Resources

About Us

Predictive Maintenance for Grid Assets Market by Component (Solutions/Software, Hardware, Services), Asset Type (Transmission Assets, Distribution Assets, Generation Assets, Protection and Control Equipment), Technology, Deployment Mode, Utility Type, Application, and Geography—Global Forecast to 2035

Report ID: MRICT - 1041615 Pages: 205 Oct-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportWhat is Predictive Maintenance for Grid Assets Market Size?

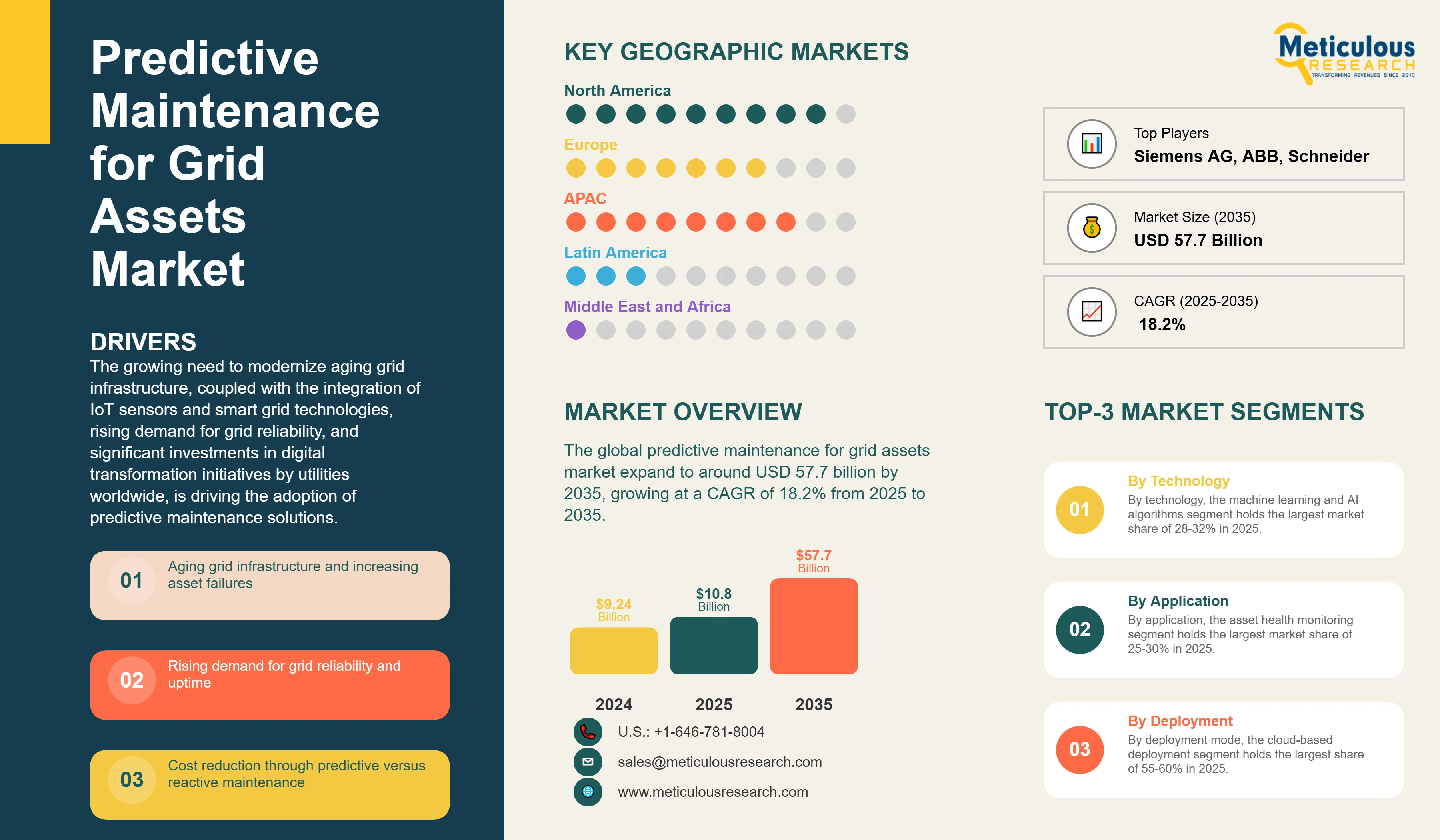

The global predictive maintenance for grid assets market was valued at USD 9.24 billion in 2024 and is expected to increase to approximately USD 10.8 billion in 2025, then expand to around USD 57.7 billion by 2035, growing at a CAGR of 18.2% from 2025 to 2035. The growing need to modernize aging grid infrastructure, coupled with the integration of IoT sensors and smart grid technologies, rising demand for grid reliability, and significant investments in digital transformation initiatives by utilities worldwide, is driving the adoption of predictive maintenance solutions for transmission, distribution, and generation assets.

Market Highlights: Hydrogen Fuel Cell Stack Modules

Click here to: Get Free Sample Pages of this Report

The predictive maintenance market for grid assets focuses on developing, deploying, and managing monitoring, analytics, and diagnostic tools. These tools help utilities predict equipment failures and improve maintenance operations in electricity transmission and distribution networks. They use IoT sensors, analytics, artificial intelligence, machine learning, and digital twin technologies to continuously check the condition and performance of key grid components like transformers, circuit breakers, transmission lines, substations, switchgear, and generation assets.

Unlike traditional time-based or reactive maintenance methods, predictive maintenance uses real-time data, condition monitoring, and predictive modeling to spot early signs of equipment wear and prevent unexpected failures. This proactive strategy helps utilities reduce unplanned outages, extend asset lifespans, cut maintenance costs, improve grid reliability, and boost overall efficiency.

Market growth is driven by the need to upgrade aging grid infrastructure, meet regulatory requirements for reliability and safety, support rising renewable energy integration, advance smart grid initiatives, and embrace digital transformation across the global utility sector.

What are the Key Trends in the Predictive Maintenance for Grid Assets Market?

Integration of Drone and Robotics Inspection: A key trend transforming predictive maintenance for grid assets market is the increasing use of drones, robots, and autonomous inspection systems to monitor transmission lines, towers, substations, and other hard-to-reach infrastructure. These technologies come with high-resolution cameras, thermal sensors, LiDAR, and AI-based image analysis. They allow utilities to perform inspections that are more frequent, thorough, and safe than traditional manual methods.

Utilities are using autonomous drones that can inspect hundreds of transmission towers in a single flight. These drones detect vegetation growth, find damaged insulators, and check structural health, all without putting personnel in dangerous situations. The visual and sensor data collected by these systems is processed by AI-driven platforms that automatically spot defects, prioritize maintenance tasks, and track asset performance trends over time.

This trend is growing as regulatory bodies start accepting drone-generated inspection data for compliance and reporting. Meanwhile, falling hardware costs and improvements in autonomous flight control make these inspection solutions more cost-effective and easier to scale.

Digital Twin Technology Adoption: Another important trend is the quick use of digital twin technology to create virtual replicas of grid assets that reflect their physical versions in real-time. Utilities are building detailed digital twins of transformers, substations, transmission networks, and entire grid systems. These digital twins integrate data from various sources, including sensors, weather systems, load forecasts, and operational history. They allow utilities to simulate different operating scenarios, test the effects of various maintenance strategies, predict equipment behavior in extreme conditions, and improve asset performance without risking real equipment. This technology is especially useful for training operators, planning grid expansions, evaluating the effects of renewable energy integration, and making backup plans for extreme weather events. As computing power grows and the cost of making digital twins drops, this trend is likely to become common across all utility segments.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 57.7 Billion |

|

Market Size in 2025 |

USD 10.8 Billion |

|

Market Size in 2024 |

USD 9.24 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 18.2% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Component, Asset Type, Technology, Deployment Mode, Utility Type, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Aging Grid Infrastructure and Rising Asset Failures

A key factor driving the growth of the predictive maintenance market for grid assets is the poor condition of aging electricity infrastructure in developed economies. In the U.S., over 70% of transmission lines and power transformers are more than 25 years old, far exceeding their original design life. Europe faces similar issues with infrastructure built in the 1960s and 1970s nearing the end of its life. This aging infrastructure is seeing higher failure rates, which leads to more frequent outages, increased maintenance costs, and safety concerns. The devastating California wildfires are partially linked to old transmission equipment, along with many grid failures during extreme weather events. These issues have shown the pressing need for better asset management. Utilities now face pressure from regulators, customers, and stakeholders to improve grid reliability while keeping costs in check. Predictive maintenance provides a practical solution. It allows utilities to monitor asset health continuously, predict failures before they happen, extend the life of equipment through timely interventions, and optimize spending by replacing equipment based on its condition rather than its age. With global investment in grid modernization expected to surpass $5 trillion over the next decade, predictive maintenance technologies are becoming vital for effectively managing aging infrastructure.

Restraint

High Initial Capital Investment and ROI Uncertainty

Implementing predictive maintenance effectively requires significant upfront investment across various technology layers. Medium-sized utilities usually need to invest between $10 million and $50 million for sensor networks, communication infrastructure, data analytics platforms, system integration, and workforce training. This represents a large capital commitment that must compete with other grid modernization projects and regulatory limits on cost recovery. Smaller municipal and cooperative utilities face even greater challenges in justifying these expenses. With strict rules on rate increases and pressure to keep electricity prices competitive, these utilities find it difficult to gain approval for significant predictive maintenance projects, despite recognizing the long-term operational benefits.

The long payback period for predictive maintenance investments adds more difficulties for getting stakeholder approval. Key benefits, such as fewer equipment failures, longer asset lifespans, and lower maintenance costs, usually appear over a period of 5 to 10 years. This delay makes it hard to get board approval and recoup costs within the usual planning cycles for utilities. Computing return on investment also presents specific challenges as success is defined by preventing failures rather than concrete results. Presenting value to stakeholders who rely on traditional accounting demands complex calculations of costs saved and improvements in reliability, which are often uncertain.

Opportunity

Renewable Energy Integration and Grid Complexity

The rapid incorporation of renewable energy sources into electric grids offers a major opportunity for the predictive maintenance market. Wind turbines, solar inverters, and battery energy storage systems bring in new types of assets that need specific monitoring and maintenance methods.

Unlike traditional synchronous generators, renewable assets fail in different ways, operate under changing conditions, and greatly affect grid stability and power quality. Wind turbines in harsh offshore environments need predictive maintenance to reduce costly downtime and make the most of limited maintenance opportunities.

Large solar installations with hundreds of thousands of inverters require automated health monitoring to spot underperforming units. Battery energy storage systems, essential for grid stability, need advanced thermal and electrochemical monitoring to avoid safety issues and extend their lifespan. The inconsistent nature of renewables also puts new strain on traditional grid equipment like transformers and voltage regulation devices, which now face more frequent load changes.

Utilities are looking for predictive maintenance solutions tailored for these mixed grid setups. These solutions must monitor both traditional and renewable assets, evaluate how renewable integration affects grid equipment, and improve the performance of the whole system. This presents opportunities for vendors providing specialized solutions for renewable asset monitoring and integrated grid asset management platforms.

Challenges

Algorithm Accuracy and False Positive Reduction

Grid assets operate under various conditions with complex failure modes affected by several factors, including ambient temperature, loading patterns, power quality events, and maintenance history. Developing machine learning models that can accurately tell the difference between normal operational variations and real failure signals requires large training datasets that many utilities simply do not have. The "rare event" problem makes these challenges even harder. Equipment failures happen infrequently compared to normal operation periods. This data imbalance creates difficulties in effective algorithm training, forcing developers to work with few failure examples while managing large amounts of normal operational data.

Conservative algorithms often produce false positives, leading to unnecessary maintenance tasks that waste resources and create doubt about the technology's value among operational teams. On the other hand, aggressive algorithms might overlook developing faults, which could cause unexpected failures and reduce system credibility and operator confidence. Different types of equipment, manufacturers, and models show distinct patterns of wear and tear, requiring tailored predictive models. Environmental factors and varying operating conditions at different locations add more complexity that generic solutions cannot effectively solve.

Component Insights

Why Do Solutions/Software Lead the Market?

Software platforms act as the core of predictive maintenance operations. They use machine learning algorithms, analytics, visualization tools, and integration features to turn raw sensor data into useful operational insights. Leading solutions, such as GE's Asset Performance Management, Siemens' Senseye, ABB Ability, and IBM Maximo, have moved beyond basic predictive maintenance. They now serve as complete asset lifecycle management platforms that help optimize work orders and ensure compliance with regulations.

The services segment is expected to grow at the fastest CAGR during the forecast period. This growth comes from utilities needing specialized skills for system implementation, integration, optimization, and management. Many utilities lack the in-house knowledge to deploy and operate complex predictive maintenance systems effectively, leading to strong demand for consulting services, system integration help, complete training programs, and ongoing technical support. Managed services, where vendors take responsibility for data collection, analysis, and maintenance suggestions through subscription models, are particularly appealing to smaller utilities.

Asset Type Insights

How Do Transmission Assets Dominate Market Adoption?

Transmission systems are the backbone of the electrical grid. They move large amounts of power over long distances from generation sources to distribution networks. Key assets include power transformers, which cost between $1-5 million each, high-voltage circuit breakers, transmission lines that stretch for hundreds of miles, and substations. These components are some of the most expensive and essential parts of the grid.

The high visibility and public impact of transmission failures, which often affect entire cities or regions, motivate utilities to invest in predictive maintenance. Transmission assets are ideal for predictive monitoring because there are fewer of them compared to millions of distribution devices. Their high value and concentration in substations make installing and connecting sensors operationally feasible. Technologies such as dissolved gas analysis for transformers, partial discharge monitoring for high-voltage equipment, and thermography for electrical connections have shown a clear return on investment by preventing failures.

The generation assets segment, especially renewable energy equipment, is expected to grow the fastest during the forecast period. The rapid increase in wind and solar installations creates many new assets that require specialized monitoring and maintenance. Wind turbines have complex mechanical, electrical, and hydraulic systems that operate in tough conditions. This complexity makes predictive maintenance essential to reduce costly downtime. A single day of unplanned outages on large offshore wind turbines can result in $50,000 to $100,000 in lost revenue, which makes predictive maintenance a financially sound choice.

Technology Insights

How Do Machine Learning and AI Algorithms Drive Innovation?

The machine learning and AI algorithms segment leads to the predictive maintenance market for grid assets, holding the largest share in 2025. This dominance comes from how these technologies improve prediction accuracy and operational intelligence. Advanced ML algorithms, including random forests, gradient boosting, neural networks, and deep learning methods, have changed fault detection capabilities by identifying the subtle patterns in complex sensor data streams. These systems process various data inputs, including vibration, temperature, oil chemistry, electrical signatures, loading patterns, and environmental conditions to create detailed equipment health models. In contrast to traditional rule-based systems that rely on threshold violations, ML algorithms find correlations and patterns that human experts may lose. This ability enables earlier detection of equipment deterioration.

The digital twin technology segment is expected to grow at the fastest CAGR through 2035. This growth is primarily due to improving computational power, lowering implementation costs, and proven benefits in complex grid tasks. Digital twins are real-time virtual replicas of physical assets. They mark the shift from predictive maintenance to full simulation, optimization, and scenario planning. Utilities are creating digital twins of key transformers. These twins combine real-time sensor data with physics-based thermal and electrical models, operational histories, and maintenance records. They can predict how long an asset will last under different loading conditions. Substation digital twins allow operators to practice switching operations, test protection systems, and plan maintenance tasks in safe virtual settings.

Deployment Mode Insights

Why is Cloud-Based Deployment Gaining Momentum?

The cloud-based deployment segment is expected to hold the largest share of the predictive maintenance for grid assets market in 2025. This is primarily due to its strong operational and economic benefits. Cloud platforms remove the need for large capital investments in on-site data centers, high-performance computing, and specialized AI/ML platforms that utilities would otherwise need. Cloud platforms improve teamwork between utilities and tech vendors through remote diagnostics, algorithm updates, and performance optimization without needing on-site visits. This model speeds up innovation by offering access to advanced AI/ML services, pre-made analytics models, and connections with new technologies like digital twins and edge computing.

The on-premises deployment segment remains important for utilities that have strict data sovereignty needs, concerns over reliance on cloud providers, or existing investments in private data centers. Utilities managing critical infrastructure often prefer to keep direct control over their operational data and systems. Hybrid deployment models are increasingly popular. They blend on-site processing for sensitive operational data with cloud analytics for complex computational tasks. This balanced approach addresses security issues while still providing access to scalable cloud resources and advanced analytics, making it a good solution for utilities looking for both data control and technological progress.

Utility Type Insights

Why Do Investor-Owned Utilities Lead Market Adoption?

The investor-owned utilities (IOUs) segment holds the largest share of the market in 2025. This is mainly due to these organizations having significant resources, size, and a supportive regulatory environment for technology investments. IOUs mainly serve major cities as the largest electricity providers. They have the financial ability to support digital transformation projects, including predictive maintenance systems.

Transmission system operators (TSOs) and distribution system operators (DSOs) are rapidly growing due to grid modernization efforts and strict reliability requirements from regulators. Independent system operators that manage high-voltage transmission networks must meet crucial reliability standards and gain considerable advantages from transformer and circuit breaker health monitoring systems. Distribution system operators, especially in Europe, are investing heavily in predictive maintenance. The market unbundling in Europe has led to the rise of independent DSOs, which are working to manage aging distribution systems, integrate distributed energy resources, and meet high reliability expectations. Although municipal and cooperative utility segments are currently smaller, they present significant growth opportunities. Cloud-based solutions and as-a-service models are making predictive maintenance affordable for organizations with limited budgets and technical skills.

Application Insights

How Does Asset Health Monitoring Drive Market Growth?

The asset health monitoring segment holds the largest share of the predictive maintenance for grid assets market in 2025. It serves as fundamental for all predictive maintenance activities. This segment includes continuous real-time data collection from sensors, SCADA systems, and monitoring devices to observe equipment condition, spot performance issues, and set baseline behavior patterns. Asset health monitoring covers vibration analysis of rotating equipment, thermal imaging of electrical connections, transformer oil analysis, and partial discharge monitoring of high-voltage equipment, among other specialized techniques. These systems give operators ongoing insight into equipment status, send alerts when parameters exceed set limits, and build important historical data sets for further analysis and machine learning.

The remaining useful life (RUL) prediction segment is expected to grow the fastest during the forecast period. This growth is mainly driven by utilities needing to optimize spending and increase asset lifespans. RUL prediction uses analytics, physics-based models, and machine learning to estimate equipment reliability under current or future operating conditions. This ability is especially important for high-value assets like power transformers. Accurate RUL predictions help utilities maximize asset use while managing replacement schedules effectively. Instead of replacing equipment based on age, utilities can replace it based on real condition assessments. This approach may extend service life by decades and delay significant capital expenses.

U.S. Predictive Maintenance for Grid Assets Market Size and Growth 2025 to 2035

The U.S. predictive maintenance for grid assets market is expected to reach USD 20.6 billion by 2035, growing at a CAGR of 18% from 2025 to 2035, driven by aging infrastructure, regulatory reliability requirements, and aggressive grid modernization initiatives.

How is the North America Predictive Maintenance for Grid Assets Market Leading Globally?

North America holds the largest share of the global predictive maintenance for grid asset market in 2025, confirming its role as the global leader in adopting predictive maintenance for grid infrastructure. This regional strength results from a mix of aging infrastructure issues, regulatory demands, and strong technological capabilities that drive investments in predictive maintenance. Utilities in North America are typically larger, better funded, and more technically advanced than those in other regions. This allows for earlier use of sophisticated predictive maintenance technologies. Major technology providers, such as GE, Honeywell, and Emerson, along with many innovative startups, create a strong vendor ecosystem. This atmosphere encourages close cooperation between utilities and solution providers. North America's dominance in smart grid projects, advanced metering installations, and grid digitalization establishes a solid data foundation needed for successful predictive maintenance. This supports the region's ongoing market leadership.

Which Factors Support the Asia-Pacific Predictive Maintenance for Grid Assets Market Growth?

The Asia-Pacific region is expected to grow at the fastest CAGR from 2025 to 2035. This growth is mainly driven by extensive grid expansion, rapid smart grid uptake, and ambitious renewable energy targets. Such expansion requires significant investments to meet increasing electricity demand, with China alone adding over 100GW of new generation capacity each year while expanding its transmission networks. Rapid urban growth in the region raises both the costs and impacts of grid failures, which heightens the importance of reliability and preventive maintenance. The technology landscape includes companies like Huawei, Toshiba, and Hitachi, along with many local firms, developing solutions tailored to regional needs and budgets. Historically, lower labor costs made reactive maintenance more appealing than predictive strategies. However, this trend is changing as the need for reliability grows and predictive maintenance costs decrease. The region also benefits from relatively modern telecommunications infrastructure, with widespread 5G deployment supporting the connectivity necessary for IoT-based monitoring systems that are crucial for effective predictive maintenance.

Recent Developments

Segments Covered in the Report

By Component

By Asset Type

By Technology

Deployment Mode

By Utility Type

By Application

By Region

The predictive maintenance for grid assets market is expected to increase from USD 10.8 billion in 2025 to USD 57.7 billion by 2035.

The predictive maintenance for grid assets market is expected to grow at a CAGR of 18.2% from 2025 to 2035.

The major players in the predictive maintenance for grid assets market include IBM Corporation, Siemens AG, ABB Ltd., Schneider Electric SE, General Electric, Honeywell International Inc., SAP SE, Oracle Corporation, PTC Inc., Microsoft Corporation, Emerson Electric Co., Rockwell Automation Inc., AVEVA Group plc, Bentley Systems Inc., C3 AI Inc., AspenTech, Uptake Technologies Inc., Hitachi Energy Ltd., IFS (Copperleaf), DNV GL, Augury Inc., SparkCognition Inc., Falkonry Inc., Prometheus Group, Veolia Water Technologies, PowerPlan Inc., and Enzen Global Solutions, among others.

The main factors driving the predictive maintenance for grid assets market include aging grid infrastructure and increasing asset failures, rising demand for grid reliability and uptime, regulatory compliance and safety mandates requiring proactive asset management, integration of IoT sensors and smart grid technologies enabling continuous monitoring, cost reduction advantages of predictive versus reactive maintenance, and the increasing complexity of managing renewable energy integration into electricity grids.

North America region will lead the global predictive maintenance for grid assets market during the forecast period 2025 to 2035, driven by aging infrastructure, stringent reliability regulations, major catastrophic failure events driving urgency, and substantial grid modernization investments.

Published Date: Jun-2025

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates