Resources

About Us

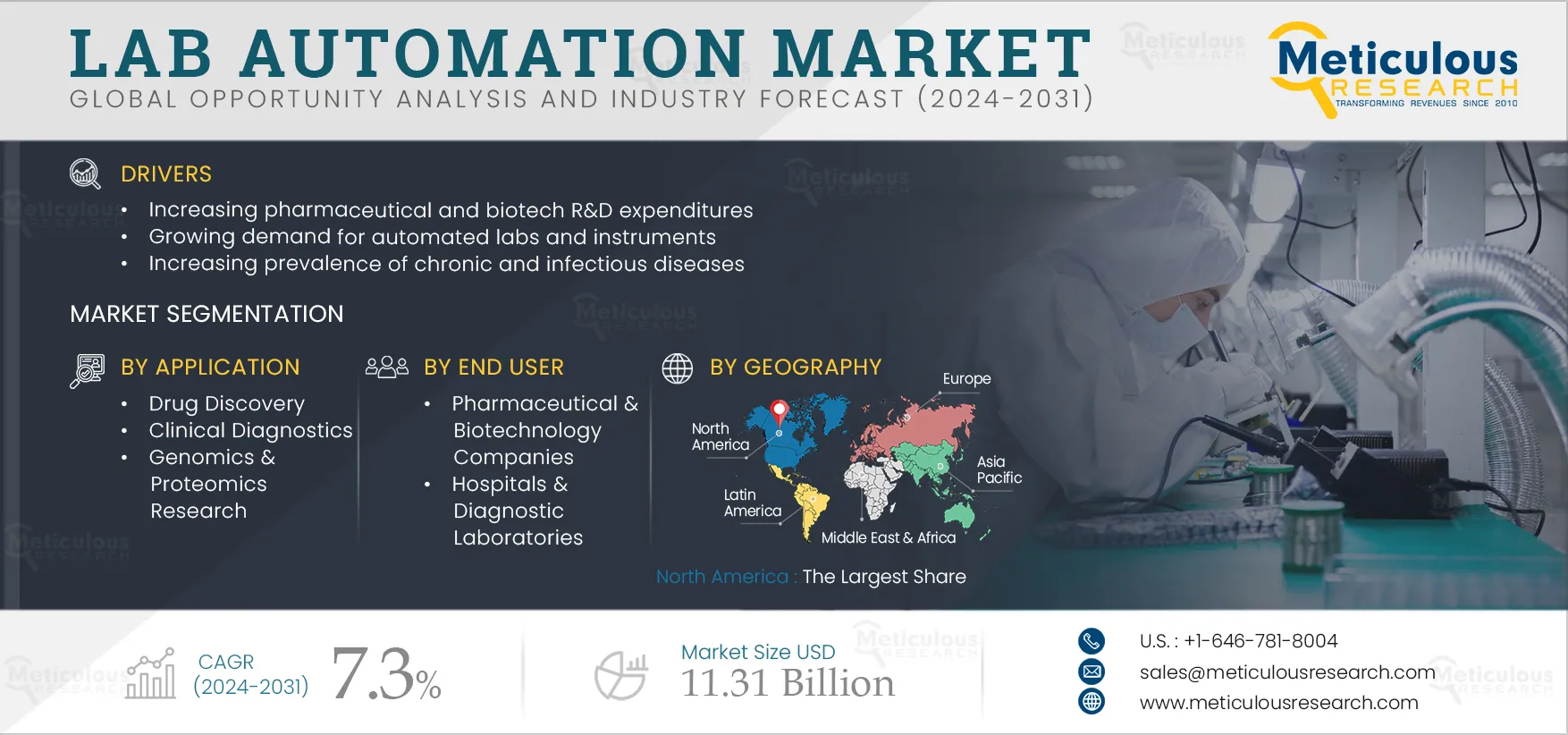

Lab Automation Market Size, Share, Forecast, & Trends Analysis by Product (Liquid Handling, Nucleic Acid Purification System, Microplate Reader, ELISA, LIMS, ELN) Application (Drug Discovery, Diagnostics, Genomics) End User – Global Forecast to 2031

Report ID: MRHC - 104175 Pages: 244 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market can be attributed to several factors, including the increasing pharmaceutical and biotech R&D expenditures, the growing demand for automated labs and instruments, the increasing prevalence of chronic and infectious diseases, and government initiatives supporting life sciences R&D. Additionally, growth in genomics & proteomics research, the increasing focus on food safety and quality, rising awareness & growing adoption of personalized medicine, and emerging economies serve as opportunities for the market.

Funding and investments are critical for the lab automation industry in driving innovation, advancing research & development, and improving patient outcomes. Investments come from various sources, such as governments, associations, and venture capitalists. For instance, according to the National Venture Capital Association, venture capital investments and funding for biotech and pharmaceutical companies in the U.S. reached USD 30.7 billion in 2022 from USD 18.7 billion in 2019. Similarly, Merck KgaA (Germany) has a program called the Advance Biotech Grant Program, which is offered to biopharmaceutical, pharmaceutical, start-ups, entrepreneurs, scientists and students in different regions of the world. This program awards products, services, and consultations to the awardees to help accelerate their growth in the market.

Increasing funding and investments are driving the growth of the life sciences industry, boosting the adoption of laboratory automation equipment.

Click here to: Get Free Sample Pages of this Report

Lab automation systems include automated liquid handling systems, automated ELISA systems, automated nucleic acid purification systems, automated storage & retrieval systems, automated microplate readers, and other lab automation systems. The integration of automation systems in laboratories eliminates the need for most repetitive tasks in a lab, such as library preparation or liquid handling, that have typically been performed manually by lab technicians or scientists. Lab automation systems can replace manual, repetitive tasks, increase throughput, and improve quality. The major benefits of lab automation include high efficiency, reproducibility, data accuracy, traceability, safety, and faster speed. There has been an increase in the demand for automated lab instruments due to the need to be interconnected. This coupled with the growing initiatives to support the growth of lab automation in various industries, are factors supporting the market growth.

There have been several technological advancements in the field of laboratory automation, one of which is the use of Artificial Intelligence (AI) and Machine Learning (ML). The reliance of laboratories on AI and ML is increasing rapidly due to the shortage of skilled professionals in laboratories. AI and ML help automate workflows, prioritize samples, differentiate between conditions, verify results, and perform quality checks. In May 2023, A. Menarini Diagnostics Ltd. (U.K.) announced the launch of Prime MDx, a fully automated molecular diagnostics platform. This sample-to-result platform allows users to process a variety of sample types through real-time Polymerase Chain Reaction (PCR). This platform can run up to 5 different assays per sample with a capacity of 240 samples per day using AI-driven software.

Adopting automation and AI can significantly increase the efficiency of laboratories and offer growth opportunities for the lab automation market.

Integrating digital and automation technologies offers better solutions such as enhanced efficiency, accuracy, and real-time data analysis. Several trends such as internet of things (IoT), artificial intelligence (AI), machine learning (ML) can lead to seamless workflow in laboratories. Integrated connectivity provides seamless connectivity, allows the process of samples in less time, better reliability and reproducibility, and fully traceable data.

Several companies are launching new software and solutions to orchestrate scientific discoveries and several new products. For instance, in March 2022, Biosero, Inc. (U.S.) launched new products and solutions in the company’s Green Button Go software suite that is an advanced laboratory automation solution that helps customers streamline, control, and generate better results from the existing automated laboratory systems.

The growing awareness & adoption of personalized medicines are expected to generate growth opportunities for the players operating in the laboratory automation market. The increasing awareness and adoption of personalized medicines are driving the demand for specialized and automated laboratory equipment and technologies that enable precise, error-free, and accurate genetic and molecular analysis. Personalized medicine heavily relies on genetic testing, sequencing, genomic & proteomic information analysis, and biomarker identification and validation, necessitating the use of advanced laboratory equipment, such as DNA sequencers, gene sequencers, PCR machines, real-time PCR systems, next-generation sequencers, mass spectrometers, immunoassay analyzers, and chromatography systems to produce accurate results.

Additionally, with advancements in DNA sequencing technologies and reduced costs, there has been a significant increase in demand for DNA sequencing in genomics research, clinical diagnostics, and personalized medicine. This demand is boosting the need for high-throughput DNA sequencers, sample preparation equipment, and data analysis tools, which is expected to generate growth opportunities for laboratory equipment manufacturers and suppliers.

Based on product, the lab automation market is segmented into systems and software. In 2024, the systems segment is expected to account for the largest share of 71.5% of the market. The main factors contributing to the large market share of this segment are the elimination of repetitive tasks in laboratories, the increasing prevalence of genetic diseases, and the advantages of automated instruments, such as high efficiency, increased throughput, greater accuracy, and reduced manual intervention. The instruments typically used in laboratories to carry out certain procedures are usually larger in size and require manual adjustment. However, in the case of automated systems, these instruments are usually compact and do not require manual intervention for any of the steps. This speeds up the research process and provides precision in the tasks, proving to be an efficient, fast, and accurate method to carry out research, thereby contributing to the growth of the market.

However, the software segment is expected to grow at the fastest CAGR of 7.4% during the forecast period of 2024–2031. With increasing data generation in research, the demand for software such as electronic laboratory notebook (ELN) to electronically document their experiments, including scientific content and observations, instrument results, and attachments from experiments such as spectra, chromatograms and, if appropriate, chemical structures is increasing, driving the market growth.

Based on application, the lab automation market is segmented into drug discovery, clinical diagnostics, genomics & proteomics research, and other applications. In 2024, the drug discovery segment is expected to account for the largest share of 35.5% of the market. The large market share of this segment is attributed to the ability of automated labs to screen large numbers of compounds more rapidly, reduction of human error, and ability to gain more reproducible, consistent results supporting the largest adoption of automated lab equipment for drug discovery applications. Further, rising pharmaceutical R&D expenditure and government initiatives supporting drug discovery and development are also positively impacting the market.

However, the clinical diagnostics segment is expected to grow at the fastest CAGR of 7.8% during the forecast period of 2024–2031. Lab automation in clinical laboratories has been widely adopted to increase accuracy and efficiency and reduce costs and errors. Automation of clinical laboratories can significantly reduce costs and human errors and can positively impact patient outcomes. Additionally, the shortage of skilled laboratory staff also drives the market growth.

Based on end user, the lab automation market is segmented into pharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, research & academic institutes, and other end users. In 2024, the pharmaceutical & biotechnology companies’ segment is expected to account for the largest share of 41.0% of the market. The large market share of this segment is attributed to the high pharmaceutical R&D expenditure, rising demand for new drug discovery and development, growing focus on increasing overall productivity, growing pharmaceutical and biotechnology R&D expenditure, and initiatives by the pharmaceutical and biotechnology companies to expand their research capabilities by opening new research centers. The introduction of new research centers will lead to an increase in the number of experiments conducted. These experiments can be conducted faster and with more accuracy by using automated lab instruments, therefore driving the growth of the market.

In 2024, North America is expected to account for the largest share of 40.8% of the lab automation market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The large share of the segment is attributed to factors such as the increasing pharmaceutical R&D expenditure, rising demand for standardization of laboratory processes, growing demand for improved efficiency, accuracy, and productivity in laboratories, and advanced healthcare infrastructure in the region.

Asia-Pacific is slated to register the highest CAGR in the lab automation market during the forecast period. The high market growth in Asia-Pacific is attributed to improving healthcare infrastructure, increasing disposable income, expanding pharmaceutical & biotechnology industry, and increasing pharmaceutical research and government funding. Improvement in healthcare infrastructure, especially in developing countries, leads to reduced costs, improved accuracy, and faster diagnosis. This, coupled with the use of automated instruments, can substantially increase the growth of the market.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the lab automation market are Thermo Fisher Scientific, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Revvity, Inc. (U.S.), Agilent Technologies, Inc. (U.S), Waters Corporation (U.S.), Tecan Group Ltd. (Switzerland), F. Hoffmann-La Roche AG (Switzerland), Siemens Healthineers AG (Germany), Abbott Laboratories (U.S.), Becton, Dickinson, and Company (U.S.), Hudson Robotics, Inc. (U.S.), and Hamilton Company (U.S.). As of 2023, Abbott Laboratories (U.S.), Danaher Corporation (U.S.), Hamilton Company (U.S.), Thermo Fisher Scientific Inc. (U.S.), and Siemens Healthineers AG (Germany) collectively hold a share of 47%-49% in the global lab automation market.

In September 2023, Bio-Rad Laboratories, Inc. launched the PTC Tempo 48/48 and PTC Tempo 384 thermal cyclers that are designed to aid PCR applications such as sequencing, cloning, and genotyping.

In February 2023, Revvity, Inc. launched the EnVision Nexus Multimode Microplate Reader, which provides high-throughput screening and accelerates drug discovery results.

|

Particular |

Details |

|

Page No |

244 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

7.3% |

|

Market Size (Value) |

$11.31 billion |

|

Market Size (Volume) |

NA |

|

Segments Covered |

By Product

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, RoE), Asia-Pacific (China, Japan, India, RoAPAC), Latin America, and the Middle East & Africa. |

|

Key Companies |

Thermo Fisher Scientific, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Revvity, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Waters Corporation (U.S.), Tecan Group Ltd. (Switzerland), F. Hoffmann-La Roche AG (Switzerland), Siemens Healthineers AG (Germany), Abbott Laboratories (U.S.), Becton, Dickinson, and Company (U.S.), Hudson Robotics, Inc. (U.S.), Hamilton Company (U.S.) |

This market study covers the market sizes & forecasts of the lab automation based on product, application, end user, and geography. This market study also provides the value analysis of various segments and subsegments of the global lab automation market at country levels.

The global lab automation market is projected to reach $11.31 billion by 2031, at a CAGR of 7.3% during the forecast period.

Based on product, the lab automation market is segmented into systems and software. In 2024, the systems segment is expected to account for the largest share of the market.

Based on application, in 2024, the drug discovery segment is expected to account for the largest share of the market. The large share of the segment is due to the benefits of lab automation in the drug discovery and development process, the ability of automated instruments to screen large numbers of compounds more rapidly, removing human error, enabling more reproducible and consistent results, and the government initiatives supporting the drug discovery and development process.

The growth of this market can be attributed to several factors, including the increasing pharmaceutical and biotech R&D expenditures, the growing demand for automated labs and instruments, the increasing prevalence of chronic and infectious diseases, and government initiatives supporting life sciences R&D. Additionally, growth in genomics & proteomics research, the increasing focus on food safety and quality, rising awareness & growing adoption of personalized medicine, and emerging economies serve as opportunities for the market.

The key players operating in the global lab automation market are Thermo Fisher Scientific, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Revvity, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Waters Corporation (U.S.), Tecan Group Ltd. (Switzerland), F. Hoffmann-La Roche AG (Switzerland), Siemens Healthineers AG (Switzerland), Abbott Laboratories (U.S.), Becton, Dickinson, and Company (U.S.), Hudson Robotics, Inc. (U.S.), and Hamilton Company (U.S.).

Growing adoption of lab automation in emerging economies such as China and India, factors such as rising healthcare expenditure, increasing focus of governments of different countries to adopt lab automation, and the increasing prevalence of chronic and infectious diseases are the major factors expected to provide growth opportunities for players operating in this market.

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Jun-2022

Published Date: Feb-2022

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates