Resources

About Us

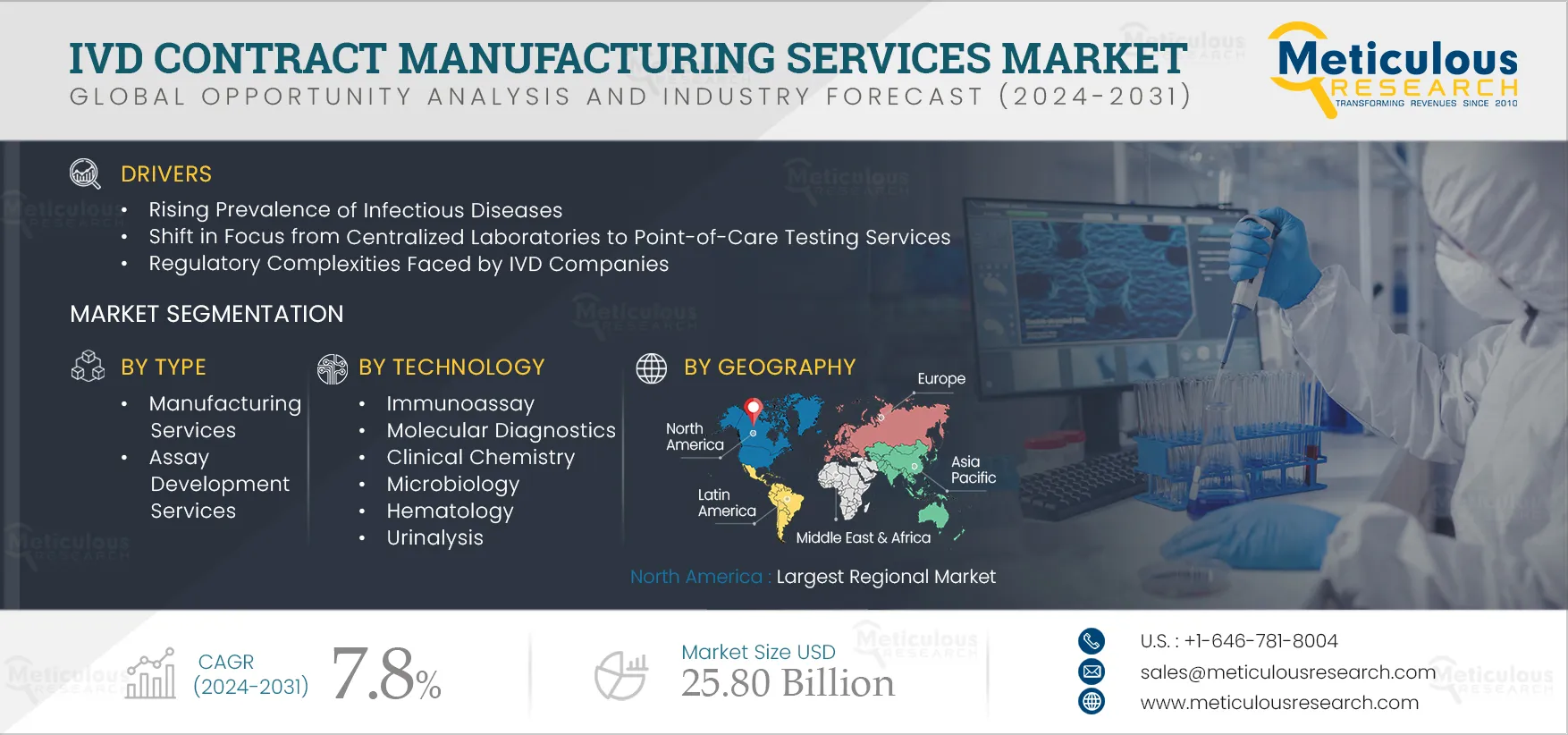

IVD Contract Manufacturing Services Market by Type (Assay Development, Manufacturing), Category (Reagents, Systems), Technology (Immunoassay, Molecular Diagnostics, Clinical Chemistry, Hematology, Microbiology, Urinalysis) – Global Forecast to 2031

Report ID: MRHC - 104539 Pages: 320 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportIVD contract manufacturing services allow organizations to outsource manufacturing processes. Companies outsource a product or part of a product. This is often used to increase production rates or to expand product offerings without investing in new equipment and machinery. The growth of the IVD contract manufacturing services market is driven by several factors, including the rising prevalence of infectious diseases, the shift in focus from centralized laboratories to point-of-care testing services, regulatory complexities faced by IVD companies, and the need for cost-effective manufacturing of IVD tests. Factors such as high economic growth and increased outsourcing to emerging countries serve as an opportunity that would help grow the market in the future. The lack of skilled professionals could be considered a challenge for the IVD contract manufacturing services market. However, the maintenance of product quality and protection of proprietary information could restrain the growth of the market.

Diagnosis of any disease is required to identify and investigate the disease and reduce the associated mortality rate. Traditionally, testing was conducted exclusively at centralized laboratories. Centralized laboratory testing is very important for the optimal and consistent functioning of diagnostic processes. In recent years, there has been a continuous shift towards point-of-care testing services or decentralized clinical laboratory testing primarily due to cost reduction, convenience to patients and clinicians, reduced waiting time for results, and improved quality of testing.

Point-of-care (POC) testing is majorly performed for diagnosis at or near the site of the patient. POC tests improve patient management in cases of infectious diseases. POC tests for various infectious diseases, such as chlamydia, gonorrhea, and influenza, help provide early diagnosis and treatment. POC testing in decentralized setups helps physicians monitor infectious diseases and improve clinical workflow. Also, advancements in information technology contributed significantly to the decentralization of clinical laboratory testing.

Most importantly, POC instruments must be simple to use since the end users may not be trained lab technicians. Specific POC device features should include minimal maintenance requirements and onboard calibrations to ensure accurate test results, a user-friendly software interface, integration with laboratory and hospital information systems, and easy-to-use disposables that contain all the reagents for sample processing and testing. POC instrumentation should also have a small footprint and, in some cases, be portable since both hospital clinics and physician offices have limited space. While such requirements may seem simple, they present IVD companies with a variety of design and manufacturing challenges. Most notably, a number of POC technologies require more complex disposable cartridges containing multiple reagents to process only one patient sample at a time, compared with simpler disposables in higher-volume laboratory instruments.

With this added complexity, product development teams must work together to ensure a smooth integration of the disposable cartridges with the instrument design and minimize costly redesigns. Working with a contract manufacturing partner who has experience in integrating disposable cartridge technologies with instrument design is the preferred option, hence driving the associated market.

Click here to: Get Free Sample Pages of this Report

IVD manufacturing requires significant capital expenditure for in-house manufacturing. In addition to the costs of equipment, the Quality Management System (QMS) also needed to be aligned with all regulatory requirements. The hiring of skilled professionals and the acquisition of appropriate certifications are also needed. Due to the significant capital expenditure requirement, companies are choosing to outsource their manufacturing so that their capital can be used towards growing their business and developing new products. In addition, supply chain disruptions & delays, product or manufacturing changes, lack of manufacturing & packaging expertise, supplier inability to support current or future demand, IVD assay variability, incomplete documentation, specification changes, and regulatory non-compliance are some of the risks experienced by IVD manufacturers. The critical raw materials require risk mitigation for manufacturing continuity, lot-to-lot continuity, regulatory compliance, and clinical test reliability. The quality systems and regulatory expertise of IVD service providers provide solutions for these risks; hence, IVD manufacturers are moving towards IVD outsourcing.

The changes in the IVD industry are being driven by increased laboratory test volumes and growing pressure to lower test turnaround times (TAT) with fewer skilled lab technicians. Any new product launch must be able to address this demanding environment. Such sweeping demands in the industry are accelerating the development of three specific areas of advancement: point-of-care (POC) technologies, automation, and graphical user interfaces. With the IVD market changing rapidly, the pressure to deliver less expensive and more efficient new products is mounting. To reduce costs and shorten product development cycles, many large and start-up IVD companies have been turning to contract developers and manufacturers for their services and relevant experience to overcome common development challenges.

Based on type, in 2024, the manufacturing services segment is expected to account for the largest share of the market. Manufacturing services include ISO-certified manufacturing facilities and carrying out full projects and production management, quality and regulatory support, and flexibility in scale and process, which results in increased demand for manufacturing services. Other factors that contribute to the growth of this segment include the growing demand for IVD devices, and IVD companies are therefore outsourcing manufacturing of these devices as these services are cost-effective and also provide quality and regulatory support.

Based on category, in 2024, the reagents & consumables segment is expected to account for the largest share of the market. IVD reagents are used for the in-vitro examination of specimens derived from a human body during disease diagnosis, treatment monitoring, prognosis, and evaluation of the patient’s health. Reagents & consumables provide high standards of innovation and quality in R&D and manufacturing of IVD assays. Some major factors contributing to the growth of this segment include the rising prevalence of infectious diseases and hence, the continuous need for IVD reagents and consumables for diagnosis of these diseases.

Based on technology, in 2024, the immunoassay segment is expected to account for the largest share of the market. A wide variety of immunoassays have been developed, with ELISA, lateral flow immunoassay, radioimmunoassay, immunofluorescence, immunohistochemistry, immunocytochemistry, microarray, and western blotting being amongst the most well-known. Immunoassays find application in cancer marker identification/testing, infectious diseases diagnostics, cardiac analysis, therapeutic drug monitoring, and allergen tests. This growth of the segment is attributed to factors such as higher preference for immunodiagnostics owing to its inherent specificity, high throughput, and the emergence of advanced diagnostic immunoassay formats.

The growth of this market is primarily driven by the rising prevalence of various infectious diseases, the growing healthcare sector, increasing awareness regarding early disease diagnosis, growing adoption of advanced diagnostic products, and increasing funding activities coupled with novel advanced diagnostic technologies.

The key players profiled in the IVD contract manufacturing services market report are Cenogenics Corporation (U.S.), In-Vitro Diagnostic Developers, Inc. (IDxDI) (U.S.), Savyon Diagnostics (Israel), KMS Systems, Inc. (U.S.), Nova Biomedical (U.S.), LRE Medical (Germany), Cone Bioproducts (U.S.), Invetech, Inc. (Australia), Avioq, Inc. (U.S.), TCS Biosciences Ltd. (U.K.), Affinity Life Sciences, Inc. (U.S.), Coris BioConcept (Belgium), Meridian Bioscience, Inc. (U.S.), Affinity Biologicals, Inc. (Canada), Biokit S.A. (Spain), Merck KgaA (Germany), Thermo Fisher Scientific, Inc. (U.S.), and Maxim Biomedical, Inc. (U.S.).

The report includes a competitive landscape based on an extensive assessment of the market based on type, category, technology, and geography. The report also provides insights into the geographic presence of major market players and their key growth strategies in the last three to four years.

|

Particular |

Details |

|

Number of Pages |

~320 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

7.8% |

|

Estimated Market Size (Value) |

$25.75 billion by 2031 |

|

Segments Covered |

By Type

By Category

By Technology

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, RoE), Asia-Pacific (China, Japan, India, RoAPAC), Latin America, and the Middle East & Africa. |

|

Key Companies |

Cenogenics Corporation (U.S.), In-Vitro Diagnostic Developers, Inc. (IDxDI) (U.S.), Savyon Diagnostics (Israel), KMS Systems, Inc. (U.S.), Nova Biomedical (U.S.), LRE Medical (Germany), Cone Bioproducts (U.S.), Invetech, Inc. (Australia), Avioq, Inc. (U.S.), TCS Biosciences Ltd. (U.K.), Affinity Life Sciences, Inc. (U.S.), Coris BioConcept (Belgium), Meridian Bioscience, Inc. (U.S.), Affinity Biologicals, Inc. (Canada), Biokit S.A. (Spain), Merck KgaA (Germany), Thermo Fisher Scientific, Inc. (U.S.), and Maxim Biomedical, Inc. (U.S.) |

This market study covers the market sizes & forecasts of the IVD contract manufacturing services market based on type, category, technology, and geography. This market study also provides the value analysis of various segments and subsegments of the IVD contract manufacturing services market at regional and country levels.

The IVD contract manufacturing services market is projected to reach $25.80 billion by 2031, at a CAGR of 7.8% during the forecast period.

The manufacturing services segment is expected to account for the largest share of the market in 2024. Factors such as growing demand for IVD devices and IVD companies outsourcing the manufacturing of IVD products due to the increased demand for these products for diagnosis purposes drive the growth of this segment.

The reagents & consumables segment is expected to account for the largest share of the IVD contract manufacturing services market. The growth of this segment can be attributed to the rising prevalence of infectious diseases, rapid growth in molecular testing for hospital-acquired infections, and the growth of companion diagnostics.

The growth of the IVD contract manufacturing services market is driven by several factors, including the rising prevalence of infectious diseases, the shift in focus from centralized laboratories to point-of-care testing services, regulatory complexities faced by IVD companies, and the need for cost-effective manufacturing of IVD tests.

Furthermore, high economic growth and increased outsourcing to emerging countries serve as a major opportunity for the existing market players and new entrants in the IVD contract manufacturing services market.

The key players profiled in the IVD contract manufacturing services market report are Cenogenics Corporation (U.S.), In-Vitro Diagnostic Developers, Inc. (IDxDI) (U.S.), Savyon Diagnostics (Israel), KMS Systems, Inc. (U.S.), Nova Biomedical (U.S.), LRE Medical (Germany), Cone Bioproducts (U.S.), Invetech, Inc. (Australia), Avioq, Inc. (U.S.), TCS Biosciences Ltd. (U.K.), Affinity Life Sciences, Inc. (U.S.), Coris BioConcept (Belgium), Meridian Bioscience, Inc. (U.S.), Affinity Biologicals, Inc. (Canada), Biokit S.A. (Spain), Merck KgaA (Germany), Thermo Fisher Scientific, Inc. (U.S.), and Maxim Biomedical, Inc. (U.S.).

Emerging economies from Asia-Pacific, such as China and India, are projected to offer significant growth opportunities for vendors operating in this market. This growth is due to rapid urbanization, the need to manage the growing burden of infectious diseases, and efforts to improve the accessibility of diagnostic services.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumption for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. Rising Prevalence of Infectious Diseases

4.2.2. Shift in Focus from Centralized Laboratories to Point-of-Care Testing Services

4.2.3 Regulatory Complexities Faced by IVD Companies

4.2.4. Need for Cost-Effective Manufacturing of IVD Tests

4.3. Restraints

4.3.1. Maintaining Product Quality and Protection of Proprietary Information

4.4. Opportunities

4.4.1. High Economic Growth and Increased Outsourcing to Emerging Countries

4.5. Challenges

4.5.1. Lack of Skilled Professionals

4.6. Industry & Technology Trends

4.7. Regulatory Scenario

4.8. Pricing Analysis

4.9. Porter’s Five Force Analysis

4.10. Adjacent/Related Market Analysis

5. Global IVD Contract Manufacturing Services Market Assessment—by Type

5.1. Overview

5.2. Manufacturing Services

5.3. Assay Development Services

5.4. Other Services

6. Global IVD Contract Manufacturing Services Market Assessment—by Category

6.1. Overview

6.2. Reagents & Consumables

6.3. Instruments & Systems

7. Global IVD Contract Manufacturing Services Market Assessment—By Technology

7.1. Overview

7.2. Immunoassay

7.2.1. Reagents & Consumables

7.2.2. Instruments & Systems

7.3. Molecular Diagnostics

7.3.1. Reagents & Consumables

7.3.2. Instruments & Systems

7.4. Clinical Chemistry

7.4.1. Reagents & Consumables

7.4.2. Instruments & Systems

7.5. Hematology

7.5.1. Reagents & Consumables

7.5.2. Instruments & Systems

7.6. Coagulation/Hemostasis

7.6.1. Reagents & Consumables

7.6.2. Instruments & Systems

7.7. Microbiology

7.7.1. Reagents & Consumables

7.7.2. Instruments & Systems

7.8. Urinalysis

7.8.1. Reagents & Consumables

7.8.2. Instruments & Systems

8. IVD Contract Manufacturing Services Market Assessment—by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.4.4. Rest of Asia-Pacific

8.5. Latin America

8.6. Middle East & Africa

9. Competitive Analysis

9.1. Overview

9.2. Competitive Benchmarking

9.3. Competitive Dashboard

9.3.1 Market Leaders

9.3.2 Market Differentiators

9.3.3. Vanguards

9.3.4. Emerging Companies

9.5. Vendor Market Positioning

9.6. Market Share Analysis/Market Ranking, By Key Players (2023)

10. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

10.1. Cenogenics Corporation

10.2. In-Vitro Diagnostic Developers, Inc. (IDxDI)

10.3. Savyon Diagnostics

10.4. KMC Systems, Inc.

10.5. Nova Biomedical

10.6. LRE Medical

10.7. Cone Bioproducts

10.8. Invetech, Inc.

10.9. Avioq, Inc.

10.10. TCS Biosciences Ltd.

10.11. Affinity Life Sciences, Inc.

10.12. Coris BioConcept

10.13. Meridian Bioscience, Inc.

10.14. Affinity Biologicals, Inc.

10.15. Biokit S.A.

10.16. Merck KgaA

10.17. Thermo Fisher Scientific, Inc.

10.18. Maxim Biomedical, Inc.

10.19. Other Companies

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Global IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 2 Global Manufacturing Services Market, by Country/Region, 2022–2031 (USD Million)

Table 3 Global Assay Development Services Market, by Country/Region, 2022–2031 (USD Million)

Table 4 Global Other Services Market, by Country/Region, 2022–2031 (USD Million)

Table 5 Global IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 6 Global IVD Contract Manufacturing Services Market for Reagents & Consumables, by Country/Region, 2022–2031 (USD Million)

Table 7 Global IVD Contract Manufacturing Services Market for Instruments & Systems, by Country/Region, 2022–2031 (USD Million)

Table 8 Global IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 9 Global IVD Contract Manufacturing Services Market for Immunoassay, by Country/Region, 2022–2031 (USD Million)

Table 10 Global IVD Contract Manufacturing Services Market for Molecular Diagnostics, by Country/Region, 2022–2031 (USD Million)

Table 11 Global IVD Contract Manufacturing Services Market for Clinical Chemistry, by Country/Region, 2022–2031 (USD Million)

Table 12 Global IVD Contract Manufacturing Services Market for Hematology, by Country/Region, 2022–2031 (USD Million)

Table 13 Global IVD Contract Manufacturing Services Market for Microbiology, by Country/Region, 2022–2031 (USD Million)

Table 14 Global IVD Contract Manufacturing Services Market for Urinalysis, by Country/Region, 2022–2031 (USD Million)

Table 15 Global IVD Contract Manufacturing Services Market, by Country/Region, 2022–2031 (USD Million)

Table 16 North America: IVD Contract Manufacturing Services Market, by Country, 2022–2031 (USD Million)

Table 17 North America: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 18 North America: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 19 North America: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 20 U.S.: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 21 U.S.: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 22 U.S.: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 23 Canada: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 24 Canada: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 25 Canada: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 26 Europe: IVD Contract Manufacturing Services Market, by Country/Region, 2022–2031 (USD Million)

Table 27 Europe: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 28 Europe: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 29 Europe: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 30 Germany: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 31 Germany: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 32 Germany: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 33 U.K.: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 34 U.K.: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 35 U.K.: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 36 France: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 37 France: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 38 France: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 39 Italy: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 40 Italy: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 41 Italy: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 42 Spain: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 43 Spain: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 44 Spain: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 45 Rest of Europe: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 46 Rest of Europe: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 47 Rest of Europe: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 48 Asia-Pacific: IVD Contract Manufacturing Services Market, by Country/Region, 2022–2031 (USD Million)

Table 49 Asia-Pacific: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 50 Asia-Pacific: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 51 Asia-Pacific: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 52 China: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 53 China: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 54 China: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 55 Japan: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 56 Japan: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 57 Japan: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 58 India: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 59 India: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 60 India: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 61 Rest of Asia-Pacific: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 62 Rest of Asia-Pacific: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 63 Rest of Asia-Pacific: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 64 Latin America: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 65 Latin America: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 66 Latin America: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 67 Middle East & Africa: IVD Contract Manufacturing Services Market, by Type, 2022–2031 (USD Million)

Table 68 Middle East & Africa: IVD Contract Manufacturing Services Market, by Category, 2022–2031 (USD Million)

Table 69 Middle East & Africa: IVD Contract Manufacturing Services Market, by Technology, 2022–2031 (USD Million)

Table 70 Recent Developments, by Company, 2020—2023

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Global IVD Contract Manufacturing Services Market, by Type, 2024 VS. 2031 (USD Million)

Figure 8 Global IVD Contract Manufacturing Services Market, by Category, 2024 VS. 2031 (USD Million)

Figure 9 Global IVD Contract Manufacturing Services Market, by Technology, 2024 VS. 2031 (USD Million)

Figure 10 IVD Contract Manufacturing Services Market, by Region

Figure 11 Impact Analysis of Market Dynamics

Figure 12 Global IVD Contract Manufacturing Services Market, by Type, 2024 VS. 2031 (USD Million)

Figure 13 Global IVD Contract Manufacturing Services Market, by Category, 2024 VS. 2031 (USD Million)

Figure 14 Global IVD Contract Manufacturing Services Market, by Technology, 2024 VS. 2031 (USD Million)

Figure 15 Global IVD Contract Manufacturing Services Market, by Region, 2024 VS. 2031 (USD Million)

Figure 16 North America: IVD Contract Manufacturing Services Market Snapshot

Figure 17 Europe: IVD Contract Manufacturing Services Market Systems Snapshot

Figure 18 Asia-Pacific: IVD Contract Manufacturing Services Market Snapshot

Figure 19 Key Growth Strategies Adopted by Leading Players, 2021—2024

Figure 20 IVD Contract Manufacturing Services Market: Competitive Benchmarking, by Type

Figure 21 IVD Contract Manufacturing Services Market: Competitive Benchmarking, by Region

Figure 22 Competitive Dashboard: IVD Contract Manufacturing Services Market

Figure 23 Global IVD Contract Manufacturing Services Market Share Analysis, By Key Players (2023)

Figure 24 KMC Systems, Inc.: Financial Overview (2022)

Figure 25 Invetech, Inc.: Financial Overview (2022)

Figure 26 Meridian Bioscience, Inc.: Financial Overview (2022)

Figure 27 Biokit S.A.: Financial Overview (2022)

Figure 28 Merck KgaA: Financial Overview (2022)

Figure 29 Thermo Fisher Scientific, Inc.: Financial Overview (2022)

Published Date: Apr-2025

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates