Resources

About Us

Asia-Pacific Air Conditioners Market by Type (Split, Centralized/Ducted, Others), Tonnage (Up to 2 Tons, 2 Tons to 5 Tons, Others), Technology (Inverter, Non-inverter), Rating (5 Star, 4 Star, Others), End User (Residential, Others), and Geography - Forecast 2032

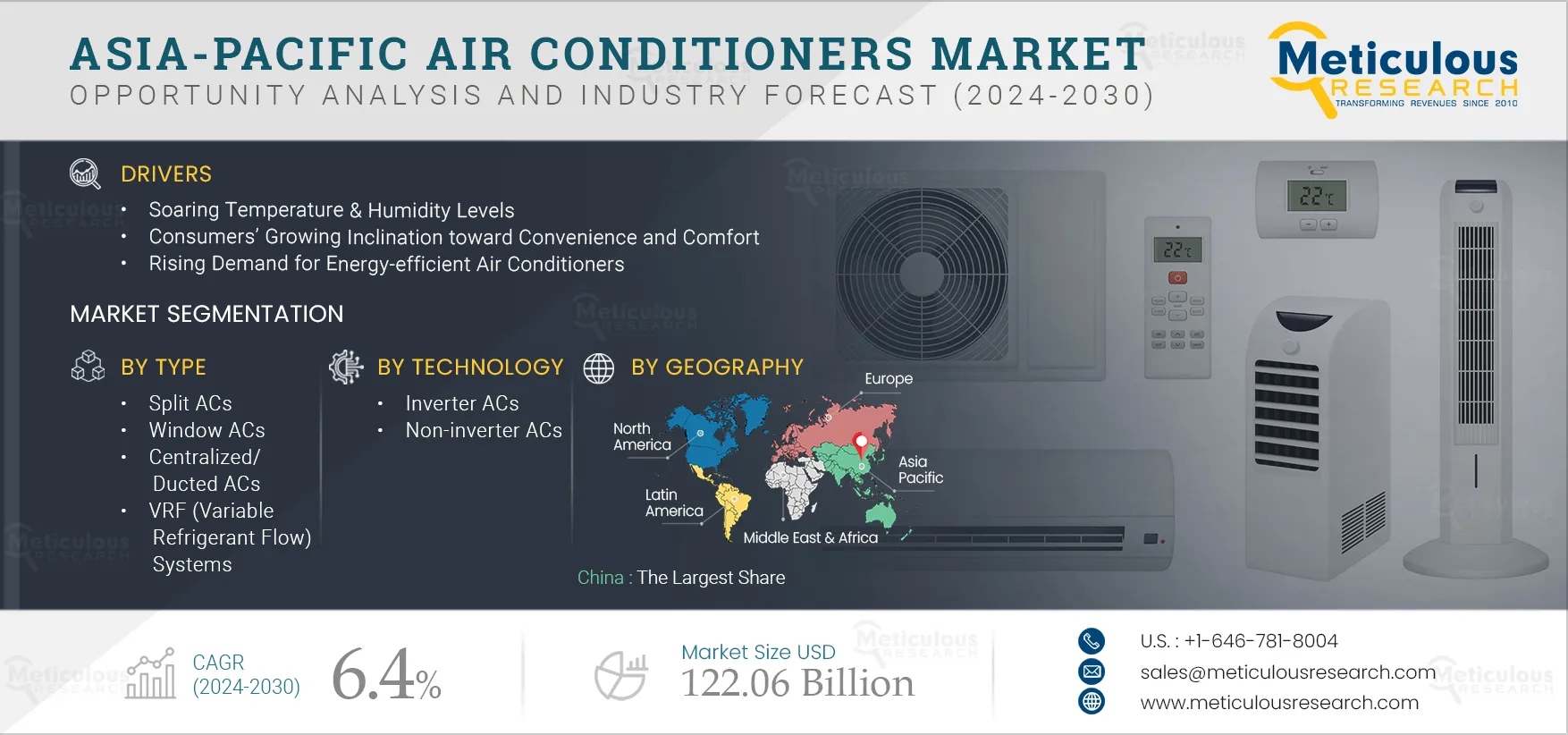

Report ID: MRSE - 104998 Pages: 200 Jan-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Asia-Pacific Air Conditioners Market is projected to reach $122.06 billion by 2032, at a CAGR of 6.4% during the forecast period of 2025–2032. The growth of the Asia-Pacific air conditioners market is attributed to the rising temperatures & humidity levels in the region, consumers’ growing inclination toward convenience & comfort, and the rising demand for energy-efficient air conditioners. However, the high costs of air conditioners restrain the growth of this market.

The rising adoption of air conditioners with inverter & air purification technologies and technological advancements in HVAC systems are creating growth opportunities for the players operating in this market. However, the high energy consumption associated with air conditioners is a challenge for market growth. Additionally, connected air conditioners and solar photovoltaic (PV) & solar thermal-assisted air conditioning systems are major trends in this market.

Click here to: Get Free Sample Pages of this Report

HVAC technology development has largely been focused on mechanical innovations and enhanced efficiency. However, priorities have now shifted toward sustainability, comfort, and energy efficiency. Technological advancements in HVAC systems have enabled connecting air conditioners with smart appliances, allowing for automatic changes based on climate conditions, preferences, and settings.

Furthermore, installing ductless HVAC systems is possible in both harsh and moderate climates. Smart AC controls can boost the effectiveness of ductless systems. These brand- and type-agnostic smart AC controllers allow for the remote operation of ductless systems. In addition, the right time for maintenance can be predicted using smart HVAC technology that senses information on air quality and equipment status. Thus, minor issues can be resolved before they become serious problems.

Moreover, key market players are launching innovative products to increase their market shares. For instance, in February 2025, Samsung India Electronics Private Limited (India) launched Line-up of WindFree ACs. The new range includes Wi-Fi-enabled models with AI Auto Cooling that save up to 77% energy, Welcome Cooling, Motion Detection Sensor, Voice Control, and more.

The Split ACs Segment to Dominate the Asia-Pacific Air Conditioners Market in 2025

Based on type, the Asia-Pacific air conditioners market is segmented into window ACs, split ACs, VRF (Variable Refrigerant Flow) systems, centralized/ducted ACs, and other air conditioner types. In 2025, the split ACs segment is expected to account for the largest share of the Asia-Pacific air conditioners market. A split system is more energy efficient, uses less energy, and helps keep indoor environments clean. The large market share of this segment is attributed to the increasing demand for energy-saving and low-noise air conditioners and the growing use of split air conditioners for large spaces.

Several companies are focused on providing quality products and launching a wide range of ACs in the market. For instance, in March 2022, Blue Star Ltd (India) launched its range of affordable split ACs with high quality, reliability, and durability. Such developments drive the sales of split air conditioners.

The Inverter ACs Segment to Dominate the Asia-Pacific Air Conditioners Market in 2025

Based on technology, the Asia-Pacific air conditioners market is segmented into inverter ACs and non-inverter ACs. In 2025, the inverter ACs segment is expected to account for the larger share of the Asia-Pacific air conditioners market. The large market share of this segment is attributed to advancements in inverter technology and growing awareness of the energy-efficiency benefits of inverter technology air conditioners and rising temperature & humidity conditions.

The Residential End Users Segment to Dominate the Asia-Pacific Air Conditioners Market in 2025

Based on end user, the Asia-Pacific air conditioners market is segmented into residential end users, commercial end users, and industrial end users. In 2025, the residential end users segment is expected to account for the largest share of the Asia-Pacific air conditioners market. The large market share of this segment is mainly attributed to the growing acceptance of smart home technologies, construction companies’ increased focus on offering air-conditioned apartments, and the rising need to improve indoor air quality. Moreover, the residential end users segment is also projected to register the highest CAGR during the forecast period.

China: Largest Market in Asia-Pacific

Based on geography, the Asia-Pacific air conditioners market is segmented into China, Japan, India, South Korea, Australia & New Zealand, Indonesia, Thailand, Malaysia, Singapore, Vietnam, Philippines, and the Rest of Asia-Pacific. In 2025, China is expected to account for the largest share of the Asia-Pacific air conditioners market. China’s significant market share can be attributed to the growing focus on agreements aimed at supplying air conditioning systems for urban transportation systems and initiatives by leading AC market players to establish manufacturing facilities in China to boost the production of energy recovery ventilator systems. Additionally, China's immense potential for air conditioner production, the presence of well-established air conditioner manufacturers, and the country's expertise in crafting efficient air conditioning systems contribute to its dominant position in the market. For instance, in March 2021, Liebherr-Transportation Systems (China) signed an agreement with Chengdu Xinzhu Road & Bridge Machinery Co., Ltd. (China) to provide air-conditioning systems for its newly developed maglev urban transportation system.

Key Players:

Some of the key players operating in the Asia-Pacific air conditioners market are Daikin Industries, Ltd. (Japan), Mitsubishi Electric Corporation (Japan), Hitachi-Johnson Controls Air Conditioning (Japan), Carrier Global Corporation (U.S.), Whirlpool Corporation (U.S.), Haier Smart Home Co. Ltd. (China), LG Electronics (South Korea), Voltas Limited (India), Panasonic Corporation (Japan), Robert Bosch GmbH (Germany), Samsung Electronics Co., Ltd. (South Korea), Fujitsu Limited (Japan), Blue Star Ltd (India), Toshiba Corporation (Japan), Gree Electric Appliances Inc. (China), and Midea Group Co. Ltd (China).

Scope of the Report:

Asia-Pacific Air Conditioners Market Assessment, by Type

Asia-Pacific Air Conditioners Market Assessment, by Tonnage

Asia-Pacific Air Conditioners Market Assessment, by Technology

Asia-Pacific Air Conditioners Market Assessment, by Rating

Asia-Pacific Air Conditioners Market Assessment, by End User

Asia-Pacific Air Conditioners Market Assessment, by Geography

Key Questions Answered in the Report:

The Asia-Pacific air conditioners market is projected to reach $122.06 billion by 2032, at a CAGR of 6.4% during the forecast period.

The growth of the Asia-Pacific air conditioners market is attributed to the rising temperatures & humidity levels in the region, consumers’ growing inclination toward convenience & comfort, and the rising demand for energy-efficient air conditioners.

Some of the key players operating in the Asia-Pacific air conditioners market are Daikin Industries, Ltd. (Japan), Mitsubishi Electric Corporation (Japan), Hitachi-Johnson Controls Air Conditioning (Japan), Carrier Global Corporation (U.S.), Whirlpool Corporation (U.S.), Haier Smart Home Co. Ltd. (China), LG Electronics (South Korea), Voltas Limited (India), Panasonic Corporation (Japan), Robert Bosch GmbH (Germany), Samsung Electronics Co., Ltd. (South Korea), Fujitsu Limited (Japan), Blue Star Ltd (India), Toshiba Corporation (Japan), Gree Electric Appliances Inc. (China), and Midea Group Co. Ltd (China).

The split ACs segment is expected to account for the largest share of the Asia-Pacific air conditioners market in 2025.

The 2 tons to 5 tons segment is expected to record the highest CAGR during the forecast period.

The inverter ACs segment is expected to register the higher CAGR during the forecast period.

The 5 Star ACs segment is expected to record the fastest growth during the forecast period.

Based on end user, which segment is expected to grow at the highest CAGR during the forecast period?

The residential end users segment is expected to record the highest CAGR during the forecast period.

1. Introduction

1.1. Market Definition & Scope

1.2. Currency & Limitations

1.2.1. Currency

1.2.2. Limitations

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecasting

2.3.1. Market Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Type

3.3. Market Analysis, by Tonnage

3.4. Market Analysis, by Technology

3.5. Market Analysis, by Rating

3.6. Market Analysis, by End User

3.7. Market Analysis, by Geography

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Soaring Temperature & Humidity Levels

4.2.1.2. Consumers’ Growing Inclination toward Convenience and Comfort

4.2.1.3. Rising Demand for Energy-efficient Air Conditioners

4.2.2. Restraints

4.2.2.1. High Costs of Air Conditioners

4.2.3. Opportunities

4.2.3.1. Rising Adoption of Air Conditioners with Inverter and Air Purification Technologies

4.2.3.2. Technological Advancements in HVAC Systems

4.2.4. Challenges

4.2.4.1. Air Conditioners’ High Energy Consumption

4.3. Market Trends

4.3.1. Connected Air Conditioners

4.3.2. Solar Photovoltaic (PV) & Solar Thermal-assisted Air Conditioning Systems

4.4. Case Studies

4.5. Value Chain Analysis

4.6. Consumer Buying Behavior Analysis

5. Asia-Pacific Air Conditioners Market Assessment—by Type

5.1. Overview

5.2. Window ACs

5.3. Split ACs

5.4. VRF (Variable Refrigerant Flow) Systems

5.5. Centralized/Ducted ACs

5.6. Portable ACs

6. Asia-Pacific Air Conditioners Market Assessment—by Tonnage

6.1. Overview

6.2. Up to 2 Tons

6.3. 2 Tons to 5 Tons

6.4. 5 Tons to 10 Tons

6.5. More than 10 Tons

7. Asia-Pacific Air Conditioners Market Assessment—by Technology

7.1. Overview

7.2. Inverter ACs

7.3. Non-inverter ACs

8. Asia-Pacific Air Conditioners Market Assessment—by Rating

8.1. Overview

8.2. 1 Star ACs

8.3. 2 Star ACs

8.4. 3 Star ACs

8.5. 4 Star ACs

8.6. 5 Star ACs

9. Asia-Pacific Air Conditioners Market Assessment—by End User

9.1. Overview

9.2. Residential

9.3. Commercial

9.4. Industrial

10. Asia-Pacific Air Conditioners Market Assessment—by Geography

10.1. China

10.2. Japan

10.3. India

10.4. South Korea

10.5. Australia & New Zealand

10.6. Indonesia

10.7. Thailand

10.8. Malaysia

10.9. Singapore

10.10. Vietnam

10.11. Philippines

10.12. Rest of Asia-Pacific

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.3.1. Industry Leaders

11.3.2. Market Differentiators

11.3.3. Vanguards

11.3.4. Emerging Companies

11.4. Vendor Market Positioning

11.5. Market Share Analysis

12. Company Profiles (Company Overview, Financial Overview, Product Portfolio, Strategic Developments)

12.1. Daikin Industries, Ltd.

12.2. Mitsubishi Electric Corporation

12.3. Hitachi-Johnson Controls Air Conditioning

12.4. Carrier Global Corporation

12.5. Whirlpool Corporation

12.6. Haier Smart Home Co., Ltd.

12.7. LG Electronics

12.8. Voltas Limited

12.9. Blue Star Ltd

12.10. Toshiba Corporation

12.11. Panasonic Corporation

12.12. Robert Bosch GmbH

12.13. Fujitsu Limited

12.14. Samsung Electronics Co., Ltd.

12.15. Gree Electric Appliances Inc.

12.16. Midea Group Co. Ltd

(Note: SWOT Analyses of the Top 5 Companies Will Be Provided)

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Tables

Table 1 Currency Conversion Rates, 2019-2025

Table 2 Asia-Pacific Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 3 Asia-Pacific Air Conditioners Market for Split ACs, by Country/Region, 2021-2032 (USD Million)

Table 4 Asia-Pacific Air Conditioners Market for Window ACs, by Country/Region, 2021-2032 (USD Million)

Table 5 Asia-Pacific Air Conditioners Market for Centralized/Ducted ACs, by Country/Region, 2021-2032 (USD Million)

Table 6 Asia-Pacific Air Conditioners Market for VRF (Variable Refrigerant Flow) Systems, by Country/Region, 2021-2032 (USD Million)

Table 7 Asia-Pacific Air Conditioners Market for Other Air Conditioner Types, by Country/Region, 2021-2032 (USD Million)

Table 8 Asia-Pacific Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 9 Asia-Pacific Up to 2 Ton Air Conditioners Market, by Country/Region, 2021-2032 (USD Million)

Table 10 Asia-Pacific 2 Ton to 5 Ton Air Conditioners Market, by Country/Region, 2021-2032 (USD Million)

Table 11 Asia-Pacific 5 Ton to 10 Ton Air Conditioners Market, by Country/Region, 2021-2032 (USD Million)

Table 12 Asia-Pacific More than 10 Ton Air Conditioners Market, by Country/Region, 2021-2032 (USD Million)

Table 13 Asia-Pacific Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 14 Asia-Pacific Air Conditioners Market for Inverter ACs, by Country/Region, 2021-2032 (USD Million)

Table 15 Asia-Pacific Air Conditioners Market for Non-inverter ACs, by Country/Region, 2021-2032 (USD Million)

Table 16 Asia-Pacific Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 17 Asia-Pacific Air Conditioners Market for 1 Star ACs, by Country/Region, 2021-2032 (USD Million)

Table 18 Asia-Pacific Air Conditioners Market for 2 Star ACs, by Country/Region, 2021-2032 (USD Million)

Table 19 Asia-Pacific Air Conditioners Market for 3 Star ACs, by Country/Region, 2021-2032 (USD Million)

Table 20 Asia-Pacific Air Conditioners Market for 4 Star ACs, by Country/Region, 2021-2032 (USD Million)

Table 21 Asia-Pacific Air Conditioners Market for 5 Star ACs, by Country/Region, 2021-2032 (USD Million)

Table 22 Asia-Pacific Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 23 Asia-Pacific Air Conditioners Market for Residential End User, by Country/Region, 2021-2032 (USD Million)

Table 24 Asia-Pacific Air Conditioners Market for Commercial End User, by Country/Region, 2021-2032 (USD Million)

Table 25 Asia-Pacific Air Conditioners Market for Industrial End User, by Country/Region, 2021-2032 (USD Million)

Table 26 Asia-Pacific Air Conditioners Market, by Country/Region, 2021-2032 (USD Million)

Table 27 China: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 28 China: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 29 China: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 30 China: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 31 China: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 32 Japan: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 33 Japan: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 34 Japan: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 35 Japan: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 36 Japan: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 37 India: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 38 India: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 39 India: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 40 India: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 41 India: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 42 South Korea: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 43 South Korea: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 44 South Korea: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 45 South Korea: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 46 South Korea: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 47 Australia & New Zealand: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 48 Australia & New Zealand: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 49 Australia & New Zealand: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 50 Australia & New Zealand: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 51 Australia & New Zealand: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 52 Indonesia: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 53 Indonesia: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 54 Indonesia: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 55 Indonesia: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 56 Indonesia: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 57 Thailand: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 58 Thailand: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 59 Thailand: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 60 Thailand: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 61 Thailand: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 62 Malaysia: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 63 Malaysia: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 64 Malaysia: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 65 Malaysia: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 66 Malaysia: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 67 Singapore: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 68 Singapore: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 69 Singapore: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 70 Singapore: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 71 Singapore: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 72 Vietnam: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 73 Vietnam: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 74 Vietnam: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 75 Vietnam: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 76 Vietnam: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 77 Philippines: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 78 Philippines: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 79 Philippines: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 80 Philippines: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 81 Philippines: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 82 Rest of Asia-Pacific: Air Conditioners Market, by Type, 2021-2032 (USD Million)

Table 83 Rest of Asia-Pacific: Air Conditioners Market, by Tonnage, 2021-2032 (USD Million)

Table 84 Rest of Asia-Pacific: Air Conditioners Market, by Technology, 2021-2032 (USD Million)

Table 85 Rest of Asia-Pacific: Air Conditioners Market, by Rating, 2021-2032 (USD Million)

Table 86 Rest of Asia-Pacific: Air Conditioners Market, by End User, 2021-2032 (USD Million)

Table 87 Recent Developments by Major Market Players (2020-2025)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Key Insights

Figure 8 Asia-Pacific Air Conditioners Market, by Type, 2025 Vs. 2032 (USD Million)

Figure 9 Asia-Pacific Air Conditioners Market, by Tonnage, 2025 Vs. 2032 (USD Million)

Figure 10 Asia-Pacific Air Conditioners Market, by Technology, 2025 Vs. 2032 (USD Million)

Figure 11 Asia-Pacific Air Conditioners Market, by Rating, 2025 Vs. 2032 (USD Million)

Figure 12 Asia-Pacific Air Conditioners Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 13 Impact Analysis of Market Drivers, Restraints, Opportunities, and Challenges

Figure 14 Consumer Buying Behavior Analysis

Figure 15 Asia-Pacific Air Conditioners Market, by Type, 2025 Vs. 2032 (USD Million)

Figure 16 Asia-Pacific Air Conditioners Market, by Tonnage, 2025 Vs. 2032 (USD Million)

Figure 17 Asia-Pacific Air Conditioners Market, by Technology, 2025 Vs. 2032 (USD Million)

Figure 18 Asia-Pacific Air Conditioners Market, by Rating, 2025 Vs. 2032 (USD Million)

Figure 19 Asia-Pacific Air Conditioners Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 20 Asia-Pacific Air Conditioners Market, by Geography, 2025 Vs. 2032 (USD Million)

Figure 21 Growth Strategies Adopted by Leading Market Players (2020–2025)

Figure 22 Competitive Dashboard: Air Conditioners Market

Figure 23 Vendor Market Positioning Analysis (2020–2025)

Figure 24 Market Share Analysis: Air Conditioners Industry

Figure 25 Daikin Industries, Ltd.: Financial Overview

Figure 26 Mitsubishi Electric Corporation: Financial Overview

Figure 27 Johnson Controls International plc: Financial Overview

Figure 28 Carrier Global Corporation: Financial Overview

Figure 29 Whirlpool Corporation: Financial Overview

Figure 30 Haier Smart Home Co. Ltd.: Financial Overview

Figure 31 LG Electronics: Financial Overview

Figure 32 Voltas Limited: Financial Overview

Figure 33 Panasonic Corporation: Financial Overview

Figure 34 Robert Bosch GmbH: Financial Overview

Figure 35 Samsung Electronics Co., Ltd.: Financial Overview

Figure 36 Fujitsu Limited: Financial Overview

Figure 37 Blue Star Ltd.: Financial Overview

Figure 38 Toshiba Corporation: Financial Overview

Figure 39 Gree Electric Appliances Inc.: Financial Overview

Figure 40 Midea Group Co. Ltd: Financial Overview

Published Date: Apr-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates