Resources

About Us

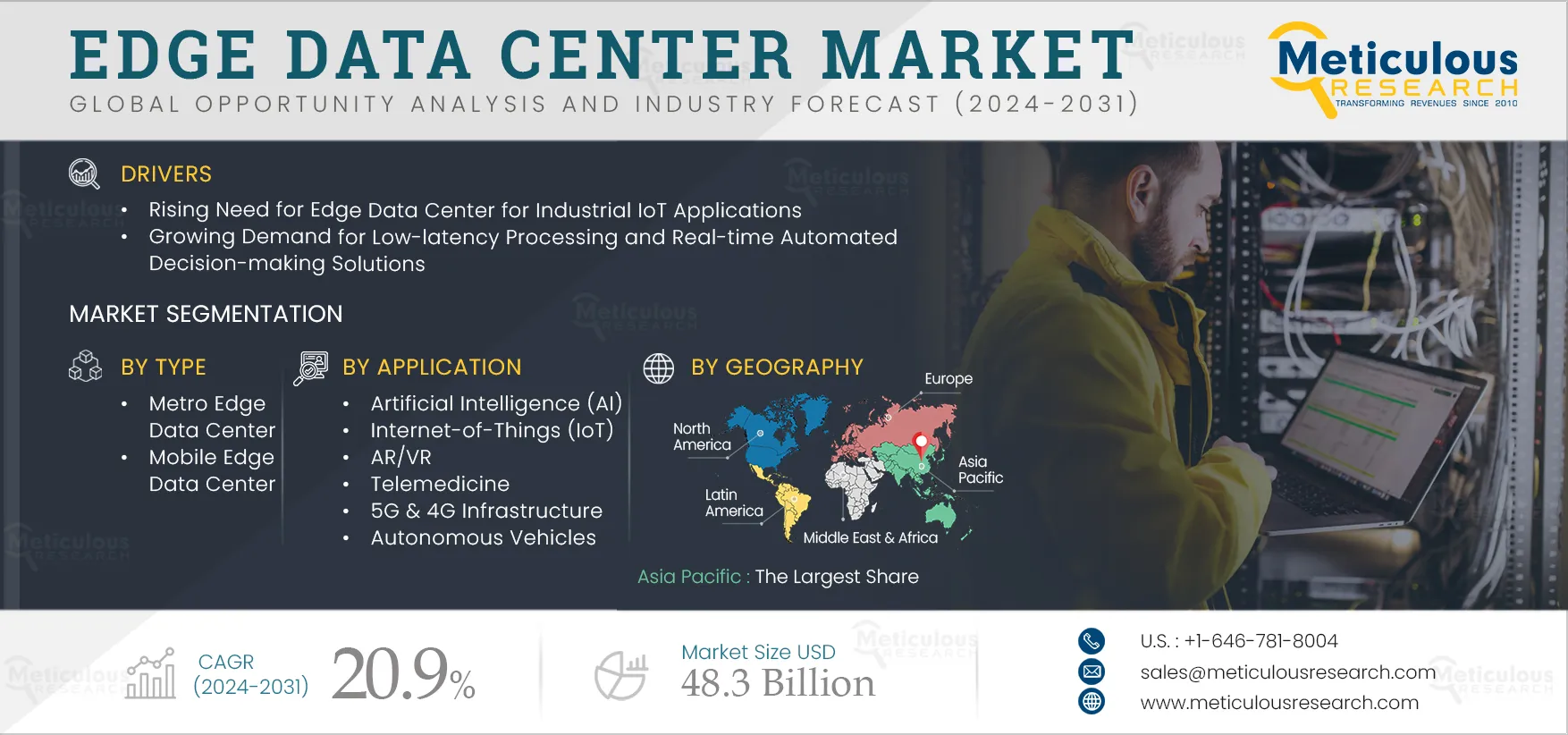

Edge Data Center Market Size, Share, Forecast, & Trends Analysis by Type (Metro, Mobile), Component, Deployment, Organization, Application (AI, IoT, 5G & 4G, AR/VR), and End-use Sector (IT & Telecommunication, Automotive, Transportation & Logistics) - Global Forecast to 2031

Report ID: MRICT - 104727 Pages: 223 Jul-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Edge Data Center market is expected to reach $48.3 billion by 2031, at a CAGR of 20.9% from 2024 to 2031. The growth of this market is attributed to the rising need for Edge Data Center for industrial IoT applications, the growing demand for low-latency processing and real-time automated decision-making solutions, and the increasing utilization of Edge Data Center in online video streaming. The emergence of autonomous vehicles and the commercialization of 4G technology are expected to generate growth opportunities for the players in the Edge Data Center market.

In recent years, Industrial Internet of Things (IIoT) technologies have evolved rapidly, however, users of IIoT technology are increasingly encountering challenges such as the security of connected infrastructures, data-related issues, scalability difficulties, IoT security, efficient data analysis, and resource shortages. These challenges are impacting productivity and efficiency across various industries. To overcome these issues, industries such as automotive, telemedicine, and telecommunications are adopting Edge Data Center. These centers enable more efficient data collection and management, increase process efficiency, improve network security, and allow for greater network scalability and faster response times.

Edge Data Center offer numerous benefits such as improving security by limiting the quantity of data stored, reducing broader network vulnerabilities, decreasing the amount of sensitive data transmitted, and enabling lower latency. They also enable significantly faster response times and lower the cost of routing and data transmission by placing computation and storage close to the end users. Edge data center solutions are designed to provide low-latency, high-performance connectivity to the cloud, making it easier for Industrial IoT users to adopt low-latency analytics technologies. Thus, the growing adoption of IIoT technology is driving the need for Edge Data Center.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

With increasing internet penetration and the increasing usage of smartphones and IoT devices, data traffic is growing exponentially, driving the demand for Edge Data Center. The surge in big data traffic is generating large volumes of data, leading to latency issues and slower network speeds. Hence, there is a growing demand for Edge Data Center to handle massive data volumes and facilitate low-latency processing for real-time automated decision-making is driving the growth of this market.

In traditional big data processing methods, data is stored and processed in batches, which time-consuming. Delays can lead to missed opportunities or inaccurate insights, especially in industries such as finance, healthcare, and telecommunications, where real-time data processing is particularly important.

Ensuring low latency can help businesses increase profits and provide a competitive advantage by enabling them to respond to market changes and customer needs quickly. With data being generated at unprecedented rates, industries must process and analyze that data quickly to gain a competitive edge. Low latency enables the processing and analysis of big data in real time. Additionally, low latency can reduce the load on traditional big data systems by processing only the necessary data in real time, saving costs.

Many ultra-low-latency solutions providers, such as Celoxica Limited (U.K.), Crown Castle Inc. (U.S.), and IPC Systems, Inc. (U.S.), are focused on helping industries manage risks by providing low-latency price discovery and proximity to key financial markets. For instance, in April 2023, IPC Systems, Inc. (U.S.) partnered with Celoxica Limited (U.K.) to deliver FPGA-powered low latency normalized market data feeds across all asset classes. These factors contribute to driving market growth.

The commercialization of 4G technology is also expected to generate market growth opportunities. Various industries, such as automotive, telemedicine, and telecommunications, are adopting 4G technology for faster communications between sensors and actuators, and enabling smarter industrial machines and assets. This technology is crucial for many industries, especially those that are under-served by today’s state-of-the-art wireless broadband networks. Edge Data Center bring industry applications, such as Internet of Things (IoT) devices or local edge servers, closer to data sources where sensors or data-collecting devices are numerous and widely distributed. This proximity improves processing time, enabling real-time analytics at a more detailed level. Therefore, the rollout of 4G technology is anticipated to spur the adoption of Edge Data Center, creating opportunities for market growth.

During the last decade, data privacy & security concerns have increased across all industries, affecting small and large enterprises alike regardless of the sensitivity of their data. Edge Data Center are interconnected with networks, hardware, and software. These interconnected networks are potential targets for cyberattacks and other malicious activities.

A successful attack has the potential to disrupt a network, compromising system integrity. These risks hinder the adoption of edge data center solutions among enterprises. Additionally, Edge Data Center collect, store, and transmit sensitive data. Any breach or unauthorized access to this data can lead to financial losses, reputational damage, and legal liabilities for companies.

Therefore, data privacy and security concerns represent significant challenges for market growth. Market players are focusing on vulnerability assessments, threat monitoring, security patches, and robust data security measures such as encryption, access controls, and secure network infrastructure to safeguard enterprises against cyber threats. These factors impede the advancement of the Edge Data Center market.

Based on type, the Edge Data Center market is broadly segmented into metro Edge Data Center and mobile Edge Data Center. In 2024, the metro Edge Data Center segment accounted for the larger share of over 60.8% of the Edge Data Center market. The large market share of this segment is mainly attributed to the growing deployment of 5G networks, increasing data traffic, and the need to provide localized cloud computing resources for businesses and organizations, supporting the segment's growth.

Metro Edge Data Center are an essential part of the distributed computing infrastructure, as they bring computing resources closer to the source of data generation, consumption, and processing. These centers are designed to provide low-latency, high-bandwidth connectivity, and computing resources to support local applications and services.

However, the mobile Edge Data Center segment is projected to record the highest CAGR during the forecast period. The growth of this segment is attributed to factors such as the increasing demand to reduce latency in mobile applications, enhance user experience, enable real-time functionalities, optimize network bandwidth, and alleviate congestion by processing data locally. Mobile Edge Data Center (MEC) are an important component of the evolving edge computing ecosystem, catering to the growing demands of emerging technologies.

Based on component, the Edge Data Center market is segmented into hardware, software, and services. In 2024, the software accounted for the largest share of over 46.4% of the Edge Data Center market. The large share of this segment is mainly attributed to the increasing demand for workload orchestration, resource allocation, real-time data analysis, and insight extraction drive the growth of the software segment. Edge data center software plays a critical role in enabling efficient data processing, resource allocation, security, and connectivity within edge computing environments. This software encompasses applications, platforms, and tools utilized to manage, orchestrate, and optimize the operations of Edge Data Center.

Additionally, the software segment is also projected to record the highest CAGR during the forecast period.

Based on deployment mode, the Edge Data Center market is segmented into on-premise deployments and cloud-based deployments. In 2024, the cloud-based deployments segment accounted for the larger share of over 54.7% of the Edge Data Center market. This segment is projected to record the highest CAGR during the forecast period. The large share of this segment is mainly attributed to the increasing need to efficiently allocate resources, rapidly deploy applications & services closer to end users and reduce latency while improving performance. Cloud computing technology has transformed businesses, enabling scalable and cost-effective data storage, processing, and delivery.

Additionally, the cloud-based deployments segment is projected to record the highest CAGR during the forecast period.

Based on organization size, the Edge Data Center market is segmented into large enterprises and small & medium-sized enterprise. In 2024, the small & medium-sized enterprise segment accounted for the larger share of over 55.6% of the Edge Data Center market. The large share of this segment is mainly attributed to the increasing demand for real-time processing and localized data management, enabling a competitive edge, optimizing operations, and accelerating the digital transformation journey. Edge Data Center have emerged as a transformative solution for small and medium-sized enterprises, effectively tackling specific challenges and providing substantial benefits.

Additionally, the small & medium-sized enterprise segment is projected to record the highest CAGR during the forecast period.

Based on application, the Edge Data Center market is segmented into artificial intelligence (AI), internet of things (IoT), AR/VR, telemedicine, 5G & 4G infrastructure, autonomous vehicles, video/live streaming, network functions virtualization (NFV), and other applications. In 2024, the 5G & 4G infrastructure segments accounted for the largest share of over 26.2% of the Edge Data Center market. The large market share of this segment is mainly attributed to the rising demand for ultra-low latency applications, growing adoption of 5G networks, and growing adoption of Edge Data Center for high bandwidth in 5G infrastructure. Edge Data Center play a crucial role in enhancing performance, hosting critical functions, and enhancing the efficiency of both 5G & 4G infrastructures.

However, the artificial intelligence (AI) segment is projected to record the highest CAGR during the forecast period. The growth of this segment can be attributed to factors such as the increasing need for real-time analytics, enhanced data privacy, and reduced network costs. Edge artificial intelligence, or AI at the edge, is the implementation of artificial intelligence in an edge computing environment that allows computations where data is collected rather than at a centralized cloud computing facility or an offsite data center.

Based on end-use sector, the Edge Data Center market is segmented into IT & telecommunications, automotive, transportation & logistics, healthcare, energy & utilities, manufacturing, government & defense, retail, and other end-use sectors. In 2024, the IT & telecommunications segment is expected to account for the largest share of over 41.1% of the Edge Data Center market. The large share of this segment is mainly attributed to the increasing demand for low-latency and high-bandwidth communication, real-time data processing, and the need to reduce the risk of data breaches during transmission while also ensuring compliance with data protection regulations in the IT & telecommunications sector.

Additionally, the IT & telecommunications segment is projected to record the highest CAGR during the forecast period.

In 2024, Asia-Pacific is expected to account for the largest share of over 36.2% of the Edge Data Center market, followed by North America, Europe, Latin America, and the Middle East & Africa. The Asia-Pacific region is projected to register the highest CAGR during the forecast period. The large share of the Asia-Pacific market is attributed to the growing demand and adoption of advanced technologies, such as IoT and cloud computing, increasing adoption of internet-of-things (IoT) devices, and rising mobile data traffic & over-the-top (OTT) traffic across the region. IoT adoption has accelerated in Asia-Pacific countries. IoT and Edge Data Center are integral components of the modern digital ecosystem. They work together to address the challenges posed by the massive influx of data from IoT devices and enable real-time, low-latency applications across various industries. High investments in smart factories, AR/VR, satellite IoT devices, and 5G IoT are expected to drive the demand for Edge Data Center.

Moreover, Asia-Pacific is also projected to register the highest CAGR of 22.5% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the product portfolios and geographic presence of leading market players and the key growth strategies adopted by them over the past three to four years. The key players operating in the Edge Data Center market include Dell Technologies Inc. (U.S.), Cisco Systems, Inc. (U.S.), Eaton Corporation plc (Ireland), Fujitsu Limited (Japan), Schneider Electric SE (France), Hewlett-Packard Enterprise Company (U.S.), Huawei Technologies Co., Ltd. (China), IBM Corporation (U.S.), NVIDIA Corporation (U.S.), Mitsubishi Electric Corporation (Japan), Equinix, Inc. (U.S.), American Tower Corporation (U.S.), Cyxtera Technologies, Inc. (U.S.), ABB (Switzerland), Nxtra Data Limited (India), Zenlayer Inc. (U.S.), Switch, Inc. (U.S.), Vertiv Holdings Co. (U.S.), Nokia Corporation (Finland), EdgeConneX, Inc. (U.S.), Reichle & De-Massari AG (Switzerland), Ubiquity Management, LLC (U.S.), and Vapor IO, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

223 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

20.9% |

|

Market Size |

$48.3 Billion by 2031 |

|

Segments Covered |

By Type

By Component

By Deployment Mode

By Organization Size

By Application

By End-use Sector

|

|

Countries Covered |

Europe (Germany, U.K., France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia- Pacific), North America (U.S. and Canada), Latin America, and the Middle East & Africa |

|

Key Companies Profiles |

Dell Technologies Inc. (U.S.), Cisco Systems, Inc. (U.S.), Eaton Corporation plc (Ireland), Fujitsu Limited (Japan), Schneider Electric SE (France), Hewlett-Packard Enterprise Company (U.S.), Huawei Technologies Co., Ltd. (China), IBM Corporation (U.S.), NVIDIA Corporation (U.S.), Mitsubishi Electric Corporation (Japan), Equinix, Inc (U.S.), American Tower Corporation (U.S.), Cyxtera Technologies, Inc. (U.S.), ABB (Switzerland), Nxtra Data Limited (India) (a subsidiary of Bharti Airtel Limited), Zenlayer Inc. (U.S.), Switch, Inc. (U.S.), Vertiv Holdings Co. (U.S.), Nokia Corporation (Finland), EdgeConneX, Inc. (U.S.), Reichle & De-Massari AG (Switzerland), Ubiquity Management, LLC (U.S.), and Vapor IO, Inc. (U.S.) |

The Edge Data Center market is expected to reach $48.3 billion by 2031, at a CAGR of 20.9% from 2024 to 2031.

The Edge Data Center market study focuses on market assessment and opportunity analysis based on the sales of Edge Data Center products across different regions, countries, and market segments. This study also includes a competitive analysis of the Edge Data Center market based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years.

Based on type, in 2024, the metro Edge Data Center segment accounted for the larger share of over 60.8% of the Edge Data Center market. The large market share of this segment is mainly attributed to the growing deployment of 5G networks, increasing data traffic, and the need to provide localized cloud computing resources for businesses and organizations are support the segment's growth. Metro Edge Data Center are an essential part of the distributed computing infrastructure, as they bring computing resources closer to the source of data generation, consumption, and processing.

Based on application, the artificial intelligence (AI) segment is projected to record the highest CAGR during the forecast period. The growth of this segment can be attributed to factors such as the increasing need for real-time analytics, enhanced data privacy, and reduced network costs. Edge artificial intelligence, or AI at the edge, is the implementation of artificial intelligence in an edge computing environment that allows computations where data is collected rather than at a centralized cloud computing facility or an offsite data center.

The growth of this market is attributed to the rising need for Edge Data Center for industrial IoT applications, the growing demand for low-latency processing and real-time automated decision-making solutions, and the increasing utilization of Edge Data Center in online video streaming. The emergence of autonomous vehicles and the commercialization of 4G technology are expected to generate growth opportunities for the players in this market.

The key players operating in the Edge Data Center market include Dell Technologies Inc. (U.S.), Cisco Systems, Inc. (U.S.), Eaton Corporation plc (Ireland), Fujitsu Limited (Japan), Schneider Electric SE (France), Hewlett-Packard Enterprise Company (U.S.), Huawei Technologies Co., Ltd. (China), IBM Corporation (U.S.), NVIDIA Corporation (U.S.), Mitsubishi Electric Corporation (Japan), Equinix, Inc (U.S.), American Tower Corporation (U.S.), Cyxtera Technologies, Inc. (U.S.), ABB (Switzerland), Nxtra Data Limited (India) (a subsidiary of Bharti Airtel Limited), Zenlayer Inc. (U.S.), Switch, Inc. (U.S.), Vertiv Holdings Co. (U.S.), Nokia Corporation (Finland), EdgeConneX, Inc. (U.S.), Reichle & De-Massari AG (Switzerland), Ubiquity Management, LLC (U.S.), and Vapor IO, Inc. (U.S.).

Asia-Pacific is projected to register the highest CAGR of 22.5% during the forecast period. Market growth in Asia-Pacific’s high is mainly driven by the growing demand and adoption of advanced technologies, such as IoT and cloud computing, increasing adoption of Internet of Things (IoT) devices, and rising mobile data traffic and over-the-top (OTT) traffic across the region. IoT adoption has accelerated in Asia-Pacific countries. IoT and Edge Data Center are integral components of the modern digital ecosystem.

Published Date: Oct-2025

Published Date: Oct-2024

Published Date: Jul-2024

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates