Resources

About Us

Medical Coatings Market by Type (Hydrophilic, Antimicrobial, Drug-eluting, Anti-thrombogenic), Material (Polymer {Fluoropolymers, Parylene, Silicon}, Metal {Silver, Titanium}), Application (Medical Devices, Implants, Equipment) - Global Forecast to 2032

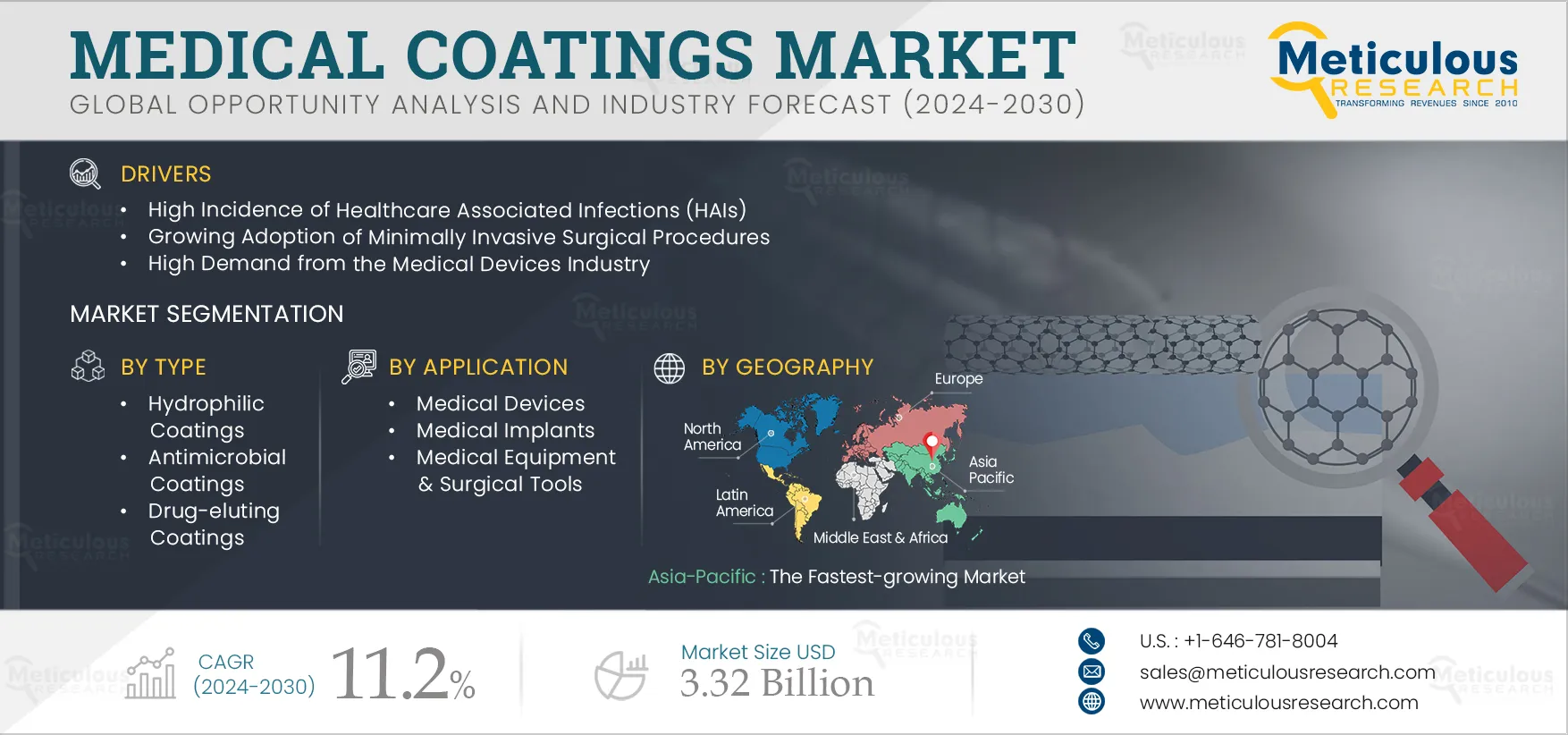

Report ID: MRHC - 104769 Pages: 180 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Medical Coatings Market is projected to reach $3.32 billion by 2032, at a CAGR of 11.20% from 2025 to 2032. Medical devices, implants, and equipment are highly specialized and require a coating of specific materials. The surface coating of medical devices improves performance and, most importantly, the safety of the devices. The medical implants placed inside the body must be compatible with the human tissue. Medical coatings are required to ensure that the device that comes in contact with human tissues is biocompatible.

The growth of this market is driven by factors such as the rising incidence of healthcare-associated infections (HAIs), growing adoption of minimally invasive surgical procedures, and high demand from the medical devices industry. Furthermore, the growing demand for customized and multifunctional coatings and potential in emerging economies are expected to provide significant growth opportunities for this market.

However, the rising raw material prices and high costs & miniaturization of medical devices are the factors that are expected to hinder the growth of this market. Additionally, factors such as the limitations of certain types of coatings with regards to biocompatibility, lack of standardization, and durability, among others and the risk of coating failure associated with the use of hydrophilic and/or hydrophobic coated medical devices are some of the major challenges for the growth of this market.

Click here to: Get a Free Sample Copy of this report

Hospital-acquired infections (HAIs), also known as nosocomial infections, are diseases acquired in hospitals or healthcare facilities that manifest 48 hours or more after admission or within 30 days of discharge. According to the WHO, out of every 100 hospitalized patients, seven in developed and ten in developing countries acquire at least one healthcare-associated infection. Also, the prevalence of device-associated infections in developing countries is up to 13 times higher than in developed countries.

It is reported that each year around 313 million surgeries are performed globally. According to the WHO, surgical site HAIs are observed frequently, with an incidence rate of 0.5% to 15% out of total surgeries. It has been reported by the Centers for Disease Control and Prevention (CDC) that approximately 27 million surgical procedures are performed in the U.S. each year, with up to 5% of patients acquiring surgical site infections.

Some medical coatings contain antimicrobial agents that prevent the growth of bacteria and other harmful pathogens. They can also be a barrier between the medical device and the patient's body, preventing contamination. Cleaning and disinfecting medical devices are made easier with medical coatings that have smooth and non-porous surfaces. Additionally, biocompatible and non-toxic coatings can reduce adverse reactions in patients, including infections. Lastly, medical coatings that reduce friction can lower the risk of device-related injuries, increasing the risk of infection. By reducing the risk of HAIs, medical coatings can improve patient outcomes and decrease the healthcare costs associated with treating infections.

In 2025, the Hydrophilic Coatings Segment is Expected to Dominate the Medical Coatings Market

Based on type, the hydrophilic coatings market is segmented into hydrophilic coatings, antimicrobial coatings, drug-eluting coatings, anti-thrombogenic coatings and other types. In 2025, the hydrophilic coatings segment is expected to account for the largest share of the medical coatings market. The large market share of this segment is attributed to the high demand for hydrophilic-coated medical devices due to its advantages such as reduced friction, increased lubrication, and high compatibility with blood & other body fluids.

In 2025, the Polymers Segment is Expected to Account for the Largest Share of the Medical Coatings Market

Based on material type, the medical coatings market is segmented into polymers, metals, and other material types. In 2025, the polymers segment is expected to account for the largest share of the medical coatings market. The large market share of this segment can be attributed to the ability of polymers to effectively improve durability and provide corrosion resistance and better biocompatibility. Further, a variety of types of polymers are available for different types of applications, such as fluoropolymer coatings, which have the property to provide dry lubrication, insulation, and non-stick properties.

In 2025, the Medical Devices Segment is Expected to Account for the Largest Share of the Medical Coatings Market

Based on application, the medical coatings market is segmented into medical devices, medical implants, medical equipment & surgical tools, and other applications. In 2025, the medical devices segment is expected to account for the largest share of the medical coatings market. The large market share of this segment is attributed to the increased demand for medical devices such as guidewires, endotracheal tubes, catheters, etc., and the ability of medical coatings to improve patient safety and reduce infections.

Asia-Pacific: The Fastest-growing Market

Asia-Pacific is slated to register the fastest growth rate in the medical coatings market during the forecast period. The high market growth in Asia-Pacific is attributed to the growing medical devices market in the region, increasing number of surgeries, growing hospitalization rates, and rising healthcare expenditure.

Key Players

The report includes a competitive landscape based on an extensive assessment of mode of use, type, application, end user, geographic presence, and the key growth strategies adopted by leading market players in the industry over the past years 2020–2022. The key players profiled in the medical coatings market are Hydromer Inc. (U.S.), Harland Medical Systems, Inc. (U.S.), SurModics, Inc. (U.S.), Koninklijke DSM N.V. (Netherlands), AST Products, Inc. (U.S.), Biocoat Incorporated (U.S.), Precision Coating Company, Inc (U.S.), Medicoat AG (Switzerland), Merit Medical Systems, Inc. (U.S.), and Specialty Coating Systems, Inc. (U.S.).

Scope of the Report:

Medical Coatings Market, by Type

Medical Coatings Market, by Material Type

(Other metals include stainless steel, nitinol, platinum, gold, nickel, and titanium, among others)

(Other material types include acrylic and ceramic, among others)

Medical Coatings Market, by Application

Medical Coatings Market, by Geography

Key questions answered in the report:

The medical coatings market report covers the market sizes & forecasts based on type, material type, application, and geography. The medical coatings market studied in this report involves the value analysis of various segments and sub-segments at the regional and country levels.

The medical coatings market is projected to reach $3.32 billion by 2032, at a CAGR of 11.20% during the forecast period of 2025–2032.

Based on type, the medical coatings market is segmented into hydrophilic coatings, antimicrobial coatings, drug-eluting coatings, anti-thrombogenic coatings and other types. In 2025, the hydrophilic coatings segment is expected to account for the largest share of the medical coatings market due to its benefits, such as higher compatibility with blood, increased lubrication, property of hydrophilic coating to cause minimal resistance, while the device comes in contact with the human tissue or body fluids.

Based on type, the medical coatings market is segmented into polymers, metals, and other material types. In 2025, the polymers segment is expected to account for the largest share of the medical coatings market. The polymers segment is further segmented into fluoropolymers, perylene, silicones, and other polymers. The fluoropolymers segment is expected to hold the largest share of the medical coatings market for polymers due to its advantageous properties, including non-stickiness, non-corrosiveness, and inert nature.

Based on application, the medical coatings market is segmented into medical devices, medical implants, medical equipment & surgical tools, and other applications. In 2025, the medical devices segment is expected to account for the largest share of the medical coatings market due to the increased demand for medical devices, especially in emerging economies, with high requirements for coated medical devices to reduce infections and improve patient safety.

The growth of this market is driven by factors such as the rising incidence of healthcare-associated infections (HAIs), growing adoption of minimally invasive surgical procedures, and high demand from the medical devices industry. Furthermore, the growing demand for customized and multifunctional coatings and potential in emerging economies are expected to provide significant growth opportunities for this market.

The rising raw material prices and high costs and miniaturization of medical devices are the factors that are expected to hinder the growth of this market. Additionally, factors such as the limitations of certain types of coatings with regards to biocompatibility, lack of standardization, and durability, among others, and the risk of coating failure associated with using hydrophilic and/or hydrophobic coated medical devices are some of the major challenges for the growth of this market.

The key players operating in the medical coatings market are Hydromer Inc. (U.S.), Harland Medical Systems, Inc. (U.S.), SurModics, Inc. (U.S.), Koninklijke DSM N.V. (Netherlands), AST Products, Inc. (U.S.), Biocoat Incorporated (U.S.), Precision Coating Company, Inc (U.S.), Medicoat AG (Switzerland), Merit Medical Systems, Inc. (U.S.), and Specialty Coating Systems, Inc. (U.S.).

The Asia-Pacific region is slated to witness the highest growth rate during the forecast period and offer significant growth opportunities for the players operating in this market. The high market growth in Asia-Pacific is attributed to the increasing healthcare expenditure, growing medical devices industry, high hospitalization rates, and rising incidents of hospital-acquired infections.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.1.3. Growth Forecast

2.3.2. Market Share Analysis

2.4. Assumptions for the Study

2.5. Limitations for the Study

3. Executive Summary

4. Market Insights

4.1. Market Overview

4.2. Drivers

4.2.1. High Incidence of Healthcare Associated Infections (HAIs)

4.2.2. Growing Adoption of Minimally Invasive Surgical Procedures

4.2.3. High Demand from the Medical Devices Industry

4.3. Restraints

4.3.1. Rising Raw Material Prices and High Costs

4.3.2. Miniaturization of Medical Devices

4.4. Opportunities

4.4.1. Growing Demand for Customized and Multifunctional Coatings

4.4.2. Potential in Emerging Economies

4.5. Challenges

4.5.1. Limitations of Certain Types of Coatings

4.5.2. Risk of Coating Failure Associated with the Use of Hydrophilic and/or Hydrophobic Coated Medical Devices

4.6. The Impact of COVID-19 on the Global Medical Coatings Market

5. Global Medical Coatings Market, by Type

5.1. Introduction

5.2. Hydrophilic Coatings

5.3. Antimicrobial Coatings

5.4. Drug-eluting Coatings

5.5. Anti-thrombogenic Coatings

5.6. Other Types

6. Global Medical Coatings Market, by Material Type

6.1. Introduction

6.2. Polymers

6.2.1. Fluoropolymers

6.2.1.1. Polytetrafluoroethylene (PTFE)

6.2.1.2. Polyvinylidene fluoride (PVDF)

6.2.1.3. Other Fluoropolymers

6.2.2. Parylene

6.2.3. Silicones

6.2.4. Other Polymers

6.3. Metals

6.3.1. Silver

6.3.2. Titanium

6.3.3. Other Metals

6.4. Other Material Types

7. Global Medical Coatings Market, by Application

7.1. Introduction

7.2. Medical Devices

7.2.1. Neurological Devices

7.2.2. Cardiovascular Devices

7.2.3. Ophthalmology Devices

7.2.4. Orthopedics Devices

7.2.5. Dental Devices

7.2.6. Gynecology Devices

7.2.7. Other Devices

7.3. Medical Implants

7.3.1. Orthopedic Implants

7.3.2. Dental Implants

7.3.3. Cardiovascular implants

7.3.4. Other Implants

7.4. Medical Equipment & Surgical Tools

7.5. Other Applications

8. Medical Coatings Market, by Geography

8.1. Introduction

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe (RoE)

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.4.4. Rest of Asia-Pacific (RoAPAC)

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3 Rest of Latin America (RoLATAM)

8.6. Middle East & Africa

9. Competitive Landscape

9.1. Introduction

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Market Share Analysis (2022)

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

10.1. Hydromer Inc. (U.S.)

10.2. Harland Medical Systems, Inc. (U.S.)

10.3. SurModics, Inc. (U.S.)

10.4. Koninklijke DSM N.V. (Netherlands)

10.5. AST Products, Inc. (U.S.)

10.6. Biocoat Incorporated (U.S.)

10.7. Precision Coating Company, Inc (U.S.)

10.8. Medicoat AG (Switzerland)

10.9. Merit Medical Systems, Inc. (U.S.)

10.10. Specialty Coating Systems, Inc. (U.S.)

10.11. Other Companies

11. Appendix

11.1. Questionnaire

11.2. Available Customization

List of Tables

Table 1 Global Medical Coatings Market Drivers: Impact Analysis (2025–2032)

Table 2 Global Medical Coatings Market Restraints: Impact Analysis (2025–2032)

Table 3 Global Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 4 Global Hydrophilic Medical Coatings Market Size, by Country/Region, 2021–2032 (USD Million)

Table 5 Global Antimicrobial Medical Coatings Market Size, by Country/Region, 2025–2032 (USD Million)

Table 6 Global Drug-eluting Medical Coatings Market Size, by Country/Region, 2025–2032 (USD Million)

Table 7 Global Anti-thrombogenic Medical Coatings Market Size, by Country/Region, 2025–2032 (USD Million)

Table 8 Global Other Types of Medical Coatings Market Size, by Country/Region, 2025–2032 (USD Million)

Table 9 Global Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 10 Global Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 11 Global Medical Coatings Market Size for Polymers, by Country/Region, 2021–2032 (USD Million)

Table 12 Global Medical Coatings Market Size for Fluoropolymers, by Country/Region, 2021–2032 (USD Million)

Table 13 Global Medical Coatings Market Size for Polytetrafluoroethylene (PTFE), by Country/Region, 2021–2032 (USD Million)

Table 14 Global Medical Coatings Market Size for Polyvinylidene Fluoride (PVDF), by Country/Region, 2021–2032 (USD Million)

Table 15 Global Medical Coatings Market Size for Other Fluoropolymers, by Country/Region, 2021–2032 (USD Million)

Table 16 Global Medical Coatings Market Size for Parylene, by Country/Region, 2021–2032 (USD Million)

Table 17 Global Medical Coatings Market Size for Silicones, by Country/Region, 2021–2032 (USD Million)

Table 18 Global Medical Coatings Market Size for Other Polymers, by Country/Region, 2021–2032 (USD Million)

Table 19 Global Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 20 Global Medical Coatings Market Size for Metals, by Country/Region, 2021–2032 (USD Million)

Table 21 Global Medical Coatings Market Size for Silver, by Country/Region, 2021–2032 (USD Million)

Table 22 Global Medical Coatings Market Size for Titanium, by Country/Region, 2021–2032 (USD Million)

Table 23 Global Medical Coatings Market Size for Other Metals, by Country/Region, 2021–2032 (USD Million)

Table 24 Global Medical Coatings Market Size for Other Material Types, by Country/Region, 2021–2032 (USD Million)

Table 25 Global Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 26 Global Medical Coatings Market Size, by Application, by Country/Region, 2025–2032 (USD Million)

Table 27 Global Medical Coatings Market Size for Medical Devices, by Type, 2025–2032 (USD Million)

Table 28 Global Medical Coatings Market Size for Neurological Devices, by Country/Region, 2025–2032 (USD Million)

Table 29 Global Medical Coatings Market Size for Cardiovascular Devices, by Country/Region, 2025–2032 (USD Million)

Table 30 Global Medical Coatings Market Size for Ophthalmology Devices, by Country/Region, 2025–2032 (USD Million)

Table 31 Global Medical Coatings Market Size for Orthopedics Devices, by Country/Region, 2025–2032 (USD Million)

Table 32 Global Medical Coatings Market Size for Dental Devices, by Country/Region, 2025–2032 (USD Million)

Table 33 Global Medical Coatings Market Size for Gynecology Devices, by Country/Region, 2025–2032 (USD Million)

Table 34 Global Medical Coatings Market Size for Other Devices, by Country/Region, 2025–2032 (USD Million)

Table 35 Global Medical Coatings Market Size for Medical Implants, by Type, 2025–2032 (USD Million)

Table 36 Global Medical Coatings Market Size for Medical Implants, by Country/Region, 2025–2032 (USD Million)

Table 37 Global Medical Coatings Market Size for Orthopedic Implants, by Country/Region, 2025–2032 (USD Million)

Table 38 Global Medical Coatings Market Size for Dental Implants, by Country/Region, 2025–2032 (USD Million)

Table 39 Global Medical Coatings Market Size for Cardiovascular Implants, by Country/Region, 2025–2032 (USD Million)

Table 40 Global Medical Coatings Market Size for Other Implants, by Country/Region, 2025–2032 (USD Million)

Table 41 Global Medical Coatings Market Size for Medical Equipment & Surgical Tools, by Country/Region, 2025–2032 (USD Million)

Table 42 Global Medical Coatings Market Size for Other Applications, by Country/Region, 2025–2032 (USD Million)

Table 43 Global Medical Coatings Market Size, by Country/Region, 2021–2032 (USD Million)

Table 44 North America: Medical Coatings Market Size, by Country, 2021–2032 (USD Million)

Table 45 North America: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 46 North America: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 47 North America: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 48 North America: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 49 North America: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 50 North America: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 51 North America: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 52 North America: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 53 U.S.: Key Macroindicators

Table 54 U.S.: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 55 U.S.: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 56 U.S.: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 57 U.S.: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 58 U.S.: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 59 U.S.: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 60 U.S.: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 61 U.S.: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 62 Canada: Key Macroindicators

Table 63 Canada: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 64 Canada: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 65 Canada: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 66 Canada: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 67 Canada: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 68 Canada: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 69 Canada: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 70 Canada: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 71 Europe: Medical Coatings Market Size, by Country/Region, 2021–2032 (USD Million)

Table 72 Europe: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 73 Europe: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 74 Europe: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 75 Europe: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 76 Europe: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 77 Europe: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 78 Europe: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 79 Europe: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 80 Germany: Key Macroindicators

Table 81 Germany: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 82 Germany: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 83 Germany: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 84 Germany: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 85 Germany: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 86 Germany: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 87 Germany: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 88 Germany: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 89 France: Key Macroindicators

Table 90 France: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 91 France: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 92 France: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 93 France: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 94 France: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 95 France: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 96 France: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 97 France: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 98 U.K.: Key Macroindicators

Table 99 U.K.: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 100 U.K.: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 101 U.K.: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 102 U.K.: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 103 U.K.: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 104 U.K.: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 105 U.K.: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 106 U.K.: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 107 Italy: Key Macroindicators

Table 108 Italy: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 109 Italy: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 110 Italy: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 111 Italy: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 112 Italy: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 113 Italy: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 114 Italy: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 115 Italy: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 116 Spain: Key Macroindicators

Table 117 Spain: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 118 Spain: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 119 Spain: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 120 Spain: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 121 Spain: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 122 Spain: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 123 Spain: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 124 Spain: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 125 RoE: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 126 RoE: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 127 RoE: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 128 RoE: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 129 RoE: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 130 RoE: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 131 RoE: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 132 RoE: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 133 Asia-Pacific: Medical Coatings Market Size, by Country, 2021–2032 (USD Million)

Table 134 Asia-Pacific: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 135 Asia-Pacific: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 136 Asia-Pacific: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 137 Asia-Pacific: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 138 Asia-Pacific: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 139 Asia-Pacific: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 140 Asia-Pacific: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 141 Asia-Pacific: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 142 Japan: Key Macroindicators

Table 143 Japan: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 144 Japan: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 145 Japan: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 146 Japan: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 147 Japan: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 148 Japan: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 149 Japan: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 150 Japan: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 151 China: Key Macroindicators

Table 152 China: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 153 China: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 154 China: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 155 China: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 156 China: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 157 China: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 158 China: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 159 China: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 160 India: Key Macroindicators

Table 161 India: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 162 India: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 163 India: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 164 India: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 165 India: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 166 India: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 167 India: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 168 India: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 169 RoAPAC: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 170 RoAPAC: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 171 RoAPAC: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 172 RoAPAC: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 173 RoAPAC: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 174 RoAPAC: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 175 RoAPAC: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 176 RoAPAC: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 177 Latin America: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 178 Latin America: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 179 Latin America: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 180 Latin America: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 181 Latin America: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 182 Latin America: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 183 Latin America: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 184 Latin America: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 185 Brazil: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 186 Brazil: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 187 Brazil: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 188 Brazil: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 189 Brazil: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 190 Brazil: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 191 Brazil: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 192 Brazil: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 193 Mexico: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 194 Mexico: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 195 Mexico: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 196 Mexico: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 197 Mexico: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 198 Mexico: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 199 Mexico: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 200 Mexico: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 201 RoLATAM: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 202 RoLATAM: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 203 RoLATAM: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 204 RoLATAM: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 205 RoLATAM: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 206 RoLATAM: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 207 RoLATAM: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 208 RoLATAM: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 209 Middle East & Africa: Medical Coatings Market Size, by Type, 2021–2032 (USD Million)

Table 210 Middle East & Africa: Medical Coatings Market Size, by Material Type, 2021–2032 (USD Million)

Table 211 Middle East & Africa: Medical Coatings Market Size for Polymers, by Type, 2021–2032 (USD Million)

Table 212 Middle East & Africa: Medical Coatings Market Size for Fluoropolymers, by Type, 2021–2032 (USD Million)

Table 213 Middle East & Africa: Medical Coatings Market Size for Metals, by Type, 2021–2032 (USD Million)

Table 214 Middle East & Africa: Medical Coatings Market Size, by Application, 2021–2032 (USD Million)

Table 215 Middle East & Africa: Medical Coatings Market Size, by Medical Devices, 2021–2032 (USD Million)

Table 216 Middle East & Africa: Medical Coatings Market Size, by Medical Implants, 2021–2032 (USD Million)

Table 217 Recent Developments, by Company (2020–2022)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Size Estimation

Figure 7 Global Medical Coatings Market Size, by Type, 2025 Vs 2032 (USD Million)

Figure 8 Global Medical Coatings Market Size, by Material Type, 2025 Vs. 2032 (USD Million)

Figure 9 Global Medical Coatings Market Size, by Application, 2025 Vs. 2032 (USD Million)

Figure 10 Medical Coatings Market Share, by Geography

Figure 11 Market Dynamics

Figure 12 Global Medical Coatings Market Size, by Type, 2025–2032 (USD Million)

Figure 13 Global Medical Coatings Market Size, by Material Type, 2025–2032 (USD Million)

Figure 14 Global Medical Coatings Market Size, by Application, 2025–2032 (USD Million)

Figure 15 Global Medical Coatings Market Size, by Geography, 2025–2032 (USD Million)

Figure 16 North America: Medical Coatings Market Snapshot

Figure 17 Europe: Medical Coatings Market Snapshot

Figure 18 Asia-Pacific: Medical Coatings Market Snapshot

Figure 19 Key Growth Strategies Adopted by Leading Players (2020–2022)

Figure 20 Medical Coatings Market: Competitive Benchmarking Based on Type

Figure 21 Medical Coatings Market: Competitive Benchmarking Based on Material Type

Figure 22 Medical Coatings Market: Competitive Benchmarking Based on Geography

Figure 23 Market Share Analysis: Medical Coatings Market (2022)

Figure 24 Hydromer Inc.: Financial Overview (2021)

Figure 25 SurModics, Inc.: Financial Overview (2021)

Figure 26 Koninklijke DSM N.V.: Financial Overview (2021)

Figure 27 Merit Medical Systems, Inc.: Financial Overview (2021)

Published Date: Jan-2025

Published Date: Aug-2024

Published Date: Jan-2023

Published Date: Jun-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates