Resources

About Us

Automotive Voice AI Assistants Market Size, Share, & Forecast by AI Engine (NLU, NLP), Language Support, Integration (Native, Cloud-Connected), and Features (Navigation, Media, Vehicle Control) - Global Forecast to 2036

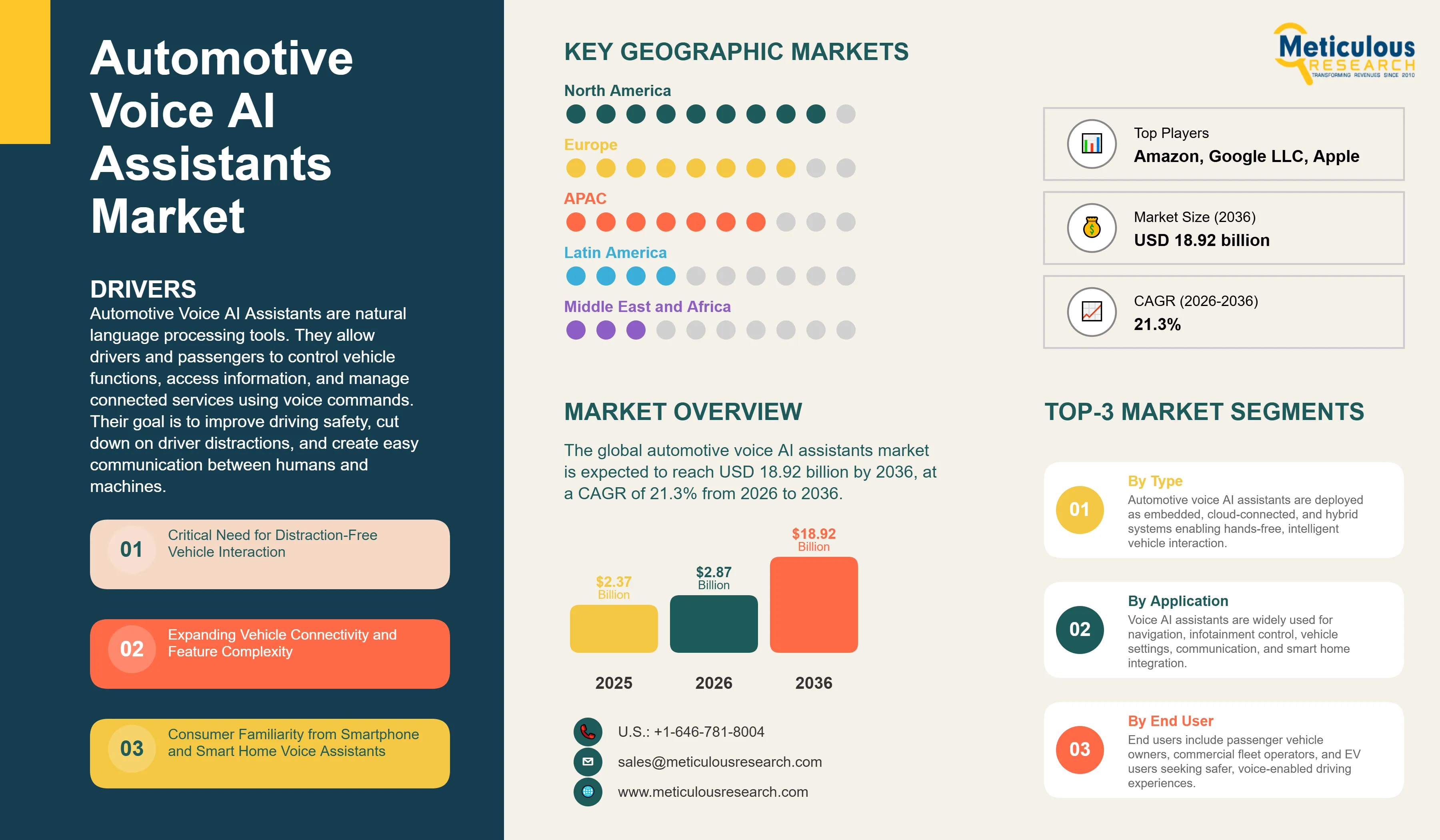

Report ID: MRAUTO - 1041649 Pages: 290 Jan-2026 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportThe global automotive voice AI assistants market is expected to reach USD 18.92 billion by 2036 from USD 2.87 billion in 2026, at a CAGR of 21.3% from 2026 to 2036.

Automotive Voice AI Assistants are natural language processing tools. They allow drivers and passengers to control vehicle functions, access information, and manage connected services using voice commands. Their goal is to improve driving safety, cut down on driver distractions, and create easy communication between humans and machines. These AI systems use technologies like Natural Language Understanding (NLU), Natural Language Processing (NLP), speech recognition, and machine learning. They interpret voice commands, understand context and intent, and perform the right actions.

Voice AI assistants can manage navigation, climate settings, infotainment systems, phone calls, messaging, smart home devices, and vehicle features through simple conversations. The system enables hands-free use of vehicle functions, gives personalized responses based on driver preferences, supports multiple languages, and learns continuously. This ensures that drivers can focus on the road while safely and conveniently accessing vehicle features and connected services.

Click here to: Get Free Sample Pages of this Report

Automotive Voice AI Assistants represent a major change in how people interact with vehicles. They replace traditional physical controls and touchscreen interfaces with natural conversational commands, changing how occupants engage with complex vehicle systems. These intelligent assistants understand natural language, interpret context and intent, remember past interactions, and carry out multi-step tasks using simple voice commands. By allowing hands-free control of vehicle functions, infotainment, navigation, and connected services, voice AI assistants reduce dangerous distractions that come from manual controls while making advanced vehicle features easy to use.

Several key trends are transforming the automotive voice AI assistants market. These trends include moving from basic command-response systems to conversational AI that can handle natural dialogue. Rapid improvements in natural language understanding allow for context awareness and multi-turn conversations. There is also growing integration of voice assistants with both vehicle and connected home systems, along with a shift from basic function control to proactive assistance and personalization. The blend of improved AI capabilities, increasing vehicle connectivity, rising consumer comfort with voice assistants from smartphones and smart homes, and the urgent need to minimize driver distraction has pushed the adoption of voice AI from luxury features to standard equipment across all vehicle types.

Key Trends Shaping the Market:

The automotive voice AI assistants market is quickly evolving to feature advanced conversational AI systems that understand context, remember past interactions, and anticipate user needs. Modern voice AI solutions go beyond recognizing set commands. They create natural conversational experiences by understanding complex requests, handling unclear queries, maintaining conversation context through multiple exchanges, interpreting user intent even with imperfect wording, and learning individual user preferences and speaking styles. The move from wake-word triggered command systems to always-listening conversational assistants that can manage interruptions, corrections, and multi-step dialogues marks significant progress in user experience and practical utility.

AI and machine learning technologies are improving quickly. This progress allows voice assistants to provide more accurate speech recognition in challenging environments, like road noise, multiple voices, and various accents. Modern systems use advanced noise cancellation, speaker identification, context-aware processing, and personalized acoustic models to achieve recognition accuracy of over 95% even in real-world driving conditions. Edge computing capabilities are enabling more processing on the device itself, which reduces latency, enhances privacy, and ensures core functions continue to work without connectivity.

The integration of automotive voice assistants with larger digital systems is creating new benefits that go beyond controlling the vehicle. Modern systems connect smoothly with smartphone assistants, smart home devices, calendar and productivity apps, music streaming services, and connected vehicle services. This integration allows for scenarios such as voice-controlled preparation at home while driving, proactive navigation suggestions based on the calendar, synchronized music playback, and a unified voice experience across user devices. The extension of voice AI from isolated in-vehicle systems to parts of broader digital ecosystems greatly enhances utility and user engagement.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 2.87 Billion |

|

Revenue Forecast in 2036 |

USD 18.92 Billion |

|

Growth Rate |

CAGR of 21.3% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

AI Engine, Language Support, Integration Type, Features, Deployment Model, Vehicle Type, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Italy, Spain, Sweden, China, Japan, South Korea, India, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa |

|

Key Companies Profiled |

Amazon (Alexa Auto), Google LLC (Google Assistant), Apple Inc. (CarPlay/Siri), Microsoft Corporation (Nuance), Cerence Inc., SoundHound AI Inc., Visteon Corporation, Harman International (Samsung Electronics), Continental AG, Bosch GmbH, Nuance Communications (Microsoft), iFlytek Co. Ltd., BMW Group (Intelligent Personal Assistant), Mercedes-Benz AG (MBUX), Volkswagen Group, Tesla Inc., NIO Inc., Baidu Inc., Alibaba Cloud, Qualcomm Technologies Inc. |

The combination of voice AI and self-driving vehicle development is creating new application scenarios and market opportunities. As vehicles move toward greater automation, voice assistants will become the main way to control the vehicle, manage passenger entertainment, set destinations, and communicate system status. In fully autonomous vehicles without steering wheels or traditional controls, voice AI will be the main interface for all interactions with the vehicle. This shift supports long-term growth for automotive voice AI technology beyond traditional driver-focused uses.

The rise of emotion AI and sentiment analysis is extending the functionality of voice assistants beyond just executing commands. These advanced systems can recognize user frustration, stress, fatigue, or distraction through voice analysis and adjust their responses. They can offer proactive assistance, change interaction styles, or suggest breaks during long drives. This focus on emotional intelligence improves user experience and opens up possibilities in driver monitoring, wellness assessment, and personalized comfort optimization.

Driver: Critical Need for Distraction-Free Vehicle Interaction

The growing awareness of the dangers of distracted driving is increasing the demand for technologies that allow safe vehicle interaction. The National Highway Traffic Safety Administration reports that manually interacting with vehicle systems adds significant cognitive and visual distractions. Traditional touchscreen infotainment systems force drivers to look away from the road, navigate complicated menus, and perform precise touch actions. All of these actions are dangerous while driving. Voice AI assistants help address this safety issue by enabling hands-free and eyes-free interaction through natural voice commands. Drivers can adjust climate settings, change music, start navigation, make phone calls, and control numerous vehicle functions without taking their hands off the wheel or eyes off the road. As vehicle systems grow more complex with additional features and connected services, using voice control becomes essential for safe operation. Regulatory bodies and safety organizations are increasingly recognizing voice interfaces as a best practice for reducing driver distraction while keeping access to vehicle features.

Driver: Expanding Vehicle Connectivity and Feature Complexity

The rapid growth of connected vehicle services and advanced features is creating strong demand for easy-to-use control interfaces. Modern vehicles come with many adjustable settings, multiple infotainment sources, navigation systems, smartphone integration, smart home device control, communication with infrastructure, and extensive vehicle customization options. Managing this complexity through traditional interfaces can become overwhelming. Deep menus and many physical controls often lead to poor user experiences and unused features. Voice AI assistants provide a great solution by allowing natural language access to complex features without users needing to grasp menu structures or memorize control locations. Commands such as "make it warmer," "play my driving playlist," or "take me home avoiding highways" are intuitive for users of all skill levels. As automotive features expand with increasing connectivity and automation, voice control becomes vital for accessing and using advanced capabilities.

Opportunity: Integration with Personal AI Ecosystems and Smart Homes

The widespread use of voice assistants in smartphones and smart homes offers significant opportunities for automotive voice AI integration. Consumers who are familiar with Amazon Alexa, Google Assistant, Apple Siri, or regional platforms like China’s DuerOS expect smooth voice experiences that extend into their cars. This expectation drives automakers to blend popular voice platforms with or instead of their own systems, aiming for a consistent user experience across devices and environments. Integration opportunities include voice-controlled smart home preparations while driving, calendar-synchronized navigation, unified music and podcast experiences, cross-device reminders and notifications, and smart home monitoring enabled by the vehicle. This ecosystem connection creates substantial value beyond in-vehicle features, making voice AI assistants crucial links between automotive, mobile, and home environments. The ecosystem approach also lowers user training needs and boosts engagement through familiar interfaces.

Opportunity: Expansion into Emerging Markets with Multi-Language Capabilities

The automotive voice AI market has significant growth potential in emerging markets as technology advances to accommodate diverse languages, dialects, and linguistic nuances. Historically, voice recognition has focused on major languages like English, Chinese, and important European languages, limiting market reach in regions with a variety of languages, such as India, Southeast Asia, the Middle East, and Africa. Recent advances in AI now allow for sophisticated multi-language and multi-dialect support, including recognizing code-switching, where users mix languages naturally in conversations. This capability greatly expands target markets, allowing voice AI deployment in vehicles sold in linguistically varied regions. Growth in emerging markets is further supported by increased smartphone usage that familiarizes people with voice interaction, rising middle-class demand for advanced vehicle features, and the significant benefit of voice interfaces in areas with different literacy levels. Automakers and voice AI providers investing in complete language support can achieve substantial growth in high-volume emerging automotive markets.

By AI Engine:

In 2026, the integrated NLU/NLP (Natural Language Understanding/Natural Language Processing) segment is expected to capture the largest share of the automotive voice AI assistants market. Integrated systems that combine both NLU and NLP capabilities provide thorough language processing. They not only recognize commands but also understand context, intent, meaning, and how conversations flow. These systems can manage complex commands, keep track of context during conversations, decipher implied meanings, clarify ambiguous references, and adjust to unique speech patterns. The combination of understanding and processing allows for natural conversations rather than rigid command-response exchanges. Premium voice assistants from both automakers and tech platforms use advanced NLU/NLP to create user experiences that feel like real conversations.

The NLU-focused segment caters to applications that prioritize recognizing intent and understanding meaning over generating language. These are often systems with set response templates and action options. They balance capability with efficiency, making them ideal for systems with limited processing power.

The speech recognition engine segment includes systems that focus mainly on accurately converting spoken words into text. This forms the basic layer for voice interaction but requires additional processing for understanding and generating responses. High-accuracy speech recognition that uses deep learning is crucial for any voice AI system, handling different accents, dialects, and acoustic conditions.

By Language Support:

The multi-language segment is set to take the biggest share of the market in 2026. This growth is driven by global automotive markets that need support for many languages and regional variations. Modern vehicles are sold in diverse language markets, and consumers expect voice interfaces in their native languages. Premium voice AI systems support many languages and dialects, allowing for effective deployment worldwide. Multi-language support goes beyond simple translation. It includes culturally relevant responses, local knowledge, point-of-interest information, and attention to language subtleties like formality and regional phrases. The challenge of providing consistent high-quality voice recognition and language understanding in different languages presents a significant barrier to entry. This favors established AI providers with strong language capabilities.

The single-language segment mainly serves region-specific vehicles or budget-conscious implementations. It focuses on excellent performance in one target language instead of supporting many languages.

The real-time translation segment is emerging as voice AI expands to enable conversations in multiple languages, provide in-car translation for passengers, and assist with international travel. This new feature allows passengers who speak different languages to communicate through AI help. It also enables voice control in languages that users may not be fluent in.

By Integration Type:

The cloud-connected segment is projected to grow the most during the forecast period. This growth comes from superior processing capabilities, access to large knowledge databases, ongoing learning and improvement, and seamless integration with connected services. Cloud-based voice AI systems use powerful remote computing resources to deliver complex natural language understanding, keep current information databases, perform detailed contextual reasoning, and continuously improve by analyzing millions of interactions. Cloud connectivity enables features that cannot be achieved through on-device processing. These include detailed information about points of interest, integration of real-time traffic and weather, extensive music catalog access, and control of smart home devices. The cloud model also allows for rapid deployment of updates and new features without needing hardware changes.

The hybrid (edge + cloud) segment is gaining traction as the best setup for automotive voice AI. It combines on-device processing for essential functions, privacy, and offline capability with cloud connectivity for advanced features and knowledge access. Hybrid systems locally process wake word detection and common commands for quick responses and privacy. More complex queries are sent to the cloud for thorough processing. This setup balances performance, privacy, features, and the ability to work offline.

The native (embedded) segment meets the needs of applications that require full functionality without relying on connectivity, handle privacy-sensitive tasks, or address cost constraints. Advances in edge AI processing and model compression are leading to more advanced voice functions in embedded systems, though these still have limitations compared to cloud-connected options.

By Features:

The navigation and location services segment is expected to make a significant contribution in 2026. Voice-controlled navigation is one of the most valued and frequently used features of voice assistants. Saying destination addresses, searching for nearby places, requesting alternate routes, and managing multi-stop trips via voice is much more convenient and safer than manual entry. Advanced voice navigation even includes natural language requests like "find coffee near my route," "avoid highways," or "take me home the scenic way." Integration with real-time traffic updates, suggested departure times, and proactive route optimization based on calendar events shows the usefulness of intelligent voice navigation.

The media and entertainment control segment covers voice control for music, podcasts, audiobooks, radio, and video for passengers. Natural language requests like "play something energetic," "skip to the next podcast episode," or "find music similar to this" showcase the system's content comprehension and recommendation ability. Integration with streaming services and personal music collections makes for a great voice-controlled entertainment experience.

The vehicle control segment is predicted to experience the highest growth rate during the forecast period. This is driven by increasing voice control over vehicle functions, including climate control (temperature, fan speed, ventilation), seating (position, heating, cooling, massage), lighting (ambient light, brightness), windows and sunroof, driving modes, and advanced vehicle settings. The intuitive nature of voice control for vehicle adjustments—like "make it cooler," "heat my seat," or "open the sunroof"—makes complex features easier to manage without distractions. Integration with vehicle sensors allows for context-aware responses, such as adjusting the temperature when someone says, "I'm cold."

The communication segment includes phone calls, messaging, and email interaction through voice. While hands-free calling has been around for a while, modern voice AI enhances communication management. This includes searching for contacts using natural language, multi-step calling, voice-to-text messaging with confirmation, and email summaries while driving

By Deployment Model:

The OEM-developed proprietary systems segment retains a strong market share, balancing brand control and differentiation despite competition from platform providers. Automakers like BMW (Intelligent Personal Assistant), Mercedes-Benz (MBUX), and Tesla develop proprietary voice AI that is deeply embedded in vehicle systems, brand identity, and distinct features. These systems allow automakers to control user experiences, data collection, feature differentiation, and brand visibility while avoiding reliance on outside technology platforms. However, developing and maintaining advanced voice AI requires significant ongoing investment in research, language support, and feature development.

The third-party platform integration segment, which includes Amazon Alexa Auto, Google Assistant, and Apple CarPlay, is growing quickly due to consumers’ familiarity and ease of integration with ecosystems. This integration provides a smooth transition between voice experiences on smartphones and in vehicles, access to many third-party services, and automatic updates as platforms evolve. This approach appeals to automakers who want to prioritize speed and broad capabilities over unique features.

A hybrid strategy that merges proprietary vehicle-specific voice control with integrated third-party platform access is becoming more popular. This allows automakers to keep control over essential vehicle functions while giving consumers access to familiar platforms for connected services and ecosystem integration.

Regional Insights:

In 2026, North America is expected to dominate the automotive voice AI assistants market. This leadership results from high rates of smartphone and voice assistant adoption, which create consumer demands for in-car voice experiences. The strong presence of leading voice AI platforms (Amazon, Google, Apple), the high penetration of connected vehicles, consumer comfort with technology, and cultural acceptance of voice interaction in public spaces all contribute to this. The United States plays a significant role, with widespread use of Amazon Alexa and Google Assistant in homes creating a demand for automotive integration, high sales of premium vehicles featuring advanced voice AI, and robust domestic AI development by automakers and tech companies.

The Asia-Pacific region is expected to grow the fastest during the forecast period due to high automotive production in countries like China, Japan, South Korea, and growing markets. Connected vehicle adoption is particularly soaring in China. Strong development of domestic AI technology led by companies such as Baidu, iFlytek, and Alibaba also drives this growth. Regional automakers are aggressively deploying voice AI, especially in electric vehicles. China, being the largest automotive market, will heavily influence regional growth. Domestic voice AI platforms are increasingly sophisticated, optimized for the Chinese language, and government initiatives are promoting intelligent connected vehicles. Japan and South Korea contribute to this growth with their advanced automotive industries and leadership in technology.

Europe represents a significant market characterized by a concentration of premium vehicles with advanced voice AI systems. Strong consumer data privacy expectations impact design decisions. Multi-language support reflects the region's linguistic diversity, with extensive voice AI integration by German luxury manufacturers. The emphasis on data protection and privacy compliance in Europe is encouraging the adoption of hybrid and edge-processing architectures that limit data transfer while preserving functionality.

Key Players:

The major players in the automotive voice AI assistants market include Amazon (Alexa Auto) (U.S.), Google LLC (Google Assistant) (U.S.), Apple Inc. (CarPlay/Siri) (U.S.), Microsoft Corporation (Nuance) (U.S.), Cerence Inc. (U.S.), SoundHound AI Inc. (U.S.), Visteon Corporation (U.S.), Harman International (Samsung Electronics) (South Korea), Continental AG (Germany), Bosch GmbH (Germany), Nuance Communications (Microsoft) (U.S.), iFlytek Co. Ltd. (China), BMW Group (Intelligent Personal Assistant) (Germany), Mercedes-Benz AG (MBUX) (Germany), Volkswagen Group (Germany), Tesla Inc. (U.S.), NIO Inc. (China), Baidu Inc. (China), Alibaba Cloud (China), and Qualcomm Technologies Inc. (U.S.), among others.

The automotive voice AI assistants market is expected to grow from USD 2.87 billion in 2026 to USD 18.92 billion by 2036.

The automotive voice AI assistants market is expected to grow at a CAGR of 21.3% from 2026 to 2036.

The major players in the automotive voice AI assistants market include Amazon (Alexa Auto), Google LLC (Google Assistant), Apple Inc. (CarPlay/Siri), Microsoft Corporation (Nuance), Cerence Inc., SoundHound AI Inc., Visteon Corporation, Harman International (Samsung Electronics), Continental AG, Bosch GmbH, iFlytek Co. Ltd., BMW Group, Mercedes-Benz AG, Volkswagen Group, Tesla Inc., NIO Inc., Baidu Inc., Alibaba Cloud, and Qualcomm Technologies Inc., among others.

The main factors driving the automotive voice AI assistants market include critical need for distraction-free vehicle interaction to enhance driving safety, expanding vehicle connectivity and feature complexity requiring intuitive control interfaces, consumer familiarity with voice assistants from smartphones and smart homes creating adoption expectations, integration with personal AI ecosystems and smart home devices, growing multi-language support enabling emerging market expansion, increasing ADAS deployment requiring effective driver communication, and continuous advancements in natural language understanding, speech recognition accuracy, and conversational AI capabilities.

North America region will lead the global automotive voice AI assistants market in 2026 due to high voice assistant adoption rates and presence of leading AI platforms, while Asia-Pacific region is expected to register the highest growth rate during the forecast period 2026 to 2036.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by AI Engine

3.3. Market Analysis, by Language Support

3.4. Market Analysis, by Integration Type

3.5. Market Analysis, by Features

3.6. Market Analysis, by Deployment Model

3.7. Market Analysis, by Vehicle Type

3.8. Market Analysis, by Geography

3.9. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Automotive Voice AI Assistants Market: Impact Analysis of Market Drivers (2026–2036)

4.2.1. Critical Need for Distraction-Free Vehicle Interaction

4.2.2. Expanding Vehicle Connectivity and Feature Complexity

4.2.3. Consumer Familiarity from Smartphone and Smart Home Voice Assistants

4.3. Global Automotive Voice AI Assistants Market: Impact Analysis of Market Restraints (2026–2036)

4.3.1. Privacy Concerns and Data Security Issues

4.3.2. Recognition Accuracy Challenges in Noisy Environments

4.4. Global Automotive Voice AI Assistants Market: Impact Analysis of Market Opportunities (2026–2036)

4.4.1. Integration with Personal AI Ecosystems and Smart Homes

4.4.2. Expansion into Emerging Markets with Multi-Language Capabilities

4.5. Global Automotive Voice AI Assistants Market: Impact Analysis of Market Challenges (2026–2036)

4.5.1. Balancing Cloud Capabilities with Privacy and Offline Functionality

4.5.2. Managing Diverse Accents, Dialects, and Code-Switching

4.6. Global Automotive Voice AI Assistants Market: Impact Analysis of Market Trends (2026–2036)

4.6.1. Evolution from Command-Response to Conversational AI

4.6.2. Integration of Emotion AI and Contextual Awareness

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. Natural Language Processing and AI Technologies in Automotive Voice Assistants

5.1. Introduction to Automotive Voice AI Architecture

5.2. Speech Recognition and Wake Word Detection

5.3. Natural Language Understanding (NLU) Techniques

5.4. Natural Language Processing (NLP) and Response Generation

5.5. Context Management and Conversational Memory

5.6. Noise Cancellation and Acoustic Modeling

5.7. Edge AI and On-Device Processing

5.8. Privacy-Preserving Voice AI Architectures

5.9. Impact on Market Growth and Technology Adoption

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share/Ranking by Key Players

7. Global Automotive Voice AI Assistants Market, by AI Engine

7.1. Introduction

7.2. Integrated NLU/NLP Systems

7.3. NLU-Focused Systems

7.4. Speech Recognition Engines

7.5. Conversational AI Platforms

7.6. Domain-Specific AI Models

8. Global Automotive Voice AI Assistants Market, by Language Support

8.1. Introduction

8.2. Single-Language Systems

8.3. Multi-Language Systems

8.3.1. Major Languages (English, Chinese, Spanish, etc.)

8.3.2. Regional Languages and Dialects

8.4. Real-Time Translation Capabilities

8.5. Code-Switching Recognition

9. Global Automotive Voice AI Assistants Market, by Integration Type

9.1. Introduction

9.2. Cloud-Connected Systems

9.3. Hybrid (Edge + Cloud) Systems

9.4. Native (Embedded) Systems

9.5. Platform-Agnostic Integration

10. Global Automotive Voice AI Assistants Market, by Features

10.1. Introduction

10.2. Navigation and Location Services

10.2.1. Destination Entry and Route Planning

10.2.2. POI Search and Discovery

10.2.3. Traffic and Route Optimization

10.3. Media and Entertainment Control

10.3.1. Music Streaming Integration

10.3.2. Podcast and Audiobook Playback

10.3.3. Content Discovery and Recommendations

10.4. Vehicle Control

10.4.1. Climate Control

10.4.2. Seating and Comfort Adjustments

10.4.3. Lighting and Ambiance

10.4.4. Windows and Sunroof Control

10.5. Communication (Phone, Messaging, Email)

10.6. Smart Home Integration

10.7. Information and Search

10.8. Calendar and Productivity Integration

11. Global Automotive Voice AI Assistants Market, by Deployment Model

11.1. Introduction

11.2. OEM-Developed Proprietary Systems

11.3. Third-Party Platform Integration

11.3.1. Amazon Alexa Auto

11.3.2. Google Assistant

11.3.3. Apple CarPlay/Siri

11.3.4. Regional Platforms (Baidu, Alibaba, etc.)

11.4. Hybrid (Proprietary + Platform) Approaches

11.5. Aftermarket Voice AI Solutions

12. Global Automotive Voice AI Assistants Market, by Vehicle Type

12.1. Introduction

12.2. Passenger Vehicles

12.2.1. Premium and Luxury Vehicles

12.2.2. Mid-Segment Vehicles

12.2.3. Compact and Entry-Level Vehicles

12.3. Electric Vehicles

12.4. Commercial Vehicles

12.5. Autonomous Vehicles

13. Automotive Voice AI Assistants Market, by Geography

13.1. Introduction

13.2. North America

13.2.1. U.S.

13.2.2. Canada

13.3. Europe

13.3.1. Germany

13.3.2. U.K.

13.3.3. France

13.3.4. Italy

13.3.5. Spain

13.3.6. Sweden

13.3.7. Rest of Europe

13.4. Asia-Pacific

13.4.1. China

13.4.2. Japan

13.4.3. South Korea

13.4.4. India

13.4.5. Australia

13.4.6. Southeast Asia

13.4.7. Rest of Asia-Pacific

13.5. Latin America

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Middle East & Africa

13.6.1. Saudi Arabia

13.6.2. UAE

13.6.3. South Africa

13.6.4. Rest of Middle East & Africa

14. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

14.1. Amazon (Alexa Auto)

14.2. Google LLC (Google Assistant)

14.3. Apple Inc. (CarPlay/Siri)

14.4. Microsoft Corporation (Nuance)

14.5. Cerence Inc.

14.6. SoundHound AI Inc.

14.7. Visteon Corporation

14.8. Harman International (Samsung Electronics)

14.9. Continental AG

14.10. Bosch GmbH

14.11. Nuance Communications (Microsoft)

14.12. iFlytek Co. Ltd.

14.13. BMW Group (Intelligent Personal Assistant)

14.14. Mercedes-Benz AG (MBUX)

14.15. Volkswagen Group

14.16. Tesla Inc.

14.17. NIO Inc.

14.18. Baidu Inc.

14.19. Alibaba Cloud

14.20. Qualcomm Technologies Inc.

14.21. Others

15. Appendix

15.1. Questionnaire

15.2. Available Customization

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Sep-2024

Published Date: Sep-2024

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates