Resources

About Us

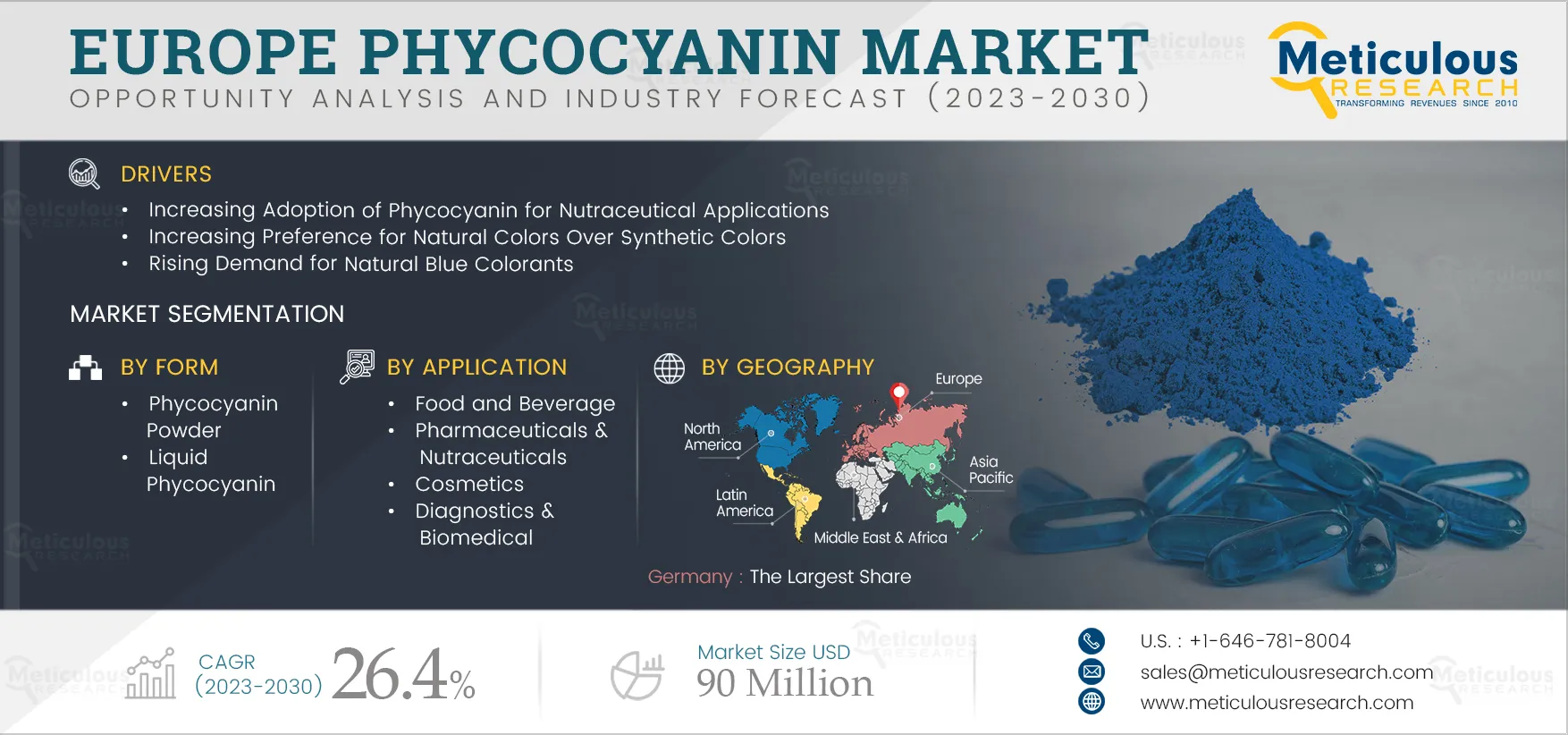

Europe Phycocyanin Market by Form (Powder, Liquid), Grade (Food Grade Phycocyanin, Cosmetic Grade Phycocyanin, Reagent and Analytical Grade Phycocyanin), Application (Food and Beverages, Pharmaceuticals and Nutraceuticals)–Forecast To 2030

Report ID: MRFB - 104804 Pages: 115 Apr-2023 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThis report is executed in collaboration with the European Algae Biomass Association (EABA). Combining Meticulous Research®’ market intelligence services with EABA’s broad expertise in the development of research, technology and industrial capacities in the field of algae, the two organizations have leveraged their research capabilities to come up with the most reliable and accurate market assessments in this field.

The Europe Phycocyanin Market is projected to reach $90 million by 2030, at a CAGR of 26.4% from 2023 to 2030. In terms of volume, the Europe phycocyanin market is projected to reach 1,138 tons by 2030, at a CAGR of 32.1% from 2023–2030. The growth of this market is mainly driven by the increasing adoption of phycocyanin for nutraceutical applications, the increasing preference for natural colors over synthetic colors, the rising demand for natural blue colorants, and increasing venture investments in phycocyanin production. However, the high prices of natural colorants, high costs of extracting and purifying phycocyanin, and complexities in algae production restrain the growth of this market. Additionally, the high potential of phycocyanin in pharmaceutical applications and increasing consumer awareness regarding clean-label products are expected to create growth opportunities for the players operating in the Europe phycocyanin market.

Phycocyanin has remarkable nutritional value and is used in dietary supplements due to its high protein content. Phycocyanin can also impart an intense blue color to various products. It is water-soluble, natural, and non-toxic and has anticancer, antioxidant, antiviral, and anti-inflammatory properties. Further, it boosts immune system function and helps the body fight off diseases. These benefits are driving the demand for phycocyanin in the nutraceuticals sector. Nutraceuticals are functional foods with health-promoting or disease-preventing properties.

Europe's population has become more health conscious and has increased the adoption of nutritional supplements to achieve dietary goals. For instance, according to the Food Supplements Europe survey conducted in 2021 across 14 EU countries, 52% of 13,200 respondents consumed supplements to maintain their overall health. Additionally, the demand for natural and organic products has grown, and so has the demand for plant-based products and functional foods due to the rapidly increasing geriatric population in Europe. According to Eurostat, in 2022, approximately 21.1% of the population in the EU was aged 65 or above. Thus, the growing demand for nutraceuticals is expected to drive the adoption of phycocyanin for the production of nutraceuticals.

In recent years, phycocyanin has been increasingly preferred as a natural alternative to synthetic nutraceutical ingredients due to its potential health benefits. This has enabled key players to successfully market phycocyanin as a multi-nutrient supplement or nutraceutical agent. Thus, the increasing adoption of phycocyanin for nutraceutical applications is expected to drive the growth of the Europe phycocyanin market.

Click here to: Get a Free Sample Copy of this report

In 2023, the Phycocyanin Powder Segment is Expected to Dominate the Europe Phycocyanin Market

Based on form, the Europe phycocyanin market is segmented into phycocyanin powder and liquid phycocyanin. In 2023, the phycocyanin powder segment is expected to account for the largest share of the Europe phycocyanin market. The large market share of this segment is mainly attributed to the benefits offered by phycocyanin powder, such as easy solubility and digestibility. Additionally, the powdered form allows active nutrient delivery and offers high flexibility with dosing. Thus, phycocyanin powder is highly used as a colorant and functional component in the food & beverage and cosmetic industries, contributing to its large market share.

However, the liquid phycocyanin segment is projected to register the highest CAGR during the forecast period. The growth of this segment is mainly driven by the increasing demand for liquid phycocyanin for applications in dietary supplements and personal care products.

In 2023, the Food Grade Phycocyanin Segment is Expected to Dominate the Europe Phycocyanin Market

Based on grade, the Europe phycocyanin market is segmented into food-grade phycocyanin, cosmetic-grade phycocyanin, and reagent- & analytical-grade phycocyanin. In 2023, the food-grade phycocyanin segment is expected to account for the largest share of the Europe phycocyanin market due to the increasing use of phycocyanin as an alternative to synthetic colors in the food & beverage industry, the growing awareness about the adverse effects of synthetic colors, and the increasing demand for clean-label brands that promote natural colors.

However, the cosmetic-grade phycocyanin segment is slated to register the highest CAGR during the forecast period. The fast growth of this segment is mainly driven by the increasing applications of phycocyanin in the cosmetic industry due to its therapeutic uses and zero to minimal side effects.

In 2023, the Food & Beverages Segment is Expected to Dominate the Europe Phycocyanin Market

Based on application, the Europe phycocyanin market is segmented into food & beverages, pharmaceuticals & nutraceuticals, cosmetics, and diagnostics & biomedical. In 2023, the food & beverages segment is expected to account for the largest share of the Europe phycocyanin market. The large market share of this segment is mainly attributed to the rising trend of replacing artificial colorants with natural colorants in the food industry, growing awareness about the adverse effects of synthetic food colorants on health, and the non-toxic & non-carcinogenic properties of phycocyanin.

However, the cosmetics segment is slated to register the highest CAGR during the forecast period. The fast growth of this segment is driven by the rising demand for natural cosmetics products and increasing awareness among consumers about the adverse effects of synthetic cosmetic products.

In 2023, Germany is Expected to Dominate the Europe Phycocyanin Market

Geographically, the Europe phycocyanin market is segmented into Germany, the U.K., Italy, Spain, the Netherlands, Denmark, Sweden, and the Rest of Europe. In 2023, Germany is expected to account for the largest share of the Europe phycocyanin market. The large share of this market is mainly attributed to the growing demand for natural food colors, the growing food & beverage industry, and rising consumer inclination toward natural, organic, and clean ingredients.

However, Italy is projected to record the highest CAGR during the forecast period. The growth of this market is mainly driven by the growing demand for functional foods, increasing demand for nutraceuticals, and rising health consciousness. Furthermore, the increasing consumer preferences for clean-label products are expected to provide growth opportunities for stakeholders operating in this market.

Key Players

The report offers a competitive landscape based on an extensive assessment of the product portfolio offerings, geographic presences, and key strategic developments adopted by leading market players in this market in the last three to four years. The key players operating in the Europe phycocyanin market include AlgoSource (France), Bluetec Naturals Co., Ltd (China), DIC Corporation (Japan), E.I.D. - Parry (India) Limited (India), Fuqing King Dnarmsa Spirulina Co., Ltd. (China), Givaudan SA (Switzerland), GNT Group B.V. (Netherlands), Hangzhou OuQi Food co., Ltd. (China), Inner Mongolia Rejuve Biotech Co., Ltd. (China), Jiangshan Comp Spirulina Co., Ltd (China), Merck KGaA (Germany), Phyco-Biotech Laboratories (France), Pond Technologies Inc. (Canada), Qingdao Haizhijiao Biotechnology Co., Ltd (China), Qingdao ZolanBio Co., Ltd. (China), Sensient Technologies Corporation (U.S.), SPIFORM (France), Tianjin Norland Biotech Co., Ltd (China), Xi’an Fengzu Biological Technology Co., Ltd (FZBIOTECH) (China), and Zhejiang Binmei Biotechnology Co., Ltd (China).

Scope of the Report:

Europe Phycocyanin Market Assessment–by Form

Europe Phycocyanin Market Assessment–by Grade

Europe Phycocyanin Market Assessment–by Application

Europe Phycocyanin Market Assessment–Geography

Key Questions Answered in the Report:

Phycocyanin is a blue pigment found in blue-green microalgae such as Arthrospira (Spirulina) platensis and is widely used in various industries, such as food & beverages, cosmetics, pharmaceuticals, and nutraceuticals due to its antioxidant, anticancer, and anti-inflammatory properties. This study provides valuable insights into the phycocyanin market segmented by form, grade, application, and geography.

The Europe phycocyanin market is projected to reach $90 Million by 2030, at a CAGR of 26.4% from 2023 to 2030.

The cosmetics segment is projected to record the fastest growth rate during the forecast period 2023–2030.

The key players operating in the Europe phycocyanin market include AlgoSource (France), Bluetec Naturals Co., Ltd (China), DIC Corporation (Japan), E.I.D. - Parry (India) Limited (India), Fuqing King Dnarmsa Spirulina Co., Ltd. (China), Givaudan SA (Switzerland), GNT Group B.V. (Netherlands), Hangzhou OuQi Food co., Ltd. (China), Inner Mongolia Rejuve Biotech Co., Ltd. (China), Jiangshan Comp Spirulina Co., Ltd (China), Merck KGaA (Germany), Phyco-Biotech Laboratories (France), Pond Technologies Inc. (Canada), Qingdao Haizhijiao Biotechnology Co., Ltd (China), Qingdao ZolanBio Co., Ltd. (China), Sensient Technologies Corporation (U.S.), SPIFORM (France), Tianjin Norland Biotech Co., Ltd (China), Xi’an Fengzu Biological Technology Co., LTD. (FZBIOTECH) (China), and Zhejiang Binmei Biotechnology Co., Ltd (China).

Italy is expected to record the highest CAGR during the forecast period. The growth of this market is mainly driven by the growing demand for functional foods, increasing demand for nutraceuticals, and rising health consciousness. Furthermore, the increasing consumer preferences for clean-label products are expected to provide growth opportunities for stakeholders operating in this market.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segment Analysis

3.2.1. Phycocyanin Market, Form Segment Analysis

3.2.2. Phycocyanin Market, Grade Segment Analysis

3.2.3. Phycocyanin Market, Application Segment Analysis

3.3. Country-Level Analysis

3.4. Key Players

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. Increasing Adoption of Phycocyanin for Nutraceutical Applications

4.2.2. Increasing Preference for Natural Colors Over Synthetic Colors

4.2.3. Rising Demand for Natural Blue Colorants

4.2.4. Increasing Venture Investments in Phycocyanin Production

4.3. Restraints

4.3.1. High Prices of Natural Colorants

4.3.2. High Costs of Extracting and Purifying Phycocyanin

4.3.3. Complexities in Algae Production

4.4. Opportunities

4.4.1. High Potential of Phycocyanin in Pharmaceutical Applications

4.4.2. Increasing Consumer Awareness Regarding Clean-label Products

4.5. Sources of Phycocyanin

5. Europe Phycocyanin Market Assessment–by Form

5.1. Overview

5.2. Phycocyanin Powder

5.3. Liquid Phycocyanin

6. Europe Phycocyanin Market Assessment–by Grade

6.1. Overview

6.2. Food-grade Phycocyanin

6.3. Reagent- & Analytical-grade Phycocyanin

6.4. Cosmetic-grade Phycocyanin

7. Europe Phycocyanin Market Assessment–by Application

7.1. Overview

7.2. Food & Beverages

7.3. Cosmetics

7.4. Pharmaceuticals & Nutraceuticals

7.5. Diagnostics and Biomedical

8. Europe Phycocyanin Market Assessment–by Geography

8.1. Overview

8.1.1. France

8.1.2. Germany

8.1.3. U.K.

8.1.4. Italy

8.1.5. Spain

8.1.6. Netherlands

8.1.7. Denmark

8.1.8. Sweden

8.1.9. Rest of Europe

9. Competition Analysis

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Dashboard

9.3.1. Industry Leaders

9.3.2. Market Differentiators

9.3.3. Vanguards

9.3.4. Emerging Companies

9.4. Vendor Market Positioning

10. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic

Developments)

10.1. AlgoSource

10.2. Bluetec Naturals Co., Ltd

10.3. DIC Corporation

10.4. E.I.D. - Parry (India) Limited (A Subsidiary Of M/S. Ambadi Investments Limited)

10.5. Fuqing King Dnarmsa Spirulina Co., Ltd.

10.6. Givaudan SA

10.7. GNT Group B.V.

10.8. Hangzhou Ouqi Food Co., Ltd.

10.9. Inner Mongolia Rejuve Biotech Co., Ltd.

10.10. Jiangshan Comp Spirulina Co., Ltd

10.11. Merck KGaA

10.12. Phyco-Biotech Laboratories

10.13. Pond Technologies Inc.

10.14. Qingdao Haizhijiao Biotechnology Co., Ltd.

10.15. Qingdao Zaolanbio Co., Ltd.

10.16. Sensient Technologies Corporation

10.17. SPIFORM

10.18. Tianjin Norland Biotech Co., Ltd

10.19. Xi’an Fengzu Biological Technology Co., LTD. (Fzbiotech)

10.20. Zhejiang Binmei Biotechnology Co.,Ltd

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Europe Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 2 Europe Phycocyanin Powder Market, by Country/Region, 2021–2030 (USD Thousand)

Table 3 Europe Liquid Phycocyanin Market, by Country/Region, 2021–2030 (USD Thousand)

Table 4 Europe Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 5 Europe Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 6 Europe Food-grade Phycocyanin Market, by Country/Region, 2021–2030 (USD Thousand)

Table 7 Europe Food-grade Phycocyanin Market, by Country/Region, 2021–2030 (Tons)

Table 8 Europe Reagent- & Analytical-grade Phycocyanin Market, by Country/Region, 2021–2030 (USD Thousand)

Table 9 Europe Reagent- & Analytical-grade Phycocyanin Market, by Country/Region, 2021–2030 (Tons)

Table 10 Europe Cosmetic-grade Phycocyanin Market, by Country/Region, 2021–2030 (USD Thousand)

Table 11 Europe Cosmetic-grade Phycocyanin Market, by Country/Region, 2021–2030 (Tons)

Table 12 Europe Phycocyanin Market, by Application, 2021—2030 (USD Thousand)

Table 13 Europe Phycocyanin Market for Food & Beverages, by Country/Region, 2021–2030 (USD Thousand)

Table 14 Europe Phycocyanin Market for Cosmetics, by Country/Region, 2021–2030 (USD Thousand)

Table 15 Europe Phycocyanin Market for Pharmaceuticals & Nutraceuticals, by Country/Region, 2021–2030 (USD Thousand)

Table 16 Europe Phycocyanin Market for Diagnostics & Biomedical, by Country/Region, 2021–2030 (USD Thousand)

Table 17 Europe: Phycocyanin Market, by Country/Region, 2021–2030 (USD Thousand)

Table 18 Europe: Phycocyanin Market, by Country/Region, 2021–2030 (Tons)

Table 19 France: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 20 France: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 21 France: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 22 France: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 23 Germany: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 24 Germany: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 25 Germany: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 26 Germany: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 27 U.K.: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 28 U.K.: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 29 U.K.: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 30 U.K.: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 31 Italy: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 32 Italy: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 33 Italy: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 34 Italy: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 35 Spain: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 36 Spain: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 37 Spain: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 38 Spain: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 39 Netherlands: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 40 Netherlands: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 41 Netherlands: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 42 Netherlands: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 43 Denmark: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 44 Denmark: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 45 Denmark: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 46 Denmark: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 47 Sweden: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 48 Sweden: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 49 Sweden: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 50 Sweden: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 51 Rest of Europe: Phycocyanin Market, by Form, 2021–2030 (USD Thousand)

Table 52 Rest of Europe: Phycocyanin Market, by Grade, 2021–2030 (USD Thousand)

Table 53 Rest of Europe: Phycocyanin Market, by Grade, 2021–2030 (Tons)

Table 54 Rest of Europe: Phycocyanin Market, by Application, 2021–2030 (USD Thousand)

Table 55 Recent Developments, by Company (2019–2023)

List of Figures

Figure 1 Market Ecosystem

Figure 2 Research Process

Figure 3 Secondary Sources Referenced for this Study

Figure 4 Primary Research Techniques

Figure 5 Key Executives Interviewed

Figure 6 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 7 Market Size Estimation and Growth Forecast Approach

Figure 8 In 2023, the Phycocyanin Powder Segment to Dominate the Phycocyanin Market

Figure 9 In 2023, the Food-Grade Segment to Dominate the Phycocyanin Market

Figure 10 The Cosmetic Segment is Projected to Register the Highest CAGR

Figure 11 France Dominates the Europe Phycocyanin Market, While Italy Leads in Growth

Figure 12 Factors Affecting Market Growth

Figure 13 Europe Phycocyanin Market, by Form, 2023 Vs. 2030 (USD Thousand)

Figure 14 Europe Phycocyanin Market, by Grade, 2023 Vs. 2030 (USD Thousand)

Figure 15 Europe Phycocyanin Market, by Grade, 2023 Vs. 2030 (Tons)

Figure 16 Europe Phycocyanin Market, by Application, 2023 Vs. 2030 (USD Thousand)

Figure 17 Europe: Phycocyanin Market Snapshot, 2023

Figure 18 Europe Phycocyanin Market, by Country/Region, 2023 Vs. 2030 (USD Thousand)

Figure 19 Europe Phycocyanin Market, by Country/Region, 2023 Vs. 2030 (Tons)

Figure 20 Key Growth Strategies Adopted by Leading Players (2019–2023)

Figure 21 Competitive Dashboard: Europe Phycocyanin Market

Figure 22 Europe Phycocyanin Market Competitive Benchmarking, by Application

Figure 23 DIC Corporation: Financial Overview (2022)

Figure 24 E.I.D. - Parry (India) Limited: Financial Overview (2022)

Figure 25 Givaudan SA: Financial Overview (2022)

Figure 26 Merck KGaA: Financial Overview (2021)

Figure 27 Sensient Technologies Corporation: Financial Overview (2021)

Published Date: Sep-2024

Published Date: Apr-2023

Published Date: Apr-2023

Published Date: Apr-2023

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates