Resources

About Us

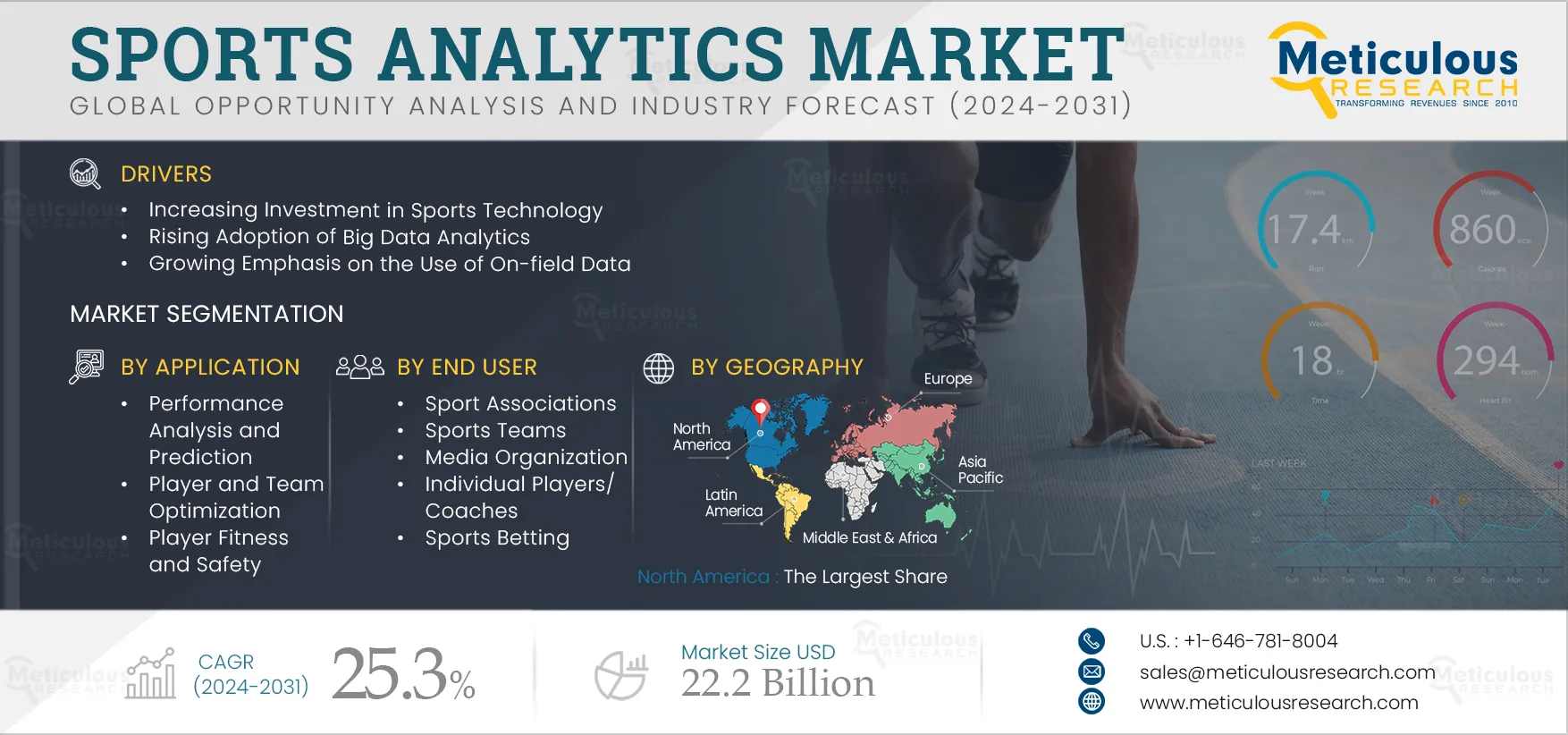

Sports Analytics Market Size, Share, Forecast, & Trends Analysis by Offering, Deployment Mode, Type, Sports (Individual, Team), Application (Player Fitness and Safety, Broadcast Management), End User (Sports Associations, Media Organization), and Geography - Global Forecast to 2032

Report ID: MRICT - 1041307 Pages: 250 Aug-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is attributed to the increasing investment in sports technology, rising adoption of big data analytics, and growing emphasis on the use of on-field data. Moreover, the integration of AI & ML technologies in sports analytics solutions and the proliferation of wearable technology are expected to offer growth opportunities for the players operating in this market.

The rapid growth in the sports industry is attributed to extensive technology investments for on-field and off-field applications. Sports technology offers a wide range of products & services, such as wearable devices, smart stadiums, data analytics, esports, and fan engagement platforms. These technologies provide athletes and coaches with insights to improve performance, prevent injuries, and gain a competitive edge. Thus, the growing investment in sports technology helps to improve athlete performance and enhance fan engagement. Also, government associations across various countries are taking initiatives to support the development and adoption of sports tech in the public sector.

Some of the recent developments in this market space are as follows:

Such investments in sports technology are further supporting the growth of the sports analytics market during the forecast period.

Click here to: Get Free Sample Pages of this Report

Sports analytics are used by sports associations to collect and measure data such as athletic performance, player evaluation & scouting, and injury prediction & prevention. In sports analytics, on-field data metrics help teams to improve in-game strategies, nutrition plans, player movement, speed, shot location, and other methods for raising athletes’ level of performance. Organizations are collaborating with sports associations and clubs to offer sports analytics solutions to provide on-field data insights to coaches, trainers, and front offices to help make better decisions. Thus, the increasing focus on tracking important data during games to help teams make better decisions is supporting the market growth.

Some of the recent developments in this market space are as follows:

Such developments are supporting the growth of the sports analytics market during the forecast period.

The sports industry has experienced significant transformation in recent years with the adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML). The integration of these technologies in sports analytics solutions offers players, coaches, and fans an enhanced sporting experience and helps to make data-driven decisions. AI analyzes historical data to predict future outcomes such as player performance, injury risks, and game results. ML helps to analyze the players' data with video feeds to pinpoint flaws in technique to optimize the training and suggest improvements.

With the integration of AI & ML in sports analytics technology, companies are focusing on providing AI-powered sports analytics solutions to sports associations. For instance, in March 2025, STATSports Group Ltd. (Ireland) launched AI-powered wearable technology to monitor, analyze, and optimize athlete performance and provide coaches with immediate actionable insights into player mechanics and performance. Such developments are offering growth opportunities for the sports analytics market during the forecast period.

Based on offering, the global sports analytics market is segmented into solutions and services. In 2025, the solutions segment is expected to account for the largest share of over 66% of the global sports analytics market. The large market share of this segment is attributed to the advancement in technology, the increasing need to enhance the player's performance, and the growing use of sports analytics solutions for the recruitment of sports persons. In May 2025, Dentsu International (U.K.) and Fonto (Australia) launched SponsorshipBI, a sports analytics platform, following a successful pilot program with Cricket Australia to provide deeper insights into the business impact of commercial partnerships in sports. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

Based on deployment mode, the global sports analytics market is segmented into on-premise deployments and cloud-based deployments. In 2025, the cloud-based deployments segment is expected to account for a larger share of over 59% of the global sports analytics market. The large market share of this segment is attributed to the increasing adoption of cloud-based sports analytics solutions to reduce investment costs in hardware & infrastructure and the increasing need to handle the vast amount of data generated in the sports industry. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

Based on type, the global sports analytics market is segmented into on-field and off-field. In 2025, the on-field segment is expected to account for a larger share of over 63% of the global sports analytics market. The large market share of this segment is attributed to the increasing need to collect real-time data on player movement, the rising need to monitor player load and identify potential injury risks, the growing need to improve in-game strategies, and the advancement in the technology in wearable devices. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

Based on sports, the global sports analytics market is segmented into individual sports, team sports, animal sports, winter sports, and e-sports. In 2025, the team sports segment is expected to account for the largest share of over 47% of the global sports analytics market. The large market share of this segment is attributed to the increasing popularity of football, cricket, and baseball in several countries, the rapid growth of streaming platforms & social media, and the increasing use of sports analytics by coaches, players, and management to collect insights on team sports.

However, the e-sports segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the widespread availability of high-speed internet, increasing sales of gaming PCs and consoles, and the increasing trend of e-sports for connecting players and fans worldwide.

Based on application, the global sports analytics market is segmented into performance analysis & prediction, player & team optimization, talent scouting & player recruitment, injury prediction & prevention, fan engagement & personalized experiences, player fitness & safety, broadcast management, ticketing, sponsorship, advertising, merchandising, and other applications. In 2025, the performance analysis & prediction segment is expected to account for the largest share of over 25% of the global sports analytics market. The large market share of this segment is attributed to the increasing adoption of sports analytics to customize training plans, the integration of AI & ML in sports analytics solutions for performance analysis & prediction, and the increasing need for player tracking & movement analysis.

In March 2024, Sports Info Solutions (U.S.) partnered with ReSpo-Vision (Poland) to provide SIS with advanced soccer analytics data based on broadcast tracking technology to enhance & automate data collection, tracking, and develop groundbreaking metrics for soccer sports.

However, the player fitness & safety segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the increasing implementation of AI & ML in sports analytics solutions which analyze player biomechanics to detect abnormal movement patterns and prevent injuries.

Based on end user, the global sports analytics market is segmented into sports associations, sports teams, media organizations, individual players/coaches, sports betting, and other end users. In 2025, the sports associations segment is expected to account for the largest share of over 34% of the global sports analytics market. The large market share of this segment is attributed to the increasing use of sports analytics to gather & analyze vital data on players’ and teams’ performance and increasing utilization of advanced technologies, online platforms, and applications for getting updates on players' availability for matches and training sessions helping administrators & coaches to access this information to organize team sheets and arrangements. In October 2024, Kitman Labs Inc (U.S.) partnered with the Premier League (U.K.) to provide a centralized and fully integrated ‘Football Intelligence Platform’ designed to collect & organize player and staff data about coaching, medical assistance, sports science, operations, player care, and education applications.

However, the sports betting segment is projected to register the highest CAGR during the period. The segment's growth is attributed to the integration of AI and ML in sports analytics for performance analysis and prediction applications and the increasing use of sports analytics to analyze vast amounts of data, identify patterns, trends, and anomalies, and predict the outcome of sporting events.

In 2025, North America is expected to account for the largest share of over 42% of the global sports analytics market. The market growth in North America is driven by rapid technological advancement, the growth in the sports industry in the region, the presence of key market players, and the growing use of wearable technology in the sports industry. The U.S. sports industry is adopting sports analytics tools in Major League Baseball (MLB), National Hockey League (NHL), National Football League (NFL), and the National Basketball Association for various applications. In September 2024, Genius Sports Group (U.K.) launched BetVision with NFL live games in the U.S. with integrated bet slips, statistical insights, and real-time augmentations.

However, Asia-Pacific is projected to record the highest CAGR of 27% during the forecast period. The region’s growth is attributed to the growing digitalization trends, increasing internet penetration, growing government investments in sports infrastructure and technology, and the popularity of sports in countries such as Australia, India, China, and Japan. In January 2025, Sport Singapore launched a data-sharing platform for the country’s sports industry to help sports ecosystem players, gym operators, and event organizers improve their programs and offerings.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the three to four years. Some of the key players operating in the sports analytics market are Oracle Corporation (U.S.), SAP SE (Germany), IBM Corporation (U.S.), SAS Institute Inc. (U.S.), Catapult Group International Ltd (Australia), Stats Perform (U.S.), Sportradar Group AG (Switzerland), Deltatre S.p.A. (Italy), Experfy Inc. (U.S.), Orreco Limited (Ireland), ChyronHego Corporation (U.S.) Genius Sports Group (U.K.), Kitman Labs (Ireland), Alteryx, Inc. (U.S.), and TruMedia Networks, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

25.3% |

|

Market Size (Value) |

$22.2 Billion by 2032 |

|

Segments Covered |

By Offering

By Deployment Mode

By Type

By Sports

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Australia & New Zealand, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Rest of Latin America), and Middle East & Africa (UAE, Israel, rest of Middle East & Africa) |

|

Key Companies |

Oracle Corporation (U.S.), SAP SE (Germany), IBM Corporation (U.S.), SAS Institute Inc. (U.S.), Catapult Group International Ltd (Australia), Stats Perform (U.S.), Sportradar Group AG (Switzerland), Deltatre S.p.A. (Italy), Experfy Inc. (U.S.), Orreco Limited (Ireland), ChyronHego Corporation (U.S.) Genius Sports Group (U.K.), Kitman Labs (Ireland), Alteryx, Inc. (U.S.), and TruMedia Networks, Inc. (U.S.) |

The sports analytics market study focuses on market assessment and opportunity analysis through the sales of sports analytics solutions across different regions and countries across different market segmentations. This study is also focused on competitive analysis for sports analytics solutions based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The global sports analytics market is projected to reach $22.2 billion by 2032, at a CAGR of 25.3% during the forecast period.

In 2025, the solutions segment is expected to account for the largest share, above 66%, of the sports analytics market.

Based on end user, the sports betting segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the increasing investment in sports technology, rising adoption of big data analytics, and growing emphasis on the use of on-field data. Moreover, the integration of AI & ML technologies in sports analytics solutions and the proliferation of wearable technology is expected to offer growth opportunities for the players operating in this market.

The key players operating in the global sports analytics market are Oracle Corporation (U.S.), SAP SE (Germany), IBM Corporation (U.S.), SAS Institute Inc. (U.S.), Catapult Group International Ltd (Australia), Stats Perform (U.S.), Sportradar Group AG (Switzerland), Deltatre S.p.A. (Italy), Experfy Inc. (U.S.), Orreco Limited (Ireland), ChyronHego Corporation (U.S.) Genius Sports Group (U.K.), Kitman Labs (Ireland), Alteryx, Inc. (U.S.), and TruMedia Networks, Inc. (U.S.).

Asia-Pacific is projected to register the highest CAGR of 27% during the forecast period.

Published Date: Jan-2025

Published Date: Aug-2024

Published Date: Jun-2023

Published Date: Jan-2023

Published Date: Mar-2021

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates