Resources

About Us

Military Satellite Payloads Market Size, Share, Forecast & Trends by Payload Type (Communication, Imaging, Navigation, and Other Payload Types) Vehicle Type (Small and Medium-to-heavy), Orbit, Application, and End-Use - Global Forecast to 2035

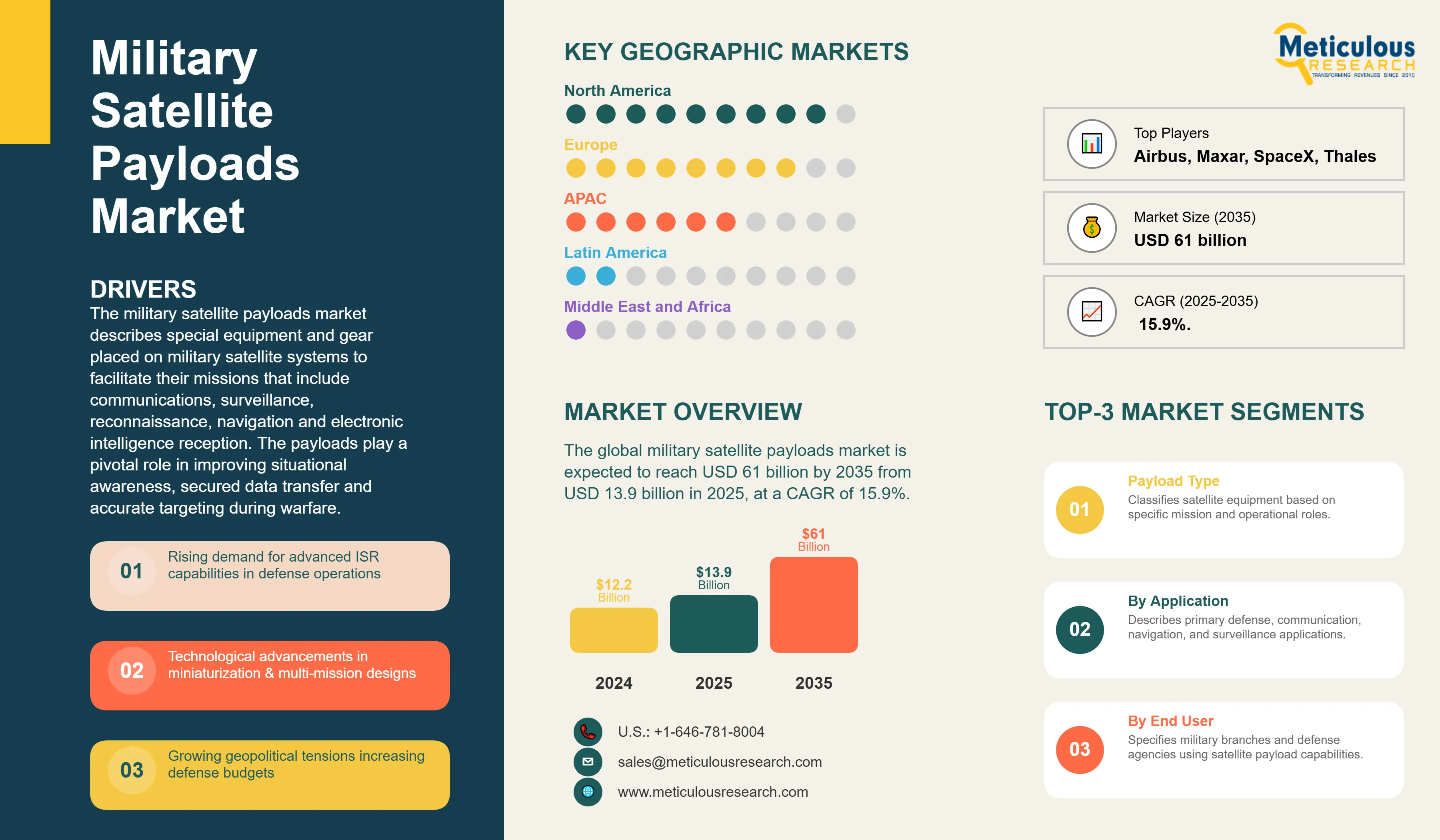

Report ID: MRAD - 1041553 Pages: 224 Aug-2025 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportThe global military satellite payloads market was valued at USD 12.2 billion in 2024. The market is expected to reach USD 61 billion by 2035 from USD 13.9 billion in 2025, at a CAGR of 15.9%.

The military satellite payloads market describes special equipment and gear placed on military satellite systems to facilitate their missions that include communications, surveillance, reconnaissance, navigation and electronic intelligence reception. The payloads play a pivotal role in improving situational awareness, secured data transfer and accurate targeting during warfare. As an example, the U.S Space Force embedded electro-optical imaging payloads on spy satellites in 2024 to create real-time intelligence support to conduct tactical operations in areas of contested operations.

Click here to: Get Free Sample Pages of this Report

The market is reasonably consolidated with some established aerospace and defense players coupled with smaller companies with specific vehicle type offering competing to win long-term government and defense contracts. The major participants are keen on miniaturization and multi-mission and high-performance payloads in response to increased need of increased intelligence, surveillance, and reconnaissance (ISR) capacity.

Recent Developments

SES Secures U.S. Army COMSATCOM Contract

Firefly Aerospace Wins Rapid-Response Launch Mission

Key Market Drivers

Key Market Restraints

Base CAGR: 15.9%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Growing Demand for Advanced ISR Capabilities |

Increased deployment of high-resolution electro-optical and SAR payloads for tactical surveillance |

Integration of next-gen hyperspectral and multi-sensor payloads for persistent global monitoring |

▲ +3.6% |

|

2. Technological Advancements in Miniaturization |

Adoption of compact, lightweight payloads to optimize satellite launch costs |

Widespread use of micro-payload constellations for real-time defense data networks |

▲ +3.3% |

|

|

3. Expansion of Secure Military Communications |

Deployment of encrypted communication payloads for joint operations |

Fully integrated global secure military communication satellite networks |

▲ +3.0% |

|

|

Restraints |

1. High Development and Launch Costs |

Limits deployment to high-priority missions and well-funded defense programs |

Advancements in reusable launch systems and cost-sharing agreements reduce barriers |

▼ −1.5% |

|

2. Vulnerability to Space Debris and ASAT Threats |

Additional shielding and redundancy measures increase payload weight and costs |

Development of autonomous maneuvering and defense countermeasures extends payload lifespan |

▼ −1.3% |

|

|

Opportunities |

1. Rapid-Response Satellite Deployment |

Growth in demand for payloads designed for quick integration into responsive launch missions |

Establishment of standby launch systems with pre-configured military payloads |

▲ +3.2% |

|

2. AI-Enhanced Data Processing |

Early adoption of onboard AI for automated target recognition and threat assessment |

AI-driven autonomous payload operations for faster decision-making in contested environments |

▲ +2.9% |

|

|

Trends |

1. Public-Private Defense Space Collaborations |

Partnerships between defense agencies and commercial satellite operators for dual-use payloads |

Long-term joint development programs standardizing payload designs across military and civilian use |

▲ +2.5% |

|

Challenges |

1. Cybersecurity Threats to Payload Data |

Increasing need for advanced encryption and intrusion detection systems |

Implementation of quantum-resistant encryption as industry standard |

▼ −1.0% |

North America’s Leadership in the Military Satellite Payloads Market

North America holds the largest share of the global military satellite payloads market in 2025, mainly due to the vast amount of investments made by the U.S. Department of Defense and its allied defense agencies. The region has solid industrial base and R&D infrastructure with Lockheed Martin, Northrop Grumman and Raytheon Technologies as the main players. As an example, in 2024, the U.S. Space Force has launched several spy satellites with high-tech electro-optical and synthetic aperture radar (SAR) payloads to increase the surveillance capabilities of key areas affirming the technological and strategic dominance of the region.

Asia Pacific Emerges as the Second-Fastest Growing Region

The Asia Pacific is the second fastest growing military satellite payloads market in the world with an increase in the modernization programs of the defense and the increasing investments to intelligence systems based on space. Some countries like China, India, Japan are increasing their military satellite influences to intensify surveillance, navigation and communications. As an example, in 2025, India Defence Research and Development Organisation (DRDO) has joined forces with ISRO to launch a specific military communication satellite having secure payloads to facilitate joint operations and strategic activities.

United States Strengthens Space-Based Defense Capabilities

The U.S. occupies a commanding leadership in the military satellite payloads market with its huge defense commitments and ongoing investment in the new generation of space technology capabilities. Key defense contractors and the U.S. Space Force lead the development of high-performance ISR, communication and missile-tracking payloads. For instance, in 2024, the U.S Space Development Agency launched a series of missile warning satellites with infrared tracking payload on board with an aim of providing better warning of threats within global scale hotspots.

China Expands Military Satellite Constellations

China is fast expanding in the military satellite payloads market and concentrates on developing large constellations oriented to military and national security deployments. China holds the view to attain strategic space-based self-reliance with the support of government funding and state-owned businesses. For instance, in 2025, China deployed a new series of Yaogan spy satellites which are fitted with synthetic aperture radar payloads to enhance day and night, all-weather surveillance.

By Payload Type, Imaging Segment Dominated the Market with Highest Revenue Share

On the basis of payload, the imaging segment experienced the largest revenue share in the military satellite payloads market due to the increased demand of high resolution, real-time imagery to ensure intelligence, surveillance and reconnaissance (ISR) missions. Electro-optical, infrared and synthetic aperture radar (SAR) imaging payloads are, in general, important to tracing movement of adversaries, estimating fighting conditions and allowing precise targeting. As an example, Airbus Defence and Space provided innovative SAR payloads in 2024 to European defence satellites, offering the all-weather, day-and-night imaging capability required to enhance strategic as well as tactical applications.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 13.9 billion |

|

Revenue forecast in 2035 |

USD 61 billion |

|

CAGR (2025-2035) |

15.9% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Payload Type (Communication, Imaging, Navigation, and Other Payload Types), Vehicle Type (Small and Medium-to-heavy), Orbit, Application, End-Use, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

L3Harries Technologies, Airbus S.A.S, Maxar Technologies, The Boeing Company, Northrop Grumman Corporation, ST Engineering, SpaceX, Thales Group, Lockheed Martin Corporation, Sierra Nevada Corporation, and Other Key Players. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The military satellite payloads market is estimated to be USD 13.9 billion in 2025 and grow at a CAGR of 15.9% to reach USD 61.0 billion by 2035.

In 2024, the military satellite payloads market was estimated at USD 12.2 billion, with projections to reach USD 13.9 billion in 2025.

L3Harries Technologies, Airbus S.A.S, Maxar Technologies, The Boeing Company, and Northrop Grumman Corporation are the major companies operating in the Military Satellite Payloads Market Analysis and Forecast.

The North America region is projected to grow at the highest CAGR over the forecast period (2025-2035), driven by digital transformation and technological autonomy initiatives.

In 2025, Imaging payload type account for the largest market share in the military satellite payloads market, with consumer electronics being the leading end-user segment.

Published Date: Oct-2024

Published Date: Aug-2024

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates