Resources

About Us

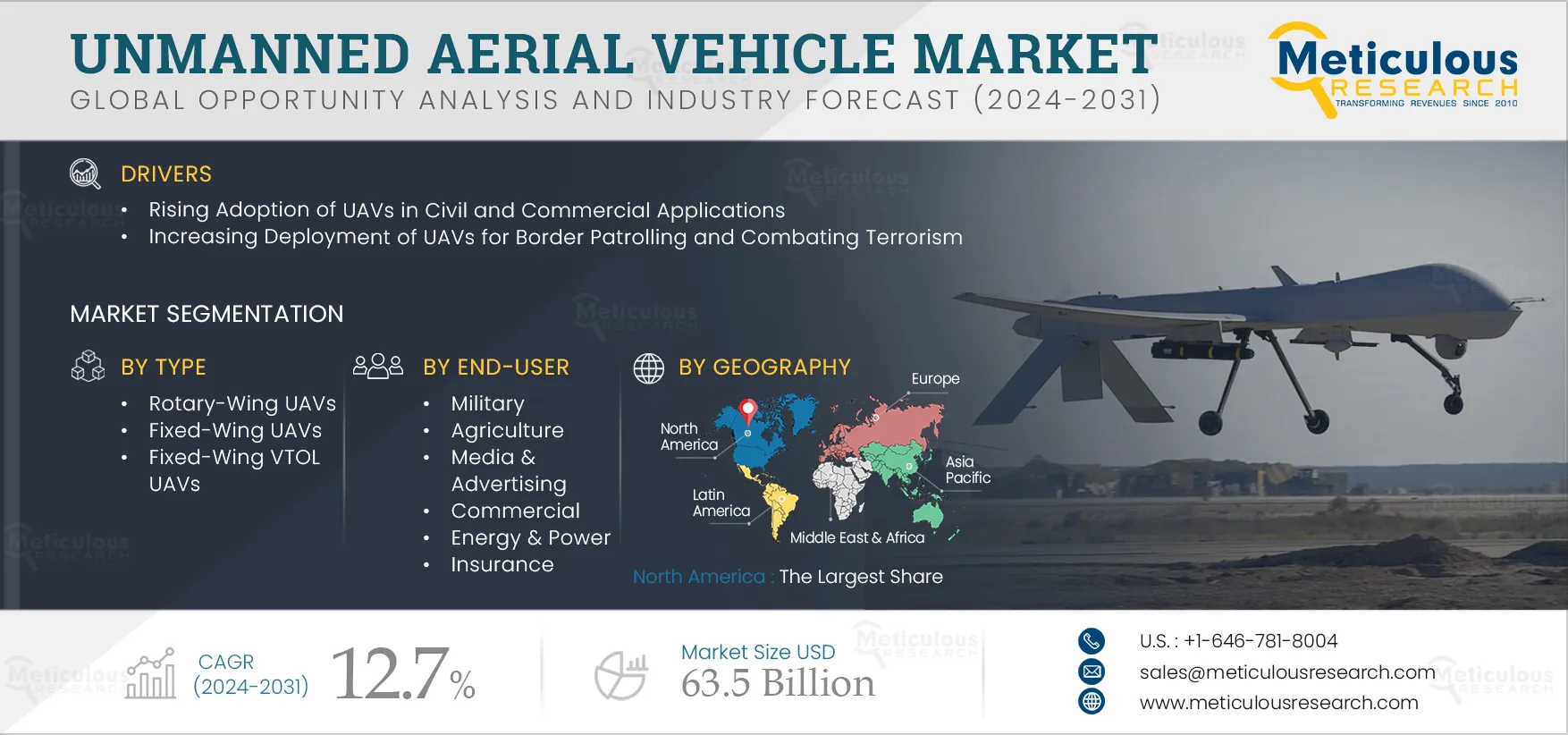

Unmanned Aerial Vehicle Market Size, Share, Forecast, & Trends Analysis by Component, Class (Small UAVs, Special Purpose UAVs), Type (Fixed-wing UAVs, Rotary-wing UAVs), Capacity, Mode of Operation, and End User (Military, Commercial, Agriculture) - Global Forecast to 2031

Report ID: MRAUTO - 104387 Pages: 450 Oct-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market is driven by the rising adoption of UAVs in civil and commercial applications, the increasing deployment of UAVs for border patrolling and combating terrorism, and exemptions made by regulatory authorities around the globe to permit the use of UAVs in several industries. However, the technical limitations of UAVs are expected to restrain the growth of this market.

The increasing deployment of UAVs to carry out aerial remote sensing and the growing defense budgets of major economies are expected to create market growth opportunities. However, the lack of proper air traffic management for UAVs, increasing threats to safety, and violation of privacy are major challenges for the players operating in this market.

Click here to: Get a Free Sample Copy of this report

The use of drones is rapidly gaining traction, particularly in the logistics and agriculture sectors. The growing popularity of online shopping among consumers has increased the demand for advanced shipping options that ensure faster delivery services. Companies such as United Parcel Service of America, Inc., Amazon.com Inc., Boeing, Zipline, Wing Aviation LLC, and Flytrex are now offering drone delivery services tailored for retailers, e-commerce marketplaces, restaurants, and delivery firms.

Drones are significantly transforming agricultural practices by enabling farms and agricultural businesses to enhance crop yields, save time, and make informed land management decisions that contribute to long-term success. Companies are increasingly offering specialized agricultural drones to support these processes. For example, in November 2021, XAG Co., Ltd. (China) launched the V40 and P40 agricultural drones, specifically designed for rural areas with aging populations and limited infrastructure. These drones facilitate mapping, spraying, and broadcasting on farms, helping farmers improve crop yields, reduce costs, monitor crop health, and detect weeds, insects, and other soil conditions. Such advancements are expected to boost the growth of the UAV market during the forecast period.

The use of unmanned aerial vehicles (UAVs) has rapidly expanded in recent years across various sectors, particularly in security and defense. UAVs are deployed for border patrol and counter-terrorism operations, significantly enhancing security measures at national borders. Equipped with high-resolution cameras, thermal imaging, and various sensors, these UAVs are effective in monitoring suspicious activities in border areas.

Advancements in technology have facilitated the development of miniaturized UAVs, which are increasingly utilized in military applications such as reconnaissance and surveillance. Numerous organizations are incorporating artificial intelligence (AI) and machine learning algorithms into UAVs to enhance their autonomous capabilities, improving mission efficiency. For example, in September 2023, Teledyne FLIR LLC (U.S.) launched the Black Recon Vehicle Reconnaissance System (VRS), a micro-unmanned aerial vehicle designed to deliver autonomous persistent reconnaissance, surveillance, and target acquisition (RSTA) for military vehicle crews. Such innovations are expected to drive the growth of the UAV market during the forecast period.

The demand for advanced systems such as drones, hypersonic missiles, and cyber warfare capabilities is increasing in the defense sector. Thus, countries with growing economies are heavily investing in their defense sector. In 2023, world military expenditures increased, reaching a total of USD 2443 billion. A part of these investments is used to implement advanced technologies to increase coverage, secure borders, and gain counterintelligence and tactical advantages over enemies.

Countries such as the U.S., China, Russia, India, and Saudi Arabia have ramped up their military spending. In December 2022, the Japanese government released a series of documents outlining plans to invest in defense and security capabilities, with a strong emphasis on enhancing drone platforms and capabilities. These initiatives from government bodies in the defense sector are creating significant growth opportunities for the UAV market within this domain.

Based on component, the unmanned aerial vehicle market is segmented into UAV hardware and UAV software. In 2024, the UAV hardware segment is expected to account for the larger share of over 72% of the unmanned aerial vehicle market. The large market share of this segment is primarily driven by the increasing need to enhance battery life in UAVs to extend flight times, as well as the demand for the replacement, upgrading, and modification of UAV hardware components to improve lifespan and performance. In July 2024, Inertial Labs, Inc. (U.S.) partnered with ideaForge Technology Ltd. (India) to integrate Inertial Labs' RESEPI LiDAR solution into ideaForge's high-performance unmanned aerial vehicles, targeting applications such as surveying, mapping, mining, construction, forestry, power line inspection, and search and rescue.

However, the UAV software segment is poised to register the highest CAGR during the forecast period. This growth can be attributed to the strategic advancements made by key players in advanced drone software technology and a rising demand for software solutions that enhance data analysis capabilities.

Based on class, the unmanned aerial vehicle market is segmented into small UAVs, strategic & tactical UAVs, and special-purpose UAVs. In 2024, the small UAVs segment is expected to account for the largest share of over 41% of the unmanned aerial vehicle market. This segment’s large market share is primarily attributed to the rising adoption of small UAVs in the commercial sector for applications such as law enforcement, delivery services, energy and power, wildlife surveys, disaster response, logistics and transportation, mapping and surveillance, and inventory management. In March 2021, Kratos Defense & Security Solutions, Inc. (U.S.) launched the ALTIUS-600, a small unmanned aircraft designed for various missions, including electronic warfare, signals intelligence, counter-UAS operations, and intelligence, surveillance, and reconnaissance. Moreover, the small UAVs segment is poised to register the highest CAGR during the forecast period.

Based on type, the unmanned aerial vehicle market is segmented into rotary-wing UAVs, fixed-wing UAVs, and fixed-wing VTOL UAVs. In 2024, the rotary-wing UAVs segment is expected to account for the largest share of over 62% of the unmanned aerial vehicle market. This segment’s large market share is primarily driven by ongoing innovations in compact design, the increasing deployment of rotary-wing drones in the agriculture sector, and their relatively lower prices compared to other types of UAVs.

However, the fixed-wing VTOL UAV segment is poised to register the highest CAGR during the forecast period due to the increasing demand for these UAVs to cover long distances at high speed and the growing adoption of them across the commercial and military sectors.

Based on capacity, the unmanned aerial vehicle market is segmented into less than 25 kilograms, greater than 170 kilograms, and between 25-170 kilograms. In 2024, the less than 25 kilograms segment is expected to account for the largest share of over 43% of the unmanned aerial vehicle market. The large market share of this segment is largely due to the rising use of UAVs in the commercial sector for applications such as aerial photography, precision agriculture, and package delivery services. Factors contributing to this growth include the lower cost of small UAVs and favorable regulatory developments in many countries.

However, the between 25-170 kilograms segment is poised to register the highest CAGR during the forecast period. This growth is driven by the increasing use of UAVs for industrial applications such as infrastructure inspection, power line maintenance, inventory management, and pipeline monitoring. Additionally, strategic developments by market players are expanding the range of operations offered, including search and rescue, mapping and monitoring, ground force support, irregular traffic surveillance, and intelligence missions.

Based on mode of operation, the unmanned aerial vehicle market is segmented into remotely operated UAVs, semi-autonomous UAVs, and fully autonomous UAVs. In 2024, the remotely operated UAV segment is expected to account for the largest share, over 46%. This segment's large market share is primarily attributed to the growing need for remotely operated UAVs in military applications and their capabilities of emergency landing, disconnecting recovery, and emergency handover between control channels.

However, the fully autonomous UAV segment is poised to register the highest CAGR during the forecast period due to the growing demand for these well-developed features, such as stability enhancement and waypoint flight.

Based on end user, the unmanned aerial vehicle market is segmented into military, agriculture, media & advertising, commercial, transportation & logistics, construction & mining, energy & power, wildlife & forestry, insurance, law enforcement, and other end users. In 2024, the military segment is expected to account for the largest share of over 64% of the unmanned aerial vehicle market. The large market share of this segment is primarily driven by the increasing demand for autonomous UAVs in military applications, including intelligence, surveillance, and reconnaissance (ISR) missions. Additionally, the preference for UAVs over manned aircraft is growing due to their affordability in terms of operation and maintenance.

However, the transportation & logistics segment is poised to register the highest CAGR during the forecast period. This growth can be attributed to the rising use of UAVs to achieve faster package delivery times in congested urban areas, along with the increasing emphasis by developed countries on utilizing UAVs for postal deliveries.

Based on geography, the unmanned aerial vehicle market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of over 48% of the unmanned aerial vehicle market, followed by Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America’s large market share is due to several key factors, including the increasing deployment of UAVs across various sectors such as military, agriculture, and commercial industries. The presence of major market players in the U.S., the growing utilization of drones for agricultural applications, and supportive government initiatives in both the U.S. and Canada further contribute to this trend. Notably, in June 2023, the Canadian Minister of Transport announced proposed regulations for Beyond Visual Line-of-Sight (BVLOS) drone operations aimed at facilitating lower-risk drone activities beyond visual line-of-sight and the operation of medium-sized drones within visual line-of-sight.

However, Asia-Pacific is poised to record the highest CAGR of over 14% during the forecast period. This growth is attributed to the growing integration of advanced technologies such as AI and machine learning in UAVs, the rising adoption of UAVs across various industries in countries like China and Japan to mitigate increasing labor costs, supportive government initiatives in developing nations, and heightened investments from major UAV companies in the region.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the unmanned aerial vehicle market are Elbit Systems Ltd. (Israel), Northrop Grumman Corporation (U.S.), General Atomics (U.S.), AeroVironment, Inc. (U.S.), Lockheed Martin Corporation (U.S.), Israel Aerospace Industries Ltd. (Israel), Parrot S.A. (France), Microdrones Gmbh (Germany), PrecisionHawk, Inc. (U.S.), SZ DJI Technology Co., Ltd. (China), 3D Robotics (U.S.), Textron Inc. (U.S.), The Boeing Company (U.S.), Saab AB (Sweden), BAE Systems Plc (U.K.), Ehang (China), Raytheon Technologies Corporation (U.S.), Yuneec (China), Turkish Aerospace Industries (Turkey), and Primoco UAV SE (Czech Republic).

|

Particulars |

Details |

|

Number of Pages |

450 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

12.7% |

|

Market Size (Value) |

USD 63.5 Billion by 2031 |

|

Segments Covered |

By Component

By Class

By Type

By Capacity

By Mode of Operation

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Australia & New Zealand, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Rest of Latin America), and the Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Elbit Systems Ltd. (Israel), Northrop Grumman Corporation (U.S.), General Atomics (U.S.), AeroVironment, Inc. (U.S.), Lockheed Martin Corporation (U.S.), Israel Aerospace industries Ltd. (Israel), Parrot S.A. (France), Microdrones Gmbh (Germany), PrecisionHawk, Inc. (U.S.), SZ DJI Technology Co., Ltd. (China), 3D Robotics (U.S.), Textron Inc. (U.S.), The Boeing Company (U.S.), Saab AB (Sweden), BAE Systems Plc (U.K.), Ehang (China), Raytheon Technologies Corporation (U.S.), Yuneec (China), Turkish Aerospace industries (Turkey), and Primoco UAV SE (Czech Republic) |

The unmanned aerial vehicle market study focuses on market assessment and opportunity analysis through the sales of unmanned aerial vehicles across different regions and countries across different market segmentations. This study is also focused on competitive analysis for unmanned aerial vehicles based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The unmanned aerial vehicle market is projected to reach $63.5 billion by 2031, at a CAGR of 12.7% during the forecast period.

In 2024, the UAV hardware segment is expected to hold a major share of over 72% of the unmanned aerial vehicle market.

The transportation and logistics segment is expected to witness the fastest growth from 2024 to 2031.

The rising adoption of UAVs in civil and commercial applications, increasing deployment of UAVs for border patrolling and combating terrorism, and exemptions made by regulatory authorities around the globe to permit the use of UAVs in several industries are the key factors supporting the growth of this market. Moreover, the increasing deployment of UAVs to carry out aerial remote sensing and the growing defense budgets of major economies create opportunities for players operating in this market.

The key players operating in the unmanned aerial vehicle market are Elbit Systems Ltd. (Israel), Northrop Grumman Corporation (U.S.), General Atomics (U.S.), AeroVironment, Inc. (U.S.), Lockheed Martin Corporation (U.S.), Israel Aerospace Industries Ltd. (Israel), Parrot S.A. (France), Microdrones Gmbh (Germany), PrecisionHawk, Inc. (U.S.), SZ DJI Technology Co., Ltd. (China), 3D Robotics (U.S.), Textron Inc. (U.S.), The Boeing Company (U.S.), Saab AB (Sweden), BAE Systems Plc (U.K.), Ehang (China), Raytheon Technologies Corporation (U.S.), Yuneec (China), Turkish Aerospace Industries (Turkey), and Primoco UAV SE (Czech Republic).

Asia-Pacific is projected to register the highest CAGR of over 14% during the forecast period.

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Jan-2024

Published Date: Jan-2024

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates