Resources

About Us

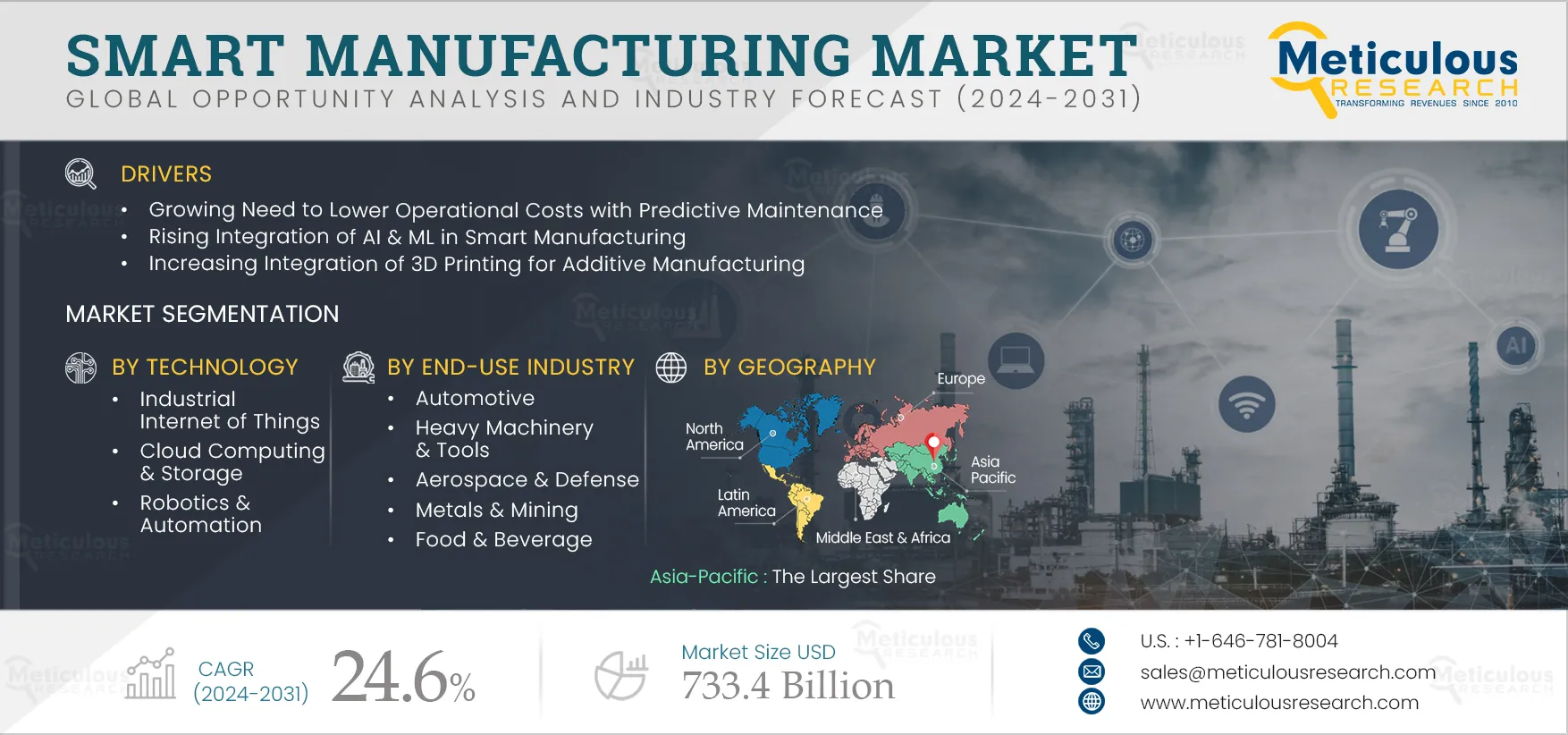

Smart Manufacturing Market Size, Share, Forecast, & Trends Analysis by Technology (Industrial IoT, AR/VR, Robotics & Automation, Blockchain), Application (Surveillance & Safety, Inventory & Warehouse Management, Quality Management), End-use Industry, and Geography - Global Forecast to 2031

Report ID: MRICT - 104579 Pages: 280 Aug-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThis market’s growth is driven by the rising need to reduce operational costs with predictive maintenance, the surge in the integration of AI & ML in smart manufacturing, and the integration of 3D printing for additive manufacturing. Additionally, the advent of 5G connectivity in smart manufacturing and the proliferation of smart manufacturing in developing countries are expected to generate growth opportunities for the players operating in this market. Furthermore, some of the prominent market trends include smart manufacturing-as-a-service and the growing integration of smart technologies that improve supply chain management.

Click here to: Get Free Sample Pages of this Report

The integration of advanced technologies such as AI & ML aids manufacturing facilities in improving productivity, quality, and operational efficiency. By implementing these technologies, manufacturers gain valuable insights, optimize processes, and make better decisions in real time. In addition, by integrating AI & ML, manufacturers improve failure prediction and maintenance planning by applying AI algorithms to production data. AI assists in identifying patterns and anomalies in data, enabling early detection of equipment malfunctions or breakdowns.

Moreover, the integration of AI & ML helps in utilizing manufacturing processes by identifying errors, optimizing production schedules, and enhancing resource allocations. This leads to streamlined operations, reduced cycle times, improved productivity, and saves on cost. With the increasing advantages of AI and ML in manufacturing, several key players are launching smart manufacturing solutions with AI & ML to automate and optimize key manufacturing workflows.

For instance, in March 2021, SAP SE (Germany) partnered with Plataine Ltd. (U.S.) to integrate IIoT and AI-based software for digital manufacturing. This partnership allows customers to benefit from a holistic smart factory solution that extends across production operations.

Manufacturing facilities are increasingly integrating advanced technologies such as automation, AI/ML, the Internet of Things (IoT), AR/VR, and robotics into their processes, enabling them to use 5G connectivity for efficient and fast results. In the manufacturing process, wired or wireless technologies such as Wi-Fi and cellular are used for operation; however, reliability and scalability are major challenges. To overcome this, manufacturers are increasingly integrating 5G connectivity across the entire manufacturing value chain for low latency and better security. Thus, 5G augments IoT capacity by supporting multiple sensors and devices, leading to extensively connected factories.

Moreover, automation and information technology are essential to Industry 4.0; integrating 5G connectivity assists manufacturing facilities in connected asset monitoring, connected warehouse, logistics & fleet management, and quality management. With the increasing adoption of Industry 4.0 in manufacturing facilities, several key players are launching 5G Advanced Wireless Connectivity Software for Industry 4.0.

For instance, in February 2024, Radisys Corporation (U.S.) launched 5G Advanced Wireless Connectivity Software designed specifically for Industry 4.0 and private 5G networks. This software is aimed at enabling enterprises to meet the rising demand for private 5G and Industry 4.0 solutions. Such growing developments help increase the demand for 5G connectivity in smart manufacturing solutions during the forecast period.

Smart Manufacturing-as-a-Service

Smart Manufacturing-as-a-Service (SMaaS) combines IT and operational systems data, enabling manufacturers to swiftly alter processes on the factory floor and across the value chain. Smart manufacturing enhances manufacturing operations through a portfolio of innovative technologies, including robotic process automation, big data analytics, and computerized controls, aiming toward maximum productivity at minimum cost.

As smart technology is already present in the cloud, SMaaS enables breakthrough end-to-end supply chain management innovations. These new technologies and service providers allow businesses to open visibility to the entire asset and product life cycle. The connected factory concept aids real-time collaboration, ensuring optimization of productivity and cost. Moreover, leading supply chain players utilizing Industry 4.0 are better positioned to keep an eye on their assets and logistics operations. Tracking and maintaining cloud-enabled deliveries, setting up a virtualized infrastructure to ensure the entire supply chain network adheres to compliance and regulatory guidelines. Considering the benefits offered by the implementation of SMaaS, the manufacturing industry is widely opting for it.

In 2024, the Industrial Internet of Things Segment to Dominate the Smart Manufacturing Market

Based on Technology, the smart manufacturing market is segmented into industrial internet of things, cloud computing & storage, robotics & automation, industrial cybersecurity, additive manufacturing, augmented reality (AR)/virtual reality (VR), digital twin, artificial intelligence, and blockchain. In 2024, the industrial Internet of Things segment is expected to account for the largest share of over 33.4% of the smart manufacturing market. The expanding use of industrial IoT in smart manufacturing to make data-driven choices about all aspects of manufacturing, help businesses cut down on asset downtime, and enhance overall equipment effectiveness is responsible for this segment's significant market share.

However, the blockchain segment is expected to register the highest CAGR during the forecast period. This segment's growth is attributed to the increasing integration of blockchain in the manufacturing process, which enhances inventory management, better traceability, and transparency and enables real-time data analysis and detection of high-value equipment movement.

In 2024, the Surveillance & Safety Segment to Dominate the Smart Manufacturing Market

Based on Application, the smart manufacturing market is surveillance & safety, quality management, resource optimization, inventory & warehouse management, machine inspection & maintenance, production planning, energy management, and other applications. In 2024, the surveillance & safety segment is expected to account for the largest share of over 21.1% of the smart manufacturing market. The segment's significant market share is due to the expanding need for dependable safety systems to guarantee asset and personal security, as well as the growing use of video surveillance technology, which enables manufacturers to actively monitor locations and take prompt action in response to real-time data.

Moreover, a number of businesses are concentrating on establishing a 5G network in diverse industrial facilities in order to offer fast and low-latency security solutions. For instance, in May 2021, Capgemini SE (France) collaborated with Telefonaktiebolaget LM Ericsson (Sweden) to accelerate the deployment of 5G solutions for various industries, including autonomous intralogistics AIV (autonomous intelligent vehicle), smart health, and smart surveillance for worker safety.

However, the inventory & warehouse management segment is expected to register the highest CAGR during the forecast period. The increasing use of smart technologies to streamline inventory, labeling, packing, stocking, and storing procedures in manufacturing facilities as well as the growing incorporation of RFID, robotics, and IoT into inventory warehouse management to track material movements in real-time from planning to production are the main factors contributing to the market growth.

In 2024, the Automotive Segment to Dominate the Smart Manufacturing Market

Based on End-use Industry, the smart manufacturing market is automotive, heavy machinery & tools, aerospace & defense, metals & mining, electronics & semiconductors, medical devices, food & beverage, pharmaceuticals, oil & gas, fast-moving consumer goods (FMCG), paints & chemicals, energy & power, pulp & paper, and other end-use industries. In 2024, the automotive segment is expected to account for the largest share of over 14.3% of the smart manufacturing market. This segment's large market share is due to the growing adoption of smart manufacturing in automotive, which allows manufacturers to predict events in the manufacturing process and plan ahead of time, as well as the increasing integration of digital twins in automotive manufacturing for product testing and predictive maintenance. Automotive manufacturers are increasingly implementing robot-human collaboration for complex tasks to improve workplace safety and efficiency.

However, the pharmaceuticals segment is expected to register the highest CAGR during the forecast period. This segment’s growth is attributed to the growing use of smart technologies in pharmaceutical manufacturing, reduced downtime between batches and streamlined operations, increased productivity, and reduced costs, and increasing adoption of industrial IoT in pharmaceutical manufacturing for real-time tracking of inventory levels to ensure optimal stock management, reduce waste, and ensure availability.

In 2024, Asia-Pacific Region to Dominate the Smart Manufacturing Market

In 2024, Asia-Pacific is expected to account for the largest share of over 37.3% of the smart manufacturing market. Asia-Pacific's substantial share of the market can be attributed to the region's expanding government initiatives for Industry 4.0 and to technology advancements such as digital twin integration and human-robot collaboration in manufacturing facilities. The region's top firms are investing more in industrial automation and predictive maintenance.

For instance, in August 2021, Hexagon AB (Sweden) partnered with Central Manufacturing Technology Institute (CMTI) (India) to establish a Smart Manufacturing Development and Demonstration Cell (SMDDC), an Industry 4.0 Centre of Excellence and Experience Centre.

Moreover, Asia-Pacific is expected to register the highest CAGR of over 26.5% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the smart manufacturing market are International Business Machines Corporation (U.S.), Siemens AG (Germany), Microsoft Corporation (U.S.), SAP SE (Germany), Capgemini SE (France), ABB Ltd (Switzerland), Deutsche Telekom AG (Germany), Telefónica, S.A. (Spain), Accenture plc (Ireland), TE Connectivity Ltd. (Switzerland), NXP Semiconductors N.V. (Netherlands), Telefonaktiebolaget LM Ericsson (Sweden), Intel Corporation (U.S.), Tata Consultancy Services Limited (India), Cisco Systems, Inc. (U.S.), Honeywell International, Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Robert Bosch GmbH (Germany), Rockwell Automation, Inc (U.S.), and Schneider Electric SE (France).

Smart Manufacturing Industry Overview: Latest Developments from Key Industry Players

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

24.6% |

|

Market Size (Value) |

USD 733.4 Billion by 2031 |

|

Segments Covered |

By Technology

By Application

By End-use Industry

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Netherlands, Spain, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, Australia & New Zealand, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, Israel, and Rest of the Middle East & Africa) |

|

Key Companies |

International Business Machines Corporation (U.S.), Siemens AG (Germany), Microsoft Corporation (U.S.), SAP SE (Germany), Capgemini SE (France), ABB Ltd (Switzerland), Deutsche Telekom AG (Germany), Telefónica, S.A. (Spain), Accenture plc (Ireland), TE Connectivity Ltd. (Switzerland), NXP Semiconductors N.V. (Netherlands), Telefonaktiebolaget LM Ericsson (Sweden), Intel Corporation (U.S.), Tata Consultancy Services Limited (India), Cisco Systems, Inc. (U.S.), Honeywell International, Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Robert Bosch GmbH (Germany), Rockwell Automation, Inc (U.S.), and Schneider Electric SE (France) |

Key questions answered in the smart manufacturing market report:

The Smart Manufacturing Market encompasses technologies and solutions that integrate automation, artificial intelligence (AI), the Internet of Things (IoT), and advanced analytics to improve manufacturing processes. This includes optimizing production efficiency, reducing operational costs, and enhancing product quality through smart technologies.

The Smart Manufacturing Market was valued at $133.1 billion in 2023.

The market is expected to reach $733.4 billion by 2031, growing from an estimated $157 billion in 2024.

The estimated size of the Smart Manufacturing Market in 2024 is $157 billion.

Key players include:

A significant trend is Smart Manufacturing-as-a-Service (SMaaS), which combines IT and operational data to enable more agile manufacturing processes. Additionally, there is an increased focus on integrating advanced technologies like AI, IoT, and robotics for enhanced operational efficiency.

Key drivers include:

The market is segmented by:

The global outlook is positive, with strong growth expected due to increasing technological advancements and the adoption of Industry 4.0 principles. The Asia-Pacific region is projected to dominate the market, driven by government initiatives and significant investments in automation.

The market is experiencing significant growth, driven by technological advancements, increased efficiency needs, and the growing importance of data analytics in manufacturing processes.

The Smart Manufacturing Market is projected to grow at a CAGR of 24.6% from 2024 to 2031.

The Asia-Pacific region is expected to hold the highest market share, accounting for over 37.3% of the Smart Manufacturing Market in 2024.

Published Date: Aug-2024

Published Date: Oct-2022

Published Date: Jul-2024

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates