacific: Modular Chillers Market Snapshot (2025)

Figure 20. Latin America: Modular Chillers Market Snapshot (2025)

Figure 21. Middle East & Africa: Modular Chillers Market Snapshot (2025)

Figure 22. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 23. Global Modular Chillers Market Competitive Benchmarking, by Product Type

Figure 24. Competitive Dashboard: Global Modular Chillers Market

Figure 25. Global Modular Chillers Market Share/Ranking, by Key Player, 2024 (%)

Figure 26. Trane Technologies plc: Financial Overview (2024)

Figure 27. Daikin Industries, Ltd.: Financial Overview (2024)

Figure 28. Carrier Global Corporation: Financial Overview (2024)

Figure 29. Johnson Controls International plc: Financial Overview (2024)

Figure 30. Mitsubishi Electric Corporation: Financial Overview (2024)

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates