Resources

About Us

Underfloor Heating Market by System Type (Electric Underfloor Heating Systems, Hydronic Underfloor Heating Systems), Installation Method, Component, Application, End User, & Geography - Global Forecast to 2035

Report ID: MREP - 1041503 Pages: 228 May-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThis report analyzes the global underfloor heating systems market, highlighting how underfloor heating system providers are addressing the growing demand for energy-efficient heating, enhanced indoor comfort, and luxury living, as well as the surge in construction activity across emerging markets. It provides a strategic assessment of market dynamics, forecasts through 2035, and evaluates the competitive landscape at global, regional, and country levels.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

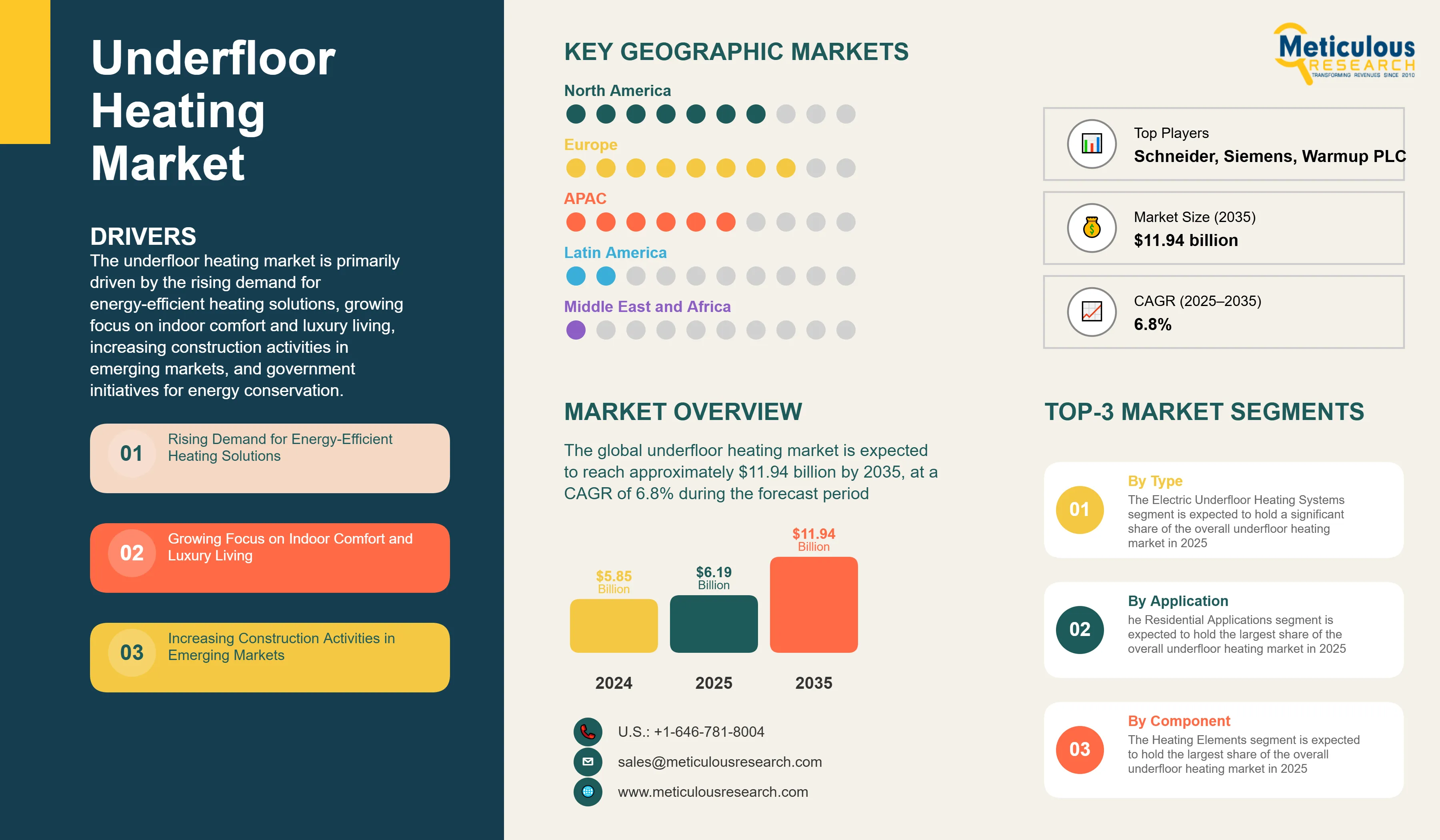

The underfloor heating market is primarily driven by the rising demand for energy-efficient heating solutions, growing focus on indoor comfort and luxury living, increasing construction activities in emerging markets, and government initiatives for energy conservation. The shift towards smart and connected underfloor heating systems and low-profile heating solutions are reshaping the industry, while wireless control systems and renewable energy integration technologies are gaining significant traction. Additionally, integration with smart home technologies and technological advancements in smart thermostats and controls are further driving market growth, especially in developed markets with advanced building infrastructure.

Key Challenges

Although the underfloor heating market holds substantial growth potential, it encounters several challenges such as high initial installation costs, complex installation processes in existing buildings, and limited awareness in developing regions. Furthermore, hurdles like regulatory compliance across different regions, quality standards and certification requirements, and competition from alternative heating solutions pose significant barriers that could hinder market adoption in different parts of the world.

Growth Opportunities

The underfloor heating market presents numerous avenues for high growth. Emerging markets offer substantial expansion opportunities for market players looking to reach new customer bases. Integration with smart home technologies provides another key opportunity, enhancing the accessibility of advanced heating control systems. Moreover, the retrofitting market potential and growing commercial and industrial applications are generating new revenue streams for solution providers as organizations seek efficient alternatives to traditional heating methods.

Market Segmentation Highlights

By System Type

The Electric Underfloor Heating Systems segment is expected to hold a significant share of the overall underfloor heating market in 2025, due to its ease of installation and growing adoption in residential applications across the globe. The segment includes electric heating cables, heating mats, heating films, and heating foils. However, the Hydronic (Water-based) Underfloor Heating Systems segment continues to maintain strong market presence, driven by its energy efficiency benefits and suitability for larger installations including wet systems, dry systems, and suspended systems.

By Installation Method

The New Construction/Build-in Installation segment is expected to dominate the overall underfloor heating market in 2025, primarily due to the increasing construction activities in emerging markets and the ease of installation during new building construction. However, the Retrofit Installation segment is expected to grow significantly during the forecast period, driven by the growing focus on energy efficiency upgrades in existing buildings and increasing awareness about the benefits of underfloor heating systems.

By Component

The Heating Elements segment is expected to hold the largest share of the overall underfloor heating market in 2025, including heating cables, heating mats, heating films, and heating pipes for hydronic systems. However, the Control Systems segment is expected to experience notable growth during the forecast period, driven by the increasing adoption of smart thermostats, smart controllers, zone control systems, and advanced sensors and actuators.

By Application

The Residential Applications segment is expected to hold the largest share of the overall underfloor heating market in 2025, due to the growing focus on indoor comfort and luxury living, and increasing adoption in residential construction projects. However, the Commercial Applications segment is expected to experience significant growth rate during the forecast period, driven by expanding commercial construction activities and the need for energy-efficient heating solutions in office buildings, retail spaces, and hospitality sectors.

By Geography

Europe is expected to hold the largest share of the global underfloor heating market in 2025, driven by advanced building standards, strong focus on energy efficiency, well-established construction industry, and favorable government initiatives for energy conservation. Additionally, high awareness about sustainable heating solutions and mature market infrastructure contribute significantly to market dominance. North America follows as a significant market, bolstered by growing construction activities and increasing adoption of smart home technologies. However, Asia-Pacific is witnessing the fastest growth rate during the forecast period, primarily driven by rapid urbanization, expanding construction activities, growing disposable income, and increasing awareness about energy-efficient heating solutions.

Competitive Landscape

The global underfloor heating market is characterized by a diverse competitive environment, comprising established heating system manufacturers, building technology experts, smart home solution providers, and innovative technology companies, each adopting unique approaches to advancing underfloor heating technologies.

Within this landscape, system providers are segmented into industry leaders, market differentiators, vanguards, and contemporary stalwarts, with each group implementing distinct strategies to sustain their competitive edge. Leading companies are prioritizing integrated solutions that merge cutting-edge heating technologies with comprehensive building automation systems, while also addressing energy efficiency challenges specific to various regions.

The key players operating in the global underfloor heating market are Uponor Corporation, Rehau SE & Co. KG, Danfoss A/S, Schneider Electric SE, Honeywell International Inc., Siemens AG, Watts Water Technologies, Inc., Warmup PLC, Nexans S.A., Polypipe Group plc, Schluter Systems LP, WarmlyYours Radiant Heating, ThermoSoft International Corporation, Comfort Heat A/S, and SunTouch (Watts Brand) among others.

|

Particulars |

Details |

|

Number of Pages |

228 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.8% |

|

Market Size (Value) in 2025 |

USD 6.19 Billion |

|

Market Size (Value) in 2035 |

USD 11.94 Billion |

|

Segments Covered |

Market Assessment, by System Type

Market Assessment, by Installation Method

Market Assessment, by Component

Market Assessment, by Application

Market Assessment, by End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Rest of Europe), Asia-Pacific (Japan, China, India, Australia, South Korea, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA) |

|

Key Companies |

Uponor Corporation, Rehau SE & Co. KG, Danfoss A/S, Schneider Electric SE, Honeywell International Inc., Siemens AG, Watts Water Technologies, Inc., Warmup PLC, Nexans S.A., Polypipe Group plc, Schluter Systems LP, WarmlyYours Radiant Heating, ThermoSoft International Corporation, Comfort Heat A/S, SunTouch (Watts Brand) |

The global underfloor heating market was valued at $5.85 billion in 2024. This market is expected to reach approximately $11.94 billion by 2035, growing from an estimated $6.19 billion in 2025, at a CAGR of 6.8% during the forecast period of 2025–2035.

The global underfloor heating market is expected to grow at a CAGR of 6.8% during the forecast period of 2025–2035.

The global underfloor heating market is expected to reach approximately $11.94 billion by 2035, growing from an estimated $6.19 billion in 2025, at a CAGR of 6.8% during the forecast period of 2025–2035.

The key companies operating in this market include Uponor Corporation, Rehau SE & Co. KG, Danfoss A/S, Schneider Electric SE, Honeywell International Inc., Siemens AG, Watts Water Technologies, Inc., Warmup PLC, Nexans S.A., Polypipe Group plc, and others.

Major trends shaping the market include smart and connected underfloor heating systems, low-profile and ultra-thin heating solutions, renewable energy integration, and wireless control systems.

• In 2025, the Electric Underfloor Heating Systems segment is expected to hold a significant share of the overall underfloor heating market by system type

• Based on installation method, the New Construction/Build-in Installation segment is expected to hold the largest share of the overall market in 2025

• Based on component, the Heating Elements segment is expected to hold the largest share of the overall market in 2025

• Based on application, the Residential Applications segment is expected to hold the largest share of the global market in 2025

Europe is expected to hold the largest share of the global underfloor heating market in 2025, driven by advanced building standards, strong focus on energy efficiency, and favorable government initiatives for energy conservation. Asia-Pacific is witnessing the fastest growth rate during the forecast period.

The growth of this market is driven by rising demand for energy-efficient heating solutions, growing focus on indoor comfort and luxury living, increasing construction activities in emerging markets, and government initiatives for energy conservation.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Underfloor Heating Market, by System Type

3.2.2. Underfloor Heating Market, by Installation Method

3.2.3. Underfloor Heating Market, by Component

3.2.4. Underfloor Heating Market, by Application

3.2.5. Underfloor Heating Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Demand for Energy-Efficient Heating Solutions

4.2.1.2. Growing Focus on Indoor Comfort and Luxury Living

4.2.1.3. Increasing Construction Activities in Emerging Markets

4.2.1.4. Government Initiatives for Energy Conservation

4.2.1.5. Technological Advancements in Smart Thermostats and Controls

4.2.2. Restraints

4.2.2.1. High Initial Installation Costs

4.2.2.2. Complex Installation Process in Existing Buildings

4.2.2.3. Limited Awareness in Developing Regions

4.2.2.4. Maintenance and Repair Challenges

4.2.3. Opportunities

4.2.3.1. Expansion in Emerging Markets

4.2.3.2. Integration with Smart Home Technologies

4.2.3.3. Retrofitting Market Potential

4.2.3.4. Commercial and Industrial Applications Growth

4.2.4. Trends

4.2.4.1. Smart and Connected Underfloor Heating Systems

4.2.4.2. Low-Profile and Ultra-Thin Heating Solutions

4.2.4.3. Renewable Energy Integration

4.2.4.4. Wireless Control Systems

4.2.5. Challenges

4.2.5.1. Regulatory Compliance Across Different Regions

4.2.5.2. Quality Standards and Certification Requirements

4.2.5.3. Competition from Alternative Heating Solutions

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on the Underfloor Heating Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Energy Efficiency and Carbon Footprint Reduction

4.4.1.2. Use of Recyclable Materials

4.4.2. Market Response to Sustainability Demands

4.4.2.1. Regulatory Compliance and Green Building Standards

4.4.2.2. Manufacturer-led Green Initiatives

4.4.3. Opportunities from Sustainability Focus

4.4.3.1. Eco-friendly System Development

4.4.3.2. Challenges in Sustainable Manufacturing

5. Underfloor Heating Market Assessment—By System Type

5.1. Overview

5.2. Electric Underfloor Heating Systems

5.2.1. Electric Heating Cables

5.2.2. Electric Heating Mats

5.2.3. Electric Heating Films

5.2.4. Electric Heating Foils

5.3. Hydronic (Water-based) Underfloor Heating Systems

5.3.1. Wet Systems (Screed-based)

5.3.2. Dry Systems

5.3.3. Suspended Systems

6. Underfloor Heating Market Assessment—By Installation Method

6.1. Overview

6.2. New Construction/Build-in Installation

6.3. Retrofit Installation

6.4. Renovation Installation

7. Underfloor Heating Market Assessment—By Component

7.1. Overview

7.2. Heating Elements

7.2.1. Heating Cables

7.2.2. Heating Mats

7.2.3. Heating Films

7.2.4. Heating Pipes (for Hydronic Systems)

7.3. Control Systems

7.3.1. Thermostats

7.3.2. Smart Controllers

7.3.3. Zone Control Systems

7.3.4. Sensors and Actuators

7.4. Insulation Materials

7.4.1. Thermal Insulation Boards

7.4.2. Reflective Foils

7.4.3. Edge Strips

7.5. Installation Accessories

7.5.1. Clamps and Fasteners

7.5.2. Manifolds and Distribution Systems

7.5.3. Adhesives and Tapes

8. Underfloor Heating Market Assessment—By Application

8.1. Overview

8.2. Residential Applications

8.3. Commercial Applications

8.4. Industrial Applications

8.5. Infrastructure Applications

9. Underfloor Heating Market Assessment—By Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.4.4. Australia

9.4.5. South Korea

9.4.6. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

9.6.1. UAE

9.6.2. Saudi Arabia

9.6.3. South Africa

9.6.4. Rest of MEA

11. Competitive Landscape

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Contemporary Stalwarts

11.5. Market Share Analysis, by Key Players, 2024

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

12.1. Uponor Corporation (Finland)

12.2. Rehau SE & Co. KG (Germany)

12.3. Danfoss A/S (Denmark)

12.4. Schneider Electric SE (France)

12.5. Honeywell International Inc. (USA)

12.6. Siemens AG (Germany)

12.7. Watts Water Technologies, Inc. (USA)

12.8. Warmup PLC (UK)

12.9. Nexans S.A. (France)

12.10. Polypipe Group plc (UK)

12.11. Schluter Systems LP (USA/Germany)

12.12. WarmlyYours Radiant Heating (USA)

12.13. ThermoSoft International Corporation (USA)

12.14. Comfort Heat A/S (Denmark)

12.15. SunTouch (Watts Brand) (USA)

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Tables

Table 1. Global Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 2. Global Electric Underfloor Heating Systems Market, by Country/Region, 2023–2035 (USD Million)

Table 3. Global Electric Heating Cables Market, by Country/Region, 2023–2035 (USD Million)

Table 4. Global Electric Heating Mats Market, by Country/Region, 2023–2035 (USD Million)

Table 5. Global Electric Heating Films Market, by Country/Region, 2023–2035 (USD Million)

Table 6. Global Electric Heating Foils Market, by Country/Region, 2023–2035 (USD Million)

Table 7. Global Hydronic (Water-based) Underfloor Heating Systems Market, by Country/Region, 2023–2035 (USD Million)

Table 8. Global Wet Systems (Screed-based) Market, by Country/Region, 2023–2035 (USD Million)

Table 9. Global Dry Systems Market, by Country/Region, 2023–2035 (USD Million)

Table 10. Global Suspended Systems Market, by Country/Region, 2023–2035 (USD Million)

Table 11. Global Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 12. Global Underfloor Heating Market for New Construction/Build-in Installation, by Country/Region, 2023–2035 (USD Million)

Table 13. Global Underfloor Heating Market for Retrofit Installation, by Country/Region, 2023–2035 (USD Million)

Table 14. Global Underfloor Heating Market for Renovation Installation, by Country/Region, 2023–2035 (USD Million)

Table 15. Global Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 16. Global Heating Elements Market, by Country/Region, 2023–2035 (USD Million)

Table 17. Global Heating Cables Market, by Country/Region, 2023–2035 (USD Million)

Table 18. Global Heating Mats Market, by Country/Region, 2023–2035 (USD Million)

Table 19. Global Heating Films Market, by Country/Region, 2023–2035 (USD Million)

Table 20. Global Heating Pipes (for Hydronic Systems) Market, by Country/Region, 2023–2035 (USD Million)

Table 21. Global Control Systems Market, by Country/Region, 2023–2035 (USD Million)

Table 22. Global Thermostats Market, by Country/Region, 2023–2035 (USD Million)

Table 23. Global Smart Controllers Market, by Country/Region, 2023–2035 (USD Million)

Table 24. Global Zone Control Systems Market, by Country/Region, 2023–2035 (USD Million)

Table 25. Global Sensors and Actuators Market, by Country/Region, 2023–2035 (USD Million)

Table 26. Global Insulation Materials Market, by Country/Region, 2023–2035 (USD Million)

Table 27. Global Thermal Insulation Boards Market, by Country/Region, 2023–2035 (USD Million)

Table 28. Global Reflective Foils Market, by Country/Region, 2023–2035 (USD Million)

Table 29. Global Edge Strips Market, by Country/Region, 2023–2035 (USD Million)

Table 30. Global Installation Accessories Market, by Country/Region, 2023–2035 (USD Million)

Table 31. Global Clamps and Fasteners Market, by Country/Region, 2023–2035 (USD Million)

Table 32. Global Manifolds and Distribution Systems Market, by Country/Region, 2023–2035 (USD Million)

Table 33. Global Adhesives and Tapes Market, by Country/Region, 2023–2035 (USD Million)

Table 34. Global Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 35. Global Underfloor Heating Market for Residential Applications, by Country/Region, 2023–2035 (USD Million)

Table 36. Global Underfloor Heating Market for Commercial Applications, by Country/Region, 2023–2035 (USD Million)

Table 37. Global Underfloor Heating Market for Industrial Applications, by Country/Region, 2023–2035 (USD Million)

Table 38. Global Underfloor Heating Market for Infrastructure Applications, by Country/Region, 2023–2035 (USD Million)

Table 39. North America: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 40. North America: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 41. North America: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 42. North America: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 43. North America: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 44. North America: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 45. North America: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 46. North America: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 47. North America: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 48. North America: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 49. U.S.: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 50. U.S.: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 51. U.S.: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 52. U.S.: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 53. U.S.: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 54. U.S.: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 55. U.S.: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 56. U.S.: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 57. U.S.: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 58. U.S.: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 59. Canada: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 60. Canada: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 61. Canada: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 62. Canada: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 63. Canada: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 64. Canada: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 65. Canada: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 66. Canada: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 67. Canada: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 68. Canada: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 69. Europe: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 70. Europe: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 71. Europe: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 72. Europe: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 73. Europe: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 74. Europe: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 75. Europe: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 76. Europe: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 77. Europe: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 78. Europe: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 79. Europe: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 80. Germany: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 81. Germany: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 82. Germany: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 83. Germany: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 84. Germany: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 85. Germany: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 86. Germany: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 87. Germany: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 88. Germany: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 89. Germany: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 90. U.K.: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 91. U.K.: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 92. U.K.: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 93. U.K.: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 94. U.K.: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 95. U.K.: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 96. U.K.: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 97. U.K.: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 98. U.K.: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 99. U.K.: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 100. France: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 101. France: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 102. France: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 103. France: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 104. France: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 105. France: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 106. France: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 107. France: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 108. France: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 109. France: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 110. Italy: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 111. Italy: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 112. Italy: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 113. Italy: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 114. Italy: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 115. Italy: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 116. Italy: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 117. Italy: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 118. Italy: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 119. Spain: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 120. Spain: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 121. Spain: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 122. Spain: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 123. Spain: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 124. Spain: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 125. Spain: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 126. Spain: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 127. Spain: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 128. Spain: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 129. Rest of Europe: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 130. Rest of Europe: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 131. Rest of Europe: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 132. Rest of Europe: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 133. Rest of Europe: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 134. Rest of Europe: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 135. Rest of Europe: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 136. Rest of Europe: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 137. Rest of Europe: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 138. Rest of Europe: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 139. Asia Pacific: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 140. Asia Pacific: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 141. Asia Pacific: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 142. Asia Pacific: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 143. Asia Pacific: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 144. Asia Pacific: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 145. Asia Pacific: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 146. Asia Pacific: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 147. Asia Pacific: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 148. Asia-Pacific: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 149. Japan: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 150. Japan: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 151. Japan: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 152. Japan: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 153. Japan: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 154. Japan: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 155. Japan: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 156. Japan: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 157. Japan: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 158. Japan: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 159. China: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 160. China: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 161. China: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 162. China: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 163. China: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 164. China: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 165. China: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 166. China: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 167. China: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 168. China: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 169. India: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 170. India: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 171. India: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 172. India: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 173. India: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 174. India: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 175. India: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 176. India: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 177. India: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 178. India: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 179. Australia: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 180. Australia: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 181. Australia: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 182. Australia: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 183. Australia: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 184. Australia: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 185. Australia: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 186. Australia: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 187. Australia: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 188. Australia: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 189. South Korea: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 190. South Korea: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 191. South Korea: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 192. South Korea: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 193. South Korea: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 194. South Korea: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 195. South Korea: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 196. South Korea: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 197. South Korea: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 198. South Korea: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 199. Rest of Asia-Pacific: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 200. Rest of Asia-Pacific: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 201. Rest of Asia-Pacific: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 202. Rest of Asia-Pacific: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 203. Rest of Asia-Pacific: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 204. Rest of Asia-Pacific: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 205. Rest of Asia-Pacific: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 206. Rest of Asia-Pacific: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 207. Rest of Asia-Pacific: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 208. Rest of Asia-Pacific: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 209. Latin America: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 210. Latin America: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 211. Latin America: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 212. Latin America: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 213. Latin America: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 214. Latin America: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 215. Latin America: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 216. Latin America: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 217. Latin America: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 218. Latin America: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 219. Brazil: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 220. Brazil: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 221. Brazil: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 222. Brazil: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 223. Brazil: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 224. Brazil: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 225. Brazil: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 226. Brazil: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 227. Brazil: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 228. Brazil: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 229. Mexico: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 230. Mexico: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 231. Mexico: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 232. Mexico: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 233. Mexico: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 234. Mexico: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 235. Mexico: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 236. Mexico: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 237. Mexico: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 238. Mexico: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 239. Rest of Latin America: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 240. Rest of Latin America: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 241. Rest of Latin America: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 242. Rest of Latin America: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 243. Rest of Latin America: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 244. Rest of Latin America: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 245. Rest of Latin America: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 246. Rest of Latin America: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 247. Rest of Latin America: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 248. Rest of Latin America: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 249. Middle East & Africa: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 250. Middle East & Africa: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 251. Middle East & Africa: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 252. Middle East & Africa: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 253. Middle East & Africa: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 254. Middle East & Africa: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 255. Middle East & Africa: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 256. Middle East & Africa: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 257. Middle East & Africa: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 258. Middle East & Africa: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 259. United Arab Emirates: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 260. United Arab Emirates: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 261. United Arab Emirates: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 262. United Arab Emirates: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 263. United Arab Emirates: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 264. United Arab Emirates: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 265. United Arab Emirates: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 266. United Arab Emirates: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 267. United Arab Emirates: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 268. United Arab Emirates: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 269. Saudi Arabia: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 270. Saudi Arabia: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 271. Saudi Arabia: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 272. Saudi Arabia: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 273. Saudi Arabia: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 274. Saudi Arabia: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 275. Saudi Arabia: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 276. Saudi Arabia: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 277. Saudi Arabia: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 278. Saudi Arabia: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 279. South Africa: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 280. South Africa: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 281. South Africa: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 282. South Africa: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 283. South Africa: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 284. South Africa: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 285. South Africa: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 286. South Africa: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 287. South Africa: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 288. South Africa: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

Table 289. Rest of Middle East & Africa: Underfloor Heating Market, by System Type, 2023–2035 (USD Million)

Table 290. Rest of Middle East & Africa: Electric Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 291. Rest of Middle East & Africa: Hydronic (Water-based) Underfloor Heating Systems, by Type, 2023–2035 (USD Million)

Table 292. Rest of Middle East & Africa: Underfloor Heating Market, by Installation Method, 2023–2035 (USD Million)

Table 293. Rest of Middle East & Africa: Underfloor Heating Market, by Component, 2023–2035 (USD Million)

Table 294. Rest of Middle East & Africa: Heating Elements Market, by Type, 2023–2035 (USD Million)

Table 295. Rest of Middle East & Africa: Control Systems Market, by Type, 2023–2035 (USD Million)

Table 296. Rest of Middle East & Africa: Insulation Materials Market, by Type, 2023–2035 (USD Million)

Table 297. Rest of Middle East & Africa: Installation Accessories Market, by Type, 2023–2035 (USD Million)

Table 298. Rest of Middle East & Africa: Underfloor Heating Market, by Application, 2023–2035 (USD Million)

List of Figures

Figure 1. Research Process

Figure 2. Secondary Components Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Electric Underfloor Heating Systems to Account for the Largest Share

Figure 8. In 2025, the New Construction/Build-in Installation to Account for the Largest Share

Figure 9. In 2025, the Heating Elements Component to Account for the Largest Share

Figure 10. In 2025, the Residential Applications to Account for the Largest Share

Figure 11. Europe to be the Largest Regional Market

Figure 12. Impact Analysis of Market Dynamics

Figure 13. Global Underfloor Heating Market: Porter's Five Forces Analysis

Figure 14. Global Underfloor Heating Market, by System Type, 2025 Vs. 2035 (USD Million)

Figure 15. Global Underfloor Heating Market, by Installation Method, 2025 Vs. 2035 (USD Million)

Figure 16. Global Underfloor Heating Market, by Component, 2025 Vs. 2035 (USD Million)

Figure 17. Global Underfloor Heating Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 18. Global Underfloor Heating Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 19. North America: Underfloor Heating Market Snapshot (2025)

Figure 20. Europe: Underfloor Heating Market Snapshot (2025)

Figure 21. Asia-Pacific: Underfloor Heating Market Snapshot (2025)

Figure 22. Latin America: Underfloor Heating Market Snapshot (2025)

Figure 23. Middle East & Africa: Underfloor Heating Market Snapshot (2025)

Figure 24. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 25. Global Underfloor Heating Market Competitive Benchmarking, by System Type

Figure 26. Competitive Dashboard: Global Underfloor Heating Market

Figure 27. Global Underfloor Heating Market Share/Ranking, by Key Player, 2024 (%)

Published Date: Sep-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates