Resources

About Us

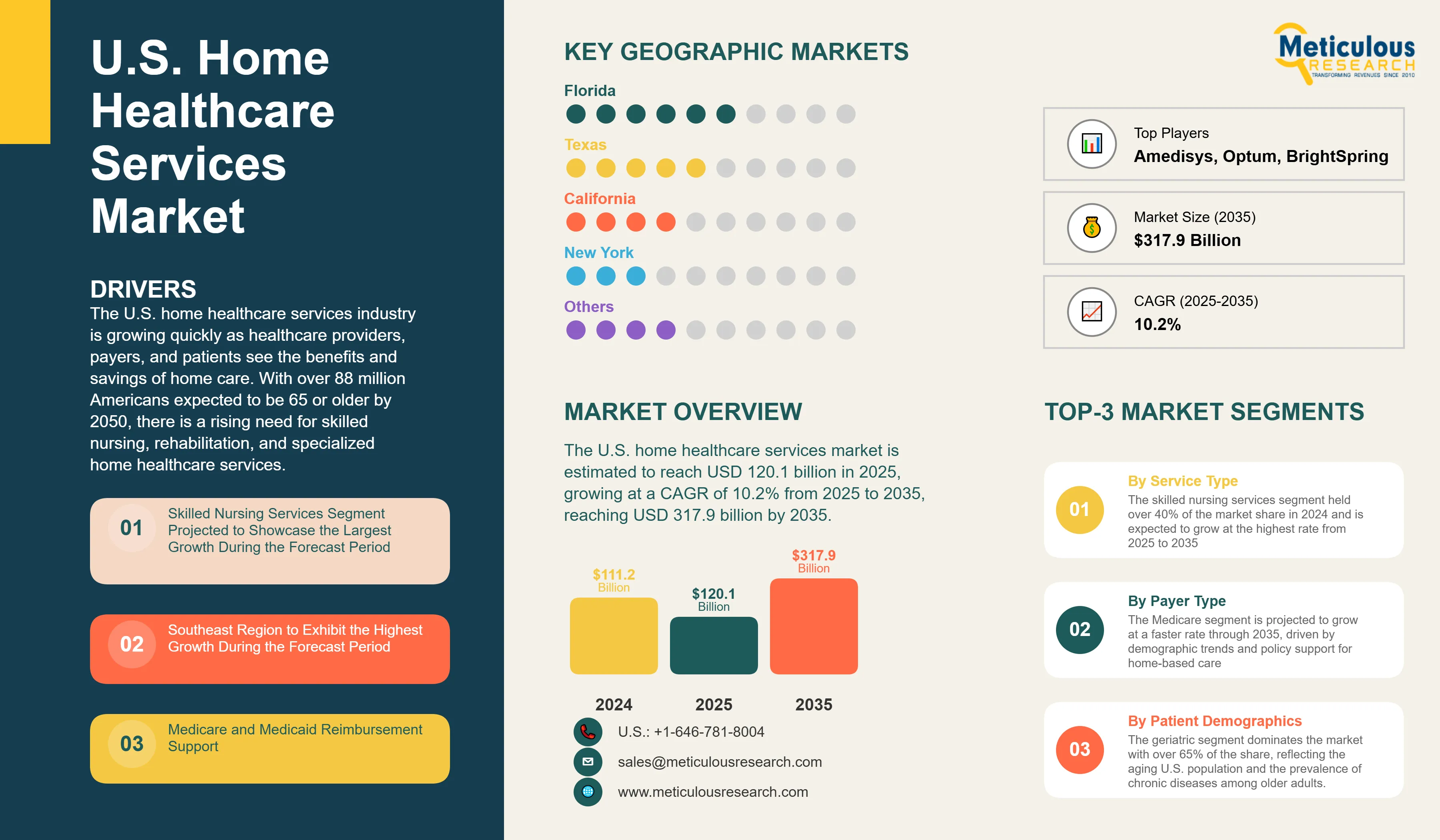

U.S. Home Healthcare Services Market: Size & Forecast by Service Type (Skilled Nursing, Rehabilitation, Aide Services), Payer (Medicare, Medicaid, Commercial), Patient Group & Region – Forecast and Analysis to 2035

Report ID: MRHC - 1041509 Pages: 203 Jun-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe U.S. home healthcare services industry is growing quickly as healthcare providers, payers, and patients see the benefits and savings of home care. With over 88 million Americans expected to be 65 or older by 2050, there is a rising need for skilled nursing, rehabilitation, and specialized home healthcare services. This demand is fueling significant market growth. Medicare and Medicaid are increasingly supporting home healthcare as a cheaper option than institutional care.

For example, in September 2024, the Centers for Medicare & Medicaid Services (CMS) announced new reimbursement rates for home healthcare services under the Patient-Driven Groupings Model (PDGM). They applied a 3.2% market basket inflation factor for 2025. This change is likely to lead to more use of home healthcare services in skilled nursing, therapy, and chronic care management.

The industry is also going through a major technological change with remote patient monitoring, AI-driven care coordination, and telehealth integration. Top home healthcare providers are investing in digital health platforms to improve patient outcomes, reduce readmission rates, and boost operational efficiency. These advancements are allowing providers to handle more complex patient needs while maintaining high care standards and improving financial results.

Skilled Nursing Services Segment Projected to Showcase the Largest Growth During the Forecast Period

Skilled nursing services are expected to grow significantly during the forecast period. They represent about 40% of the total home healthcare services market in the U.S. These services include wound care management, medication administration, chronic disease monitoring, and post-acute care after hospital discharge. The complexity of care in home settings is increasing as healthcare systems push for earlier hospital discharges. Value-based care models also focus on outcomes instead of volume.

The demand for skilled nursing services is linked to the rising number of chronic diseases. Over 190 million Americans live with at least one chronic condition. This group needs ongoing medical supervision and clinical intervention, which skilled nurses can effectively provide at home. Medicare data shows that beneficiaries who receive skilled home health services have much lower readmission rates than those without home healthcare support.

Major home healthcare providers like Amedisys, Optum Home Health, and BrightSpring Health Services are actively expanding and restructuring their services. They are doing this through mergers, acquisitions, and divestitures in 2024 and 2025 to meet the growing need for skilled nursing and home healthcare services. The integration of telehealth platforms and remote monitoring technologies allows skilled nurses to manage larger patient loads while keeping clinical quality and safety standards high.

Southeast Region to Exhibit the Highest Growth During the Forecast Period

The Southeast region is expected to see strong growth during the forecast period. This growth is fueled by a rapidly aging population, an increase in Medicare Advantage plans, and supportive government policies. States like Florida, Texas, and North Carolina are seeing a huge demand for home healthcare services as the retiree population rises and healthcare systems focus on community-based care.

Florida is at the forefront with around 4.6 million residents aged 65 and older, making up about 21% of the state's population in 2025. The state's home healthcare market mainly benefits from the growth of Medicare Advantage plans and state Medicaid waiver programs that focus on home and community-based services. Texas is also making strides, with important investments in rural home healthcare access and telehealth infrastructure.

U.S. Home Healthcare Services Market Analysis

The U.S. home healthcare services industry faces major workforce shortages, especially in nursing and therapy roles. Turnover rates average around 70% each year, which creates ongoing challenges for delivering care and maintaining access. Regulatory requirements from CMS quality reporting programs and state licensing differences add to operational complexity and raise administrative costs. Pressures on reimbursement rates from Medicare and Medicaid managed care organizations continue to affect provider margins. This situation requires improvements in operational efficiency and investments in technology.

Despite these challenges, the market presents significant growth opportunities through value-based care contracts, technology-driven service delivery, and expansion into underserved areas. The use of remote patient monitoring and artificial intelligence helps providers manage larger patient populations while enhancing clinical outcomes and lowering costs. Government initiatives that support aging-in-place policies and the growth of Medicare Advantage create stable reimbursement options for innovative service delivery models.

The home healthcare services market is divided by service type into skilled nursing services, rehabilitation services, home health aide services, medical social services, hospice and palliative care services, specialized services, and technology-enabled services. The skilled nursing services segment held over 40% of the market share in 2024 and is expected to grow at the highest rate from 2025 to 2035.

By payer type, the market is categorized into Medicare, Medicaid, commercial insurance, private pay, and other payers. The Medicare segment is projected to grow at a faster rate through 2035, driven by demographic trends and policy support for home-based care.

The market also serves different patient demographics, including geriatric patients (65+ years), adult patients (18-64 years), and pediatric patients (0-17 years). The geriatric segment dominates the market with over 65% of the share, reflecting the aging U.S. population and the prevalence of chronic diseases among older adults.

Regional Market Analysis

Florida leads the U.S. home healthcare market with strong Medicare Advantage enrollment and state support for aging-in-place programs. The regulations in the state promote home healthcare expansion. Easier licensing processes and telehealth-friendly policies encourage provider growth and innovation.

Texas is growing its home healthcare infrastructure to serve both urban and rural communities. The state's Medicaid managed care programs are increasingly focusing on home and community-based services. This trend creates opportunities for specialized providers who serve low-income individuals and those with disabilities.

California shows significant growth in technology-based home healthcare services. Companies in Silicon Valley are developing new care delivery platforms. The state's large Medicare Advantage population and progressive healthcare policies support new home healthcare models, including hospital-at-home programs and AI-driven care coordination.

New York is working to integrate home healthcare with managed long-term care programs and dual-eligible special needs plans. The state's focus on social determinants of health and health equity opens doors for home healthcare models that serve a variety of patients.

U.S. Home Healthcare Services Market Share

Major players like Amedisys, Optum (LHC Group), BrightSpring Health Services, BAYADA Home Healthcare, AccentCare Inc., and Enhabit Home Health & Hospice compete strongly in the U.S. home healthcare services industry. These companies focus on acquisitions, technology investments, and partnerships in value-based care to improve their market positions and expand services. As the demand for home healthcare grows among Medicare, Medicaid, and commercial populations, companies invest heavily in workforce development, clinical quality programs, and operational efficiency.

Leading providers are forming partnerships with health systems, Medicare Advantage plans, and technology companies to create integrated care delivery models. These collaborations enable better care coordination, improved patient outcomes, and sustainable financial performance under value-based payment arrangements. The market is also seeing more private equity investment in home healthcare platforms that can grow operations and integrate new technologies.

U.S. Home Healthcare Services Market Companies

Major players operating in the U.S. home healthcare services industry include:

U.S. Home Healthcare Services Industry Segmentation

The U.S. home healthcare services market consists of skilled nursing, rehabilitation therapy, personal care, medical social services, and specialized clinical services provided in patients' homes. It does not include institutional care settings and focuses only on home-based service delivery models.

The home healthcare services market is divided by service type, payer type, patient demographics, service model, and geography, which includes the Northeast, Southeast, Midwest, and West regions. By service type, the market features skilled nursing services, rehabilitation services, home health aide services, medical social services, hospice and palliative care services, specialized services, and technology-enabled services. By payer type, the market includes Medicare, Medicaid, commercial insurance, private pay, and other payers. The report offers a thorough market analysis and forecasts for each segment.

For each segment, market size is given in value (USD million) and includes growth projections through 2030.

|

Service Type |

Skilled Nursing Services |

|

Rehabilitation Services |

|

|

Home Health Aide Services |

|

|

Medical Social Services |

|

|

Hospice and Palliative Care Services |

|

|

Specialized Services |

|

|

Technology-Enabled Services |

|

|

Payer Type |

Medicare |

|

Medicaid |

|

|

Commercial Insurance |

|

|

Private Pay |

|

|

Other Payers |

|

|

Patient Demographics |

Geriatric Patients (65+ years) |

|

Adult Patients (18-64 years) |

|

|

Pediatric Patients (0-17 years) |

|

|

Geography |

Northeast Region |

|

Southeast Region |

|

|

Midwest Region |

|

|

West Region |

The U.S. home healthcare services market was valued at USD 111.2 billion in 2024 and is estimated to reach USD 120.1 billion in 2025, growing at a CAGR of 10.2% from 2025 to 2035, reaching USD 317.9 billion by 2035.

In 2025, the U.S. Home Healthcare Services Market size is expected to reach USD 120.1 billion.

Key players operating in the U.S. home healthcare services industry include Amedisys, Inc. (with over 519 care centers across 38 states and the District of Columbia), Optum (LHC Group), BrightSpring Health Services, Enhabit Home Health & Hospice, AccentCare, Inc., Addus HomeCare Corporation, Bayada Home Health Care, Elara Caring, and Gentiva, among others.

The Southeast region is estimated to grow at the highest CAGR over the forecast period (2025-2030).

In 2025, skilled nursing services account for the largest market share in the U.S. Home Healthcare Services Market.

In 2024, the U.S. Home Healthcare Services Market size was estimated at USD 111.2 billion. The report covers historical market size data and forecasts through 2035.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2023

Published Date: Feb-2023

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates