Resources

About Us

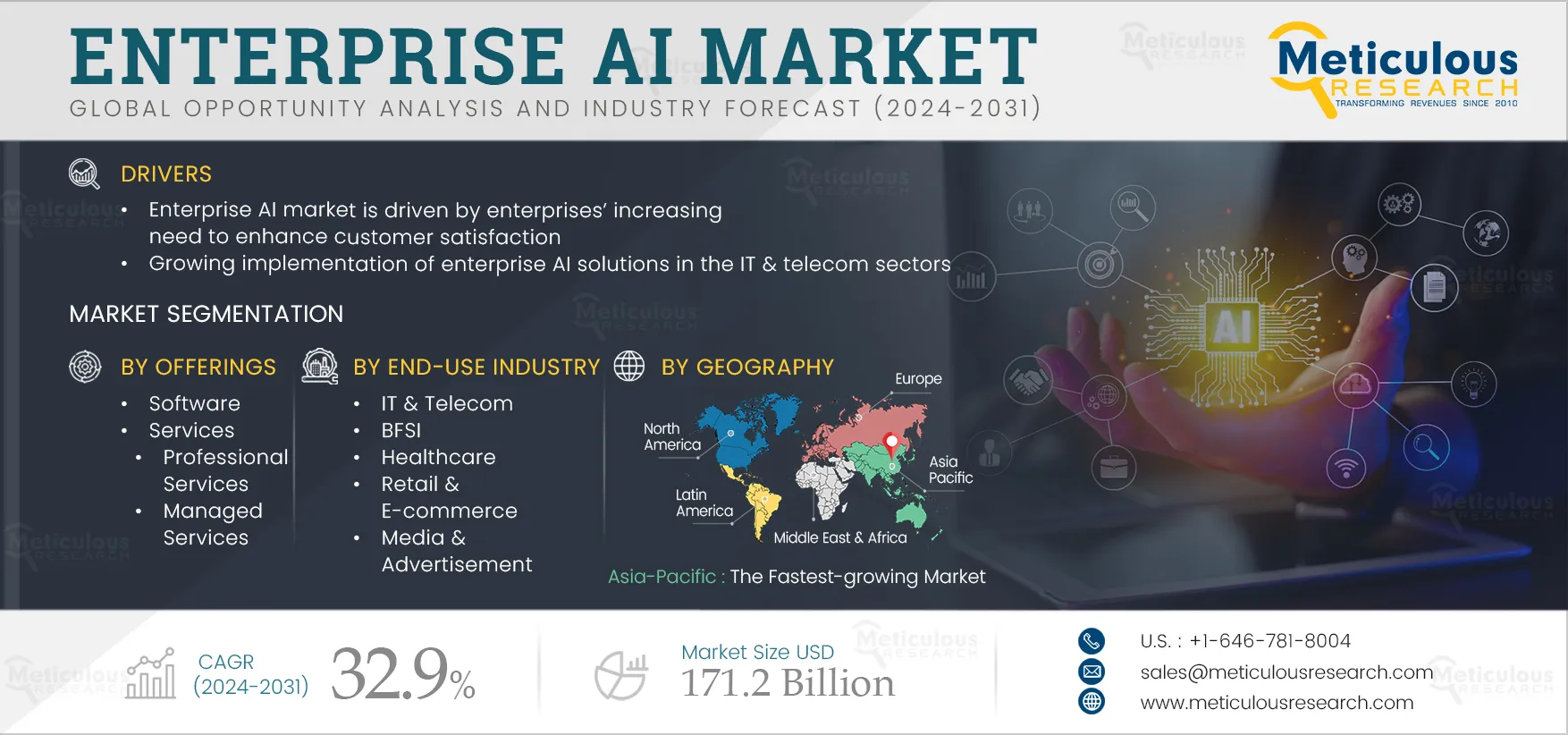

Enterprise AI Market by Offering (Solutions, Services), Deployment Mode, Organization Size, Technology (ML, NLP), End-use Industry (IT & Telecom, Healthcare, Retail & E-commerce, Media & Advertisement) and Geography - Global Forecast to 2031

Report ID: MRICT - 1041123 Pages: 249 Apr-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Enterprise AI Market to reach $171.2 billion by 2031 at a CAGR of 32.9% during 2024–2031. The growth of the enterprise AI market is driven by enterprises’ increasing need to enhance customer satisfaction and the growing implementation of enterprise AI solutions in the IT & telecom sectors. However, the high costs of enterprise AI solutions restrain the growth of this market. Furthermore, the increasing need for conversational AI solutions for optimized sales & marketing management and the growing need to automate business processes are expected to generate growth opportunities for the players operating in this market. However, data privacy & security concerns are a major challenge impacting market growth. Additionally, the growing adoption of AI chatbots for customer interaction and the increasing integration of Machine Learning (ML) technology into enterprise AI solutions are prominent trends in this market.

Business process automation solutions help businesses reduce costs by automating routine tasks and allowing employees to focus on more complex and high-value activities. AI can automate business functions, enabling machines to learn from data, identify patterns, and make decisions without human intervention. AI solutions are increasingly being used to automate business processes, leading to increased efficiency, reduced costs, improved customer experiences, and enhanced business efficiency and productivity. Some of the ways in which AI can be leveraged to automate business processes are as follows:

AI-powered predictive analytics helps analyze vast amounts of data to predict future outcomes. It also helps automate decision-making processes like predicting customer behavior or identifying fraud. AI-powered predictive analytics is used to automate decision-making processes in various industries, including finance, healthcare, and retail. Additionally, natural language processing (NLP) enables machines to understand and interpret human languages. NLP is used to automate customer service tasks such as responding to customer queries and complaints. NLP can enable chatbots to understand and respond to customer queries without human intervention.

Adopting machine learning enables machines to learn from data and make intelligent decisions. Machine learning automates tasks such as data entry and extraction, where devices can learn to identify and classify information from documents. Moreover, robotic Process Automation (RPA) involves using software robots to automate tasks such as data entry, invoice processing, and customer service. Robotic Process Automation (RPA) is used in the finance, healthcare, and manufacturing industries to automate routine tasks such as data entry, claims processing, and inventory management.

With the increasing use of AI to automate business processes, market players are focused on launching AI-powered business process automation solutions. For instance, in March 2024, Coupa Software Inc. (U.S.) launched a new AI-driven automation solution to help businesses drive efficiencies. Coupa helps businesses make more informed buying, sourcing, supply chain, and financial decisions to drive growth and better match supply and demand. Thus, innovative automation offerings are helping businesses increase efficiency and productivity.

Click here to: Get Free Sample Pages of this Report

Based on offering, In 2024, the solutions segment is expected to account for the larger share of the global enterprise AI market. However, the services segment is expected to register a higher CAGR during the forecast period. Factors such as the growing need for AI consulting, data analysis, and enterprise-grade AI solution development, maintenance, and support and the rising adoption of services to automate tasks and help improve business operations efficiently are expected to support the growth of this segment. Additionally, the rising implementation of enterprise AI services has promoted several companies to offer various services such as AI consulting, data analysis, enterprise-grade AI solution development, and AI integration. For instance, in September 2023, Lenovo Group Ltd. (Hong Kong) launched edge AI services and solutions designed to enable mass deployment of remote computing capabilities that will significantly accelerate AI readiness and empower new AI applications for any business.

Based on deployment mode, in 2024, the on-premise deployment segment is expected to account for the larger share of the global enterprise AI market. However, the cloud-based deployment segment is expected to register a higher CAGR during the forecast period. The growing benefits associated with cloud-based deployment, including easy maintenance of customer data, cost-effectiveness, and scalability, and the increasing demand for enterprise AI solutions that support multi-cloud deployments are expected to support the growth of this segment.

Based on organization size, in 2024, the large enterprises segment is expected to account for the larger share of the global enterprise AI market. However, the small & medium-sized enterprises segment is expected to register a higher CAGR during the forecast period. The increasing need for chatbots and digital assistants among small & medium-sized enterprises, the benefits offered by chatbots for small & medium-sized enterprises, and the increasing need to improve performance, quality management, and customer satisfaction in call centers are expected to support the growth of this segment.

Based on technology, in 2024, the machine learning segment is expected to account for the largest share of the global enterprise AI market. However, the natural language processing segment is expected to register the highest CAGR during the forecast period. Factors such as the growing need to understand, interpret, and generate human language data and the rising adoption of NLP to analyze user preferences, behaviors, and interactions to deliver personalized content are expected to support the growth of this segment. Additionally, several companies are launching enterprise AI solutions with NLP capabilities for automation, efficiency, personalization, and enhanced user experiences across a wide range of applications and domains. For instance, in November 2021, IBM Corporation (U.S.) announced new natural language processing (NLP) enhancement plans for IBM Watson Discovery. These planned updates are designed to help business users in industries such as financial services, insurance, and legal services enhance customer care and accelerate business processes.

Based on end-use industry, in 2024, the IT & telecom segment is expected to account for the largest share of the global enterprise AI market. Additionally, this segment is expected to register the highest CAGR during the forecast period. The increasing demand for personalized customer experiences enabled by AI technologies, the rising adoption of AI for analyzing data from network sensors to optimize operations, and the growing utilization of AI to enhance network performance and deliver customized services are expected to support the growth of this segment.

Based on geography, in 2024, North America is expected to account for the largest share of the global enterprise AI market. However, Asia-Pacific is expected to register the highest CAGR during the forecast period. The growing emphasis by companies to launch chatbots and virtual assistants in the Asia-Pacific region, growing demand for chatbots and voice assistant solutions, and increasing demand for AI-powered customer support services are expected to support the growth of this market. Across the region, companies are extensively adopting and providing enterprise AI-based solutions to provide improved customer services. For instance, in May 2023, Lazada Group (Singapore) launched LazzieChat, the first eCommerce AI chatbot in Southeast Asia powered by OpenAI ChatGPT technology in Azure OpenAI Service. LazzieChat can answer users' shopping queries on the Lazada platform to provide an engaging, informed, personalized shopping experience.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants over the past 3 to 4 years. The key players operating in the enterprise AI market are NVIDIA Corporation (U.S.), Google LLC (A subsidiary of Alphabet Inc.) (U.S.), Amazon Web Services, Inc. (A Subsidiary of Amazon.com, Inc.) (U.S.), International Business Machines Corporation (U.S.), Microsoft Corporation (U.S.), Verint Systems Inc. (U.S.), SAP SE (Germany), Pegasystems Inc. (U.S.), Wipro Limited (India), Intel Corporation (U.S.), Oracle Corporation (U.S.), Hewlett Packard Enterprise (U.S.), MicroStrategy Incorporated (U.S.), Amelia US LLC (U.S.), and Sentient.io (Singapore).

|

Particulars |

Details |

|

Number of Pages |

249 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2022 |

|

CAGR |

32.9% |

|

Estimated Market Size (Value) |

$171.2 billion by 2031 |

|

Segments Covered |

By Offering

By Deployment Mode

By Organization Size

By Technology

By End-use Industry

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, RoE), Asia-Pacific (China, Japan, India, Singapore, South Korea, RoAPAC), Latin America, and the Middle East & Africa. |

|

Key Companies |

NVIDIA Corporation (U.S.), Google LLC (A subsidiary of Alphabet Inc.) (U.S.), Amazon Web Services, Inc. (A Subsidiary of Amazon.com, Inc.) (U.S.), International Business Machines Corporation (U.S.), Microsoft Corporation (U.S.), Verint Systems Inc. (U.S.), SAP SE (Germany), Pegasystems Inc. (U.S.), Wipro Limited (India), Intel Corporation (U.S.), Oracle Corporation (U.S.), Hewlett Packard Enterprise (U.S.), MicroStrategy Incorporated (U.S.), Amelia US LLC (U.S.), Sentient.io (Singapore). |

The global enterprise AI market is projected to reach $171.2 Billion by 2031, at a CAGR of 32.9% during the forecast period.

In 2024, the machine learning segment is expected to account for the largest share of the global enterprise AI market. The segment's large market share is attributed to the growing adoption of enterprise AI solutions with machine learning capabilities to analyze historical data and identify patterns, the rising need for threat detection, anomaly detection, and malware analysis, and the increasing use of these solutions in e-commerce, streaming platforms, and content websites.

The growth of the enterprise AI market is driven by enterprises’ increasing need to enhance customer satisfaction and the growing implementation of enterprise AI solutions in the IT & telecom sectors. Furthermore, the increasing need for conversational AI solutions for optimized sales & marketing management and the growing need to automate business processes are expected to generate growth opportunities for the players operating in this market.

The key players operating in the enterprise AI market are NVIDIA Corporation (U.S.), Google LLC (A subsidiary of Alphabet Inc.) (U.S.), Amazon Web Services, Inc. (A Subsidiary of Amazon.com, Inc.) (U.S.), International Business Machines Corporation (U.S.), Microsoft Corporation (U.S.), Verint Systems Inc. (U.S.), SAP SE (Germany), Pegasystems Inc. (U.S.), Wipro Limited (India), Intel Corporation (U.S.), Oracle Corporation (U.S.), Hewlett Packard Enterprise (U.S.), MicroStrategy Incorporated (U.S.), Amelia US LLC (U.S.), and Sentient.io (Singapore).

1. Introduction

1.1. Market Definition & Scope

1.2. Currency & Limitations

1.2.1. Currency

1.2.2. Limitations

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research /Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Offering

3.3. Market Analysis, by Deployment Mode

3.4. Market Analysis, by Organization Size

3.5. Market Analysis, by Technology

3.6. Market Analysis, by End-use Industry

3.7. Market Analysis, by Geography

3.8. Competitive Analysis

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Increasing Need to Enhance Customer Satisfaction Boosting the Adoption of AI Solutions Among Enterprises

4.2.2. Growing Implementation of Enterprise AI Solutions in the IT & Telecom Sectors Driving Market Growth

4.2.3. High Costs of Enterprise AI Solutions Restraining Market Growth

4.2.4. Increasing Need for Conversational AI Solutions Expected to Generate Growth Opportunities for Market Stakeholders

4.2.5. Growing Need to Automate Business Processes Expected to Accelerate Market Expansion

4.2.6. Data Privacy & Security Concerns Hindering the Adoption Of Enterprise AI Solutions

4.3. Key Trends

4.3.1. Growing Adoption of AI Chatbots for Customer Interaction

4.3.2. Increasing Integration of Machine Learning (ML) Technology into Enterprise AI Solutions

4.4. Case Studies

4.4.1. Case Study A

4.4.2. Case Study B

4.4.3. Case Study C

4.5. Vendor Selection Criteria/Factors Influencing Purchase Decisions

5. Enterprise AI Market Assessment—by Offering

5.1. Overview

5.2. Solutions

5.3. Services

5.3.1. Professional Services

5.3.2. Managed Services

6. Enterprise AI Market Assessment—by Deployment Mode

6.1. Overview

6.2. On-premise Deployment

6.3. Cloud-based Deployment

7. Enterprise AI Market Assessment—by Organization Size

7.1. Overview

7.2. Large Enterprises

7.3. Small & Medium-sized Enterprises

8. Enterprise AI Market Assessment—by Technology

8.1. Overview

8.2. Machine Learning

8.3. Natural Language Processing

8.4. Image Processing

8.5. Speech Recognition

9. Enterprise AI Market Assessment—by End-use Industry

9.1. Overview

9.2. IT & Telecom

9.2.1. Network Optimization

9.2.2. Customer Service Automation and Virtual Assistants

9.2.3. Human Resource Management

9.2.4. Customer Analytics

9.2.5. Cybersecurity

9.2.6. Other IT & Telecom Applications

9.3. BFSI

9.3.1. Security and Risk Management

9.3.2. Streamlining Regulatory Compliance

9.3.3. Customer Relationship Management

9.3.4. Real-Time Transaction Monitoring

9.3.5. Data Analytics & Prediction

9.3.6. Other BFSI Applications

9.4. Healthcare

9.4.1. Hospital Workflow Management

9.4.2. Lifestyle Management

9.4.3. Patient Data & Risk Analytics

9.4.4. Medical Imaging & Diagnosis

9.4.5. Precision Medicine

9.4.6. Remote Patient Monitoring

9.4.7. Robot-assisted Surgery

9.4.8. Drug Discovery

9.5. Retail & E-commerce

9.5.1. Search and Recommendations

9.5.2. Customer Relationship Management

9.5.3. Inventory Management

9.5.4. Supply Chain Optimization

9.5.5. In-store Visual Monitoring & Surveillance

9.5.6. Predictive Analytics

9.5.7. Demand Forecasting

9.5.8. Chatbots

9.6. Media & Advertisement

9.6.1. Chatbots and Virtual Assistants

9.6.2. Predictive Analytics

9.6.3. Sales & Marketing Automation

9.6.4. Advertising Recommendation

9.6.5. Content Generation

9.6.6. Talent Identification

9.6.7. Production Planning & Management

9.7. Automotive

9.7.1. Advanced Driver Assistance Systems

9.7.2. Human-Machine Interface

9.7.3. Vehicle Personalization

9.7.4. Designing and Production Management

9.7.5. Supply Chain Management

9.7.6. Other Automotive Applications

9.8. Government

9.8.1. Fraud Detection and Prevention

9.8.2. Administrative Processes

9.8.3. Disaster Management and Response

9.8.4. Personalized User Support

9.8.5. Other Government Applications

9.9. Other End-use Industries

10. Enterprise AI Market Assessment—by Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. Singapore

10.4.6. Rest of Asia-Pacific

10.5. Latin America

10.6. Middle East & Africa

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Emerging Companies

11.5. Market Ranking, by Key Players

12. Company Profiles

12.1. NVIDIA Corporation

12.2. Google LLC (A subsidiary of Alphabet Inc.)

12.3. Amazon Web Services, Inc. (A Subsidiary of Amazon.com, Inc.)

12.4. International Business Machines Corporation

12.5. Microsoft Corporation

12.6. Verint Systems Inc.

12.7. SAP SE

12.8. Pegasystems Inc.

12.9. Wipro Limited

12.10. Intel Corporation

12.11. Oracle Corporation

12.12. Hewlett Packard Enterprise

12.13. MicroStrategy Incorporated

12.14. Amelia US LLC

12.15. Sentient.io

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Tables

Table 1 Currency Conversion Rate (2018–2022)

Table 2 Global Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 3 Global Enterprise AI Solutions Market, by Country/Region, 2022–2031 (USD Million)

Table 4 Global Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 5 Global Enterprise AI Services Market, by Country/Region, 2022–2031 (USD Million)

Table 6 Global Enterprise AI Professional Services Market, by Country/Region, 2022–2031 (USD Million)

Table 7 Global Enterprise AI Managed Services Market, by Country/Region, 2022–2031 (USD Million)

Table 8 Global Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 9 Global Enterprise AI Market For On-premise Deployment, by Country/Region, 2022–2031 (USD Million)

Table 10 Global Enterprise AI Market For Cloud-based Deployment, by Country/Region, 2022–2031 (USD Million)

Table 11 Global Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 12 Global Enterprise AI Market For Large Enterprises, by Country/Region, 2022–2031 (USD Million)

Table 13 Global Enterprise AI Market For Small & Medium-Sized Enterprises, by Country/Region, 2022–2031 (USD Million)

Table 14 Global Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 15 Global Enterprise AI Market For Machine Learning, by Country/Region, 2022–2031 (USD Million)

Table 16 Global Enterprise AI Market For Natural Language Processing, by Country/Region, 2022–2031 (USD Million)

Table 17 Global Enterprise AI Market For Image Processing, by Country/Region, 2022–2031 (USD Million)

Table 18 Global Enterprise AI Market For Speech Recognition, by Country/Region, 2022–2031 (USD Million)

Table 19 Global Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 20 Global Enterprise AI Market For It & Telecom, by Application, 2022–2031 (USD Million)

Table 21 Global Enterprise AI Market For It & Telecom, by Country/Region, 2022–2031 (USD Million)

Table 22 Global Enterprise AI Market For BFSI, by Application, 2022–2031 (USD Million)

Table 23 Global Enterprise AI Market For BFSI, by Country/Region, 2022–2031 (USD Million)

Table 24 Global Enterprise AI Market For Healthcare, by Application, 2022–2031 (USD Million)

Table 25 Global Enterprise AI Market For Healthcare, by Country/Region, 2022–2031 (USD Million)

Table 26 Global Enterprise AI Market For Retail & E-commerce, by Application, 2022–2031 (USD Million)

Table 27 Global Enterprise AI Market For Retail & E-commerce, by Country/Region, 2022–2031 (USD Million)

Table 28 Global Enterprise AI Market For Media & Advertisement, by Application, 2022–2031 (USD Million)

Table 29 Global Enterprise AI Market For Media & Advertisement, by Country/Region, 2022–2031 (USD Million)

Table 30 Global Enterprise AI Market For Automotive, by Application, 2022–2031 (USD Million)

Table 31 Global Enterprise AI Market For Automotive, by Country/Region, 2022–2031 (USD Million)

Table 32 Global Enterprise AI Market For Government, by Application, 2022–2031 (USD Million)

Table 33 Global Enterprise AI Market For Government, by Country/Region, 2022–2031 (USD Million)

Table 34 Global Enterprise AI Market For Other End-use Industry, by Country/Region, 2022–2031 (USD Million)

Table 35 Global Enterprise AI Market, by Country/Region, 2022–2031 (USD Million)

Table 36 North America: Enterprise AI Market, by Country, 2022–2031 (USD Million)

Table 37 North America: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 38 North America: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 39 North America: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 40 North America: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 41 North America: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 42 North America: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 43 U.S.: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 44 U.S.: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 45 U.S.: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 46 U.S.: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 47 U.S.: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 48 U.S.: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 49 Canada: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 50 Canada: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 51 Canada: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 52 Canada: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 53 Canada: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 54 Canada: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 55 Europe: Enterprise AI Market, by Country/Region, 2022–2031 (USD Million)

Table 56 Europe: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 57 Europe: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 58 Europe: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 59 Europe: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 60 Europe: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 61 Europe: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 62 Germany: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 63 Germany: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 64 Germany: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 65 Germany: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 66 Germany: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 67 Germany: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 68 U.K.: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 69 U.K.: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 70 U.K.: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 71 U.K.: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 72 U.K.: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 73 U.K.: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 74 France: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 75 France: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 76 France: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 77 France: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 78 France: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 79 France: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 80 Italy: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 81 Italy: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 82 Italy: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 83 Italy: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 84 Italy: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 85 Italy: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 86 Spain: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 87 Spain: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 88 Spain: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 89 Spain: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 90 Spain: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 91 Spain: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 92 Rest Of Europe: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 93 Rest Of Europe: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 94 Rest Of Europe: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 95 Rest Of Europe: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 96 Rest Of Europe: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 97 Rest Of Europe: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 98 Asia-Pacific: Enterprise AI Market, by Country/Region, 2022–2031 (USD Million)

Table 99 Asia-Pacific: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 100 Asia-Pacific: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 101 Asia-Pacific: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 102 Asia-Pacific: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 103 Asia-Pacific: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 104 Asia-Pacific: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 105 China: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 106 China: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 107 China: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 108 China: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 109 China: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 110 China: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 111 Japan: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 112 Japan: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 113 Japan: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 114 Japan: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 115 Japan: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 116 Japan: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 117 India: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 118 India: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 119 India: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 120 India: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 121 India: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 122 India: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 123 South Korea: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 124 South Korea: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 125 South Korea: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 126 South Korea: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 127 South Korea: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 128 South Korea: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 129 Singapore: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 130 Singapore: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 131 Singapore: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 132 Singapore: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 133 Singapore: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 134 Singapore: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 135 Rest Of Asia-Pacific: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 136 Rest Of Asia-Pacific: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 137 Rest Of Asia-Pacific: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 138 Rest Of Asia-Pacific: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 139 Rest Of Asia-Pacific: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 140 Rest Of Asia-Pacific: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 141 Latin America: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 142 Latin America: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 143 Latin America: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 144 Latin America: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 145 Latin America: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 146 Latin America: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 147 Middle East & Africa: Enterprise AI Market, by Offering, 2022–2031 (USD Million)

Table 148 Middle East & Africa: Enterprise AI Services Market, by Type, 2022–2031 (USD Million)

Table 149 Middle East & Africa: Enterprise AI Market, by Deployment Mode, 2022–2031 (USD Million)

Table 150 Middle East & Africa: Enterprise AI Market, by Organization Size, 2022–2031 (USD Million)

Table 151 Middle East & Africa: Enterprise AI Market, by Technology, 2022–2031 (USD Million)

Table 152 Middle East & Africa: Enterprise AI Market, by End-use Industry, 2022–2031 (USD Million)

Table 153 Recent Developments by Major Market Players (2021–2024)

Table 154 Market Ranking, by Key Players

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholders

Figure 3 Research Process

Figure 4 Key Secondary Sources

Figure 5 Primary Research Techniques

Figure 6 Key Executives Interviewed

Figure 7 Breakdown Of Primary Interviews (Supply-Side & Demand-Side)

Figure 8 Market Sizing And Growth Forecast Approach

Figure 9 Key Insights

Figure 10 In 2024, the Solutions Segment is Expected to Dominate The Global Enterprise AI Market

Figure 11 In 2024, the On-Premise Deployment Segment to Dominate The Global Enterprise AI Market

Figure 12 In 2024, the Large Enterprises Segment to Dominate The Global Enterprise AI Market

Figure 13 In 2024, the Machine Learning Segment to Dominate The Global Enterprise AI Market

Figure 14 In 2024, the IT & Telecom Segment to Dominate The Global Enterprise AI Market

Figure 15 Global Enterprise AI Market, by Region (2024 Vs. 2031)

Figure 16 Impact Analysis Of Market Dynamics

Figure 17 Vendor Selection Criteria/Factors Influencing Purchase Decisions

Figure 18 Global Enterprise AI Market, by Offering, 2024 Vs. 2031 (USD Million)

Figure 19 Global Enterprise AI Market, by Deployment Mode, 2024 Vs. 2031 (USD Million)

Figure 20 Global Enterprise AI Market, by Organization Size, 2024 Vs. 2031 (USD Million)

Figure 21 Global Enterprise AI Market, by Technology, 2024 Vs. 2031 (USD Million)

Figure 22 Global Enterprise AI Market, by End-use Industry, 2024 Vs. 2031 (USD Million)

Figure 23 Global Enterprise AI Market, by Geography, 2024 Vs. 2031 (USD Million)

Figure 24 Geographic Snapshot: Enterprise AI Market In North America

Figure 25 Geographic Snapshot: Enterprise AI Market In Europe

Figure 26 Geographic Snapshot: Enterprise AI Market In Asia-Pacific

Figure 27 Growth Strategies Adopted by Leading Market Players (2021–2024)

Figure 28 Competitive Benchmarking Analysis (2021–2024)

Figure 29 Competitive Dashboard: Enterprise AI Market

Figure 30 NVIDIA Corporation: Financial Overview (2022)

Figure 31 Alphabet Inc.: Financial Overview (2023)

Figure 32 Amazon.com, Inc.: Financial Overview (2023)

Figure 33 International Business Machines Corporation: Financial Overview (2023)

Figure 34 Microsoft Corporation: Financial Overview (2022)

Figure 35 Verint Systems Inc.: Financial Overview (2022)

Figure 36 SAP SE: Financial Overview (2023)

Figure 37 Pegasystems Inc.: Financial Overview (2023)

Figure 38 Wipro Limited: Financial Overview (2022)

Figure 39 Intel Corporation: Financial Overview (2023)

Figure 40 Oracle Corporation: Financial Overview (2022)

Figure 41 Hewlett Packard Enterprise: Financial Overview (2022)

Figure 42 MicroStrategy Incorporated: Financial Overview (2023)

Published Date: Aug-2025

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates