Resources

About Us

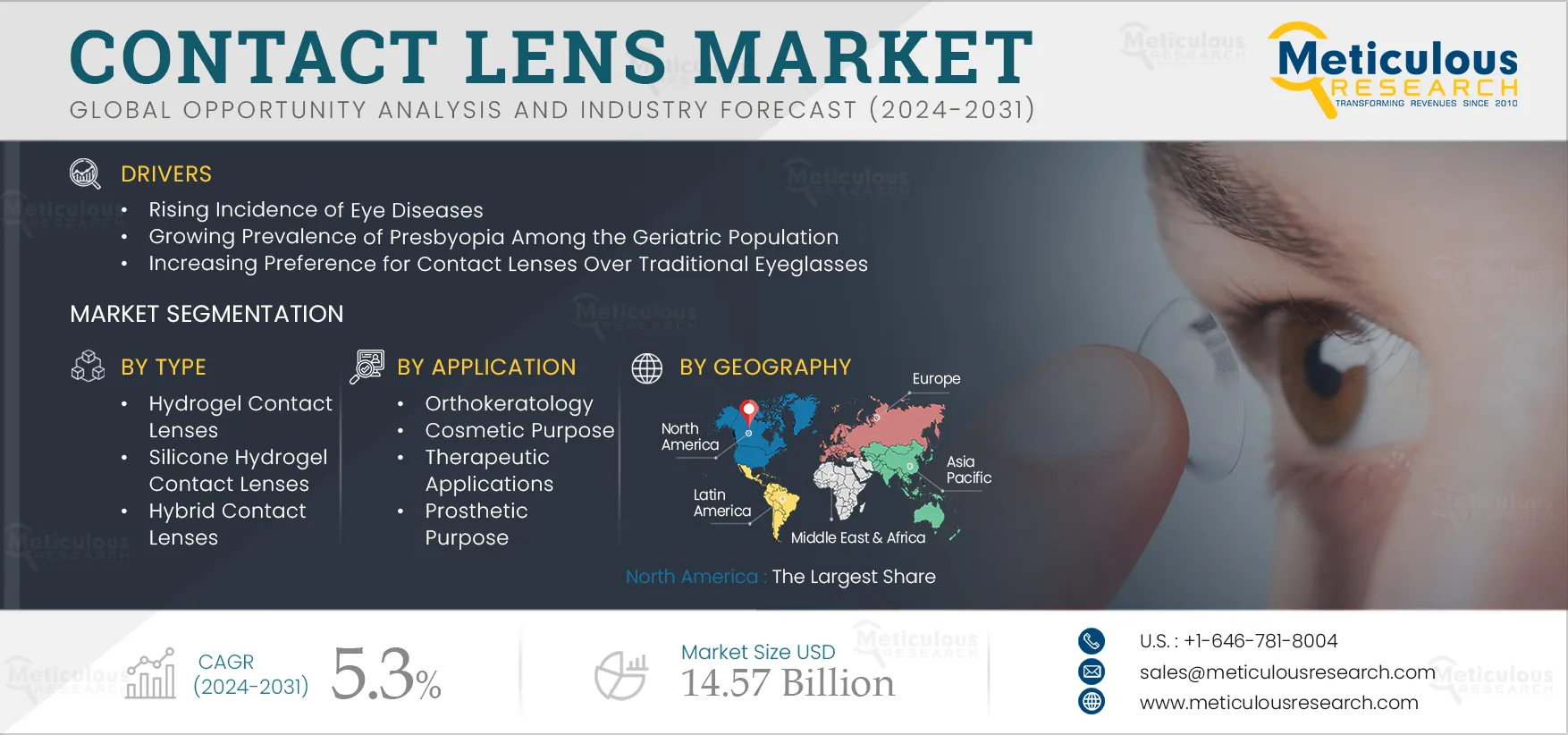

Contact Lens Market Size, Share, Forecast & Trends Analysis by Type (Hydrogel, Hybrid, RGP) Design (Spherical, Bifocal, Toric) Application (Orthokeratology, Cosmetic, Therapeutic) Color (Opaque, Tinted) Usage, Distribution Channel - Global Forecast to 2032

Report ID: MRHC - 1041208 Pages: 270 Oct-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is driven by the rising incidence of eye diseases, a growing prevalence of presbyopia among the geriatric population, the increasing preference for contact lenses over traditional eyeglasses, and the rising utilization of contact lenses for aesthetic purposes. Furthermore, the rising awareness regarding contact lens usage, advancements in contact lens materials, and technological innovations are expected to create market growth opportunities.

As the prevalence of eye problems like astigmatism, hyperopia, presbyopia, corneal ectasias, and post-refractive surgeries continues to rise, there is a growing demand for vision correction solutions such as contact lenses. Contact lenses offer valuable and effective treatment options for many individuals with these conditions, thus fueling their demand.

Moreover, according to the World Health Organization (WHO) 2024 data, approximately 2.2 billion people globally have distance vision impairment. Additionally, 826 million people suffered from presbyopia, and 88.4 million suffered from a refractive error worldwide. The increasing incidence of eye diseases drives the demand for contact lenses.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Contact lenses offer a broader range of vision correction options compared to eyeglasses, catering to various refractive issues such as hyperopia, myopia, presbyopia, and astigmatism. Special contact lenses like multifocal lenses for presbyopia and toric lenses for astigmatism provide tailored solutions for specific vision problems. This versatility makes contact lenses an attractive choice for individuals seeking precise and customized vision correction.

Additionally, contact lenses offer user-friendly convenience and enhanced mobility compared to eyeglasses. Unlike glasses, wearers can engage in various activities without worrying about their lenses slipping off or becoming damaged. This advantage makes contact lenses popular among sports enthusiasts and individuals in professions that demand unimpeded vision without the need for glasses.

Many individuals are increasingly becoming aware of the use of contact lenses as an alternative to traditional eyeglasses for vision correction. Furthermore, various organizations have initiated awareness programs to create awareness among people. For instance:

In August 2024, the Contact Lens Institute (CLI) (U.S.) introduced the 'EASY' awareness program, aiming to educate patients about contact lens cleaning, wear, and care advice.

Therefore, the rising public awareness about contact lenses is anticipated to create opportunities for the growth of the contact lens market.

Contact lens materials have undergone significant improvements to enhance comfort for consumers. Traditional contact lenses were often associated with discomfort, including pain, dryness, and irritation. However, modern materials such as polymethyl methacrylate, silicone hydrogels, and hydrogel offer increased oxygen permeability and wettability, allowing more oxygen to reach the cornea. This improved oxygenation reduces dryness and fosters better eye health, resulting in enhanced comfort throughout the day.

Furthermore, advancements in contact lens materials have facilitated the development of lenses suitable for prolonged wear, including overnight wear. These extended-wear contact lenses allow patients to wear them continuously for several days without the need for nightly removal. This option is convenient for individuals who prefer not to manage their lenses daily and offers flexibility for those with busy schedules.

Smart contact lenses represent a groundbreaking advancement in contact lens technology. These lenses integrate microelectronics and sensors to monitor various aspects of eye health. They can measure glucose levels in tears, which is particularly relevant for diabetic individuals, as well as monitor intraocular pressure, tear fluid composition, and early indicators of eye disorders. By providing continuous monitoring, smart contact lenses empower both doctors and consumers to proactively manage eye health.

Moreover, according to research from Nanyang Technological University (NTU) (Singapore) in August 2024, a breakthrough was achieved with the development of an ultra-thin battery, measuring only a few micrometers in size, capable of powering smart contact lenses and harnessing tear fluid for recharging. Furthermore, smart contact lenses can potentially offer vision improvements beyond standard correction methods. They can potentially enable clear vision at multiple distances without the need for multifocal lenses and can enhance contrast sensitivity while addressing color blindness in individuals with vision impairments.

Based on type, the contact lens market is segmented into hydrogel contact lenses, silicone hydrogel contact lenses, Rigid Gas Permeable (RGP) contact lenses, hybrid contact lenses, Polymethyl Methacrylate (PMMA) contact lenses, and accessories. In 2025, the silicone hydrogel contact lenses segment is expected to account for the largest share of 64.3% of the contact lens market. This segment's large market share can be attributed to the numerous benefits provided by silicone hydrogel lenses. These lenses allow more oxygen to reach the cornea compared to conventional hydrogel lenses, thereby reducing symptoms such as dryness, redness, impaired vision, and discomfort. Additionally, market players are actively introducing innovative products to meet the increasing demand for contact lenses. For instance, in September 2024, Vision Path, Inc. (U.S.) launched SkyHy by Hubble, a line of silicone hydrogel daily contact lenses. These lenses offer high oxygen permeability and comfort.

Moreover, the hydrogel contact lenses segment is projected to register the highest growth rate of 6.2% during the forecast period 2025–2032. This growth can be attributed to the rising demand for hydrogel contact lenses among consumers, driven by advancements in contact lens materials.

Based on design, the contact lens market is segmented into spherical, toric, bifocal, multifocal, and monovision. In 2025, the spherical segment is expected to account for the largest share of the contact lens market. Spherical contact lenses are comfortable to wear, widely available, and can move around the cornea without negatively affecting vision, which contributes to the large market share of this segment.

Based on usage, the contact lens market is segmented into daily wear contact lenses, daily disposable contact lenses, monthly replacement contact lenses, extended wear contact lenses, traditional contact lenses, and cosmetic contact lenses. In 2025, the daily wear contact lenses segment is expected to account for the largest share of the contact lens market. This segment's large market share can be attributed to the increasing consumer demand for daily wear lenses, driven by their convenience, growing awareness of eye health, and rising disposable incomes. Additionally, market players are actively seeking approvals from regulatory bodies to meet the rising demand for daily wear contact lenses. For instance, in June 2022, Johnson & Johnson Vision Care, Inc. (U.S.) received clearance from the U.S. Food & Drug Administration (FDA), approval from Health Canada, and completed CE Mark activities for ACUVUE OASYS MAX 1-Day and ACUVUE OASYS MAX 1-Day MULTIFOCAL daily wear contact lenses. These lenses offer exceptional visual clarity and all-day comfort.

Based on application, the contact lens market is segmented into orthokeratology, cosmetic purpose, therapeutic applications, prosthetic purpose, and other applications. In 2025, the orthokeratology segment is expected to account for the largest share of the contact lens market. This segment's large market share can be attributed to advancements in ortho-k contact lenses, facilitating improved stability and centration compared to corneal lenses. Moreover, market players are actively seeking approvals to meet the increasing demand for ortho-k contact lenses. For instance, in May 2021, Johnson & Johnson Vision Care, Inc. (U.S.) obtained approval from the U.S. Food and Drug Administration (FDA) for ACUVUE Abiliti overnight therapeutic lenses for myopia management.

Based on color variation, the contact lens market is segmented into opaque color contact lenses, enhancers/tinted contact lenses, and visibility tint contact lenses. In 2025, the opaque color contact lenses segment is expected to account for the largest share of the contact lens market. These contact lenses are typically available in solid colors and block patterns, offering a natural-looking enhancement to eye color. Additionally, opaque contact lenses help provide a natural appearance while preserving the original color of the eye. These factors contribute to the significant market share of this segment.

Based on distribution channel, the contact lens market is segmented into hospitals & clinics, retail stores, and E-commerce. In 2025, the hospitals & clinics segment is expected to account for the largest share of 52.0% of the contact lens market. This segment's large market share can be attributed to the high influx of patients in hospitals & clinics due to the presence of highly skilled healthcare professionals and advanced infrastructure, the significant demand for contact lenses from the pharmacies within these hospitals & clinics, and the proliferation of hospitals & clinics.

In 2025, North America is expected to account for the largest share of 34.5% of the contact lens market, followed by Europe and Asia-Pacific. North America's significant market share can be attributed to several factors, including the presence of major contact lens companies such as Johnson & Johnson Services, Inc (U.S.), a well-established healthcare infrastructure, and the increasing prevalence of eye diseases such as astigmatism, hyperopia, presbyopia, corneal ectasias, and post-refractive surgeries in this region.

However, the market in Asia-Pacific is projected to register the highest growth rate of 6.4% during the forecast period. The growth of this regional market is driven by the rising awareness about eye care and contact lenses, improving healthcare systems in countries such as China and India, increasing healthcare expenditures, and the growing awareness about contact lenses.

The report offers a competitive analysis based on an extensive assessment of the leading players' product portfolios and geographic presence and the key growth strategies adopted by them over the past 3–4 years. Some of the key players operating in the contact lens market are Johnson & Johnson Vision Care, Inc. (U.S.), Alcon Inc. (Switzerland), CooperVision, Inc. (U.S.), Bausch + Lomb Corporation (Canada), Carl Zeiss AG (Germany), HOYA Corporation (Japan), Essilor International SA (France), Menicon Co., Ltd. (Japan), UltraVision CLPL (U.K.), STAAR SURGICAL (U.S.), BenQ Materials Corporation (Taiwan), Visioneering Technologies, Inc. (U.S.), Excellent Hi-Care Pvt Ltd (India), and SEED Co., Ltd. (Japan).

In October 2024, Alcon Inc. (Switzerland) launched the TOTAL30 Multifocal, the only monthly Water Gradient multifocal contact lens for Patients with Presbyopia.

In June 2024, Bausch + Lomb Corporation (Canada) launched the INFUSE Multifocal silicone hydrogel (SiHy) daily disposable contact lenses in the U.S.

|

Particulars |

Details |

|

Number of Pages |

~270 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.3% |

|

Market Size (Value) |

USD 14.57 Billion by 2032 |

|

Segments Covered |

By Type

By Design

By Usage

By Application

By Color Variation

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, Switzerland, Rest of Europe), Asia-Pacific (India, China, Japan, Australia, South Korea, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson Vision Care, Inc. (U.S.), Alcon Inc. (Switzerland), CooperVision, Inc. (U.S.), Bausch + Lomb Corporation (Canada), Carl Zeiss AG (Germany), HOYA Corporation (Japan), Essilor International SA (France), Menicon Co., Ltd. (Japan), UltraVision CLPL (U.K.), STAAR SURGICAL (U.S.), BenQ Materials Corporation (Taiwan), Visioneering Technologies, Inc. (U.S.), Excellent Hi-Care Pvt Ltd (India), and SEED Co., Ltd. (Japan). |

This study offers a detailed assessment of the contact lens market and analyzes the market sizes & forecasts based on type, design, usage, application, color variation, and distribution channel. This report also provides value analyses of various segments and subsegments of the contact lens market at the regional and country levels.

The contact lens market is projected to reach $14.57 billion by 2032, at a CAGR of 5.3% during the forecast period.

Among all types covered in this report, in 2025, the hydrogel contact lenses segment is expected to account for the largest share of the market. This segment's large market share can be attributed to the numerous benefits provided by silicone hydrogel lenses. These lenses allow more oxygen to reach the cornea compared to conventional hydrogel lenses, thereby reducing symptoms such as dryness, redness, impaired vision, and discomfort.

Among all designs covered in this report, in 2025, the spherical segment is expected to account for the largest share of the contact lens market. The large market share of this segment can be attributed to the increasing demand for spherical contact lenses due to their comfortable wear, wide availability, and ability to move around the cornea without negatively affecting vision.

The growth of this market is driven by the rising incidence of eye diseases, a growing prevalence of presbyopia among the geriatric population, the increasing preference for contact lenses over traditional eyeglasses, and the rising utilization of contact lenses for aesthetic purposes.

Furthermore, the rising awareness regarding contact lens usage, advancements in contact lens materials, and technological innovations are expected to create market growth opportunities.

The key players profiled in the contact lens market report are Johnson & Johnson Vision Care, Inc. (U.S.), Alcon Inc. (Switzerland), CooperVision, Inc. (U.S.), Bausch + Lomb Corporation (Canada), Carl Zeiss AG (Germany), HOYA Corporation (Japan), Essilor International SA (France), Menicon Co., Ltd. (Japan), UltraVision CLPL (U.K.), STAAR SURGICAL (U.S.), BenQ Materials Corporation (Taiwan), Visioneering Technologies, Inc. (U.S.), Excellent Hi-Care Pvt Ltd (India), and SEED Co., Ltd. (Japan).

Emerging economies like China and India are expected to offer substantial growth opportunities for market players due to several factors, including the expansion of healthcare infrastructure, increased investments in advanced contact lens materials, and the rising awareness of contact lenses in these countries.

Published Date: Aug-2024

Published Date: Jun-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates