Resources

About Us

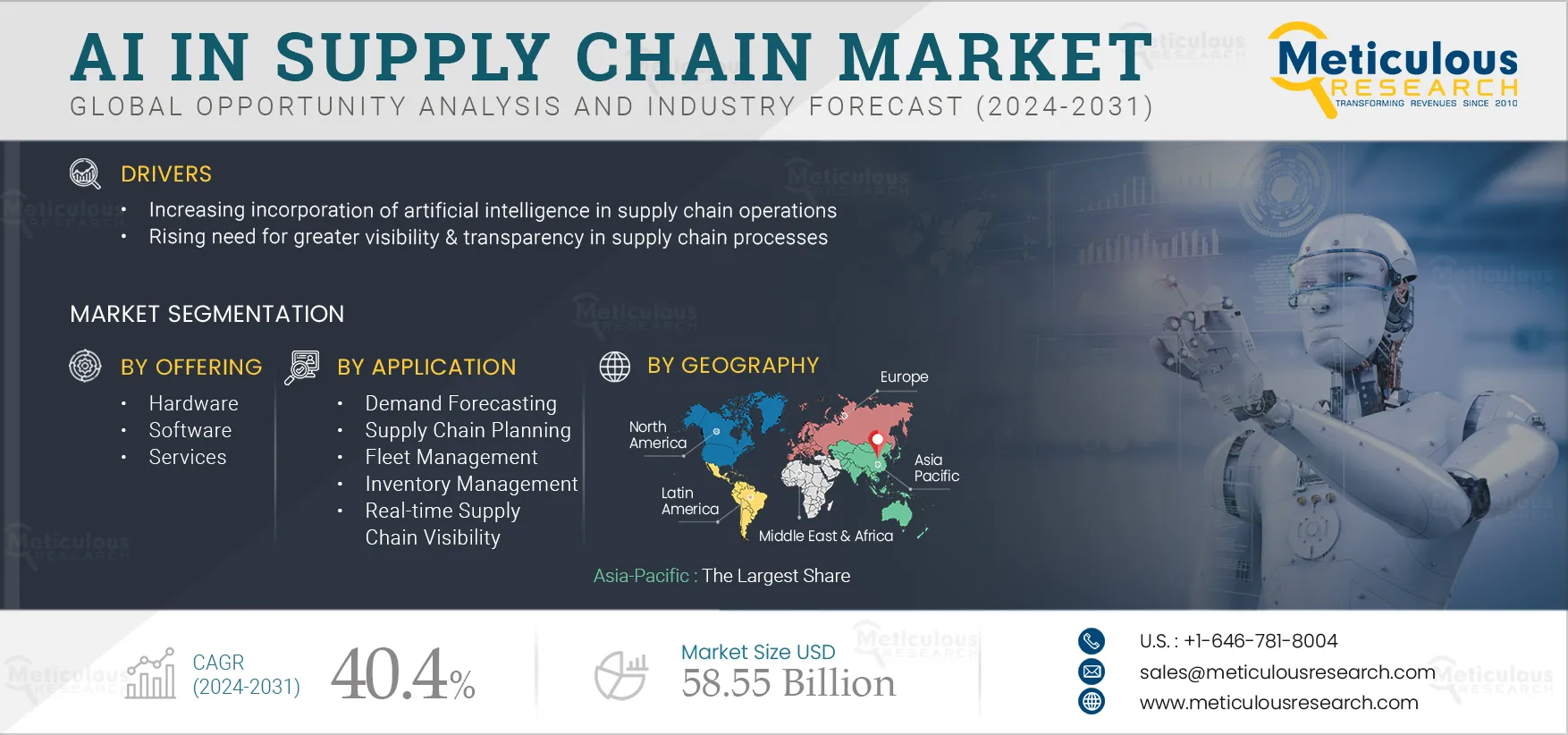

AI in Supply Chain Market Size, Share, Forecast, & Trends Analysis by Offering (Hardware, Software, Other), Technology (ML, NLP, RPA, Other), Deployment Mode, Application (Demand Forecasting, Other), End-use Industry (Manufacturing, Retail, F&B, Other) & Geography - Global Forecasts to 2031

Report ID: MRICT - 104365 Pages: 282 May-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe AI in Supply Chain Market is expected to reach $58.55 billion by 2031, at a CAGR of 40.4% from 2024 to 2031. The growth of the AI in supply chain market is driven by the increasing incorporation of artificial intelligence in supply chain operations and the rising need for greater visibility & transparency in supply chain processes. However, the high procurement & operating costs of AI-based supply chain solutions and the lack of supporting infrastructure restrain the growth of this market.

Furthermore, the growing demand for AI-based business automation solutions is expected to generate growth opportunities for the players operating in this market. However, performance issues in integrating data from multiple sources and data security & privacy concerns are major challenges impacting market growth. Additionally, the rising demand for cloud-based supply chain solutions is a prominent trend in the AI in supply chain market.

Customer experience and satisfaction are largely influenced by the complexity of returns processes, delivery times & accuracy, and visibility into stock levels. These factors can be optimized by leveraging AI capabilities. The players in this market are focused on expanding AI-supported features in their supply chain management solutions.

Furthermore, machine learning approaches, such as deep analytics and real-time monitoring, significantly improve supply chain visibility, allowing businesses to offer enhanced customer experiences and meet delivery schedules. Market players are launching AI-based supply chain management solutions to offer enterprises better efficiency and productivity. For instance, in February 2023, XPDEL (U.S.), a leading omnichannel fulfillment and logistics services company, launched its AI-enabled shipping solution in India. The solution helps enterprises choose the best rates and the fastest delivery methods based on product dimensions, delivery distance, and service levels, enhancing customer experience. Thus, companies’ rising focus on optimizing supply chain operations using AI to enhance customer experience and satisfaction is driving the growth of the AI in supply chain market.

Click here to: Get Free Sample Pages of this Report

Modern-day businesses have realized the importance of collecting and sharing supply chain information with trading partners and customers. By increasing supply chain transparency, companies can connect with customers, build trust, and gain better visibility into all stages of their supply chains to drive process improvements and react faster and more effectively when problems occur.

There are numerous advantages to supply chain transparency, such as increasing confidence among companies that their suppliers, materials, and products are genuine, acquired honestly, and live up to company standards. Market players are focused on product launches and partnerships to offer enhanced supply chain visibility. For instance:

Cloud technologies have become the core of businesses’ digital transformation efforts. Many organizations consider cloud-based multiparty networks a key enabler of complete supply chain network visibility and transparency. They eliminate the need for complex and costly point-to-point integration, which leads to siloed data, data latencies, and blind spots in the supply chain.

Organizations are steadily moving their workloads from on-premise IT infrastructure and data processing to public clouds, which is expected to boost the demand for cloud-based supply chain solutions. The main reason companies move to the cloud is cost savings. Moreover, cloud computing also provides speed, agility, and visibility.

Some of the cloud-based offerings recently launched in the market are as follows:

Businesses are adopting automation technologies to increase efficiency, reduce efforts, and optimize costs and the utilization of resources and time. With advances in technologies such as Robotic Process Automation (RPA) and Artificial Intelligence (AI), businesses are transitioning from legacy practices to automated workflows to make business processes proactive, intelligent, and effective.

Artificial intelligence is increasingly being integrated into automated workflows, with supply chain processes, such as order processing, inventory management, and logistics, benefitting from reduced staffing needs and time and cost savings. The increasing focus on AI-powered business automation solutions is expected to generate growth opportunities for market players. Hence, the players in this market are launching advanced solutions to help enterprises increase business productivity and efficiency. For instance, in May 2023, ServiceNow, Inc. (U.S.), a leading digital workflow company, launched Finance and Supply Chain Workflows to help enterprises apply intelligent automation to business-critical processes.

Based on offering, the AI in supply chain market is segmented into hardware, software, and services. In 2024, the hardware segment is expected to account for the largest share of 44.4% of the AI in supply chain market. The large market share of this segment is attributed to advancements in data center capabilities, the growing need for storage hardware due to increasing storage requirements for AI applications, the crucial need for constant connectivity in the supply chain operations, and the emphasis on product development and enhancement by manufacturers. For instance, in January 2023, Intel Corporation launched its 4th Gen Intel Xeon Scalable processors (code-named Sapphire Rapids), the Intel Xeon CPU Max Series (code-named Sapphire Rapids HBM), and the Intel Data Center GPU Max Series (code-named Ponte Vecchio). These new processors deliver significant improvements in data center performance, efficiency, security, and AI capabilities.

However, the software segment is expected to record the highest CAGR of 43.2% during the forecast period. This segment's growth is driven by the rising focus on product development and the enhancement of supply chain software and the benefits offered by supply chain software in facilitating supply chain visibility and centralized operations.

Based on technology, the AI in supply chain market is segmented into machine learning, computer vision, natural language processing, context-aware computing, and robotic process automation. In 2024, the machine learning segment is expected to account for the largest share of 63.0% of the AI in supply chain market. The large market share of this segment is attributed to the advancements in data center capabilities, increasing deployment of machine learning solutions and its ability to perform tasks without relying on human input, and the rapid adoption of cloud-based technology across several industries. For instance, in June 2022, FedEx Corporation (U.S.) invested in FourKites, Inc. (U.S.), a supply chain visibility startup. This strategic collaboration allows FedEx to leverage its machine learning and AI capabilities with data from FedEx, enhancing its operational efficiency and visibility.

However, the robotic process automation segment is expected to record the highest CAGR of 42.9% during the forecast period. The growth of this segment is driven by the increased adoption of RPA across various industries and the rising demand for automating business processes to meet heightened customer expectations.

Based on deployment mode, the AI in supply chain market is segmented into cloud-based deployments and on-premise deployments. In 2024, the cloud-based deployments segment is expected to account for the larger share of 75.6% of the AI in supply chain market. The large market share of this segment is attributed to the increasing avenues for cloud-based deployments, the superior flexibility and affordability offered by cloud-based deployments, and the increasing adoption of cloud-based solutions by small & medium-sized enterprises.

Moreover, the cloud-based deployments segment is expected to record the highest CAGR during the forecast period. The rapid development of new security measures for cloud-based deployments is expected to drive this segment's growth in the coming years.

Based on application, the AI in supply chain market is segmented into demand forecasting, supply chain planning, warehouse management, fleet management, risk management, inventory management, predictive maintenance, real-time supply chain visibility, and other applications. In 2024, the demand forecasting segment is expected to account for the largest share of 25.2% of the AI in supply chain market. The large market share of this segment is attributed to the rising initiatives to integrate AI capabilities in supply chain solutions, dynamic changes in customer behaviors and expectations, and the rising need to achieve accuracy and resilience in the supply chain. For instance, in March 2023, Zionex, Inc. (South Korea), a prominent provider of advanced supply chain and integrated business planning platforms, launched PlanNEL Beta. This AI-powered SaaS platform is designed for demand forecasting and inventory optimization.

However, the real-time supply chain visibility segment is expected to record the highest CAGR during the forecast period. This segment's growth is driven by the rising integration of AI capabilities into supply chains to obtain real-time data on them.

Based on end-use industry, the AI in supply chain market is segmented into manufacturing, food and beverage, healthcare & pharmaceuticals, automotive, retail, building & construction, medical devices & consumables, aerospace & defense, and other end-use industries. In 2024, the manufacturing segment is expected to account for the largest share of 23.1% of the AI in supply chain market. The large market share of this segment is attributed to the increasing number of manufacturing companies, favorable initiatives to integrate artificial capabilities in the supply chain, and the increasing focus on achieving accuracy and resilience in the supply chain among manufacturers.

However, the retail segment is expected to record the highest CAGR of 47.8% during the forecast period. This segment's growth is driven by the rising integration of AI capabilities in the retail supply chain to forecast inventory and demand and retailers' growing focus on meeting consumer expectations.

In 2024, Asia-Pacific is expected to account for the largest share of 36.9% of the AI in supply chain market. The large market share of this region is attributed to the rapid pace of digitalization and modernization across industries, the advent of Industry 4.0, and the growing adoption of advanced technologies across various businesses.

Moreover, the Asia-Pacific region is projected to record the highest CAGR of 42.7% during the forecast period. This market's growth is driven by the proliferation of advanced supply chain solutions, the rising deployment of AI tools across the region, and efforts by major market players to implement AI technology across various sectors.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3 to 4 years. Some of the key players operating in the AI in supply chain market are IBM Corporation (U.S.), SAP SE (Germany), Microsoft Corporation (U.S.), Google LLC (U.S.), Amazon Web Services, Inc. (U.S.), Intel Corporation (U.S.), NVIDIA Corporation (U.S.), Oracle Corporation (U.S.), C3.ai, Inc. (U.S.), Samsung SDS CO., Ltd. (South Korea), Coupa Software Inc. (U.S.), Micron Technology, Inc. (U.S.), Advanced Micro Devices, Inc. (U.S.), FedEx Corporation (U.S.), and Deutsche Post DHL Group (Germany).

|

Particulars |

Details |

|

Number of Pages |

282 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

40.4% |

|

Market Size (Value) |

USD 58.55 Billion by 2031 |

|

Segments Covered |

By Offering

By Technology

By Deployment Mode

By Application

By End-use Industry

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Sweden, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (UAE, Israel, Rest of the Middle East & Africa) |

|

Key Companies |

IBM Corporation (U.S.), SAP SE (Germany), Microsoft Corporation (U.S.), Google LLC (U.S.), Amazon Web Services, Inc. (U.S.), Intel Corporation (U.S.), NVIDIA Corporation (U.S.), Oracle Corporation (U.S.), C3.ai, Inc. (U.S.), Samsung SDS CO., Ltd. (South Korea), Coupa Software Inc. (U.S.), Micron Technology, Inc. (U.S.), Advanced Micro Devices, Inc. (U.S.), FedEx Corporation (U.S.), and Deutsche Post DHL Group (Germany). |

The AI in supply chain market study focuses on market assessment and opportunity analysis through the sales of AI in supply chain solutions across different regions and countries across different market segmentations. This study is also focused on competitive analysis for the AI in supply chain market based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The AI in Supply Chain Market is expected to reach $58.55 billion by 2031, at a CAGR of 40.4% from 2024 to 2031.

In 2024, the manufacturing segment is expected to hold the largest share of the AI in supply chain market.

The real-time supply chain visibility segment is expected to register the highest CAGR during the forecast period.

The growth of the AI in supply chain market is driven by the increasing incorporation of artificial intelligence in supply chain operations and the rising need for greater visibility & transparency in supply chain processes. Furthermore, the growing demand for AI-based business automation solutions is expected to generate growth opportunities for the players operating in this market.

Key players operating in the AI in supply chain market are IBM Corporation (U.S.), SAP SE (Germany), Microsoft Corporation (U.S.), Google LLC (U.S.), Amazon Web Services, Inc. (U.S.), Intel Corporation (U.S.), NVIDIA Corporation (U.S.), Oracle Corporation (U.S.), C3.ai, Inc. (U.S.), Samsung SDS CO., Ltd. (South Korea), Coupa Software Inc. (U.S.), Micron Technology, Inc. (U.S.), Advanced Micro Devices, Inc. (U.S.), FedEx Corporation (U.S.), and Deutsche Post DHL Group (Germany).

Asia-Pacific is expected to record a higher CAGR during the forecast period.

Published Date: Aug-2025

Published Date: Apr-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates