Resources

About Us

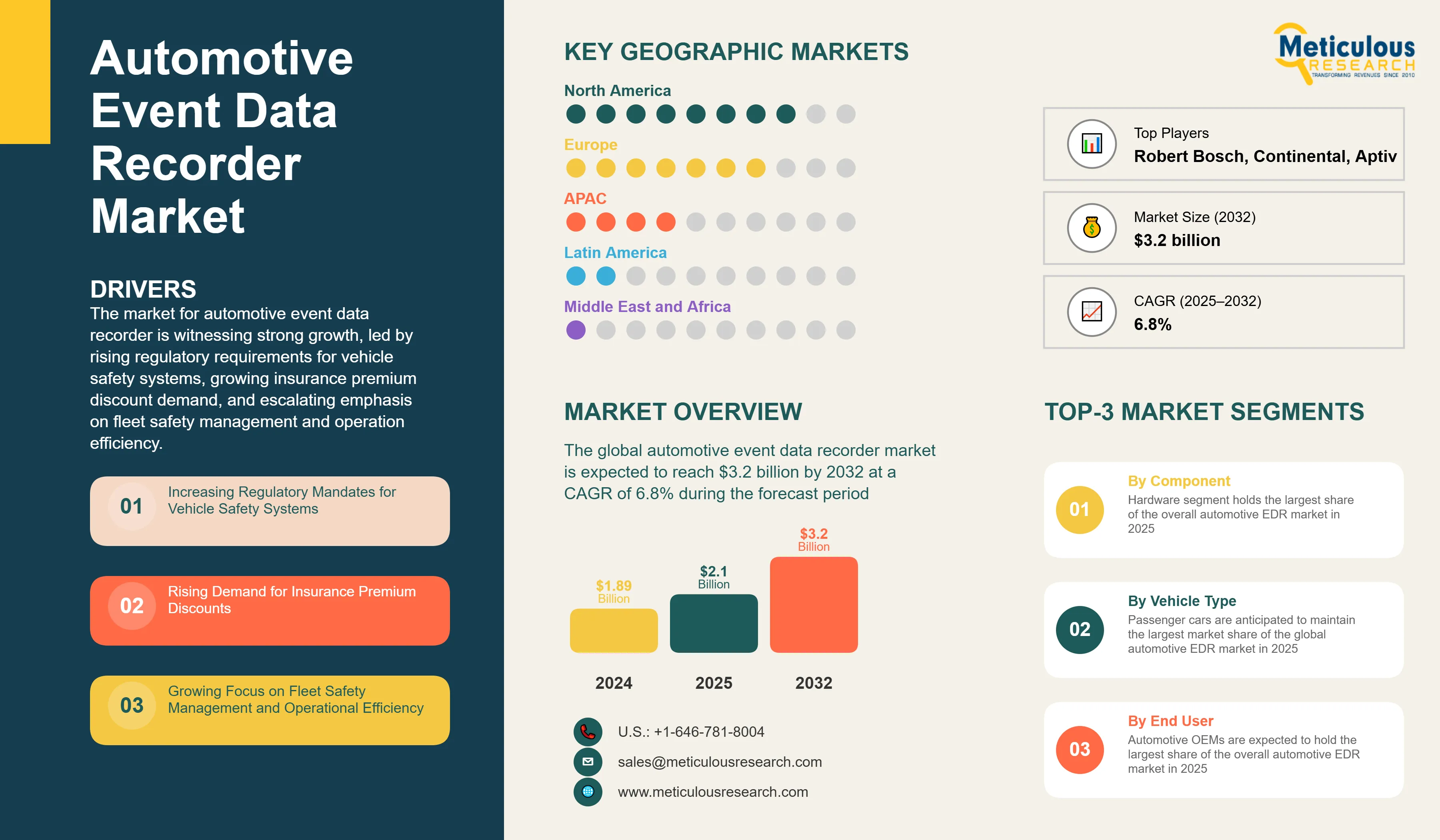

Automotive Event Data Recorder Market by Component (Hardware, Software, Services), Vehicle Type (Passenger, Commercial), End User (Automotive OEMs, Commercial Fleet Operators, Insurance Industry), Distribution Channel, and Geography - Global Forecast to 2032

Report ID: MRAUTO - 1041484 Pages: 280 May-2025 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportReport Overview

This comprehensive market research report analyzes the dynamic automotive event data recorder (EDR) market, evaluating how advanced recording technologies are transforming vehicle safety, insurance assessment, fleet management, and accident investigation across passenger vehicles, commercial fleets, and public sector applications. The report provides strategic analysis of market dynamics, growth projections till 2032, and competitive positioning across global and regional/country-level markets.

Market Dynamics Overview

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

The market for automotive event data recorder is witnessing strong growth, led by rising regulatory requirements for vehicle safety systems, growing insurance premium discount demand, and escalating emphasis on fleet safety management and operation efficiency. The growth is also aided by the integration of EDRs with Advanced Driver Assistance Systems (ADAS) and increased accident investigation requirements. As safety applications in vehicles require more accuracy and functionality, conventional EDR designs are changing. At the same time, the use of cloud-connected systems and high-end features such as video and audio recording capabilities are picking up pace. The market is also being powered by the transition from simple crash recording to full vehicle monitoring and AI-supported data analysis and event detection, especially in automotive OEMs, commercial fleet operations, and insurance.

Key Challenges

In spite of the robust growth curve of the vehicle EDR industry, there are certain challenges impacting the wider adoption of automatic event data recorder solutions. Harmonizing data protection with security and analytics demands continue to be one of the bigger issues, especially in privacy-savvy economies. Protection against unauthorized use has remained a continuing risk to deployability, even as things grow more integrated. Differing cross-border regulations and compliance levels complicate global deployment strategies, while standardization and interoperability problems with EDR data complicate platform integration. Moreover, technical limitations in the accuracy and completeness of crash data are limiting reliability in safety-critical applications. As the automotive world continues to evolve, integrating EDR technology into electric and autonomous vehicles introduces new engineering and compatibility challenges.

Growth Opportunities

The automotive EDR market is positioned for significant growth opportunities, based on integration with connected vehicle ecosystems and telematics, which is substantially enhancing data collection capabilities and real time monitoring. Development of predictive analytics based on EDR data creates new value propositions beyond traditional crash recording. Besides, developing economies with enhanced road safety regulations are creating untapped regional markets for growth, making EDRs critical tools in overall safety efforts. The market is also supported by growing demand for value added services through monetization of EDR data, generating recurring revenue streams for providers. Additionally, the advancement of EDR systems specifically geared to the development of autonomous vehicles is creating new uses by solving the distinct monitoring and validation needs of autonomous technologies.

Market Segmentation Highlights

By Component

Hardware segment holds the largest share of the overall automotive EDR market in 2025, primarily driven by the essential role of EDR control units, sensors, storage systems, and connectivity modules in enabling core recording functionality. These components form the backbone of core recording capabilities, and their durable construction and dependable performance across diverse sensor types and storage formats make them suitable for use in passenger cars, commercial fleets, and specialized vehicles.

On the other hand, software solutions are expected to grow at the fastest CAGR through 2032, mainly driven by rising demand for advanced data analytics, crash detection algorithms, and driver behaviour monitoring. This rapid expansion is fuelled by innovations in AI-powered analysis and a growing preference for cloud-integrated systems, particularly within fleet management, insurance evaluation, and next-generation safety solutions.

By Vehicle Type

Passenger cars are anticipated to maintain the largest market share of the global automotive EDR market in 2025 due to rising consumer demand for safety features, expanding regulatory requirements in developed economies, and the widespread adoption of EDRs in mid-size and luxury vehicles. These trends position passenger car applications as the key revenue driver, particularly in markets with sophisticated automotive safety regulations.

In the meanwhile, electric vehicles are likely to experience the fastest growth during the forecast period owing to the aggressive transition toward electric mobility, demand for specialized observation of EV powertrains, and higher use of sophisticated electronic systems. Specialized EDR systems to monitor EV-specific data points render this segment a key area of opportunity as the sector moves toward large-scale electrification.

By End User

Automotive OEMs are expected to hold the largest share of the overall automotive EDR market in 2025, driven primarily by the growing trend of factory-installed EDR systems, increasing regulatory mandates, and the growing convergence of EDRs with more extensive in-vehicle systems. As the prime designers and manufacturers of vehicles, OEMs stand as the first implementers of EDR technology, creating foundation demand within the market.

Conversely, the insurance industry is poised to see the highest growth rate until 2032, mainly driven by the growing application of usage-based insurance programs, increased dependence on objective crash data for claim adjustment, and the industry's migration toward data-based risk assessment.

By Distribution Channel

The direct channel is expected to hold the largest share of the global automotive EDR market in 2025, primarily driven by the OEMs' preference for factory installed EDR systems, especially in new vehicle models complying with safety regulations. This channel benefits from seamless integration with vehicle systems and standardized quality control throughout the manufacturing process.

However, professional installation services are expected to witness the highest growth rate over the forecast period, driven by increasing demand for aftermarket EDR solutions with specialized features, the growing retrofit market for older vehicles, and the expansion of value-added installation services.

By Geography

North America is expected to hold the largest share of the global automotive EDR market in 2025, closely followed by Europe. This leadership is attributed to the region's stringent vehicle safety regulations, early EDR adoption in commercial fleets, substantial investments in advanced vehicle technologies, and the presence of key industry players. These factors collectively position North America as a pivotal market for EDR technology innovation and deployment across automotive, insurance, and fleet management sectors. Europe remains a significant market with strong growth potential, supported by EU regulations on vehicle safety, the region's focus on road safety improvements, and the increasing adoption of telematics and connected vehicle technologies.

However, the Asia-Pacific region, particularly China, Japan, and South Korea, is expected to experience the highest growth rate over the forecast period. This momentum is mainly driven by rapidly evolving vehicle safety standards, increasing vehicle production volumes, growing consumer awareness about safety technologies, and substantial investments in smart transportation infrastructure.

Competitive Landscape

The global automotive event data recorder market is characterized by technological innovation and strategic partnerships, driven by established automotive component manufacturers, specialized EDR developers, and technology companies expanding into the automotive safety space.

Market dynamics are increasingly influenced by key trends such as integration with vehicle telematics platforms, enhancement of data analytics capabilities, and development of comprehensive safety ecosystems that combine EDRs with other safety technologies. Leading companies are prioritizing improvements in data security, privacy compliance, and seamless connectivity to address evolving customer requirements and regulatory frameworks.

Key players operating in the global automotive event data recorder market include Robert Bosch GmbH, Continental AG, Aptiv PLC, Denso Corporation, ZF Friedrichshafen AG, Harman International Industries (Samsung Electronics), Veoneer Inc., BlackVue (Pittasoft Co., Ltd.), Nexar Ltd., Garmin Ltd., Digital Ally, Inc., THINKWARE Corporation, Waylens, Inc., Voyomotive, LLC, and Octo Telematics S.p.A., among others.

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.8% |

|

Market Size (Value)in 2025 |

USD 2.1 Billion |

|

Market Size (Value) in 2032 |

USD 3.2 Billion |

|

Segments Covered |

By Component

By Vehicle Type,

By End User

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

Robert Bosch GmbH, HP Inc., ZF Friedrichshafen AG, Continental AG, Aptiv PLC (formerly Delphi Automotive), Koninklijke Philips N.V., Infineon Technologies AG, Knorr-Bremse AG, Garmin Ltd., Samsung Electronics Co., Ltd., Denso Corporation, Digital Ally, Inc., Incredisonic Inc., PAPAGO Inc., Cansonic Inc., Auto-vox Technology Co., Ltd., Waylens, Inc., Voyomotive, LLC, Octo Group S.p.A., Applied Technical Services, LLC |

The global automotive event data recorder market was valued at $1.89 billion in 2024. This market is expected to reach $3.2 billion by 2032 from an estimated $2.1 billion in 2025, at a CAGR of 6.8% during the forecast period of 2025–2032.

The global automotive event data recorder market is expected to grow at a CAGR of 6.8% during the forecast period of 2025–2032.

The global automotive event data recorder market is expected to reach $3.2 billion by 2032 from an estimated $2.1 billion in 2025, at a CAGR of 6.8% during the forecast period of 2025–2032.

The key companies operating in this market include Robert Bosch GmbH, HP Inc., ZF Friedrichshafen AG, Continental AG, Aptiv PLC (formerly Delphi Automotive), Koninklijke Philips N.V., Infineon Technologies AG, Knorr-Bremse AG, Garmin Ltd., Samsung Electronics Co., Ltd., Denso Corporation, Digital Ally, Inc., Incredisonic Inc., PAPAGO Inc., Cansonic Inc., Auto-vox Technology Co., Ltd., Waylens, Inc., Voyomotive, LLC, Octo Group S.p.A., Applied Technical Services, LLC.

Major trends shaping the market include the shift from basic crash recording to comprehensive vehicle monitoring, cloud-connected EDR systems with remote data access, integration of video and audio recording capabilities, AI-enhanced data analysis and event detection, and multi-purpose EDRs with additional functionality.

In 2025, the hardware component segment is expected to account for the largest share of the automotive EDR market; based on vehicle type, passenger vehicles are expected to hold the largest share of the overall market in 2025; and the automotive OEMs segment is expected to account for the largest market share in 2025.

North America leads the global market followed by Europe due to stringent safety regulations, established telematics infrastructure, and early EDR adoption. Asia-Pacific is witnessing the highest growth rate driven by rapidly evolving safety standards, increasing vehicle production volumes, and growing consumer awareness about safety technologies, particularly in China, Japan, and South Korea.

The growth of this market is driven by increasing regulatory mandates for vehicle safety systems, rising demand for insurance premium discounts, growing focus on fleet safety management and operational efficiency, integration of EDRs with Advanced Driver Assistance Systems (ADAS), and enhanced accident investigation and liability determination needs.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Sep-2024

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates