Resources

About Us

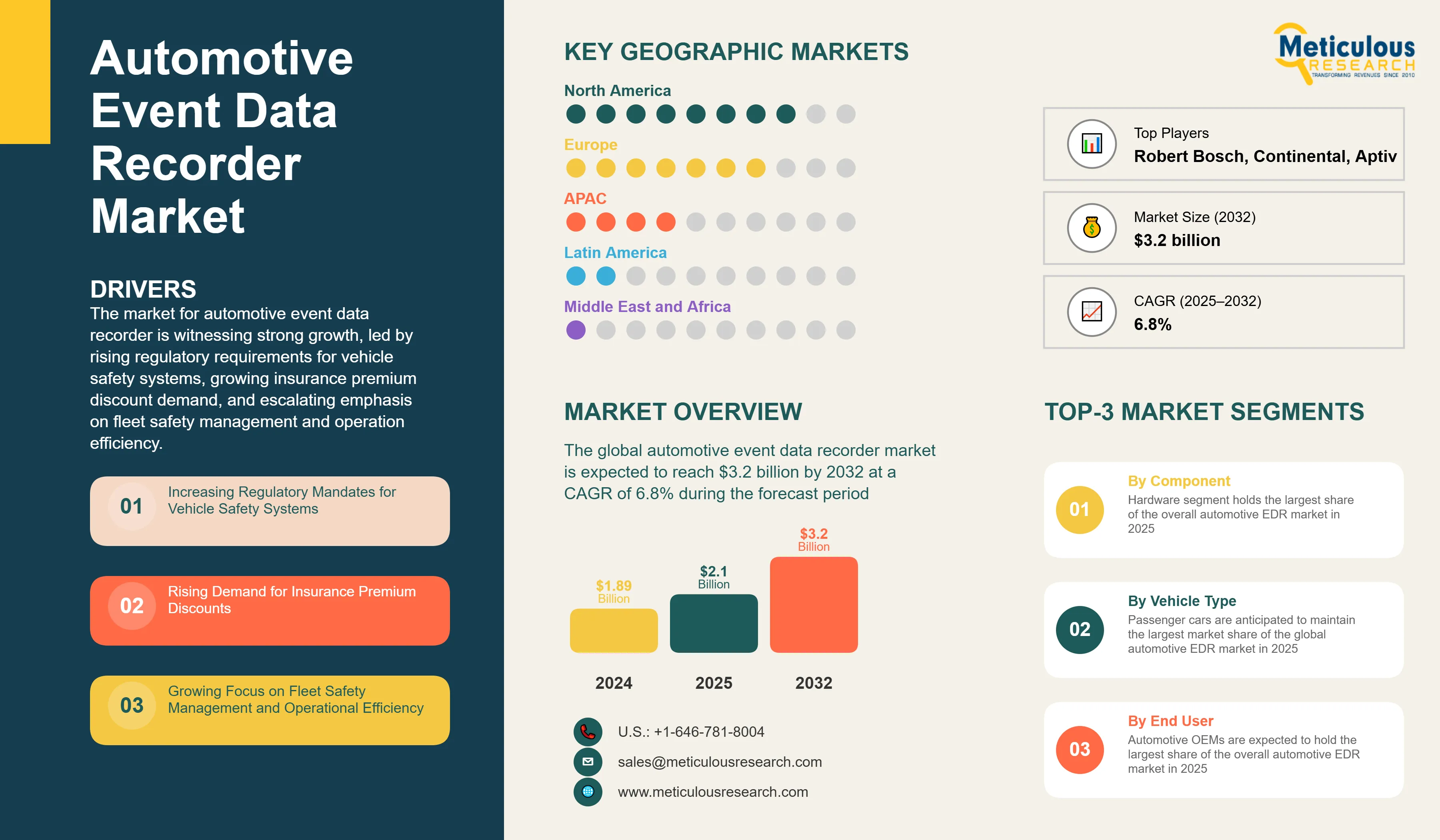

Automotive Event Data Recorder Market by Component (Hardware, Software, Services), Vehicle Type (Passenger, Commercial), End User (Automotive OEMs, Commercial Fleet Operators, Insurance Industry), Distribution Channel, and Geography - Global Forecast to 2032

Report ID: MRAUTO - 1041484 Pages: 280 May-2025 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportReport Overview

This comprehensive market research report analyzes the dynamic automotive event data recorder (EDR) market, evaluating how advanced recording technologies are transforming vehicle safety, insurance assessment, fleet management, and accident investigation across passenger vehicles, commercial fleets, and public sector applications. The report provides strategic analysis of market dynamics, growth projections till 2032, and competitive positioning across global and regional/country-level markets.

Market Dynamics Overview

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

The market for automotive event data recorder is witnessing strong growth, led by rising regulatory requirements for vehicle safety systems, growing insurance premium discount demand, and escalating emphasis on fleet safety management and operation efficiency. The growth is also aided by the integration of EDRs with Advanced Driver Assistance Systems (ADAS) and increased accident investigation requirements. As safety applications in vehicles require more accuracy and functionality, conventional EDR designs are changing. At the same time, the use of cloud-connected systems and high-end features such as video and audio recording capabilities are picking up pace. The market is also being powered by the transition from simple crash recording to full vehicle monitoring and AI-supported data analysis and event detection, especially in automotive OEMs, commercial fleet operations, and insurance.

Key Challenges

In spite of the robust growth curve of the vehicle EDR industry, there are certain challenges impacting the wider adoption of automatic event data recorder solutions. Harmonizing data protection with security and analytics demands continue to be one of the bigger issues, especially in privacy-savvy economies. Protection against unauthorized use has remained a continuing risk to deployability, even as things grow more integrated. Differing cross-border regulations and compliance levels complicate global deployment strategies, while standardization and interoperability problems with EDR data complicate platform integration. Moreover, technical limitations in the accuracy and completeness of crash data are limiting reliability in safety-critical applications. As the automotive world continues to evolve, integrating EDR technology into electric and autonomous vehicles introduces new engineering and compatibility challenges.

Growth Opportunities

The automotive EDR market is positioned for significant growth opportunities, based on integration with connected vehicle ecosystems and telematics, which is substantially enhancing data collection capabilities and real time monitoring. Development of predictive analytics based on EDR data creates new value propositions beyond traditional crash recording. Besides, developing economies with enhanced road safety regulations are creating untapped regional markets for growth, making EDRs critical tools in overall safety efforts. The market is also supported by growing demand for value added services through monetization of EDR data, generating recurring revenue streams for providers. Additionally, the advancement of EDR systems specifically geared to the development of autonomous vehicles is creating new uses by solving the distinct monitoring and validation needs of autonomous technologies.

Market Segmentation Highlights

By Component

Hardware segment holds the largest share of the overall automotive EDR market in 2025, primarily driven by the essential role of EDR control units, sensors, storage systems, and connectivity modules in enabling core recording functionality. These components form the backbone of core recording capabilities, and their durable construction and dependable performance across diverse sensor types and storage formats make them suitable for use in passenger cars, commercial fleets, and specialized vehicles.

On the other hand, software solutions are expected to grow at the fastest CAGR through 2032, mainly driven by rising demand for advanced data analytics, crash detection algorithms, and driver behaviour monitoring. This rapid expansion is fuelled by innovations in AI-powered analysis and a growing preference for cloud-integrated systems, particularly within fleet management, insurance evaluation, and next-generation safety solutions.

By Vehicle Type

Passenger cars are anticipated to maintain the largest market share of the global automotive EDR market in 2025 due to rising consumer demand for safety features, expanding regulatory requirements in developed economies, and the widespread adoption of EDRs in mid-size and luxury vehicles. These trends position passenger car applications as the key revenue driver, particularly in markets with sophisticated automotive safety regulations.

In the meanwhile, electric vehicles are likely to experience the fastest growth during the forecast period owing to the aggressive transition toward electric mobility, demand for specialized observation of EV powertrains, and higher use of sophisticated electronic systems. Specialized EDR systems to monitor EV-specific data points render this segment a key area of opportunity as the sector moves toward large-scale electrification.

By End User

Automotive OEMs are expected to hold the largest share of the overall automotive EDR market in 2025, driven primarily by the growing trend of factory-installed EDR systems, increasing regulatory mandates, and the growing convergence of EDRs with more extensive in-vehicle systems. As the prime designers and manufacturers of vehicles, OEMs stand as the first implementers of EDR technology, creating foundation demand within the market.

Conversely, the insurance industry is poised to see the highest growth rate until 2032, mainly driven by the growing application of usage-based insurance programs, increased dependence on objective crash data for claim adjustment, and the industry's migration toward data-based risk assessment.

By Distribution Channel

The direct channel is expected to hold the largest share of the global automotive EDR market in 2025, primarily driven by the OEMs' preference for factory installed EDR systems, especially in new vehicle models complying with safety regulations. This channel benefits from seamless integration with vehicle systems and standardized quality control throughout the manufacturing process.

However, professional installation services are expected to witness the highest growth rate over the forecast period, driven by increasing demand for aftermarket EDR solutions with specialized features, the growing retrofit market for older vehicles, and the expansion of value-added installation services.

By Geography

North America is expected to hold the largest share of the global automotive EDR market in 2025, closely followed by Europe. This leadership is attributed to the region's stringent vehicle safety regulations, early EDR adoption in commercial fleets, substantial investments in advanced vehicle technologies, and the presence of key industry players. These factors collectively position North America as a pivotal market for EDR technology innovation and deployment across automotive, insurance, and fleet management sectors. Europe remains a significant market with strong growth potential, supported by EU regulations on vehicle safety, the region's focus on road safety improvements, and the increasing adoption of telematics and connected vehicle technologies.

However, the Asia-Pacific region, particularly China, Japan, and South Korea, is expected to experience the highest growth rate over the forecast period. This momentum is mainly driven by rapidly evolving vehicle safety standards, increasing vehicle production volumes, growing consumer awareness about safety technologies, and substantial investments in smart transportation infrastructure.

Competitive Landscape

The global automotive event data recorder market is characterized by technological innovation and strategic partnerships, driven by established automotive component manufacturers, specialized EDR developers, and technology companies expanding into the automotive safety space.

Market dynamics are increasingly influenced by key trends such as integration with vehicle telematics platforms, enhancement of data analytics capabilities, and development of comprehensive safety ecosystems that combine EDRs with other safety technologies. Leading companies are prioritizing improvements in data security, privacy compliance, and seamless connectivity to address evolving customer requirements and regulatory frameworks.

Key players operating in the global automotive event data recorder market include Robert Bosch GmbH, Continental AG, Aptiv PLC, Denso Corporation, ZF Friedrichshafen AG, Harman International Industries (Samsung Electronics), Veoneer Inc., BlackVue (Pittasoft Co., Ltd.), Nexar Ltd., Garmin Ltd., Digital Ally, Inc., THINKWARE Corporation, Waylens, Inc., Voyomotive, LLC, and Octo Telematics S.p.A., among others.

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.8% |

|

Market Size (Value)in 2025 |

USD 2.1 Billion |

|

Market Size (Value) in 2032 |

USD 3.2 Billion |

|

Segments Covered |

By Component

By Vehicle Type,

By End User

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

Robert Bosch GmbH, HP Inc., ZF Friedrichshafen AG, Continental AG, Aptiv PLC (formerly Delphi Automotive), Koninklijke Philips N.V., Infineon Technologies AG, Knorr-Bremse AG, Garmin Ltd., Samsung Electronics Co., Ltd., Denso Corporation, Digital Ally, Inc., Incredisonic Inc., PAPAGO Inc., Cansonic Inc., Auto-vox Technology Co., Ltd., Waylens, Inc., Voyomotive, LLC, Octo Group S.p.A., Applied Technical Services, LLC |

The global automotive event data recorder market was valued at $1.89 billion in 2024. This market is expected to reach $3.2 billion by 2032 from an estimated $2.1 billion in 2025, at a CAGR of 6.8% during the forecast period of 2025–2032.

The global automotive event data recorder market is expected to grow at a CAGR of 6.8% during the forecast period of 2025–2032.

The global automotive event data recorder market is expected to reach $3.2 billion by 2032 from an estimated $2.1 billion in 2025, at a CAGR of 6.8% during the forecast period of 2025–2032.

The key companies operating in this market include Robert Bosch GmbH, HP Inc., ZF Friedrichshafen AG, Continental AG, Aptiv PLC (formerly Delphi Automotive), Koninklijke Philips N.V., Infineon Technologies AG, Knorr-Bremse AG, Garmin Ltd., Samsung Electronics Co., Ltd., Denso Corporation, Digital Ally, Inc., Incredisonic Inc., PAPAGO Inc., Cansonic Inc., Auto-vox Technology Co., Ltd., Waylens, Inc., Voyomotive, LLC, Octo Group S.p.A., Applied Technical Services, LLC.

Major trends shaping the market include the shift from basic crash recording to comprehensive vehicle monitoring, cloud-connected EDR systems with remote data access, integration of video and audio recording capabilities, AI-enhanced data analysis and event detection, and multi-purpose EDRs with additional functionality.

In 2025, the hardware component segment is expected to account for the largest share of the automotive EDR market; based on vehicle type, passenger vehicles are expected to hold the largest share of the overall market in 2025; and the automotive OEMs segment is expected to account for the largest market share in 2025.

North America leads the global market followed by Europe due to stringent safety regulations, established telematics infrastructure, and early EDR adoption. Asia-Pacific is witnessing the highest growth rate driven by rapidly evolving safety standards, increasing vehicle production volumes, and growing consumer awareness about safety technologies, particularly in China, Japan, and South Korea.

The growth of this market is driven by increasing regulatory mandates for vehicle safety systems, rising demand for insurance premium discounts, growing focus on fleet safety management and operational efficiency, integration of EDRs with Advanced Driver Assistance Systems (ADAS), and enhanced accident investigation and liability determination needs.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Automotive Event Data Recorder Market, by Component

3.2.2. Automotive Event Data Recorder Market, by Vehicle Type

3.2.3. Automotive Event Data Recorder Market, by End User

3.2.4. Automotive Event Data Recorder Market, by Distribution Channel

3.2.5. Automotive Event Data Recorder Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Increasing Regulatory Mandates for Vehicle Safety Systems

4.2.1.2. Rising Demand for Insurance Premium Discounts

4.2.1.3. Growing Focus on Fleet Safety Management and Operational Efficiency

4.2.1.4. Integration of EDRs with Advanced Driver Assistance Systems (ADAS)

4.2.1.5. Enhanced Accident Investigation and Liability Determination Needs

4.2.2. Restraints

4.2.2.1. Privacy Concerns Regarding Driver Data Collection

4.2.2.2. High Implementation Costs for Advanced EDR Systems

4.2.2.3. Technical Limitations in Crash Data Accuracy and Completeness

4.2.2.4. Lack of Standardization Across Different Markets

4.2.2.5. Resistance from Certain Consumer Groups

4.2.3. Opportunities

4.2.3.1. Integration with Connected Vehicle Ecosystems and Telematics

4.2.3.2. Development of Predictive Analytics Based on EDR Data

4.2.3.3. Emerging Markets with Improving Road Safety Regulations

4.2.3.4. Value-Added Services Through EDR Data Monetization

4.2.3.5. Advanced EDR Systems for Autonomous Vehicle Development

4.2.4. Trends

4.2.4.1. Shift from Basic Crash Recording to Comprehensive Vehicle Monitoring

4.2.4.2. Cloud-Connected EDR Systems with Remote Data Access

4.2.4.3. Integration of Video and Audio Recording Capabilities

4.2.4.4. AI-Enhanced Data Analysis and Event Detection

4.2.4.5. Multi-Purpose EDRs with Additional Functionality

4.2.5. Challenges

4.2.5.1. Balancing Data Privacy with Safety and Analytics Requirements

4.2.5.2. Ensuring Data Security Against Unauthorized Access

4.2.5.3. Varying Cross-Border Regulations and Compliance Requirements

4.2.5.4. EDR Data Standardization and Interoperability Issues

4.2.5.5. Adapting EDR Technology for Electric and Autonomous Vehicles

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on Automotive Event Data Recorder Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Product Lifecycle Management

4.4.1.2. Energy Efficiency

4.4.1.3. Material Selection

4.4.2. Economic Sustainability

4.4.2.1. Insurance Incentives

4.4.2.2. Fleet Optimization

4.4.2.3. Maintenance Efficiency

4.4.3. Social Sustainability

4.4.3.1. Safety Improvements

4.4.3.2. Driver Education

5. Automotive Event Data Recorder Market Assessment—by Component

5.1. Overview

5.2. Hardware

5.2.1. EDR Control Units

5.2.2. Sensors & Data Collection Systems

5.2.3. Storage Systems

5.2.4. Video Recording Hardware

5.2.5. Connectivity Modules

5.3. Software

5.3.1. Data Collection & Recording Software

5.3.2. Data Analysis & Interpretation Software

5.3.3. Fleet Management Software

5.3.4. Crash Detection & Notification Software

5.3.5. Driver Behavior Analysis Software

5.4. Services

6. Automotive Event Data Recorder Market Assessment—by Vehicle Type

6.1. Overview

6.2. Passenger Vehicles

6.2.1. Economy Cars

6.2.2. Mid-Size & Luxury Cars

6.3. Commercial Vehicles

6.3.1. Light Commercial Vehicles

6.3.2. Heavy Commercial Vehicles

6.4. Others

7. Automotive EDR Market Assessment—by End User

7.1. Overview

7.2. Automotive OEMs

7.3. Commercial Fleet Operators

7.4. Insurance Industry

7.5. Public Sector & Government

7.6. Automotive Service Providers

7.7. Data Analytics Companies

8. Automotive Event Data Recorder Market Assessment—by Distribution Channel

8.1. Overview

8.2. Direct Channel

8.3. Aftermarket Retailers

8.4. Professional Installation Services

9. Automotive Event Data Recorder Market Assessment—by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of Asia-Pacific (RoAPAC)

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America (RoLATAM)

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. United Arab Emirates (UAE)

9.6.3. Rest of Middle East & Africa (RoMEA)

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Contemporary Stalwarts

10.5. Market Share/Ranking Analysis, by the Key Players, 2024

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

11.1. Robert Bosch GmbH

11.2. HP Inc.

11.3. ZF Friedrichshafen AG

11.4. Continental AG

11.5. Aptiv PLC (formerly Delphi Automotive)

11.6. Koninklijke Philips N.V.

11.7. Infineon Technologies AG

11.8. Knorr-Bremse AG

11.9. Garmin Ltd.

11.10. Samsung Electronics Co., Ltd.

11.11. Denso Corporation

11.12. Digital Ally, Inc.

11.13. Incredisonic Inc.

11.14. PAPAGO Inc.

11.15. Cansonic Inc.

11.16. Auto-vox Technology Co., Ltd.

11.17. Waylens, Inc.

11.18. Voyomotive, LLC

11.19. Octo Group S.p.A.

11.20. Applied Technical Services, LLC

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1. Global Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 2. Global Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 3. Global EDR Control Units Market, by Country/Region, 2023–2032 (USD Million)

Table 4. Global Sensors & Data Collection Systems Market, by Country/Region, 2023–2032 (USD Million)

Table 5. Global Storage Systems Market, by Country/Region, 2023–2032 (USD Million)

Table 6. Global Video Recording Hardware Market, by Country/Region, 2023–2032 (USD Million)

Table 7. Global Connectivity Modules Market, by Country/Region, 2023–2032 (USD Million)

Table 8. Global Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 9. Global Data Collection & Recording Software Market, by Country/Region, 2023–2032 (USD Million)

Table 10. Global Data Analysis & Interpretation Software Market, by Country/Region, 2023–2032 (USD Million)

Table 11. Global Fleet Management Software Market, by Country/Region, 2023–2032 (USD Million)

Table 12. Global Crash Detection & Notification Software Market, by Country/Region, 2023–2032 (USD Million)

Table 13. Global Driver Behavior Analysis Software Market, by Country/Region, 2023–2032 (USD Million)

Table 14. Global Automotive Event Data Recorder Services Market, by Country/Region, 2023–2032 (USD Million)

Table 15. Global Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 16. Global Automotive Event Data Recorder Market for Passenger Vehicles, by Type, 2023–2032 (USD Million)

Table 17. Global Automotive Event Data Recorder Market for Economy Cars, by Country/Region, 2023–2032 (USD Million)

Table 18. Global Automotive Event Data Recorder Market for Mid-Size & Luxury Cars, by Country/Region, 2023–2032 (USD Million)

Table 19. Global Automotive Event Data Recorder Market for Commercial Vehicles, by Type, 2023–2032 (USD Million)

Table 20. Global Automotive Event Data Recorder Market for Light Commercial Vehicles, by Country/Region, 2023–2032 (USD Million)

Table 21. Global Automotive Event Data Recorder Market for Heavy Commercial Vehicles, by Country/Region, 2023–2032 (USD Million)

Table 22. Global Automotive Event Data Recorder Market for Other Vehicles, by Type, 2023–2032 (USD Million)

Table 23. Global Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 24. Global Automotive Event Data Recorder Market for Automotive OEMs, by Type, 2023–2032 (USD Million)

Table 25. Global Automotive Event Data Recorder Market for Commercial Fleet Operators, by Type, 2023–2032 (USD Million)

Table 26. Global Automotive Event Data Recorder Market for Insurance Industry, by Type, 2023–2032 (USD Million)

Table 27. Global Automotive Event Data Recorder Market for Public Sector & Government, by Type, 2023–2032 (USD Million)

Table 28. Global Automotive Event Data Recorder Market for Automotive Service Providers, by Type, 2023–2032 (USD Million)

Table 29. Global Automotive Event Data Recorder Market for Data Analytics Companies, by Type, 2023–2032 (USD Million)

Table 30. Global Automotive Event Data Recorder Market for Traffic Analytics Providers, by Country/Region, 2023–2032 (USD Million)

Table 31. Global Automotive Event Data Recorder Market for Driver Behavior Analysis Services, by Country/Region, 2023–2032 (USD Million)

Table 32. Global Automotive Event Data Recorder Market for Safety Research Organizations, by Country/Region, 2023–2032 (USD Million)

Table 33. Global Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 34. Global Automotive Event Data Recorder Market for Direct Channel, by Country/Region, 2023–2032 (USD Million)

Table 35. Global Automotive Event Data Recorder Market for Aftermarket Retailers, by Country/Region, 2023–2032 (USD Million)

Table 36. Global Automotive Event Data Recorder Market for Professional Installation Services, by Country/Region, 2023–2032 (USD Million)

Table 37. North America: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 38. North America: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 39. North America: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 40. North America: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 41. North America: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 42. North America: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 43. North America: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 44. North America: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 45. U.S.: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 46. U.S.: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 47. U.S.: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 48. U.S.: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 49. U.S.: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 50. U.S.: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 51. U.S.: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 52. U.S.: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 53. Canada: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 54. Canada: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 55. Canada: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 56. Canada: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 57. Canada: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 58. Canada: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 59. Canada: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 60. Canada: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 61. Europe: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 62. Europe: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 63. Europe: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 64. Europe: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 65. Europe: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 66. Europe: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 67. Europe: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 68. Europe: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 69. Germany: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 70. Germany: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 71. Germany: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 72. Germany: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 73. Germany: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 74. Germany: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 75. Germany: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 76. Germany: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 77. France: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 78. France: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 79. France: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 80. France: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 81. France: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 82. France: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 83. France: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 84. France: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 85. U.K.: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 86. U.K.: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 87. U.K.: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 88. U.K.: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 89. U.K.: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 90. U.K.: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 91. U.K.: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 92. U.K.: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 93. Italy: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 94. Italy: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 95. Italy: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 96. Italy: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 97. Italy: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 98. Italy: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 99. Italy: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 100. Italy: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 101. Spain: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 102. Spain: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 103. Spain: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 104. Spain: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 105. Spain: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 106. Spain: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 107. Spain: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 108. Spain: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 109. Rest of Europe: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 110. Rest of Europe: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 111. Rest of Europe: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 112. Rest of Europe: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 113. Rest of Europe: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 114. Rest of Europe: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 115. Rest of Europe: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 116. Rest of Europe: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 117. Asia-Pacific: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 118. Asia-Pacific: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 119. Asia-Pacific: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 120. Asia-Pacific: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 121. Asia-Pacific: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 122. Asia-Pacific: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 123. Asia-Pacific: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 124. Asia-Pacific: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 125. China: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 126. China: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 127. China: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 128. China: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 129. China: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 130. China: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 131. China: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 132. China: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 133. Japan: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 134. Japan: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 135. Japan: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 136. Japan: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 137. Japan: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 138. Japan: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 139. Japan: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 140. Japan: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 141. India: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 142. India: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 143. India: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 144. India: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 145. India: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 146. India: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 147. India: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 148. India: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 149. South Korea: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 150. South Korea: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 151. South Korea: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 152. South Korea: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 153. South Korea: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 154. South Korea: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 155. South Korea: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 156. South Korea: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 157. Australia: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 158. Australia: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 159. Australia: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 160. Australia: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 161. Australia: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 162. Australia: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 163. Australia: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 164. Australia: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 165. Rest of Asia-Pacific: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 166. Rest of Asia-Pacific: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 167. Rest of Asia-Pacific: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 168. Rest of Asia-Pacific: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 169. Rest of Asia-Pacific: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 170. Rest of Asia-Pacific: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 171. Rest of Asia-Pacific: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 172. Rest of Asia-Pacific: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 173. Latin America: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 174. Latin America: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 175. Latin America: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 176. Latin America: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 177. Latin America: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 178. Latin America: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 179. Latin America: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 180. Latin America: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 181. Brazil: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 182. Brazil: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 183. Brazil: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 184. Brazil: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 185. Brazil: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 186. Brazil: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 187. Brazil: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 188. Brazil: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 189. Mexico: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 190. Mexico: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 191. Mexico: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 192. Mexico: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 193. Mexico: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 194. Mexico: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 195. Mexico: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 196. Mexico: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 197. Rest of Latin America: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 198. Rest of Latin America: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 199. Rest of Latin America: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 200. Rest of Latin America: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 201. Rest of Latin America: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 202. Rest of Latin America: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 203. Rest of Latin America: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 204. Rest of Latin America: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 205. Middle East and Africa: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 206. Middle East and Africa: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 207. Middle East and Africa: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 208. Middle East and Africa: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 209. Middle East and Africa: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 210. Middle East and Africa: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 211. Middle East and Africa: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 212. Middle East and Africa: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 213. Saudi Arabia: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 214. Saudi Arabia: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 215. Saudi Arabia: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 216. Saudi Arabia: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 217. Saudi Arabia: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 218. Saudi Arabia: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 219. Saudi Arabia: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 220. Saudi Arabia: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 221. United Arab Emirates: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 222. United Arab Emirates: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 223. United Arab Emirates: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 224. United Arab Emirates: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 225. United Arab Emirates: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 226. United Arab Emirates: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 227. United Arab Emirates: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 228. United Arab Emirates: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

Table 229. Rest of Middle East and Africa: Automotive Event Data Recorder Market, by Component, 2023–2032 (USD Million)

Table 230. Rest of Middle East and Africa: Automotive Event Data Recorder Hardware Market, by Type, 2023–2032 (USD Million)

Table 231. Rest of Middle East and Africa: Automotive Event Data Recorder Software Market, by Type, 2023–2032 (USD Million)

Table 232. Rest of Middle East and Africa: Automotive Event Data Recorder Market, by Vehicle Type, 2023–2032 (USD Million)

Table 233. Rest of Middle East and Africa: Passenger Vehicles Market, by Type, 2023–2032 (USD Million)

Table 234. Rest of Middle East and Africa: Commercial Vehicles Market, by Type, 2023–2032 (USD Million)

Table 235. Rest of Middle East and Africa: Automotive Event Data Recorder Market, by End User, 2023–2032 (USD Million)

Table 236. Rest of Middle East and Africa: Automotive Event Data Recorder Market, by Distribution Channel, 2023–2032 (USD Million)

List of Figures

Figure 1. Research Process

Figure 2. Secondary Components Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Hardware segment to Account for the Largest Share

Figure 8. In 2025, the Passenger vehicles to Account for the Largest Share

Figure 9. In 2025, the Automotive Event Data Recorder Market for Automotive OEMs to Account for the Largest Share

Figure 10. In 2025, the Automotive Event Data Recorder Market for direct channel to Account for the Largest Share

Figure 11. Asia-Pacific to be the Fastest-growing Regional Market

Figure 12. Impact Analysis of Market Dynamics

Figure 13. Global Automotive Event Data Recorder Market: Porter's Five Forces Analysis

Figure 14. Global Automotive Event Data Recorder Market, by Component, 2025 Vs. 2032 (USD Million)

Figure 15. Global Automotive Event Data Recorder Market, by Vehicle Type, 2025 Vs. 2032 (USD Million)

Figure 16. Global Automotive Event Data Recorder Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 17. Global Automotive Event Data Recorder Market, by Distribution Channel, 2025 Vs. 2032 (USD Million)

Figure 18. Global Automotive Event Data Recorder Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 19. North America: Automotive Event Data Recorder Market Snapshot (2025)

Figure 20. Europe: Automotive Event Data Recorder Market Snapshot (2025)

Figure 21. Asia-Pacific: Automotive Event Data Recorder Market Snapshot (2025)

Figure 22. Latin America: Automotive Event Data Recorder Market Snapshot (2025)

Figure 23. Middle East and Africa: Automotive Event Data Recorder Market Snapshot (2025)

Figure 24. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 25. Global Automotive Event Data Recorder Market Competitive Benchmarking, by Product Type

Figure 26. Competitive Dashboard: Global Automotive Event Data Recorder Market

Figure 27. Global Automotive Event Data Recorder Market Share/Ranking, by Key Player, 2024 (%)

Figure 28. Robert Bosch GmbH: Financial Overview (2024)

Figure 29. Denso Corporation: Financial Overview (2024)

Figure 30. Continental AG: Financial Overview (2024)

Figure 31. Aptiv PLC: Financial Overview (2024)

Figure 32. Garmin Ltd.: Financial Overview (2024)

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Sep-2024

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates