Resources

About Us

Medical Lithium Battery Market by Battery Type (Primary Lithium Batteries, Rechargeable Lithium-Ion Batteries), Application (Implantable Medical Devices, Portable Medical Devices, Wearable Medical Devices, Diagnostic Equipment, Surgical Instruments), End User, and Geography - Global Forecast to 2035

Report ID: MRHC - 1041623 Pages: 230 Oct-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Medical Lithium Battery Market Size?

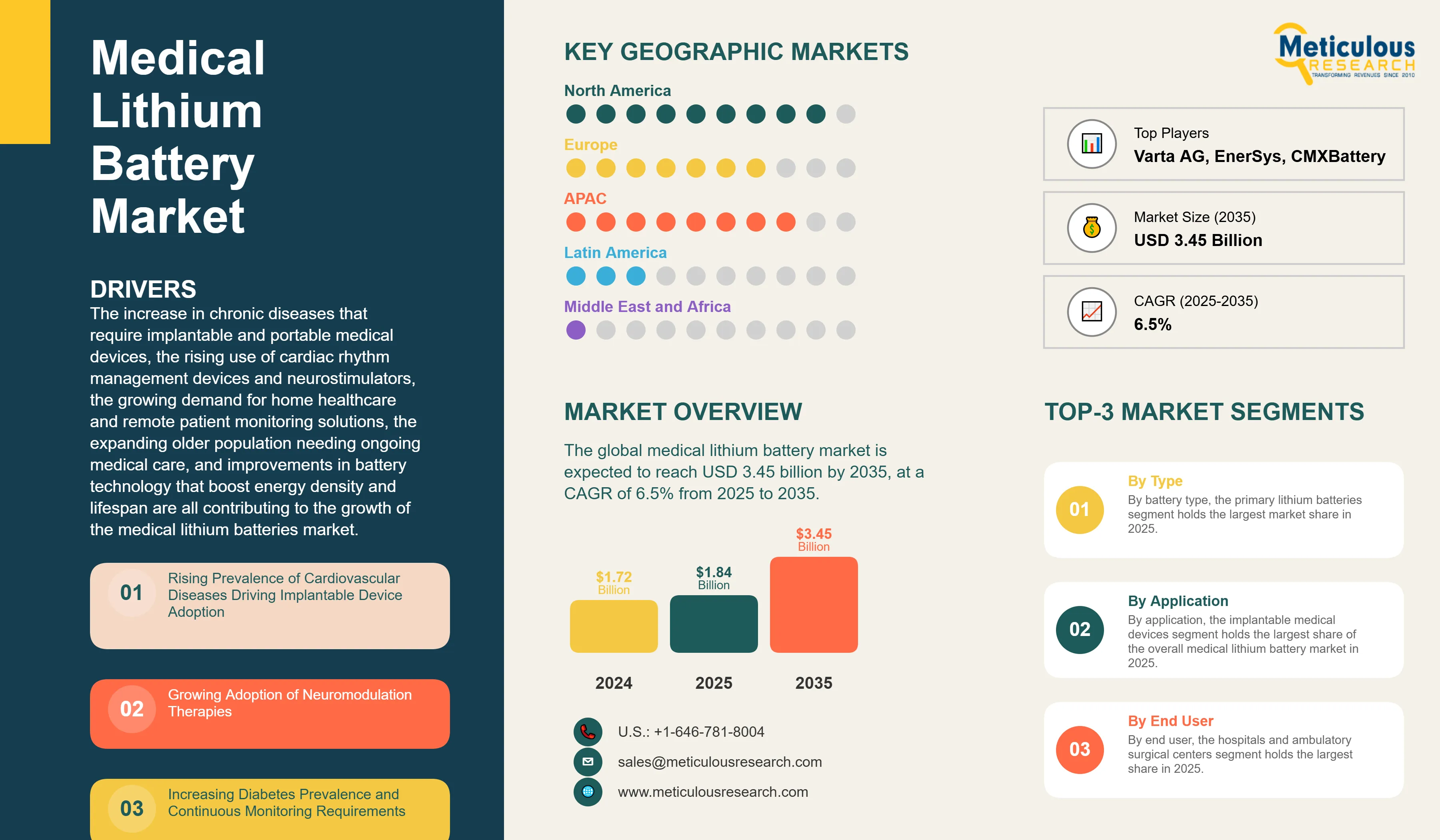

The global medical lithium battery market was valued at USD 1.72 billion in 2024. This market is expected to reach USD 1.84 billion in 2025 and grow to about USD 3.45 billion by 2035, at a CAGR of 6.5% from 2025 to 2035. The increase in chronic diseases that require implantable and portable medical devices, the rising use of cardiac rhythm management devices and neurostimulators, the growing demand for home healthcare and remote patient monitoring solutions, the expanding older population needing ongoing medical care, and improvements in battery technology that boost energy density and lifespan are all contributing to the growth of the medical lithium batteries market. These batteries are used in hospitals, outpatient surgical centers, home care settings, and long-term care facilities around the world.

Market Highlights: Medical Lithium Batteries

Click here to: Get Free Sample Pages of this Report

The medical lithium batteries provide reliable, long-lasting energy for life-critical applications. Medical lithium batteries are built to meet strict regulatory standards and performance needs specific to healthcare, such as biocompatibility, hermetic sealing, predictable discharge rates, wide temperature ranges, and long shelf life. These power sources are vital for implantable cardiac devices like pacemakers and defibrillators, neurostimulators for managing pain and movement disorders, drug delivery systems, hearing aids, portable diagnostic equipment, and wearable health monitors that need steady, dependable power over long periods.

The market includes primary (non-rechargeable) lithium batteries that offer excellent energy density and reliability for implantable devices that need to operate for decades. It also includes rechargeable lithium-ion and lithium-polymer batteries for external medical equipment that needs frequent recharging. These come in different configurations, such as coin cells, cylindrical cells, prismatic cells, and custom-designed battery packs with advanced battery management systems for safety and performance monitoring.

The overall medical lithium battery market is growing primarily due to the growing global burden of cardiovascular diseases, neurological disorders, and metabolic conditions that require device-based interventions. There is also a rising preference for less invasive procedures and outpatient care that rely on battery-powered medical technologies. Furthermore, the factors such as increased healthcare spending in emerging economies that improve access to medical devices, aging populations facing more chronic diseases, innovations in battery chemistry that extend device life, miniaturization that allows for smaller implants with longer operational life, and the growing trend toward connected health and remote patient monitoring that requires portable and wearable medical devices drive the growth of this market.

What are the Key Trends in the Medical Lithium Battery Market?

Extended battery life and energy density improvements: A major trend in the medical lithium battery market is the ongoing progress in battery chemistry and design aimed at extending operational life and increasing energy density. This change is driven by the demand for longer-lasting implants that lower the need for surgical replacements and improve patient quality of life. Modern pacemaker batteries now typically last 10 to 15 years, compared to 5 to 7 years for earlier models. Implantable cardioverter defibrillators achieve operational spans of 7 to 10 years despite their higher power needs for shock delivery. Manufacturers are creating lithium-silver vanadium oxide and lithium-manganese dioxide chemistries that offer better voltage stability and energy capacity in smaller sizes. This trend allows for the development of next-generation implantable devices with improved features, including multi-chamber pacing, advanced arrhythmia detection algorithms, wireless telemetry, and integrated sensors, all while maintaining or extending battery life. The push for longer battery life lowers healthcare costs linked to replacement surgeries, reduces patient risk from repeat procedures, and boosts device reliability. Battery innovations also help miniaturize implantable devices, making them suitable for pediatric patients and allowing for less invasive implantation procedures that speed up recovery times and cut complications.

Wireless charging and rechargeable systems adoption: Another significant trend transforming the market is the rapid adoption of rechargeable lithium-ion battery systems with wireless charging for external and semi-implantable medical devices. This shift addresses the issues of primary batteries in high-power applications while providing greater convenience and flexibility for patients managing chronic conditions. Rechargeable systems are becoming standard in cochlear implants, spinal cord stimulators, deep brain stimulators, and external insulin pumps, where power needs surpass what primary batteries can efficiently provide or where frequent battery changes would be impractical.

The shift toward rechargeable systems is particularly strong in neuromodulation applications, where the effectiveness of therapy often depends on stimulation intensity and frequency, creating power demands that primary batteries cannot support over acceptable replacement periods. Advanced battery management systems in these devices track charge levels, optimize charging cycles, and give patients clear feedback through smartphone applications, integrating medical device management into connected health systems. This change supports more aggressive therapy protocols, allows for adaptive stimulation based on patient activity and symptoms, and positions medical devices as long-term therapeutic partners instead of products that require periodic replacement.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 3.45 Billion |

|

Market Size in 2025 |

USD 1.84 Billion |

|

Market Size in 2024 |

USD 1.72 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 6.5% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Battery Type, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Cardiovascular Diseases Driving Implantable Device Adoption

A key factor driving the growth of the medical lithium battery market is the increasing global burden of cardiovascular diseases. These diseases are the leading cause of death worldwide and create a significant demand for cardiac rhythm management devices powered by lithium batteries. The World Health Organization reports that cardiovascular diseases cause about 17.9 million deaths every year, which is 32% of all global deaths. The rates of cardiac arrhythmias, heart failure, and sudden cardiac arrest risk continue to rise due to an aging population, higher rates of obesity and diabetes, and improved survival from acute cardiac events that leave patients with chronic conditions needing device-based treatments.

Pacemakers and implantable cardioverter defibrillators are the largest application segment for medical lithium batteries, with millions of devices implanted around the world each year. These life-saving devices rely entirely on battery performance since battery depletion requires the surgical replacement of the entire device generator. The American Heart Association estimates that over 3 million people globally live with pacemakers, and about 300,000 new pacemakers are implanted every year in the United States. Implantable cardioverter defibrillators provide life-saving shocks for dangerous arrhythmias and serve an additional 1.5 million patients worldwide, with around 200,000 new implants each year.

The growing uses for cardiac rhythm management devices, such as heart failure with reduced ejection fraction, bradycardia in older populations, and the primary prevention of sudden cardiac death in high-risk patients, continue to widen the patient population eligible for these treatments. Newer devices now offer cardiac resynchronization therapy, remote monitoring capabilities, and advanced diagnostic features, which all increase power needs and raise the importance of battery technology in device performance. The essential nature of these applications, where battery failure could lead to serious injury or death, drives stringent quality standards and creates significant demand for high-reliability medical-grade lithium batteries that can provide predictable performance over long operational periods.

Opportunity

Expansion of Neuromodulation Therapies Creating New Battery Demand

The rapid growth of neuromodulation therapies for pain management, movement disorders, psychiatric conditions, and other neurological applications creates significant opportunities for the medical lithium battery market. Neuromodulation devices, such as spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, and sacral nerve stimulators, are among the fastest-growing areas of implantable medical technology. This growth is fueled by expanding clinical evidence, wider indications, and improved patient outcomes compared to drug treatments.

Chronic pain affects about 1.5 billion people worldwide, leading to a huge demand for effective treatments. Spinal cord stimulation has proven effective for conditions like failed back surgery syndrome, complex regional pain syndrome, and diabetic neuropathy, with over 50,000 new implants each year in the U.S. and increasing use in Europe and Asia-Pacific. These devices usually require more power than cardiac pacemakers because of their continuous stimulation needs. This drives the demand for both high-capacity primary lithium batteries in non-rechargeable systems and advanced lithium-ion rechargeable batteries in high-power setups.

Deep brain stimulation for Parkinson's disease, essential tremor, dystonia, and new psychiatric applications is another area of high growth. With more than 10 million people affected by Parkinson's disease worldwide and the number rising as the population ages, the market for deep brain stimulation keeps expanding. These applications need advanced battery solutions that can support bilateral stimulation, adaptive stimulation protocols, and sensing features that enable closed-loop therapeutic delivery.

Manufacturers are working on specialized battery technologies for neuromodulation applications. This includes rechargeable systems with wireless charging to avoid replacement surgeries, high-capacity primary cells for patients who prefer non-rechargeable options, and miniaturized batteries for less invasive implant procedures. The rising clinical acceptance of neuromodulation in various treatment areas, along with technology improvements that make devices more effective and user-friendly, positions this segment as a key growth factor for medical lithium battery demand in the coming years, especially in markets where alternatives like opioid medications face stricter regulations due to addiction risks.

Battery Type Insights

Why Do Primary Lithium Batteries Dominate the Market?

The primary lithium batteries segment accounts for about 65-70% of the overall medical lithium battery market in 2025. The largest share of this segment is mainly due to their reliability, predictable discharge without surprises, long operational life, and established use in life-critical implantable medical devices, where changing the battery requires surgery.

Primary lithium batteries, especially lithium-iodine and lithium-silver vanadium oxide types, have become the preferred choice for pacemakers and implantable cardioverter defibrillators because they provide consistent voltage for 8-15 years of continuous operation. These batteries have a sealed design that keeps out moisture and ensures they remain safe to use throughout their lifespan. They also have very low self-discharge rates, usually under 1% per year. This reliability gives both doctors and patients confidence in treatment planning.

Major medical device companies like Medtronic, Abbott, and Boston Scientific use primary lithium battery technology in their cardiac rhythm management products, leading to high and steady demand. This segment also supplies batteries for hearing aids, drug delivery pumps, and diagnostic sensors, where primary batteries provide simplicity, reliability, and cost benefits compared to rechargeable options.

On the other hand, the rechargeable lithium-ion batteries segment is expected to grow at the fastest CAGR from 2025 to 2035. This growth is fueled by an increase in high-power neuromodulation applications, portable medical devices, wearable health monitors, and connected devices where frequent recharging is feasible.

Application Insights

How Do Implantable Medical Devices Lead the Market?

Based on application, the implantable medical devices segment holds the largest share of the overall medical lithium battery market in 2025.

Cardiac rhythm management devices, such as pacemakers, implantable cardioverter defibrillators, and cardiac resynchronization therapy devices, are the largest application for medical lithium batteries. These devices rely completely on internal battery power for operation. When batteries run low, they require surgical generator replacement, making battery life a key design concern. Modern pacemakers use advanced sensing, pacing algorithms, wireless telemetry, and diagnostic features while achieving a 10-15 year operational life through improved battery technologies.

On the other hand, the wearable medical devices segment is expected to grow at the fastest CAGR during the forecast period. This growth is fueled by the surge in continuous glucose monitors, wearable cardiovascular monitors, smart insulin delivery systems, and connected health devices that combine medical-grade sensing with consumer-friendly designs. This segment benefits from the merging of medical device technology with consumer electronics, increasing the need for compact, high-performance rechargeable lithium batteries that can last for multiple days between charges while supporting wireless connectivity and advanced processing features.

End User Insights

Why Do Hospitals and Ambulatory Surgical Centers Lead the Market?

The hospitals and ambulatory surgical centers segment holds the largest share of the overall market in 2025.

The high number of procedures, varied device needs across many specialties, and the crucial nature of battery performance in surgical settings create strong and ongoing demand for medical lithium batteries from hospitals through the supply chains of device manufacturers. This segment also includes hospital-based diagnostic and therapeutic equipment powered by lithium batteries. Such equipment includes portable ultrasound systems, telemetry monitors, infusion pumps, and emergency response tools that need dependable battery performance in clinical environments.

The homecare settings segment is expected to grow at the fastest CAGR through 2035. This growth is driven by the rising trend toward home-based healthcare, remote patient monitoring, and patients managing their own chronic conditions.

U.S. Medical Lithium Battery Market Size and Growth 2025 to 2035

The U.S. medical lithium battery market is projected to grow at a CAGR of 6.2% from 2025 to 2035.

How is North America Maintaining Dominance in the Medical Lithium Battery Market?

North America holds the largest share of the global medical lithium battery market in 2025. This is mainly due to its strong healthcare infrastructure, high healthcare spending per person, early adoption of new medical technologies, a solid regulatory framework that supports device innovation, the presence of major medical device manufacturers, and a high number of chronic diseases that drive device implantation rates.

The U.S. is the largest market for medical lithium batteries. It has a wide network of hospitals, surgical centers, and cardiac electrophysiology labs that perform hundreds of thousands of implantable device procedures each year. The U.S. leads the world in cardiac rhythm management device implantation rates, with around 500,000 pacemaker and defibrillator procedures performed annually. Each of these procedures relies on advanced lithium battery technology.

High rates of cardiovascular disease, diabetes, and neurological disorders in the region create significant demand for battery-powered implantable and portable medical devices. Medicare and private insurance offer good coverage for implantable cardiac devices, neurostimulators, and continuous glucose monitoring systems. This reduces financial barriers to adopting these devices and boosts battery demand.

Which Factors Support the Asia Pacific Medical Lithium Battery Market Growth?

Asia Pacific is expected to witness the fastest growth from 2025 to 2035. This growth is mainly attributed to the rapidly aging populations in Japan, China, and South Korea, the rising prevalence of lifestyle-related chronic diseases, improving healthcare infrastructure, more affordable medical devices, and the growing use of new therapeutic technologies in emerging economies in the region.

Economic development and a growing middle class in China, India, Southeast Asia, and other countries in the Asia Pacific are making it easier for people to access advanced medical care. This includes implantable cardiac devices and neurostimulators that were once mainly available in developed markets. Government healthcare programs in places like China and India are focusing on managing cardiovascular diseases. They are also expanding insurance coverage for implantable medical devices, which creates demand for medical-grade lithium batteries.

With greater health awareness and patient empowerment, more people are accepting medical device therapies. This trend is broadening the market to include not just hospitals but also outpatient clinics, specialized cardiac centers, and home healthcare. E-commerce platforms and growing pharmacy networks make it easier for people to get portable medical devices and wearable health monitors powered by lithium batteries.

Medical tourism in countries like Thailand, Singapore, and India is attracting international patients for cardiac procedures and neurosurgery. This increase leads to higher device implantation rates and greater battery use. The lower initial penetration of implantable medical devices in these markets compared to Western countries, along with better healthcare access and affordability, offers significant growth potential as these markets develop over the forecast period.

Key Players

The major players in the medical lithium battery market include EaglePicher Technologies LLC, Quallion LLC (Integer Holdings Corporation), Saft Batteries (TotalEnergies), Ultralife Corporation, Panasonic Industry Co. Ltd., EVE Energy Co. Ltd., Varta AG, Maxell Holdings Ltd., Renata SA (Swatch Group), Electrochem Solutions Inc., Tadiran Batteries, EnerSys, GrepowBattery, Shenzhen Grepow Battery Co. Ltd., Shenzhen Jiayi Lithium Battery Co. Ltd., Shenzera Industries Ltd., CMXBattery, Murata Manufacturing Co. Ltd., Sony Corporation, and Samsung SDI Co. Ltd. among others.

Segments Covered in the Report

By Battery Type

By Application

By End User

By Region

The medical lithium battery market is expected to grow from USD 1.84 billion in 2025 to USD 3.45 billion by 2035.

The medical lithium battery market is expected to grow at a CAGR of 6.5% from 2025 to 2035.

The major players in the medical lithium battery market include EaglePicher Technologies LLC, Quallion LLC (Integer Holdings Corporation), Saft Batteries (TotalEnergies), Ultralife Corporation, Panasonic Industry Co. Ltd., EVE Energy Co. Ltd., Varta AG, Maxell Holdings Ltd., Renata SA (Swatch Group), Electrochem Solutions Inc., Tadiran Batteries, EnerSys, GrepowBattery, Shenzhen Grepow Battery Co. Ltd., Shenzhen Jiayi Lithium Battery Co. Ltd., Shenzera Industries Ltd., CMXBattery, Murata Manufacturing Co. Ltd., Sony Corporation, and Samsung SDI Co. Ltd. among others.

The main factors driving the medical lithium battery market include rising prevalence of cardiovascular diseases requiring cardiac rhythm management devices, growing adoption of neurostimulation therapies for chronic pain and neurological disorders, increasing diabetes prevalence driving insulin pump and continuous glucose monitor usage, expanding elderly population requiring implantable medical interventions, technological advancements in battery chemistry extending device longevity, and growing trends toward home healthcare and portable medical equipment.

North America region will lead the global medical lithium battery market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Battery Type

3.3. Market Analysis, By Application

3.4. Market Analysis, By End User

3.5. Market Analysis, By Geography

3.6. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Medical Lithium Battery Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Rising Prevalence of Cardiovascular Diseases Driving Implantable Device Adoption

4.2.2. Growing Adoption of Neuromodulation Therapies

4.2.3. Increasing Diabetes Prevalence and Continuous Monitoring Requirements

4.3. Global Medical Lithium Battery Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. High Development and Regulatory Compliance Costs

4.3.2. Competition from Alternative Battery Technologies

4.4. Global Medical Lithium Battery Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Expansion of Neuromodulation Therapies Creating New Battery Demand

4.4.2. Growth of Wearable and Connected Medical Devices

4.5. Global Medical Lithium Battery Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Stringent Regulatory Requirements and Biocompatibility Standards

4.5.2. Battery Life Limitations in High-Power Applications

4.6. Global Medical Lithium Battery Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Extended Battery Life and Energy Density Improvements

4.6.2. Wireless Charging and Rechargeable Systems Adoption

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Battery Technology Advancements on the Global Medical Lithium Battery Market

5.1. Introduction to Advanced Battery Technologies in Medical Applications

5.2. Solid-State Battery Development and Medical Applications

5.3. Wireless Power Transfer and Inductive Charging Technologies

5.4. Smart Battery Management Systems and IoT Integration

5.5. Miniaturization Technologies and High Energy Density Solutions

5.6. Biocompatible Materials and Hermetic Sealing Innovations

5.7. Battery Monitoring and Predictive End-of-Life Technologies

5.8. Impact on Market Growth and Technology Adoption

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share/Ranking by Key Players

7. Global Medical Lithium Battery Market, By Battery Type

7.1. Introduction

7.2. Primary Lithium Batteries

7.2.1. Lithium-Iodine Batteries

7.2.2. Lithium-Silver Vanadium Oxide Batteries

7.2.3. Lithium-Manganese Dioxide Batteries

7.2.4. Other Primary Lithium Chemistries

7.3. Rechargeable Lithium-Ion Batteries

7.3.1. Lithium-Ion Batteries

7.3.2. Lithium-Polymer Batteries

8. Global Medical Lithium Battery Market, By Application

8.1. Introduction

8.2. Implantable Medical Devices

8.3. Portable Medical Devices

8.4. Wearable Medical Devices

8.5. Diagnostic Equipment

8.6. Surgical Instruments

8.7. Other Applications

9. Global Medical Lithium Battery Market, By End User

9.1. Introduction

9.2. Hospitals and Ambulatory Surgical Centers

9.3. Homecare Settings

9.4. Long-Term Care Facilities

9.5. Diagnostic Centers

9.6. Specialty Clinics

9.7. Research and Academic Institutes

9.8. Others

10. Medical Lithium Battery Market, By Geography

10.1. Introduction

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Switzerland

10.3.7. Rest of Europe

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. Australia

10.4.6. Southeast Asia

10.4.7. Rest of Asia-Pacific

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Rest of Latin America

10.6. Middle East & Africa

10.6.1. Saudi Arabia

10.6.2. UAE

10.6.3. South Africa

10.6.4. Rest of Middle East & Africa

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

11.1. EaglePicher Technologies LLC

11.2. Quallion LLC (Integer Holdings Corporation)

11.3. Saft Batteries (TotalEnergies)

11.4. Ultralife Corporation

11.5. Panasonic Industry Co. Ltd.

11.6. EVE Energy Co. Ltd.

11.7. Varta AG

11.8. Maxell Holdings Ltd.

11.9. Renata SA (Swatch Group)

11.10. Electrochem Solutions Inc.

11.11. Tadiran Batteries

11.12. EnerSys

11.13. GrepowBattery

11.14. Shenzhen Grepow Battery Co. Ltd.

11.15. Shenzhen Jiayi Lithium Battery Co. Ltd.

11.16. Shenzera Industries Ltd.

11.17. CMXBattery

11.18. Murata Manufacturing Co. Ltd.

11.19. Sony Corporation

11.20. Samsung SDI Co. Ltd.

11.21. Others

12. Appendix

12.1. Questionnaire

12.2. Available Customization

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates