Resources

About Us

Smart Badges Market Analysis and Forecast Size, Share, Forecast & Trends by Type (Smart Badges with Display and Smart Badges without Display), Communication (Contact Badges and Contactless Badges), and Application - Global Forecast to 2035

Report ID: MRICT - 1041589 Pages: 215 Sep-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportSmart Badges Market Analysis and Forecast Booms as Security and Real-Time Tracking Demand Drive Growth

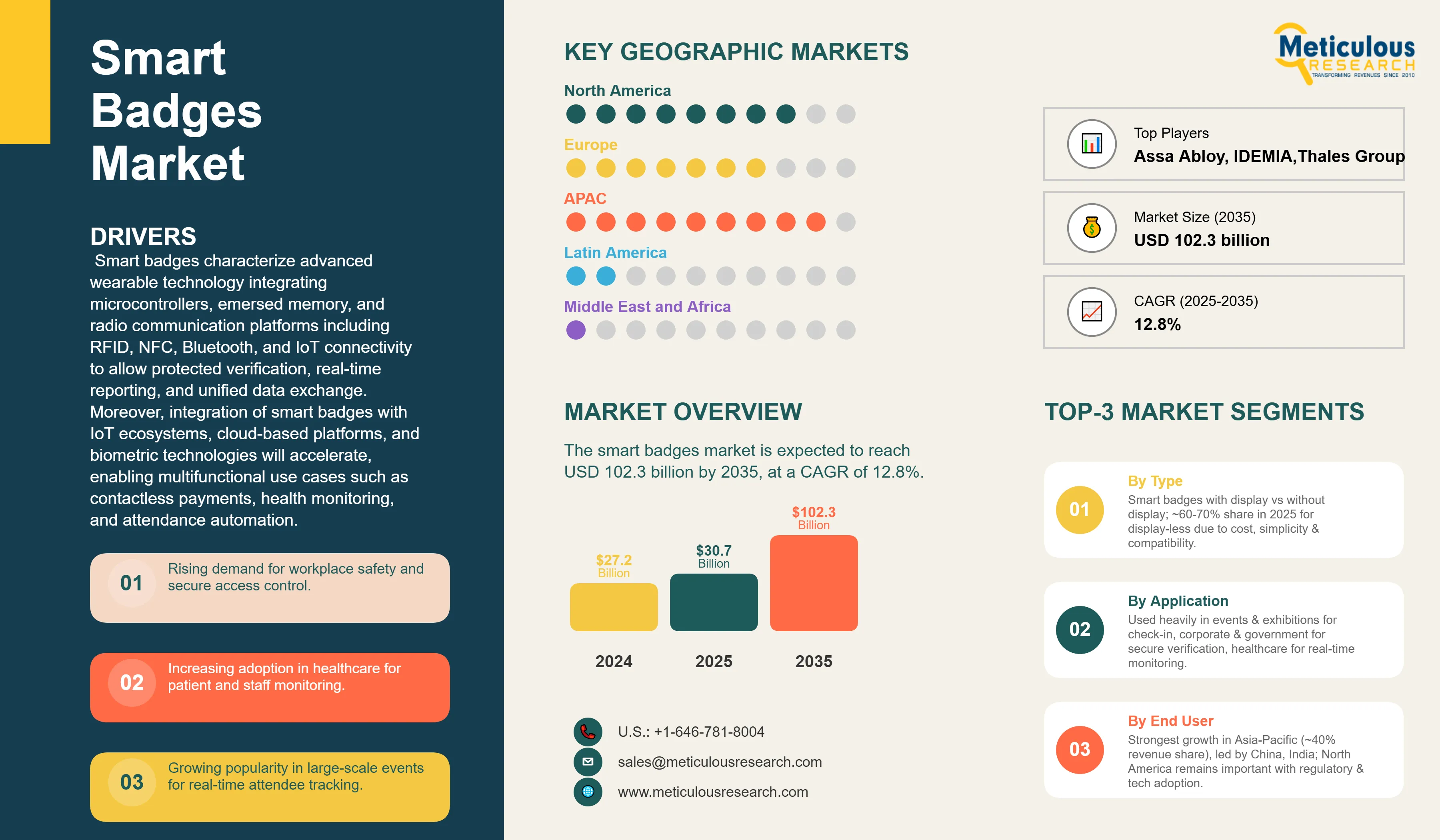

The smart badges market was valued at USD 27.2 billion in 2024 and is expected to reach USD 102.3 billion by 2035 from USD 30.7 billion in 2025, at a CAGR of 12.8%. This growth trajectory is attributed to the increasing demand for protected identification, quick-access regulation, and workforce administration solutions across multiple sectors including corporate institutions, government services, healthcare industry, events, and education, among others. Smart badges characterize advanced wearable technology integrating microcontrollers, emersed memory, and radio communication platforms including RFID, NFC, Bluetooth, and IoT connectivity to allow protected verification, real-time reporting, and unified data exchange.

Moreover, integration of smart badges with IoT ecosystems, cloud-based platforms, and biometric technologies will accelerate, enabling multifunctional use cases such as contactless payments, health monitoring, and attendance automation. With their ability to enhance operational efficiency, security, and user convenience, smart badges are transitioning from simple access tools into strategic digital identity enablers, supporting the global shift toward connected workplaces and secure smart environments.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The competitive landscape of the smart badges market is shaped by leading defense, aerospace, and technology firms, including L3Harris Technologies Inc., BAE Systems Plc, Honeywell International Inc., Diehl Defense GmbH & Co. KG, and Kord Technologies. These companies leverage their expertise in secure communication, advanced authentication, and defense-grade identification systems to capture market share across military, government, and enterprise sectors. Competition is intensifying as players invest heavily in R&D for contactless technologies, IoT integration, and biometric-enabled smart badges, while simultaneously expanding their presence through strategic partnerships, defense contracts, and technology collaborations. Firms such as L3Harris and BAE Systems are strengthening their foothold by aligning with government and defense clients to deliver next-generation secure identification solutions, whereas

Recent Developments

IDEMIA partnered with HYPR

In April 2025, IDEMIA partnered with HYPR to produce FIDO-certified smart badges merging physical and digital access (badge + passkey) under unified credentialing.

UK Smart Badge Accreditation Program Launched

In August 2024, Event Footprints introduced the United Kingdom's smart badge accreditation scheme, marking the first in the industry to enhance the sustainability and safety of events. The program utilises live data to improve contact with attendees and green convention management.

SmartBadge Introduced to Enhance School Safety

In September 2024, Palarum introduced the SmartBadge system at the Saint Susanna School in Ohio. The wearable also enables staff to send tiered alerts (from low-level incidents to active shooters) that facilitate faster and more precise emergency responses.

Key Market Drivers

Key Market Restraints

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Rising Demand for Workplace Safety & Access Control |

Increased adoption in corporate offices and industrial facilities |

Widespread integration with enterprise IoT ecosystems |

▲ +3.6% |

|

2. Adoption in Healthcare for Staff & Patient Monitoring |

Implementation in hospitals for nurse shift tracking and emergency alerts |

Full integration with hospital management systems |

▲ +3.3% |

|

|

3. Growth in Smart Event Management Solutions |

Use in large-scale conferences for contactless registration |

Standardization of smart badge type |

▲ +3.0% |

|

|

Restraints |

1. High Initial Implementation & Maintenance Costs |

Limits adoption among SMEs and smaller institutions |

Economies of scale and cheaper production |

▼ −1.5% |

|

2. Data Privacy & Cybersecurity Risks |

Concerns over location tracking and personal data breaches |

Stronger encryption standards and privacy regulations |

▼ −1.3% |

|

|

Opportunities |

1. Expansion in Smart City & Public Safety Projects |

Deployment for law enforcement and municipal staff tracking |

Nationwide integration into public safety |

▲ +3.2% |

|

2. Adoption in Educational Institutions |

Use for student attendance and campus security |

Full integration with digital learning platforms |

▲ +2.8% |

|

|

Trends |

1. Contactless & Wearable Type Shift |

Rise in NFC/Bluetooth-enabled smart badges |

Becomes the default standard for organizational access control |

▲ +2.5% |

|

Challenges |

1. Interoperability Between Systems |

Difficulty integrating badges with existing diverse security infrastructures |

Development of universal communication protocols |

▼ −1.1% |

Regional Analysis

Rapid Digitalization and Smart City Initiatives Accelerate Regional Market Expansion in Asia Pacific

Asia Pacific holds significant market share, accounting for around 40% revenue share in 2025, driven by rapid digitalization, extensive smart city initiatives, and government investments in advanced identification technologies across major economies. China leads regional adoption through comprehensive smart city development programs and government policies promoting IoT integration across public services, transportation systems, and urban infrastructure. The country's manufacturing expertise and supply chain advantages enable cost-effective smart badge production and deployment at scale. India demonstrates significant growth potential through digital governance initiatives, healthcare modernization programs, and corporate sector expansion requiring secure identification and access control solutions. Japan contributes through advanced technology development and aging population demographics driving demand for assistive and monitoring technologies integrated with smart badges. South Korea's emphasis on technological innovation and 5G network infrastructure creates favorable conditions for IoT-enabled smart badge applications across various sectors. Thus, the myriads of factors including government support through digital transformation funding, smart city investments, and regulatory frameworks encouraging technology adoption accelerates market penetration throughout the forecast period.

North America Maintains Substantial Share owing to Technology Innovation and Enterprise Adoption

North America is growing at a sustainable pace, with 10.9% CAGR, supported by advanced digital infrastructure, high adoption of secure identification systems, and strong regulatory compliance frameworks. The U.S. is at the forefront, with widespread deployment of smart badges across corporate enterprises, healthcare systems, government agencies, and defense organizations, driven by the need for data security, workplace safety, and regulatory adherence. Federal mandates such as HIPAA for healthcare and FIPS (Federal Information Processing Standards) for government security accelerate the adoption of advanced authentication tools, while the region’s large-scale events and tech-driven enterprises further fuel demand. Similarly, Canada complements this leadership through investments in smart city initiatives, healthcare digitization, and industrial safety standards. With a strong presence of global players and continuous innovation in IoT integration, biometric authentication, and cloud-based badge solutions, North America region is set to push the smart badges market expansion.

Smart City Development and Manufacturing Scale Drive Rapid Market Expansion in China

China demonstrates exceptional growth in the smart badge market through comprehensive smart city development programs, government digital transformation initiatives, and massive manufacturing scale advantages. The government's emphasis on digital governance and IoT integration across public services creates substantial demand for smart badge applications in transportation systems, government facilities, and urban infrastructure management. State-owned enterprises and major corporations implement smart badges for workforce management, security enhancement, and operational optimization aligned with national digitalization goals. Moreover, China's advanced 5G network infrastructure and IoT ecosystem development create favorable conditions for sophisticated smart badge applications requiring high-speed connectivity and real-time data processing. The Belt and Road Initiative extend market opportunities to partner countries through infrastructure projects incorporating Chinese smart badge technologies. Cultural acceptance of surveillance technologies and digital identification systems facilitates rapid consumer and enterprise adoption, while government procurement programs guarantee initial market demand supporting continued investment and innovation.

Healthcare-Driven Implementation Driving Industry Growth in France

The French smart badge market is expanding at 11.4% growth rate, primarily expanding the market as they are adopted in healthcare, where RFID and biometric technologies are used to monitor employee presence and shifts and enhance emergency responses. The RFID and biometric technologies commands the majority of share in the French healthcare automatic identification and data capture market, demonstrating their essentiality in hospitals. Hospitals have implemented systems like the RFID Discovery Staff Serenity Emergency Call system that utilizes RFID-enabled badges that trigger the alarm to the security personnel, giving them real-time alerts as to the location of staff in an emergency. Moreover, RFID-equipped smart cabinets are deployed to manage the inventories of life-saving products such as surgical implants and controlled drugs, where auto-monitoring of contents eliminates waste and prevents errors with patient safety.

Segmental Analysis

Smart Badges without Display Segment Dominated the Market with Highest Revenue Share of 60-70%

The smart badges without display segment of the industry acquired the largest market share, around 60-70%, in 2025. Due to its cost-effectiveness, simplicity, and versatility, the badges find favor where secure identification, access, and attendance tracking are required. For instance, HID Global has implemented its contactless smart badges without any displays in corporate offices in both the U.S. and Europe, allowing their employees to enter buildings and monitor attendance in a simplified style. Similarly, Avery Dennison offers non-display smart badges to institutions of learning to control student identification and track access points within the learning centers. They are being used extensively due to compatibility with already installed security systems, minimal maintenance, and consistency in running key tasks without undue complexities. Considering these benefits, display-less smart badges maintain their presence as the solution of choice within organizations where their functionality becomes more valuable than such extra features as real-time display or notifications.

Contactless Solutions Lead Through Safety and Convenience Advantages

The contactless badges segment is expected to dominate the smart badges market in 2025. The technology used in these badges is RFID or NFC, and it allows both convenience and security, as well as hygiene, because of the touch-free interaction. For instance, Google and Microsoft have implemented contactless smart badges in their own offices, which enable employees to bypass secure areas more quickly and without any form of physical contact, eliminating queues at checkpoints. The contactless staff badges in Mayo Clinic and Cleveland Clinics are used to let employees enter restricted access areas and monitor work shift timing, enhancing the workflow and patient safety in the healthcare sector. Establishments such as Siemens or Bosch, even in the manufacturing process, have embedded the use of contactless smart badges to identify employees and grant them access to machines in a streamlined manner on the factory floor. The growing emphasis on reducing touchpoints and providing rapid, safe access in corporate, healthcare, and industrial settings has established contactless badges as the most common type of communication in the market of smart badges.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 30.7 billion |

|

Revenue forecast in 2035 |

USD 102.3 billion |

|

CAGR (2025-2035) |

12.8% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers, and restraints |

|

Segments covered |

Type (Smart Badges with Display and Smart Badges without Display), Communication (Contact Badges and Contactless Badges), Application, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

|

Key companies profiled |

Watchdata Co., Ltd., Giesecke+Devrient GmbH, Identiv, Inc., Unitech Electronics Co., Ltd., CardLogix Corporation, Dorma+Kaba Holdings AG, Zebra Technologies Corp., Assa Abloy, IDEMIA, Thales Group, and Other Key Players. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models. |

Market Segmentation

The Smart Badges Market size is estimated to be USD 30.7 billion in 2025 and grow at a CAGR of 12.8% to reach USD 102.3 billion by 2035.

In 2024, the Smart Badges Market was estimated at USD 27.2 billion, with projections to reach USD 30.7 billion in 2025.

Watchdata Co., Ltd., Giesecke+Devrient GmbH, Identiv, Inc., Unitech Electronics Co., Ltd., CardLogix Corporation, Dorma+Kaba Holdings AG, Zebra Technologies Corp., Assa Abloy, IDEMIA, and Thales Group are the major companies operating in the Smart Badges Market.

The Asia Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

The smart badges without display segment is expected to command the largest share of around 60-70% in 2025.

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Jul-2024

Published Date: Jun-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates