Resources

About Us

Storage Water Heater Market Size, Share, Forecast & Trends by Energy Source (Electric, Gas), Capacity (400 Liters, 250-400 Liters, 100-250 Liters, 30-100 Liters, <30 Liters), Capacity (Commercial, Residential), Geography- Global Forecast to 2035

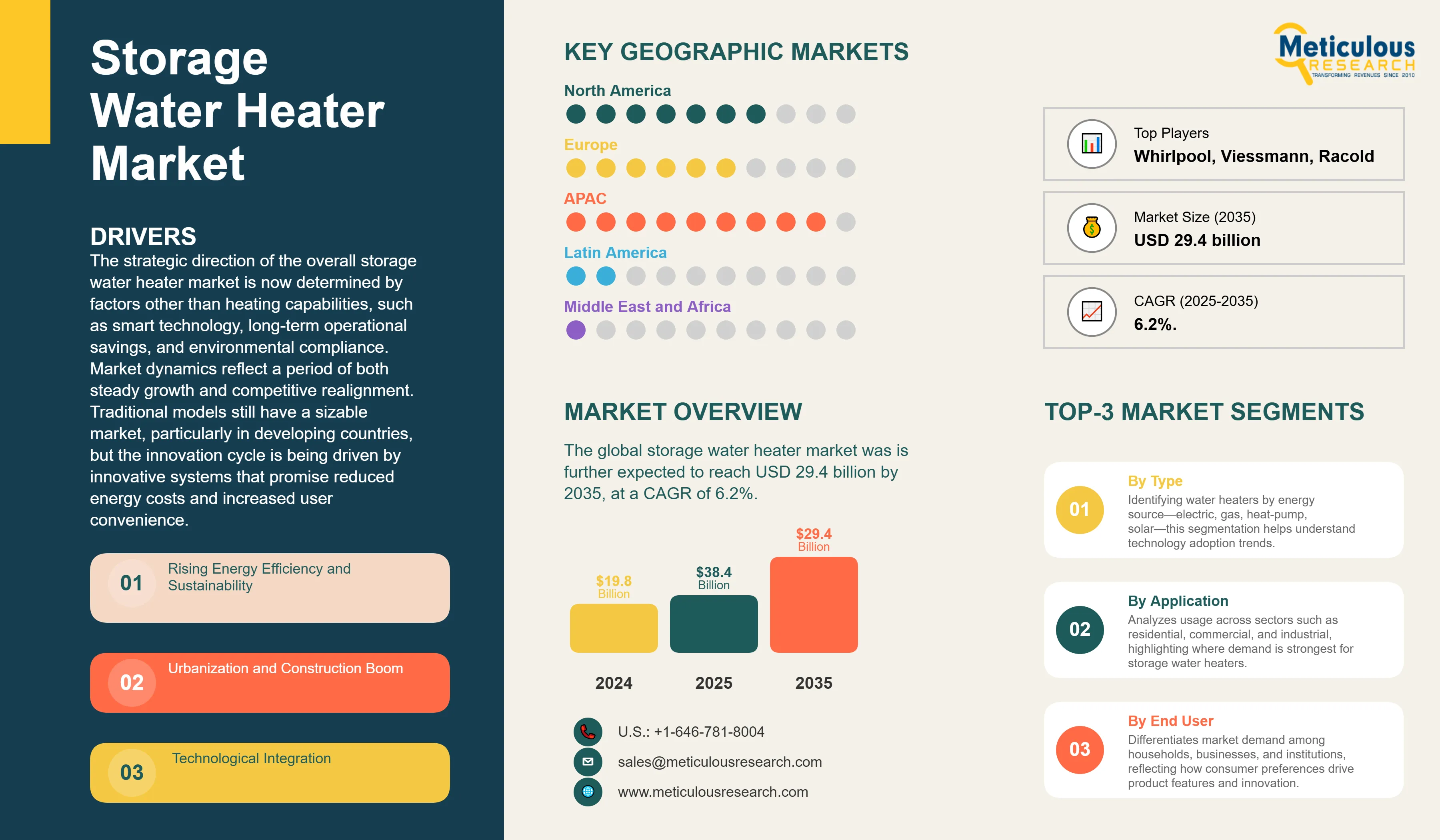

Report ID: MREP - 1041583 Pages: 205 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global storage water heater market was valued at USD 19.8 billion in 2024. The market is further expected to reach USD 29.4 billion by 2035 from USD 38.4 billion in 2025, at a CAGR of 6.2%. A fundamental shift toward connected and energy-efficient solutions, accelerated by shifting consumer preferences and a global emphasis on sustainability, characterizes the global market for storage water heaters.

The strategic direction of the overall storage water heater market is now determined by factors other than heating capabilities, such as smart technology, long-term operational savings, and environmental compliance. Market dynamics reflect a period of both steady growth and competitive realignment. Traditional models still have a sizable market, particularly in developing countries, but the innovation cycle is being driven by innovative systems that promise reduced energy costs and increased user convenience.

The primary factors propelling the optimistic outlook of storage water heater market are the growing middle-class population globally and ongoing infrastructure development, which consistently generate new demand for reliable water heating solutions.

Competitive Scenario of Global Storage Water Heater Market and Insights

Click here to: Get Free Sample Pages of this Report

The global storage water heater market is fiercely competitive, with a strategic mix of local specialists and multinational corporations. Major international players rely on extensive distribution networks, strong R&D capabilities, and established brand awareness to stay ahead of the competition. They have a competitive advantage thanks to their wide range of products, which includes both high-capacity commercial units and small residential models. These companies are actively engaged in M&A and strategic alliances to expand their market share and penetrate emerging markets. Companies such as A.O. Smith, Rheem Manufacturing Company, and Ariston Thermo are well known for their robust product lines and commitment to energy efficiency. A.O. Smith, for instance, focuses on commercial-grade quality for residential applications and provides durable products with warranties.

Recent Developments in Storage Water Heater Market

Rheem Manifacturing launched "Engineered for Life" brand

In 2025, Rheem Manifacturing announced the launch of its "Engineered for Life" brand identity. This initiative emphasizes the company's legacy of durability, innovation, and a long-term commitment to creating reliable and sustainable solutions.

Ariston Thermo Group’s acquisition of DDR Heating

In 2025, Ariston Thermo Group acquired a 100% stake in DDR Heating, a U.S.-based manufacturer of tubular electric heaters. This acquisition marks a strategic entry point into the North American components market for Ariston's Components Division.

Key Market Drivers

Key Market Restraints

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

Rising Energy Efficiency and Sustainability |

Rising energy costs and government incentives |

Efficiency becomes a standard expectation, with heat pumps and hybrid technologies |

▲ +2.0% |

|

Urbanization and Construction Boom |

Rapid residential and commercial construction creates high- demand |

Continued population growth and infrastructure development |

▲ +1.5% |

|

|

Technological Integration |

Tech-savvy consumers and early adopters |

Smart features such as remote control, energy monitoring, and predictive maintenance |

▲ +1.0% |

|

|

Restraints |

Energy Price Volatility |

The high upfront cost of advanced and efficient models |

Economies of scale and increasing subsidies help lower costs |

▼ −1.5% |

|

Complex Installation |

Consumers prioritize tankless models for space-saving designs |

As the market matures, the competitive dynamic stabilizes consumer needs |

▼ −1.0% |

|

|

Opportunities |

Replacement of Aging Infrastructure |

New government mandates and financial incentives |

Widespread global decarbonization efforts establish electric-based storage water heaters |

▲ +1.5% |

|

Emerging Economies |

A strong replacement cycle in mature markets |

This opportunity sustains steady growth |

▲ +0.5% |

|

|

Trends |

Shift to Hybrid and Heat Pump Systems |

Consumers begin to embrace hybrid models |

Heat pump water heaters have become a mainstream solution |

▲ +1.5% |

|

Challenges |

Competition from Instantaneous (Tankless) Water Heaters |

A limited number of qualified technicians |

Industry training programs and simplified system designs help alleviate this bottleneck |

▼ −0.5% |

Regional Analysis

Urbanization and Infrastructure Development in Asia Pacific Drive Regional Market Leadership

Asia Pacific dominates the global storage water heater market, with the highest market share, driven by massive urbanization, rising disposable incomes, and comprehensive infrastructure development across major economies. Other growth variables reflect rapid urban development, government incentives promoting energy-efficient appliances, and extensive construction of residential and commercial buildings. Economies such as China, India, Japan, South Korea among others benefit from substantial manufacturing capabilities, competitive pricing, and established distribution networks that facilitate market penetration across diverse consumer segments.

India demonstrates significant growth potential through expanding middle-class populations, increasing electrification rates, and government initiatives promoting modern appliances in urban and rural areas. Japan and South Korea contribute through advanced technology development and premium efficiency standards, while Southeast Asian countries including Thailand, Vietnam, and Indonesia represent emerging opportunities through rapid economic development and urbanization trends. The region benefits from competitive manufacturing costs, established supply chains, and growing consumer awareness of energy-efficient technologies that support continued market expansion throughout the forecast period.

Energy Efficiency Standards and Retrofit Programs Accelerate Market Expansion in Europe

Europe represents a mature and technologically advanced storage water heater market, growing at a steady CAGR of 6%, driven by stringent energy efficiency regulations, comprehensive retrofit programs, and government incentives promoting sustainable heating technologies. The region's aging building stock creates substantial opportunities for modernization and equipment replacement, with old, inefficient water heaters increasingly replaced by energy-efficient models meeting current environmental standards.

European Union directives mandating energy labeling, efficiency standards, and carbon emission reductions create favorable regulatory environments for advanced water heating technologies. The region emphasizes integration with renewable energy systems, heat pump technologies, and smart city initiatives that optimize energy consumption across urban environments. European manufacturers focus on premium efficiency ratings, advanced materials, and innovative designs that exceed regulatory requirements while providing superior performance and reliability throughout product lifecycles.

U.S. Storage Water Heater Market is Driven by Efficiency and Smart Technology Adoption

The U.S. maintains significant market influence through advanced technology development, comprehensive energy efficiency programs, and established consumer awareness of energy conservation benefits. The market benefits from federal and state incentive programs including tax credits, utility rebates, and energy efficiency standards that encourage adoption of high-performance water heating systems. Major manufacturers including A.O. Smith, Rheem, and Bradford White maintain substantial R&D investments in heat pump technologies, smart controls, and advanced materials that establish global industry standards. The country's mature construction industry and comprehensive building codes create demand for energy-efficient systems in both new construction and retrofit applications. Regional variations in climate conditions and energy costs drive diverse product requirements, from high-efficiency electric models in moderate climates to advanced heat pump systems in regions with favorable conditions. Moreover, additional factors such as established distribution networks, professional installation services, and comprehensive technical support facilitate adoption of storage water heaters systems across the U.S. throughout the forecast period.

Manufacturing Superiority and Government Policy Support Drive Rapid Market Expansion

China holds a significant share of the Asia Pacific storage water heater market through robust manufacturing capabilities, comprehensive government support programs, and massive domestic demand driven by rapid urbanization and rising living standards. The storage water heater market in China characterizes government incentives promoting energy-efficient appliances, extensive construction activities, and increasing consumer preference for modern water heating systems.

Government initiatives including energy-saving product subsidies, building efficiency standards, and smart city development programs create favorable conditions for advanced water heater adoption across residential and commercial sectors. Major domestic manufacturers leverage competitive production costs, established supply chains, and technological innovation to serve both local and international markets.

The country's extensive infrastructure development including new residential complexes, commercial buildings, and industrial facilities creates substantial demand for high-capacity storage water heater systems. China's commitment to carbon neutrality by 2060 drives investment in energy-efficient technologies and renewable energy integration that supports continued market growth throughout the forecast period. Additionally, the market is experiencing a shift in consumer behavior, with a growing middle class moving away from low-cost, basic models toward more technologically advanced, energy-efficient products.

Segmental Analysis

Electric Storage Water Heater Holds Highest Market Share Due to Widespread Adoption and Better Efficiency

The electric storage water heater segment holds the largest share of the overall storage water heater market through widespread electrical infrastructure availability, advanced efficiency technologies, and comprehensive product ranges addressing diverse capacity requirements. Electric systems benefit from heat pump technology integration, smart controls, and advanced insulation that deliver superior efficiency ratings compared to conventional resistance heating methods.

Moreover, the widespread availability of electricity, the simplicity of installation, and the lower initial purchase price compared to gas-powered alternatives further drives the product adoption. In many developing regions, where gas infrastructure is either limited or non-existent, electric water heaters are the only viable option, solidifying their market leadership. Furthermore, the continuous improvement in insulation technology and the development of smart, energy-efficient electric models are helping to address historical concerns about their operational costs, making them a more compelling choice for a growing number of consumers.

Residential Segment Fuels Surge in Storage Water Heater Demand Owing to Consistent Replacement Demand and Increasing Consumer Awareness

The residential sector dominates the storage water heater market, holding the largest share by application in 2025. The demand in this segment is mainly fueled by a global population increase, ongoing housing development, and the essential need for hot water in daily household activities. The rise in disposable incomes, especially in emerging economies, is enabling more consumers to purchase water heaters, moving away from traditional, less sanitary methods. The ongoing trend of homeowners investing in smart home technology is also benefiting this segment, with a growing number of consumers opting for smart, connected water heaters that enhance convenience and provide energy management capabilities. The market is highly consumer-driven, with purchasing decisions influenced by factors such as brand reputation, product design, and warranty terms. The combination of new installations and a steady replacement cycle ensures that the residential market is set to remain the primary engine of growth for the storage water heater industry over the forecast period.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 38.4 billion |

|

Revenue forecast in 2035 |

USD 29.4 billion |

|

CAGR (2025-2035) |

6.2% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers, and restraints |

|

Segments covered |

Energy Source (Electric, Gas), Capacity (400 Liters, 250-400 Liters, 100-250 Liters, 30-100 Liters, <30 Liters), Capacity (Commercial, Residential), Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

|

Key companies profiled |

Saudi Ceramics, Viessmann Group, A.O. Smith, General Electric Appliances, Whirlpool Corporation, Havells India Limited, State Water Heaters, Nihon Itomic, Bosch Thermotechnology, Racold, Jaquar Group, Rheem Manufacturing Company, Ariston Thermo, Linuo Ritter International, Ferroli, Groupe Atlantic, Rinnai Corporation, Hubbell Inc., Bradford White Corporation, Vaillant Group, Haier Group Corporation |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models. |

Market Segmentation

The Storage Water Heater Market size is estimated to be USD 38.4 billion in 2025 and grow at a CAGR of 6.2% to reach USD 29.4 billion by 2035.

In 2024, the Storage Water Heater Market size was estimated at USD 19.8 billion, with projections to reach USD 38.4 billion in 2025.

Saudi Ceramics, Viessmann Group, A.O. Smith, General Electric Appliances, Whirlpool Corporation, Havells India Limited, State Water Heaters, Nihon Itomic, Bosch Thermotechnology, Racold, Jaquar Group, Rheem Manufacturing Company are the major companies operating in the Storage Water Heater Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035), driven by the growing middle class in the region is increasingly able to invest in more energy-efficient and technologically advanced home appliances, including storage water heaters.

In 2025, electric accounted for the largest market share in the storage water heater market, with residential being the leading type of segment.

Published Date: Jul-2025

Published Date: Oct-2025

Published Date: Oct-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates