Resources

About Us

AI Hardware Market Size, Share, Forecast & Trends by Component (GPU, CPU, Memory, Storage) Technology (Edge AI, Cloud AI) Industry (Consumer Electronics, Automotive, Healthcare) - Global Forecast to 2035

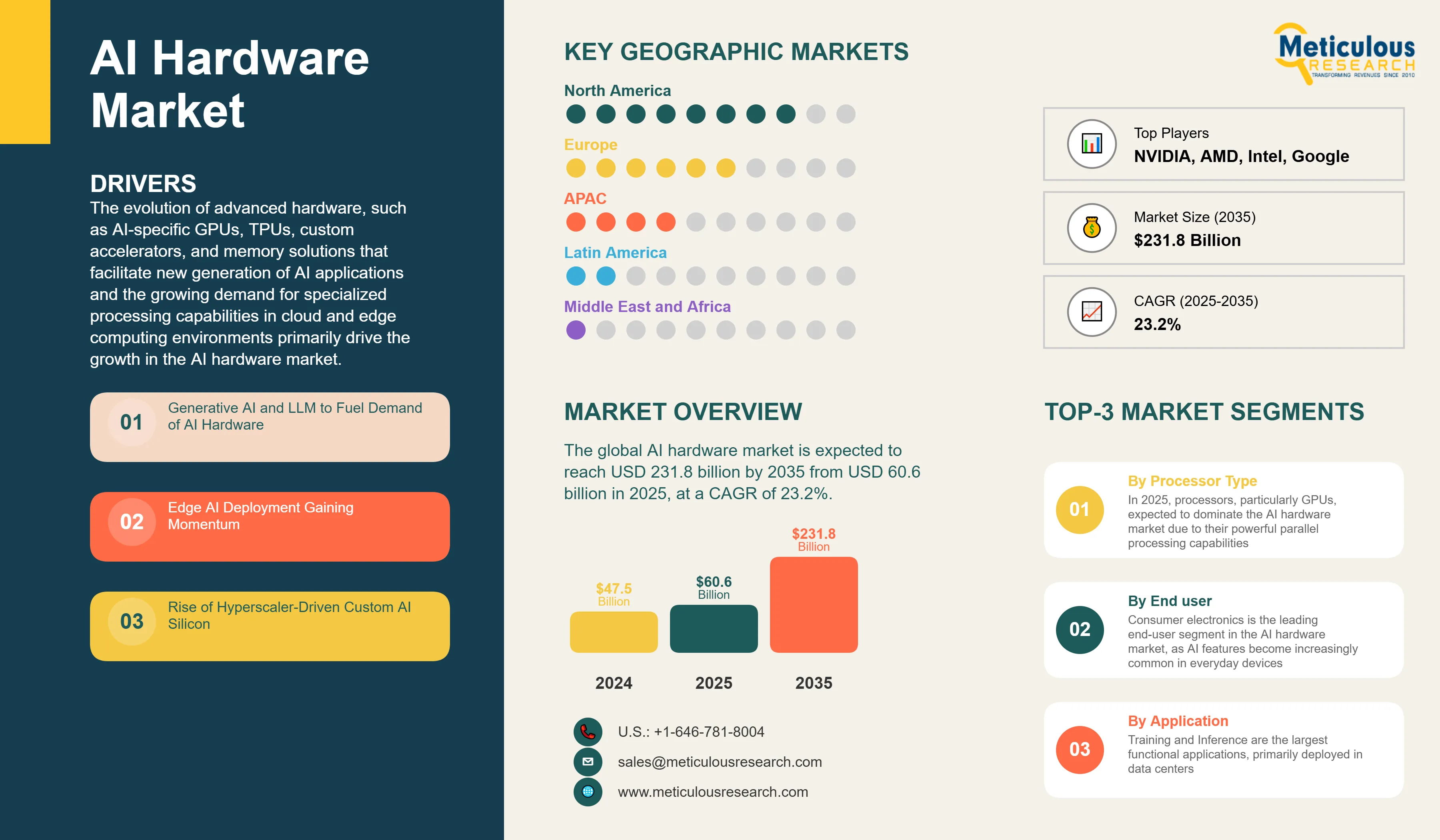

Report ID: MRICT - 1041539 Pages: 270 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global AI hardware market was valued at USD 47.5 billion in 2024. The market is expected to reach USD 231.8 billion by 2035 from USD 60.6 billion in 2025, at a CAGR of 23.2%. The evolution of advanced hardware, such as AI-specific GPUs, TPUs, custom accelerators, and memory solutions that facilitate new generation of AI applications and the growing demand for specialized processing capabilities in cloud and edge computing environments primarily drive the growth in the AI hardware market. According to McKinsey, semiconductor companies historically captured roughly 20–30% of the technology stack's value in PCs and only 10–20% in mobile devices. However, the rise of AI significantly shifts this dynamic: semiconductors are projected to capture 40–50% of the total value in the emerging AI technology stack, marking their most substantial opportunity in decades.

Competitive Scenario

The AI hardware market is characterized by intense competition between chipmakers, cloud hyperscalers, and new silicon innovators. Although Nvidia remains the industry leader, AMD, Intel, and cloud-native companies such as AWS and Google are all accelerating the development of new AI accelerators. Networking and interconnect specialists, including Broadcom and Marvell, are also expanding their market share as compute systems scale. Meanwhile, startups like Cerebras are disrupting with novel architectures, such as wafer-scale compute. The competitive landscape is rapidly shifting as companies compete for control of AI infrastructure.

Recent Developments

AMD Unveils MI350/MI400 & “Helios” AI Server with Open Ecosystem

NVIDIA Launches Blackwell & Rubin

Key Market Drivers

Key Market Restraints

Table: Key Factors Impacting Global AI Hardware Market (2025–2035)

Base CAGR: 23.2%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Generative AI and LLM Exponential Growth |

Foundation models scaling rapidly |

Mainstream enterprise AI adoption |

▲ +3.8% |

|

2. Edge AI Deployment and Real-Time Processing |

Autonomous vehicles and IoT expansion |

Ubiquitous edge computing infrastructure |

▲ +2.5% |

|

|

3. Hyperscaler Custom Silicon Development |

Major cloud providers reduce NVIDIA dependence |

Fully integrated custom chip ecosystems |

▲ +1.9% |

|

|

Restraints |

1. Escalating R&D Costs and Design Complexity |

Limits participation to major players |

Advanced tools reduce barriers slightly |

▼ −1.2% |

|

2. Power Consumption and Environmental Concerns |

Sustainability regulations restrict growth |

Energy-efficient architectures emerge |

▼ −1.5% |

|

|

Opportunities |

1. Semiconductor Value Stack Expansion |

AI chips capture 40-50% of tech stack value |

Complete AI hardware ecosystem maturity |

▲ +3.1% |

|

2. Regional Manufacturing and Supply Chain Resilience |

CHIPS Act and national strategies launch |

Diversified global production networks |

▲ +3.0% |

|

|

Trends |

1. Wafer-Scale and Novel Architecture Innovation |

Startups like Cerebras gain market share |

Alternative architectures become mainstream |

▲ +2.4% |

|

Challenges |

1. Memory Bandwidth and System Integration |

Performance bottlenecks in current systems |

Advanced memory solutions resolve issues |

▼ −0.6% |

Regional Analysis

North America: Silicon Supremacy and Cloud Titans Lead AI Hardware Surge

In 2025, North America is expected to lead the AI hardware market, driven by strengths in semiconductors, cloud computing, and large-scale AI applications. U.S.-based giants like NVIDIA, Intel, and AMD form a strong tech ecosystem, while Google, Microsoft, and Amazon bolster regional dominance through major AI infrastructure investments. Amazon alone committed around USD 30 billion to new U.S. data centers. These strategic moves enable rapid training and deployment of large AI models, meeting rising enterprise and public sector demand for secure, scalable compute. The region’s firms also lead in GPU and AI accelerator innovation, with strong R&D fueling a steady pipeline of advanced hardware, giving local enterprises early access to cutting-edge AI chips and boosting competitiveness.

The CHIPS Act, along with continued venture funding for startups, is strengthening AI research and domestic chip production. North America is poised to lead the market through 2035, owing to a strong focus on securing its AI supply chain and advancing cutting-edge technologies, particularly as AI adoption grows in industries such as healthcare, defense, and autonomous vehicles.

Asia-Pacific: Speed, Scale, and Technological Autonomy Accelerate AI Hardware Growth

During the forecast period, the Asia-Pacific (APAC) region is expected to grow at the fastest pace, driven by digital transformation, smart city projects, and a push for tech self-reliance. Countries such as China, South Korea, India, and key Southeast Asian nations are making substantial investments in cloud, telecom, and electronics infrastructure, fueling strong demand for GPUs, NPUs, and edge AI processors.

China leads with its AI roadmap and chip independence goals, backed by companies like Huawei and Alibaba that are driving key breakthroughs in AI chip design. Some of the notable developments include Huawei’s Kunlun AI processors developed for cloud and edge applications, while Alibaba’s development of proprietary AI inference chips powering its cloud AI services. Such advancements are complemented by critical support offered through government investment in fabrication capacity and supportive frameworks to reduce reliance on foreign suppliers. Similarly, South Korea has bolstered itself as a critical hub for memory and logic chip advancements, with Samsung and SK Hynix pioneering to innovate next-generation DRAM and NAND technologies. Samsung, notably, is also enhancing its 3nm and 2nm process nodes to strengthen its position in the chip density and power efficiency areas, crucial for AI workloads.

With a predominantly mobile-first population and accelerating 5G adoption, Asia-Pacific is poised to witness substantial growth. It has become a portfolio of diverse AI hardware applications, spanning from AI-powered smart surveillance to ultra-low latency edge computing in industrial IoT applications. The region’s collective push to develop indigenous chip ecosystems, complemented with rising R&D investments and supportive government policies, positions the Asia-Pacific region to outpace other geographies over the next years.

Country-level Analysis

Innovation Ecosystem and Federal Funding Propel U.S. AI Hardware Surge

The US leads AI hardware innovation, with AWS, Microsoft Azure, and Google Cloud investing heavily in AI infrastructure. These companies power the majority of the world's AI workloads with cutting-edge NVIDIA GPUs and custom accelerators such as TPUs and FPGAs. For instance, in 2024, Amazon’s capital expenditures surpassed USD 83 billion, primarily directed towards the expansion of AI-focused data centres and the deployment of advanced hardware such as AI accelerators, GPUs, and high-speed networking components. Other players, including Nvidia, AMD, Intel, and Broadcom, are accelerating advanced chip development, while startups and specialized firms such as Cerebras Systems and Groq are carving out niche offerings in wafer-scale and ultra-fast AI inference hardware.

The US government plays a critical role in ensuring supply chain resilience and next-generation chip development through the CHIPS and Science Act and DARPA's multibillion-dollar initiatives. This collaboration of public funding and private innovation is expected to boost domestic AI hardware manufacturing significantly. The Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, signed in August 2022, allocated over USD 75 billion to promote competitiveness in the semiconductor industry and reduce dependence on foreign suppliers.

As foundational models and LLMs grow, so does the demand for powerful chips, resulting in a self-sustaining growth cycle. In healthcare, AI adoption has notably surged, with over 35% of U.S. healthcare organizations reporting using AI in 2024 (up from 30% in 2023). Also, around 80% of hospitals are leveraging AI for patient care and workflow efficiency. In the defense sector, the Department of Defense awarded USD 16.3 million in 2024 to the California-Pacific-Northwest AI Hardware Hub, funding projects that enhance scalable, energy-efficient, and smart AI chip modalities that are specifically aimed at next-generation defense requirements.

Policy-Driven Growth and Technological Autonomy Shape China’s AI Hardware Landscape

China's push for technological self-sufficiency is driving the AI hardware market, due to domestic innovation and a strong policy framework. In response to semiconductor export restrictions, major players such as Alibaba, Baidu, and Huawei are using proprietary chips like Hanguang, Kunlun, and Ascend to power smart cities, surveillance, and automation.

In response to supply chain risks, China is bolstering its semiconductor ecosystem through SMIC’s foundry expansion and investments in homegrown lithography tools. National initiatives such as the New Generation AI Plan and Digital China Plan 2025—each committing over $50 billion—are laying the foundation for sustained technological leadership. This public-private synergy is fueling rapid advancements in both edge AI and data center-grade computing infrastructure. China is well-positioned for sustained, high-value growth in sectors such as manufacturing, healthcare, and transportation, as national security and economic goals are inextricably linked.

Germany’s AI Hardware Surge Driven by Industry 4.0 and Innovation

With a strong emphasis on edge AI and machine vision, Germany is driving innovation in AI hardware to support its advanced industrial base. Through initiatives like “Industrie 4.0,” the country is not only modernizing manufacturing but also laying the groundwork to become a major player in the global semiconductor landscape. Edge processors, vision chips, and real-time inference hardware are in high demand as AI chips are integrated into robotics, autonomous systems, and smart factories by Siemens, Bosch, and BMW.

In July 2025, Germany unveiled a €5.5 billion national AI strategy aimed at driving AI to contribute 10% of GDP by 2030. Led by the Federal Ministry of Education and Research (BMBF), the plan emphasizes AI innovation, infrastructure, and talent development, with significant impact on Germany’s leading technology sector: machine vision.

Germany's focus on privacy, ethical AI, and trusted computing creates secure edge hardware niches. Its national policy prioritizes privacy and “trusted computing,” driving the demand for efficient and secure edge chips that align with strict data protection (GDPR and upcoming EU AI Act) requirements. The country is becoming Europe's high-value AI hardware innovation hub, especially in automotive, smart infrastructure, and precision manufacturing, due to Fraunhofer and DFKI. Fraunhofer’s AI chip advancements (such as the SENNA) target energy optimization and security at the edge. Similarly, DFKI is advancing "Trusted AI" with projects such as explainable AI for better quality management and robust AI technologies built for the automobile, smart infrastructure, and green manufacturing industries.

Segmental Analysis

Processors Dominate the AI Hardware Market

In 2025, processors, particularly GPUs, expected to dominate the AI hardware market due to their powerful parallel processing capabilities and crucial role in training and inference. NVIDIA’s cutting-edge Blackwell Ultra GB300 and upcoming Rubin architectures are setting new performance benchmarks. For instance, the Blackwell Ultra GB300 provides a 50% surge in dense FP4 compute versus its predecessors, allowing ultra-large-scale model training and robust inference for heavy AI applications. AMD's MI300X series, which is widely used by Microsoft and Meta, can outperform NVIDIA's H100 in certain workloads by up to 1.6x. The GPUs are expected to grow at a CAGR of 17.3% over the forecast period.

Google's TPU lineup is rapidly growing. TPU v6 (Trillium) is nearly five times faster than its predecessor, and TPU v7 (Ironwood) supports more than 4,600 TFLOP/s per pod, making it ideal for inference-intensive applications. Cerebras and other startups are developing wafer-scale architectures with massive core counts and energy-efficient performance that far outperform traditional GPUs. Thus, the robust deployment capabilities and advancements related to processors have entrenched this segment’s leadership in the AI hardware landscape. It has also set new performance benchmarks for the peer segments to pursue, and this momentum is anticipated to propel further developments, as the processors segment is poised to be the key driving force, facilitating innovations in the AI hardware market.

Consumer Electronics Devices Fuel Surge in AI Hardware Demand

Consumer electronics is the leading end-user segment in the AI hardware market, as AI features become increasingly common in everyday devices, including smartphones, televisions, voice assistants, wearables, and AR/VR systems. These devices heavily rely on edge AI chips to perform low-latency, power-efficient real-time tasks like facial recognition, voice commands, and content personalization. The consumer electronics category is projected to witness growth at a CAGR of 23.9% over the coming years.

Smartphone manufacturers are using AI accelerators to improve camera, security, and smart assistant capabilities. Chipmakers are also including neural processing units (NPUs) in SoC designs to enable offline generative AI, real-time translation, and multimodal inference, bringing powerful AI capabilities to the device while improving privacy and responsiveness. With shorter product lifecycles and rising consumer expectations, AI is poised to become a critical feature in personal technology, accelerating cutting-edge AI innovation and driving long-term demand for hardware.

Report Specifications:

|

Report Attribute |

Details |

|

Market size (2025) |

USD 60.6 billion |

|

Revenue forecast in 2035 |

USD 231.8 billion |

|

CAGR (2025-2035) |

23.2% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Component (Processors, Memory, Networking, Storage), Technology, Application (Training, Inference), Processor Type, Application, End-User Industry, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

NVIDIA Corporation; Advanced Micro Devices (AMD); Intel Corporation; Google (Alphabet Inc.); Amazon Web Services; Broadcom Inc.; Marvell Technology; Cerebras Systems; Groq Inc.; Huawei Technologies |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Market Segmentation

Key Questions Answered in the Report:

The AI Hardware Market size is estimated to be USD 60.6 billion in 2025 and grow at a CAGR of 23.2% to reach USD 231.8 billion by 2035.

In 2024, the AI Hardware Market size was estimated at USD 47.5 billion, with projections to reach USD 60.6 billion in 2025.

NVIDIA Corporation, Advanced Micro Devices (AMD), Intel Corporation, Google (Alphabet), Amazon Web Services, Broadcom Inc., and Cerebras Systems are the major companies operating in the AI Hardware Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035), driven by digital transformation and technological autonomy initiatives.

In 2025, processors (particularly GPUs) account for the largest market share in the AI Hardware Market, with consumer electronics being the leading end-user segment.

Published Date: Aug-2025

Published Date: Oct-2024

Published Date: Sep-2024

Published Date: Sep-2024

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates