Resources

About Us

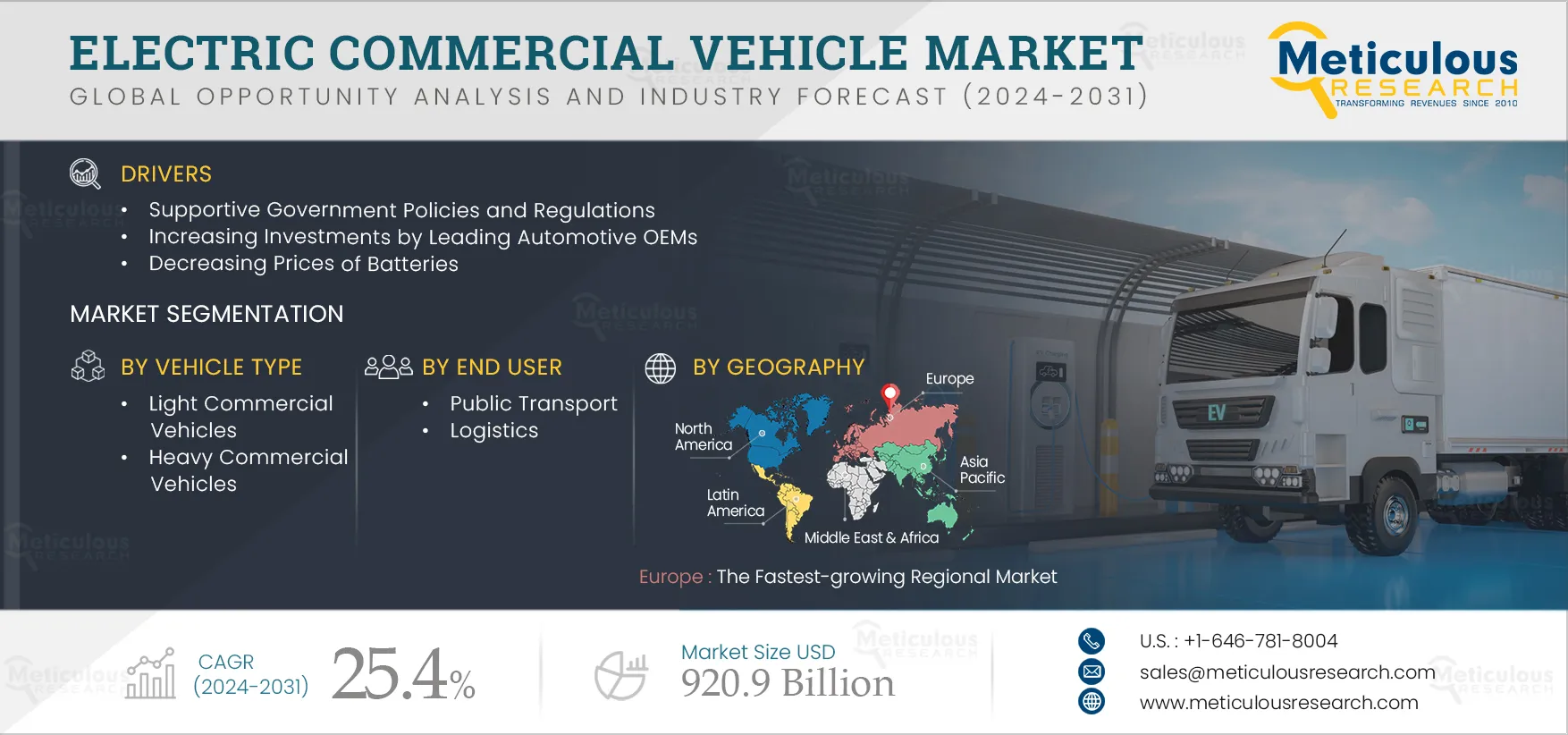

Electric Commercial Vehicle Market by Vehicle Type (Light Commercial Vehicles and Heavy Commercial Vehicles), Propulsion Type (BEV and HEV), Power Output, End User (Public Transport and Logistics), and Geography - Global Forecast to 2032

Report ID: MRAUTO - 1041083 Pages: 250 Aug-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportThe Electric Commercial Vehicle Market is expected to reach $920.9 billion by 2032, at a CAGR of 25.4% from 2025–2032. By Volume, this market is projected to reach 9.4 million units by 2032, at a CAGR of 26.3% from 2025–2032. The growth of the electric commercial vehicle market is driven by supportive government policies and regulations, increasing investments by leading automotive OEMs, and decreasing prices of batteries. However, the high purchasing costs of electric vehicles and the lack of charging infrastructure in developing countries restrain the growth of this market.

Furthermore, growing scope in emerging economies and growth in smart city & infrastructure projects are expected to offer significant growth opportunities for players operating in the electric commercial vehicle market. However, the range limitations of electric vehicles and the lack of reliable performance in heavy-duty applications may hinder the growth of this market.

Governments around the world are implementing policies and regulations to support EV adoption. Financial incentives, such as tax credits and rebates, are being offered to encourage consumers to purchase electric vehicles. These incentives are helping reduce the upfront costs of electric vehicles, making them more affordable for consumers. Electric light commercial vehicles (LCV) include pick-up trucks, minivans, and three-wheeler vehicles used to transport goods. Retail MNCs and transport fleet operators are increasingly shifting to electric light commercial vehicles due to improved battery capacities, an expanding lineup of attractive new models, reductions in fleet emissions, and growing charging station networks.

The mass production of batteries and the attractive tax incentives offered by governments have further reduced these vehicles' costs, making electric light commercial vehicles much more cost-effective. For instance, in July 2024, the government of India is planning to renew the subsidy scheme for the Faster Adoption and Manufacturing of Electric Vehicles scheme or FAME 3.0. The subsidy is likely to cover light commercial vehicles along with supporting research and development in the renewable energy sector. In June 2024, the U.S. Department of Transportation provided USD 1.7 billion in grants for buying zero- and low-emission buses, with the money going to transit projects in 46 states and territories. The grants will enable transit agencies and state and local governments to buy 1,700 U.S.-built buses, nearly half of which will have zero carbon emissions. Such government initiatives help to drive the growth of electric commercial vehicles during the forecast period.

Click here to: Get Free Sample Pages of this Report

Based on vehicle type, the global electric commercial vehicle market is segmented into light commercial vehicles and heavy commercial vehicles. The heavy commercial vehicles segment is sub-segmented into electric tractors, electric trucks, and other commercial vehicles. The light commercial vehicles segment is projected to register the highest CAGR during the forecast period due to the growing awareness regarding the role of electric commercial vehicles in reducing carbon emissions, the increase in demand for electric vehicles to reduce fleet emissions, and stringent government rules and regulations towards electric vehicles.

Based on propulsion type, the global electric commercial vehicle market is segmented into battery electric vehicles and hybrid electric vehicles. The hybrid electric vehicles segment is sub-segmented into pure hybrid electric vehicles and plug-in hybrid electric vehicles. The battery electric vehicles segment is projected to register the highest CAGR during the forecast period due to the increasingly stringent emission standards, rising demand for increased fuel efficiency, growing demand for zero-emission vehicles, and a continuous reduction in battery prices.

Based on power output, the global electric commercial vehicle market is segmented into less than 100 kW, 100 kW to 250 kW, and more than 250 kW. The 100 kW to 250 kW segment is projected to register the highest CAGR during the forecast period due to the increasing adoption of electric buses and trucks, mainly for public transportation and freight service applications.

Based on end user, the global electric commercial vehicle market is segmented into public transport and logistics. The public transport segment is projected to register the highest CAGR during the forecast period due to the increase in fuel prices and stringent emission norms set by governments, the growing adoption of autonomous delivery vehicles, and the increasing adoption of electric buses and trucks.

Based on geography, the electric commercial vehicle market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Europe is projected to record the highest CAGR during the forecast period. The growth of this regional market is majorly attributed to the increasing adoption of electric mobility in emerging economies, supportive government subsidies & tax rebates for promoting EVs, the growing adoption of autonomous delivery vehicles, and the increasing adoption of electric buses and trucks for public transport and freight services.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading players over the past three-four years. The key players operating in the global electric commercial vehicle market include NFI Group Inc. (Canada), AB Volvo (Sweden), Traton SE (Germany), Mercedes-Benz Group AG (Germany), Zhengzhou Yutong Bus Co., Ltd. (China), Ford Motor Company (U.S.), Tesla Inc. (U.S.), Ashok Leyland Limited (India), Tata Motor Limited (India), Olectra Greentech Limited (India), Groupe Renault (France), BMW AG (Germany), BYD Company Ltd. (China), DAF Trucks N.V. (Netherlands), and Workhorse Group Inc. (U.S.).

|

Particular |

Details |

|

|

Number of Pages |

250 |

|

|

Format |

|

|

|

Forecast Period |

2025–2032 |

|

|

Base Year |

2024 |

|

|

CAGR (Value) |

25.4% |

|

|

Estimated Market Size (Value) |

$920.9 billion by 2032 |

|

|

CAGR (Volume) |

26.3% |

|

|

Estimated Market Size (Volume) |

9.4 million units by 2032 |

|

|

Segments Covered |

By Vehicle Type

By Propulsion Type

By Power Output

By End User

By Geography

|

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), Latin America, and Middle East & Africa |

|

|

Key Companies |

|

The global electric commercial vehicle market is projected to reach $920.9 billion by 2032, at a CAGR of 25.4% from 2025–2032.

In 2025, the light commercial vehicles segment is expected to account for the larger share of the global electric commercial vehicle market. The growth of this segment is attributed to the growing awareness regarding the role of electric commercial vehicles in reducing carbon emissions, the increase in demand for electric vehicles to reduce fleet emissions, and stringent government rules and regulations towards electric vehicles.

The growth of the electric commercial vehicle market is driven by supportive government policies and regulations, increasing investments by leading automotive OEMs, and decreasing prices of batteries.

Furthermore, growing scope in emerging economies and growth in smart city & infrastructure projects are expected to offer significant growth opportunities for players operating in the electric commercial vehicle market.

The key players operating in the global electric commercial vehicle market include NFI Group Inc. (Canada), AB Volvo (Sweden), Traton SE (Germany), Mercedes-Benz Group AG (Germany), Zhengzhou Yutong Bus Co., Ltd. (China), Ford Motor Company (U.S.), Tesla Inc. (U.S.), Ashok Leyland Limited (India), Tata Motor Limited (India), Olectra Greentech Limited (India), Groupe Renault (France), BMW AG (Germany), BYD Company Ltd. (China), DAF Trucks N.V. (Netherlands), and Workhorse Group Inc. (U.S.).

Published Date: Sep-2024

Published Date: Jan-2024

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates