Resources

About Us

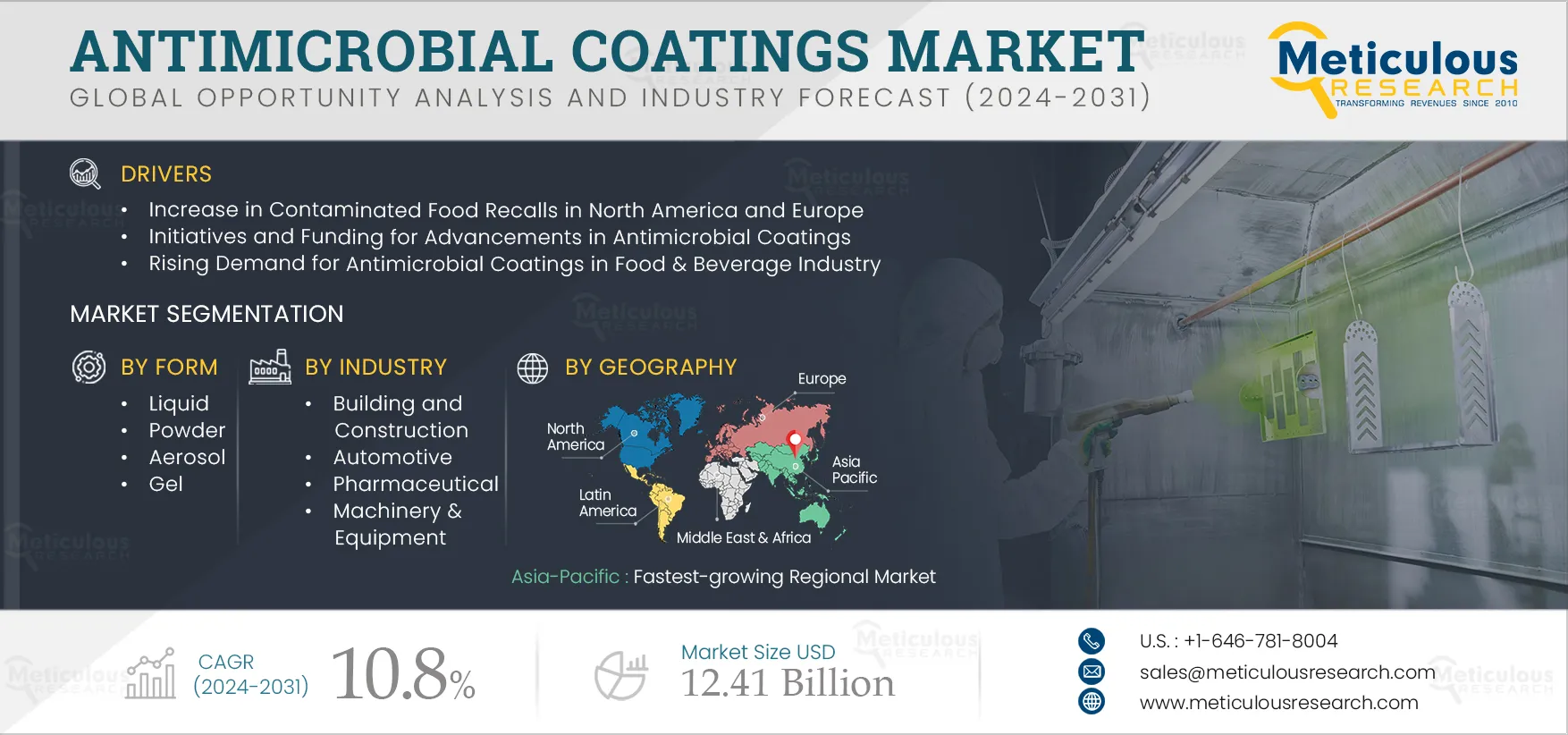

Antimicrobial Coatings Market by Product (Silver, Copper, Aluminum, Organic, Polymer), Form (Liquid [Solvent, Water Borne], Powder, Aerosol, Gel), Industry (Construction, Food, Medical, Pharmaceutical, Automotive, Machinery) - Global Forecast to 2031

Report ID: MRHC - 104378 Pages: 205 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe antimicrobial coatings help to keep surfaces pathogen-free by obstructing the growth of fungi, bacteria, and other parasites. Antimicrobial coatings provide long-lasting protection against these pathogens and help to keep hygiene in the environment. Moreover, antimicrobial coatings are used as sterilizers on medical devices such as catheters, urological tools, and medical electronics to reduce healthcare-associated infections. Furthermore, the growing adoption of antimicrobial coatings by various end users, such as food and beverage industries, material manufacturers, and aerospace industries, contributes to the market’s growth.

The growth of this market is driven by rising applications of antimicrobial coatings to reduce healthcare-associated infections, the increase in contaminated food recalls in North America and Europe, initiatives and funding for advancements in antimicrobial coatings, and rising demand for antimicrobial coatings in the food & beverage industry. Additionally, emerging economies, the introduction of antimicrobial coatings in the retail food marketplace, and rising space programs across the world are expected to offer significant market growth opportunities.

However, the stringent regulations related to Volatile Organic Compounds (VOCs) content and rising prices of raw materials restrain the growth of this market. Additionally, the development of antimicrobial resistance in microbes and the high cost of antimicrobial coatings pose a significant challenge to the market's growth.

Click here to: Get Free Sample Pages of this Report

Healthcare-associated infections have been the most frequent adverse events in both developed and developing countries in the past few years. For instance, according to the World Health Organization (WHO), in 2022, out of every 100 patients, 15 patients in low- and middle-income countries and 7 patients in high-income countries developed at least one healthcare-associated infection (HAI) during their hospitalization. In addition, according to the WHO, in 2021, 8.9 million healthcare-associated infections occurred in acute and long-term care facilities in Europe.

Antimicrobial protective coatings are utilized on medical equipment surfaces such as IV poles, doorknobs, bed rails, and medical device handles. These coatings prevent the spread of pathogenic microorganisms and other diseases on high-touch surfaces, lowering the risk of infection. They are also applied on floors, walls, and other surfaces in operating rooms, prosthetic devices, catheters, other implants, and Personal Protective Equipment (PPE) such as masks, gloves, and gowns to inhibit the growth of microorganisms and minimize the risk of device-related infections. Thus, factors such as growing awareness programs and active participation of hospitals to reduce healthcare-associated infections by using antimicrobial coatings, and rising healthcare-associated infections are expected to drive the growth of the antimicrobial coatings market.

Biocontamination of medical devices and implants is a growing issue in developing countries, causing medical complications and increased expenses. In the fight against biocontamination, developing synthetic surfaces, which reduce the adhesion of microbes and provide biocidal activity or combinatory effects, has emerged as a major strategy across emerging economies. Advances in nanotechnology and biological sciences have made it possible to design smart surfaces for decreasing infections.

Developing and underdeveloped countries have limited penetration of antimicrobial coatings due to a lack of awareness. However, industries like automobile, aviation, food, and medical device manufacturing are expanding in these countries. This provides a great opportunity for the antiviral and antimicrobial market to expand in these countries. Countries such as Singapore, Japan, South Korea, and Australia have been at the forefront of technology adoption in the healthcare sector of the APAC region, whereas China, India, Malaysia, Indonesia, and Thailand are emerging markets. Though developed markets dominate medical device sales, emerging markets represent high growth opportunities.

As per the International Trade Administration (ITA) data, the medical devices market in China is expected to increase up to USD 48.8 billion by 2026. This provides high growth opportunities for the antimicrobial coating market to expand in China. Another emerging economy is India, where the medical devices market is expected to grow from USD 11 billion in 2022 to USD 50 billion in 2030, according to the India Brand Equity Foundation (IBEF).

Furthermore, the automotive and the food & beverage industries were booming in some of the emerging economies. According to the International Organization of Motor Vehicle Manufacturers, South African cars and commercial vehicle production increased by 4.1% in 2020 from 2019. In Brazil, the production of vehicles increased by 34.5% in 2022 compared to 2020. Antimicrobial coatings have wide applications in the automotive industry to protect cars or vehicles from bacteria, mold, and mildew. Further, antimicrobial coatings are utilized in the food & beverage industry to improve food safety, extend shelf life, and prevent contamination during storage, postharvest transportation, and retail display of produce. Hence, the growth in these industries in emerging economies presents a lucrative opportunity for the antimicrobial coatings market.

Among the products, in 2024, the metal-based coatings segment is expected to account for the largest share of the antimicrobial coatings market. The segment’s large share is attributed to the high adoption of metal-based antimicrobial coatings such as silver coatings, copper coatings, and other coatings by the packaging industry and medical device manufacturers and increasing funding from government and organizations to develop metal-based antimicrobial coatings to reduce healthcare-associated infections. The increasing demand for antimicrobial coatings in space missions also contributes to the segment’s large market share. For instance, in November 2023, The Boeing Company (U.S.) launched a project for the International Space Station (ISS) on SpaceX’s 29th Commercial Resupply Services (CRS) mission to test the durability and effectiveness of an advanced antimicrobial coating in space, contributing to the large market share of this segment.

Among the forms, in 2024, the liquid segment is expected to account for the largest share of the antimicrobial coatings market. A high preference for liquid coatings by the end-use industries due to their advantages, such as better protection against corrosion, easy application, and provision of a more uniform finish than powder coatings, is a key factor for the highest adoption of liquid antimicrobial coatings.

Among the industries, in 2024, the building & construction segment is expected to account for the largest share of the antimicrobial coatings market. The large market share of this segment is attributed to growing threats of microbial deterioration of building material and rising heating, ventilation, and air conditioning (HVAC) related microbial contamination. Moreover, growing initiatives taken by organizations to address the issues related to microbial contamination in commercial buildings and the construction sector further support the dominance of this segment.

Asia-Pacific is one of the fastest-growing markets for antimicrobial coatings, mainly due to the significant burden of healthcare-associated infections, the growing construction industry, rising automotive assembly plants, and growing food product recalls due to microbial contamination. The adoption of antimicrobial coatings in food facilities, the transport sector, air purifiers, medical devices, and others has also contributed to the market's growth.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them in the last three to four years. The key players profiled in the antimicrobial coatings market report are Akzo Nobel N. V. ( Netherlands), Lonza Group Ltd (Switzerland), PPG Industries Inc. (U.S.), Axalta Coating Systems (U.S.), The Sherwin-Williams Company (U.S.), DOW Chemical Company (U.S.), Nippon Paint Holdings Co., Ltd. (Japan), Sciessent LLC (U.S.), Sika AG (Switzerland), BASF SE (Germany), Specialty Coating Systems Inc. (U.S.), Advanced NanoTech Lab (India), Novapura AG (Switzerland), Pylon Coatings Pty Ltd (Australia) and Troy Corporation (U.S.).

|

Particulars |

Details |

|

Number of Pages |

~205 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

10.8% |

|

Estimated Market Size (Value) |

$12.41 billion by 2031 |

|

Segments Covered |

By Product

By Form

By Industry

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, Switzerland, Rest of Europe) Asia–Pacific (India, China, Japan, South Korea, Australia, Rest of Asia–Pacific), Latin America (Brazil, Mexico, Rest of Latin America), Middle East & Africa. |

|

Key Companies |

Akzo Nobel N. V. ( Netherlands), Lonza Group Ltd (Switzerland), PPG Industries Inc. (U.S.), Axalta Coating Systems (U.S.), The Sherwin-Williams Company (U.S.), DOW Chemical Company (U.S.), Nippon Paint Holdings Co., Ltd. (Japan), Sciessent LLC (U.S.), Sika AG (Switzerland), BASF SE (Germany), Specialty Coating Systems Inc. (U.S.), Advanced NanoTech Lab (India), Novapura AG (Switzerland), Pylon Coatings Pty Ltd (Australia) and Troy Corporation (U.S.). |

This study offers a detailed assessment of the antimicrobial coatings market and analyzes the market sizes & forecasts based on product, form, and industry. This report also involves the value analysis of various segments and subsegments of the antimicrobial coatings market at the regional and country levels.

The antimicrobial coatings market is projected to reach $12.41 billion by 2031, at a CAGR of 10.8% during the forecast period.

Among the products, in 2024, the metal-based coatings segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the advancements in antimicrobial coatings technology and the high adoption of metal-based antimicrobial coatings by the packaging industry and medical device manufacturers.

The growth of this market is driven by rising applications of antimicrobial coatings to reduce healthcare-associated infections, the increase in contaminated food recalls in North America and Europe, initiatives and funding for advancements in antimicrobial coatings, and rising demand for antimicrobial coatings in the food & beverage industry. Additionally, emerging economies, the introduction of antimicrobial coatings in the retail food marketplace, and rising space programs across the world are expected to offer significant market growth opportunities.

The key players profiled in the antimicrobial coatings market report are Akzo Nobel N. V. ( Netherlands), Lonza Group Ltd (Switzerland), PPG Industries Inc. (U.S.), Axalta Coating Systems (U.S.), The Sherwin-Williams Company (U.S.), DOW Chemical Company (U.S.), Nippon Paint Holdings Co., Ltd. (Japan), Sciessent LLC (U.S.), Sika AG (Switzerland), BASF SE (Germany), Specialty Coating Systems Inc. (U.S.), Advanced NanoTech Lab (India), Novapura AG (Switzerland), Pylon Coatings Pty Ltd (Australia) and Troy Corporation (U.S.).

Emerging economies, such as China and India, are expected to provide significant growth opportunities for market players due to the increasing R&D spending in these countries.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates