Resources

About Us

ELISA Market Size, Share, Forecast, & Trends Analysis by Type (Direct, Sandwich, Competitive) Offering (Analyzer, Software) Technology (Chemiluminescence, Colorimetry, Fluorescence) Application (Research, Diagnostic) End User - Global Forecast to 2032

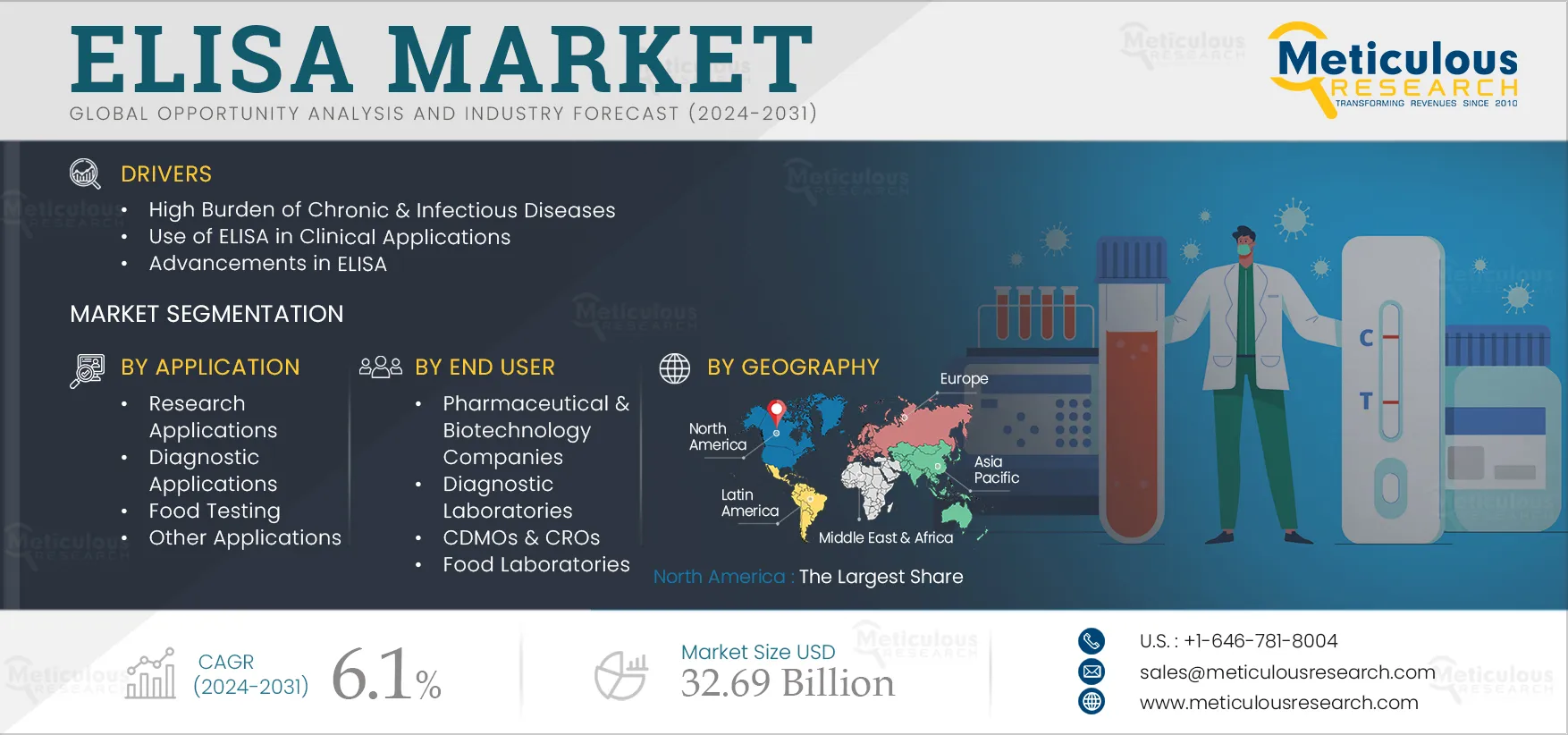

Report ID: MRHC - 1041314 Pages: 350 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the ELISA market is primarily driven by the high burden of chronic & infectious diseases, the increasing use of ELISA in clinical applications, advancements in ELISA, and the growing use of ELISA in the food industry. Furthermore, growing research activities in developing countries, increasing R&D for biomarker detection, and the growing focus on vaccine development are expected to offer growth opportunities for market stakeholders.

ELISA is performed to detect or screen patients for diseases such as cancer, HIV, and autoimmune diseases. The rising prevalence of these diseases drives the utilization of ELISA kits. According to the World Health Organization (WHO) report published in July 2024, nearly 39 million people had HIV as of 2022.

ELISA uses antibodies that are specific and sensitive to target antigens. It can detect lower concentrations of biomarkers. In cancer detection, ELISA kits detect biomarkers such as Alpha-fetoprotein (AFP) and β-2microglobulin (B2M). ELISA is easier to perform and provides results faster compared to other tests. According to GLOBOCAN, the number of new cancer cases is expected to rise by 63.4% between 2022 and 2045. Thus, rising cancer incidence and the high preference for ELISA tests in cancer detection and diagnosis drive the growth of this market.

Click here to: Get Free Sample Pages of this Report

ELISA is used to detect and measure antigens in biological samples. In recent years, key players have been focused on advancing ELISA. The integration of nanomaterials in ELISA is one such advancement that has improved sensitivity, enhanced overall performance, and helped in the detection of trace amounts of proteins or biomarkers. Nanomaterials such as white Fe-based Coordination Polymer Nanozymes (FCPN), Multiwalled Carbon Nanotubes (MWCNTs), and Metallic Nanoparticles (NP) help in hassle-free enzyme loading.

Aptamers produced through chemical synthesis are now replacing antibodies in ELISA procedures. Aptamers can be modified as required and are cheaper to produce. Also, aptamers can be synthesized against a wide range of target molecules; hence, ELISA tests can be used for detecting many chronic & infectious diseases. These advancements have enabled more accurate and faster results, easy processing, and cost and time savings.

Digital ELISA is considered an advanced and sensitive immunoassay technique built on the principles of the traditional ELISA technique. Digital ELISA uses beads to induce enzyme reactions in femtoliter-sized wells that can detect single-enzyme molecules. The technique is used to accurately detect biomarkers or proteins in ultra-low-level concentration solutions. Magnetic microbead detection, single-molecule counting, and electrochemical detection are some of the types of digital ELISA. Digital ELISA helps researchers and scientists optimize results faster and more accurately. Digital ELISA serves applications in environmental monitoring, drug discovery, and clinical diagnostics. For instance, digital ELISA supports neurological research and diagnostics by measuring brain biomarkers. Digital ELISA offers high sensitivity, flexibility, and multiplexed capabilities. Quanterix Corp. (U.S.) offers digital ELISA for the detection of brain biomarkers.

The integration of robotics and automation in ELISA streamlines the entire assay process, from sample preparation to data analysis. Automation helps in precise processing by dispensing accurate amounts of required reagents and samples. It helps in decreasing variabilities from the results and reducing the time required for conducting experiments. Automation and robotics improve accuracy and reproducibility as robots work on algorithms that do not change, reducing the risk of variations in sample volumes and detection time.

Automation and robotics follow system-integrated workflows that result in seamless processing without interruptions. ELISA robots can simultaneously perform pipetting procedures for multiple assays. Simultaneous processing results in reduced manual errors and increases time efficiency. According to Automata (U.K.), the use of ELISA robots reduces manual intervention during assays by 80%-95.25%.

Biomarkers are biomolecules present in cells that help in disease detection. Biomarkers are largely used for identifying mutations and other chromosomal abnormalities during the detection of early-stage cancers. Biomarker detection helps in assessing diagnostic, predictive and monitoring results. Patients’ increasing inclination toward personalized medicines is increasing the utilization of ELISA for biomarker detection. In precision medicine, biomarker estimation helps in designing treatment strategies and optimizing therapeutic outcomes for patients. Thus, the growing focus on precision medicine coupled with high cancer prevalence is increasing research in the area of biomarker detection. Also, funding for biomarker R&D is increasing, generating opportunities for market growth. For instance, in August 2024, the National Comprehensive Cancer Network (U.S.), an alliance of 33 cancer centers in the U.S., in partnership with Fight Colorectal Cancer (U.S.), a patient empowerment organization, and Pfizer Inc. (U.S.), announced new grants for initiatives focused on optimizing biomarker-directed therapy for metastatic colorectal cancer.

Based on type, the ELISA market is segmented into direct ELISA, indirect ELISA, sandwich ELISA, and competitive ELISA. In 2025, the indirect ELISA segment is expected to account for the largest share of 43.5% of the ELISA market. Indirect ELISA is a detection type where a primary antigen-specific antibody is recognized by a secondary conjugated antibody. Indirect ELISA is highly sensitive and flexible, which helps in binding more than one labeled secondary antibody. Indirect ELISA uses fewer labeled antibodies and is used to detect total antibody concentrations in biological samples. Thus, the high sensitivity, flexibility, and cost-effectiveness of indirect ELISA contribute to the segment’s large market share.

Based on offering, the ELISA market is segmented into kits & assays, analyzers, and software. In 2025, the kits & assays segment is expected to account for the largest share of 85.2% of the ELISA market. ELISA kits are commonly used for disease diagnosis, pregnancy testing, cancer detection, vaccine development, and food allergen testing. The rising prevalence of diseases, coupled with growing awareness regarding early disease diagnosis, is contributing to the segment’s large market share.

Based on technology, the ELISA market is segmented into chemiluminescence ELISA, colorimetric ELISA, and fluorescence ELISA. In 2025, the colorimetric ELISA segment is expected to account for the largest share of the ELISA market. Colorimetric ELISA uses colored reaction products to produce results. It uses labeled enzymes such as peroxidase or phosphatase for testing. Colorimetric ELISA is used for various types of samples, making it ideal for research applications. Colorimetric ELISA is non-destructive, and the samples can be used for further analysis. These factors support the segment’s large market share.

Based on application, the ELISA market is segmented into research applications, diagnostic applications, food testing, and other applications. In 2025, the diagnostic applications segment is expected to account for the largest share of the ELISA market. Diagnostic applications are further subsegmented into infectious diseases, autoimmune diseases, oncology, and other diagnostic applications. The increasing prevalence of cancer, autoimmune diseases, and infectious diseases is driving the utilization of ELISA kits in diagnostic applications.

According to the National Institute of Environmental Health Sciences (NIEHS), 50 million people in the U.S. have autoimmune diseases. Thus, the high prevalence of target diseases, coupled with the benefits of ELISA, such as high sensitivity, accuracy, and reliability, supports the segment’s large share.

Based on end user, the ELISA market is segmented into pharmaceutical & biotechnology companies, diagnostic laboratories, CDMOs & CROs, academic & research institutes, food laboratories, and other end users. In 2025, the diagnostic laboratories segment is expected to account for the largest share of the ELISA market. The segment’s large share is attributed to the high prevalence of infectious and chronic diseases, the reliable test results provided by diagnostic laboratories, and the expansion of diagnostic laboratories. Diagnostic laboratories perform various medical tests that help identify and diagnose medical conditions. Diagnostic laboratories are well-equipped with advanced technological solutions and, therefore, are able to process more samples quicker. Thus, the rising burden of diseases and diagnostic laboratories’ high preference for ELISA tests contribute to the segment’s large share.

In 2025, North America is expected to account for the largest share of 37.7% of the ELISA market. The region’s large share is attributed to pharmaceutical companies’ high focus on R&D, supportive government initiatives, and the presence of large pharmaceutical players in the region. There is also an increased focus on food testing due to the increasing number of food adulteration cases in the region. Key players in North America are also undertaking strategic initiatives to increase food testing capacities in the region. For instance, in June 2025, Spectacular Labs Inc. (U.S.) collaborated with the Canadian Centre for Meat Innovation & Technology to improve food safety testing. Similarly, in June 2024, Bureau Veritas (France) opened its fourth food laboratory in the U.S. in Chesterfield, Missouri. The laboratory offers rapid and conventional microbiology testing for food and agricultural commodities. Such developments are expected to drive the demand for ELISA kits for food testing, supporting the growth of this regional market.

However, Asia-Pacific is slated to register the highest growth rate of 7.1% during the forecast period. The increasing number of healthcare facilities, diagnostic laboratories, and food testing laboratories in Asia-Pacific are driving the demand for ELISA in the region. Additionally, government initiatives for veterinary disease testing are driving the ELISA market in the region. Countries’ growing focus on improving human and animal healthcare, increasing investments in drug discovery, growth in diagnostic testing, and the growing focus on vaccination in Asia-Pacific are driving the demand for ELISA in the region. For instance, in May 2025, the Government of Australia started its vaccination drive for Influenza and released the list of available vaccines (Source: Commonwealth of Australia).

The report includes a competitive landscape based on an extensive assessment of the product offerings, geographic presence, and key strategic developments of leading market players (2021–2025). The key players operating in the ELISA market include Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Bio-Rad Laboratories Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), Danaher Corporation (U.S.), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (U.S.), Abbott Laboratories (U.S.), bioMérieux SA (France), Revvity Inc. (U.S.), QuidelOrtho Corporation (U.S.), Becton, Dickinson and Company (U.S.), Repligen Corporation (U.S.), BioLegend (U.S.), and Bio-Techne Corporation (U.S.).

ELISA Market Overview: Latest Developments from Key Industry Players

|

Particulars |

Details |

|

Number of Pages |

350 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

6.1% |

|

Estimated Market Size (Value) |

$32.69 Billion by 2032 |

|

Segments Covered |

By Type

By Offering

By Technology

By Application

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa) |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Bio-Rad Laboratories Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), Danaher Corporation (U.S.), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (U.S.), Abbott Laboratories (U.S.), bioMérieux SA (France), Revvity Inc. (U.S.), QuidelOrtho Corporation (U.S.), Becton, Dickinson and Company (U.S.), Repligen Corporation (U.S.), BioLegend (U.S.), and Bio-Techne Corporation (U.S.) |

This report includes qualitative and quantitative analyses of the ELISA market based on type, offering, technology, application, end user, and geography. The report also provides insights on factors impacting market growth, along with a regulatory analysis, a pricing analysis, and Porter’s Five Forces analysis for the ELISA market.

The ELISA market is projected to reach $32.69 billion by 2032 at a CAGR of 6.1% from 2025 to 2032.

Among all the ELISA types studied in this report, in 2025, the indirect ELISA segment is expected to account for the largest share of 43.5% of the ELISA market. The segment’s large share is attributed to the benefits of indirect ELISA such as high sensitivity, specificity, and flexibility, and the ability to capture total antibody concentration from samples.

The growth of this market is driven by various factors, including the increasing burden of target diseases, the growing use of ELISA in clinical applications, the introduction of technologically advanced ELISA analyzers, and the increasing application of ELISA in the food industry. Furthermore, growing research activities in developing countries, growing R&D for biomarker detection, and the increasing focus on vaccine development are expected to offer growth opportunities for market stakeholders.

The key players operating in the ELISA market include Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Bio-Rad Laboratories Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), Danaher Corporation (U.S.), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (U.S.), Abbott Laboratories (U.S.), bioMérieux SA (France), Revvity Inc. (U.S.), QuidelOrtho Corporation (U.S.), Becton, Dickinson and Company (U.S.), Repligen Corporation (U.S.), BioLegend (U.S.), and Bio-Techne Corporation (U.S.).

Asia-Pacific is slated to register the highest growth rate of 7.1% during the forecast period, primarily due to the increasing number of healthcare facilities, diagnostic laboratories, and food testing laboratories in the region. Additionally, government initiatives supporting veterinary disease testing are supporting market growth in Asia-Pacific.

Published Date: Jun-2022

Published Date: Jan-2024

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates