Resources

About Us

Enterprise Generative AI Market Size, Share, Forecast & Trends by Component (Software, Services), Deployment (Cloud, On-Premise, Hybrid), Model Type, Application (Content Creation, Marketing and Sales, Customer Service & Support, Product Design & Development, Supply Chain Management) - Global Forecast to 2035

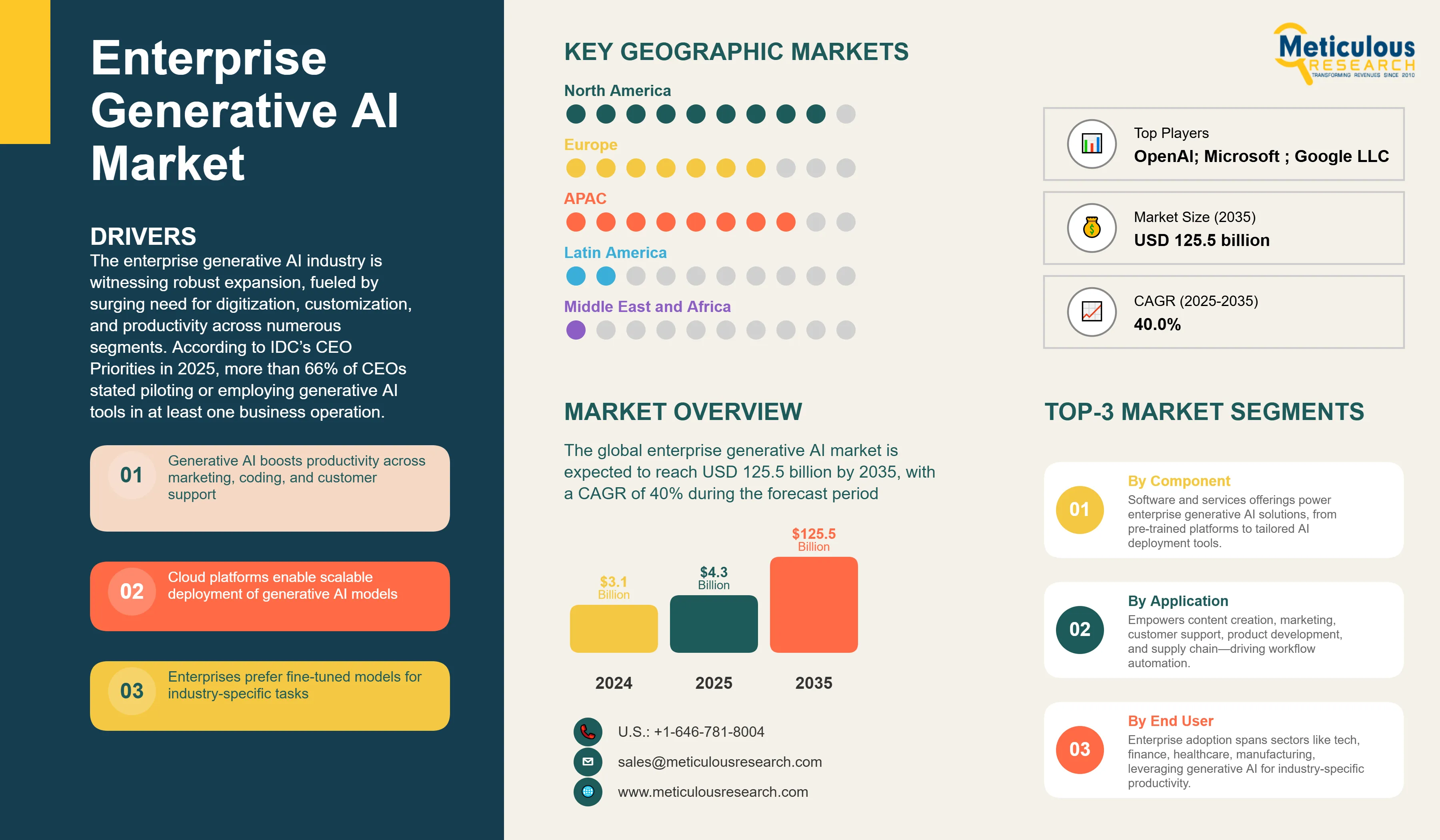

Report ID: MRICT - 1041577 Pages: 240 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe enterprise generative AI industry is witnessing robust expansion, fueled by surging need for digitization, customization, and productivity across numerous segments. According to IDC’s CEO Priorities in 2025, more than 66% of CEOs stated piloting or employing generative AI tools in at least one business operation, with applications such as marketing, customer service, communications, and software development driving the adoption charts.

Corporate institutions are incorporating generative AI into current workstreams to create business content, write programming codes, and synthesize information, while also utilizing it for supporting critical decision making. The rise of multi-faceted models and sector-specific LLMs is allowing more precise and context-based responses. Cloud providers such as Amazon Web Services, Alphabet (Google Cloud), and Microsoft Corporation (Azure), among others are integrating GenAI solutions into legacy systems, while small-medium enterprises (SMEs) are offering fine-tuned models with niche capabilities for multiple domains including IT, human resources, legal, financial services, defense, and healthcare. The market is anticipated to remain invention-empowered, with surging focus on governance, model safety, and ROI.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The competitive landscape is led by Microsoft, Google, Amazon, and IBM, each offering enterprise-grade generative AI platforms integrated with cloud and productivity tools. Microsoft’s Copilot suite is embedded across Office 365, while Google’s Gemini is being adopted in enterprise search and analytics. IBM’s watsonx platform focuses on regulated industries, offering governance and model transparency. Startups like Cohere, Anthropic, and Jasper are gaining traction with customizable LLMs and vertical-specific solutions. Competition is increasingly centered on model safety, integration ease, and enterprise control.

Recent Developments

Google Released Gemini 1.5 Pro for Enterprise Use Cases

In early 2025, Google released Gemini 1.5 Pro, a multimodal generative AI model designed for enterprise use cases. The model supports long-context processing (up to 1 million tokens), enabling document summarization, code generation, and video analysis. Enterprises in legal and healthcare sectors are piloting the model for contract review and diagnostic support. Google reports a 30% improvement in output accuracy compared to previous versions, with enhanced safety filters and audit capabilities.

IBM acquired Mistral AI for Generative Model Development

In Q4 2024, IBM acquired Mistral AI, a French startup known for developing open-weight generative models optimized for enterprise deployment. The acquisition strengthens IBM’s WatsonX portfolio, allowing clients to deploy models on-premise or in hybrid environments. Mistral’s models are designed for low-latency inference and high interpretability, aligning with IBM’s focus on regulated industries. Post-acquisition, IBM plans to integrate Mistral’s technology into its AI governance and lifecycle management tools.

Key Market Drivers

Key Market Restraints

Table: Key Factors Impacting Global Enterprise Data Visualization System Market (2025–2035)

Base CAGR: 40.0%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Generative AI boosts productivity |

Faster workflows |

AI in all operations |

▲ +32% |

|

2. Cloud platforms enable scalable deployment of generative AI models |

Spike in cloud AI use |

Global AI infrastructure |

▲ +29% |

|

|

3. Enterprises prefer fine-tuned models for industry-specific tasks |

Custom model pilots |

Standard domain models |

▲ +26% |

|

|

Restraints |

1. Training large models requires significant compute and financial resources |

Budget limits development |

Costs fall with scale |

▼ −12% |

|

2. Data privacy concerns |

Compliance delays |

Streamlined frameworks |

▼ −9% |

|

|

Opportunities |

1. Expansion of AI-powered productivity tools and embedded AI capabilities |

AI features in ERP/CRM |

AI-native software |

▲ +25% |

|

2. Industry-specific generative AI solutions |

Sector pilot projects |

Full vertical adoption |

▲ +23% |

|

|

Trends |

1. Growing adoption of hybrid AI architectures combining cloud and on-premise solutions |

Early hybrid setups |

Seamless cloud-edge AI |

▲ +20% |

|

Challenges |

1. Ensuring AI ethics, bias, and responsible AI deployment practices |

Ethics reviews |

Automated compliance |

▼ −11% |

Regional Analysis

North America Leads Global Innovation and Enterprise Adoption of Generative AI

North America leads the enterprise generative AI market, with highest market share of 40-45%, due to widespread adoption across technology, finance, healthcare, and retail. In 2024, over 70% of U.S. enterprises reported active generative AI pilots, with Microsoft and Google dominating platform usage. Microsoft’s Copilot and OpenAI’s GPT models are widely used for coding, content generation, and analytics. Further, the region benefits from robust cloud infrastructure, skilled talent, and venture funding over USD 10 billion was invested in generative AI startups in 2024 alone. Regulatory clarity from the FTC and NIST is encouraging responsible deployment, prompting enterprises to invest in model explainability and risk management; While enterprise buyers prioritize governance and ROI. Canada is also seeing growth, particularly in bilingual AI applications and public sector use. Thus, the aforementioned variables are expected to drive the regional market growth.

Asia-Pacific Poised for Rapid Growth Through Government Initiatives and Digital Transformation

Asia-Pacific is the fastest growing region with 45% CAGR during the forecast period, fuelled by digital transformation initiatives and government support. The enterprise adoption in India and Southeast Asia rose significantly, with telecom, banking, and manufacturing leading deployments. China’s tech giants are developing proprietary models for enterprise use, while Japan and South Korea are investing in AI governance and safety. Leading economies such as Japan, India, and South Korea are driving regional innovation through strategic public-private partnerships and regulatory frameworks that encourage AI experimentation. Localized large language model development and vibrant startup ecosystems contribute significantly to market dynamics, with regional players developing industry-specific solutions tailored to local languages and business contexts. Thus, the proliferation of cloud computing infrastructure and increasing enterprise digitization are driving the business demand.

Government-Led Growth and Extensive Industry Integration is Fuelling Demand in China

China’s enterprise generative AI market is expected to witness growth at 50% CAGR during the forecast period, supported by government-led digital transformation programs. As per the National Bureau of Asian Research in 2024, over 50% of large enterprises adopted generative AI tools for customer service, manufacturing optimization, and legal automation. Tech firms like Baidu, Alibaba, and Tencent are developing proprietary models tailored to local language and regulatory needs. The government’s AI Development Plan emphasizes safe deployment, with new guidelines on model training and data usage. Demand is strong in finance, healthcare, and public services.

China's focus on technological self-reliance drives innovation in localized AI models and applications, particularly in natural language processing for Chinese languages and industry-specific use cases. The country's massive digital infrastructure, expanding cloud computing capabilities, and tech-savvy consumer base provide strong foundations for enterprise AI adoption.

Regulated Growth Supported by Ethical AI and Manufacturing Applications in Germany is Propelling Growth

Germany is expected to dominate the Europe market for enterprise generative AI with more than 25% of the market share in 2025. Germany is adopting enterprise generative AI cautiously, with emphasis on compliance and industrial use. In 2024, over 40% of enterprises in manufacturing and automotive sectors piloted generative AI for design, documentation, and predictive maintenance. The EU AI Act is shaping deployment strategies, with German firms investing in model governance and auditability. SAP and Siemens are integrating generative AI into enterprise software, while startups are offering solutions for legal and engineering workflows. Additionally, the country’s emphasis on data privacy, reflected in stringent GDPR enforcement and emerging EU AI Act compliance, drives demand for transparent, explainable AI solutions with robust governance capabilities. Collaboration between established technology providers, regulatory bodies, and academic institutions fosters innovation while ensuring ethical AI deployment.

Segmental Analysis

Robust AI Solutions Drive Enterprise Digital Transformation

Based on component, the solutions segment is expected to dominate the enterprise generative AI market, capturing the largest revenue share of over 60-65% in 2025. Leading solutions providers such as OpenAI, Microsoft, Google, and IBM offer scalable platforms that enable organizations to deploy generative AI across multiple business functions simultaneously. These platforms feature pre-trained models, customization capabilities, API integrations, and enterprise-grade security measures essential for large-scale deployments. Key features offered by these solutions include multi-modal AI capabilities, workflow automation, collaboration tools, and analytics dashboards that enable business users to leverage AI without technical expertise. Integration with existing enterprise systems such as CRM, ERP, and data warehouses enhances adoption rates and demonstrates tangible business value. Furthermore, the segment's growth is driven by enterprises' preference for comprehensive solutions that reduce implementation complexity, ensure interoperability, and provide consistent user experiences across departments.

Marketing Teams Use Generative AI to Personalize Campaigns and Scale Output

Based on application, marketing & sales is expected to grow at 42.3% CAGR over the forecast period 2025-2035. Generative AI is transforming enterprise marketing by enabling personalized content creation at scale. Enterprises deploy generative AI for automated content creation, personalized email campaigns, social media management, and dynamic advertising optimization that adapts to real-time customer behavior patterns. In 2024, as per the National University, approximately 46% of business owners anticipate generative AI to develop optimal responses to colleagues, such as emails. Adobe and Jasper reported a 30% increase in campaign ROI among enterprise clients using generative tools. AI models analyze customer behavior and preferences to tailor messaging, while also automating A/B testing and performance tracking. Enterprises are integrating these tools into CRM and analytics platforms to optimize engagement. As marketing environments become increasingly complex and data-driven, generative AI tools become indispensable for translating vast customer datasets into actionable insights and personalized experiences that drive customer acquisition and retention.

Customized Language Models Drive Enterprise AI Growth with Secure, Industry-Specific Text Solutions

Based on model type, the text segment is expected to dominate the market in 2025, with a revenue share of over 40-45%. Growth in this segment is being fueled by the development of customized language models tailored to industry-specific needs. These models emphasize improvements in text generation, comprehension, and data privacy. For instance, in July 2024, Fujitsu partnered with U.S.-based Cohere to launch Takane, a Japanese language model designed for private cloud environments. The solution delivers secure generative AI capabilities for enterprises, combining Fujitsu’s AI expertise with Cohere’s advanced language models. This partnership particularly benefits sectors such as finance and government by enhancing productivity while ensuring compliance and security. Enterprise adoption of text-based generative AI remains especially strong in customer-facing functions, where it significantly improves response times and consistency while reducing operational costs.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 4.3 billion |

|

Revenue forecast in 2035 |

USD 125.5 billion |

|

CAGR (2025-2035) |

40.0% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Component (Software, Services), Deployment (Cloud, On-Premise), Model Type, Application (Content Creation, Marketing and Sales, Customer Service & Support, Product Design & Development, Supply Chain Management), Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

OpenAI; Microsoft Corporation; Google LLC (Alphabet Inc.); Amazon Web Services (AWS); Anthropic; Meta Platforms, Inc.; NVIDIA Corporation; Salesforce, Inc.; Adobe Inc.; IBM Corporation; Oracle Corporation; SAP SE; Cohere; Databricks; Hugging Face; Stability AI; Fujitsu Limited; Cognizant Technology Solutions; Accenture plc; ServiceNow, Inc. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Market Segmentation

The Enterprise Generative AI Market size is estimated to be USD 4.3 billion in 2025 and grow at a CAGR of 40.0% to reach USD 125.5 billion by 2035.

In 2024, the Enterprise Generative AI Market size was estimated at USD 3.1 billion, with projections to reach USD 4.3 billion in 2025.

OpenAI, Microsoft Corporation, Google LLC (Alphabet Inc.), Amazon Web Services (AWS), Anthropic, Meta Platforms, Inc., NVIDIA Corporation, Salesforce, Inc., Adobe Inc., IBM Corporation, Oracle Corporation, and ServiceNow, Inc. among others are the major companies operating in the Enterprise Generative AI Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

Based on application, content creation is estimated to dominate the enterprise generative AI in 2025.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates