Resources

About Us

Cloud-native Application Protection Platform Market Analysis and Forecast Size, Share, Forecast & Trends by Component (Solution and Services) Cloud (Hybrid cloud and Multi-cloud) Organization Size, and Application - Global Forecast to 2035

Report ID: MRICT - 1041594 Pages: 210 Sep-2025 Formats*: Excel Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Cloud-native Application Protection Platform Market Size?

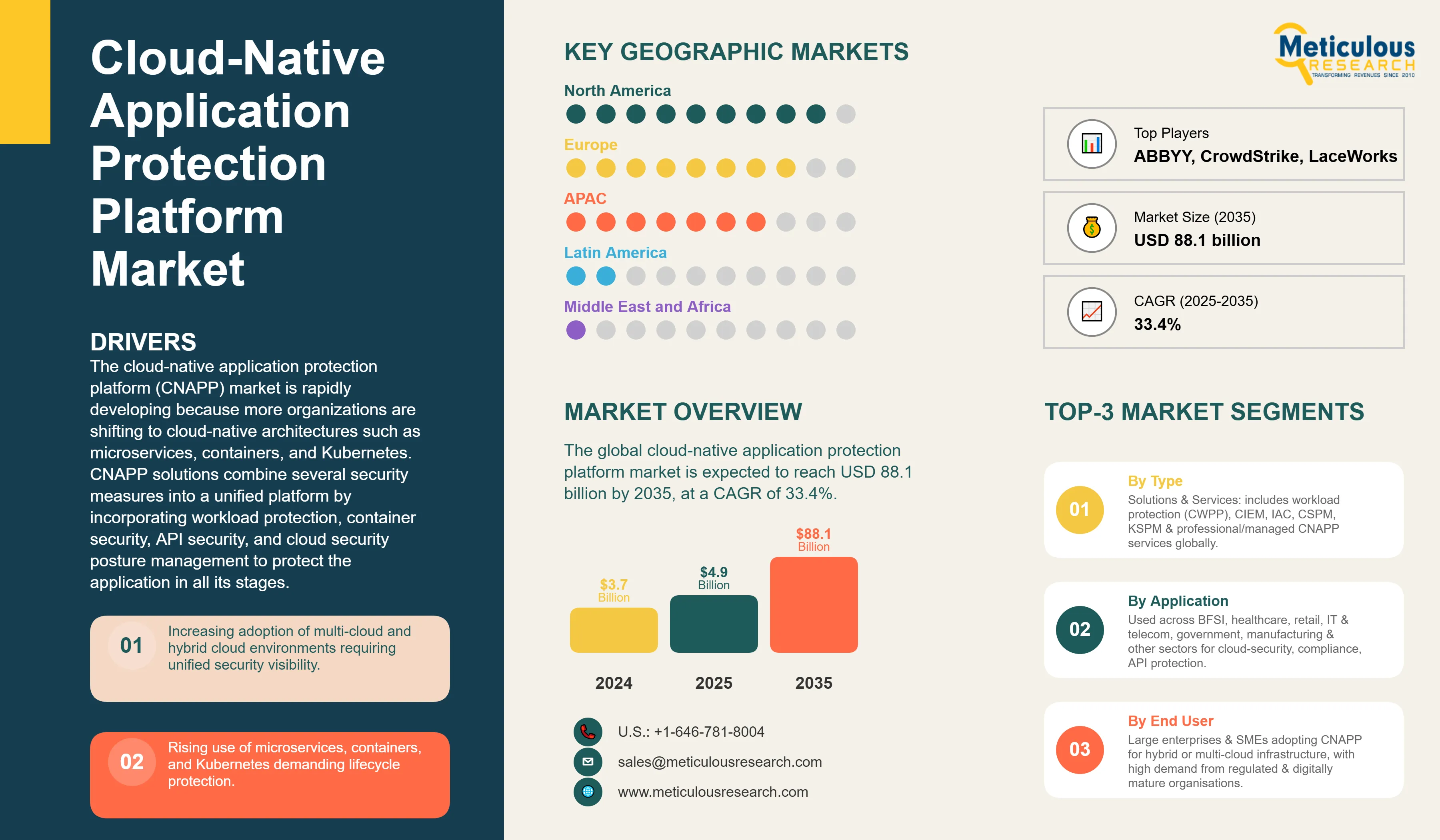

The global cloud-native application protection platform market was valued at USD 3.7 billion in 2024. The market is expected to reach USD 88.1 billion by 2035 from USD 4.9 billion in 2025, at a CAGR of 33.4%. The cloud-native application protection platform (CNAPP) market is rapidly developing because more organizations are shifting to cloud-native architectures such as microservices, containers, and Kubernetes. CNAPP solutions combine several security measures into a unified platform by incorporating workload protection, container security, API security, and cloud security posture management to protect the application in all its stages. This integrated strategy helps simplify it and enhance identification of threats on the dynamic cloud landscape. As an example, Prisma Cloud, provided by Palo Alto Networks, supports CNAPP functionality and allows the Siemens Company to meet compliance requirements and protect its worldwide multi-cloud infrastructure against the modern threat environment of the cyber world.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

CNAPP market is increasingly competitive as vendors are attempting to distinguish themselves with full-featured offerings, integration features, and scale. Cogent security-based businesses like Palo Alto Networks, Check Point Software technologies, and Trend Micro have well established, end-to-end platforms that combine workload, container, and API security. In the meantime, new industry players such as Orca Security, Wiz and Lacework are gaining popularity, implementing an agentless scanning capability, quicker deployment and an in-depth perspective on a multi-cloud environment.

Recent Developments

Trend Micro & Google Cloud Expand AI-Driven Security Integration

In July 2025, Trend Micro has extended its partnership with Google Cloud, to advance AI-driven cybersecurity in complex cloud environments. This extended collaboration brings together Trend Micro Vision One Sovereign and Private Cloud (SPC) solution with Google Cloud Assured Workloads that strengthen the protection of data in the public, hybrid and air-gapped environments.

Palo Alto Networks Launches “Cortex Cloud” to Elevate Real-Time CNAPP Capabilities

In February 2025, Palo Alto Networks launched Cortex Cloud, an integration of its next-generation CNAPP solutions with the world-leading SecOps platform to provide real-time cloud security. The launch combines the capabilities of Prisma Cloud and the runtime detection and response (CDR) used by Cortex, so there is one backend and simplified tools.

Key Market Drivers

Key Market Restraints

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

Rising Multi-Cloud & Hybrid Cloud Adoption |

Increased demand for unified security platforms |

Standardization of cross-cloud security frameworks |

▲ +3.5% |

|

Shift-Left Security Practices |

Greater integration of security scanning |

Full automation of DevSecOps workflows |

▲ +3.2% |

|

|

AI & ML-Powered Threat Detection |

Enhanced real-time anomaly detection and automated incident response |

Predictive threat intelligence preventing zero-day vulnerabilities |

▲ +3.0% |

|

|

Restraints |

High Implementation & Integration Costs |

Slower adoption by SMBs due to budget constraints |

Gradual cost reduction with SaaS-based CNAPP offerings |

▼ −1.5% |

|

Integration Challenges with Legacy Systems |

Delays in deployment due to incompatibility with existing security tools |

Broader API and connector support reducing integration friction |

▼ −1.3% |

|

|

Opportunities |

Expansion of Agentless Security Models |

Rapid adoption due to ease of deployment |

Agentless CNAPP becoming default model |

▲ +3.1% |

|

CNAPP Integration with AI-Driven Cloud Governance |

Early adoption in regulated industries |

AI-powered policy enforcement |

▲ +2.8% |

|

|

Trends |

Convergence with DevSecOps Platforms |

Security fully embedded into developer workflows |

Unified security & development dashboards |

▲ +2.5% |

|

Challenges |

Managing Dynamic & Large-Scale Cloud Environments |

Difficulty in maintaining consistent security posture |

Advanced orchestration & automated policy enforcement |

▼ −1.0% |

Regional Analysis

North America Leads the CNAPP Market with Highest Revenue Share

The North American region is expected to command the highest market share in the cloud-native application protection platform market, accounting for 40–45% market share globally in 2025. This high market share is majorly owing to the early adoption of modern cloud-native security services, and a strong presence of most key players. The area has a high penetration level of clouds wherein more than 85% of organizations are utilizing at least one cloud services as well as approximately 70% pursuing multi-cloud tactics. Strict regulatory compliance requirement as well as huge investments in the integration of DevSecOps further enhance market growth. As an example, large US based enterprises (Capital One, etc.) deploy kubernetes, securing it with tools such as Prisma Cloud developed by Palo Alto Networks to be compliant in large scale Kubernetes-based deployments and be compliant with much of the environments in which they exist (AWS, Azure, and Google Cloud, etc.).

Europe Emerging as a Rapidly Growing CNAPP Market

The Europe cloud-native application protection platform (CNAPP) market is experiencing a robust growth in the region, pertaining to rising cloud adoption, growth in containerized applications, and strict data protection policies. The implementation of GDPR has been a significant catalyst, compelling organizations to adopt comprehensive security measures for cloud applications. Other key variables include a mature cloud adoption landscape, high regulatory compliance standards, and a proactive approach towards cybersecurity. Several companies in various industries are now spending on CNAPP solutions to be able to meet the multi-cloud operations with a guaranteed security at the same time observing the regulations. For instance, the Deutsche Telekom has implemented and integrated CNAPP tools to improve visibility, threat detection and compliance monitoring within its hybrid cloud environment that serves its operational efficiency and compliance. Additionally, the surging use of cloud services in essential industries such as the banking, healthcare, and government, along with the rise of remote working and digital transformation initiatives, are propelling the industry growth.

Country-level Analysis

Federal Security Requirements and Enterprise Innovation Drive Technology Leadership in the U.S.

The U.S. market boasts of a commanding influence on the cloud-native application protection platform business, owing to high concentration of cloud-native companies, quick pace of digitalization, and high profile of international Cybersecurity giants. Federal agencies implement extensive cybersecurity frameworks including NIST guidelines, FedRAMP certification requirements, and zero-trust architecture mandates that establish security standards influencing global adoption. Major enterprises across finance, healthcare, and technology sectors deploy comprehensive CNAPP solutions to address regulatory compliance, protect intellectual property, and maintain competitive advantages in digital markets. The market maturity is fostered by the country focus on the implementation of DevSecOps and AI to detect threats. For instance, Netflix, CNAPP is used to protect its large Kubernetes and microservices stack, but with important scalability and security. Additionally, industry organizations and associations promote cybersecurity best practices and provide training resources for security professionals implementing CNAPP solutions across diverse enterprise environments, thereby driving the country market.

Government Digital Strategy and Cloud Infrastructure Investment Drive Rapid Market Growth in China

China demonstrates significant growth potential in the CNAPP market, and is expanding at 35.8% CAGR, owing to comprehensive government digital transformation strategies and massive investments in cloud infrastructure that require sophisticated security protection. The government's emphasis on technological self-reliance and data sovereignty drives development of indigenous CNAPP solutions that comply with national cybersecurity regulations and data localization requirements. Major technology companies including Alibaba, Tencent, and Baidu develop comprehensive cloud security platforms serving both domestic and international markets, while state-owned enterprises implement advanced security measures for critical infrastructure protection. Moreover, the integration of CNAPP solutions with national monitoring systems and compliance frameworks enables comprehensive security management across multiple administrative levels. Thus, the surging emphasis on international cybersecurity cooperation and standards harmonization facilitates technology transfer and global market expansion opportunities for Chinese CNAPP vendors throughout the forecast period.

Segmental Analysis

Solution Segment Dominated the Market Through Comprehensive Security Integration

The cloud native application protection platform market is expected to be dominated by the solution segment, accounting for more than 60% market share in 20245. This market dominance is majorly pertaining to the continued to rise due to the increased demand of one-stop comprehensive and integrated security platforms that deliver workload protection, container security, API monitoring and compliance management combined. Organizations are choosing end-to-end CNAPP solutions on a subscription basis rather than standalone tools to minimize complexity, better understand, and automate cloud-native environments. As an example, Prisma Cloud by Palo Alto Networks gained popularity among the international organizations as the system with the potential to provide unified security across multi-cloud and hybrid environments, assuring quicker discovery and mitigation of the threats. The solution-centric methodology focuses on seamless integration with current cloud infrastructure, providing unified visibility and control. The segment further benefits from AI and machine learning integration that enables sophisticated pattern recognition, automated threat hunting, and intelligent risk scoring for proactive security measures.

By Cloud, Hybrid Segment held the Majority of Market Share

Hybrid cloud segment is the largest in the CNAPP market as businesses gradually move to on-premises and multi-cloud environments to achieve balance between scalability, control and compliance. CNAPP in Hybrid environments provide visibility, detection of threats, and policy enforcement of all varieties of infrastructures across organizations, which decreases security silos. For instance, Microsoft Defender for Cloud offers end to end security management among the Azure, AWS, and on-premises workloads, a feature that makes it ideal in a hybrid cloud application. The segment's dominance reflects organizational confidence in hybrid cloud security when protected by comprehensive CNAPP solutions that provide real-time threat detection, automated response capabilities, and continuous compliance monitoring. The hybrid cloud segment further projects significant expansion potential, driven by organizations requiring consistent security governance across on-premises and multiple cloud infrastructures. These environments demand integrated security management platforms offering centralized visibility, policy enforcement, and compliance monitoring across diverse infrastructure types.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 4.9 billion |

|

Revenue forecast in 2035 |

USD 88.1 billion |

|

CAGR (2025-2035) |

33.4% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Component (Solution and Services), Cloud (Hybrid cloud and Multi-cloud), Organization Size, Application, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Checkpoint Security, ABBYY, CrowdStrike, LaceWorks, Fortinet, Zscaler, Palo Alto Networks, Tenable, Qualys, Trend Micro, and Other Key Players. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Market Segmentation

The Cloud-native Application Protection Platform Market size is estimated to be USD 4.9 billion in 2025 and grow at a CAGR of 33.4% to reach USD 88.1 billion by 2035.

In 2024, the Cloud-native Application Protection Platform Market size was estimated at USD 3.7 billion, with projections to reach USD 4.9 billion in 2025.

Checkpoint Security, ABBYY, CrowdStrike, LaceWorks, Fortinet, Zscaler, and Palo Alto Networks are the major companies operating in the Cloud-native Application Protection Platform Market.

The Asia Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

The cloud native application protection platform market is expected to be dominated by the solution segment, accounting for more than 60% market share in 2025.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: May-2024

Published Date: May-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates