Resources

About Us

Microgrid Control System Market by Component (Hardware, Software, Services), Grid Type (AC, DC, Hybrid), Connectivity (Grid-Connected, Off-Grid), Application (Power Generation, Energy Storage), End User, and Geography - Global Forecast to 2035

Report ID: MRSE - 1041598 Pages: 201 Sep-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Microgrid Control System Market Size?

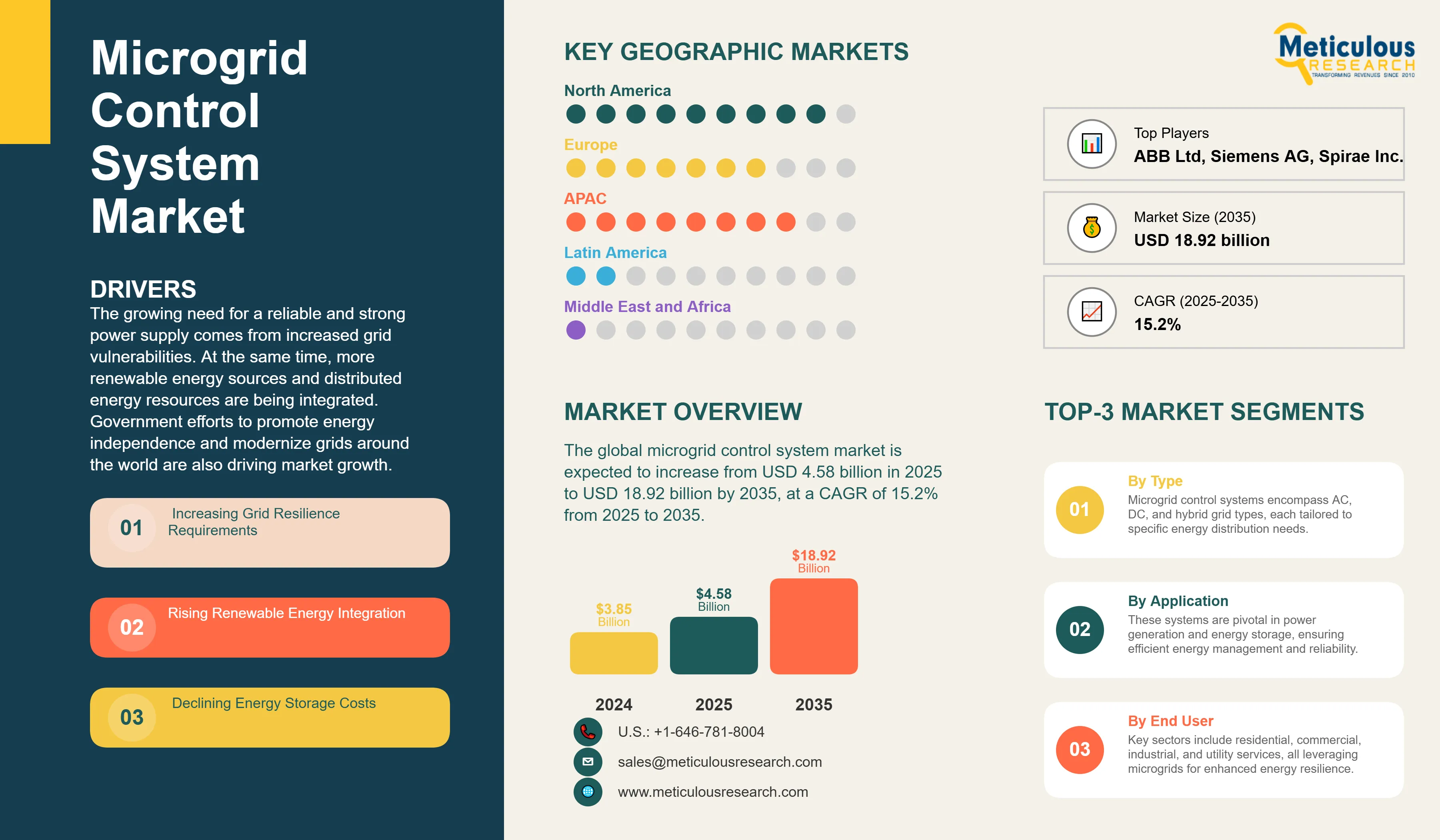

The global microgrid control system market was valued at USD 3.85 billion in 2024 and is expected to increase from USD 4.58 billion in 2025 to USD 18.92 billion by 2035, at a CAGR of 15.2% from 2025 to 2035. The growing need for a reliable and strong power supply comes from increased grid vulnerabilities. At the same time, more renewable energy sources and distributed energy resources are being integrated. Government efforts to promote energy independence and modernize grids around the world are also driving market growth.

Microgrid Control System Market Key Highlights

Click here to: Get Free Sample Pages of this Report

The microgrid control system market involves the design, development, deployment, and maintenance of complex control platforms that manage and optimize microgrids. These are localized energy grids that can work alone or together with the main power grid. These systems combine software algorithms, SCADA systems, energy management systems, communication networks, and smart controllers to manage distributed energy sources, including solar PV, wind turbines, energy storage systems, diesel generators, and loads within specific electrical boundaries.

Unlike traditional grid control systems, microgrid controllers allow for independent operation, easy islanding and reconnection, real-time optimization of various energy sources, demand response management, and improved grid resilience. The market is growing due to more frequent power outages and natural disasters, increased use of renewable energy, lower costs for battery storage, supportive government policies for distributed energy resources, and higher demand for energy security in commercial, industrial, institutional, and remote community applications.

How is AI Transforming the Microgrid Control System Market?

Artificial intelligence integration in microgrid control systems allows for predictive analytics in load forecasting, autonomous grid management through reinforcement learning, optimal dispatch of distributed resources, and self-healing during grid disturbances. AI algorithms handle large amounts of real-time data from sensors, weather forecasts, and market signals. They predict energy demand patterns, optimize the use of renewable energy, and cut operational costs while keeping the grid stable.

Machine learning models help with predictive maintenance of microgrid assets by spotting anomalies and signs of wear before failures happen. This reduces downtime and maintenance expenses. AI-powered controllers can quickly respond to grid events. They automatically adjust the network layout, manage voltage and frequency, and coordinate multiple microgrids in connected setups. This achieves response times that traditional control methods cannot match and improves overall system reliability by 30-40%.

What are the Key Trends in the Microgrid Control System Market?

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 18.92 Billion |

|

Market Size in 2025 |

USD 4.58 Billion |

|

Market Size in 2024 |

USD 3.85 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 15.2% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Component, Grid Type, Connectivity, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Grid Resilience and Energy Security Requirements

A key factor driving the growth of the microgrid control system market is the rise in power outages due to extreme weather, outdated grid infrastructure, and cyber threats. This situation underscores the urgent need for reliable energy systems. Natural disasters, such as hurricanes, wildfires, and ice storms, have led to long blackouts that affected millions and resulted in billions of dollars in economic losses. Microgrids with effective control systems can separate from the main grid during disruptions, keeping power to essential facilities like hospitals, data centers, military bases, and emergency services. Government efforts, such as the U.S. Department of Energy's Grid Modernization Initiative and the European Union's Clean Energy Package, encourage the use of microgrids for better resilience. Moreover, the increasing electrification of transportation and heating raises the reliance on a steady electricity supply, making microgrid control systems crucial for ensuring uninterrupted power and protecting vital infrastructure.

Restraint

High Capital Investment and Technical Complexity

Despite promising growth prospects, the microgrid control system market faces significant challenges. These include high upfront investments and technical difficulties related to system design, integration, and operation. To implement a complete microgrid control system, you need advanced software platforms, communication infrastructure, protective relays, sensors, and skilled staff. Costs can range from hundreds of thousands to millions of dollars, depending on the system's size and complexity.

Integrating various distributed energy resources, which have different operating traits, communication methods, and control interfaces, poses major engineering challenges. Regulatory uncertainties about interconnection standards, utility rates, and market rules create risks for project development. A shortage of experienced engineers and technicians familiar with microgrid control technologies limits how quickly systems can be deployed. Additionally, concerns about cybersecurity risks in critical infrastructure discourage some organizations from adopting these systems.

Opportunity

Virtual Power Plants and Grid Services

The rise of microgrid control systems creates an exciting opportunity to support virtual power plants (VPPs) and provide services to the grid, leading to strong market growth. Modern control systems can combine multiple microgrids and distributed resources to take part in wholesale energy markets. They can offer services like frequency regulation, voltage support, and capacity reserves, which large power plants usually supply. This combination opens up new revenue sources for microgrid operators while helping maintain grid stability and integrate renewable energy. The growth of electric vehicles and vehicle-to-grid (V2G) technology increases the resources that microgrid controllers can manage, allowing mobile batteries to become assets for the grid. Utilities are starting to see microgrids as alternatives to traditional grid upgrades, which creates chances for microgrid-as-a-service business models. In these models, control system providers deliver complete solutions with performance guarantees.

Component Insights

Why does Software Dominate the Microgrid Control System Market?

The software segment holds the largest market share of about 40-45% in 2025. Software is the central intelligence of microgrid control systems. It includes energy management systems (EMS), distributed energy resource management systems (DERMS), SCADA platforms, and optimization algorithms that coordinate all microgrid operations. The software's capacity to integrate equipment from different vendors, handle real-time data, execute complex control strategies, and adjust to changing conditions makes it the most valuable part. Regular software updates bring new features, improved algorithms, and cybersecurity fixes without needing to replace hardware, offering long-term value. The trend toward software-defined microgrids, where control logic is virtualized and cloud-based, reduces reliance on hardware and allows for scalable, flexible setups.

On the other hand, the services segment is expected to grow at the fastest CAGR during the forecast period. The increasing demand for consulting, system integration, commissioning, training, and managed services is driving this growth as microgrid complexity rises. A lack of in-house expertise forces organizations to depend on specialized service providers for the design, implementation, and ongoing optimization of control systems.

Grid Type Insights

How do AC Microgrids Support Market Growth?

The AC microgrid segment holds the largest share of around 55-60% of the overall microgrid control system market in 2025. AC microgrids lead the market because they work well with current electrical infrastructure, standard AC loads, and utility grids that run on AC frequencies. Most distributed generation sources and loads are made for AC operation. This makes AC microgrids the best option for retrofitting existing facilities and connecting with traditional power systems. The well-established ecosystem of AC protection devices, transformers, and switchgear ensures reliable operation and easier maintenance. AC microgrids are especially suited for applications that need grid connection for backup power or economic optimization through energy trading.

The hybrid microgrid segment is expected to grow at the fastest CAGR through 2035. Hybrid AC/DC microgrids combine the benefits of both types. They efficiently bring together DC sources like solar PV and batteries while serving AC loads. This setup reduces conversion losses and allows for better integration of various energy resources and new DC loads like EV chargers and LED lighting.

Connectivity Insights

How do Grid-Connected Systems Dominate the Market?

The grid-connected segment accounts for the largest share of around 65% in 2025. Grid-connected microgrids provide economic benefits through energy trading, reducing demand charges, and participating in utility programs while ensuring grid backup for reliability. These systems can import power when prices are low and export excess renewable energy, which helps manage energy costs and supports grid stability. Their ability to switch easily between grid-connected and island modes offers resilience without losing economic benefits. Regulatory frameworks in many areas encourage the development of grid-connected microgrids through interconnection standards and net metering policies.

The off-grid or island mode segment is likely to grow at the fastest CAGR during the forecast year. The need for electricity in remote communities, islands, and developing regions without grid access drives the demand for off-grid microgrids. Mining operations, military bases, and remote industrial sites need self-sufficient microgrids with advanced control systems for a reliable power supply.

Application Insights

Why does Power Generation & Distribution Lead Applications?

The power generation and distribution segment holds the largest market share at nearly 40-45% in 2025. Managing and coordinating multiple generation sources, including renewables, conventional generators, and combined heat and power systems, is the main job of microgrid control systems. Optimizing diverse generation assets with different costs, emissions, and operating constraints is complex. It requires advanced control algorithms. Balancing generation with load in real-time while keeping voltage and frequency within acceptable ranges requires continuous operation of control systems. The integration of a lot of variable renewable energy adds further complexity that controllers must handle through forecasting and resource scheduling.

On the other hand, the energy storage management segment is expected to grow at the fastest CAGR through 2035. Rapidly falling battery costs and more storage deployments create a need for control systems that optimize charging and discharging cycles, manage the state of charge, and coordinate several storage assets for different uses, such as peak shaving, frequency regulation, and backup power.

End User Insights

Why do Commercial & Industrial Sectors Drive Adoption?

The commercial and industrial segment holds the largest share of 38% of the overall microgrid control system market in 2025. These facilities often suffer significant economic losses due to power outages and quality issues. This situation justifies investing in microgrid control systems to improve reliability. Manufacturing facilities with critical processes, data centers that need continuous uptime, and commercial campuses focused on sustainability are pushing for adoption.

The military and defense segment is expected to have the fastest growth rate during the coming years. Military installations have a critical need for energy security and want to be less dependent on vulnerable civilian grids. This necessity drives the quick adoption of advanced microgrid control systems. Defense facilities are often early adopters of new technologies, including cybersecure controllers, AI-based optimization, and networked microgrid operations.

U.S. Microgrid Control System Market Size and Growth 2025 to 2035

The U.S. microgrid control system market is projected to be worth USD 5.68 billion by 2035, growing at a CAGR of 14.9% from 2025 to 2035.

How is the North America Microgrid Control System Market Growing Dominantly Across the Globe?

North America commands the largest share of 35% of the global microgrid control system market in 2025. This leadership comes from active grid modernization efforts, significant federal and state funding for microgrid projects, and frequent extreme weather events that show how vulnerable the grid is. The U.S. Department of Energy's Grid Modernization Laboratory Consortium supports microgrid control technologies with research and demonstration projects. State programs, like California's Self-Generation Incentive Program and New York's NY Prize competition, offer funding for microgrid development. Major technology providers such as Schneider Electric, Honeywell, S&C Electric, and many innovative startups create a strong ecosystem. Strong regulatory frameworks in states like California, New York, and Connecticut help with microgrid deployment through specific tariffs and interconnection rules. The region's established renewable energy market and lower storage costs further boost microgrid adoption across commercial, industrial, and community uses.

Which Factors Support the Asia Pacific Microgrid Control System Market Growth?

Asia Pacific is expected to see the fastest growth rate from 2025 to 2035. This growth comes from significant rural electrification needs in India and Southeast Asia, where microgrids offer affordable options compared to extending the grid. China's commitment to carbon neutrality and its leadership in renewable energy drive the development of advanced microgrids that integrate a high amount of renewable energy. Japan is focusing on energy resilience after the Fukushima disaster, which boosts microgrid projects for essential facilities and communities. Island nations like Indonesia and the Philippines, with thousands of inhabited islands, need off-grid microgrids to ensure reliable electricity access. The rapid industrialization and urbanization are creating demand for dependable power in commercial and industrial sectors. Government programs like India's National Smart Grid Mission and Australia's microgrid initiatives provide support and funding. Additionally, the region's ability to manufacture solar panels, batteries, and power electronics lowers system costs, making microgrids a more attractive option.

Key Players in the Global Microgrid Control System Market

Recent Developments

Segments Covered in the Report

By Component

By Grid Type

By Connectivity

By Application

By End User

By Region

The microgrid control system market is expected to increase from USD 3.85 billion in 2024 to USD 18.92 billion by 2035.

The microgrid control system market is expected to grow at a CAGR of 15.2% from 2025 to 2035.

The major players in the microgrid control system market include Schneider Electric SE, ABB Ltd., Siemens AG, General Electric Company, Honeywell International Inc., Eaton Corporation plc, S&C Electric Company, Schweitzer Engineering Laboratories, Emerson Electric Co., Hitachi Ltd., Toshiba Corporation, Mitsubishi Electric Corporation, Caterpillar Inc., Cummins Inc., Rolls-Royce Holdings plc, Spirae Inc., Advanced Microgrid Solutions, AutoGrid Systems Inc., Opus One Solutions, and GridPoint Inc.

The driving factors of the microgrid control system market are the increasing demand for reliable and resilient power supply amid growing grid vulnerabilities, rising integration of renewable energy sources and distributed energy resources, and government initiatives promoting energy independence and grid modernization projects globally.

North America region will lead the global microgrid control system market during the forecast period 2025 to 2035.

Published Date: Jul-2025

Published Date: May-2025

Published Date: Oct-2024

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates