Resources

About Us

Genomics Market by Technology (Sequencing, Microarray, PCR, Nucleic Acid Extraction), Application (Drug Discovery, Diagnostic, Research), End User (Pharmaceutical, Hospital, Academic), Offering (Instrument, Consumables, Software) - Global Forecast to 2031

Report ID: MRHC - 104157 Pages: 320 Feb-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportGenomics studies the structure, function, evolution, and mapping of genomes. It includes several operations, ranging from sequencing to analysis, to understand the genetic basis of various biological phenomena. Genomics can be applied in various fields, including medicine, agriculture, biotechnology, and ecology, and is critical for understanding the complexity of living organisms. By understanding the genetic makeup of an organism, researchers can develop targeted therapies, design new crops and livestock, and gain insights into evolutionary history and ecological interactions.

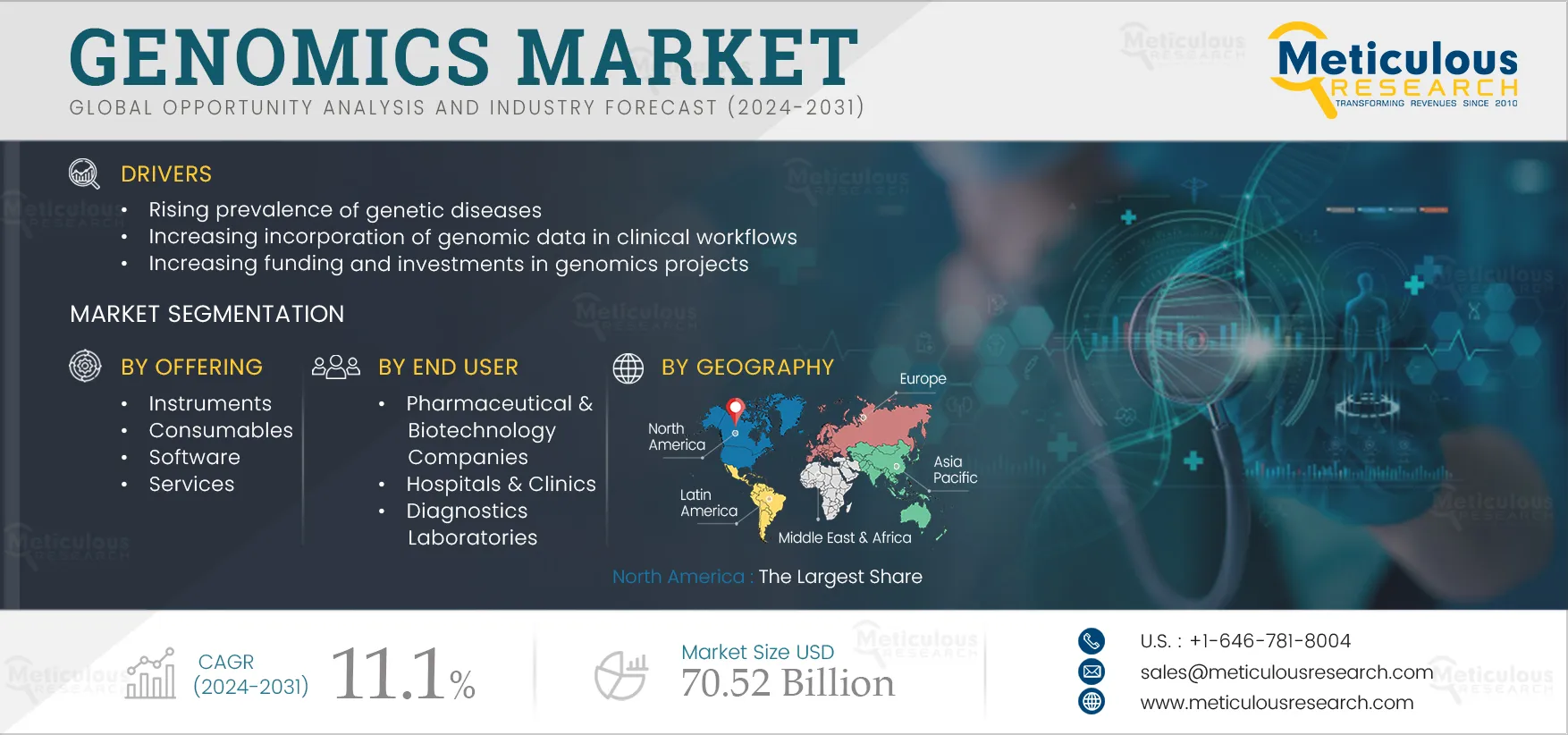

The growth of the genomics market is driven by the rising prevalence of genetic diseases, the increasing incorporation of genomic data in clinical workflows, increasing funding and investments in genomics projects, the growing applications of genomics in the healthcare sector, rising pharmaceutical R&D expenditures, decreasing costs of sequencing, and increasing healthcare spending. However, the lack of standardized approaches in genomics and concerns over the security & privacy of genomic data restrain the growth of this market.

Moreover, the rising adoption of personalized medicines and gene therapies is expected to generate market growth opportunities. However, the shortage of skilled bioinformatics and genomics personnel and the commercialization and scaling of genomic technologies are major challenges for market stakeholders.

There has been a significant increase in funding for genomics research due to various research activities, which has led to the development of advanced sequencing technologies and bioinformatics tools that have made it possible to rapidly analyze vast amounts of genomic data. Pharmaceutical companies are investing in genomics research to discover new drugs, develop personalized medicines, and improve their understanding of disease mechanisms. The pharmaceutical industry is also investing in genomic data-sharing initiatives to accelerate research and development. In December 2022, the U.K. government announced $217 million (£175 million) in funding for genomics research, including $130 million (£105 million) to boost the diagnosis of rare genetic diseases in newborns.

The availability of genomic data has also created opportunities for developing targeted therapies and precision medicine and enabled researchers to understand the genetic basis of diseases, develop new diagnostics, and find potential targets for drug development. Increasing investments in genomics research are expected to lead to significant medical advancements, including new drugs, targeted therapies, and personalized medicine.

The rising adoption of personalized medicines and gene therapies indicates advancements in genomics and molecular biology aimed at tailoring treatments to the needs of individual patients and addressing diseases at the genetic level. Personalized medicine has made significant progress in cancer treatment. The genetic profiling of tumors helps identify targetable mutations, enabling the development of targeted therapies that attack cancer cells with precision, minimizing harm to healthy cells. For rare genetic disorders, personalized medicine approaches involve identifying specific genetic mutations causing a condition and designing therapies to correct or mitigate their effects.

Gene therapy can correct or replace defective genes responsible for causing diseases. Gene therapy has been successful in treating certain genetic disorders of the blood and immune system, such as Severe Combined Immunodeficiency (SCID), by modifying a patient’s own hematopoietic stem cells outside the body and then reintroducing them into the body. Moreover, gene therapies for neurodegenerative diseases like Parkinson’s and Alzheimer’s are being researched, with an aim to deliver therapeutic genes to affected brain cells. These factors are boosting the adoption of genomics products, thereby driving market growth.

Based on offering, the genomics market is segmented into systems, consumables, software, and services. In 2024, the consumables segment is expected to account for the largest share of the genomics market. The segment’s large market share can be attributed to the high adoption of genetic testing and increased usage of consumables for the same. Genomic testing during pregnancy can help identify genetic disorders in the developing fetus, which is increasing the adoption of consumables for genetic testing. The demand for high-throughput sequencing and automation has risen in recent years, leading to an increase in sample preparation rates and quality control procedures. Furthermore, it has boosted the utilization of consumables such as kits and reagents. The recurring purchase of consumables also contributes to the substantial market share of this segment.

Based on technology, the genomics market is segmented into sequencing, microarray, PCR, nucleic acid extraction and purification, and other technologies. The sequencing segment is expected to record the highest CAGR during the forecast period. The factors contributing to the segment’s highest CAGR are technological advancements in sequencing, improvements in the efficiency of sequencing processes, and the increased scalability of sequencing technologies. With the development of new sequencing technologies, the cost of sequencing has significantly decreased, and the speed and accuracy of sequencing have improved. These factors have made sequencing more accessible and cost-effective, allowing researchers to sequence more genomes.

Click here to: Get Free Sample Pages of this Report

Based on application, the genomics market is segmented into drug discovery & development, diagnostics, life science research, and other applications. The drug discovery & development segment is expected to record the highest CAGR during the forecast period. The segment’s growth is mainly driven by the high prevalence of chronic diseases such as diabetes and cancer and the need to discover effective drugs and therapies against these diseases. The use of genomic technologies is rising in the field of precision medicine, especially for the discovery of novel therapeutics. As precision medicine continues to gain momentum, pharmaceutical companies are increasingly investing in genomics to advance their drug discovery and development efforts.

Based on end user, the genomics market is segmented into pharmaceutical & biotechnology companies, hospitals, academic & research institutes, diagnostic laboratories, contract research organizations, and other end users. In 2024, the pharmaceutical & biotechnology companies segment is expected to account for the largest share of the genomics market. The large market share of this segment can be attributed to the increasing use of genomics by pharmaceutical & biotechnology companies for the identification and validation of potential drug targets for biomarker discovery, pharmacogenomics, and genomic screening techniques. In drug discovery, genomics has been instrumental in identifying potential targets, reducing errors in clinical trials, and accelerating the time taken to bring new drugs to the market. Moreover, the use of genomics in personalized medicine is also increasing, as it allows for a more targeted approach to drug development by identifying specific genetic targets for new therapies. This approach can lead to the development of more effective drugs with fewer side effects. The increased need to commercialize novel therapies faster also supports the segment’s large share.

Based on geography, the genomics market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of the genomics market. North America’s large market share can be attributed to the high burden of genetic diseases, growing awareness about early genetic disease diagnostics, government support for genetic testing for hereditary cancers and newborn screening, and the presence of major market players in the region. Rising investments in genomics research to support the development of therapeutics for cancer and other therapy areas also contribute to the growth of this regional market. According to data published by the Government of Canada in November 2022, the Canadian government supports the Genomics Research and Development Initiative (GRDI) with nearly USD 20 million annually to conduct vital genomics research.

The report offers a competitive landscape based on an extensive assessment of the product portfolios, geographic presence, and key strategic developments of leading market players in the last three to four years. The key players operating in the genomics market are Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), Pacific Biosciences of California, Inc. (U.S.), Oxford Nanopore Technologies Plc. (U.K.), Eppendorf SE (Germany), Myriad Genetics, Inc. (U.S.), Revvity, Inc. (Formerly PerkinElmer, Inc.) (U.S.), and BGI Genomics Co. Ltd (China).

|

Particulars |

Details |

|

Number of Pages |

320 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR (2024–2031) |

11.1% |

|

Estimated Market Size (Value) |

$70.52 Billion by 2031 |

|

Segments Covered |

By Offering

By Technology

By Application

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa |

|

Key Companies Profiled |

Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), Pacific Biosciences of California, Inc. (U.S.), Oxford Nanopore Technologies Plc. (U.K.), Eppendorf SE (Germany), Myriad Genetics, Inc. (U.S.), Revvity, Inc. (Formerly PerkinElmer, Inc.) (U.S.), and BGI Genomics Co. Ltd (China) |

This study offers a detailed assessment of the genomics market, including the market sizes & forecasts for offering, technology, application, end user, and geography segments. This report also provides the value analysis of various segments and subsegments of the genomics market at the regional and country levels.

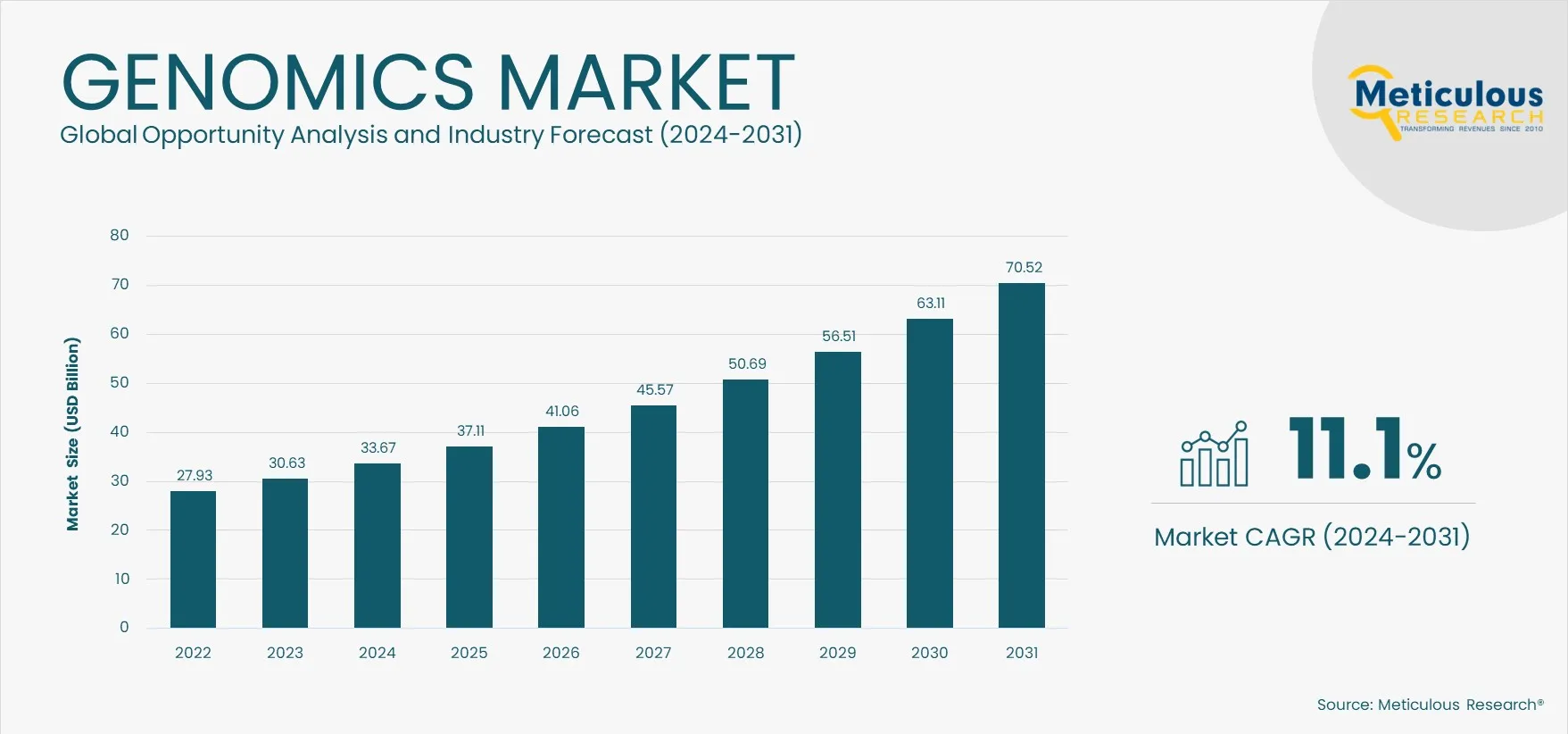

The genomics market is projected to reach $70.52 billion by 2031, at a CAGR of 11.1% during the forecast period.

Based on offering, in 2024, the consumables segment is expected to account for the largest share of the market due to the high demand for consumables due to the increasing number of genetic testing and quality control processes.

Based on end user, in 2024, the pharmaceutical & biotechnology companies segment is expected to account for the largest market share due to increased R&D spending among pharmaceutical companies.

The growth of the genomics market is driven by the rising prevalence of genetic diseases, the increasing incorporation of genomic data in clinical workflows, increasing funding and investments in genomics projects, the growing applications of genomics in the healthcare sector, rising pharmaceutical R&D expenditures, decreasing costs of sequencing, and increasing healthcare spending.

Moreover, the rising adoption of personalized medicines and gene therapies is expected to generate market growth opportunities.

The key players profiled in the genomics market report are Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), Pacific Biosciences of California, Inc. (U.S.), Oxford Nanopore Technologies Plc. (U.K.), Eppendorf SE (Germany), Myriad Genetics, Inc. (U.S.), Revvity, Inc. (Formerly PerkinElmer, Inc.) (U.S.), and BGI Genomics Co. Ltd (China).

Emerging economies in the Asia-Pacific region are expected to offer significant growth opportunities for market players due to increasing cases of inherited diseases such as Down syndrome, colon (colorectal) cancer, and breast cancer, growing awareness about the significance of genetic tests, increasing healthcare expenditures, government initiatives promoting genetic testing, and increasing investments by major market players.

Published Date: May-2024

Published Date: Jan-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates