Resources

About Us

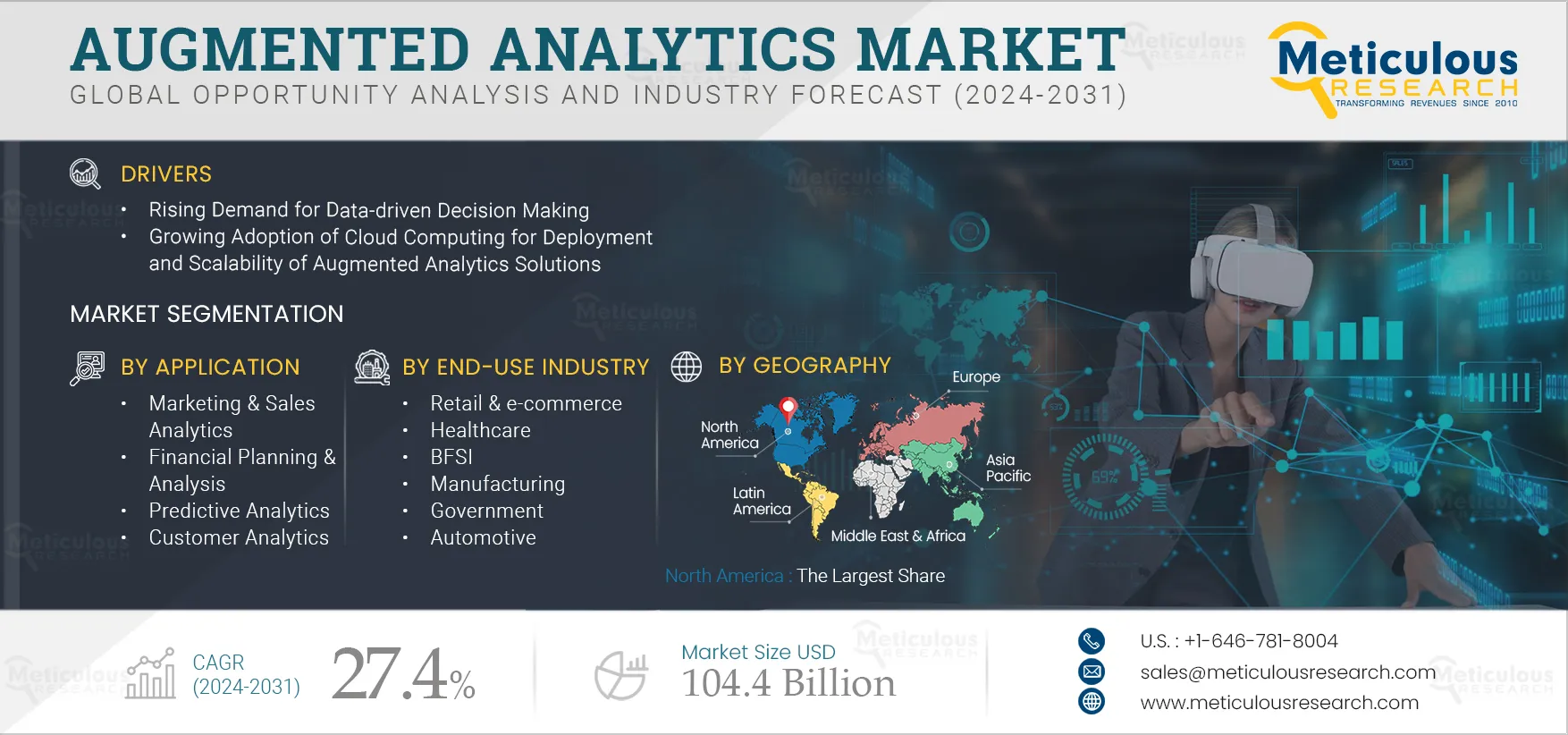

Augmented Analytics Market Size, Share, Forecast, & Trends Analysis by Offering (Software, Services), Deployment Mode, Organization Size, Application (Marketing & Sales, Financial Planning & Analysis), End-use Industry (Retail & E-commerce, BFSI), and Geography - Global Forecast to 2032

Report ID: MRICT - 1041308 Pages: 300 Aug-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the augmented analytics market is driven by the rising demand for data-driven decision-making and the growing adoption of cloud computing for the deployment and scalability of augmented analytics solutions. Furthermore, the rising integration of augmented analytics solutions in sales and marketing is expected to generate growth opportunities for the players operating in this market.

Augmented analytics refers to the use of artificial intelligence (AI) and machine learning (ML) for data analysis. Augmented analytics enables data preparation, analysis, and insight derivation without the requirement for data scientists to convert data into decisions. Businesses have increasingly relied on data-driven decision-making solutions to boost their advertising strategies, staff development, and supply chain management. With the growing demand, more firms are incorporating augmented analytics solutions into their operations, allowing them to evaluate data based on multiple business criteria and improve their decision-making abilities.

Moreover, the augmented analytics solutions integrate machine learning technology into analytics, giving business leaders greater insight into the context of their data. This allows businesses to determine the types of changes that will lead to massive improvements in business operations. Additionally, augmented analytics solutions enable businesses to acquire real-time data-driven insights that help them determine future business strategies. With the increasing adoption, various solutions providers provide augmented analytics solutions for businesses to provide meaningful data quality insights.

For instance, in November 2024, Datactics Ltd. (U.K.) launched an upgraded data quality solution. The platform automates data profiling, cleaning, matching, and remediation and uses AI to deliver significant data quality insights on data breaks, causes, and outlier detection. Such changes are expected to raise demand for augmented analytics solutions for data-driven decision-making during the forecast period.

Click here to: Get Free Sample Pages of this Report

Businesses constantly utilize data to obtain insights and make informed decisions. However, companies frequently need help to use the created data due to the vast number of data and the complexity of the analytical process. Businesses are using augmented analytics solutions more frequently in response to this difficulty, which enables them to employ a variety of strategies for data analysis and decision-making. Thus, the strength of advanced analytics combined with the scalability and flexibility of cloud computing is being used extensively in augmented analytics solutions.

Cloud computing of augmented analytics solutions leverages ML, NLP, and AI to automate and enhance various stages of the data analysis process, such as data preparations, pattern detection, insight generation, and data visualization. These expanding advantages encourage firms to use cloud computing for the deployment and scalability of augmented analytics systems.

Traditional infrastructure, on the other hand, presents a challenge for firms with significant expenditures in hardware, software licensing, and information technology resources. This rigidity impairs firms' capacity to adapt to changing demand, resulting in missed opportunities and limited innovations for data analysis. As a result, many firms are turning to cloud computing to improve their analysis while also increasing scalability, flexibility, and cost-efficiency in managing their IT infrastructure. With the rising need for cloud computing, more suppliers are introducing cloud-based augmented analytics solutions for businesses.

For example, in June 2024, GoodData Corporation (US), a leader in cloud-based analytics, partnered with Arria NLG Limited (US) to update augmented analytics. Using an integrated application programming interface (API), GoodData will use Arria's technology to give self-service natural language insights to its worldwide client base directly within existing systems. Such advances help to increase the demand for cloud computing in augmented analytics.

Augmented analytics uses advanced technologies such as AI and ML to improve data analysis and deliver actionable insights for better sales strategies and outcomes. Businesses have progressively integrated augmented analytics technologies into their sales processes in recent years, allowing them to boost efficiency, precise forecasting, customized client interaction, and gain a competitive advantage in the market. In businesses, sales professionals are increasingly using augmented analytics to gain a better understanding of consumer behavior, sales patterns, and predictive analytics. With streamlined data, businesses can easily spot opportunities and personalize consumer interactions, hence improving the customer experience.

In addition, marketing managers are increasingly relying on augmented analytics solutions to monitor campaign effectiveness and optimize strategies in real-time for optimal impact. With the growing use of augmented analytics solutions in sales and marketing, a number of organizations are offering solutions to improve corporate operations.

For instance, in April 2024, Trinity (US) partnered with Whizdotai, Inc. (US) to provide data infrastructure, services, and augmented analytics technologies. WhizAI's augmented analytics may be placed on top of Trinity's enterprise reporting systems to provide insights to more stakeholders across the organization. Commercial life sciences teams can use the combined technologies for a range of applications, including field sales analytics, longitudinal patient claims analytics, market access analytics, patient services analytics, and more. Such improvements contribute to a rise in demand for augmented analytics in sales and marketing over the forecast period.

Based on offering, the augmented analytics market is software and services. In 2025, the software segment is expected to account for a larger share of over 64.0% of the augmented analytics market. This segment's large market share is due to the growing adoption of augmented analytics software to eliminate human error, improve accuracy, and make informed decisions in business operations, the increasing integration of augmented analytics software to provide predictive insights and prescriptive recommendations, and the growing adoption of cloud computing for augmented analytics solution deployment and scalability.

However, the services segment is expected to register a higher CAGR during the forecast period. The growth of this segment is attributed to the growing implementation of augmented analytics services to automate tasks and help to improve business operations efficiently, the growing need for support & maintenance services for augmented analytics software to update algorithms, data processing pipelines, and integration points to ensure data quality, and the rising need to check software updates and upgrades to ensure compatibility and access to the latest features and improvements.

Based on organization size, the augmented analytics market is large enterprises and small & medium-sized enterprises. In 2025, the large enterprises segment is expected to account for the larger share of over 71.0% of the augmented analytics market. This segment's large market share is due to the increasing adoption of augmented analytics in large enterprises to automate data preparation, analysis, and reporting tasks, reducing the time and effort required for manual data handling. Additionally, the integration of augmented analytics in large enterprises allows for the customization of analytics models and dashboards to meet the specific needs of different departments or business units. Furthermore, augmented analytics solutions provide insights particular to regions or markets, assisting multinational organizations in controlling and improving their global plans.

However, the small & medium-sized enterprises segment is estimated to register a higher CAGR during the forecast period. This segment's growth is attributed to SMEs' increasing use of augmented analytics solutions to adjust their analytics solutions to changing business needs, such as new data sources or evolving market conditions, as well as the growing integration of augmented analytics to manage compliance with data protection regulations via built-in security and privacy features. Furthermore, due to subscription-based pricing, SMEs are increasingly adopting cloud-based augmented analytics solutions, which are less expensive than investing in on-premise infrastructure.

Based on deployment mode, the augmented analytics market is cloud-based and on-premise. In 2025, the cloud-based segment is expected to account for the largest share of over 66.0% of the augmented analytics market. This segment's large market share is attributed to the growing adoption of cloud-based augmented analytics due to its robust protections such as encryption, access controls, and threat detection, the increasing integration of advanced technologies such as machine learning and AI in cloud-based augmented analytics for efficient data analysis, and the rising use of cloud-based augmented analytics to reduces the burden on IT teams by managing infrastructure, software updates, and security concerns.

Moreover, the cloud-based segment is also anticipated to register a higher CAGR during the forecast period.

Based on application, the augmented analytics market is marketing & sales analytics, financial planning & analysis, supply chain management, human resource management, business intelligence & reporting, predictive analytics, customer analytics, and other applications. In 2025, the marketing & sales analytics segment is expected to account for the largest share of over 24.0% of the augmented analytics market. This segment's significant market share is attributed to the increasing use of augmented analytics in marketing and sales to detect customer behavior patterns and preferences by analyzing massive amounts of data from diverse sources. Furthermore, augmented analytics aids in tracking the efficacy of marketing efforts by providing precise data that allows for ROI calculation and the identification of viable methods.

However, the financial planning & analysis segment is expected to register the highest CAGR during the forecast period. This segment's growth can be attributed to the growing use of augmented analytics in financial planning and analysis to generate financial reports and dashboards, reducing manual effort and lowering the risk of errors. Businesses are increasingly adopting augmented analytics solutions for financial planning, which use more accurate and dynamic budgeting processes by incorporating real-time data and predictive analytics. Furthermore, augmented analytics assists in monitoring and assuring compliance with financial regulations and reporting standards by automating compliance checks and audits.

Based on end-use industry, the augmented analytics market is retail & e-commerce, healthcare, BFSI, manufacturing, government, automotive, transportation, media & entertainment, energy & utilities, IT & telecommunications, military & defense, and other end-use industries. In 2025, the retail & e-commerce segment is expected to account for the largest share of over 22.0% of the augmented analytics market. This segment's large market share is due to the increasing use of augmented analytics to analyze customer behavior across multiple channels, such as online and in-store, to identify patterns and preferences and the growing use of augmented analytics to automate routine operational tasks, such as data entry and report generation to reduce manual workload. Furthermore, retailers and e-commerce companies use augmented analytics to forecast future product demand based on historical sales data in order to manage inventory levels and reduce stockouts.

However, the BFSI segment is anticipated to register the highest CAGR during the forecast period. This segment's growth is attributed to the increasing use of augmented analytics solutions in BFSI to offer financial products and services based on customer preferences, as well as the development of more advanced algorithms to predict risks such as fraud and credit defaults, allowing institutions to take preventative measures. Furthermore, augmented analytics helps to automate the tracking and reporting of regulatory obligations, reducing the risk of non-compliance and simplifying the process.

In 2025, North America is estimated to account for the largest share of over 33.0% of the augmented analytics market. North America’s significant market share can be attributed to the growing adoption of augmented analytics solutions in retail & e-commerce businesses for data-driven decision-making, increasing technological advancement and government initiatives to minimize the cyberattacks in businesses in the region, and the rising need for personalized and self-service analytics.

However, Asia-Pacific is expected to register the highest CAGR of over 29.0% during the forecast period. The growth of this regional market is attributed to the increasing shift of enterprises from traditional tools to augmented analytics tools in countries such as China, Japan, and India, the growing adoption of augmented analytics solutions using ML and AI in the IT and telecommunications industries to improve customer service and rising technological advancements such as cloud computing for deployment and scalability of augmented analytics solutions in the region.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the augmented analytics market are Salesforce, Inc. (U.S.), SAP SE (Germany), International Business Machines Corporation (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), MicroStrategy Incorporated (U.S.), Domo, Inc. (U.S.), SAS Institute Inc. (U.S.), QlikTech International A.B. (U.S.), Cloud Software Group, Inc. (U.S.), Sisense Ltd. (U.S.), ThoughtSpot, Inc. (U.S.), Yellowfin International Pty Ltd ( A Subsidiary of Idera, Inc.) (U.S.), Pyramid Analytics B.V. (Netherlands), and Alteryx, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

300 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

27.4% |

|

Market Size (Value) |

USD 104.4 Billion by 2032 |

|

Segments Covered |

By Offering

By Deployment Mode

By Organization Size

By Application

By End-use Industry

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Netherlands, Spain, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, Australia & New Zealand, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, Israel, and Rest of the Middle East & Africa) |

|

Key Companies |

Salesforce, Inc. (U.S.), SAP SE (Germany), International Business Machines Corporation (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), MicroStrategy Incorporated (U.S.), Domo, Inc. (U.S.), SAS Institute Inc. (U.S.), QlikTech International A.B. (U.S.), Cloud Software Group, Inc. (U.S.), Sisense Ltd. (U.S.), ThoughtSpot, Inc. (U.S.), Yellowfin International Pty Ltd ( A Subsidiary of Idera, Inc.) (U.S.), Pyramid Analytics B.V. (Netherlands), and Alteryx, Inc. (U.S.) |

The augmented analytics market study focuses on market assessment and opportunity analysis through the sales of augmented analytics across different regions and countries across different market segmentations. This study is also focused on competitive analysis for augmented analytics based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The augmented analytics market is expected to reach $104.4 billion by 2032, at a CAGR of 27.4% from 2025 to 2032.

In 2025, the software segment is expected to account for over 64.0% of the augmented analytics market. The segment's large market share is attributed to the growing adoption of augmented analytics software to eliminate human error, improve accuracy, and make informed decisions in business operations and the growing adoption of cloud computing for the deployment and scalability of augmented analytics solutions.

The financial planning & analysis segment is expected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increasing use of augmented analytics in financial planning & analysis to generate financial reports and dashboards, reducing manual effort and minimizing the risk of errors. Augmented analytics helps in monitoring and ensuring compliance with financial regulations and reporting requirements by automating compliance checks and audits.

The growth of the augmented analytics market is driven by the rising demand for data-driven decision-making and the growing adoption of cloud computing for the deployment and scalability of augmented analytics solutions. Furthermore, the rising integration of augmented analytics solutions in sales & marketing is expected to generate growth opportunities for the players operating in this market.

The key players operating in the augmented analytics market are Salesforce, Inc. (U.S.), SAP SE (Germany), International Business Machines Corporation (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), MicroStrategy Incorporated (U.S.), Domo, Inc. (U.S.), SAS Institute Inc. (U.S.), QlikTech International A.B. (U.S.), Cloud Software Group, Inc. (U.S.), Sisense Ltd. (U.S.), ThoughtSpot, Inc. (U.S.), Yellowfin International Pty Ltd ( A Subsidiary of Idera, Inc.) (U.S.), Pyramid Analytics B.V. (Netherlands), and Alteryx, Inc. (U.S.).

Asia-Pacific is expected to register the highest CAGR of over 29.0% during the forecast period. The growth of this regional market is attributed to the increasing shift of enterprises from conventional tools to augmented analytics tools in countries such as China, Japan, and India and rising technological advancements such as cloud computing for the deployment and scalability of augmented analytics solutions in the region.

1. Introduction

1.1. Market Definition & Scope

1.2. Currency & Limitations

1.2.1. Currency

1.2.2. Limitations

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research /Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Market Overview

3.2. Market Analysis, by Offering

3.3. Market Analysis, by Deployment Mode

3.4. Market Analysis, by Organization Size

3.5. Market Analysis, by Application

3.6. Market Analysis, by End-use Industry

3.7. Market Analysis, by Geography

3.8. Competitive Analysis

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Demand for Data-driven Decision Making

4.2.1.2. Growing Adoption of Cloud Computing for Deployment and Scalability of Augmented Analytics Solutions

4.2.2. Restraints

4.2.2.1. Data Privacy and Security Concerns

4.2.3. Opportunities

4.2.3.1. Rising Integration of Augmented Analytics Solutions in Sales & Marketing

4.2.4. Challenges

4.2.4.1. Complex Implementation with Current Business Operations

4.3. Key Trends

4.3.1. Growing Integration of Machine Learning and Natural Language Processing (NLP)

4.4. Case Studies

4.4.1. Case Study A

4.4.2. Case Study B

4.4.3. Case Study C

5. Global Augmented Analytics Market Assessment—by Offering

5.1. Overview

5.2. Software

5.3. Services

5.3.1. Training & Consulting Services

5.3.2. Deployment & Integration Services

5.3.3. Support & Maintenance Services

6. Global Augmented Analytics Market Assessment—by Deployment Mode

6.1. Overview

6.2. Cloud-based

6.3. On-premise

7. Global Augmented Analytics Market Assessment—by Organization Size

7.1. Overview

7.2. Large Enterprises

7.3. Small & Medium-sized Enterprises

8. Global Augmented Analytics Market Assessment—by Application

8.1. Overview

8.2. Marketing & Sales Analytics

8.3. Financial Planning & Analysis

8.4. Supply Chain Management

8.5. Human Resource Management

8.6. Business Intelligence & Reporting

8.7. Predictive Analytics

8.8. Customer Analytics

8.9. Other Applications

9. Global Augmented Analytics Market Assessment—by End-use Industry

9.1. Overview

9.2. Retail & e-commerce

9.3. Healthcare

9.4. BFSI

9.5. Manufacturing

9.6. Government

9.7. Automotive

9.8. Transportation

9.9. Media & Entertainment

9.10. Energy & Utilities

9.11. IT & Telecommunication

9.12. Military & Defense

9.13. Other End-use Industries

10. Augmented Analytics Market Assessment—by Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Italy

10.3.5. Netherlands

10.3.6. Spain

10.3.7. Sweden

10.3.8. Rest of Europe

10.4. Asia-Pacific

10.4.1. Japan

10.4.2. China

10.4.3. India

10.4.4. South Korea

10.4.5. Singapore

10.4.6. Australia & New Zealand

10.4.7. Indonesia

10.4.8. Rest of Asia-Pacific

10.5. Latin America

10.5.1. Mexico

10.5.2. Brazil

10.5.3. Rest of Latin America

10.6. Middle East & Africa

10.6.1. UAE

10.6.2. Saudi Arabia

10.6.3. Israel

10.6.4. Rest of Middle East & Africa

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Emerging Companies

11.5. Market Ranking by Key Players

12. Company Profiles (Company Overview, Financial Overview, Product Portfolio, Strategic Development, and SWOT Analysis)

12.1. Salesforce, Inc.

12.2. SAP SE

12.3. International Business Machines Corporation

12.4. Microsoft Corporation

12.5. Oracle Corporation

12.6. MicroStrategy Incorporated

12.7. Domo, Inc.

12.8. SAS Institute Inc.

12.9. QlikTech International A.B.

12.10. Cloud Software Group, Inc.

12.11. Sisense Ltd.

12.12. ThoughtSpot, Inc.

12.13. Yellowfin International Pty Ltd (A Subsidiary of Idera, Inc.)

12.14. Pyramid Analytics B.V.

12.15. Alteryx, Inc.

(Note: SWOT Analysis Will Be Provided for the Top 5 Companies)

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Tables

Table 1 Currency Conversion Rate (2019–2024)

Table 2 Global Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 3 Global Augmented Analytics Software Market, by Country/Region, 2022–2032 (USD Million)

Table 4 Global Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 5 Global Augmented Analytics Services Market, by Country/Region, 2022–2032 (USD Million)

Table 6 Global Training & Consulting Services Market, by Country/Region, 2022–2032 (USD Million)

Table 7 Global Deployment & Integration Services Market, by Country/Region, 2022–2032 (USD Million)

Table 8 Global Support & Maintenance Services Market, by Country/Region, 2022–2032 (USD Million)

Table 9 Global Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 10 Global Cloud-based Augmented Analytics Market, by Country/Region, 2022–2032 (USD Million)

Table 11 Global On-premise Augmented Analytics Market, by Country/Region, 2022–2032 (USD Million)

Table 12 Global Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 13 Global Augmented Analytics Market for Large Enterprises, by Country/Region, 2022–2032 (USD Million)

Table 14 Global Augmented Analytics Market for Small & Medium-sized Enterprises, by Country/Region, 2022–2032 (USD Million)

Table 15 Global Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 16 Global Augmented Analytics Market for Marketing & Sales Analytics, by Country/Region, 2022–2032 (USD Million)

Table 17 Global Augmented Analytics Market for Financial Planning & Analysis, by Country/Region, 2022–2032 (USD Million)

Table 18 Global Augmented Analytics Market for Supply Chain Management, by Country/Region, 2022–2032 (USD Million)

Table 19 Global Augmented Analytics Market for Human Resource Management, by Country/Region, 2022–2032 (USD Million)

Table 20 Global Augmented Analytics Market for Business Intelligence & Reporting, by Country/Region, 2022–2032 (USD Million)

Table 21 Global Augmented Analytics Market for Predictive Analytics, by Country/Region, 2022–2032 (USD Million)

Table 22 Global Augmented Analytics Market for Customer Analytics, by Country/Region, 2022–2032 (USD Million)

Table 23 Global Augmented Analytics Market for Other Applications, by Country/Region, 2022–2032 (USD Million)

Table 24 Global Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 25 Global Augmented Analytics Market for Retail & E-commerce, by Country/Region, 2022–2032 (USD Million)

Table 26 Global Augmented Analytics Market for Healthcare, by Country/Region, 2022–2032 (USD Million)

Table 27 Global Augmented Analytics Market for BFSI, by Country/Region, 2022–2032 (USD Million)

Table 28 Global Augmented Analytics Market for Manufacturing, by Country/Region, 2022–2032 (USD Million)

Table 29 Global Augmented Analytics Market for Government, by Country/Region, 2022–2032 (USD Million)

Table 30 Global Augmented Analytics Market for Automotive, by Country/Region, 2022–2032 (USD Million)

Table 31 Global Augmented Analytics Market for Transportation, by Country/Region, 2022–2032 (USD Million)

Table 32 Global Augmented Analytics Market for Media & Entertainment, by Country/Region, 2022–2032 (USD Million)

Table 33 Global Augmented Analytics Market for Energy & Utilities, by Country/Region, 2022–2032 (USD Million)

Table 34 Global Augmented Analytics Market for IT & Telecommunication, by Country/Region, 2022–2032 (USD Million)

Table 35 Global Augmented Analytics Market for Military & Defense, by Country/Region, 2022–2032 (USD Million)

Table 36 Global Augmented Analytics Market for Other End-use Industries, by Country/Region, 2022–2032 (USD Million)

Table 37 Global Augmented Analytics Market, by Country/Region, 2022–2032 (USD Million)

Table 38 North America: Augmented Analytics Market, by Country, 2022–2032 (USD Million)

Table 39 North America: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 40 North America: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 41 North America: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 42 North America: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 43 North America: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 44 North America: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 45 U.S.: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 46 U.S.: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 47 U.S.: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 48 U.S.: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 49 U.S.: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 50 U.S.: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 51 Canada: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 52 Canada: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 53 Canada: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 54 Canada: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 55 Canada: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 56 Canada: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 57 Europe: Augmented Analytics Market, by Country/Region, 2022–2032 (USD Million)

Table 58 Europe: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 59 Europe: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 60 Europe: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 61 Europe: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 62 Europe: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 63 Europe: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 64 Germany: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 65 Germany: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 66 Germany: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 67 Germany: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 68 Germany: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 69 Germany: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 70 France: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 71 France: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 72 France: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 73 France: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 74 France: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 75 France: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 76 U.K.: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 77 U.K.: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 78 U.K.: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 79 U.K.: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 80 U.K.: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 81 U.K.: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 82 Spain: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 83 Spain: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 84 Spain: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 85 Spain: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 86 Spain: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 87 Spain: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 88 Netherlands: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 89 Netherlands: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 90 Netherlands: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 91 Netherlands: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 92 Netherlands: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 93 Netherlands: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 94 Italy: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 95 Italy: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 96 Italy: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 97 Italy: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 98 Italy: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 99 Italy: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 100 Sweden: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 101 Sweden: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 102 Sweden: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 103 Sweden: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 104 Sweden: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 105 Sweden: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 106 Rest of Europe: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 107 Rest of Europe: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 108 Rest of Europe: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 109 Rest of Europe: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 110 Rest of Europe: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 111 Rest of Europe: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 112 Asia-Pacific: Augmented Analytics Market, by Country/Region, 2022–2032 (USD Million)

Table 113 Asia-Pacific: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 114 Asia-Pacific: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 115 Asia-Pacific: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 116 Asia-Pacific: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 117 Asia-Pacific: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 118 Asia-Pacific: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 119 China: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 120 China: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 121 China: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 122 China: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 123 China: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 124 China: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 125 Japan: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 126 Japan: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 127 Japan: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 128 Japan: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 129 Japan: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 130 Japan: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 131 India: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 132 India: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 133 India: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 134 India: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 135 India: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 136 India: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 137 South Korea: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 138 South Korea: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 139 South Korea: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 140 South Korea: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 141 South Korea: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 142 South Korea: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 143 Singapore: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 144 Singapore: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 145 Singapore: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 146 Singapore: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 147 Singapore: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 148 Singapore: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 149 Australia & New Zealand: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 150 Australia & New Zealand: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 151 Australia & New Zealand: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 152 Australia & New Zealand: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 153 Australia & New Zealand: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 154 Australia & New Zealand: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 155 Indonesia: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 156 Indonesia: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 157 Indonesia: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 158 Indonesia: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 159 Indonesia: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 160 Indonesia: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 161 Rest of Asia-Pacific: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 162 Rest of Asia-Pacific: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 163 Rest of Asia-Pacific: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 164 Rest of Asia-Pacific: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 165 Rest of Asia-Pacific: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 166 Rest of Asia-Pacific: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 167 Latin America: Augmented Analytics Market, by Country/Region, 2022–2032 (USD Million)

Table 168 Latin America: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 169 Latin America: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 170 Latin America: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 171 Latin America: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 172 Latin America: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 173 Latin America: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 174 Mexico: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 175 Mexico: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 176 Mexico: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 177 Mexico: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 178 Mexico: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 179 Mexico: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 180 Brazil: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 181 Brazil: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 182 Brazil: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 183 Brazil: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 184 Brazil: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 185 Brazil: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 186 Rest of Latin America: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 187 Rest of Latin America: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 188 Rest of Latin America: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 189 Rest of Latin America: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 190 Rest of Latin America: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 191 Rest of Latin America: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 192 Middle East & Africa: Augmented Analytics Market, by Country/Region, 2022–2032 (USD Million)

Table 193 Middle East & Africa: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 194 Middle East & Africa: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 195 Middle East & Africa: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 196 Middle East & Africa: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 197 Middle East & Africa: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 198 Middle East & Africa: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 199 UAE: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 200 UAE: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 201 UAE: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 202 UAE: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 203 UAE: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 204 UAE: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 205 Saudi Arabia: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 206 Saudi Arabia: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 207 Saudi Arabia: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 208 Saudi Arabia: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 209 Saudi Arabia: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 210 Saudi Arabia: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 211 Israel: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 212 Israel: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 213 Israel: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 214 Israel: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 215 Israel: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 216 Israel: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 217 Rest of Middle East & Africa: Augmented Analytics Market, by Offering, 2022–2032 (USD Million)

Table 218 Rest of Middle East & Africa: Augmented Analytics Services Market, by Type, 2022–2032 (USD Million)

Table 219 Rest of Middle East & Africa: Augmented Analytics Market, by Deployment Mode, 2022–2032 (USD Million)

Table 220 Rest of Middle East & Africa: Augmented Analytics Market, by Organization Size, 2022–2032 (USD Million)

Table 221 Rest of Middle East & Africa: Augmented Analytics Market, by Application, 2022–2032 (USD Million)

Table 222 Rest of Middle East & Africa: Augmented Analytics Market, by End-use Industry, 2022–2032 (USD Million)

Table 223 Recent Developments by Major Market Players (2021–2025)

Table 224 Market Ranking by Key Players

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholders

Figure 3 Research Process

Figure 4 Key Secondary Sources

Figure 5 Primary Research Techniques

Figure 6 Key Executives Interviewed

Figure 7 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 8 Market Sizing and Growth Forecast Approach

Figure 9 Key Insights

Figure 10 In 2025, the Software Segment is Expected to Dominate the Global Augmented Analytics Market

Figure 11 In 2025, the Cloud-based Segment is Expected to Dominate the Global Augmented Analytics Market

Figure 12 In 2025, the Large Enterprises Segment is Expected to Dominate the Global Augmented Analytics Market

Figure 13 In 2025, the Marketing & Sales Analytics Segment is Expected to Dominate the Global Augmented Analytics Market

Figure 14 In 2025, the Retail & E-commerce Segment is Expected to Dominate the Global Augmented Analytics Market

Figure 15 Global Augmented Analytics Market, by Region (2025 Vs. 2032)

Figure 16 Impact Analysis Of Market Dynamics

Figure 17 Global Augmented Analytics Market, by Offering, 2025 Vs. 2032 (USD Million)

Figure 18 Global Augmented Analytics Market, by Deployment Mode, 2025 Vs. 2032 (USD Million)

Figure 19 Global Augmented Analytics Market, by Organization Size, 2025 Vs. 2032 (USD Million)

Figure 20 Global Augmented Analytics Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 21 Global Augmented Analytics Market, by End-use Industry, 2025 Vs. 2032 (USD Million)

Figure 22 Global Augmented Analytics Market, by Geography, 2025 Vs. 2032 (USD Million)

Figure 23 Geographic Snapshot: Augmented Analytics Market In North America

Figure 24 Geographic Snapshot: Augmented Analytics Market In Europe

Figure 25 Geographic Snapshot: Augmented Analytics Market In Asia-Pacific

Figure 26 Geographic Snapshot: Augmented Analytics Market In Latin America

Figure 27 Geographic Snapshot: Augmented Analytics Market In Middle East & Africa

Figure 28 Growth Strategies Adopted by Leading Market Players (2021–2025)

Figure 29 Competitive Benchmarking Analysis (2021–2025)

Figure 30 Competitive Dashboard: Augmented Analytics Market

Figure 31 Salesforce, Inc.: Financial Overview (2022)

Figure 32 SAP SE: Financial Overview (2022)

Figure 33 International Business Machines Corporation: Financial Overview (2022)

Figure 34 Microsoft Corporation: Financial Overview (2022)

Figure 35 Oracle Corporation: Financial Overview (2022)

Figure 36 MicroStrategy Incorporated: Financial Overview (2022)

Figure 37 Domo, Inc.: Financial Overview (2022)

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Aug-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates