Resources

About Us

Cardiovascular Genomics Market by Product & Services (Consumables & Reagents, Testing Services, Instruments, Software & Bioinformatics Solutions), Test Type, Application, End User, and Geography — Global Forecast to 2035

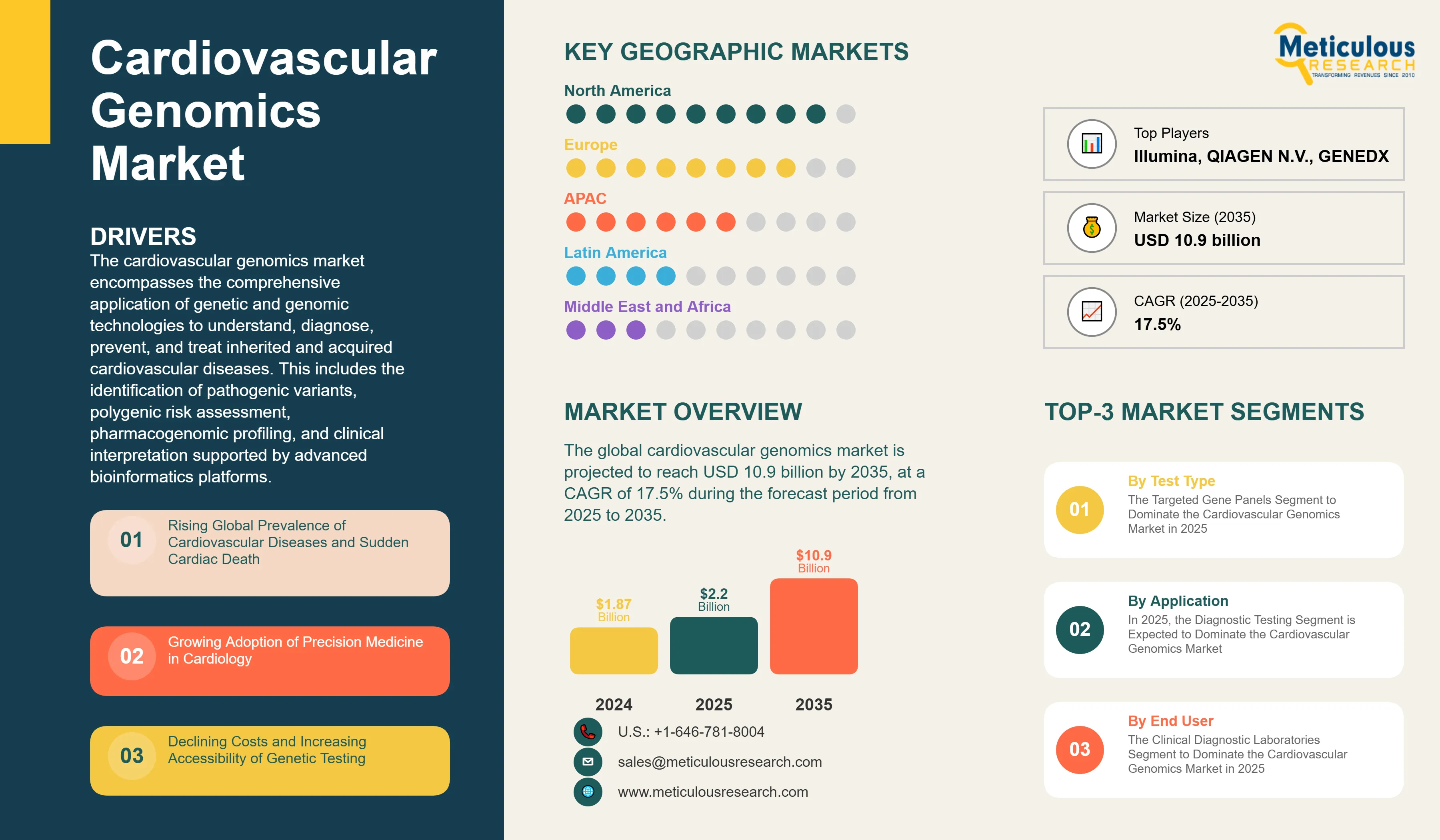

Report ID: MRHC - 1041800 Pages: 240 Feb-2026 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe global cardiovascular genomics market is estimated at USD 2.2 billion in 2025 and is projected to reach USD 10.9 billion by 2035, at a CAGR of 17.5% during the forecast period from 2025 to 2035.

The cardiovascular genomics market encompasses the comprehensive application of genetic and genomic technologies to understand, diagnose, prevent, and treat inherited and acquired cardiovascular diseases. This includes the identification of pathogenic variants, polygenic risk assessment, pharmacogenomic profiling, and clinical interpretation supported by advanced bioinformatics platforms. The discipline addresses a broad spectrum of conditions—ranging from inherited cardiomyopathies and arrhythmia syndromes to familial hypercholesterolemia and aortopathies—as well as polygenic contributions to prevalent conditions such as coronary artery disease and atrial fibrillation.

Key factors propelling this market include the rising global burden of cardiovascular diseases, which account for approximately 17.9 million deaths annually according to the World Health Organization, growing clinical adoption of precision medicine supported by Class I and Class IIa guideline recommendations, and the continuous decline in next-generation sequencing costs—from over USD 100 million per genome in 2001 to approximately USD 600–1,000 in 2024. The establishment of dedicated cardiogenetics clinics, expanding cascade screening programs, and increasing integration of polygenic risk scores into preventive cardiology are further reinforcing market growth.

The increasing recognition that 40–60% of cardiovascular disease risk is attributable to inherited genetic variants has placed genomics at the center of modern cardiovascular care. Diagnostic yields ranging from 25–80% depending on indication and phenotype, combined with guideline-driven testing recommendations for conditions such as hypertrophic cardiomyopathy (affecting 1 in 500 individuals) and familial hypercholesterolemia (affecting 1 in 250), are contributing to a steady rise in testing volumes across clinical settings.

Looking ahead, the cardiovascular genomics market is positioned for robust growth driven by the convergence of falling sequencing costs, AI-powered bioinformatics platforms, and an expanding evidence base for polygenic risk scoring in common cardiovascular conditions. As genomic testing transitions from specialized academic centers to mainstream clinical practice, the market is expected to witness significant opportunities across diagnostic, preventive, and pharmacogenomic applications.

Click here to: Get Free Sample Pages of this Report

Rising Global Prevalence of Cardiovascular Diseases and Sudden Cardiac Death

Cardiovascular diseases continue to represent the single largest contributor to global mortality, creating sustained and growing demand for advanced diagnostic and risk assessment solutions, including genomic testing. According to the World Health Organization, cardiovascular diseases account for approximately 32% of all global deaths, with the prevalence of heart failure exceeding 64 million individuals and atrial fibrillation affecting nearly 60 million people worldwide. The burden of these conditions is expected to grow further, with atrial fibrillation cases projected to potentially double by 2050 as populations age and cardiometabolic risk factors become more widespread.

Inherited cardiovascular disorders represent a critical subset of this burden and are among the most compelling clinical rationales for genomic testing. Hypertrophic cardiomyopathy, the most common inherited cardiac condition, affects approximately 1 in 500 individuals globally. Dilated cardiomyopathy occurs in an estimated 1 in 250–400 individuals, while familial hypercholesterolemia—one of the most prevalent monogenic disorders—affects approximately 1 in 250 but remains significantly underdiagnosed, with fewer than 10% of affected individuals currently identified. Inherited arrhythmia syndromes, including long QT syndrome (approximately 1 in 2,000–2,500 individuals) and Brugada syndrome (approximately 1 in 2,000–5,000), collectively affect hundreds of thousands of people worldwide.

Sudden cardiac death adds a further and particularly urgent dimension to the market. In the United States alone, sudden cardiac death accounts for an estimated 350,000–450,000 deaths annually. Post-mortem genetic testing, or molecular autopsy, has gained increasing guideline support, with diagnostic yields of approximately 25–35% for the identification of causative pathogenic variants. These results support cascade screening of at-risk family members, enabling preventive interventions that can directly reduce future mortality. This dual clinical utility—clarifying cause of death while protecting living relatives—is a powerful driver of genomic testing adoption.

Growing Adoption of Precision Medicine in Cardiology

The shift toward precision medicine has become one of the most consequential drivers in the cardiovascular genomics market, as cardiology moves from uniform treatment pathways toward genotype-guided approaches for diagnosis, risk stratification, and therapeutic decision-making. Professional societies including the American Heart Association, the American College of Cardiology, and the Heart Rhythm Society have incorporated genetic testing recommendations into guidelines for multiple inherited cardiovascular conditions, with Class I or Class IIa recommendations now in place for several clinical scenarios spanning cardiomyopathies and inherited arrhythmia syndromes.

The clinical utility of cardiovascular genetic testing is well supported by consistent diagnostic yields across major indications. Pathogenic or likely pathogenic variants are identified in approximately 30–60% of patients with hypertrophic cardiomyopathy, 25–40% of patients with dilated cardiomyopathy, and 40–80% of individuals with well-phenotyped long QT syndrome. These yields translate into tangible clinical outcomes, including confirmation of diagnoses, guidance for implantable cardioverter-defibrillator placement, tailored pharmacotherapy, prognostic assessment, and cascade family screening.

The growth of dedicated cardiogenetics clinics and multidisciplinary care programs has further embedded precision medicine into cardiovascular practice. Academic medical centers and integrated health systems are increasingly building specialized programs that combine cardiology, genetic counseling, molecular genetics, and bioinformatics expertise, serving as hubs for both clinical implementation and translational research. As precision cardiology matures, these programs are expected to expand significantly in both number and scope.

Declining Costs and Increasing Accessibility of Next-Generation Sequencing

The dramatic reduction in sequencing costs has been a foundational enabler of cardiovascular genomics market growth, transforming genetic testing from an expensive research capability into a clinically accessible and cost-effective diagnostic tool. Whole genome sequencing costs have fallen from approximately USD 100 million in 2001 to below USD 600–1,000 in recent years, driven by advances in sequencing chemistry, higher throughput platforms, and more efficient bioinformatics pipelines. For cardiovascular-specific applications, targeted gene panel testing costs have declined from approximately USD 3,000–5,000 in the early 2010s to roughly USD 1,000–2,500 currently, while comprehensive panels covering 50–200 genes are now offered at price points comparable to, or lower than, single-gene testing costs a decade ago.

This cost evolution has meaningfully improved the value proposition of genetic testing, enabling broader clinical application beyond patients with highly penetrant hereditary conditions. Direct-to-consumer genetic testing has further expanded access, with cardiovascular risk assessments and pharmacogenomic panels now available at USD 100–300, increasing public awareness of genetic contributions to heart disease and building demand for confirmatory clinical testing. As sequencing costs continue to decline and platform accessibility improves, broader integration of genomic testing into routine cardiovascular and primary care workflows is expected to follow.

Integration of Cardiovascular Genomics into Routine Clinical Workflows

The integration of cardiovascular genomics into routine clinical workflows represents one of the most significant near-term opportunities for market expansion. At present, the majority of cardiovascular genetic testing occurs within tertiary care settings and dedicated cardiogenetics clinics, reaching only a fraction of patients who meet clinical testing criteria. Embedding genomic testing into standard cardiology, primary care, and emergency medicine workflows could substantially increase testing volumes while supporting earlier diagnosis and intervention.

Electronic health record–based clinical decision support tools are a key enabler, capable of identifying eligible patients based on diagnoses, family history, and clinical findings, and streamlining test ordering, result tracking, and cascade screening coordination. Health systems that have implemented integrated genomic workflows have demonstrated meaningful improvements in guideline adherence and appropriate testing rates. Advances in rapid pharmacogenomic testing—such as CYP2C19 genotyping during percutaneous coronary intervention—and point-of-care applications for sudden cardiac arrest survivors represent additional opportunities to bring genomic decision-making directly into acute care settings.

Expanding Applications in Pharmacogenomics for Cardiovascular Drug Response

Pharmacogenomics for cardiovascular drug response is positioned for accelerated growth, supported by an expanding clinical evidence base, increasing CPIC guidance, and growing interest in preemptive testing models. CYP2C19-guided antiplatelet therapy is the most established application, with loss-of-function alleles present in approximately 30% of individuals and clinical evidence confirming that genotype-guided therapy reduces adverse cardiovascular outcomes following percutaneous coronary intervention. Statin pharmacogenomics, guided by SLCO1B1 variants associated with myopathy risk, represents an emerging opportunity given that statin intolerance affects an estimated 10–20% of patients and adherence remains a major challenge in lipid management.

Preemptive pharmacogenomic testing—generating and embedding genomic data into the electronic health record ahead of prescribing decisions—offers a paradigm shift with the potential to substantially expand testing volumes. Health systems implementing such programs have demonstrated clinical feasibility and utility, and cardiovascular pharmacogenomic variants are consistently among those included given the widespread prescription of cardiovascular medications. As implementation evidence grows and reimbursement coverage evolves, this application is expected to move progressively from pilot programs toward mainstream clinical deployment.

Development of Multi-Ancestry Polygenic Risk Scores for Diverse Populations

The development and validation of multi-ancestry polygenic risk scores represents an important opportunity at the intersection of health equity and market expansion. Most currently available PRSs have been developed predominantly from populations of European ancestry, and predictive accuracy in African, Asian, Hispanic, and other non-European populations is estimated to decline by approximately 20–50% or more compared with European cohorts—a limitation that constrains both the clinical utility and the global reach of PRS-based cardiovascular risk stratification.

Large-scale genomics initiatives including the All of Us Research Program, the PAGE consortium, and H3Africa are generating the diverse population data needed to address these gaps. Combined with methodological advances in multi-ancestry meta-analysis and machine learning approaches, these efforts are improving PRS portability across populations. From a market perspective, validated multi-ancestry PRSs open pathways into high-growth regions in Asia, Latin America, and Africa, while within established markets they align with increasing regulatory and payer emphasis on equitable precision medicine. Companies investing in this space are likely to gain competitive advantages as evidence requirements for diverse population performance become more formally embedded in regulatory and clinical adoption frameworks.

By Product & Services: The Consumables & Reagents Segment to Dominate the Cardiovascular Genomics Market in 2025

Based on product & services, the cardiovascular genomics market is segmented into consumables & reagents, testing services, instruments, and software & bioinformatics solutions. In 2025, the consumables & reagents segment is expected to account for the largest share of 40.0% of the cardiovascular genomics market. This segment is projected to reach USD 4.36 billion by 2035 from an estimated USD 0.87 billion in 2025, at a CAGR of 17.4% during the forecast period.

The dominant position of this segment reflects the inherently recurring and volume-driven nature of consumable usage across cardiovascular genomic workflows. NGS library preparation kits, target enrichment reagents, PCR consumables, enzymes, probes, and sample processing materials are required for every sample processed—across research, clinical diagnostics, biobanking, and drug discovery—making them a structurally stable and continuously expanding revenue contributor. The growing number of genetic tests performed, combined with rising biobanking initiatives and population-scale sequencing programs, is expected to sustain high consumable demand throughout the forecast period.

However, the software & bioinformatics solutions segment is expected to grow at the fastest CAGR of 21.1% during the forecast period, driven by the increasing data burden of whole-genome and whole-exome sequencing and growing demand for AI/ML-based variant annotation, polygenic risk scoring platforms, and cloud-based clinical decision support systems. As cardiovascular genomics shifts from research to routine clinical use, the need for scalable, automated, and clinically validated software infrastructure is accelerating faster than demand for hardware or laboratory reagents.

By Test Type: The Targeted Gene Panels Segment to Dominate the Cardiovascular Genomics Market in 2025

Based on test type, the cardiovascular genomics market is segmented into targeted gene panels, single gene testing, whole exome sequencing (WES), polygenic risk score (PRS) testing, pharmacogenomic testing, and whole genome sequencing (WGS). In 2025, the targeted gene panels segment is expected to account for the largest share of 35.8% of the cardiovascular genomics market. This segment is projected to reach USD 3.56 billion by 2035 from an estimated USD 0.78 billion in 2025, at a CAGR of 16.3% during the forecast period.

Targeted gene panels command the largest share because they offer the most practical balance between clinical utility, cost, turnaround time, and interpretability for cardiovascular disorders. By focusing on a well-defined set of high-confidence genes linked to cardiomyopathies, arrhythmias, familial hypercholesterolemia, and aortopathies, these panels generate highly actionable results with simpler bioinformatics requirements and less incidental data compared with WES or WGS. These attributes make targeted panels the preferred option for hospitals, diagnostic laboratories, and specialty cardiology centers for mainstream clinical testing.

However, polygenic risk score (PRS) testing is expected to register the fastest CAGR of 22.9% during the forecast period, as cardiovascular care broadens from rare disease diagnosis toward population-level risk prediction and prevention. As AI-driven analytics mature, large biobank datasets become more accessible, and precision medicine expands into primary care, the adoption of PRS testing for coronary artery disease, atrial fibrillation, and stroke risk stratification is accelerating well ahead of traditional diagnostic modalities.

By Application: In 2025, the Diagnostic Testing Segment to Dominate the Cardiovascular Genomics Market

Based on application, the cardiovascular genomics market is segmented into diagnostic testing, research applications, risk assessment & predictive testing, cascade/family screening, pharmacogenomics & drug response testing, and prenatal & newborn screening. In 2025, the diagnostic testing segment is expected to account for the largest share of 39.5% of the cardiovascular genomics market. This segment is projected to reach USD 3.73 billion by 2035 from an estimated USD 0.86 billion in 2025, at a CAGR of 15.7% during the forecast period.

The dominant position of the diagnostic testing segment reflects the rising prevalence of inherited and acquired cardiovascular disorders, increasing adoption of genetic testing in routine cardiology care, growing availability of targeted gene panels, and broad integration of genomic testing into hospitals, specialty clinics, and diagnostic laboratories for accurate disease identification and clinical decision support.

However, the risk assessment & predictive testing segment is expected to witness the fastest CAGR of 21.7% during the forecast period, driven by the shift toward preventive cardiology, growing use of polygenic risk scores, large-scale biobank initiatives, and rising adoption of genomics in population health screening and early risk stratification for conditions such as coronary artery disease and stroke.

By End User: The Clinical Diagnostic Laboratories Segment to Dominate the Cardiovascular Genomics Market in 2025

Based on end user, the cardiovascular genomics market is segmented into clinical diagnostic laboratories, hospitals & health systems, academic & research institutes, specialized cardiogenetics clinics, pharmaceutical & biotechnology companies, and direct-to-consumer/retail genetic testing companies. In 2025, the clinical diagnostic laboratories segment is expected to account for the largest share of 32.9% of the cardiovascular genomics market. This segment is projected to reach USD 3.46 billion by 2035 from an estimated USD 0.72 billion in 2025, at a CAGR of 17.0% during the forecast period.

Clinical diagnostic laboratories dominate the end-user landscape because they serve as primary hubs for high-volume cardiovascular genetic testing, with the automation, sequencing infrastructure, accreditation, and skilled workforce required to process large sample volumes efficiently. Most hospitals and cardiology centers outsource complex genomic testing to centralized labs rather than maintaining in-house capabilities, further concentrating demand in this segment.

However, the specialized cardiogenetics clinics segment is expected to register the fastest CAGR of 20.0% during the forecast period. As cardiovascular care becomes increasingly genetics-driven and multidisciplinary, these clinics—integrating cardiology with clinical genetics, genetic counseling, and family screening—are well-positioned to absorb the growing demand for comprehensive management of inherited heart diseases including cardiomyopathies, arrhythmias, and familial hypercholesterolemia.

North America Dominates the Cardiovascular Genomics Market in 2025

Based on geography, the global cardiovascular genomics market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of 43.7% of the global cardiovascular genomics market. The North America cardiovascular genomics market is projected to reach USD 4.42 billion by 2035 from an estimated USD 0.95 billion in 2025, at a CAGR of 16.15% during the forecast period.

The region's leadership is underpinned by well-established healthcare infrastructure, high adoption of precision medicine, a strong concentration of leading genomics companies, large-scale biobanking initiatives, and robust funding for cardiovascular research. Widespread integration of genomics into clinical cardiology, favorable reimbursement policies for established indications, and high awareness among physicians and patients have further reinforced North America's dominant position in the market.

However, Asia-Pacific is expected to register the highest CAGR during the forecast period. Rapid growth in this region is driven by increasing healthcare investments, expanding genetic testing infrastructure, rising cardiovascular disease prevalence, government-supported genomics programs, and growing collaboration between global genomics companies and regional diagnostic players. Improving access to advanced sequencing technologies and the expansion of private diagnostic chains are accelerating market development across key Asia-Pacific countries.

Some of the prominent players operating in the global cardiovascular genomics market include Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), QIAGEN N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Quest Diagnostics (U.S.), Danaher Corporation (U.S.), Invitae Corporation (U.S.), GeneDx, LLC (U.S.), Blueprint Genetics Oy (Finland), Genomics plc (U.K.), Fulgent Genetics, Inc. (U.S.), Ambry Genetics Corporation (U.S.), Color Health, Inc. (U.S.), Centogene N.V. (Germany), Myriad Genetics, Inc. (U.S.), Praxis Genomics LLC (U.S.), PerkinElmer, Inc. (U.S.), Agilent Technologies (U.S.), and Oxford BioDynamics Plc (U.K.).

These companies have actively pursued strategic developments to strengthen their market positions, with the most prevalent strategies being partnerships, agreements & collaborations; product launches & enhancements; and geographic expansions.

|

Particulars |

Details |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

17.5% |

|

Market Size (Value) in 2025 |

USD 2.2 Billion |

|

Market Size (Value) in 2035 |

USD 10.9 Billion |

|

Segments Covered |

By Product & Services: Consumables & Reagents, Testing Services, Instruments, Software & Bioinformatics Solutions; By Test Type: Targeted Gene Panels, Single Gene Testing, Whole Exome Sequencing, Polygenic Risk Score Testing, Pharmacogenomic Testing, Whole Genome Sequencing; By Application: Diagnostic Testing, Research Applications, Risk Assessment & Predictive Testing, Cascade/Family Screening, Pharmacogenomics & Drug Response Testing, Prenatal & Newborn Screening; By End User: Clinical Diagnostic Laboratories, Hospitals & Health Systems, Academic & Research Institutes, Specialized Cardiogenetics Clinics, Pharmaceutical & Biotechnology Companies, Direct-to-Consumer/Retail Genetic Testing Companies |

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, South Africa, UAE) |

|

Key Companies |

Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), QIAGEN N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Quest Diagnostics (U.S.), Danaher Corporation (U.S.), Invitae Corporation (U.S.), GeneDx, LLC (U.S.), Blueprint Genetics Oy (Finland), Genomics plc (U.K.), Fulgent Genetics, Inc. (U.S.), Ambry Genetics Corporation (U.S.), Color Health, Inc. (U.S.), Centogene N.V. (Germany), Myriad Genetics, Inc. (U.S.), Praxis Genomics LLC (U.S.), PerkinElmer, Inc. (U.S.), Agilent Technologies (U.S.), and Oxford BioDynamics Plc (U.K.) |

The global cardiovascular genomics market is estimated at USD 2.2 billion in 2025.

The market is projected to grow from USD 2.2 billion in 2025 to USD 10.9 billion by 2035, at a CAGR of 17.5%.

The cardiovascular genomics market analysis indicates strong growth momentum, with the market projected to reach USD 10.9 billion by 2035, at a CAGR of 17.5% from 2025 to 2035.

Key companies operating in this market include Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., F. Hoffmann-La Roche Ltd, Quest Diagnostics, Danaher Corporation, Invitae Corporation, GeneDx, LLC, Blueprint Genetics Oy, Genomics plc, Fulgent Genetics, Inc., Ambry Genetics Corporation, Color Health, Inc., Centogene N.V., and Myriad Genetics, Inc., among others.

Growing use of whole genome sequencing in cardiovascular diagnostics, increasing adoption of direct-to-consumer cardiovascular genetic testing, and the integration of AI and machine learning in variant interpretation and polygenic risk scoring are prominent trends shaping the cardiovascular genomics market.

Which segments will hold large market shares in the cardiovascular genomics market during 2025–2035?

By product & services, the consumables & reagents segment is forecasted to hold the largest share; by test type, the targeted gene panels segment is expected to dominate; by application, the diagnostic testing segment is expected to hold the largest share; by end user, the clinical diagnostic laboratories segment is expected to lead; and by geography, North America is expected to hold the largest market share during 2025–2035.

North America is expected to hold the largest share of the cardiovascular genomics market in 2025, supported by a well-established healthcare infrastructure, high precision medicine adoption, and favorable reimbursement for established genomic indications. However, Asia-Pacific is expected to register the highest growth rate during the forecast period, driven by increasing healthcare investments, expanding genetic testing infrastructure, and government-backed genomics programs.

Key drivers include the rising global prevalence of cardiovascular diseases and sudden cardiac death, growing adoption of precision medicine and guideline-driven genetic testing in cardiology, declining costs of next-generation sequencing, expanding clinical utility of polygenic risk scores for cardiovascular risk stratification, and increasing integration of pharmacogenomics into cardiovascular drug therapy. These factors are collectively accelerating the adoption of cardiovascular genomic technologies across research, clinical, and preventive healthcare applications.

1. Introduction

1.1. Market Definition & Scope

1.2. Currency & Limitations

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Global Prevalence of Cardiovascular Diseases and Sudden Cardiac Death

4.2.1.2. Growing Adoption of Precision Medicine in Cardiology

4.2.1.3. Declining Costs and Increasing Accessibility of Genetic Testing

4.2.1.4. Expanding Clinical Utility of Polygenic Risk Scores for CVD Risk Stratification

4.2.2. Restraints

4.2.2.1. Limited Reimbursement Coverage for Cardiovascular Genetic Testing

4.2.2.2. Shortage of Genetic Counselors and Cardiogenetics Expertise

4.2.3. Opportunities

4.2.3.1. Integration of Cardiovascular Genomics into Routine Clinical Workflows

4.2.3.2. Expanding Applications in Pharmacogenomics for Cardiovascular Drug Response

4.2.3.3. Development of Multi-Ancestry Polygenic Risk Scores for Diverse Populations

4.2.4. Challenges

4.2.4.1. Regulatory and Ethical Considerations in Genetic Data Privacy

4.2.5. Trends

4.2.5.1. Growing Use of Whole Genome Sequencing in Cardiovascular Diagnostics

4.2.5.2. Increasing Adoption of Direct-to-Consumer Cardiovascular Genetic Testing

4.2.5.3. AI and Machine Learning Integration in Variant Interpretation

4.3. Regulatory Landscape

4.4. Reimbursement Scenario

5. Global Cardiovascular Genomics Market, By Product & Service

5.1. Overview

5.2. Consumables & Reagents

5.2.1. Library Preparation & Target Enrichment Kits

5.2.2. Sequencing Reagents

5.2.3. Sample Collection & Extraction Kits

5.3. Instruments

5.3.1. Next-Generation Sequencing Platforms

5.3.2. Genotyping Arrays & Microarray Systems

5.3.3. PCR & qPCR Systems

5.4. Software & Bioinformatics Solutions

5.5. Testing Services

6. Global Cardiovascular Genomics Market, By Test Type

6.1. Overview

6.2. Targeted Gene Panels

6.3. Whole Exome Sequencing (WES)

6.4. Whole Genome Sequencing (WGS)

6.5. Polygenic Risk Score (PRS) Testing

6.6. Pharmacogenomic Testing (Cardiovascular Drugs)

6.7. Single Gene Testing

7. Global Cardiovascular Genomics Market, By Application

7.1. Overview

7.2. Diagnostic Testing

7.3. Risk Assessment & Predictive Testing

7.4. Cascade/Family Screening

7.5. Prenatal & Newborn Screening

7.6. Research Applications

8. Global Cardiovascular Genomics Market, By End User

8.1. Overview

8.2. Hospitals & Health Systems

8.3. Specialized Cardiovascular Centers & Cardiogenetics Clinics

8.4. Clinical Diagnostic Laboratories

8.5. Academic & Research Institutes

8.6. Direct-to-Consumer/Retail Genetic Testing Companies

8.7. Pharmaceutical & Biotechnology Companies

9. Cardiovascular Genomics Market Assessment, By Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Switzerland

9.3.6. Spain

9.3.7. Netherlands

9.3.8. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. UAE

9.6.3. South Africa

9.6.4. Rest of Middle East & Africa

10. Competitive Landscape

10.1. Introduction

10.2. Competitive Benchmarking

10.3. Competitive Dashboard

10.3.1. Industry Leaders

10.3.2. Market Differentiators

10.3.3. Vanguards

10.3.4. Emerging Companies

10.4. Market Share/Position Analysis

11. Company Profiles

11.1. Illumina, Inc. (U.S.)

11.1.1. Company Overview

11.1.2. FINANCIAL OVERVIEW

11.1.3. Product Portfolio

11.1.4. Strategic Developments

11.1.5. SWOT ANALYSIS

11.2. Thermo Fisher Scientific, Inc.

11.2.1. Company Overview

11.2.2. Financial Overview

11.2.3. Product Portfolio

11.2.4. SWOT ANALYSIS

11.3. QIAGEN N.V.

11.3.1. Company Overview

11.3.2. Financial Overview

11.3.3. Product Portfolio

11.3.4. Strategic Developments

11.3.5. SWOT ANALYSIS

11.4. INVITAE CORPORATION

11.4.1. Company Overview

11.4.2. Product Portfolio

11.4.3. SWOT ANALYSIS

11.5. GENEDX, LLC

11.5.1. Company Overview

11.5.2. FINANCIAL OVERVIEW

11.5.3. Product Portfolio

11.5.4. SWOT ANALYSIS

11.6. BLUEPRINT GENETICS

11.6.1. Company Overview

11.6.2. Financial Overview

11.6.3. Product Portfolio

11.6.4. SWOT ANALYSIS

11.7. Ambry Genetics Corporation

11.7.1. COMPANY OVERVIEW

11.7.2. Product Portfolio

11.7.3. SWOT ANALYSIS

11.8. FULGENT GENETICS, INC.

11.8.1. Company Overview

11.8.2. FINANCIAL OVERVIEW

11.8.3. Product Portfolio

11.8.4. SWOT ANALYSIS

11.9. F. Hoffmann-La Roche Ltd. (U.S.)

11.9.1. Company Overview

11.9.2. Financial Overview

11.9.3. Product Portfolio

11.9.4. SWOT ANALYSIS

11.10. PerkinElmer, Inc. (U.S.)

11.10.1. Company Overview

11.10.2. Product Portfolio

11.10.3. Strategic Developments

11.10.4. SWOT ANALYSIS

11.11. CENTOGENE N.V.

11.11.1. Company Overview

11.11.2. Product Portfolio

11.11.3. Strategic Developments

11.11.4. SWOT ANALYSIS

11.12. Myriad Genetics, Inc.

11.12.1. Company Overview

11.12.2. Financial Overview

11.12.3. Product Portfolio

11.12.4. SWOT ANALYSIS

11.13. Genomics plc

11.13.1. Company Overview

11.13.2. Product Portfolio

11.13.3. SWOT ANALYSIS

11.14. Praxis Genomics LLC

11.14.1. Company Overview

11.14.2. Product Portfolio

11.14.3. SWOT ANALYSIS

11.15. Color Health, Inc.

11.15.1. Company Overview

11.15.2. Product Portfolio

11.15.3. SWOT ANALYSIS

12. Appendix

12.1. Available Customization

12.2. Related Reports

LIST OF TABLES

TABLE 1. Global Cardiovascular Genomics Market, by Product & Service, 2025–2035 (USD Million)

TABLE 2. Global Cardiovascular Genomics Consumables & Reagents Market, by Type, 2025–2035 (USD Million)

TABLE 3. Global Cardiovascular Genomics Consumables & Reagents Market, by Country/Region, 2023–2035 (USD Million)

TABLE 4. Global Cardiovascular Genomics Library Preparation & Target Enrichment Kits Market, by Country/Region, 2023–2035 (USD Million)

TABLE 5. Global Cardiovascular Genomics Sequencing Reagents Market, by Country/Region, 2023–2035 (USD Million)

TABLE 6. Global Cardiovascular Genomics Sample Collection & Extraction Kits Market, by Country/Region, 2023–2035 (USD Million)

TABLE 7. Global Cardiovascular Genomics Instruments Market, by Type, 2025–2035 (USD Million)

TABLE 8. Global Cardiovascular Genomics Instruments Market, by Country/Region, 2023–2035 (USD Million)

TABLE 9. Global Cardiovascular Genomics Next-Generation Sequencing Platforms Market, by Country/Region, 2023–2035 (USD Million)

TABLE 10. Global Cardiovascular Genomics Genotyping Arrays & Microarray Systems Market, by Country/Region, 2023–2035 (USD Million)

TABLE 11. Global Cardiovascular Genomics PCR & qPCR Systems Market, by Country/Region, 2023–2035 (USD Million)

TABLE 12. Global Cardiovascular Genomics Software & Bioinformatics Solutions Market, by Country/Region, 2023–2035 (USD Million)

TABLE 13. Global Cardiovascular Genomics Testing Services Market, by Country/Region, 2023–2035 (USD Million)

TABLE 14. Global Cardiovascular Genomics Market, by Test Type, 2025–2035 (USD Million)

TABLE 15. Global Cardiovascular Genomics Market for Targeted Gene Panels, by Country/Region, 2023–2035 (USD Million)

TABLE 16. Global Cardiovascular Genomics Market for Whole Exome Sequencing (WES), by Country/Region, 2023–2035 (USD Million)

TABLE 17. Global Cardiovascular Genomics Market for Whole Genome Sequencing (WGS), by Country/Region, 2023–2035 (USD Million)

TABLE 18. Global Cardiovascular Genomics Market for Polygenic Risk Score (PRS), by Country/Region, 2023–2035 (USD Million)

TABLE 19. Global Cardiovascular Genomics Market for Pharmacogenomic Testing, by Country/Region, 2023–2035 (USD Million)

TABLE 20. Global Cardiovascular Genomics Market for Single Gene Testing, by Country/Region, 2023–2035 (USD Million)

TABLE 21. Global Cardiovascular Genomics Market, by Application, 2025–2035 (USD Million)

TABLE 22. Global Cardiovascular Genomics Market for Diagnostic Testing, by Country/Region, 2023–2035 (USD Million)

TABLE 23. Global Cardiovascular Genomics Market for Risk Assessment & Predictive Testing, by Country/Region, 2023–2035 (USD Million)

TABLE 24. Global Cardiovascular Genomics Market for Cascade / Family Screening, by Country/Region, 2023–2035 (USD Million)

TABLE 25. Global Cardiovascular Genomics Market for Prenatal & Newborn Screening, by Country/Region, 2023–2035 (USD Million)

TABLE 26. Global Cardiovascular Genomics Market for Research Applications, by Country/Region, 2023–2035 (USD Million)

TABLE 27. Global Cardiovascular Genomics Market, by End User, 2025–2035 (USD Million)

TABLE 28. Global Cardiovascular Genomics Market for Hospitals & Health Systems, by Country/Region, 2023–2035 (USD Million)

TABLE 29. Global Cardiovascular Genomics Market for Specialized Cardiogenetics Clinics, by Country/Region, 2023–2035 (USD Million)

TABLE 30. Global Cardiovascular Genomics Market for Clinical Diagnostic Laboratories, by Country/Region, 2023–2035 (USD Million)

TABLE 31. Global Cardiovascular Genomics Market for Academic & Research Institutes, by Country/Region, 2023–2035 (USD Million)

TABLE 32. Global Cardiovascular Genomics Market for Direct-to-Consumer / Retail Genetic Testing Companies, by Country/Region, 2023–2035 (USD Million)

TABLE 33. Global Cardiovascular Genomics Market for Pharmaceutical & Biotechnology Companies, by Country/Region, 2023–2035 (USD Million)

TABLE 34 North America: Cardiovascular Genomics Market, by country, 2023-2035 (USD Million)

TABLE 35 North America: Cardiovascular Genomics Market, by Product and Services, 2023-2035 (USD Million)

TABLE 36 North America: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023-2035 (USD Million)

TABLE 37 North America: Cardiovascular Genomics Instruments Market, By Type, 2023-2035 (USD Million)

TABLE 38 North America: Cardiovascular Genomics Market, by Test Type, 2023-2035 (USD Million)

TABLE 39 North America: Cardiovascular Genomics Market, by Application, 2023-2035 (USD Million)

TABLE 40 North America: Cardiovascular Genomics Market, by End User, 2023-2035 (USD Million)

TABLE 41. United States: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 42. United States: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 43. United States: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 44. United States: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 45. United States: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 46. United States: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 47. Canada: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 48. Canada: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 49. Canada: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 50. Canada: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 51. Canada: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 52. Canada: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 53. Europe: Cardiovascular Genomics Market, by Country, 2023–2035 (USD Million)

TABLE 54. Europe: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 55. Europe: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 56. Europe: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 57. Europe: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 58. Europe: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 59. Europe: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 60. Germany: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 61. Germany: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 62. Germany: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 63. Germany: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 64. Germany: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 65. Germany: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 66. U.K.: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 67. U.K.: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 68. U.K.: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 69. U.K.: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 70. U.K.: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 71. U.K.: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 72. France: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 73. France: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 74. France: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 75. France: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 76. France: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 77. France: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 78. Italy: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 79. Italy: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 80. Italy: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 81. Italy: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 82. Italy: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 83. Italy: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 84. Switzerland: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 85. Switzerland: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 86. Switzerland: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 87. Switzerland: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 88. Switzerland: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 89. Switzerland: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 90. Spain: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 91. Spain: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 92. Spain: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 93. Spain: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 94. Spain: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 95. Spain: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 96. Netherlands: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 97. Netherlands: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 98. Netherlands: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 99. Netherlands: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 100. Netherlands: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 101. Netherlands: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 102. Rest of Europe: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 103. Rest of Europe: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 104. Rest of Europe: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 105. Rest of Europe: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 106. Rest of Europe: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 107. Rest of Europe: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 108. Asia-Pacific: Cardiovascular Genomics Market, by Country, 2023–2035 (USD Million)

TABLE 109. Asia-Pacific: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 110. Asia-Pacific: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 111. Asia-Pacific: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 112. Asia-Pacific: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 113. Asia-Pacific: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 114. Asia-Pacific: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 115. China: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 116. China: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 117. China: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 118. China: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 119. China: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 120. China: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 121. Japan: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 122. Japan: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 123. Japan: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 124. Japan: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 125. Japan: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 126. Japan: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 127. India: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 128. India: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 129. India: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 130. India: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 131. India: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 132. India: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 133. South Korea: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 134. South Korea: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 135. South Korea: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 136. South Korea: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 137. South Korea: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 138. South Korea: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 139. Australia: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 140. Australia: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 141. Australia: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 142. Australia: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 143. Australia: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 144. Australia: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 145. Rest of Asia-Pacific: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 146. Rest of Asia-Pacific: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 147. Rest of Asia-Pacific: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 148. Rest of Asia-Pacific: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 149. Rest of Asia-Pacific: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 150. Rest of Asia-Pacific: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 151. Latin America: Cardiovascular Genomics Market, by Country, 2023–2035 (USD Million)

TABLE 152. Latin America: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 153. Latin America: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 154. Latin America: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 155. Latin America: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 156. Latin America: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 157. Latin America: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 158. Brazil: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 159. Brazil: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 160. Brazil: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 161. Brazil: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 162. Brazil: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 163. Brazil: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 164. Mexico: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 165. Mexico: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 166. Mexico: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 167. Mexico: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 168. Mexico: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 169. Mexico: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 170. Rest of Latin America: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 171. Rest of Latin America: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 172. Rest of Latin America: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 173. Rest of Latin America: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 174. Rest of Latin America: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 175. Rest of Latin America: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 176. Middle East & Africa: Cardiovascular Genomics Market, by Country, 2023–2035 (USD Million)

TABLE 177. Middle East & Africa: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 178. Middle East & Africa: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 179. Middle East & Africa: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 180. Middle East & Africa: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 181. Middle East & Africa: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 182. Middle East & Africa: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 183. Saudi Arabia: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 184. Saudi Arabia: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 185. Saudi Arabia: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 186. Saudi Arabia: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 187. Saudi Arabia: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 188. Saudi Arabia: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 189. UAE: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 190. UAE: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 191. UAE: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 192. UAE: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 193. UAE: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 194. UAE: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 195. South Africa: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 196. South Africa: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 197. South Africa: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 198. South Africa: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 199. South Africa: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 200. South Africa: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

TABLE 201. Rest of Middle East & Africa: Cardiovascular Genomics Market, by Product & Services, 2023–2035 (USD Million)

TABLE 202. Rest of Middle East & Africa: Cardiovascular Genomics Consumables & Reagents Market, by Type, 2023–2035 (USD Million)

TABLE 203. Rest of Middle East & Africa: Cardiovascular Genomics Instruments Market, by Type, 2023–2035 (USD Million)

TABLE 204. Rest of Middle East & Africa: Cardiovascular Genomics Market, by Test Type, 2023–2035 (USD Million)

TABLE 205. Rest of Middle East & Africa: Cardiovascular Genomics Market, by Application, 2023–2035 (USD Million)

TABLE 206. Rest of Middle East & Africa: Cardiovascular Genomics Market, by End User, 2023–2035 (USD Million)

LIST OF FIGURES

FIGURE 1. Research Process

FIGURE 2. Key Secondary Sources

FIGURE 3. Primary Research Techniques

FIGURE 4. Key Executives Interviewed

FIGURE 5. Breakdown of Primary Interviews (Supply-Side & Demand-Side)

FIGURE 6. Market Sizing and Growth Forecast Approach

FIGURE 7. Global Cardiovascular Genomics Market, by Product and Services, 2025 vs. 2035 (USD Million)

FIGURE 8. Global Cardiovascular Genomics Market, by Test Type, 2025 vs. 2035 (USD Million)

FIGURE 9. Global Cardiovascular Genomics Market, by Application, 2025 vs. 2035 (USD Million)

FIGURE 10. Global Cardiovascular Genomics Market, by End User, 2025 vs. 2035 (USD Million)

FIGURE 11. Cardiovascular Genomics Market, by Geography, 2025 vs. 2035 (USD Million)

FIGURE 12. Factors Affecting Market Growth

FIGURE 13. Global Cardiovascular Genomics Market, by Product & Service, 2025 vs. 2035 (USD Million)

FIGURE 14. Global Cardiovascular Genomics Market, by Test Type, 2025 vs. 2035 (USD Million)

FIGURE 15. Global Cardiovascular Genomics Market, by Application, 2025 vs. 2035 (USD Million)

FIGURE 16. Global Cardiovascular Genomics Market, by End User, 2025 vs. 2035 (USD Million)

FIGURE 17. Global Cardiovascular Genomics Market, by Region, 2025 vs. 2035 (USD Million)

FIGURE 18. North America Cardiovascular Genomics Market Snapshot

FIGURE 19. Europe Cardiovascular Genomics Market Snapshot

FIGURE 20. Asia-Pacific Cardiovascular Genomics Market Snapshot

FIGURE 21. Latin America Cardiovascular Genomics Market Snapshot

FIGURE 22. Middle East & Africa Cardiovascular Genomics Market Snapshot

FIGURE 23. Cardiovascular Genomics Competitive Benchmarking, by Region

FIGURE 24. Competitive Dashboard: Cardiovascular Genomics Market

FIGURE 25. Cardiovascular Genomics Market Position Analysis, 2024

FIGURE 26. Illumina Inc.: Financial Overview (2024)

FIGURE 27. Thermo Fisher Scientific, Inc.: Financial Overview (2024)

FIGURE 28. QIAGEN N.V.: Financial Overview (2024)

FIGURE 29. GeneDx, LLC: Financial Overview (2024)

FIGURE 30. Quest Diagnostics Incorporated: Financial Overview (2024)

FIGURE 31. Fulgent Genetics, Inc.: Financial Overview (2024)

FIGURE 32. F. Hoffmann-La Roche Ltd.: Financial Overview (2024)

FIGURE 33. Myriad Genetics, Inc.: Financial Overview (2024)

Published Date: May-2024

Published Date: Feb-2024

Published Date: Jan-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates