Resources

About Us

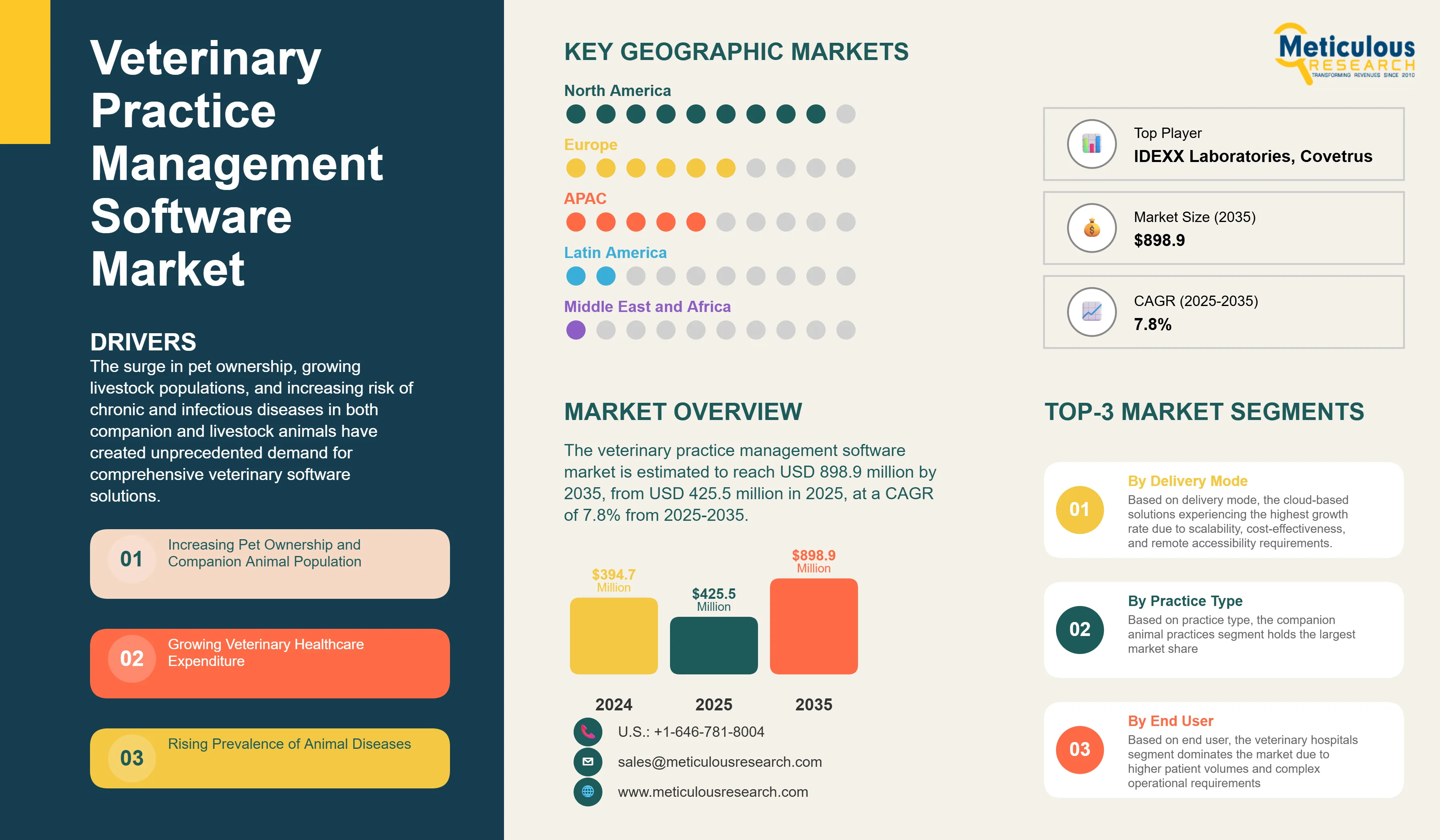

Veterinary Practice Management Software Market Size, Share, Forecast, & Trends Analysis by Delivery Mode (On-premise, Cloud) Practice (Companion Animals, Mixed, Equine) Functionality (Billing, EMR, Scheduling, Inventory) End User - Global Forecast to 2035

Report ID: MRHC - 104147 Pages: 232 Jun-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe veterinary practice management software industry continues to expand rapidly as veterinary practices increasingly recognize the importance of digital transformation for efficient practice operations, enhanced patient care, and improved client engagement.

The surge in pet ownership, growing livestock populations, and increasing risk of chronic and infectious diseases in both companion and livestock animals have created unprecedented demand for comprehensive veterinary software solutions. The integration of cloud-based platforms, electronic medical records, and automated appointment scheduling systems has democratized advanced veterinary care management, making it accessible to both large veterinary hospitals and small independent practices.

The growing number of strategic partnerships between software providers and veterinary organizations, coupled with increasing animal health expenditure and pet insurance adoption in developed countries, has created a massive demand for integrated practice management solutions. The proliferation of telemedicine capabilities and regulatory compliance requirements has further amplified the need for robust software systems that can handle everything from appointment scheduling to billing and invoicing across diverse practice types.

The industry is experiencing significant technological transformation through cloud/web-based delivery models, mobile accessibility, and integrated functionality approaches. Leading veterinary software providers are investing heavily in user experience design, data security, and multi-practice compatibility to improve operational efficiency and expand market reach. These technological advances are enabling practices to achieve clinical excellence while maintaining cost-effectiveness and regulatory compliance.

Veterinary Practice Management Software Market Trends and Insights

Veterinary Practice Management Software Market Trends

Cloud/Web-Based Model Segment Projected to Showcase the Largest Growth During the Forecast Period

Cloud/web-based veterinary practice management software is projected to show significant growth during the forecast period, driven by the increasing demand for remote accessibility, automatic updates, and reduced IT infrastructure costs. These systems provide superior scalability, data security, and multi-location practice management compared to on-premise alternatives. The flexibility and integration capabilities of cloud-based systems make them ideal for veterinary hospitals, ambulatory services, and referral practices requiring seamless data access across multiple devices and locations.

The growth in cloud/web-based solutions is attributed to declining costs of cloud infrastructure and increasing demand for real-time data synchronization across appointment scheduling, electronic medical records, inventory management, and billing systems. Veterinary practices now require comprehensive platforms that can handle diverse functionalities while maintaining compliance with data protection regulations. The segment benefits from continuous innovation in mobile applications, API integrations, and automated workflow management.

Major veterinary software providers such as IDEXX Laboratories, Covetrus, and Hippo Manager Software have significantly expanded their cloud-based offerings. These providers have collectively increased their Software-as-a-Service (SaaS) model adoption to meet diverse practice requirements from companion animal practices to food-producing animal operations. The integration of telemedicine capabilities and mobile accessibility is enabling cloud-based platforms to serve broader market segments while maintaining enterprise-grade security standards.

North America Region to Maintain Market Leadership During the Forecast Period

North America is estimated to maintain the largest share of the veterinary practice management software market during the forecast period, driven by high pet ownership rates, advanced veterinary infrastructure, and significant animal health expenditure. The United States leads the region with the world's most mature veterinary services market and highest per-animal healthcare spending, creating substantial demand for comprehensive practice management solutions across all practice types.

The region's dominance is supported by well-established regulatory frameworks, high technology adoption rates among veterinary professionals, and significant investment in veterinary education and training. Canada's expanding rural veterinary services and increasing focus on livestock health management create additional growth opportunities for specialized practice management solutions.

Asia-Pacific demonstrates strong growth potential during the forecast period, particularly in countries like China, Japan, India, and Australia, where increasing pet ownership, growing livestock populations, and expanding veterinary education infrastructure create demand for modern practice management tools. The region's rapid digitization and mobile-first approach to healthcare technology adoption provide opportunities for innovative, cost-effective software solutions.

Veterinary Practice Management Software Market Analysis

The veterinary practice management software industry faces significant challenges from limited adoption among small veterinary medical practices due to cost constraints and technology hesitancy. The dearth of veterinary practitioners for livestock animals creates market limitations, particularly in rural areas where food-producing animal practices require specialized functionality. Integration complexity with existing practice workflows and concerns about data migration from legacy systems continue to impact adoption rates among established practices.

Despite these constraints, the market offers substantial growth opportunities in emerging markets where veterinary infrastructure is rapidly developing, and digital adoption is accelerating. The increasing number of strategic partnerships between software providers, veterinary equipment manufacturers, and practice management consultants is creating integrated ecosystem solutions that address multiple practice needs simultaneously. Growing demand for specialized functionality across different practice types provides sustainable growth pathways for innovative software solutions.

Based on delivery mode, the veterinary practice management software market is segmented into on-premise models and cloud/web-based models, with cloud-based solutions experiencing the highest growth rate due to scalability, cost-effectiveness, and remote accessibility requirements.

Based on practice type, the market is segmented into companion animal practices, mixed animal practices, food-producing animal practices, and equine practices. The companion animal practices segment holds the largest market share, reflecting the predominance of pet-focused veterinary services and higher healthcare spending on companion animals.

Based on functionality, the market is segmented into appointment scheduling, electronic medical records, inventory management, billing and invoicing, and other functionalities. The integrated platforms combining multiple functionalities are experiencing the highest growth as practices seek comprehensive solutions rather than standalone modules.

Based on end user, the market is segmented into veterinary hospitals, ambulatory veterinary services, and referral & specialty practices. The veterinary hospitals segment dominates the market due to higher patient volumes and complex operational requirements necessitating comprehensive software solutions.

Regional Market Analysis

North America leads the veterinary practice management software market with mature veterinary infrastructure, high technology adoption rates, and significant animal health expenditure. The region's established pet insurance market and regulatory support for digital health records drive demand for integrated software solutions across all practice types.

Europe continues to expand its veterinary software adoption through increasing pet ownership, aging pet populations requiring more healthcare services, and stringent data protection regulations driving demand for compliant software solutions. Key markets including Germany, France, U.K., Italy, Spain, Switzerland, and Netherlands demonstrate strong growth potential.

Asia-Pacific demonstrates the strongest growth potential with rapidly increasing pet ownership, expanding livestock operations, and growing awareness of professional veterinary care. Major markets including China, Japan, India, Australia, and South Korea show significant opportunity for both companion animal and food-producing animal practice management solutions.

Latin America focuses on expanding access to modern veterinary practice tools through affordable cloud-based solutions and growing companion animal markets. The region's increasing livestock productivity focus and expanding middle-class pet ownership create opportunities for diverse practice management platforms.

Middle East & Africa demonstrates emerging growth potential driven by expanding urban pet ownership, growing veterinary education programs, and increasing livestock management technology adoption in agricultural development initiatives.

Veterinary Practice Management Software Market Share

Major players including IDEXX Laboratories Inc., Covetrus Inc., and Hippo Manager Software Inc. compete strongly in the veterinary practice management software industry, representing the industry leaders category in competitive positioning. These companies focus on technological innovation, strategic partnerships with veterinary organizations, and expanding functionality integration to strengthen their market positions and capture emerging opportunities across different practice segments.

Market differentiators include companies like Advanced Technology Corp. and VETport LLC, which focus on specialized functionality or niche market segments. Vanguards such as DaySmart Software and emerging companies including Animal Intelligence Software Inc., FirmCloud Corp., ClienTrax, and ezofficesystems Ltd, Shepherd Veterinary Software, Digitail, ProVet (NordHealth), and Carestream Health are driving innovation through new technology approaches and competitive pricing strategies.

Leading software providers are forming strategic partnerships with veterinary schools, industry associations, and equipment manufacturers to create comprehensive ecosystem solutions. These collaborations enable better workflow integration, improved user adoption, and access to larger customer bases through established veterinary networks. The market is witnessing increased investment in cloud infrastructure, mobile applications, and integrated functionality to enhance practice efficiency and client engagement capabilities.

Veterinary Practice Management Software Market Companies

Major players operating in the veterinary practice management software industry include:

Industry Leaders:

Market Differentiators & Vanguards:

Veterinary Practice Management Software Industry Drivers & Market Insights

Key Market Drivers

Increasing Pet Ownership: Rising companion animal ownership rates globally drive demand for veterinary services and supporting practice management software, particularly in developed markets where pets are increasingly considered family members requiring regular healthcare.

Growing Livestock Population: Expanding global livestock populations and increasing focus on animal protein production create demand for specialized practice management solutions for food-producing animal practices and large animal veterinary services.

Growing Risk of Developing Chronic & Infectious Diseases: Increasing prevalence of chronic conditions in companion animals and infectious disease outbreaks in livestock populations drive demand for comprehensive medical record keeping and treatment tracking capabilities.

Strategic Partnerships Driving Innovation: Growing number of partnerships between software providers, veterinary equipment manufacturers, and practice consultants result in integrated solutions and enhanced functionality development.

Increasing Animal Health Expenditure & Pet Insurance: Rising animal healthcare spending and expanding pet insurance coverage in developed countries create demand for sophisticated billing, invoicing, and insurance claim management functionality.

Market Restraints & Challenges

Limited Adoption Among Small Practices: Cost constraints, technology hesitancy, and limited IT resources restrict adoption among small veterinary medical practices, particularly in rural areas with fewer resources for technology investment.

Dearth of Veterinary Practitioners: Shortage of veterinary practitioners, particularly for livestock animals, limits market growth potential in agricultural regions where food-producing animal practices require specialized software solutions.

Market Opportunities

Emerging Markets: Rapid veterinary infrastructure development in emerging economies creates significant growth opportunities for affordable, cloud-based practice management solutions tailored to developing market needs and price sensitivities.

Veterinary Practice Management Software Industry Segmentation

The veterinary practice management software market includes on-premise and cloud/web-based solutions designed for veterinary practices, animal hospitals, and specialized veterinary care facilities across companion animal, mixed animal, food-producing animal, and equine practice applications. The report covers integrated practice management systems with comprehensive functionality including appointment scheduling, electronic medical records, inventory management, and billing capabilities.

The market is segmented by delivery mode, practice type, functionality, end user, and geography. By delivery mode, the market includes on-premise models and cloud/web-based models with increasing emphasis on cloud adoption. By practice type, the market covers companion animal practices, mixed animal practices, food-producing animal practices, and equine practices with varying functionality requirements.

For each segment, market size is provided in terms of value (USD million) and growth projections through 2035.

|

Particulars |

Details |

|

Number of Pages |

240 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

7.8% |

|

Market Size (Value)in 2025 |

USD 425.5 Million |

|

Market Size (Value) in 2035 |

USD 898.9 Million |

|

Segments Covered |

By Delivery Mode

By Practice Type,

By Functionality,

By End User,

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

IDEXX Laboratories Inc., Covetrus Inc., and Hippo Manager Software Inc., Advanced Technology Corp. and VETport LLC, which focus on specialized functionality or niche market segments. Vanguards such as DaySmart Software and emerging companies including Animal Intelligence Software Inc., FirmCloud Corp., ClienTrax, and ezofficesystems Ltd, Shepherd Veterinary Software, Digitail, ProVet (NordHealth), and Carestream Health |

The Veterinary Practice Management Software Market is expected to reach USD 898.9 million by 2035, growing at a CAGR of 7.8% from 2024 to 2035.

In 2025, the Veterinary Practice Management Software Market size was estimated at USD 425.5 million.

IDEXX Laboratories Inc., Covetrus Inc., Hippo Manager Software Inc., Advanced Technology Corp., and VETport LLC are the major companies operating in the market.

The cloud/web-based model segment is experiencing the highest growth rate during the forecast period due to scalability and accessibility advantages.

Companion animal practices account for the largest market share, reflecting high pet ownership rates and healthcare spending on companion animals.

In 2025, the market size was estimated at USD 425.5 million. The report covers historical market data and forecasts through 2035.

Key drivers include increasing pet ownership, growing livestock populations, rising chronic disease prevalence in animals, strategic partnerships driving innovation, and increasing animal health expenditure with pet insurance adoption.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates