Resources

About Us

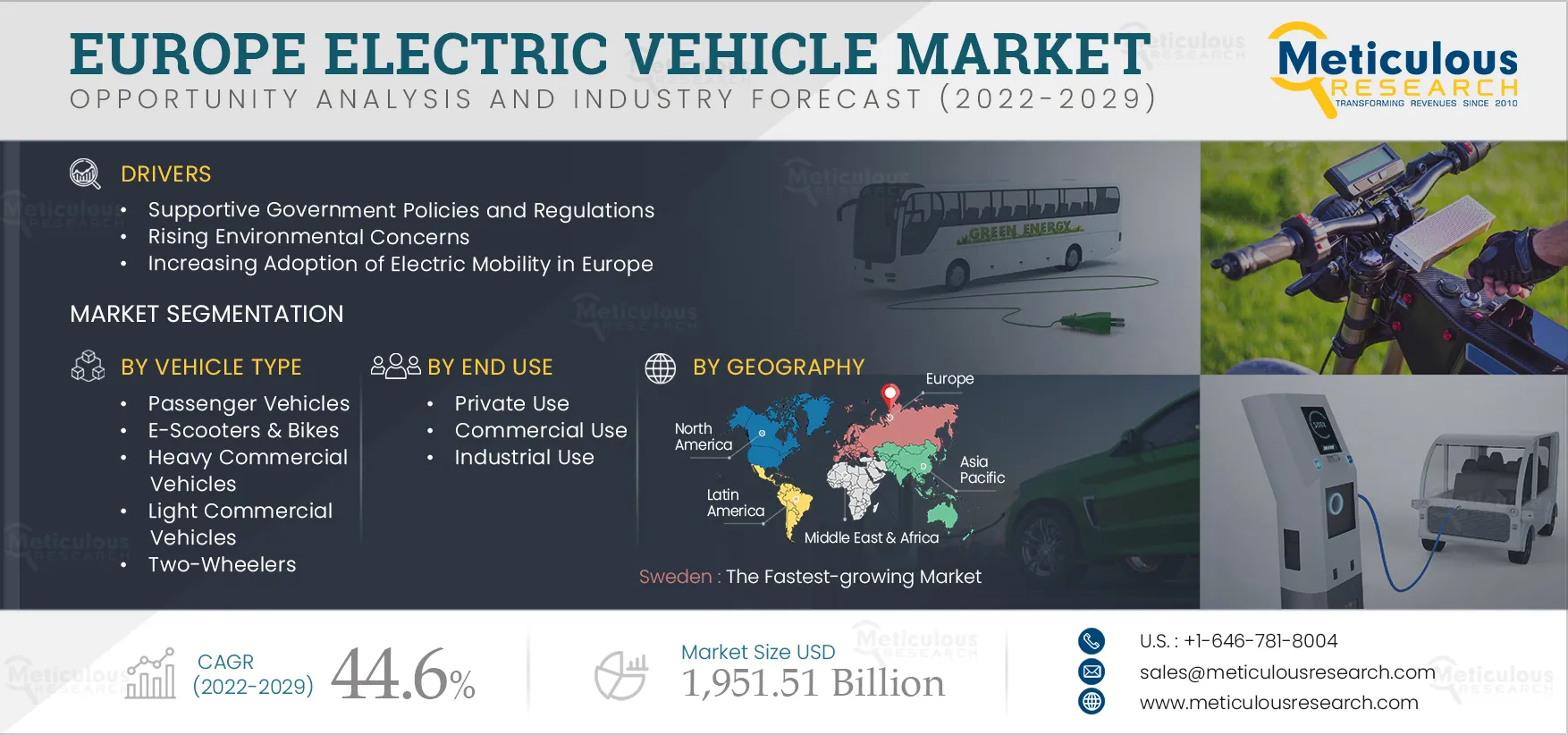

Europe Electric Vehicle Market by Vehicle Type (Passenger Vehicle, LCV, HCV, Two-wheeler, e-Scooters & Bikes); Propulsion Type (BEV, FCEV, HEV); Power Output (Less Than 100kW, 100 kW to 250 kW); End Use, Charging Standard, and Country—Forecasts to 2029

Report ID: MRAUTO - 104540 Pages: 195 Jun-2021 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market is attributed to supportive government policies and regulations, rising environmental concerns, and increasing adoption of electric mobility in Europe. The growing adoption of autonomous driving vehicles, increasing adoption of electric vans and trucks for delivery, and increasing shared mobility trends offer lucrative growth opportunities for this market's growth.

The COVID-19 outbreak has caused a widespread economic downturn as several countries imposed strict lockdowns to contain the infection, resulting in the closure of manufacturing industries and disruptions in supply chains and production schedules. There has been a significant impact on technology supply chains across several countries. During the lockdowns in Europe, several manufacturing facilities, supply chains, and consumer demands were paralyzed in the first half of 2020.

The Electric Vehicle market in Europe was moderately affected. As a result, the market is estimated to witness a slow recovery from 2022. Several governments supported the automotive industry by regulating policies that benefitted both consumers and manufacturers. Incentives and subsidies were notably increased on purchasing an EV in countries such as Germany, the U.K., and Norway. Also, the prices for batteries continued to reduce, which helped increase the adoption rate of EVs in these countries. The sale of EVs was doubled in 2020, as compared to the previous year. Developed countries such as Germany, France, the U.K., and Norway commanded most of the stakes in this sale. Thus, the market is anticipated to grow significantly during the forecast period.

In March 2022, the French government announced the launch of a €100 million ($ 120.7 million) funding program to support the installation of fast-charging stations for electric cars. This funding support will be provided to companies planning to invest in EV charging stations in service areas located along public motorways and the national road network. This funding aims at equipping all service areas with fast charging stations by the end of 2022.

Furthermore, the French government had announced in October 2020 that it aims to have 100,000 public charging points in operation by the end of 2022. Such funding programs are expected to boost the adoption rate of EVs in Europe.

The Europe Electric Vehicle Market is segmented based on vehicle type, propulsion type, power output, charging standard, end use, and country. The study also evaluates industry competitors and analyses the market at the country level.

Click here to: Get Free Sample Copy of this report

The European government is prioritizing the adoption of electric vehicles to help to improve air quality. Increasing the adoption of electric vehicles to control pollution and carbon emissions, growing awareness about the use of electric vehicles to reduce emissions, and stringent government rules and emissions regulations towards vehicle emission are driving the demand for EVs and contributing to the growth of this market. Several governments offer financial incentives, such as tax exemptions and rebates, subsidies, and reduced parking/toll fees for EVs, to encourage the adoption of zero-emission vehicles.

In 2018, the Government of Denmark announced plans to ban the sale of fossil fuel-powered vehicles by 2022. Also, in 2019, Colombia set a target to deploy 600,000 EVs on its roads to reduce emissions significantly by 2030. Additionally, in 2018, the Government of Italy announced plans to have 1 million electric vehicles on the roads of Italy by 2022.

Thus, rising environmental concerns and increasing government initiatives to reduce harmful pollutants and improve air quality are expected to increase EV demand and drive the growth of this market.

Based on vehicle type, the Europe Electric Vehicle Market is segmented into passenger vehicles, light commercial vehicles, heavy commercial vehicles, two-wheelers, and e-scooters & bikes. In 2022, the light commercial vehicles segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is mainly driven by the growing awareness regarding the role of electric vehicles in reducing emissions, rising demand for electric vehicles to reduce fleet emissions, and stringent government rules and regulations towards vehicle emissions.

In addition, electric LCVs are a key element of urban distribution and transport systems and offer a promising low-emission solution. They require low maintenance and have relatively lower operating costs due to the non-requirement of lubricating the engines and the maintenance costs associated with gas engines. Electric LCVs contribute to reducing greenhouse gas emissions and the dependence on fuels. Hence, These are the key factors driving the adoption of electric light commercial vehicles.

Based on propulsion type, the Europe Electric Vehicle Market is segmented into battery electric vehicles, hybrid vehicles, and fuel cell electric vehicles. In 2022, the fuel cell electric vehicles segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is mainly driven by the increasing demand for vehicles with low carbon emissions, growing emphasis on the adoption of FCEVs due to advantages such as fast refueling, and increasing government initiatives and investments for advancing fuel cell technology.

Several major players and governments in Europe are encouraging the use of hydrogen fuel cells for vehicles through various policies, investments, and regulations. For instance, in 2019, Proton Motor Fuel Cell GmbH (Germany) collaborated with Schafer Elektronik GmbH (Germany) to launch a new joint venture—NEXUS-e GmbH—for the development, production, and marketing of fuel cell-based quick-charging stations.

Based on power output, the Europe Electric Vehicle Market is segmented into less than 100kW, 100kW to 250kW, and more than 250kW. In 2022, the 100 kW to 250 kW segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is mainly driven by the increasing adoption of electric buses and trucks, mainly for public transportation and freight service applications.

In addition, several companies in Europe are introducing new EVs, including light commercial vehicles such as vans, pick-up trucks, and buses with advanced technologies and power outputs ranging from 100kW to 250kW.

Based on end use, the Europe Ev Market is segmented into private use, commercial use, and industrial use. In 2022, the commercial use segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is mainly driven by the increase in fuel prices and stringent emission norms set by governments, the growing adoption of autonomous delivery vehicles, and the increasing adoption of electric buses and trucks.

In addition, several manufacturers and suppliers in countries such as Spain, the U.S., France, and Japan are focused on improving battery and charging technology efficiency for commercial EVs. Electric commercial vehicles help lower greenhouse gas emissions, reduce dependence on fossil fuels, ensure smooth operation, and meet the latest emissions regulations. Electric buses are the most commonly used EVs for commercial applications. E-trucks are used for distribution and courier services. According to a leading research firm, by 2030, e-trucks such as vans or articulated lorries will account for approximately 15% of European truck sales. All these factors are expected to boost the adoption of EVs for commercial use in the coming years.

Sweden is expected to record the highest CAGR during the forecast period. Growing consumer interests in adopting EVs over traditional cars, the increasing number of projects undertaken by the companies operating in the electric mobility industry, and growing government support for enhancing the sales of EVs across the country are some of the factors anticipated to drive the growth of this market in Sweden.

Electric mobility stakeholders in Sweden are actively investing in pilot projects for electric vehicles' wireless charging. For instance, in 2015, Evatran installed its Plugless system of inductive wireless chargers in 20 electric vehicles located in Gothenburg, Stockholm, and Uppsala. This project was financed by the Swedish Energy Agency.

Moreover, major automotive OEMs in the country are launching new electric vehicles for private and commercial use. For instance, in 2022, Scania launched a fully electric truck to achieve a fossil-free commercial transport system and decarbonize the heavy transport system. Also, in 2019, Swedish fuel cell technology developer PowerCell Sweden AB received an order worth €121,869 to deliver PowerCell S2 fuel cell stacks to automotive OEMs in China.

Key Players

The key players operating in the Europe Electric Vehicle Market are BMW Group (Germany), Volkswagen AG (Germany), AB Volvo (Sweden), Daimler AG (Germany), Alcraft Motor Company Ltd. (U.K.), Groupe Renault (France), Stellantis N.V. (Netherlands), DAF Truck N.V. (Netherlands), Iveco s.p.A. (Italy), and Volta Trucks AB (Sweden).

Key Questions Answered in the Report:

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Jan-2024

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates