Resources

About Us

Marine & Aviation EV Charging Hubs Market Size, Share, Forecast & Trends by Type (Hybrid, Battery Electric, and Plug-in Hybrid Electric), Platform (Marine and Aviation), Mode of Operation, End-Use Industry, Geography - Global Forecast to 2035

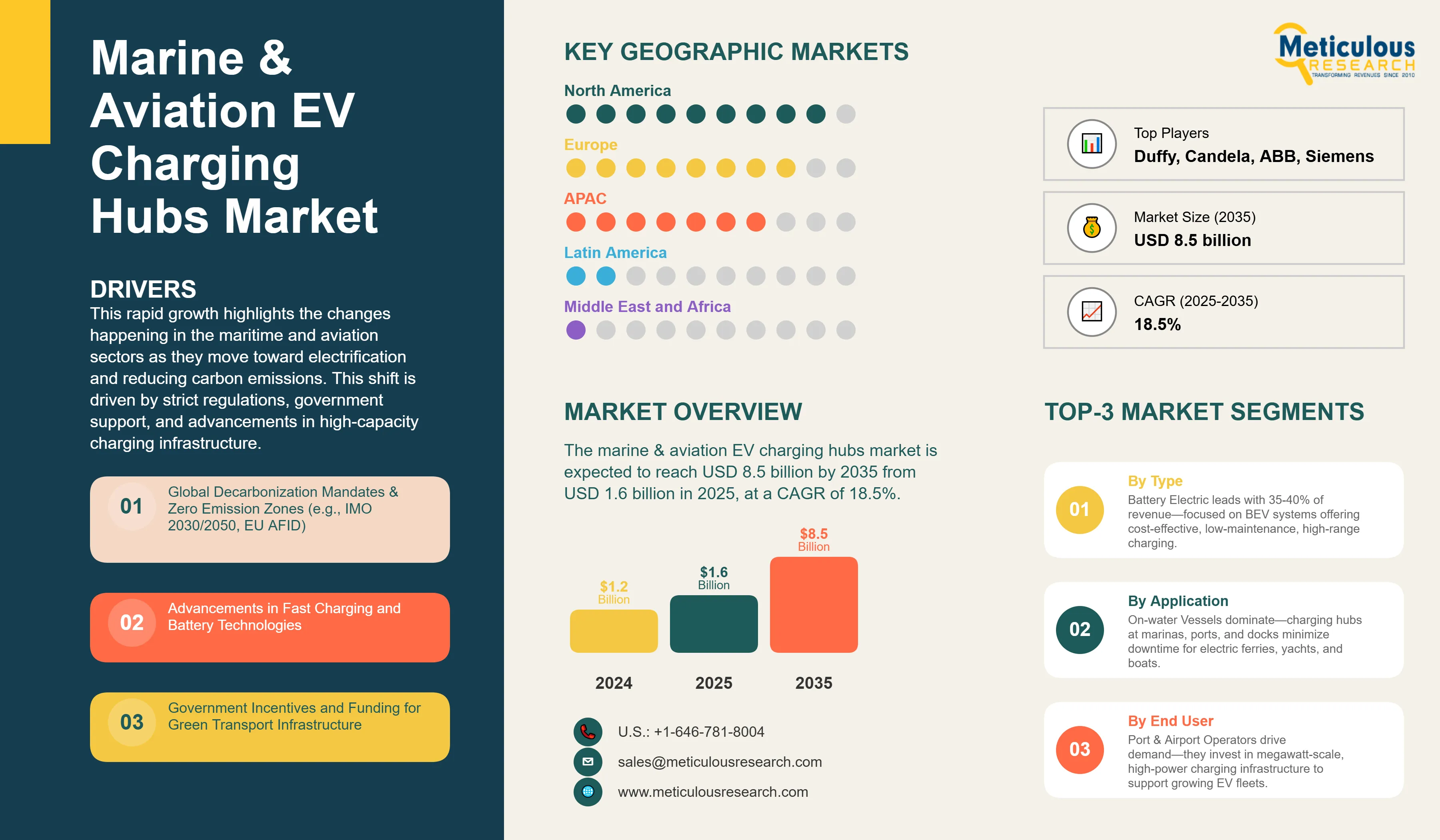

Report ID: MREP - 1041581 Pages: 192 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe marine & aviation EV charging hubs market was valued at USD 1.2 billion in 2024. The market is expected to reach USD 8.5 billion by 2035 from USD 1.6 billion in 2025, at a CAGR of 18.5%.

This rapid growth highlights the changes happening in the maritime and aviation sectors as they move toward electrification and reducing carbon emissions. This shift is driven by strict regulations, government support, and advancements in high-capacity charging infrastructure.

Looking ahead, the market is likely to gain momentum from the rollout of megawatt-scale charging systems. We can expect more electric water transport and hybrid-electric aviation, along with improvements in sustainable transport networks. These developments make marine and aviation charging hubs vital to global efforts to reduce carbon emissions.

In Europe, proactive regulations and ambitious climate goals put it in the lead. North America is making progress through extensive electrification projects at airports and along coastlines. Asia-Pacific is heavily investing in large-scale infrastructure due to rising demand and government backing. Together, these factors position the marine and aviation EV charging hubs market as a key player in promoting sustainable mobility worldwide.

Marine & Aviation EV Charging Hubs Market - Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The marine and aviation EV charging hubs market is characterized by a highly competitive landscape, with established players and emerging innovators driving technological advancement and infrastructure development. Leading companies such as Duffy, Candela, Pure Watercraft, ABB, Twin Vee, Siemens AG, Wärtsilä, BAE Systems, Corvus Energy, and Kongsberg Gruppen are actively shaping the market through strategic initiatives, including product innovation, partnerships, and large-scale infrastructure projects. These players are focusing on developing megawatt-scale charging systems, energy storage integration, and smart grid connectivity to meet the growing demand for electrification in marine and aviation applications.

Recent Developments

New Hybrid-Electric Ferry Launch in New York

In August 2025, New York State launched its inaugural hybrid-electric public vessel, the Harbor Charger, which passed its maiden trip between Lower Manhattan and Governors Island. The ship has up to 70 percent less carbon emissions and a reduction in the annual cost of fuel than the conventional ferry powered by diesel. It runs on 122 lithium-ion batteries to be able to travel 2.5 hours in electric-only mode, then have diesel mode.

ALIA: First Electric Passenger Flight in North America Lands at JFK

In June 2025, BETA Technologies reached the milestone point to make the first historic electric-powered passenger flight in North America. The aircraft that they used, an eVTOL/airplane ALIA, flew to JFK Airport and flew silently between East Hampton and Queens. The nearly 50-minute flight consumed only US$8 of electricity and demonstrated that ALIA could fit in highly regulated Class B airspace.

Marine & Aviation EV Charging Hubs Market Drivers

Global Climate Policies Accelerating Electrification in Marine & Aviation: Mounting environmental pressure to decarbonize is emerging as a decisive driver for the marine and aviation EV charging hubs market. The International Maritime Organization (IMO) has set a target of achieving net-zero greenhouse gas (GHG) emissions by around 2050, with interim milestones of at least a 20% reduction by 2030 compared to 2008 levels. Similarly, the European Union’s “Fit for 55” package mandates a 55% reduction in net GHG emissions by 2030 and full climate neutrality by 2050, while the United States’ Inflation Reduction Act, established in 2022, allocates billions of dollars toward clean energy and transport electrification, including grants to decarbonize port equipment and infrastructure. In this evolving landscape, early adopters of green charging infrastructure will gain a decisive advantage in navigating the shift to a low-carbon economy.

Battery and Charging Technology: Battery and charging technology advancements are emerging as a pivotal driver of growth in the marine and aviation EV charging hubs market. Enhancements in high-capacity lithium-ion batteries are delivering longer ranges, higher energy density, and improved safety standards, making electrification a more viable alternative to traditional propulsion systems. In parallel, the development of rapid and megawatt-scale charging technologies is enabling significantly reduced turnaround times for vessels and aircraft, a critical factor for operational efficiency in commercial and passenger transport. Together, these technological advancements are reinforcing the role of EV charging hubs as essential infrastructure for the next generation of marine and aviation mobility.

Funding and Incentives by Government: Funding and Incentives by different governments are emerging as pivotal enablers of growth in the marine and aviation EV charging hubs market. National and regional authorities are deploying substantial financial support in the form of grants, subsidies, and tax incentives to accelerate the adoption of clean transport infrastructure. In the United States, the Inflation Reduction Act (2022) has earmarked hundreds of billions of dollars for clean energy and transportation electrification, including targeted investments in port electrification and sustainable aviation initiatives. The European Union is channelling funds through its Green Deal and Fit for 55 programs, which mandate significant reductions in emissions and provide financial support for the development of zero-emission ports and airports. These incentives also de-risk early-stage projects, positioning government-backed funding as a critical catalyst for private sector investment and market expansion.

Table: Key Factors Impacting Growth of Global Marine & Aviation EV Charging Hubs Market (2025–2035)

Base CAGR: 18.5%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Global Decarbonization and Emission Reduction Mandates |

Rapid adoption of charging hubs in ports and airports to meet IMO, ICAO, and national emission targets |

Widespread integration of zero-emission infrastructure |

▲ +3.5% |

|

2. Advancements in Fast-Charging and Battery Technology |

Deployment of high-capacity chargers enabling quicker turnaround |

Ultra-fast charging becomes standard, supporting operations |

▲ +3.2% |

|

|

3. Government Incentives and Green Infrastructure Funding |

Increased investments through grants and subsidies for electrification projects |

Self-sustaining charging networks with reduced dependency on subsidies |

▲ +3.0% |

|

|

Restraints |

1. High Initial Infrastructure and Installation Costs |

Slower adoption in smaller ports and regional airports |

Cost reductions through scale and advances |

▼ −1.5% |

|

2. Lack of Standardized Charging Protocols |

Compatibility issues between different charging systems |

Industry-wide adoption of universal charging standards |

▼ −1.3% |

|

|

Opportunities |

1. Integration with Renewable Energy Sources |

Solar, wind, and tidal power integration into charging hubs |

Fully renewable-powered charging ecosystems |

▲ +3.1% |

|

2. Expansion into Emerging Markets |

New charging networks are being established |

Broad electrification in global transport corridors |

▲ +2.9% |

|

|

Trends |

1. Hybrid-Electric and Fully Electric Fleet Adoption |

Rapid shift toward hybrid-electric ferries and eVTOL aircraft |

Dominance of fully electric fleets in passenger and cargo transport |

▲ +2.6% |

|

Challenges |

1. Ensuring Reliability in Harsh Operational Environments |

Charging hubs require robust designs |

Long-term durability through advanced materials |

▼ −1.0% |

Marine & Aviation EV Charging Hubs Market Analysis

The North America region leads the Global Marine & Aviation EV Charging Hubs Market in 2025

The North America region leads the global marine and aviation EV charging hubs market with the highest share of revenue, underpinned by its advanced industrial base, strong regulatory environment, and significant investment in sustainable transport infrastructure. The US, in particular, has emerged as a frontrunner, driven by extensive federal funding programs such as the Inflation Reduction Act (IRA), which allocates billions toward port and airport electrification, alongside aggressive state-level clean energy initiatives. The rapid expansion of hyperscale data-driven airports, coastal electrification projects, and zero-emission shipping corridors further strengthens the region’s dominance. Canada complements this growth through its emphasis on clean energy adoption and green port initiatives. With a combination of policy support, capital availability, and early adoption of megawatt-scale charging technologies, North America dominates the global market.

Rapid Maritime Electrification and Government Support Accelerate Infrastructure Deployment in the Asia Pacific region

The Asia-Pacific region is emerging as the fastest-growing market for marine and aviation EV charging hubs, driven by aggressive government policies, large-scale infrastructure investments, and rapid adoption of clean energy technologies.

Countries such as China, Japan, and Singapore are at the forefront, channelling substantial funding into green port initiatives, airport electrification, and megawatt-scale charging systems to meet ambitious carbon-neutrality targets. China, with its vast shipbuilding and aviation industries, is spearheading large-scale electrification programs, while Japan and Singapore are positioning themselves as regional leaders in sustainable maritime and aviation infrastructure.

In addition, rising demand for efficient logistics, growing passenger traffic, and strong regulatory frameworks are accelerating adoption across the region. With a combination of policy-driven momentum, expanding industrial bases, and increasing private sector participation, the Asia-Pacific is expected to deliver the highest CAGR globally, establishing itself as a pivotal growth engine for the long-term expansion of the marine and aviation EV charging hubs market.

Japan is Developing the Electrification of Ferry and Aircraft Charging Infrastructure

Japan marine & aviation EV charging hubs market is expected to grow at a healthy growth rate, pertaining to advancements in the electrification of ferry and aircraft charging infrastructure, positioning itself as a technology-driven market in the Asia-Pacific marine and aviation EV charging hubs industry.

Backed by the government’s ambitious carbon neutrality target for 2050, Japan is channelling investments into the development of electric ferries, hybrid vessels, and regional electric aircraft while simultaneously upgrading port and airport infrastructure to support high-capacity charging.

In aviation, initiatives led by both government and private sectors are exploring charging solutions for short-haul and regional aircraft, reinforcing Japan’s commitment to sustainable air mobility.

By leveraging its strong industrial base, advanced R&D capabilities, and public-private partnerships, Japan is creating a scalable ecosystem that integrates electrification into both marine and aviation sectors, ensuring its role as a key innovator and regional frontrunner in next-generation charging infrastructure.

UK Advances Specialized Marine and Aviation EV Charging Infrastructure Through Strategic Investment and Innovation

The United Kingdom uses its strong maritime and aviation knowledge to speed up the growth of specialized EV charging stations. This effort is backed by the government’s significant GBP 1.6 billion allocation under the EV Infrastructure Strategy. The nation has set an ambitious goal of installing 300,000 public charge points by 2030.

The UK focuses on building specific infrastructure to support marine and aviation sectors at important ports and airports. Leading British ports like Portsmouth, Southampton, and Liverpool have started pilot programs for electric ferry charging. Meanwhile, major airports such as London Heathrow and Manchester are setting up high-power charging systems for electric ground support equipment and getting ready for future eVTOL aircraft operations.

To support this ecosystem, the government’s Zero Emission Vehicle Infrastructure Strategy requires public chargers to have 99% uptime. This ensures they are reliable and boosts user confidence. With strong policy support, targeted infrastructure investment, and innovative technology, the UK stands out as a leader in specialized EV charging for the maritime and aviation sectors in Europe.

Segmental Analysis

Battery Electric Segment Leads Marine and Aviation EV Charging Hubs Market with Largest Revenue Share of 35-40% in 2025

By type, the Battery Electric Vehicle (BEV) segment holds the largest share of the marine and aviation EV charging hubs market, representing an estimated 35-40% of total revenue in 2025.

This strong position comes from the cost-saving benefits of BEVs. They offer lower operational costs, reduced maintenance needs, and cheaper electricity compared to traditional fuels. These factors make them very attractive for both commercial and recreational uses.

Technological improvements have increased battery energy density, sped up charging times, and extended the operational range. These advancements have solved previous issues like range anxiety and long charging durations.

Together with supportive policies and growing popularity, these changes are likely to strengthen the BEV segment’s role as the main growth driver in the marine and aviation EV charging hubs market.

On-water Segment Drives Growth with Established Infrastructure and Operational Demand

In the marine and aviation EV charging hubs market, platforms are divided into marine and aviation categories. The marine platforms are further split into on-water vessels and subsurface platforms. The on-water segment holds the largest market share in 2025 and is expected to remain the leader throughout the forecast period. This consistent growth mainly comes from the rising use of electric propulsion systems in boats, ferries, yachts, and other watercraft that need dedicated on-water charging hubs for smooth operation.

The increasing deployment of electric vessels highlights this trend. For instance, Vision Marine Technologies Inc. recently launched its E-Motion high-voltage electric marine powertrain. This fully industrialized propulsion system is designed for zero-emission boats. This development shows a clear move towards electrifying marine transportation.

On-water charging hubs offer convenient and accessible charging options at marinas, ports, and docking stations. They reduce vessel downtime and ensure smooth operations.

With growing investments in port infrastructure and government incentives, the on-water platform segment is driving the overall growth of the marine EV charging hubs market.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 1.6 billion |

|

Revenue forecast in 2035 |

USD 8.5 billion |

|

CAGR (2025-2035) |

18.5% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers, and restraints |

|

Segments covered |

Type (Hybrid, Battery Electric, and Plug-in Hybrid Electric), Platform (Marine and Aviation), Mode of Operation, End-Use Industry, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

|

Key companies profiled |

Duffy, Candela, Pure Watercraft, ABB, Twin Vee, Siemens AG, Wartsila, BAE Systems, Corvus Energy, Kongsberg Gruppen, and Other Key Players |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models. |

Market Segmentation

The Marine & Aviation EV Charging Hubs Market is estimated to be USD 1.6 billion in 2025 and grow at a CAGR of 18.5% to reach USD 8.5 billion by 2035.

The marine & aviation EV charging hubs market was valued at USD 1.2 billion in 2024. The market is expected to reach USD 8.5 billion by 2035 from USD 1.6 billion in 2025, at a CAGR of 18.5%.

In 2024, the Marine & Aviation EV Charging Hubs Market was valued at USD 1.2 billion, with projections to reach USD 1.6 billion in 2025.

Duffy, Candela, Pure Watercraft, ABB, Twin Vee, and Siemens AG are the major companies operating in the marine & aviation ev charging hubs market.

The Asia Pacific region is projected to grow at the fastest CAGR over the forecast period (2025-2035).

The battery electric type segment holds the highest share of the marine & aviation EV charging hubs market, accounting for 35-40% revenue share in 2024.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research / Interviews with Industry Experts & Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. By Charging Technology Type

3.2.2. By Platform

3.2.3. By Mode of Operation

3.2.4. By End-Use Industry

3.2.5. By Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Global Decarbonization Mandates & Zero Emission Zones (e.g., IMO 2030/2050, EU AFID)

4.2.1.2. Advancements in Fast Charging and Battery Technologies

4.2.1.3. Government Incentives and Funding for Green Transport Infrastructure

4.2.1.4. Growing Adoption of Electric Ferries, Cargo Drones, eVTOL Aircraft, and Autonomous Vessels

4.2.2. Restraints

4.2.2.1. High Initial Infrastructure and Installation Costs

4.2.2.2. Limited Charging Standards, Interoperability Issues

4.2.2.3. Grid Capacity Constraints in Remote Port and Airport Locations

4.2.2.4. Battery Weight and Range Limitations Affecting Marine and Aviation EV Adoption

4.2.3. Opportunities

4.2.3.1. Integration of Renewable Energy Sources into Charging Hubs

4.2.3.2. Expansion in Emerging Maritime and Aviation Markets

4.2.3.3. Complementary Hydrogen Fuel Cell Charging/Refueling Infrastructure

4.2.4. Trends

4.2.4.1. Development of Hybrid-Electric and Fuel Cell Vessels and Aircraft

4.2.4.2. Public-Private Partnerships for Sustainable Infrastructure Development

4.2.5. Challenges

4.2.5.1. Adapting Charging Solutions to Varying Vessel and Aircraft Designs

4.2.5.2. Ensuring Reliability and Uptime in Harsh Marine and Aviation Environments

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Marine & Aviation EV Charging Hubs Market

4.4.1. Ultra-Fast Charging Systems

4.4.1.1. Reduced Charging Time for Ferries and eVTOLs (<1 hour)

4.4.1.2. High-Capacity DC Charging for Quick Turnaround in Busy Ports and Airports

4.4.1.3. Smart Load Management and Grid Integration to Prevent Overloads and Enable Microgrids

4.4.2. Wireless/Inductive Charging Technologies

4.4.2.1. Contactless Charging for Autonomous Surface Vessels and eVTOLs

4.4.3. Standardized & Modular Charging Infrastructure

4.4.3.1. Development of Universal Connectors and Protocols for Cross-Compatibility

4.4.3.2. Modular Hub Designs for Scalable Expansion and Easier Maintenance

5. Impact of Sustainability on Marine & Aviation EV Charging Hubs Market

5.1. Sustainability Initiatives and Green Port/Airport Developments

5.2. Regulatory Landscape and Carbon Emission Reduction Mandates

5.3. Environmental Impact Assessment of Charging Infrastructure

5.4. Circular Economy: Battery Recycling and Sustainable Material Usage

5.5. Energy Efficiency and Integration with Renewable Energy Sources

5.6. Social Impacts: Community Wellbeing and Workforce Transition

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies Adopted by Market Players

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis by Key Players (2024)

7. Marine & Aviation EV Charging Hubs Market Assessment—By Type

7.1. Overview

7.1.1. Hybrid Electric

7.1.2. Battery Electric

7.1.3. Plug-in Hybrid Electric

7.1.4. Fuel Cell Electric (Hydrogen-Based Systems)

8. Marine & Aviation EV Charging Hubs Market Assessment—By Platform

8.1. Overview

8.2. Marine Platforms

8.2.1. On-water Vessels (Ferries, Cargo Ships, Yachts)

8.2.2. Subsurface Platforms

8.3. Aviation Platforms

8.3.1. eVTOL Aircraft

8.3.2. Seaplanes and Electric Aircraft

9. Marine & Aviation EV Charging Hubs Market Assessment—By Mode of Operation

9.1. Overview

9.2. Manned Operations

9.3. Autonomous Operations

9.4. Semi-Autonomous Operations

9.5. Remotely Operated Systems

10. Marine & Aviation EV Charging Hubs Market Assessment—By End-Use Industry

10.1. Overview

10.2. Oil & Gas Industry

10.3. Military and Defense

10.4. Logistics and Transportation

10.5. Tourism and Recreation

10.6. Port Authorities and Airport Operators

10.7. Urban Air Mobility and eVTOL Services

10.8. Others

11. Marine & Aviation EV Charging Hubs Market Assessment—By Geography

11.1. Overview

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Netherlands

11.3.5. Norway and Scandinavia

11.3.6. Switzerland

11.3.7. Rest of Europe

11.4. Asia-Pacific

11.4.1. China

11.4.2. Japan

11.4.3. South Korea

11.4.4. Taiwan

11.4.5. India

11.4.6. Singapore

11.4.7. Australia

11.4.8. Rest of Asia-Pacific

11.5. Latin America

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Argentina

11.5.4. Rest of Latin America

11.6. Middle East & Africa

11.6.1. UAE

11.6.2. Saudi Arabia

11.6.3. Israel

11.6.4. South Africa

11.6.5. GCC Countries (Qatar, Oman, Kuwait)

11.6.6. Rest of Middle East & Africa

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

12.1. ABB

12.2. Siemens AG

12.3. Wartsila

12.4. BAE Systems

12.5. Kongsberg Gruppen

12.6. ChargePoint

12.7. Schneider Electric

12.8. Leclanché

12.9. Candela

12.10. Pure Watercraft

12.11. Other Key Players

13. Appendix

13.1. Available Customization

13.2. Related Reports

Published Date: Aug-2025

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates