Resources

About Us

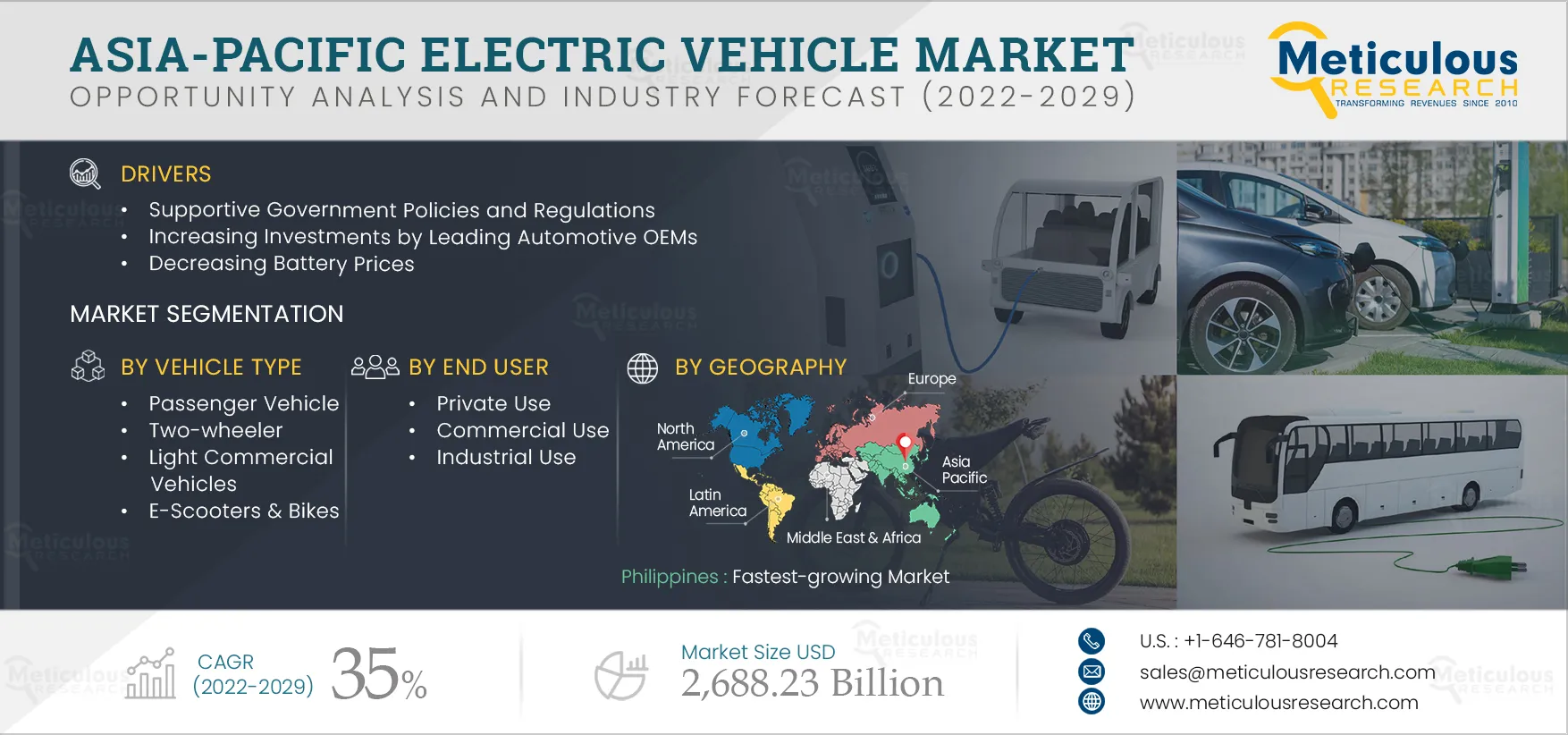

Asia-Pacific Electric Vehicle Market by Vehicle Type (Passenger Vehicle, LCV, HCV, Two-wheeler, e-Scooters & Bikes); Propulsion Type (BEV, FCEV, HEV); Power Output (Less Than 100kW, 100 kW to 250 kW); End Use, Charging Standard, and Country - Forecast to 2029

Report ID: MRAUTO - 104549 Pages: 153 Jul-2022 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe Asia-Pacific Electric Vehicle Market is expected to grow at a CAGR of 35% from 2022 to 2029 to reach $2,688.23 billion by 2029. By volume, this market is expected to reach 389.62 million units by 2029, at a CAGR of 30.3% during the forecast period. The growth of this market is attributed to supportive government policies and regulations, increasing investments by leading automotive OEMs, and decreasing prices of batteries. Increasing adoption of electric mobility in emerging economies and increasing EV and battery manufacturing capabilities in Southeast Asia provides lucrative growth opportunities for the growth of this market.

Impact of COVID-19 on the Asia-Pacific Electric Vehicle Market

The outbreak of the COVID-19 pandemic severely impacted several sectors, including the automotive sector, with major manufacturers shutting down their operations completely or operating at reduced capacities following the directives issued by their respective governments. The automotive industry was also severely affected by the nationwide lockdowns and quarantines. Uncertainty regarding the duration of the lockdown and supply-chain disruptions made it more difficult for industry players to anticipate the recovery of the industry. This crisis caused structural shifts that had significant implications on the market.

The COVID-19 pandemic declined the demand for EVs across India, but the incentives offered by the Indian Government are expected to promote exponential growth of the EVs market in the coming years. For instance, in May 2021, the Indian government rolled out a Production-Linked Incentive Scheme (PLI) for ACC Battery Storage Manufacturing, which will incentivize the domestic production of batteries and limit the dependency on imports. This scheme is expected to support the EV industry with the requisite infrastructure and significantly cause a reduction in the cost of EVs.

Moreover, the policymakers of India are developing a mobility option that is “Shared, Connected, and Electric” and have projected an ambitious target of achieving 100 percent electrification by 2030. In addition to this, a study by the CEEW Centre for Energy Finance (CEEW-CEF) states that the Indian EV market will be a $206 billion opportunity by 2030 if India maintains steady progress to meet its ambitious 2030 target. This would require a cumulative investment of over $180 billion in electric vehicle production and charging infrastructure. Additionally, a study by the India Energy Storage Alliance (IESA) states that the Indian EVs market will grow at a CAGR of 36% by 2026.

The EV batteries market is also projected to grow at a CAGR of 30% during the same period. Hence, the abundance of renewable energy resources and the availability of skilled manpower in the technology and manufacturing sectors are expected to fuel the growth of the EVs market in the coming years.

The Asia-Pacific electric vehicle market is segmented based on vehicle type, propulsion type, power output, charging standard, end use, and country. The study also evaluates industry competitors and analyses the market at the country level.

Click here to: Get Free Sample Pages of this Report

Decreasing Battery Prices to Support Market growth

Battery electric vehicle mainly include passenger cars, autonomous delivery vehicle, industrial vehicle, and public transport vehicle. However, the cost and range limitations associated with EV batteries are a major restraining factor for the complete transition to electric mobility. Its capacity determines the cost of an electric vehicle battery in kilowatt-hours (kWh), which dictates its range and the power level of the motor that it supplies. Advancements in battery technologies have brought down the cost of EV battery per kWh. Today, EV battery manufacturers are aiming to provide EV manufacturers with high-capacity batteries with reduced battery prices to ensure the overall cost of a vehicle falls under the subsidized range.

Government initiatives across Asia-Pacific to phase out fossil fuel-powered vehicle, increasing concerns raised over the environmental impacts of conventional vehicle, improvements in battery capacity, and supporting government policies and regulations to set up battery manufacturing capabilities are promoting the growth of this market.

In 2020, the Government of India announced its plans to invest $4.6 billion in incentives for setting up advanced battery manufacturing facilities and promoting the use of EVs. Also, the Government of India announced to retain import tax rate of 5% for EV batteries until 2022 to support local manufacturing. Therefore, such initiatives are expected to reduce the total manufacturing cost of batteries, thus promoting the adoption of electric vehicle in the coming years.

According to a report by BloombergNEF, the average price per kilowatt-hour for batteries is expected to be approximately $100/kWh by 2023, making it possible for EVs to be priced the same as comparable gasoline-powered vehicle.

Several players in the market are incorporating advanced technologies and focusing on ways to reduce the vehicle’s battery size effectively, cost and improve its performance and power to weight ratio. In 2020, Samsung SDI (South Korea) commercialized a li-ion battery product that would replace liquid electrolytes in a battery cell with a solid electrolyte to improve battery performance. Such developments by major players in reducing the vehicle’s battery size and improving its performance for EVs also contribute to the overall market growth.

Key Findings in the Asia-Pacific Electric Vehicle Market Study:

Light commercial vehicle Segment Expected to Grow at Highest CAGR During Forecast period

Based on vehicle type, the Asia-Pacific electric vehicle market is segmented into passenger vehicle, light commercial vehicle, heavy commercial vehicle, two-wheelers, and e-scooters & bikes.

The light commercial vehicle segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is mainly driven by the growing awareness regarding the role of electric vehicle in reducing emissions, rising demand for electric vehicle to reduce fleet emissions, and stringent government rules and regulations towards vehicle emissions.

Electric LCVs are a key element of urban distribution and transport systems and offer a promising low-emission solution. They require low maintenance and have relatively lower operating costs due to the non-requirement of lubricating the engines and lack of maintenance costs associated with gas engines. Electric LCVs contribute to the reduction of greenhouse gas emissions and lower the dependence on fuels. Hence, these are the key factors driving the adoption of electric light commercial vehicle.

Fuel Cell Electric Vehicle Segment Expected to Grow at Highest CAGR During Forecast Period

Based on propulsion type, the Asia-Pacific electric vehicle market is segmented into battery electric vehicle, hybrid vehicle, and fuel cell electric vehicle. The fuel cell electric vehicle segment is expected to grow at the highest CAGR during the forecast period.

The high growth rate of this segment is mainly driven by the increasing demand for vehicle with low carbon emissions, a growing emphasis on the adoption of FCEVs due to advantages, such as fast refueling, and increasing government initiatives and investments for advancing fuel cell technology. Several major players and governments across Asia-Pacific are trying to encourage the use of hydrogen fuel cells for vehicle through various policies, investments, and regulations.

100kW to 250kW Segment Expected to Grow at Highest CAGR During Forecast Period

Based on power output, the Asia-Pacific electric vehicle market is segmented into less than 100kW, 100kW to 250kW, and more than 250kW. The 100kW to250 kW segment is expected to grow at the highest CAGR during the forecast period.

The high growth rate of this segment is attributed to the increasing adoption of electric buses and trucks, mainly for public transportation and freight service applications. Power output between 100kW–250kW is widely utilized in EVs, such as passenger vehicle and light commercial vehicle, including vans, pick-up trucks, and utility vehicle.

The adoption of these EVs is increasing due to the rise in fuel prices and government initiatives for lowering fleet emissions of buses and trucks. Transport authorities worldwide are formulating policies to increase the number of electric buses for mass transit, which further supports the growth of this segment.

Commercial Use Segment Expected to Grow at Highest CAGR During Forecast Period

Based on end use, the Asia-Pacific electric vehicle market is segmented into private use, commercial use, and industrial use. The commercial use segment is expected to grow at the highest CAGR during the forecast period. The high growth rate of this segment is mainly driven by the increase in fuel prices and stringent emission norms set by governments, the growing adoption of autonomous delivery vehicle, and the increasing adoption of electric buses and trucks.

Several manufacturers and suppliers in countries including Japan, France, and the U.S., are focused on improving battery and charging technology efficiency for commercial EVs. Electric commercial vehicle help lower greenhouse gas emissions, reduce dependence on fossil fuels, ensure smooth operation, and meet the latest emissions regulations.

The Philippines to be Fastest-growing Market in Asia-Pacific

The Philippines is expected to record the highest CAGR during the forecast period. The Philippines EVs market is largely driven by the local government initiatives to encourage investments in electric mobility and the adoption of cleaner technologies.

In early 2018, The Department of Transportation (DOTr) launched a Public Utility Vehicle (PUV) modernization program aimed at phasing out fossil fuel-powered vehicle in public transportation and replacing them with environmentally friendly alternatives. The Electric Vehicle Association of the Philippines (EVAP) forecasts an annual growth rate of 8-12% with revenue generation of $33.6 million from services and sales of approximately 200,000 units of electric vehicle by 2024.

Key Players

The key players operating in the Asia-Pacific electric vehicle market are TATA Motors Limited (India), BYD Company Ltd. (China), Honda Motor Co., Ltd. (Japan), Nissan Motor Co., Ltd. (Japan), Hyundai Motor Company (South Korea), Yamaha Motor Co., Ltd. (Japan), Hero MotoCorp Ltd. (India), Ather Energy Pvt. Ltd. (India), Geely Automobile Holdings Limited (China), and XPeng Inc. (China).

Scope of the Report:

Asia-Pacific Electric Vehicle Market, by Vehicle Type

Asia-Pacific Electric Vehicle Market, by Propulsion Type

Asia-Pacific Electric Vehicle Market, by Power Output

Asia-Pacific Electric Vehicle Market, by End Use

Asia-Pacific Electric Vehicle Market, by Country

Key Questions Answered in the Report:

The Asia-Pacific electric vehicles market report covers the market size & forecasts by vehicle type, propulsion type, power output, charging standard, end use, and country. The market study involves the value analysis of various electric vehicles segments at the country level.

The Asia-Pacific electric vehicles market is poised to grow at a CAGR of 35% from 2022 to 2029 to reach $ 2,688.23 billion by 2029.

Based on the vehicle type, the passenger vehicles segment is expected to account for the largest share of the Asia-Pacific electric vehicles market in 2022.

Based on end use, the private use segment is expected to account for the largest share of the Asia-Pacific electric vehicles in 2022.

The growth of this market is attributed to supportive government policies and regulations, increasing investments by leading automotive OEMs, and decreasing prices of batteries. Increasing adoption of electric mobility in emerging economies and increasing EV and battery manufacturing capabilities in Southeast Asia provides lucrative growth opportunities for the growth of this market.

The key players operating in Asia-Pacific electric vehicles market are TATA Motors Limited (India), BYD Company Ltd. (China), Honda Motor Co., Ltd. (Japan), Nissan Motor Co., Ltd. (Japan), Hyundai Motor Company (South Korea), Yamaha Motor Co., Ltd. (Japan), Hero MotoCorp Ltd. (India), Ather Energy Pvt. Ltd. (India), Geely Automobile Holdings Limited (China), and XPeng Inc. (China).

The Philippines is projected to offer significant growth opportunities for the vendors in this market due to the local government initiatives to encourage investments in electric mobility and the adoption of cleaner technologies.

Published Date: Aug-2024

Published Date: Jan-2024

Published Date: May-2022

Published Date: Jan-2022

Published Date: Jun-2021

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates