Resources

About Us

Induction Heating System Market Size, Share & Forecast by Frequency Range (LF, MF, RF, VHF), Power Output (Below 10 kW, 10-50 kW, 50-100 kW), Application (Metal Melting, Annealing, Heat Treating), Industry - Global Forecast to 2035

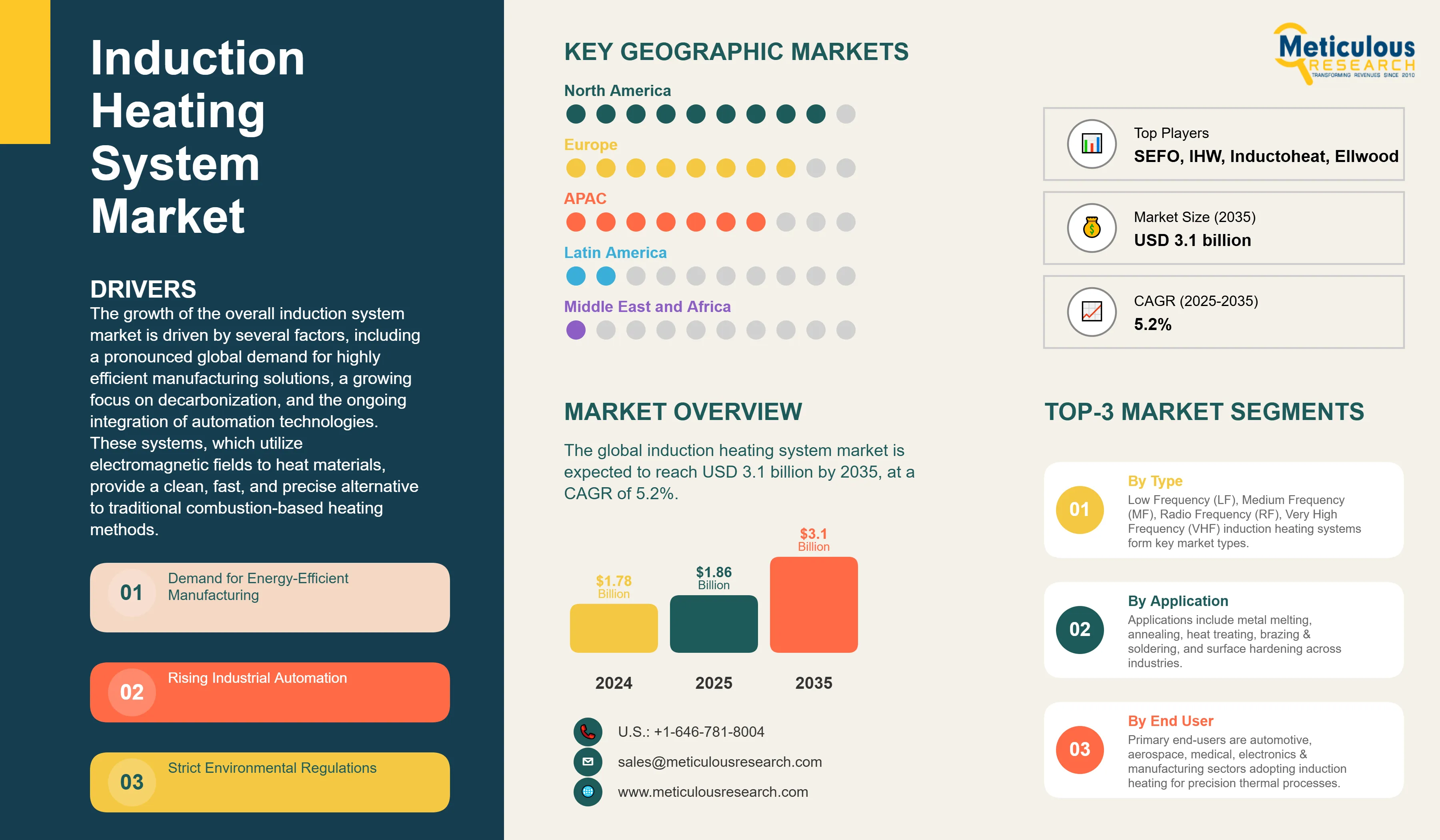

Report ID: MREP - 1041586 Pages: 210 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global induction heating system market was valued at USD 1.78 billion in 2024. The market is expected to reach USD 3.1 billion by 2035 from USD 1.86 billion in 2025, at a CAGR of 5.2%. The global induction heating system market is undergoing a significant expansion, a testament to its role as a cornerstone technology in modern industrial processes.

The growth of the overall induction system market is driven by several factors, including a pronounced global demand for highly efficient manufacturing solutions, a growing focus on decarbonization, and the ongoing integration of automation technologies. These systems, which utilize electromagnetic fields to heat materials, provide a clean, fast, and precise alternative to traditional combustion-based heating methods.

This technological advantage is particularly appealing to industries aiming to improve their environmental footprint while optimizing production workflows. The positive trajectory of the market reflects a broader industrial shift toward sustainable and smart manufacturing practices, positioning induction heating as a critical technology for future industrial development.

Competitive Scenario of the Global Induction Heating System Market and Insights

Click here to: Get Free Sample Pages of this Report

The induction heating market is characterized by a robust competitive landscape, featuring a diverse array of global powerhouses and specialized regional innovators. Companies are competing not just on product quality but on technological sophistication, offering systems that integrate seamlessly with Industry 4.0 platforms, provide advanced controls, and use AI for predictive maintenance. The competitive environment is also shaped by strategic acquisitions and partnerships, as firms seek to expand their product portfolios and geographical reach. Companies are also investing heavily in after-sales support and technical training to secure long-term client relationships and maintain a competitive edge.

Recent Developments

Fives Group Showcases Digital and Sustainable Induction Heating Solutions

In February 2025, Fives Group has been actively showcasing its synergy of induction heating technology and digital solutions at major industry events in 2024 and 2025. The company's focus is on providing high-performance and flexible induction solutions that are environmentally friendly and can be integrated into digitalized factories.

Ambrell Launches EKOHEAT 2 Induction Heating Products with Advanced Monitoring and Precision

In December 2023, Ambrell introduced the new EKOHEAT 2 family of induction heating products. It features a proprietary Advanced Internal Monitoring system. Built with the latest semiconductor technologies, EKOHEAT 2 improves process heating precision and efficiency. It sets new industry standards for digital control, responsiveness, and lower cooling needs. This next-generation system marks a significant progress in Ambrell’s exclusive VPA Technology.

Key Market Drivers

Table: Key Factors Impacting Global Induction Heating System Market (2025–2035)

Base CAGR: 5.2%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

Demand for Energy-Efficient Manufacturing |

Steady adoption by large-scale manufacturers |

Becomes a standard, with widespread adoption |

▲ +2.0% |

|

Rising Industrial Automation |

High integration into advanced manufacturing and robotics |

An integral component of Industry 4.0, driving efficiency |

▲ +1.5% |

|

|

Strict Environmental Regulations |

Growing demand in response to new emission standards |

Fundamental shift away from combustion-based heating |

▲ +1.0% |

|

|

Restraints |

High Initial Capital Investment |

The high upfront cost acts as a significant barrier, slowing |

As economies of scale and financing options |

▼ -1.5% |

|

Requirement for Specialized Skills and Expertise |

Shortage of skilled technicians leads to installation delays |

The impact lessens as industry-wide training programs help bridge the gap |

▼ -0.5% |

|

|

Opportunities |

Renewable Energy Sector |

Initial demand for manufacturing high-quality components |

Massive long-term demand as the global green energy transition |

▲ +1.0% |

|

Growth in Electric Vehicle (EV) Production |

A major driver, that induction heating is a critical technology |

A cornerstone technology in the rapidly expanding EV industry |

▲ +2.0% |

|

|

Trends |

High Initial Capital Investment |

New materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) enhance efficiency |

Becomes a standard feature in induction heating systems, enabling smarter controls |

▲ +0.5% |

|

Challenges |

High Initial Cost and Affordability |

Traditional technologies like gas and electric furnaces |

The challenge diminishes as the long-term benefits and a maturing regulatory environment |

▼ -0.5% |

Regional Analysis

Industrial Modernization and Policy Support Drive the North America Heating System Market

The North American induction heating market is experiencing robust growth, driven by a strong push for industrial modernization and supportive government policies. The region's industrial base, particularly in the automotive, aerospace, and energy sectors, is undergoing a significant transformation towards more efficient and automated manufacturing processes. The U.S. leads regional adoption through extensive automotive manufacturing, aerospace production, and metalworking industries that require precision heating solutions for component manufacturing and heat treatment applications.

Major manufacturers including Ajax Tocco Magnethermic and Ambrell Corporation maintain substantial R&D facilities and manufacturing operations that serve both domestic and international markets. This trend is bolstered by government initiatives aimed at promoting domestic manufacturing and energy efficiency, creating a favourable regulatory environment. The demand for portable induction heating systems is also growing, as these units offer flexibility for on-site repairs and maintenance, further contributing to the market's positive trajectory.

Industrial Expansion and Manufacturing Growth Drive the Asia Pacific Heating System Market

The Asia-Pacific region held a dominant market share in the global induction heating market, characterized by its immense manufacturing scale and rapid technological advancements. Countries such as China and India, with their expansive industrial bases, are at the forefront of this growth. Japan contributes through high-technology manufacturing applications and precision engineering requirements that demand advanced induction heating capabilities for electronics and semiconductor production. South Korea's focus on advanced manufacturing and technology innovation creates opportunities for sophisticated induction heating systems in shipbuilding, automotive, and electronics industries.

The growth of induction heating system in this region is further propelled by significant investments in infrastructure, automotive manufacturing, and a thriving electronics sector. Thus, the focus on improving manufacturing competitiveness, combined with a growing emphasis on energy conservation and environmental compliance, positions the region for sustained leadership in the global market. The sheer volume of industrial activity ensures a constant, high-volume demand for reliable and efficient heating solutions in many countries in the region.

Advanced Manufacturing Excellence and Technological Innovation in Japan Fuels the Market

Japan's induction heating systems market demonstrates substantial growth within the Asia-Pacific region, expanding at a 5.1% CAGR through 2035. This growth is majorly pertaining to the advanced manufacturing ecosystem, particularly in automotive production, where the sector recorded a 15% increment in 2023, driven by accelerating electric vehicle manufacturing and precision component requirements. Japan's extensive industrial automation infrastructure, encompassing a large number of global industrial robots, creates substantial demand for sophisticated induction heating applications across electronics, semiconductor fabrication, and aerospace sectors. Leading domestic manufacturers, including Fuji Electric Co., Ltd., Dai-ichi High Frequency Co., Ltd., and Inductotherm Group Japan, leverage advanced inverter technologies, high-frequency power supplies, and IoT-enabled monitoring systems to deliver energy-efficient solutions tailored for precision thermal processing. The Japanese market benefits significantly from the country’s ventures in decarbonization and sustainable manufacturing practices, with government incentives promoting clean energy technologies and carbon emission reductions across industrial sectors.

UK’s Industrial Modernization and Regulatory Excellence Shape Industrial Heating System Market Development

The United Kingdom's induction heating systems market exhibits robust growth potential, driven by increasing industrial automation and demand for energy-efficient heating solutions. Key industrial sectors, including automotive, aerospace, electronics, and metallurgy, adopt induction heating technologies for their superior energy efficiency, precise temperature control, and enhanced process repeatability compared to conventional heating methods. The market benefits from the UK's comprehensive regulatory framework addressing electromagnetic emissions, worker safety, and energy efficiency standards, which encourages the adoption of compliant advanced heating systems while ensuring operational safety across industrial applications. Moreover, the industrial decarbonization and government incentives promoting clean technology adoption create favorable conditions for market expansion in the UK, while leading providers focus on expanding service networks and optimizing product portfolios to meet stringent environmental regulations and diverse customer requirements throughout the forecast period.

Segmental Analysis

Low Frequency (LF) Dominates the Induction Heating System Market by Frequency Range

The low-frequency (LF) segment is a cornerstone of the induction heating market, mainly owing to its suitability for heating large, irregularly shaped, and heavy workpieces. Systems operating at lower frequencies have a greater depth of penetration, which is ideal for applications such as forging, melting, and stress relieving. This makes them the preferred choice in heavy industries, including steel manufacturing, foundry operations, and metalworking. The dominance of this segment is a direct reflection of the significant demand from these foundational industrial sectors, which rely on the high power and deep heating capabilities that low-frequency systems provide. The market for low-frequency (LF) is expected to grow at a notable pace over the forecast period.

By End-Use Industry, the Automotive Sector Drives Induction Heating System Market Expansion Owing to Component Manufacturing Demand

The automotive industry holds the largest share of the overall induction heating system market through extensive utilization of induction heating for component heat treatment, brazing, welding, and assembly processes that enhance vehicle quality and durability. Electric vehicle production creates additional opportunities for induction heating in battery component manufacturing, motor assembly, and charging infrastructure production that requires precision thermal management. The aerospace and defense sector demonstrates strong growth through requirements for lightweight, high-strength components necessitating advanced heat treatment processes with precise temperature control and repeatability.

The electronics and semiconductor industries expand adoption for specialized heating applications in component manufacturing and assembly processes requiring contamination-free environments and precise thermal profiles. Metal processing and mining industries utilize induction heating for smelting, forging, and material treatment applications that benefit from energy efficiency and environmental advantages compared to conventional heating methods.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 1.86 billion |

|

Revenue forecast in 2035 |

USD 3.1 billion |

|

CAGR (2025-2035) |

5.2% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers, and restraints |

|

Segments covered |

Frequency Range (Low Frequency (LF), Medium Frequency (MF), Radio Frequency (RF), Very High Frequency (VHF)) Application (Metal melting, annealing, heat treating, brazing, soldering, and surface hardening) Power Output (Below 10 kW, 10-50 kW, 50-100 kW, over 100 kW) Industry (Automotive, aerospace, medical, electronics) Control Mode (Manual, semi-automatic, automatic), Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

|

Key companies profiled |

SEFO, ABP Induction Systems, IHW, CEC Induction, Riello Induction, Inductoheat, Ellwood, LINTEC, American Induction Heating Corporation |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models. |

Market Segmentation

The Induction Heating System Market size is estimated to be USD 1.86 billion in 2025 and grow at a CAGR of 5.2% to reach USD 3.1 billion by 2035.

In 2024, the Induction Heating System Market size was estimated at USD 1.78 billion, with projections to reach USD 1.86 billion in 2025.

SEFO, ABP Induction Systems, IHW, CEC Induction, Riello Induction, Inductoheat, Ellwood, LINTEC, and American Induction Heating Corporation are the major companies operating in the Induction Heating System Market.

The Asia-Pacific region is experiencing the fastest growth in the induction heating system market due to a powerful combination of factors. The region's rapid industrialization, particularly in countries like China and India, has created a massive demand for advanced manufacturing technologies. This is further fueled by a strong and expanding automotive sector, including the booming production of electric vehicles (EVs), which relies heavily on induction heating for processes such as heat treating, forging, and welding.

In 2025, Low Frequency accounted for the largest market share in the induction heating system market.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Induction Heating System Market, by Frequency Range

3.2.2. Induction Heating System Market, by Power Output

3.2.3. Induction Heating System Market, by Capacity

3.2.4. Induction Heating System Market, by Industry

3.2.5. Induction Heating System Market, by Control Mode

3.2.6. Induction Heating System Market, by Geography

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Demand for Energy-Efficient Manufacturing

4.2.1.2. Rising Industrial Automation

4.2.1.3. Strict Environmental Regulations

4.2.2. Restraints

4.2.2.1. High Initial Capital Investment

4.2.2.2. Requirement for Specialized Skills and Expertise

4.2.2.3. Limited Flexibility and Application-Specific Constraints

4.2.3. Opportunities

4.2.3.1. Renewable Energy Sector

4.2.3.2. Growth in Electric Vehicle (EV) Production

4.2.3.3. Food and Beverage Industry

4.2.4. Trends

4.2.4.1. High Initial Capital Investment

4.2.4.2. Complexity and Need for Skilled Labor

4.2.4.3. Specific Application Requirements

4.2.5. Challenges

4.2.5.1. High Initial Cost and Affordability

4.2.5.2. Shortage of Skilled Installers

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Induction Heating System Market

4.4.1. Power Electronics and Semiconductor Materials

4.4.1.1. Impact on Efficiency

4.4.1.2. Compact and Lighter Designs

4.4.2. Industry 4.0 Integration (IoT, AI, and Automation)

4.4.2.1. IoT for Real-Time Monitoring and Data Analytics

4.4.2.2. Automation and Control Systems

4.4.3. Coil Design and Materials Science

4.4.3.1. Advanced Coil Designs

4.4.3.2. Heat-Resistant Materials

5. Impact of Sustainability on Induction Heating System Market

5.1. Market Growth Driven by Decarbonization Efforts

5.2. Enhanced Energy Efficiency

5.3. Elimination of Emissions and Waste

5.4. Integration with the Renewable Energy Sector

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Induction Heating System Market Assessment—By Frequency Range

7.1. Overview

7.2. Low Frequency (LF)

7.3. Medium Frequency (MF)

7.4. Radio Frequency (RF)

7.5. Very High Frequency (VHF)

8. Induction Heating System Market Assessment—By Application

8.1. Overview

8.2. Metal Melting

8.3. Annealing

8.4. Heat Treating

8.5. Brazing and Soldering

8.6. Surface Hardening

9. Induction Heating System Market Assessment—By Power Output

9.1. Overview

9.2. Below 10 kW

9.3. 10-50 kW

9.4. 50-100 kW

9.5. Over 100 kW

10. Induction Heating System Market Assessment—By Industry

10.1. Overview

10.2. Automotive

10.3. Aerospace

10.4. Medical

10.5. Electronics

10.6. Manufacturing

10.7. Others

11. Induction Heating System Market Assessment—By Control Mode

11.1. Overview

11.2. Manual

11.3. Semi-Automatic

11.4. Automatic

12. Induction Heating System Market Assessment—By Geography

12.1. Overview

12.2. North America

12.2.1. U.S.

12.2.2. Canada

12.3. Europe

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Netherlands

12.3.5. Switzerland

12.3.6. Rest of Europe

12.4. Asia-Pacific

12.4.1. China

12.4.2. Japan

12.4.3. South Korea

12.4.4. Taiwan

12.4.5. India

12.4.6. Singapore

12.4.7. Australia

12.4.8. Rest of Asia-Pacific

12.5. Latin America

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Argentina

12.5.4. Rest of Latin America

12.6. Middle East & Africa

12.6.1. UAE

12.6.2. Saudi Arabia

12.6.3. Israel

12.6.4. South Africa

12.6.5. Rest of Middle East & Africa

13. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

13.1. Inductotherm Group (Inductoheat, Inc.)

13.2. Ajax TOCCO Magnethermic Corporation

13.3. Ambrell Corporation

13.4. Interpower Induction LLC

13.5. Radyne Corporation

13.6. CEIA S.p.A.

13.7. EFD Induction (Norican Group)

13.8. Eldec Induction GmbH

13.9. SMS Elotherm GmbH

13.10. GH Induction Atmospheres

13.11. Himmelwerk GmbH

13.12. RDO Induction LLC

13.13. Induction Technology Solutions (Inductronix)

13.14. EMAG Machine Tools (eldec)

13.15. Pillar Induction Company

13.16. Thermatool Corp.

13.17. Ultraflex Power Technologies

13.18. Park Ohio Holdings Corp. (Ajax TOCCO)

13.19. Nippon Avionics Co., Ltd.

13.20. Fuji Electronic Industrial Co., Ltd.

13.21. HeatTek Inc.

13.22. Across International LLC

13.23. Miller Electric Manufacturing LLC

13.24. Other Key Players

14. Appendix

14.1. Available Customization

14.2. Related Reports

Published Date: May-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates