Resources

About Us

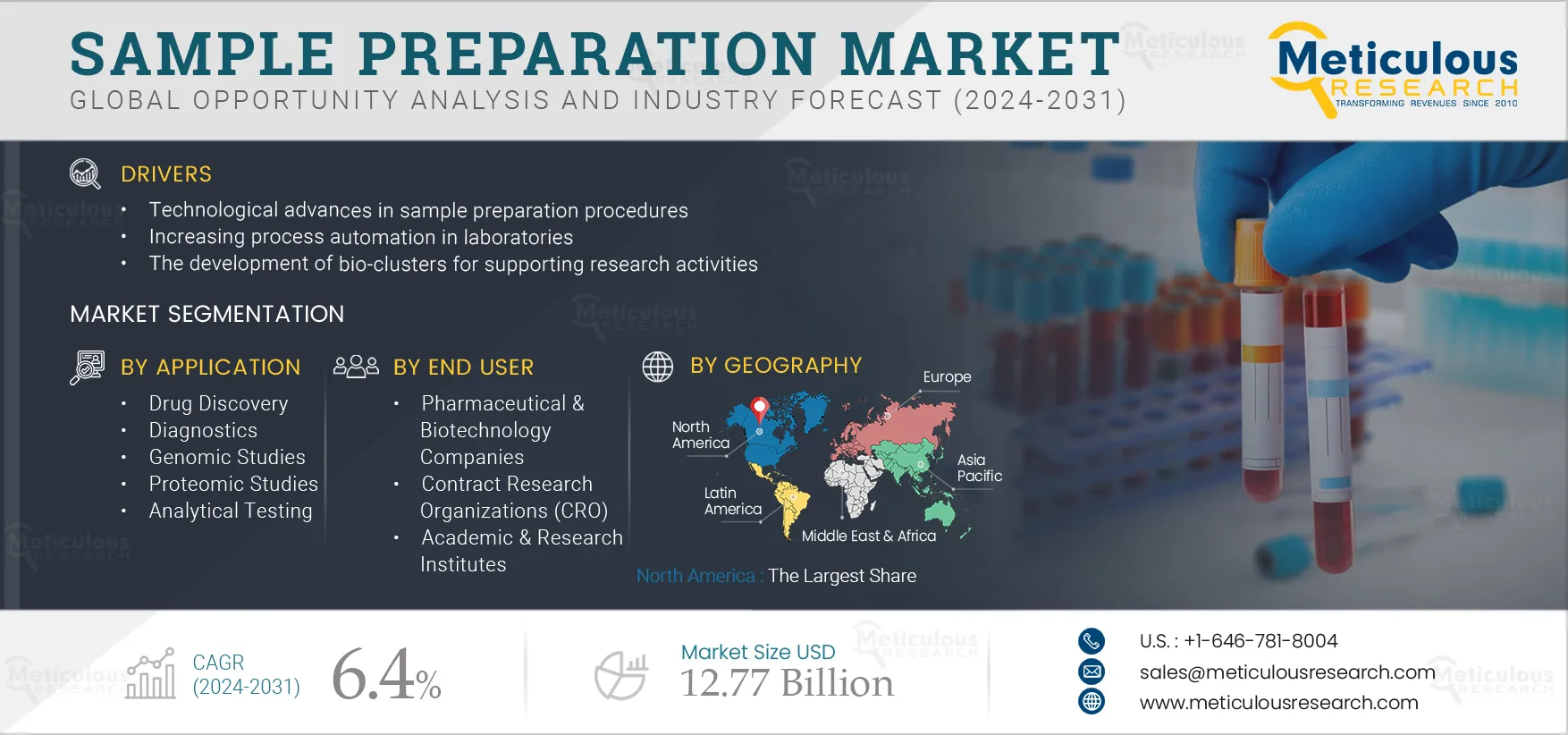

Sample Preparation Market Size, Share, Forecast & Trends Analysis by Product (Workstation, Pipette, Washer, Centrifuge, Grinder, Filters, Plates, Kits) Technique (Solid Phase Extraction, Purification), Application, End User – Global Forecast to 2031

Report ID: MRHC - 104844 Pages: 412 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market is driven by technological advances in sample preparation procedures, increasing process automation in laboratories, the development of bio-clusters for supporting research activities, increasing R&D investments in the pharmaceutical and biotechnology industries, and active research in genomics and proteomics.

Moreover, the widening applications of sample preparation in emerging economies and the increasing focus on personalized medicines are expected to offer significant market growth opportunities.

Advancements in the sample preparation techniques lead to increased efficiency and accuracy of the sample preparation process. These enhancements help in the assessment of sample suitability and sample optimization. These advancements include integrating multiple sample preparation steps into a single chip for PoC devices, miniaturizing extraction techniques based on conventional sample preparation procedures, and automated sample preparation systems.

Automation in sample preparation results in an increase in the number of samples to be processed within less time, fewer errors due to automated workflow, increased safety for lab technicians, and improved customization and optimization for research protocols. Additionally, miniaturized sample preparation methods have been used to analyze complex matrices. The miniaturized extraction techniques are more feasible due to their advantages, such as low consumption of organic solvents and reagents, low amount of sample, simplified procedures, and high enrichment factors. Hence, miniaturized sample preparation techniques have great potential for improved sample preparation.

Click here to: Get Free Sample Pages of this Report

Pharmaceutical companies invest heavily in R&D and expand their pharmaceutical manufacturing facilities to meet the growing market demand. The increasing R&D investments in the pharmaceutical industry increase the scope for commercialization of new drugs. According to the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA), R&D investments in the pharmaceutical industries in the U.S. and Europe have grown considerably. According to PhRMA & National Venture Capital Association, in the U.S., the venture capital investment by established biopharmaceutical companies in emerging biotechnology firms for R&D has increased from USD 11 billion in 2015 to USD 15 billion in 2020.

Moreover, the R&D activities in the F&B industry led to the development of food products with higher nutritional value and longer shelf life. For instance, in the U.K., the R&D expenditure in food, beverages, and tobacco product businesses increased from approximately USD 513 million (GBP 424 million) in 2015 to USD 553 million (GBP 457 million) in 2020. These research studies require sample preparation as a prior step, driving the demand for sample preparation products and software.

Emerging economies such as China, Japan, and India are making significant investments in R&D in a variety of industries, including biotechnology, pharmaceuticals, food and beverages, and environmental sciences. To properly evaluate and extract materials, these types of studies require the use of robust sample preparation techniques. The increasing R&D sector in emerging economies drives up demand for sample preparation products and technology.

In addition, countries such as India and China have witnessed considerable advances in healthcare infrastructure, such as the development of new diagnostic laboratories. hospitals, and clinics. These facilities demand sample preparation procedures for performing research studies, identifying and detecting diseases, and assure medical product quality are the factors creates the opportunity for the sample preparation market.

Based on product, the sample preparation market is segmented into consumables, instruments, sample preparations workstations, and software. In 2024, the consumables segment is expected to account for the largest share of 50.8% the sample preparation market. Factors contributing to the market's growth are developments in consumables leading to new product launches and an increase in the use of analytical techniques, which is expected to drive the adoption of kits such as isolation, extraction, and purification kits for nucleic acids and proteins and frequent usage of plates and tubes during the sample preparation procedure. Also, kits provide consistency for the sample preparation, which will further increase their demand for various applications.

Furthermore, the consumables segment is projected to witness the highest growth rate of 8.0% during the forecast period of 2024–2031.

Based on technique, the sample preparation market is segmented into Solid Phase Extraction (SPE), Liquid Phase Extraction (LPE), filtration, dilution, precipitation, and other sample preparation techniques. In 2024, the Solid Phase Extraction (SPE) segment is expected to account for the largest share of the sample preparation market. The large market share can be attributed to the developments in the technique, such as automated and miniaturized devices, increase their adoption compared to other techniques. It is widely employed in various industries, including pharmaceuticals, environmental analysis, food and beverage, clinical diagnostics, and forensic sciences. Also, this technique can be used to isolate analytes from a wide variety of matrices, including urine, blood, water, beverages, soil, and animal tissue. Hence, it is widely adopted among all the end users.

Based on application, the sample preparation market is segmented into drug discovery, diagnostics, genomic studies, proteomic studies, analytical testing, and other applications. In 2024, the drug discovery segment is expected to account for the largest share of the sample preparation market. The large market share can be attributed to the developments in the high R&D expenditure in the pharmaceutical industry, high prevalence of non-infectious diseases and infectious diseases, and a growing number of collaborations between research institutes and pharmaceutical companies for developing novel therapies are attributed to the segment’s largest share.

Based on end users, the sample preparation market is segmented into pharmaceutical & biotechnology companies, Contract Research Organizations (CROs), academic & research institutes, hospital & diagnostics laboratories, food & beverage companies, environmental testing laboratories, and other end users. In 2024, the pharmaceutical & biotechnology companies’ segment is expected to account for the largest share of 26.2% of the sample preparation market. The large market share can be attributed to the high spending on pharmaceutical R&D, the burden on pharmaceutical companies to introduce novel therapies, and companies moving towards process automation and integration, leading to the adoption of automated and integrated sample preparation workstations.

In 2024, North America is expected to account for the largest share of 41.3% of the sample preparation market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America’s significant market share can be attributed to several key factors, including the presence of major advanced sample preparation companies, growing awareness regarding early disease diagnosis, the well-established healthcare sector, the high prevalence of infectious and chronic diseases, favorable government initiatives aimed at advancing genomics research,

Moreover, the market in Asia-Pacific is slated to register the highest growth rate of 8.0% during the forecast period. The growth of this regional market is attributed to the rapid urbanization, the need to control the growing burden of chronic diseases, the increase in pharmaceutical R&D activities, improvements in healthcare infrastructure, and the increasing government investments and initiatives aimed at supporting genomic sequencing projects.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them in the last three to four years. The key players profiled in the sample preparation market report are Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Illumina, Inc. (U.S.), Merck KGaA (Germany), Hamilton Company (U.S.), PerkinElmer, Inc. (U.S.), QIAGEN N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), Tecan Group Ltd. (Switzerland), Promega Corporation (U.S.), and Norgen Biotek Corp. (Canada). The top 4-5 players of this market together hold around 53-58% share in the global sample preparation market.

|

Particular |

Details |

|

Page No |

412 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

6.4% |

|

Market Size (Value) |

USD 12.77 billion by 2031 |

|

Segments Covered |

By Product

By Technique

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa |

|

Key Companies |

Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Illumina, Inc. (U.S.), Merck KGaA (Germany), Hamilton Company (U.S.), PerkinElmer, Inc. (U.S.), QIAGEN N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), Tecan Group Ltd. (Switzerland), Promega Corporation (U.S.), and Norgen Biotek Corp. (Canada) |

This study offers a detailed assessment of the sample preparation market and analyzes the market sizes & forecasts based on product, technique, application, and end user. This report also involves the value analysis of various segments and subsegments of the sample preparation market at the regional and country levels.

The sample preparation market is projected to reach $12.77 billion by 2031, at a CAGR of 6.4% during the forecast period.

Among the products, in 2024, the consumable segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the new product launches and an increase in the use of analytical techniques, which is expected to drive the adoption of kits such as isolation, extraction, and purification kits for nucleic acids and proteins. Also, kits provide consistency for the sample preparation, which will further increase their demand for various applications.

The growth of this market is driven by technological advances in sample preparation procedures, increasing process automation in laboratories, the development of bio-clusters for supporting research activities, increasing R&D investments in the pharmaceutical and biotechnology industries, and active research in genomics and proteomics. Additionally, the widening applications of sample preparation in emerging economies and the increasing focus on personalized medicines are expected to offer significant market growth opportunities.

The key players profiled in the sample preparation market report are Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Illumina, Inc. (U.S.), Merck KGaA (Germany), Hamilton Company (U.S.), PerkinElmer, Inc. (U.S.), QIAGEN N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), Tecan Group Ltd. (Switzerland), Promega Corporation (U.S.), and Norgen Biotek Corp. (Canada).

Emerging economies, such as China and India, are expected to provide significant growth opportunities for market players due to the increasing government research and development spending in these countries.

Published Date: Jun-2023

Published Date: Mar-2021

Published Date: Jan-2025

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates